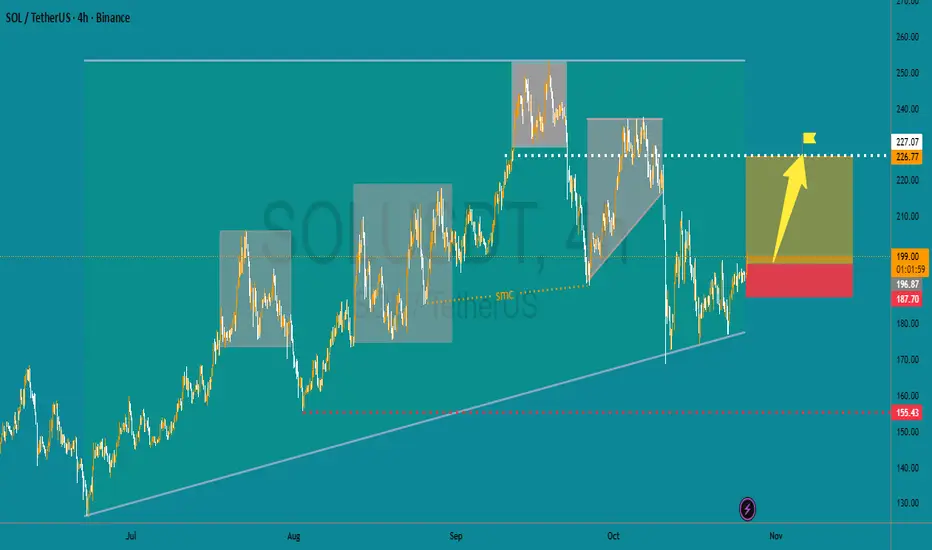

📊 SOL/USDT 4H – Bullish Reversal Setup 🚀

🔍 Market Structure Analysis

The market has shown a clear uptrend structure with higher lows (HLs) consistently forming along an ascending trendline 📈.

After a recent retracement, price respected the trendline support, signaling potential bullish continuation 🔁.

⚙️ Key Levels

Support Zone (Demand Area): 🟢 $185 – $190 → Buyers defending this region strongly.

Resistance Zone (Target Area): 🟡 $225 – $230 → Previous supply zone and structure high.

Invalidation (Stop-Loss Zone): 🔴 Below $185 → Break of structure if price drops here.

🧭 Trade Setup (as highlighted)

Entry Idea: Around $195 – $200 (current price range).

Stop-Loss: 🔻 Below $187 support.

Take Profit: 🎯 $227 zone (previous high).

Risk-to-Reward: Approximately 1:2.5, favorable for swing traders ⚖️.

💡 Market Psychology

The chart shows liquidity sweep of previous lows (liquidity grab 💧), followed by strong bullish momentum, indicating smart money accumulation (SMC concept).

The yellow arrow shows a potential break of structure (BOS) toward upside continuation.

📈 Summary

✅ Bullish momentum respected structure.

⚠️ Watch for confirmation candle close above $205–$210 before entering.

🔥 If confirmed, next bullish impulse could target $227+.

🏁 Conclusion: “Buy the Reversal, Ride the Trend” 🚀

Bias: Bullish 🟢

Strategy: Trend continuation after correction

Confidence: High if price holds above $190

🔍 Market Structure Analysis

The market has shown a clear uptrend structure with higher lows (HLs) consistently forming along an ascending trendline 📈.

After a recent retracement, price respected the trendline support, signaling potential bullish continuation 🔁.

⚙️ Key Levels

Support Zone (Demand Area): 🟢 $185 – $190 → Buyers defending this region strongly.

Resistance Zone (Target Area): 🟡 $225 – $230 → Previous supply zone and structure high.

Invalidation (Stop-Loss Zone): 🔴 Below $185 → Break of structure if price drops here.

🧭 Trade Setup (as highlighted)

Entry Idea: Around $195 – $200 (current price range).

Stop-Loss: 🔻 Below $187 support.

Take Profit: 🎯 $227 zone (previous high).

Risk-to-Reward: Approximately 1:2.5, favorable for swing traders ⚖️.

💡 Market Psychology

The chart shows liquidity sweep of previous lows (liquidity grab 💧), followed by strong bullish momentum, indicating smart money accumulation (SMC concept).

The yellow arrow shows a potential break of structure (BOS) toward upside continuation.

📈 Summary

✅ Bullish momentum respected structure.

⚠️ Watch for confirmation candle close above $205–$210 before entering.

🔥 If confirmed, next bullish impulse could target $227+.

🏁 Conclusion: “Buy the Reversal, Ride the Trend” 🚀

Bias: Bullish 🟢

Strategy: Trend continuation after correction

Confidence: High if price holds above $190

🔍 Market Structure Analysis

The market has shown a clear uptrend structure with higher lows (HLs) consistently forming along an ascending trendline 📈.

After a recent retracement, price respected the trendline support, signaling potential bullish continuation 🔁.

⚙️ Key Levels

Support Zone (Demand Area): 🟢 $185 – $190 → Buyers defending this region strongly.

Resistance Zone (Target Area): 🟡 $225 – $230 → Previous supply zone and structure high.

Invalidation (Stop-Loss Zone): 🔴 Below $185 → Break of structure if price drops here.

🧭 Trade Setup (as highlighted)

Entry Idea: Around $195 – $200 (current price range).

Stop-Loss: 🔻 Below $187 support.

Take Profit: 🎯 $227 zone (previous high).

Risk-to-Reward: Approximately 1:2.5, favorable for swing traders ⚖️.

💡 Market Psychology

The chart shows liquidity sweep of previous lows (liquidity grab 💧), followed by strong bullish momentum, indicating smart money accumulation (SMC concept).

The yellow arrow shows a potential break of structure (BOS) toward upside continuation.

📈 Summary

✅ Bullish momentum respected structure.

⚠️ Watch for confirmation candle close above $205–$210 before entering.

🔥 If confirmed, next bullish impulse could target $227+.

🏁 Conclusion: “Buy the Reversal, Ride the Trend” 🚀

Bias: Bullish 🟢

Strategy: Trend continuation after correction

Confidence: High if price holds above $190

🔍 Market Structure Analysis

The market has shown a clear uptrend structure with higher lows (HLs) consistently forming along an ascending trendline 📈.

After a recent retracement, price respected the trendline support, signaling potential bullish continuation 🔁.

⚙️ Key Levels

Support Zone (Demand Area): 🟢 $185 – $190 → Buyers defending this region strongly.

Resistance Zone (Target Area): 🟡 $225 – $230 → Previous supply zone and structure high.

Invalidation (Stop-Loss Zone): 🔴 Below $185 → Break of structure if price drops here.

🧭 Trade Setup (as highlighted)

Entry Idea: Around $195 – $200 (current price range).

Stop-Loss: 🔻 Below $187 support.

Take Profit: 🎯 $227 zone (previous high).

Risk-to-Reward: Approximately 1:2.5, favorable for swing traders ⚖️.

💡 Market Psychology

The chart shows liquidity sweep of previous lows (liquidity grab 💧), followed by strong bullish momentum, indicating smart money accumulation (SMC concept).

The yellow arrow shows a potential break of structure (BOS) toward upside continuation.

📈 Summary

✅ Bullish momentum respected structure.

⚠️ Watch for confirmation candle close above $205–$210 before entering.

🔥 If confirmed, next bullish impulse could target $227+.

🏁 Conclusion: “Buy the Reversal, Ride the Trend” 🚀

Bias: Bullish 🟢

Strategy: Trend continuation after correction

Confidence: High if price holds above $190

Join My Telegram Channel Link 👇

t.me/honeyspottrading

Join My Refferel Broker Link 👇

one.exnessonelink.com/a/uvd1etcgg1

Refferel code 👇

uvd1etcgg1

t.me/honeyspottrading

Join My Refferel Broker Link 👇

one.exnessonelink.com/a/uvd1etcgg1

Refferel code 👇

uvd1etcgg1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Join My Telegram Channel Link 👇

t.me/honeyspottrading

Join My Refferel Broker Link 👇

one.exnessonelink.com/a/uvd1etcgg1

Refferel code 👇

uvd1etcgg1

t.me/honeyspottrading

Join My Refferel Broker Link 👇

one.exnessonelink.com/a/uvd1etcgg1

Refferel code 👇

uvd1etcgg1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.