Captain Vincent – Gold Plan XAU/USD

1. Market Waves 🌍

The USD continues to weaken as investors grow more confident that the FED will cut rates in the coming months. With the greenback losing appeal, large flows are leaving cash and moving into safe-haven assets → gold stands out as the number one choice.

👉 This supports gold’s sustainable bullish trend. If USD selling pressure persists, the market could see fresh breakouts into year-end.

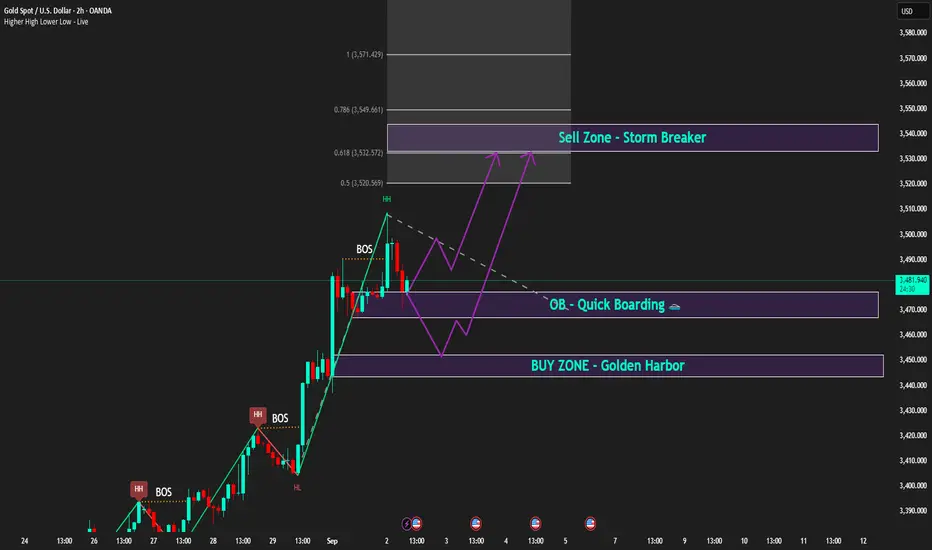

2. Technical Outlook ⚙️

H2 Chart: gold just created a Higher High after BOS, confirming bullish dominance.

Golden Harbor 🏝️ (Buy Zone 3,450 – 3,452): aligned with previous FVG, heavy liquidity zone.

Quick Boarding 🚤 (OB ~3,470): intermediate support, ideal for quick pullback entries.

Storm Breaker 🌊 (Sell Zone 3,538 – 3,540): resistance at Fibo 0.618 – 0.786, strong chance of profit-taking if tested.

Intraday bias: Wait for pullback to Buy. Short-term Sell only if price hits Storm Breaker.

3. Captain Vincent’s Map – Key Levels 🪙

Golden Harbor 🏝️ (Buy Zone): 3,450 – 3,452

Quick Boarding 🚤 (OB Support): 3,470

Storm Breaker 🌊 (Sell Zone): 3,538 – 3,540

4. Trade Scenarios 📌

🔺 Golden Harbor 🏝️ (BUY – Priority)

Entry: 3,450 – 3,452

SL: 3,444

TP: 3,455 → 3,458 → 3,462 → 3,465 → 34xx

🔻 Storm Breaker 🌊 (SELL Reaction)

Entry: 3,538 – 3,540

SL: 3,548

TP: 3,535 → 3,532 → 3,529 → 35xx

5. Captain’s Note ⚓

“The gold sail is still filled with bullish wind, but Storm Breaker 🌊 above may create counter waves. Stay patient at Golden Harbor 🏝️ for precise entries, and watch the PMI at 21:00 – the catalyst for the next wave.”

1. Market Waves 🌍

The USD continues to weaken as investors grow more confident that the FED will cut rates in the coming months. With the greenback losing appeal, large flows are leaving cash and moving into safe-haven assets → gold stands out as the number one choice.

👉 This supports gold’s sustainable bullish trend. If USD selling pressure persists, the market could see fresh breakouts into year-end.

2. Technical Outlook ⚙️

H2 Chart: gold just created a Higher High after BOS, confirming bullish dominance.

Golden Harbor 🏝️ (Buy Zone 3,450 – 3,452): aligned with previous FVG, heavy liquidity zone.

Quick Boarding 🚤 (OB ~3,470): intermediate support, ideal for quick pullback entries.

Storm Breaker 🌊 (Sell Zone 3,538 – 3,540): resistance at Fibo 0.618 – 0.786, strong chance of profit-taking if tested.

Intraday bias: Wait for pullback to Buy. Short-term Sell only if price hits Storm Breaker.

3. Captain Vincent’s Map – Key Levels 🪙

Golden Harbor 🏝️ (Buy Zone): 3,450 – 3,452

Quick Boarding 🚤 (OB Support): 3,470

Storm Breaker 🌊 (Sell Zone): 3,538 – 3,540

4. Trade Scenarios 📌

🔺 Golden Harbor 🏝️ (BUY – Priority)

Entry: 3,450 – 3,452

SL: 3,444

TP: 3,455 → 3,458 → 3,462 → 3,465 → 34xx

🔻 Storm Breaker 🌊 (SELL Reaction)

Entry: 3,538 – 3,540

SL: 3,548

TP: 3,535 → 3,532 → 3,529 → 35xx

5. Captain’s Note ⚓

“The gold sail is still filled with bullish wind, but Storm Breaker 🌊 above may create counter waves. Stay patient at Golden Harbor 🏝️ for precise entries, and watch the PMI at 21:00 – the catalyst for the next wave.”

Join Real - Time Trade Post: t.me/+hdUNYZejfMo1ZWQ1

🔥 3 - 4 DAILY TRADE

🔥 15 - 20 SCALPING SIGNALS

🔥 Real - Time Proceed Orders

🔥 3 - 4 DAILY TRADE

🔥 15 - 20 SCALPING SIGNALS

🔥 Real - Time Proceed Orders

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Join Real - Time Trade Post: t.me/+hdUNYZejfMo1ZWQ1

🔥 3 - 4 DAILY TRADE

🔥 15 - 20 SCALPING SIGNALS

🔥 Real - Time Proceed Orders

🔥 3 - 4 DAILY TRADE

🔥 15 - 20 SCALPING SIGNALS

🔥 Real - Time Proceed Orders

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.