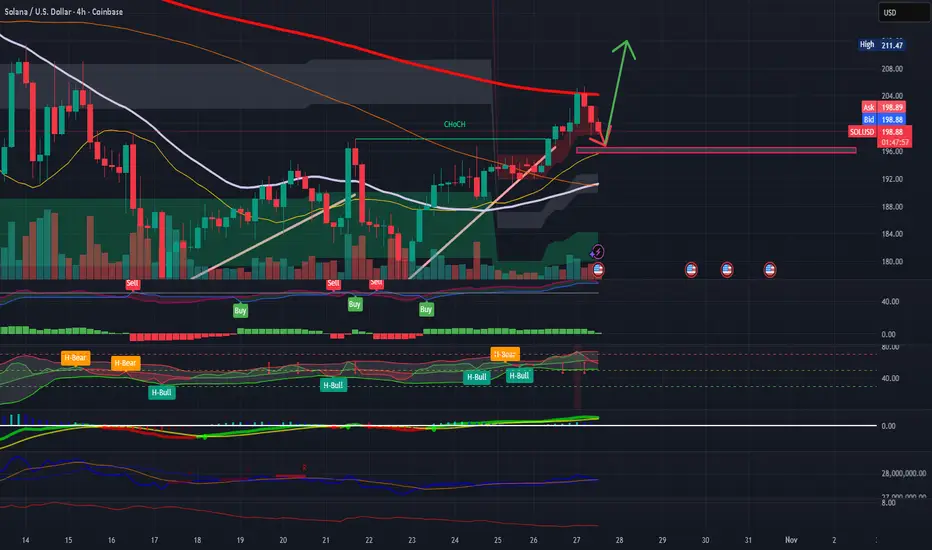

Solana is currently consolidating near $200–$205 after a strong impulsive move from the $177 base. On the 1H–4H timeframes, price action suggests that Wave (3) has completed, and the market is preparing for a short-term Wave (4) correction toward $195–$196.

This zone aligns with key confluences — 0.382 Fibonacci retracement, VWMA support, and a 1H demand/OB cluster. As long as SOL stays above $192, the bullish structure remains intact.

Once momentum indicators (RSI > 55 + QQE green) confirm support in that zone, a new Wave (5) expansion is expected, targeting $211–$219 within the next few days.

Scenarios:

Base Case: Controlled dip to $195–$196 → continuation to $211–$219 (Wave 5).

Invalidation: Daily close below $191.8 would neutralize the bullish count.

Bias: Bullish continuation after pullback

Timeframe: 1H–4H (Short- to mid-term outlook)

Next key levels: Support $195–$196 → Targets $211–$219

This zone aligns with key confluences — 0.382 Fibonacci retracement, VWMA support, and a 1H demand/OB cluster. As long as SOL stays above $192, the bullish structure remains intact.

Once momentum indicators (RSI > 55 + QQE green) confirm support in that zone, a new Wave (5) expansion is expected, targeting $211–$219 within the next few days.

Scenarios:

Base Case: Controlled dip to $195–$196 → continuation to $211–$219 (Wave 5).

Invalidation: Daily close below $191.8 would neutralize the bullish count.

Bias: Bullish continuation after pullback

Timeframe: 1H–4H (Short- to mid-term outlook)

Next key levels: Support $195–$196 → Targets $211–$219

Trade active

SOL / USD – Wave (4) Corrective Pullback Holding Key Zone (1H–4H Outlook Update)Price action continues to respect the projected Wave (4) correction zone between $192 – $195, aligning with the 0.382 Fib retracement of the prior Wave (3) leg and the lower Ichimoku cloud edge. Despite short-term weakness, the larger impulsive count toward Wave (5) remains intact as long as this support band holds on 4-hour closes.

The 1-hour structure shows a clear three-legged (a-b-c) correction finishing near $192.8 with bullish absorption tails and reduced sell-side delta. OBV remains stable and no breakdown has confirmed below the VWMA (200).

Momentum outlook:

– RSI Games printing mixed H-Bear/H-Bull signals but curling from mid-40s zone.

– QQE and CM_Ult MACD beginning to flatten, suggesting bearish momentum is fading.

– Volume declining through the correction, which favors accumulation over distribution.

Ichimoku & EMA structure:

Price still trades within the 4H cloud and above the 100 EMA cluster. A daily close back above $198.5–$200 would confirm bullish continuation and trigger Wave (5) initiation toward the $205 – $210 supply zone.

Invalidation:

A decisive 4H close below $191.5 – $188.8 would violate Wave (4) proportions and confirm a structure shift → neutral-bearish.

Near-term plan:

– Maintain long bias while $191–$192 support holds.

– Add on reclaim of $198.6 + volume confirmation > 15 k.

– First Wave (5) target: $205.3, secondary extension: $211 – $214.

Note

The previous SOL setup has now been invalidated due to a break below the key structural support and failure of the Wave-4 hold.Keyvan Khodakhah

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Keyvan Khodakhah

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.