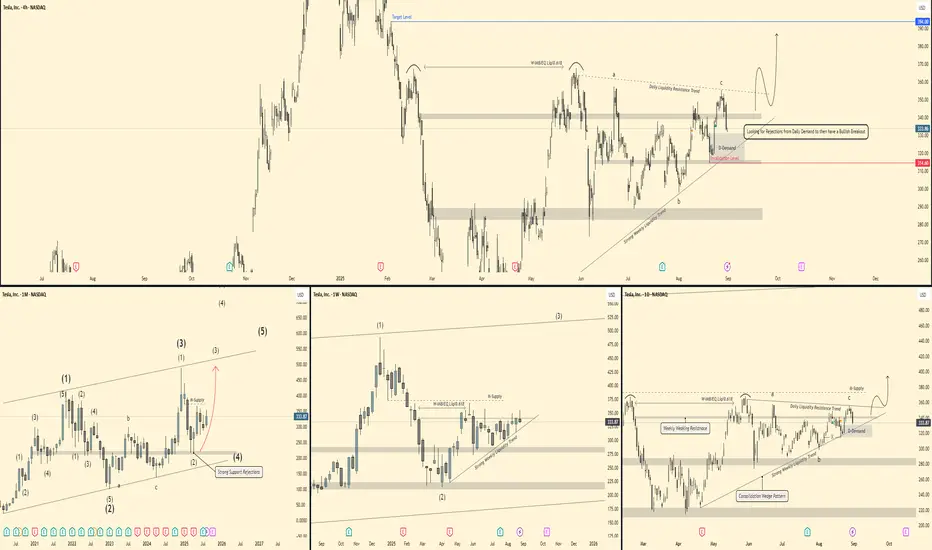

🕰 Monthly View

Price is respecting a long-term ascending channel.

Strong rejections from support confirm bullish momentum.

Current wave count suggests we are working through a larger impulsive structure – potential for Wave (3) continuation higher.

If momentum holds, upside could target the 450–500 zone in the longer run.

📆 Weekly View

Structure shows a 3-wave correction complete (ABC) into demand.

Price has tapped weekly demand + liquidity trendline.

Currently bouncing, with a breakout potential toward 375–400 (supply zone).

Breakout of the wedge pattern would confirm strength and continuation higher.

📅 Daily View

Price is reacting off Daily Demand (≈320–325 zone).

Strong liquidity resistance trend overhead (≈355–365).

If rejections hold and demand stays valid, a bullish breakout setup forms → target near 390–400.

Invalidation if we close below 314 (daily demand break).

⏱ 4H View

Local liquidity sweep into demand.

Bullish scenario: push toward 350–355 short-term.

Watch for confirmation: rejection candles + momentum shift needed before entry.

🎯 Bias & Trade Idea

Bias: Bullish (buy from demand)

Entry Zone: 320–330 (Daily Demand)

Targets:

Short-term → 355

Mid-term → 390–400

Invalidation: Daily close below 314

⚠️ Risk Note

Tesla is highly volatile. Stick to clear confirmations at demand before entry, and manage risk tightly below invalidation.

Price is respecting a long-term ascending channel.

Strong rejections from support confirm bullish momentum.

Current wave count suggests we are working through a larger impulsive structure – potential for Wave (3) continuation higher.

If momentum holds, upside could target the 450–500 zone in the longer run.

📆 Weekly View

Structure shows a 3-wave correction complete (ABC) into demand.

Price has tapped weekly demand + liquidity trendline.

Currently bouncing, with a breakout potential toward 375–400 (supply zone).

Breakout of the wedge pattern would confirm strength and continuation higher.

📅 Daily View

Price is reacting off Daily Demand (≈320–325 zone).

Strong liquidity resistance trend overhead (≈355–365).

If rejections hold and demand stays valid, a bullish breakout setup forms → target near 390–400.

Invalidation if we close below 314 (daily demand break).

⏱ 4H View

Local liquidity sweep into demand.

Bullish scenario: push toward 350–355 short-term.

Watch for confirmation: rejection candles + momentum shift needed before entry.

🎯 Bias & Trade Idea

Bias: Bullish (buy from demand)

Entry Zone: 320–330 (Daily Demand)

Targets:

Short-term → 355

Mid-term → 390–400

Invalidation: Daily close below 314

⚠️ Risk Note

Tesla is highly volatile. Stick to clear confirmations at demand before entry, and manage risk tightly below invalidation.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.