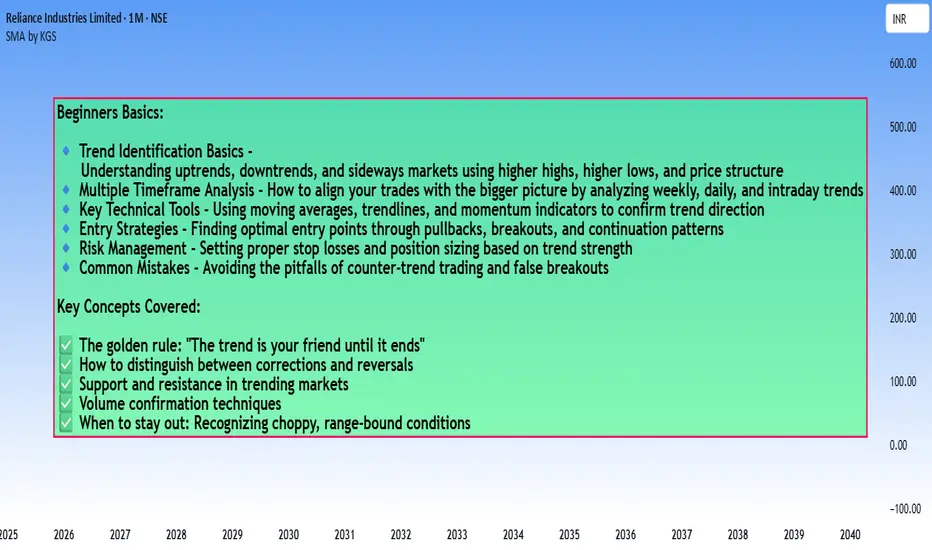

How to Identify a Trend in a Chart?

Here's a practical breakdown of trend identification methods:

1. Price Structure Method (Most Fundamental)

Uptrend:

- Series of Higher Highs (HH) and Higher Lows (HL)

- Each peak is higher than the previous peak

- Each trough is higher than the previous trough

Downtrend:

- Series of Lower Highs (LH) and Lower Lows (LL)

- Each peak is lower than the previous peak

- Each trough is lower than the previous trough

Sideways/Range:

- Price oscillates between horizontal support and resistance

- No clear higher highs/lows or lower highs/lows

2. Moving Averages

Simple Rules:

- Price consistently above MA = Uptrend

- Price consistently below MA = Downtrend

- Price crossing back and forth = No clear trend

Popular MAs:

- 20 EMA (short-term)

- 50 SMA (medium-term)

- 200 SMA (long-term)

Golden Cross/Death Cross:

- 50 MA crosses above 200 MA = Bullish trend signal

- 50 MA crosses below 200 MA = Bearish trend signal

3. Trendline Method

Drawing Trendlines:

- Uptrend: Connect at least 2 higher lows with a straight line

- Downtrend: Connect at least 2 lower highs with a straight line

- The more touches, the stronger the trendline

- Price respecting the trendline confirms trend strength

4. Multi-Timeframe Analysis

The Complete Picture:

- Weekly chart: Overall market direction

- Daily chart: Intermediate trend

- 4H/1H chart: Entry timing

Rule: Always trade in the direction of the higher timeframe trend

#5. Indicators for Confirmation

ADX (Average Directional Index):

- Above 25 = Strong trend

- Below 20 = Weak/no trend

- Doesn't show direction, only strength

MACD:

- Histogram above zero = Uptrend

- Histogram below zero = Downtrend

- Crossovers signal potential trend changes

RSI:

- Consistently above 50 = Uptrend

- Consistently below 50 = Downtrend

6. Volume Confirmation

Healthy Trends Show:

- Rising volume on moves in trend direction

- Declining volume on corrections/pullbacks

- Volume spikes at breakout points

Quick Checklist for Trend Identification:

✅ Strong Uptrend:

- Higher highs and higher lows

- Price above rising moving averages

- Valid upward trendline intact

- ADX above 25

- Increasing volume on rallies

✅ Strong Downtrend:

- Lower highs and lower lows

- Price below falling moving averages

- Valid downward trendline intact

- ADX above 25

- Increasing volume on declines

⚠️ No Clear Trend (Stay Out):

- Choppy price action

- MAs flat or intertwined

- ADX below 20

- Price between support/resistance

Common Beginner Mistakes:

❌ Looking at only one timeframe

❌ Ignoring the bigger picture

❌ Trading every small wiggle as a "trend"

❌ Not waiting for confirmation

❌ Confusing corrections with reversals

Pro Tips:

💡 **The 3-Touch Rule:** A trend becomes more reliable after price respects a trendline at least 3 times

💡 **Trend is Your Timeframe:** What's an uptrend on daily might be a pullback on weekly

💡 **When in Doubt, Zoom Out:** Higher timeframes show the true direction

💡 **Trade WITH the trend, not against it:** Counter-trend trades have lower probability

**Remember:** Trend identification isn't about being perfect - it's about being on the right side of the market more often than not. Start with the basics (higher highs/lows), then add confirmation tools as you gain experience.

More updates with examples and Explanation on individual topics in a easy way to understand.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.