SERVE Robotics (NASDAQ: SERV) – Ichimoku-Based Trade Setup

Ticker: SERV

Exchange: NASDAQ

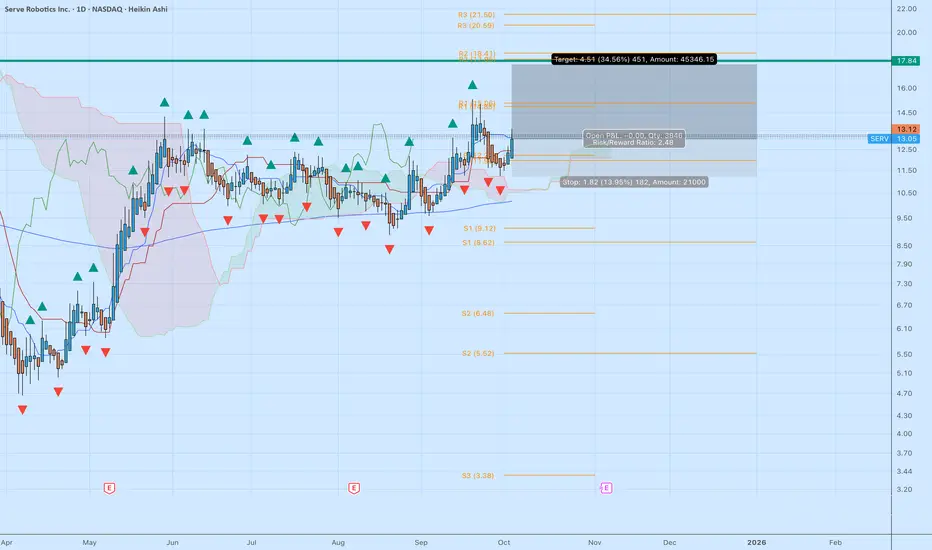

Chart: 1D Heikin Ashi with Ichimoku Cloud, Pivot Points, and Risk/Reward setup

Trade Idea: Long position targeting 17.84 (+34.5%) with stop at 11.23 (–13.9%)

Risk/Reward Ratio: 2.48

Technical Analysis (Ichimoku Focus)

Price has reclaimed the top of the Ichimoku cloud, confirming a bullish Kumo breakout. The Senkou Span A is angled upward, signaling improving short-term momentum after a multi-month consolidation.

The Tenkan-sen (conversion line) has crossed above the Kijun-sen (base line), generating a strong bullish signal above the cloud. The Chikou Span (lagging line) has also cleared price action, confirming trend continuation.

Support levels are seen at 12.00–12.30 (Kijun support) and 10.80 (bottom of the cloud and S1 zone). Resistance levels are near 13.85 (R1 pivot) and 17.84 (R2 target).

Volume has been rising during the recent breakout, suggesting renewed institutional participation. With the range between 11–13 resolving upward, the technical structure favors continuation rather than rejection.

Fundamental Overview

Serve Robotics, a spinout of Uber’s autonomous delivery division, continues expanding its partnerships with Uber Eats and other delivery platforms. The company is actively deploying autonomous sidewalk delivery robots across multiple U.S. cities.

Recent financials show improved revenue growth and cost efficiency per delivery, with losses narrowing quarter over quarter. Key catalysts include continued Uber Eats integration, expansion of the robot fleet, and increased investor interest in AI-driven logistics and robotics infrastructure.

Summary

SERV is positioned in a textbook Ichimoku breakout zone. Technical signals—cloud breakout, bullish Tenkan/Kijun cross, and confirmed Chikou alignment—are supported by strong fundamental momentum in the autonomous robotics sector.

If current support holds, the technical target remains 17.80–18.00 with a favorable risk/reward setup around 2.5:1.

Ticker: SERV

Exchange: NASDAQ

Chart: 1D Heikin Ashi with Ichimoku Cloud, Pivot Points, and Risk/Reward setup

Trade Idea: Long position targeting 17.84 (+34.5%) with stop at 11.23 (–13.9%)

Risk/Reward Ratio: 2.48

Technical Analysis (Ichimoku Focus)

Price has reclaimed the top of the Ichimoku cloud, confirming a bullish Kumo breakout. The Senkou Span A is angled upward, signaling improving short-term momentum after a multi-month consolidation.

The Tenkan-sen (conversion line) has crossed above the Kijun-sen (base line), generating a strong bullish signal above the cloud. The Chikou Span (lagging line) has also cleared price action, confirming trend continuation.

Support levels are seen at 12.00–12.30 (Kijun support) and 10.80 (bottom of the cloud and S1 zone). Resistance levels are near 13.85 (R1 pivot) and 17.84 (R2 target).

Volume has been rising during the recent breakout, suggesting renewed institutional participation. With the range between 11–13 resolving upward, the technical structure favors continuation rather than rejection.

Fundamental Overview

Serve Robotics, a spinout of Uber’s autonomous delivery division, continues expanding its partnerships with Uber Eats and other delivery platforms. The company is actively deploying autonomous sidewalk delivery robots across multiple U.S. cities.

Recent financials show improved revenue growth and cost efficiency per delivery, with losses narrowing quarter over quarter. Key catalysts include continued Uber Eats integration, expansion of the robot fleet, and increased investor interest in AI-driven logistics and robotics infrastructure.

Summary

SERV is positioned in a textbook Ichimoku breakout zone. Technical signals—cloud breakout, bullish Tenkan/Kijun cross, and confirmed Chikou alignment—are supported by strong fundamental momentum in the autonomous robotics sector.

If current support holds, the technical target remains 17.80–18.00 with a favorable risk/reward setup around 2.5:1.

Trade active

Note

You could take some profit here, but I am going to let it run. Trade closed: target reached

If you found my trades helpful, please consider sending a tip in BTC to: bc1qr35mrh82hykpy9v6znpsyuew85x84ezjyrrf6m

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

If you found my trades helpful, please consider sending a tip in BTC to: bc1qr35mrh82hykpy9v6znpsyuew85x84ezjyrrf6m

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.