We see this bullish novel on the 1D timeframe, which is a strong formation in this kind of trend.

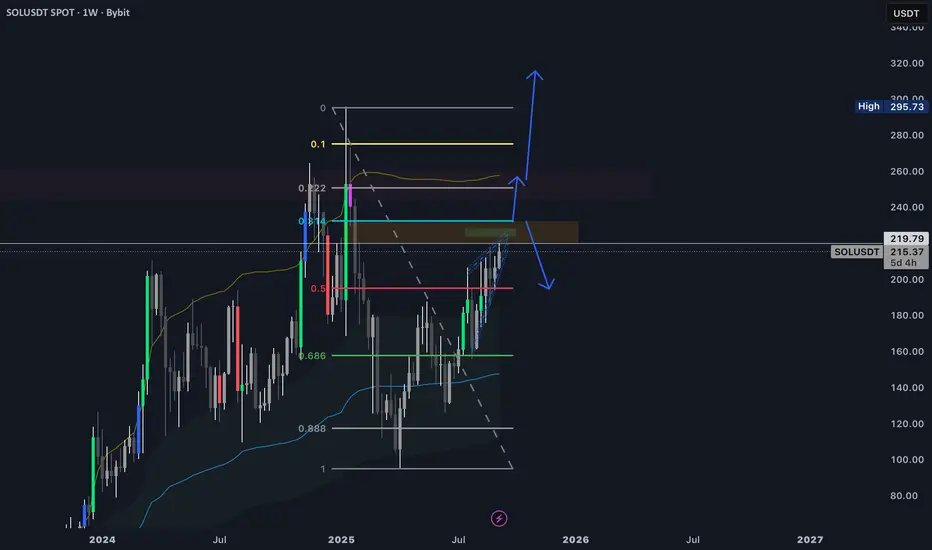

Next, one of the most important Fibonacci levels in my opinion is 0.314, which is closing our volume gap (visible more clearly on the 1W timeframe). These two confluences, plus the divergence seen from the 1D TF downward, make me think of a possible slight downtrend from the 223–229 area, with potential liquidity grabs up to 232. In that case, we could be back at 193 and then continue the ride toward a new ATH.

One thing we need to keep in mind (but just as a possibility) is the Head & Shoulders formation from March 2024, with the head at the ATH and a potential right shoulder forming right now. It’s a darker scenario, but we shouldn’t forget about it.

So, I remain bearish until we break above $240.

Let’s see what the market gives us.

Next, one of the most important Fibonacci levels in my opinion is 0.314, which is closing our volume gap (visible more clearly on the 1W timeframe). These two confluences, plus the divergence seen from the 1D TF downward, make me think of a possible slight downtrend from the 223–229 area, with potential liquidity grabs up to 232. In that case, we could be back at 193 and then continue the ride toward a new ATH.

One thing we need to keep in mind (but just as a possibility) is the Head & Shoulders formation from March 2024, with the head at the ATH and a potential right shoulder forming right now. It’s a darker scenario, but we shouldn’t forget about it.

So, I remain bearish until we break above $240.

Let’s see what the market gives us.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.