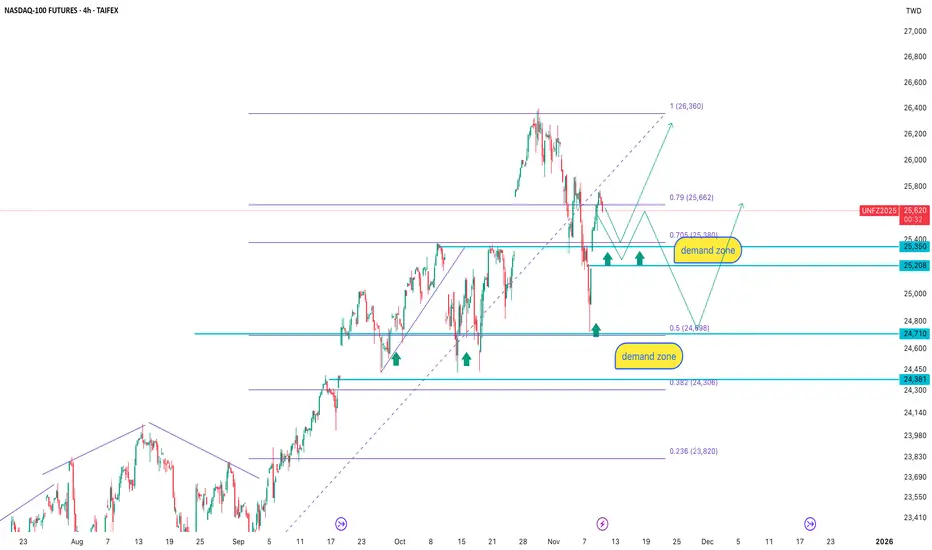

After the recent upward impulse, the price retraced into the key demand zone at 25 350–25 208, an area that has repeatedly triggered buying reactions in the past. T

he latest correction pushed the price into the 0.79–0.705 Fibonacci range, which frequently acts as a retest zone before continuation.

Below that lies an even stronger demand zone at 24 710–24 381, aligning with the 0.5 Fibonacci level and previous volume accumulation.

The trading logic here is simple: don’t chase the move, let the price come to demand and wait for confirmation.

As long as the market structure holds, the primary scenario remains bullish from demand zones with a target toward 26 360 and potentially higher.

Fundamentally, NASDAQ remains supported by expectations of softer Fed policy, strong tech capital inflows, and continued investment in AI, cloud, and data-center infrastructure. Smart money accumulates on corrections, not on peaks.

When price falls into demand, it’s not fear — it’s opportunity.

he latest correction pushed the price into the 0.79–0.705 Fibonacci range, which frequently acts as a retest zone before continuation.

Below that lies an even stronger demand zone at 24 710–24 381, aligning with the 0.5 Fibonacci level and previous volume accumulation.

The trading logic here is simple: don’t chase the move, let the price come to demand and wait for confirmation.

As long as the market structure holds, the primary scenario remains bullish from demand zones with a target toward 26 360 and potentially higher.

Fundamentally, NASDAQ remains supported by expectations of softer Fed policy, strong tech capital inflows, and continued investment in AI, cloud, and data-center infrastructure. Smart money accumulates on corrections, not on peaks.

When price falls into demand, it’s not fear — it’s opportunity.

👨🎓 Наш телеграм t.me/totoshkatrading

🉐 Платформы linktr.ee/totoshka55

💬 Наши контакты @totoshkatips

🔗 Сайт totoshkatrades.com

🉐 Платформы linktr.ee/totoshka55

💬 Наши контакты @totoshkatips

🔗 Сайт totoshkatrades.com

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

👨🎓 Наш телеграм t.me/totoshkatrading

🉐 Платформы linktr.ee/totoshka55

💬 Наши контакты @totoshkatips

🔗 Сайт totoshkatrades.com

🉐 Платформы linktr.ee/totoshka55

💬 Наши контакты @totoshkatips

🔗 Сайт totoshkatrades.com

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.