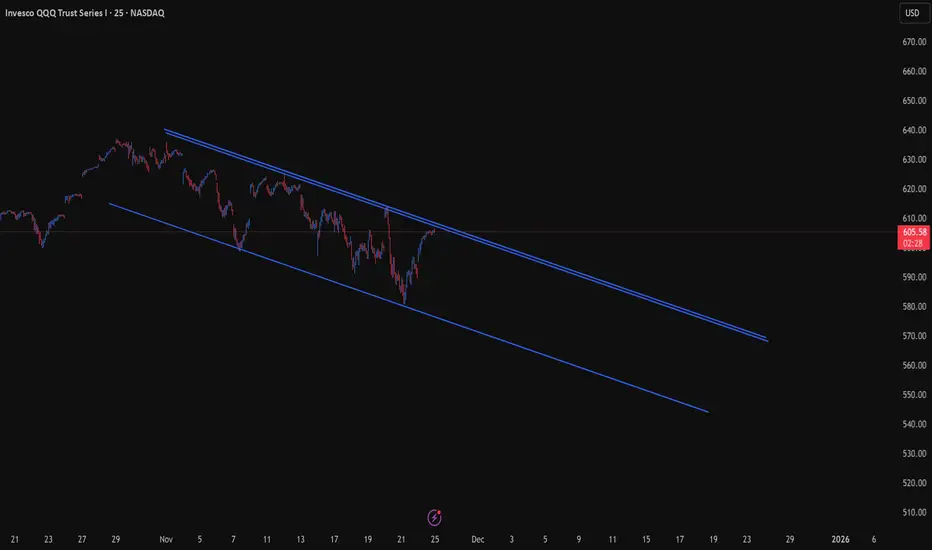

This week’s market map centers on a single dominant structure —

a perfect declining parallel channel guiding QQQ through the entire November decline.

Price is now rallying back into the upper rail, the same geometric boundary that rejected every advance this month.

This rail rises at a 1×2 natural angle, meaning:

1 trading day = $2 of vertical movement

A classic slope in fast corrective markets.

1. What Must Happen for the Market to Rise

For QQQ to reclaim strength and retest the November highs, one condition must be met:

QQQ needs a daily close above the upper rail of the declining channel.

Nothing less.

This angle is the gatekeeper.

Without a close above, upside follow-through is limited.

And if price rejects off the trendline?

→ The geometry remains intact

→ The downtrend holds

→ Lower prices become the natural next step

In geometric markets, rejection at the angle is the signal.

2. Compass Reading for the Week

Primary Trend: Down

Secondary Move: Counter-trend rally

Market Location: Testing upper rail resistance

Key Zone: 606-608

Bias: Watch for daily close above or rejection at the angle.

Market Knots Reading — Bull vs. Bear Bias

🔵 Bullish Bias

What the bulls can build a case from:

1. Acceleration is Positive

Acceleration has flipped above zero and is holding there.

This is the earliest sign of internal energy returning.

→ Trend force is rising

→ Short-term conditions favor continuation upward.

2. Speed Is Rising From the Lows

Speed has made a clear higher low and is now climbing toward the mid-range.

→ The market is gaining internal velocity

→ Bulls are defending the short-term structure

3. Price Is Rising Cleanly Within the Channel

On the 50-min view, price is stair-stepping upward and respecting short-term support.

→ Short-term bias: Up

Bull Case Summary:

Acceleration > 0 + rising Speed =

Bulls have the initiative going into the next rail test.

🔴 Bearish Bias

What the bears can counter with:

1. Speed Still Below the October Highs

Even at 125, Speed is far below the momentum peaks seen earlier.

→ The current rally remains weaker than the prior thrusts

→ Internal strength is not matching price strength

2. Rising Into a Major Structure

Price is pushing directly into the upper parallel rail.

→ This is where rallies have consistently failed

→ Bears control the geometry, even if bulls control the short-term motion

3. Acceleration Is Positive But Weak

Acceleration is above zero but not expanding aggressively.

→ This is not “trend breakout” force

→ It’s counter-trend lift inside a broader downtrend

Bear Case Summary:

Speed < November peaks + Weak Acceleration =

Rally may exhaust at the upper rail and fail.

a perfect declining parallel channel guiding QQQ through the entire November decline.

Price is now rallying back into the upper rail, the same geometric boundary that rejected every advance this month.

This rail rises at a 1×2 natural angle, meaning:

1 trading day = $2 of vertical movement

A classic slope in fast corrective markets.

1. What Must Happen for the Market to Rise

For QQQ to reclaim strength and retest the November highs, one condition must be met:

QQQ needs a daily close above the upper rail of the declining channel.

Nothing less.

This angle is the gatekeeper.

Without a close above, upside follow-through is limited.

And if price rejects off the trendline?

→ The geometry remains intact

→ The downtrend holds

→ Lower prices become the natural next step

In geometric markets, rejection at the angle is the signal.

2. Compass Reading for the Week

Primary Trend: Down

Secondary Move: Counter-trend rally

Market Location: Testing upper rail resistance

Key Zone: 606-608

Bias: Watch for daily close above or rejection at the angle.

Market Knots Reading — Bull vs. Bear Bias

🔵 Bullish Bias

What the bulls can build a case from:

1. Acceleration is Positive

Acceleration has flipped above zero and is holding there.

This is the earliest sign of internal energy returning.

→ Trend force is rising

→ Short-term conditions favor continuation upward.

2. Speed Is Rising From the Lows

Speed has made a clear higher low and is now climbing toward the mid-range.

→ The market is gaining internal velocity

→ Bulls are defending the short-term structure

3. Price Is Rising Cleanly Within the Channel

On the 50-min view, price is stair-stepping upward and respecting short-term support.

→ Short-term bias: Up

Bull Case Summary:

Acceleration > 0 + rising Speed =

Bulls have the initiative going into the next rail test.

🔴 Bearish Bias

What the bears can counter with:

1. Speed Still Below the October Highs

Even at 125, Speed is far below the momentum peaks seen earlier.

→ The current rally remains weaker than the prior thrusts

→ Internal strength is not matching price strength

2. Rising Into a Major Structure

Price is pushing directly into the upper parallel rail.

→ This is where rallies have consistently failed

→ Bears control the geometry, even if bulls control the short-term motion

3. Acceleration Is Positive But Weak

Acceleration is above zero but not expanding aggressively.

→ This is not “trend breakout” force

→ It’s counter-trend lift inside a broader downtrend

Bear Case Summary:

Speed < November peaks + Weak Acceleration =

Rally may exhaust at the upper rail and fail.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.