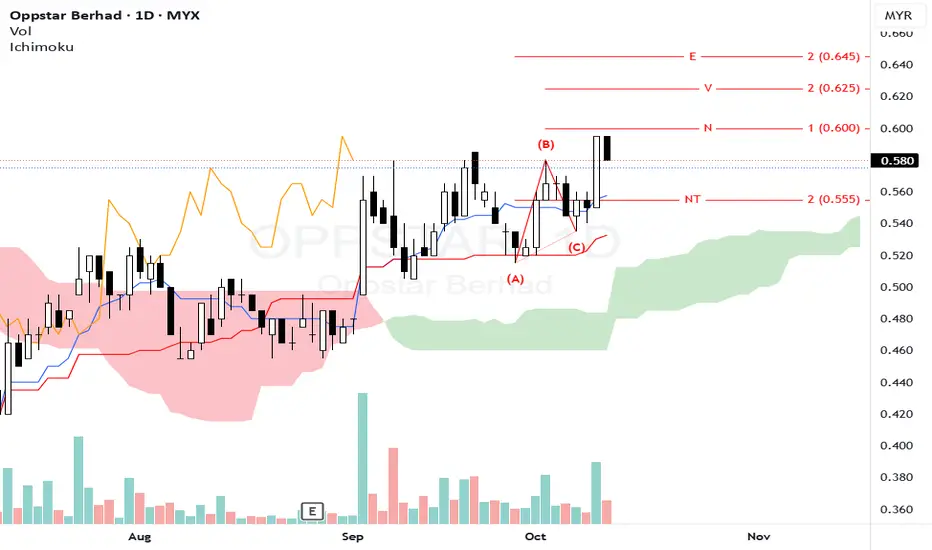

The stock is in an uptrend after a consolidation, with price around 0.58.

Price is testing the NT zone (0.555–0.565) with recent higher highs, indicating a potential setup for continuation if breakout occurs.

Kumo sits below and offers support; price is trading above the Kumo boundary in a favorable context.

Volume has shown spikes on rallies; confirm breakout with sustained volume.

The N-wave suggests a corrective pullback followed by continuation. A break above NT would suggest progression toward N, then V, and possibly E.

Key levels:

Resistance: NT at ~0.555-0.565, then N at ~0.600, V at ~0.625, E at ~0.645

Support: Near-term support near 0.540-0.550 and the Kumo lower edge.

Signals to watch:

Bullish confirmation if there is a daily close above 0.565 with higher volume

Failure to clear NT or a drop back under 0.550 would weaken the setup.

Entry: Enter long on a decisive breakout above 0.565-0.570 with strong volume and bullish candlestick price action.

Stop Loss: Place SL below the NT level, around 0.545-0.550 (or below the Kumo lower boundary for tighter risk).

If price fails to stay above 0.565 or volume does not pick up, consider waiting for a pullback and a safer entry near 0.550.

Notes:

1. Analysis for education purpose only.

2. Trade at your own risk.

Price is testing the NT zone (0.555–0.565) with recent higher highs, indicating a potential setup for continuation if breakout occurs.

Kumo sits below and offers support; price is trading above the Kumo boundary in a favorable context.

Volume has shown spikes on rallies; confirm breakout with sustained volume.

The N-wave suggests a corrective pullback followed by continuation. A break above NT would suggest progression toward N, then V, and possibly E.

Key levels:

Resistance: NT at ~0.555-0.565, then N at ~0.600, V at ~0.625, E at ~0.645

Support: Near-term support near 0.540-0.550 and the Kumo lower edge.

Signals to watch:

Bullish confirmation if there is a daily close above 0.565 with higher volume

Failure to clear NT or a drop back under 0.550 would weaken the setup.

Entry: Enter long on a decisive breakout above 0.565-0.570 with strong volume and bullish candlestick price action.

Stop Loss: Place SL below the NT level, around 0.545-0.550 (or below the Kumo lower boundary for tighter risk).

If price fails to stay above 0.565 or volume does not pick up, consider waiting for a pullback and a safer entry near 0.550.

Notes:

1. Analysis for education purpose only.

2. Trade at your own risk.

Trade closed: stop reached

Hit SLDisclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.