(From someone who’s watched this chart fake everyone out before.)

I’ve been wrong before on SPY — especially in weird low-volume chop zones — but here’s what I

do feel confident about today:

SPY looks like it wants lower.

Yes, we had a potential bull flag.

Yes, buyers keep trying to gap this thing up.

But every time, it gets slammed down by sellers.

That tells me one thing:

We’re in a controlled descent unless bulls flip the script *hard*.

🔍 TA View (No Macro Needed)

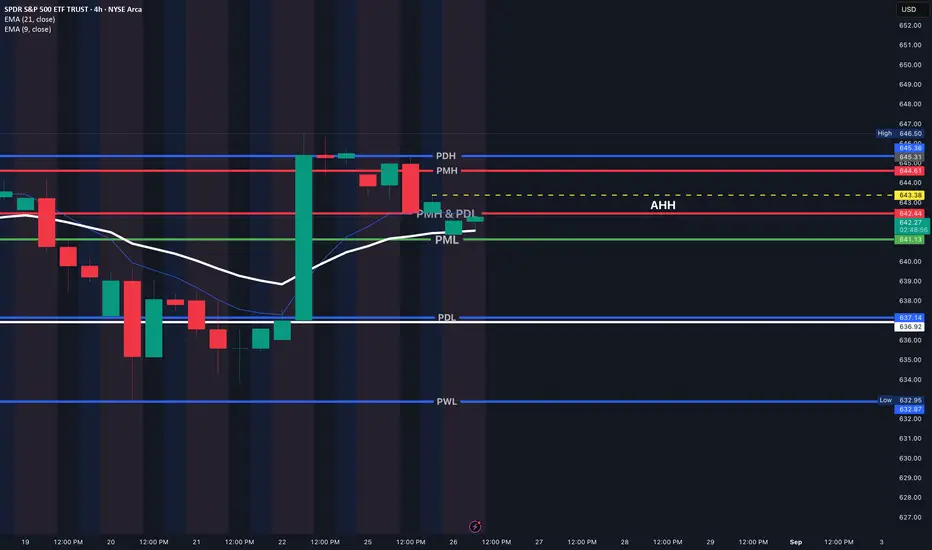

→ The 4H bull flag failed — sellers stepped in before it could break.

→ 642–644 is now a battlefield — if price can’t hold above it, there’s no real momentum.

→ VIX is creeping up and bonds aren’t helping → pressure is building, not easing.

→ Seasonality? Late August into September = historically bearish. That lines up perfectly.

🧭 Scenarios I’m Trading

1. ✅ Base Case: Downside Plays Out

* Price fails to reclaim 642–644.

* Stays under VWAP.

* Targets = 637 → 633

* Stretch = **628** if flows get aggressive.

2. ➖ Chop Trap

* Range between 642–644.

* Expect fakeouts both directions.

* No swings here — just scalp and survive.

3. ❌ I’m Wrong: Bulls Rip It

* Clean break over 646.5 with volume.

* Squeeze target = 648.5 → 650

* I stop out, reassess — not fading that move.

🎯 Final Bias (Unfiltered)

Unless bulls pull off a miracle over 646.5, I’m staying short-biased under 641

Looking for 637, maybe 633 if sellers stay in control.

If we chop? Cool. I’ll scalp the range.

If we squeeze? I’ll admit I’m wrong and flip.

But right now? This chart still wants lower.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.