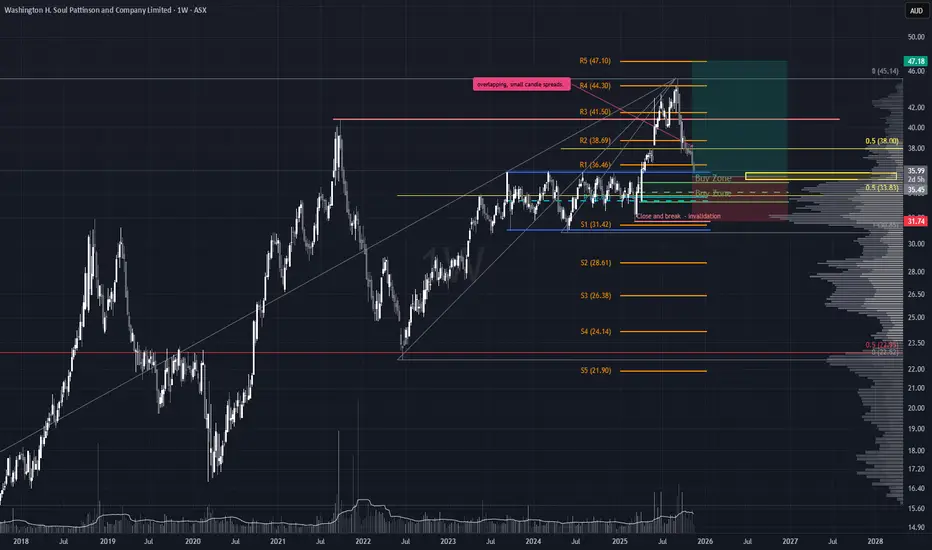

Washington SOL shaping up nicely. After the initial breakout from the range, price is pulling back into a key Area of Interest. So far, the retrace is coming in on declining volume with tight, overlapping candles classic signs of demand stepping in. No confirmation yet on a local trend shift, and of course, a surge in supply could flip the script. But for now, we take it step by step.

Trade Scenario

Starting to layer in here makes sense. Price is sitting right on top of the prior range, which also aligns with a minor Low Volume Node acting as support.

The second zone (marked on the chart) is more significant: it lines up with the yearly pivot, the EQ of the monthly demand wick, and a key 50% level. If that zone gives way, we’re likely looking at a deeper reaccumulation phase.

Stop Loss

Clean invalidation is a break and close below 31.69.

If we print a higher weekly swing low, we can tighten stops to that level.

Take Profit

First target is just below the ATH, quick and clean.

Trail the rest using weekly higher swing lows to stay in sync with structure.

Trade Scenario

Starting to layer in here makes sense. Price is sitting right on top of the prior range, which also aligns with a minor Low Volume Node acting as support.

The second zone (marked on the chart) is more significant: it lines up with the yearly pivot, the EQ of the monthly demand wick, and a key 50% level. If that zone gives way, we’re likely looking at a deeper reaccumulation phase.

Stop Loss

Clean invalidation is a break and close below 31.69.

If we print a higher weekly swing low, we can tighten stops to that level.

Take Profit

First target is just below the ATH, quick and clean.

Trail the rest using weekly higher swing lows to stay in sync with structure.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.