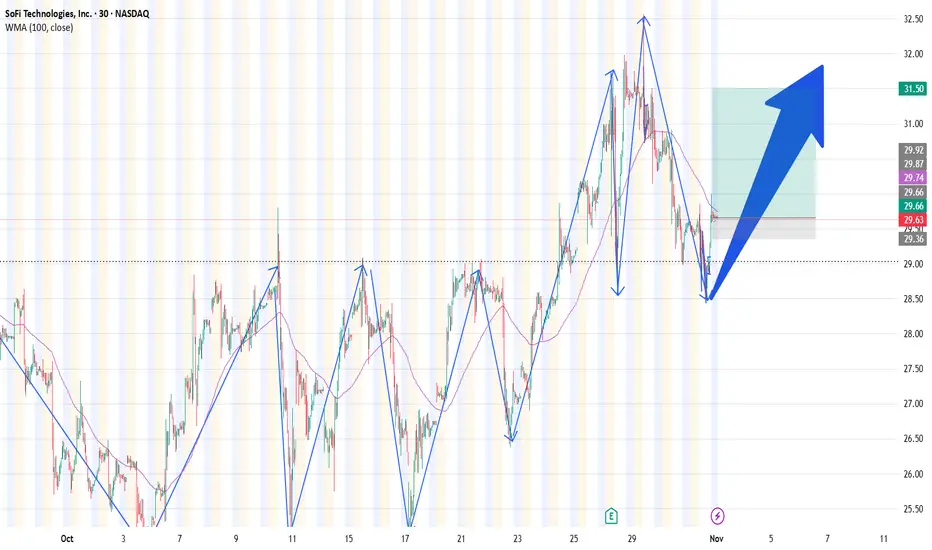

Sofi has shown a clear pattern of sell-offs and investors buying the dips. Since the first sell-off on October 10, sofi has risen to its area of ATH. On Oct 1st, Sofi made a strong rebound from the previous closing day price to close above 2%, signaling a possible low.

Fundamentally, SOFI had a strong performance on their ER, which made it reach ATH of 32.57.

The recent sell-off, due to Powell mentioning that Dec cuts were not factored in, also dropped GOOG, from its ATH after their ER.

It crossed its 100WMA. It needs to stay above this support. On the previous sell-off, when it crossed this 100WMA, it reached its resistance. If it drops below, I will be out.

I am long on this stock

TP: 31.50

Fundamentally, SOFI had a strong performance on their ER, which made it reach ATH of 32.57.

The recent sell-off, due to Powell mentioning that Dec cuts were not factored in, also dropped GOOG, from its ATH after their ER.

It crossed its 100WMA. It needs to stay above this support. On the previous sell-off, when it crossed this 100WMA, it reached its resistance. If it drops below, I will be out.

I am long on this stock

TP: 31.50

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.