Technical Analysis (from your chart)

Trend & Structure

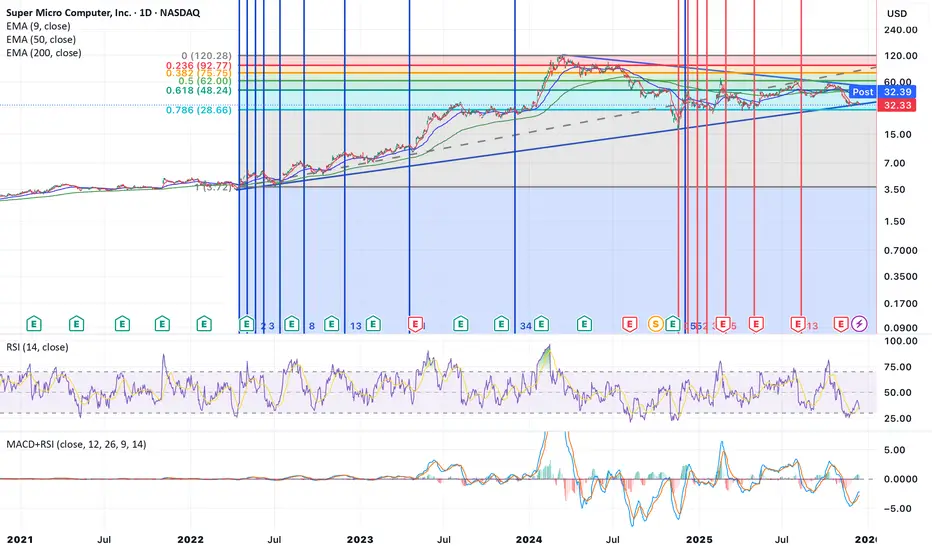

• The stock has been in a long-term uptrend since 2022 with several consolidation phases.

• Multiple support/resistance horizontals and trendlines are drawn — price currently sitting near a major support zone around ~$30–$35.

• Price oscillates around the 50 & 200 EMAs — often a sign of trend indecision or transition.

Oscillators

• RSI (14): currently mid-range — not strongly overbought or oversold, but recent downward bias suggests short-term bearish momentum building.

• MACD: recent signal line crossover indicates possible short-term relief bounce, but overall trend direction still unclear.

Key Levels

• Support: ~$30 (historical pivot, rising trendline)

• Resistance: ~$50–$55 (cluster of previous highs)

• Break above/below these could signal the next leg.

Short-Term Bias: Neutral to slightly bearish until confirmation above recent range high.

⸻

📈 Fundamental Snapshot

Valuation

• P/E (TTM): ~27–29x — moderately high relative to historical norms but not extreme for tech hardware.

• Forward P/E: ~19–20x — suggests expected earnings growth priced in.

Earnings

• EPS (TTM): ~1.25–1.67 (data vary slightly by source)

• EPS recently declined year-over-year, reflecting tightening margins and cost pressures.

Profitability & Other Ratios

• Profit Margin around ~4–5% — fairly slim for tech.

• P/B: ~3.1–3.6, P/S: ~0.9–1.0 — moderate valuation relative to sales and book.

Company Context

• Serves servers/storage for enterprise, cloud, AI & 5G.

• Revenue growth and EPS have shown volatility due to demand cycles and cost pressures.

⸻

📌 Trade-Ready Summary (Caption-Style)

SMCI – Super Micro Computer (NASDAQ)

Current Price: ~$32–33

P/E (TTM): ~27–29x

Forward P/E: ~19–20x

EPS: ~1.3–1.7

Key Support: ~$30

Key Resistance: ~$50–55

Tech View: Price holding long-term trend support; oscillators neutral to bearish short-term. Need break above recent range for bullish confirmation.

Fundamental View: Valuation reflects growth expectations but margins are thin; earnings have recently softened.

Bias: Neutral to cautious — trade range, watch breakout or breakdown.

Trend & Structure

• The stock has been in a long-term uptrend since 2022 with several consolidation phases.

• Multiple support/resistance horizontals and trendlines are drawn — price currently sitting near a major support zone around ~$30–$35.

• Price oscillates around the 50 & 200 EMAs — often a sign of trend indecision or transition.

Oscillators

• RSI (14): currently mid-range — not strongly overbought or oversold, but recent downward bias suggests short-term bearish momentum building.

• MACD: recent signal line crossover indicates possible short-term relief bounce, but overall trend direction still unclear.

Key Levels

• Support: ~$30 (historical pivot, rising trendline)

• Resistance: ~$50–$55 (cluster of previous highs)

• Break above/below these could signal the next leg.

Short-Term Bias: Neutral to slightly bearish until confirmation above recent range high.

⸻

📈 Fundamental Snapshot

Valuation

• P/E (TTM): ~27–29x — moderately high relative to historical norms but not extreme for tech hardware.

• Forward P/E: ~19–20x — suggests expected earnings growth priced in.

Earnings

• EPS (TTM): ~1.25–1.67 (data vary slightly by source)

• EPS recently declined year-over-year, reflecting tightening margins and cost pressures.

Profitability & Other Ratios

• Profit Margin around ~4–5% — fairly slim for tech.

• P/B: ~3.1–3.6, P/S: ~0.9–1.0 — moderate valuation relative to sales and book.

Company Context

• Serves servers/storage for enterprise, cloud, AI & 5G.

• Revenue growth and EPS have shown volatility due to demand cycles and cost pressures.

⸻

📌 Trade-Ready Summary (Caption-Style)

SMCI – Super Micro Computer (NASDAQ)

Current Price: ~$32–33

P/E (TTM): ~27–29x

Forward P/E: ~19–20x

EPS: ~1.3–1.7

Key Support: ~$30

Key Resistance: ~$50–55

Tech View: Price holding long-term trend support; oscillators neutral to bearish short-term. Need break above recent range for bullish confirmation.

Fundamental View: Valuation reflects growth expectations but margins are thin; earnings have recently softened.

Bias: Neutral to cautious — trade range, watch breakout or breakdown.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.