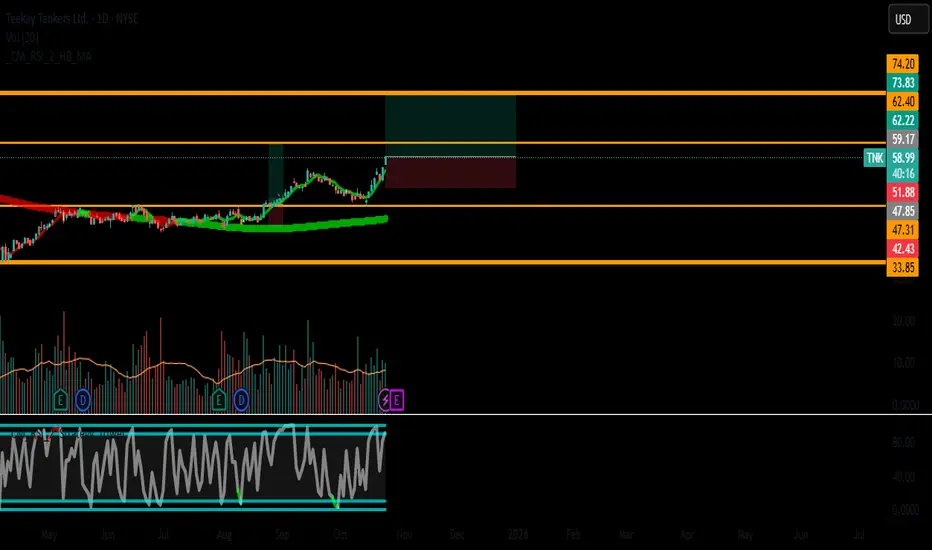

Symbol: TNK (Teekay Tankers Ltd.)

Timeframe: Daily/Weekly

Strategy: Trend Following - Long Position

🎯 TRADE SETUP

ENTRY: $59.15

STOP LOSS: $51.80

TAKE PROFIT: $73.85

RISK/REWARD: 1:2.0

📊 TECHNICAL ANALYSIS

Trend Structure:

✅ All Timeframes BULLISH (Daily, 4H, 1H)

✅ Higher Highs & Higher Lows pattern intact

✅ Price above all key Moving Averages

Key Levels:

Current Support: $57.00-58.00

Breakout Level: $59.00 (recent resistance)

Next Resistance: $65.00 → $73.85

📈 INDICATOR CONFIRMATION

Momentum & Strength:

RSI (14): 67-72 (Strong momentum, not overbought)

MACD: Bullish crossover above zero line

Volume: Consistent above average on up moves

SMA Alignment: Price > MA20 > MA50 > MA200

Volume Profile:

Accumulation visible at current levels

Institutional interest supporting uptrend

⛴️ SECTOR TAILWINDS

Shipping Industry Catalysts:

Strong tanker rates environment

Global energy transportation demand

Favorable supply/demand dynamics

Seasonal strength in shipping sector

🎯 TRADE MANAGEMENT

Position Sizing:

Risk: 1-1.5% of capital per trade

Stop: Hard stop at $51.80 (12.4% risk)

Profit Taking Strategy:

TP1: $65.00 (Partial take profit)

TP2: $73.85 (Full position target)

Alternative: Scale out 50% at $65, 50% at $73.85

Time Horizon: 4-12 weeks

⚠️ RISK MANAGEMENT

Invalidation Criteria:

Daily close below $51.80 = Exit trade

Failed breakout below $57.00 = Reduce position

Warning Signs:

Volume drying up on advances

RSI divergence on new highs

Broad market weakness affecting transports

🔄 ALTERNATIVE SCENARIOS

Bullish Case (60%):

Hold above $58.00, rally to $73.85+

Next extended target: $80.00

Neutral Case (30%):

Consolidate between $57-62 before next leg up

Bearish Case (10%):

Stop hit at $51.80, reassess market structure

💡 WHY THIS SETUP WORKS

Clean uptrend across all timeframes

Favorable 2:1 risk/reward ratio

Sector fundamentals supportive

Technical alignment confirms strength

Trade Plan Summary:

#TNK #SHIPPING #TANKERS #TRADINGSETUP #BREAKOUT #UPTREND #ENERGYTRANSPORT

Disclaimer: This is technical analysis only. Not financial advice. Always do your own research and manage risk appropriately. Past performance doesn't guarantee future results.

✅ Like if you find this analysis helpful!

🔔 Follow for more high-probability trade setups!

🔄 Share if you're also bullish on shipping!

Timeframe: Daily/Weekly

Strategy: Trend Following - Long Position

🎯 TRADE SETUP

ENTRY: $59.15

STOP LOSS: $51.80

TAKE PROFIT: $73.85

RISK/REWARD: 1:2.0

📊 TECHNICAL ANALYSIS

Trend Structure:

✅ All Timeframes BULLISH (Daily, 4H, 1H)

✅ Higher Highs & Higher Lows pattern intact

✅ Price above all key Moving Averages

Key Levels:

Current Support: $57.00-58.00

Breakout Level: $59.00 (recent resistance)

Next Resistance: $65.00 → $73.85

📈 INDICATOR CONFIRMATION

Momentum & Strength:

RSI (14): 67-72 (Strong momentum, not overbought)

MACD: Bullish crossover above zero line

Volume: Consistent above average on up moves

SMA Alignment: Price > MA20 > MA50 > MA200

Volume Profile:

Accumulation visible at current levels

Institutional interest supporting uptrend

⛴️ SECTOR TAILWINDS

Shipping Industry Catalysts:

Strong tanker rates environment

Global energy transportation demand

Favorable supply/demand dynamics

Seasonal strength in shipping sector

🎯 TRADE MANAGEMENT

Position Sizing:

Risk: 1-1.5% of capital per trade

Stop: Hard stop at $51.80 (12.4% risk)

Profit Taking Strategy:

TP1: $65.00 (Partial take profit)

TP2: $73.85 (Full position target)

Alternative: Scale out 50% at $65, 50% at $73.85

Time Horizon: 4-12 weeks

⚠️ RISK MANAGEMENT

Invalidation Criteria:

Daily close below $51.80 = Exit trade

Failed breakout below $57.00 = Reduce position

Warning Signs:

Volume drying up on advances

RSI divergence on new highs

Broad market weakness affecting transports

🔄 ALTERNATIVE SCENARIOS

Bullish Case (60%):

Hold above $58.00, rally to $73.85+

Next extended target: $80.00

Neutral Case (30%):

Consolidate between $57-62 before next leg up

Bearish Case (10%):

Stop hit at $51.80, reassess market structure

💡 WHY THIS SETUP WORKS

Clean uptrend across all timeframes

Favorable 2:1 risk/reward ratio

Sector fundamentals supportive

Technical alignment confirms strength

Trade Plan Summary:

#TNK #SHIPPING #TANKERS #TRADINGSETUP #BREAKOUT #UPTREND #ENERGYTRANSPORT

Disclaimer: This is technical analysis only. Not financial advice. Always do your own research and manage risk appropriately. Past performance doesn't guarantee future results.

✅ Like if you find this analysis helpful!

🔔 Follow for more high-probability trade setups!

🔄 Share if you're also bullish on shipping!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.