🟡 Gold Macro Structure — The End of a 50-Year Bullish Epoch

Symbol: XAU/USD (OANDA Data)

Timeframe: 1M (Monthly Candles)

Published by: Ping Tech Academy

🕰️ The Story of Gold — Faith, Fear, and Cycles

Gold has always been more than a commodity — it’s the mirror of human belief.

When trust in paper fades, gold rises. When euphoria returns, gold retreats.

Since the U.S. dollar detached from gold in December 1971, every major swing has reflected the balance between fear and faith.

Today, after more than five decades, gold may be reaching the final chapter of its generational bull cycle.

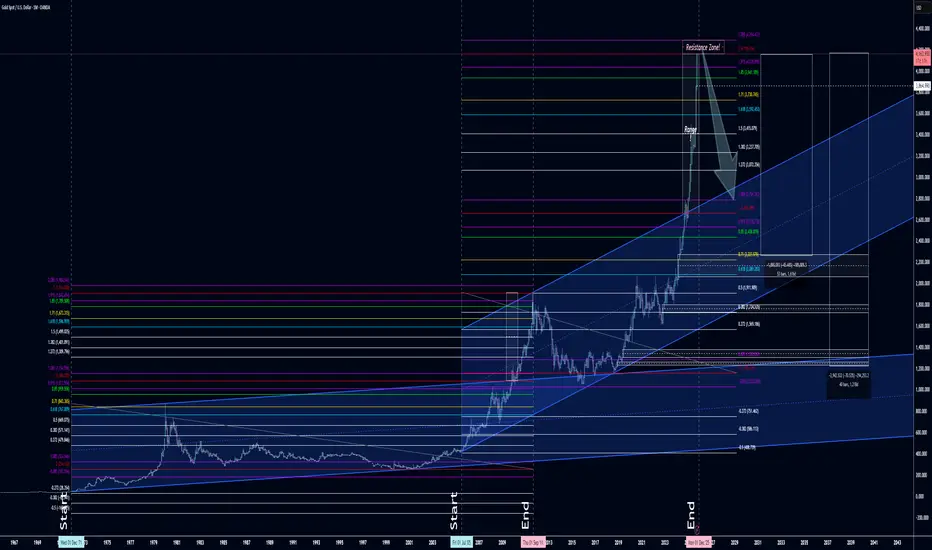

🔹 Historical Structure (1971–2009)

From December 1st, 1971, gold has moved within a long-term ascending price channel,

anchored between $43.50 (bottom) and $1,195.40 (top).

That upper boundary was broken and retested on November 2nd, 2009,

marking the transition into a new bullish macro channel — the one that has guided us for the past 16 years.

🔹 The Second Channel (2005–2024)

The base of this channel formed on July 1st, 2005, at $417.90,

while its upper boundary expanded to around $2,663.50, reached on September 2nd, 2024.

This level was broken and retested — a classical continuation signal —

and from there, gold surged into the $4,165 region (October 2025).

⚠️ Critical Zone: The Completion of the Macro Channel

According to price behavior symmetry and channel geometry,

gold has now fulfilled the structural target of its multi-decade bullish channel:

📍 $4,166.66 (OANDA XAU/USD)

Accounting for margin of deviation, the potential final resistance zone is estimated between:

📉 $4,166.66 – $4,294.43

This area is expected to represent the macro peak of this cycle,

after which a multi-year corrective phase could begin.

🧭 Projected Downside Path (Long-Term Correction Targets)

If price confirms rejection within this resistance cluster,

these levels are projected as sequential macro targets:

$3,940

$3,730

$3,415

$3,072

$2,791 → Key Structural Level

Breaking below $2,791 could unlock the next leg toward:

• $2,438

• $2,227

• $2,089 → Final Macro Target

🧠 Market Psychology & Cyclic Behavior

Every gold supercycle follows a rhythm of human emotion and institutional logic:

Accumulation (Smart Money Phase):

Institutions buy quietly when the world stops caring — at undervalued extremes.

Expansion & Public Awareness:

The trend becomes “obvious,” and narratives such as inflation, rate cuts, or war become convenient justifications.

Euphoria (Public Participation):

Retail capital floods in at all-time highs. Media coverage peaks.

Institutions distribute into optimism, slowly unloading into retail demand.

Distribution → Correction:

Price action weakens, volatility expands, and the illusion of “new paradigms” fades.

Fear replaces greed — and the cycle resets.

Gold is currently showing late-euphoria behavior on the monthly timeframe —

the classic footprint of a distribution phase in motion.

🧩 Conclusion

Gold may be closing the final leg of a 50-year macro expansion,

completing a structure that began in 1971 — an era that redefined global value systems.

While an overshoot beyond $4,294 remains possible,

the reward-to-risk profile now shifts decisively toward defensive positioning.

This could mark the beginning of a generational correction before a new cycle of accumulation emerges.

⚖️ Disclaimer

This analysis is for educational and informational purposes only and does not constitute financial advice.

All projections are derived from long-term historical modeling and price structure analysis.

Financial markets carry risk; always perform your own research or consult a licensed advisor before making investment decisions.

📘 Ping Tech Academy

“Trade Smart. Trade Fearless.”

© 2025 – All Rights Reserved.

Symbol: XAU/USD (OANDA Data)

Timeframe: 1M (Monthly Candles)

Published by: Ping Tech Academy

🕰️ The Story of Gold — Faith, Fear, and Cycles

Gold has always been more than a commodity — it’s the mirror of human belief.

When trust in paper fades, gold rises. When euphoria returns, gold retreats.

Since the U.S. dollar detached from gold in December 1971, every major swing has reflected the balance between fear and faith.

Today, after more than five decades, gold may be reaching the final chapter of its generational bull cycle.

🔹 Historical Structure (1971–2009)

From December 1st, 1971, gold has moved within a long-term ascending price channel,

anchored between $43.50 (bottom) and $1,195.40 (top).

That upper boundary was broken and retested on November 2nd, 2009,

marking the transition into a new bullish macro channel — the one that has guided us for the past 16 years.

🔹 The Second Channel (2005–2024)

The base of this channel formed on July 1st, 2005, at $417.90,

while its upper boundary expanded to around $2,663.50, reached on September 2nd, 2024.

This level was broken and retested — a classical continuation signal —

and from there, gold surged into the $4,165 region (October 2025).

⚠️ Critical Zone: The Completion of the Macro Channel

According to price behavior symmetry and channel geometry,

gold has now fulfilled the structural target of its multi-decade bullish channel:

📍 $4,166.66 (OANDA XAU/USD)

Accounting for margin of deviation, the potential final resistance zone is estimated between:

📉 $4,166.66 – $4,294.43

This area is expected to represent the macro peak of this cycle,

after which a multi-year corrective phase could begin.

🧭 Projected Downside Path (Long-Term Correction Targets)

If price confirms rejection within this resistance cluster,

these levels are projected as sequential macro targets:

$3,940

$3,730

$3,415

$3,072

$2,791 → Key Structural Level

Breaking below $2,791 could unlock the next leg toward:

• $2,438

• $2,227

• $2,089 → Final Macro Target

🧠 Market Psychology & Cyclic Behavior

Every gold supercycle follows a rhythm of human emotion and institutional logic:

Accumulation (Smart Money Phase):

Institutions buy quietly when the world stops caring — at undervalued extremes.

Expansion & Public Awareness:

The trend becomes “obvious,” and narratives such as inflation, rate cuts, or war become convenient justifications.

Euphoria (Public Participation):

Retail capital floods in at all-time highs. Media coverage peaks.

Institutions distribute into optimism, slowly unloading into retail demand.

Distribution → Correction:

Price action weakens, volatility expands, and the illusion of “new paradigms” fades.

Fear replaces greed — and the cycle resets.

Gold is currently showing late-euphoria behavior on the monthly timeframe —

the classic footprint of a distribution phase in motion.

🧩 Conclusion

Gold may be closing the final leg of a 50-year macro expansion,

completing a structure that began in 1971 — an era that redefined global value systems.

While an overshoot beyond $4,294 remains possible,

the reward-to-risk profile now shifts decisively toward defensive positioning.

This could mark the beginning of a generational correction before a new cycle of accumulation emerges.

⚖️ Disclaimer

This analysis is for educational and informational purposes only and does not constitute financial advice.

All projections are derived from long-term historical modeling and price structure analysis.

Financial markets carry risk; always perform your own research or consult a licensed advisor before making investment decisions.

📘 Ping Tech Academy

“Trade Smart. Trade Fearless.”

© 2025 – All Rights Reserved.

AbduAlsalamLolo

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

AbduAlsalamLolo

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.