Date: November 04, 2025

Current Price: PKR 83.05

Change: +2.24 (+2.77%)

Volume: 9.78M

Executive Summary

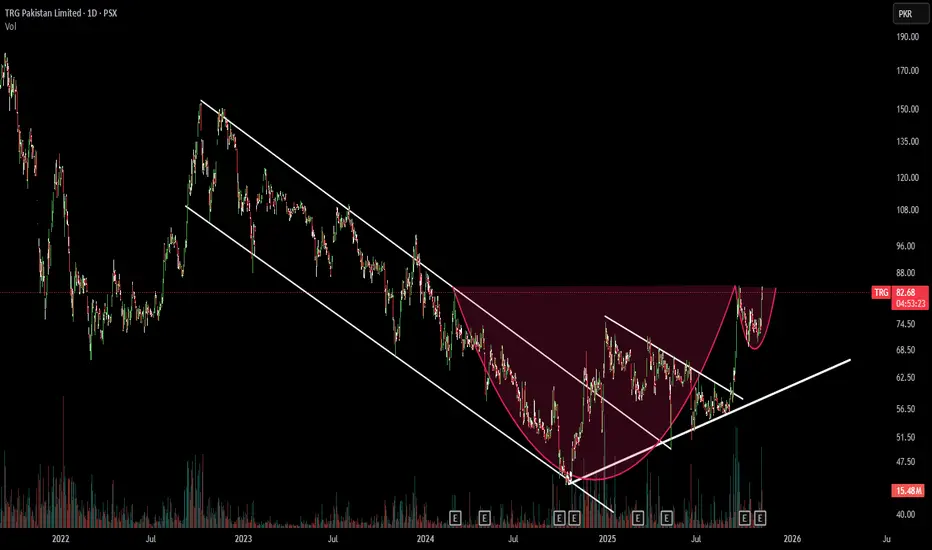

TRG Pakistan Limited exhibits a highly bullish technical setup with multiple confirming patterns signaling a potential major reversal. The stock has broken out from both a falling wedge and a cup and handle formation, both accompanied by significant volume expansion. This confluence of bullish indicators suggests strong upside potential.

Pattern Analysis

1. Cup and Handle Formation (Primary Pattern)

The Cup (Mid-2024 to Late 2024)

Left Rim: ~94 PKR

Base/Bottom: 43-48 PKR (rounded bottom formation)

Right Rim: Recovered to ~74-76 PKR

Duration: Approximately 12-15 months

Shape: Well-defined U-shaped cup (optimal formation)

The Handle (Sep-Oct 2025)

Formation Zone: 66-76 PKR consolidation

Retracement: Approximately 1/3 of cup's advance (healthy)

Volume Profile: Declining during handle formation (textbook pattern)

Breakout Level: ~75 PKR

Pattern Quality: Excellent

✓ U-shaped cup (not V-shaped)

✓ Proper handle retracement (1/3 to 1/2 of advance)

✓ Volume confirmation on breakout

✓ Declining volume in handle

2. Falling Wedge Pattern (Secondary Confirmation)

Structure:

Formation Period: Q2 2024 to Q4 2024

Pattern Type: Bullish reversal

Breakout: Successfully cleared upper trendline

Volume: Strong expansion on breakout

Significance:

The falling wedge nested within the cup's right side provides additional confirmation of accumulation and bullish sentiment. The breakout from this pattern coincides with the cup and handle breakout, creating a powerful dual-signal.

Key Technical Levels

Resistance Levels

88-94 PKR - Major long-term descending trendline from 2022 highs (immediate target)

100 PKR - Psychological level and previous support/resistance

125-130 PKR - Cup and handle measured move target

Support Levels

74-76 PKR - Breakout zone and previous wedge resistance (now support)

66-68 PKR - Handle low and secondary support

60 PKR - Psychological support level

Volume Analysis

Recent Activity:

Significant volume spikes marked at key reversal points (labeled 'E' on chart)

Current volume: 9.78M - well above recent average

Volume profile confirms institutional accumulation

Interpretation:

The volume expansion during breakout phases indicates genuine buying pressure and not just technical short-covering. This is a critical confirmation factor for the bullish thesis.

Price Targets & Projections

Conservative Target (High Probability)

88-94 PKR (6-13% upside)

Testing major descending trendline

Previous resistance zone

Timeframe: 2-4 weeks

Moderate Target (Medium Probability)

100-110 PKR (20-32% upside)

Breaking through long-term resistance

Psychological milestone

Timeframe: 1-3 months

Aggressive Target (Cup & Handle Measured Move)

125-130 PKR (50-56% upside)

Cup depth: ~51 points (94 - 43)

Measured from breakout at 75

Timeframe: 3-6 months

Risk Management

Bullish Scenario Remains Valid If:

Price holds above 74 PKR (breakout level)

Volume remains elevated on up days

Closes above major trendline (88-94 range)

Pattern Invalidation/Stop Loss

Critical Support: 74 PKR

Recommended Stop Loss: 72 PKR (below breakout with buffer)

Pattern Failure: Sustained close below 68 PKR

Risk-Reward Ratio

Entry at current levels (~83 PKR)

Stop loss at 72 PKR (11 points risk)

Target at 125 PKR (42 points reward)

R:R Ratio: 1:3.8 (Excellent)

Trading Strategy Recommendations

For Aggressive Traders

Entry: Current levels (82-85 PKR)

Stop Loss: 72 PKR

Target 1: 94 PKR (partial booking)

Target 2: 110 PKR (partial booking)

Target 3: 125 PKR (exit remaining)

For Conservative Traders

Entry: Wait for pullback to 76-78 PKR OR confirmation above 88 PKR

Stop Loss: 74 PKR (if entered on pullback) / 82 PKR (if entered on breakout)

Target: 100-110 PKR

Position Sizing

Given the technical strength but considering general market volatility, recommended position sizing: 2-4% of portfolio for aggressive traders, 1-2% for conservative traders.

Conclusion

TRG Pakistan Limited presents a compelling bullish opportunity with multiple technical confirmations:

Dual Pattern Breakout: Both cup and handle and falling wedge patterns have triggered

Volume Confirmation: Strong institutional buying evident

Risk-Reward: Favorable at current levels

Momentum: Building positive momentum after extended consolidation

Overall Rating: ⭐⭐⭐⭐ (4/5 - Strong Buy Signal)

The primary risk remains the overhead resistance from the long-term descending trendline. A confirmed break above 90-94 PKR would open the path to significantly higher levels. However, failure to hold above 74 PKR would invalidate the bullish setup and require reassessment.

Monitoring Points

Watch for daily closes above 88 PKR (trendline break)

Monitor volume on down days (should be declining)

Track broader Pakistan equity market sentiment

Observe any fundamental news/catalysts

Current Price: PKR 83.05

Change: +2.24 (+2.77%)

Volume: 9.78M

Executive Summary

TRG Pakistan Limited exhibits a highly bullish technical setup with multiple confirming patterns signaling a potential major reversal. The stock has broken out from both a falling wedge and a cup and handle formation, both accompanied by significant volume expansion. This confluence of bullish indicators suggests strong upside potential.

Pattern Analysis

1. Cup and Handle Formation (Primary Pattern)

The Cup (Mid-2024 to Late 2024)

Left Rim: ~94 PKR

Base/Bottom: 43-48 PKR (rounded bottom formation)

Right Rim: Recovered to ~74-76 PKR

Duration: Approximately 12-15 months

Shape: Well-defined U-shaped cup (optimal formation)

The Handle (Sep-Oct 2025)

Formation Zone: 66-76 PKR consolidation

Retracement: Approximately 1/3 of cup's advance (healthy)

Volume Profile: Declining during handle formation (textbook pattern)

Breakout Level: ~75 PKR

Pattern Quality: Excellent

✓ U-shaped cup (not V-shaped)

✓ Proper handle retracement (1/3 to 1/2 of advance)

✓ Volume confirmation on breakout

✓ Declining volume in handle

2. Falling Wedge Pattern (Secondary Confirmation)

Structure:

Formation Period: Q2 2024 to Q4 2024

Pattern Type: Bullish reversal

Breakout: Successfully cleared upper trendline

Volume: Strong expansion on breakout

Significance:

The falling wedge nested within the cup's right side provides additional confirmation of accumulation and bullish sentiment. The breakout from this pattern coincides with the cup and handle breakout, creating a powerful dual-signal.

Key Technical Levels

Resistance Levels

88-94 PKR - Major long-term descending trendline from 2022 highs (immediate target)

100 PKR - Psychological level and previous support/resistance

125-130 PKR - Cup and handle measured move target

Support Levels

74-76 PKR - Breakout zone and previous wedge resistance (now support)

66-68 PKR - Handle low and secondary support

60 PKR - Psychological support level

Volume Analysis

Recent Activity:

Significant volume spikes marked at key reversal points (labeled 'E' on chart)

Current volume: 9.78M - well above recent average

Volume profile confirms institutional accumulation

Interpretation:

The volume expansion during breakout phases indicates genuine buying pressure and not just technical short-covering. This is a critical confirmation factor for the bullish thesis.

Price Targets & Projections

Conservative Target (High Probability)

88-94 PKR (6-13% upside)

Testing major descending trendline

Previous resistance zone

Timeframe: 2-4 weeks

Moderate Target (Medium Probability)

100-110 PKR (20-32% upside)

Breaking through long-term resistance

Psychological milestone

Timeframe: 1-3 months

Aggressive Target (Cup & Handle Measured Move)

125-130 PKR (50-56% upside)

Cup depth: ~51 points (94 - 43)

Measured from breakout at 75

Timeframe: 3-6 months

Risk Management

Bullish Scenario Remains Valid If:

Price holds above 74 PKR (breakout level)

Volume remains elevated on up days

Closes above major trendline (88-94 range)

Pattern Invalidation/Stop Loss

Critical Support: 74 PKR

Recommended Stop Loss: 72 PKR (below breakout with buffer)

Pattern Failure: Sustained close below 68 PKR

Risk-Reward Ratio

Entry at current levels (~83 PKR)

Stop loss at 72 PKR (11 points risk)

Target at 125 PKR (42 points reward)

R:R Ratio: 1:3.8 (Excellent)

Trading Strategy Recommendations

For Aggressive Traders

Entry: Current levels (82-85 PKR)

Stop Loss: 72 PKR

Target 1: 94 PKR (partial booking)

Target 2: 110 PKR (partial booking)

Target 3: 125 PKR (exit remaining)

For Conservative Traders

Entry: Wait for pullback to 76-78 PKR OR confirmation above 88 PKR

Stop Loss: 74 PKR (if entered on pullback) / 82 PKR (if entered on breakout)

Target: 100-110 PKR

Position Sizing

Given the technical strength but considering general market volatility, recommended position sizing: 2-4% of portfolio for aggressive traders, 1-2% for conservative traders.

Conclusion

TRG Pakistan Limited presents a compelling bullish opportunity with multiple technical confirmations:

Dual Pattern Breakout: Both cup and handle and falling wedge patterns have triggered

Volume Confirmation: Strong institutional buying evident

Risk-Reward: Favorable at current levels

Momentum: Building positive momentum after extended consolidation

Overall Rating: ⭐⭐⭐⭐ (4/5 - Strong Buy Signal)

The primary risk remains the overhead resistance from the long-term descending trendline. A confirmed break above 90-94 PKR would open the path to significantly higher levels. However, failure to hold above 74 PKR would invalidate the bullish setup and require reassessment.

Monitoring Points

Watch for daily closes above 88 PKR (trendline break)

Monitor volume on down days (should be declining)

Track broader Pakistan equity market sentiment

Observe any fundamental news/catalysts

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.