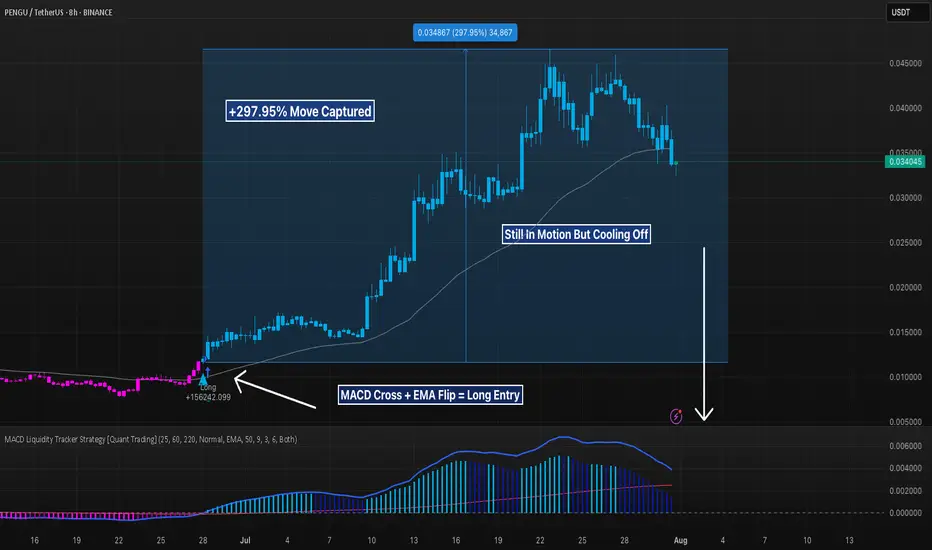

PENGU’s recent move is the kind of textbook trend trade that makes systems like the MACD Liquidity Tracker shine.

The strategy stayed flat throughout the entire sideways grind in June — filtering out chop with its 60/220 EMA trend filter. It wasn’t until late June that MACD flipped bullish and price reclaimed both EMAs. That was the trigger — and from there, it was lift-off.

The system held through a clean +297.95% move from sub-$0.012 to just under $0.045. No early exits. No fakeouts. Just a single, conviction-based trade.

The exit signal hit near the top as momentum waned and MACD rolled over. Since then, price has retraced and is now hovering right above the 60 EMA — a level that's acted as dynamic support all run long.

📊 Strategy Overview:

– MACD Settings: 25 / 60 / 220

– EMA Trend Filter: 60 & 220

– Mode: Normal

– Timeframe: 8H

⚠️ If price holds above the EMA and MACD stabilizes, bulls may still have fuel. But a breakdown below ~$0.029 would shift structure back into bearish territory.

Let the chart tell the story — this was pure momentum trading in action.

The strategy stayed flat throughout the entire sideways grind in June — filtering out chop with its 60/220 EMA trend filter. It wasn’t until late June that MACD flipped bullish and price reclaimed both EMAs. That was the trigger — and from there, it was lift-off.

The system held through a clean +297.95% move from sub-$0.012 to just under $0.045. No early exits. No fakeouts. Just a single, conviction-based trade.

The exit signal hit near the top as momentum waned and MACD rolled over. Since then, price has retraced and is now hovering right above the 60 EMA — a level that's acted as dynamic support all run long.

📊 Strategy Overview:

– MACD Settings: 25 / 60 / 220

– EMA Trend Filter: 60 & 220

– Mode: Normal

– Timeframe: 8H

⚠️ If price holds above the EMA and MACD stabilizes, bulls may still have fuel. But a breakdown below ~$0.029 would shift structure back into bearish territory.

Let the chart tell the story — this was pure momentum trading in action.

Explore 5,000 Strategies at quanttradingpro.com

Search for the most profitable, lowest risk by symbol!

Search by indicators like Supertrend, Ichimoku, macd.

Join our discord discord.gg/2systG9frc

We provide education & tools.

Search for the most profitable, lowest risk by symbol!

Search by indicators like Supertrend, Ichimoku, macd.

Join our discord discord.gg/2systG9frc

We provide education & tools.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Explore 5,000 Strategies at quanttradingpro.com

Search for the most profitable, lowest risk by symbol!

Search by indicators like Supertrend, Ichimoku, macd.

Join our discord discord.gg/2systG9frc

We provide education & tools.

Search for the most profitable, lowest risk by symbol!

Search by indicators like Supertrend, Ichimoku, macd.

Join our discord discord.gg/2systG9frc

We provide education & tools.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.