SBS - Strong Buy Setup with Connors RSI2 Confirmation

SBS - Companhia de Saneamento Básico do Estado de São Paulo

📈 Strong Buy Signal | Triple Confirmation: Fundamental + Technical + Connors RSI2

🎯 Trade Idea Overview

Direction: LONG

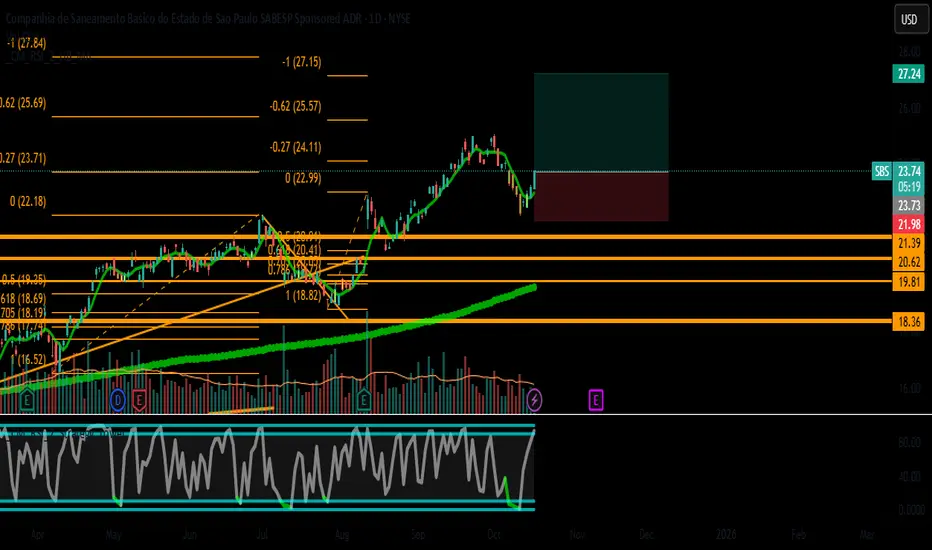

Entry Zone: $23.50 - $23.80

Stop Loss: $21.98

Take Profit: $27.24

Strategy: Swing Trade (1–3 weeks)

Confidence Level: High (95%)

📊 Why SBS?

✅ Fundamental Strength (Score: 9/9)

Revenue Growth: Strong 📈

Net Income Growth: Strong 💹

Valuation: Undervalued across P/E, P/B, and P/S ratios

Debt Health: Excellent (Score: 8/10)

Overall Fundamental Score: 9/9 🏆

✅ Technical Alignment

Daily Trend: ✅ Alcista

4H Trend: 🔁 Bajista (Corrective) → Ideal for entry

1H Trend: ✅ Alcista

RSI: Neutral (53.75) – Room to run

MACD: On the verge of bullish crossover

✅ Connors RSI2 Confirmation

Señal de Compra: Active on Oct 9–10

Strategy: RSI2 oversold bounce + momentum follow-through

Timing: Ideal entry within the 5-day signal window

📍 Entry & Risk Management

Recommended Entry: $23.72 (market or limit)

Stop Loss: $21.98 (7.3% risk)

Take Profit: $27.24 (14.8% reward)

R/R Ratio: 1:2.03 ✅

🧠 Trade Rationale

SBS combines strong fundamentals with a technical pullback and a confirmed Connors RSI2 buy signal.

The 4H downtrend offers a clean entry before resumption of the daily uptrend.

Minimal debt risk and strong growth profile support a medium-term hold.

📆 Watch List

Monitor for a close above $24.20 for confirmation of bullish momentum.

Watch for any fundamental news from earnings or sector updates.

✅ Summary

Asset: SBS

Action: BUY

Entry: $23.72

SL: $21.98

TP: $27.24

Signal Type: Multi-timeframe + Connors RSI2 Confirmed

‼️ Disclaimer

This post is for educational and informational purposes only and does not constitute financial advice or a recommendation to buy or sell any security. Trading stocks and other financial instruments carries a high level of risk and may not be suitable for all investors. You should carefully consider your investment objectives, experience, and risk appetite before acting on any information contained in this analysis. The author is not a registered financial advisor and assumes no liability for any financial losses or gains resulting from this information. Past performance is not indicative of future results. Always conduct your own due diligence.

📈 Strong Buy Signal | Triple Confirmation: Fundamental + Technical + Connors RSI2

🎯 Trade Idea Overview

Direction: LONG

Entry Zone: $23.50 - $23.80

Stop Loss: $21.98

Take Profit: $27.24

Strategy: Swing Trade (1–3 weeks)

Confidence Level: High (95%)

📊 Why SBS?

✅ Fundamental Strength (Score: 9/9)

Revenue Growth: Strong 📈

Net Income Growth: Strong 💹

Valuation: Undervalued across P/E, P/B, and P/S ratios

Debt Health: Excellent (Score: 8/10)

Overall Fundamental Score: 9/9 🏆

✅ Technical Alignment

Daily Trend: ✅ Alcista

4H Trend: 🔁 Bajista (Corrective) → Ideal for entry

1H Trend: ✅ Alcista

RSI: Neutral (53.75) – Room to run

MACD: On the verge of bullish crossover

✅ Connors RSI2 Confirmation

Señal de Compra: Active on Oct 9–10

Strategy: RSI2 oversold bounce + momentum follow-through

Timing: Ideal entry within the 5-day signal window

📍 Entry & Risk Management

Recommended Entry: $23.72 (market or limit)

Stop Loss: $21.98 (7.3% risk)

Take Profit: $27.24 (14.8% reward)

R/R Ratio: 1:2.03 ✅

🧠 Trade Rationale

SBS combines strong fundamentals with a technical pullback and a confirmed Connors RSI2 buy signal.

The 4H downtrend offers a clean entry before resumption of the daily uptrend.

Minimal debt risk and strong growth profile support a medium-term hold.

📆 Watch List

Monitor for a close above $24.20 for confirmation of bullish momentum.

Watch for any fundamental news from earnings or sector updates.

✅ Summary

Asset: SBS

Action: BUY

Entry: $23.72

SL: $21.98

TP: $27.24

Signal Type: Multi-timeframe + Connors RSI2 Confirmed

‼️ Disclaimer

This post is for educational and informational purposes only and does not constitute financial advice or a recommendation to buy or sell any security. Trading stocks and other financial instruments carries a high level of risk and may not be suitable for all investors. You should carefully consider your investment objectives, experience, and risk appetite before acting on any information contained in this analysis. The author is not a registered financial advisor and assumes no liability for any financial losses or gains resulting from this information. Past performance is not indicative of future results. Always conduct your own due diligence.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.