My overall bias for Solana is bullish, but I must say it has been very frustrating asset to hold and trade for the last 18 months.

There are a lot of positive news coming up in the Solana ecosystem and the value of Solana should be much higher than the current price. However, the current chart set up is very bearish and I think it can potentially go lower. I will happily revise my view when the situation changes but I won't be buying the dip for the reasons below:

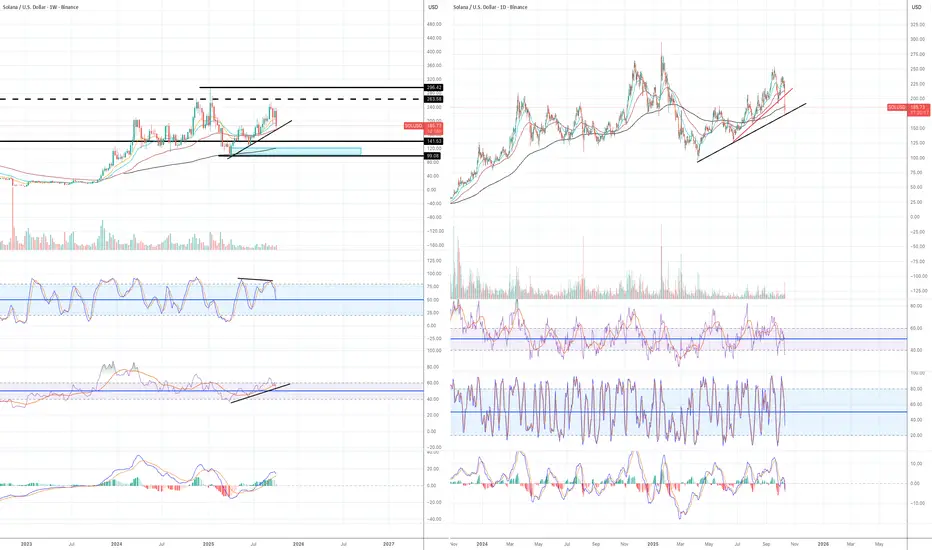

Weekly:

Stochastic indicator has formed a very clear negative divergence.

RSI lines have crossed to the downside and breached below the ascending trendline.

MACD histogram is losing bullish momentum and lines are about to cross (not confirmed)

The price has failed to go above not only the previous higher high, but also the previous cycle's all time high.

The price has breached below the ascending trendline, EMA 12 and EMA 21. (no confirmed until the end of tomorrow)

There is an unmitigated fair value gap (order block?) around $100 and $123 area (see light blue rectangular block). That is the April low when the market started to have a V-shape recovery.

I have been hearing over and over in the mainstream media that at the market bottom in April 2025, retail investors went in and bought the dip, but institutional players missed the rally by staying on the sideline. I am just wondering if big players are trying to push the price to the level where they were initially left behind. It is just my speculation, but the price is getting closer to that level.

Daily:

A daily candle closed below EMA55 and is now hovering over EMA200.

The price broke below the first ascending trendline (red line) and now moving toward the second one (black one)

All three momentum indicators have decisively entered the bear zone.

Conclusions:

I will only focus on daily and weekly charts for now. I have been watching the price move in the lower time frames and the price is refusing to go above yesterday's closing price, which makes me think there are lots of selling pressures still.

Good luck, everyone. I hope you are doing ok in this wild market.

There are a lot of positive news coming up in the Solana ecosystem and the value of Solana should be much higher than the current price. However, the current chart set up is very bearish and I think it can potentially go lower. I will happily revise my view when the situation changes but I won't be buying the dip for the reasons below:

Weekly:

Stochastic indicator has formed a very clear negative divergence.

RSI lines have crossed to the downside and breached below the ascending trendline.

MACD histogram is losing bullish momentum and lines are about to cross (not confirmed)

The price has failed to go above not only the previous higher high, but also the previous cycle's all time high.

The price has breached below the ascending trendline, EMA 12 and EMA 21. (no confirmed until the end of tomorrow)

There is an unmitigated fair value gap (order block?) around $100 and $123 area (see light blue rectangular block). That is the April low when the market started to have a V-shape recovery.

I have been hearing over and over in the mainstream media that at the market bottom in April 2025, retail investors went in and bought the dip, but institutional players missed the rally by staying on the sideline. I am just wondering if big players are trying to push the price to the level where they were initially left behind. It is just my speculation, but the price is getting closer to that level.

Daily:

A daily candle closed below EMA55 and is now hovering over EMA200.

The price broke below the first ascending trendline (red line) and now moving toward the second one (black one)

All three momentum indicators have decisively entered the bear zone.

Conclusions:

I will only focus on daily and weekly charts for now. I have been watching the price move in the lower time frames and the price is refusing to go above yesterday's closing price, which makes me think there are lots of selling pressures still.

Good luck, everyone. I hope you are doing ok in this wild market.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.