US Treasury 10Y Technical Outlook for the week Aug 4-8 (updated daily)

Overnight

The yield on the US 10-year Treasury note dropped sharply by nearly 20 basis points to 4.25% on Friday, hitting a three-month low, driven by revised labor market data indicating significant weakness. Nonfarm payrolls for July increased by only 73,000, far below the expected 110,000, with prior data revised downward by 258,000 jobs for the previous two months. These figures highlighted the adverse effects of tariff threats and economic policy uncertainty, challenging earlier perceptions of a strong US labor market. As a result, market expectations shifted, reducing the likelihood of a Federal Reserve rate cut in September and limiting anticipated cuts to two for the year. Additionally, President Trump’s imposition of 39% tariffs on Switzerland, effective next week, and new tariffs on the EU, Japan, and Korea, effective immediately, further pressured yields. The Treasury’s announcement of increased buybacks for notes, bonds, and TIPS also contributed to the decline in yields.

Economic Release Aug 4 to 8 myfxbook.com/forex-economic-calendar

Weekly Outlook

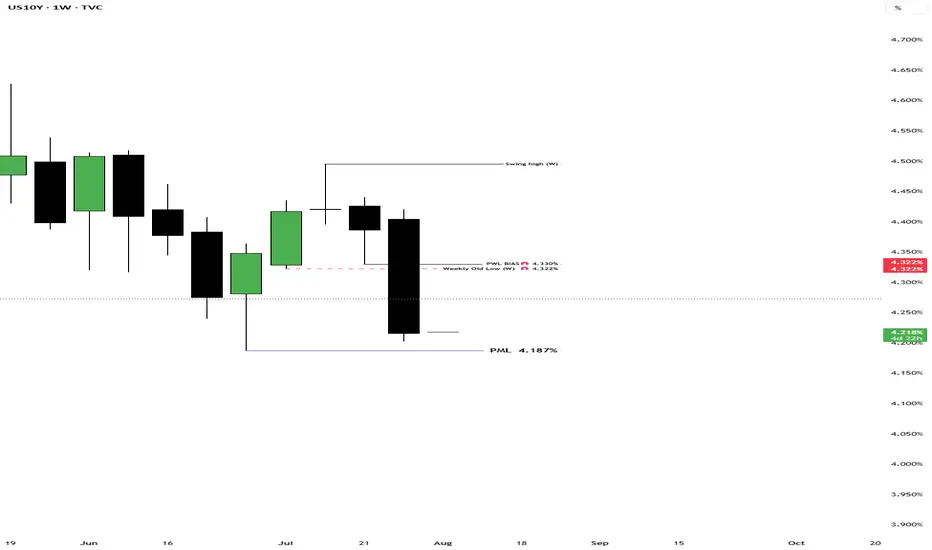

Last week’s market has been very volatile. Yield has closed below prior week’s low and may continue to reach the previous month’s low of 4.187% . There are lots of noise in Trump’s administration from firing of the National statistician to fed governor Adriana Kuger resignation and Nuclear talks. These might affect the market in the coming days.

**Disclaimer:**

The technical analyses provided herein are based solely on my personal analysis and are intended for my own study and reference. They do not constitute a recommendation or solicitation to buy or sell any financial instruments. Any decision made by individuals based on this analysis is their own responsibility, and I assume no liability for any losses or damages incurred as a result of using this information. It is advisable to conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

Overnight

The yield on the US 10-year Treasury note dropped sharply by nearly 20 basis points to 4.25% on Friday, hitting a three-month low, driven by revised labor market data indicating significant weakness. Nonfarm payrolls for July increased by only 73,000, far below the expected 110,000, with prior data revised downward by 258,000 jobs for the previous two months. These figures highlighted the adverse effects of tariff threats and economic policy uncertainty, challenging earlier perceptions of a strong US labor market. As a result, market expectations shifted, reducing the likelihood of a Federal Reserve rate cut in September and limiting anticipated cuts to two for the year. Additionally, President Trump’s imposition of 39% tariffs on Switzerland, effective next week, and new tariffs on the EU, Japan, and Korea, effective immediately, further pressured yields. The Treasury’s announcement of increased buybacks for notes, bonds, and TIPS also contributed to the decline in yields.

Economic Release Aug 4 to 8 myfxbook.com/forex-economic-calendar

Weekly Outlook

Last week’s market has been very volatile. Yield has closed below prior week’s low and may continue to reach the previous month’s low of 4.187% . There are lots of noise in Trump’s administration from firing of the National statistician to fed governor Adriana Kuger resignation and Nuclear talks. These might affect the market in the coming days.

**Disclaimer:**

The technical analyses provided herein are based solely on my personal analysis and are intended for my own study and reference. They do not constitute a recommendation or solicitation to buy or sell any financial instruments. Any decision made by individuals based on this analysis is their own responsibility, and I assume no liability for any losses or damages incurred as a result of using this information. It is advisable to conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

Note

US 10Y DAILY BIAS AUG 5Overnight

The yield on the 10-year US Treasury note fell to a three-month low of 4.22% on Monday, following a nearly 20 basis point drop from the previous session’s high. This decline was driven by revised Bureau of Labor Statistics data, which removed over 250,000 nonfarm payrolls from the past two months’ aggregates, signaling a weaker-than-expected labor market. Additionally, the Institute for Supply Management reported the steepest annual drop in manufacturing employment, reflecting the impact of tariff threats and economic policy uncertainty. As a result, market expectations shifted, increasing the likelihood of a Federal Reserve rate cut in September and two cuts within the year. The Treasury’s announcement of increased buybacks for notes, bonds, and TIPS further contributed to the downward pressure on yields.

Economic Release Aug 5 myfxbook.com/forex-economic-calendar

Daily Bias

Monday’s price action saw a continuation of Friday’s bullish move (on price) with yield closing below last week’s low of 4.202%. For today my outlook would still be a continuation below mondys low of 4.194% possibly through previous month low (PML) of 4.1875%. Fundamentals continue to influence the market so advice to watch out for any fundamental events that may affect the yield or price of the security.

**Disclaimer:**

The technical analyses provided herein are based solely on my personal analysis and are intended for my own study and reference. They do not constitute a recommendation or solicitation to buy or sell any financial instruments. Any decision made by individuals based on this analysis is their own responsibility, and I assume no liability for any losses or damages incurred as a result of using this information. It is advisable to conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

Note

US 10Y DAILY BIAS AUG 8Overnight

The yield on the 10-year US Treasury note stabilized at 4.23% on Thursday, close to a three-month low of 4.19% recorded on August 5th, as signs of an economic slowdown bolstered expectations for multiple Federal Reserve rate cuts in 2025. Rising continuing jobless claims reached a three-year high, coupled with a higher July unemployment rate and significant downward revisions to June and May nonfarm payrolls totaling 258,000. ISM data further indicated widespread employment declines, exacerbated by tariff threats and economic policy uncertainty. The Treasury’s plan to increase buybacks of notes, bonds, and TIPS also pressured yields downward, though persistent inflation concerns led to weak demand at a recent 10-year note auction.

Economic Release Aug 8 myfxbook.com/forex-economic-calendar

No high impact news today but brace for next week when inflation numbers are scheduled to be released on Tuesday

Daily Bias

We closed yesterday as an inside day candle where we market traded inside the range of the prior day. My Bias remains in consolidation with bias of a possible testing the previous day low and previous week low. Please refer to chart for annotations

**Disclaimer:**

The technical analyses provided herein are based solely on my personal analysis and are intended for my own study and reference. They do not constitute a recommendation or solicitation to buy or sell any financial instruments. Any decision made by individuals based on this analysis is their own responsibility, and I assume no liability for any losses or damages incurred as a result of using this information. It is advisable to conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.