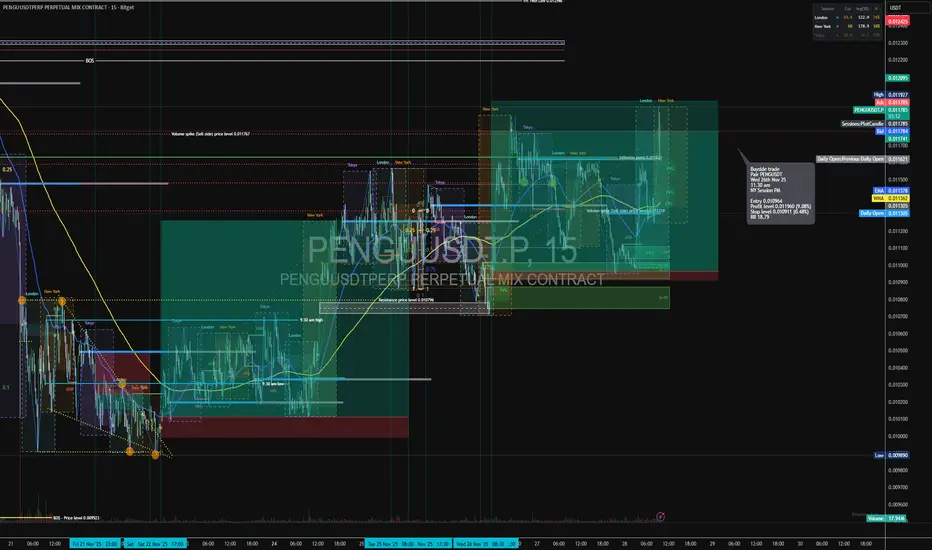

🟦 Trade Details

Direction: Buyside Trade

Pair: PENGUSDT

Date: Wed 26th Nov 25

Time: 11:30 am

Session: NY Session PM

🟩 Execution Metrics

Entry: 0.010964

Take Profit: 0.011960 (+9.08%)

Stop Loss: 0.010911 (–0.48%)

Risk-to-Reward: 18.79

🟧 Market Structure Context

Price respects session highs/lows across London → NY transitions.

Prior sell-side sweep brought price into a discount where buyers stepped in.

Clear BOS to the upside confirms bullish orderflow.

NY PM continuation aligns with earlier accumulation from London.

🟥 Liquidity Narrative

Liquidity engineered beneath 0.01090 levels.

Strong reaction from:

Volume spike (sell-side)

Session liquidity pools

Open-to-close inefficiencies

Final draw on liquidity targets:

The inefficiency above 0.01190

Session equal highs in premium

🟪 PD Arrays / POIs

Price retraced into:

FVG (discount zone)

PMD retracement alignment

NY PM bullish re-pricing zone

POI validated with rejection from previous Daily Open zone.

🟨 Entry Model

Entry taken on 15-minute confirmation after:

Micro BOS

Retest into discount FVG

Strong PM session displacement

Clear continuation model (ICT-style buyside draw)

🟫 Sentiment

Strong market interest, rising volatility into NY PM.

Volume confirming active accumulation.

Micro-cap rotational sentiment supportive of fast expansion moves.

🟩 Outcome

A high-probability, high-RR continuation trade.

Clean narrative: Sell-side sweep → Discount entry → BOS → Expansion to buyside inefficiency.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.