Description / Idea Body:

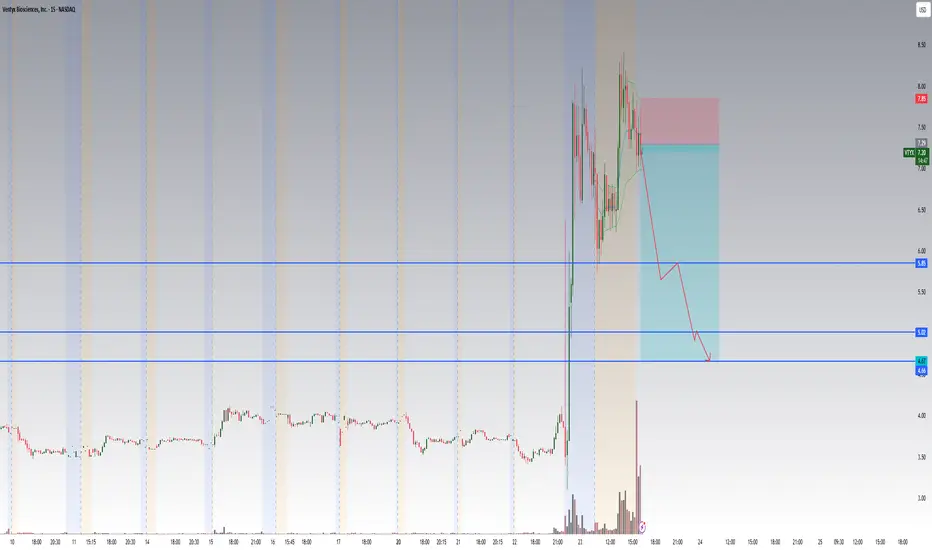

Biotech stocks have a habit of surprising the market — and VTYX (Ventyx Biosciences) just reminded everyone of that.

After months of quiet trading, the stock exploded more than +90% pre-market, powered by heavy volume and a positive update on its cardiovascular risk study.

Let’s break down what’s happening technically and what traders can learn from it:

🧭 Chart Context

Massive gap up following a long accumulation base under $4.

Float rotation nearly 1× before market open — early momentum confirmed.

VWAP reclaim held throughout the morning session → shows strong demand.

Key resistance levels: $7.80 → $8.50 (daily supply zone).

Support area: $5.80–$6.00, where first consolidation formed.

🔍 Momentum Lesson

This type of setup demonstrates how volume and psychology align:

When liquidity concentrates in a low-float biotech, frontside control belongs to buyers.

Short sellers often misjudge the risk, creating fuel for the move.

The best traders stay objective — trade the structure, not the emotion.

💡 TradingView Education Takeaway

Whether you trade momentum or fade parabolic moves, watch for:

First base after the gap → often defines next trend leg.

VWAP and pre-market high alignment → triggers for both scalpers and swing traders.

Volume exhaustion → where strength turns into opportunity for reversals.

⚠️ Disclaimer

This idea is shared for educational purposes only.

It is not financial advice or a signal to buy or sell securities.

Always manage your own risk and confirm with your own analysis.

Biotech stocks have a habit of surprising the market — and VTYX (Ventyx Biosciences) just reminded everyone of that.

After months of quiet trading, the stock exploded more than +90% pre-market, powered by heavy volume and a positive update on its cardiovascular risk study.

Let’s break down what’s happening technically and what traders can learn from it:

🧭 Chart Context

Massive gap up following a long accumulation base under $4.

Float rotation nearly 1× before market open — early momentum confirmed.

VWAP reclaim held throughout the morning session → shows strong demand.

Key resistance levels: $7.80 → $8.50 (daily supply zone).

Support area: $5.80–$6.00, where first consolidation formed.

🔍 Momentum Lesson

This type of setup demonstrates how volume and psychology align:

When liquidity concentrates in a low-float biotech, frontside control belongs to buyers.

Short sellers often misjudge the risk, creating fuel for the move.

The best traders stay objective — trade the structure, not the emotion.

💡 TradingView Education Takeaway

Whether you trade momentum or fade parabolic moves, watch for:

First base after the gap → often defines next trend leg.

VWAP and pre-market high alignment → triggers for both scalpers and swing traders.

Volume exhaustion → where strength turns into opportunity for reversals.

⚠️ Disclaimer

This idea is shared for educational purposes only.

It is not financial advice or a signal to buy or sell securities.

Always manage your own risk and confirm with your own analysis.

Do not have 30K followers, do not have to share 15 trade a day, because you pay subscription, do not live from subscription, but sharing my knowledge, analysis and trades. For free. If you want to join, you are welcomed. t.me/+CE3Vdc5m72w4MjRk

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Do not have 30K followers, do not have to share 15 trade a day, because you pay subscription, do not live from subscription, but sharing my knowledge, analysis and trades. For free. If you want to join, you are welcomed. t.me/+CE3Vdc5m72w4MjRk

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.