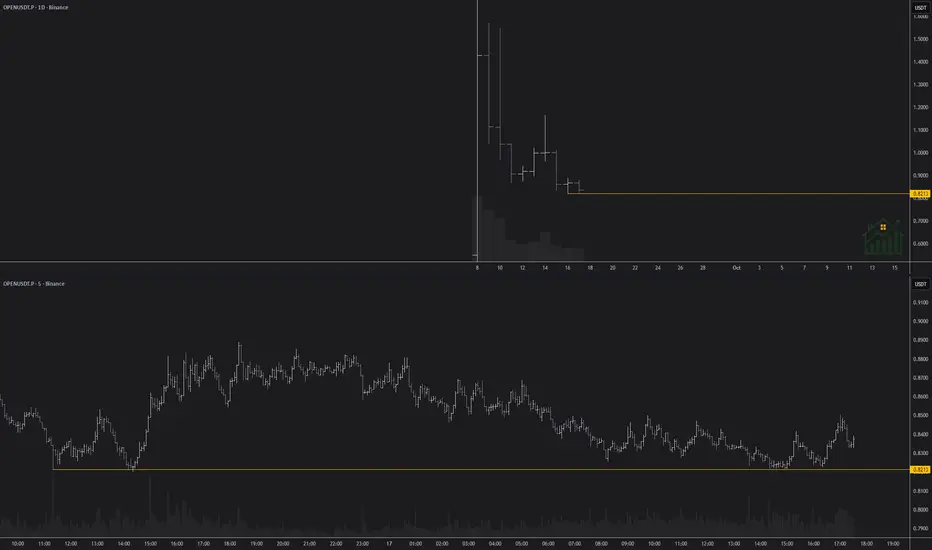

The level is local and fresh, which means it's not strong. However, below it lies a "clean zone" with no obstacles to a free fall. This factor lowers the requirements for the level's strength; a break below it, even though weak, could trigger panic selling as it serves as the only reference point. This panic, in turn, would only accelerate the fall.

Therefore, I am closely watching how the asset approaches this level. A sharp move into it is undesirable.

Key factors for this scenario

- Global & local trend alignment

- Price void / low liquidity zone beyond level

- Volatility contraction on approach

- Immediate retest

- Repeated precise tests of the level ("sticking")

Note

Asset is returning to its level, but it's doing so very quickly and with high volatility. I typically avoid such risky entries, but perhaps this price behavior fits someone else's trading strategy. I'll be glad if the idea proves useful.Note

OPENUSDT is in a local channel between the 0.8213 (support) and 0.8891 (resistance) levels.

Sooner or later, one of these levels will be broken. Considering the overall short trend, I am leaning towards a breakdown of the support level. This level has already confirmed its strength with several clear tests. In contrast, the strength of the resistance level is not yet clear, as it has not been tested at all.

I expect more clarity closer to the close of the US session.

Note

The level remains relevant as long as the asset doesn't move too far away from it.Right now, I see a local rally, but it could end up being what I call a "fakeout"—when the price is pushed up only to be slammed back down. This could all be part of building a position for a further move with the trend.

Therefore, it's worth setting an alert near the level and continuing to wait.

Trading facts, not expectations.

Follow our full analysis & track record on Telegram: t.me/the_traders_house

Not financial advice. High risk. DYOR.

Follow our full analysis & track record on Telegram: t.me/the_traders_house

Not financial advice. High risk. DYOR.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Trading facts, not expectations.

Follow our full analysis & track record on Telegram: t.me/the_traders_house

Not financial advice. High risk. DYOR.

Follow our full analysis & track record on Telegram: t.me/the_traders_house

Not financial advice. High risk. DYOR.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.