1. Technical Levels — Weekly Pivot Points & Fibonacci Zones

Thanks to TopStockResearch, here are the key pivot-derived levels for the weekly timeframe:

Standard Weekly Pivots:

Support 2 (S2): ~24,213.80

Support 1 (S1): ~24,000.80

Pivot (Central): ~24,830.70

Resistance 1 (R1): ~25,234.60

Resistance 2 (R2): ~25,447.60

Fibonacci Weekly Levels:

S2: ~24,236.46

Pivot: ~24,617.70

R1: ~24,853.36

R2: ~24,998.94

R3: ~25,234.60

Summary of horizontal price zones (support / resistance):

Support zones: 24,000 – 24,213

Pivot zone: 24,617 – 24,830

Resistance zones: 24,853 – 25,447

Additional Important Levels from Analysts & Market Reports

Consumers, Tariffs & Volatility

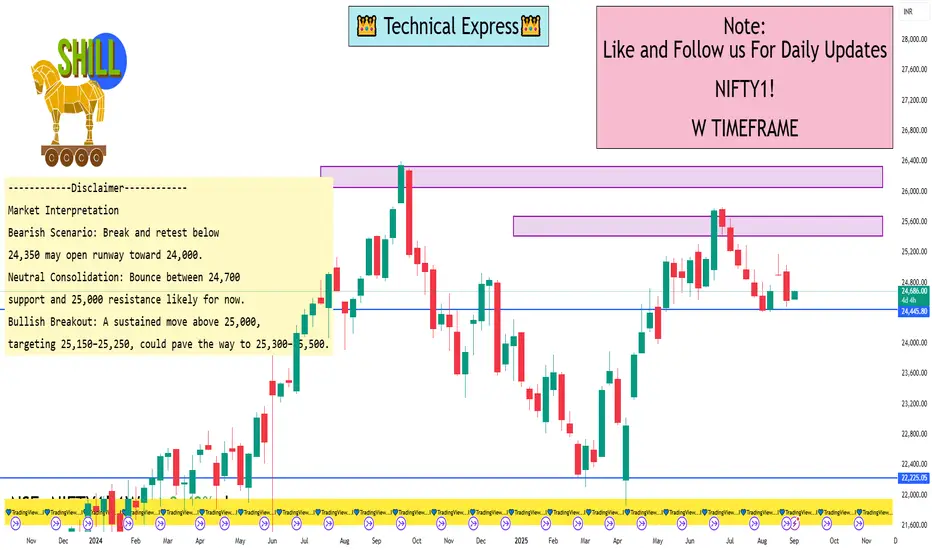

Analysts warn that a breakdown below 24,350 may trigger more selling pressure.

Previous Week’s Support

As of late August 2025, 24,250 has been identified as a critical support level.

Strong Support Around 24,700

Analysts indicated that there’s robust support near 24,700. A breakout above 25,150 could pave the way toward 25,300–25,500, while a dip below 24,800 might drag the index down to around 24,600.

Expected Trading Range

Market experts suggest that in the near term, the Nifty may oscillate between 24,200 and 24,800, with the 200-day exponential moving average (DEMA) acting as support around 24,200.

Thanks to TopStockResearch, here are the key pivot-derived levels for the weekly timeframe:

Standard Weekly Pivots:

Support 2 (S2): ~24,213.80

Support 1 (S1): ~24,000.80

Pivot (Central): ~24,830.70

Resistance 1 (R1): ~25,234.60

Resistance 2 (R2): ~25,447.60

Fibonacci Weekly Levels:

S2: ~24,236.46

Pivot: ~24,617.70

R1: ~24,853.36

R2: ~24,998.94

R3: ~25,234.60

Summary of horizontal price zones (support / resistance):

Support zones: 24,000 – 24,213

Pivot zone: 24,617 – 24,830

Resistance zones: 24,853 – 25,447

Additional Important Levels from Analysts & Market Reports

Consumers, Tariffs & Volatility

Analysts warn that a breakdown below 24,350 may trigger more selling pressure.

Previous Week’s Support

As of late August 2025, 24,250 has been identified as a critical support level.

Strong Support Around 24,700

Analysts indicated that there’s robust support near 24,700. A breakout above 25,150 could pave the way toward 25,300–25,500, while a dip below 24,800 might drag the index down to around 24,600.

Expected Trading Range

Market experts suggest that in the near term, the Nifty may oscillate between 24,200 and 24,800, with the 200-day exponential moving average (DEMA) acting as support around 24,200.

Hello Guys ..

WhatsApp link- wa.link/d997q0

Email - techncialexpress@gmail.com ...

Script Coder/Trader//Investor from India. Drop a comment or DM if you have any questions! Let’s grow together!

WhatsApp link- wa.link/d997q0

Email - techncialexpress@gmail.com ...

Script Coder/Trader//Investor from India. Drop a comment or DM if you have any questions! Let’s grow together!

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Hello Guys ..

WhatsApp link- wa.link/d997q0

Email - techncialexpress@gmail.com ...

Script Coder/Trader//Investor from India. Drop a comment or DM if you have any questions! Let’s grow together!

WhatsApp link- wa.link/d997q0

Email - techncialexpress@gmail.com ...

Script Coder/Trader//Investor from India. Drop a comment or DM if you have any questions! Let’s grow together!

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.