Analysis:

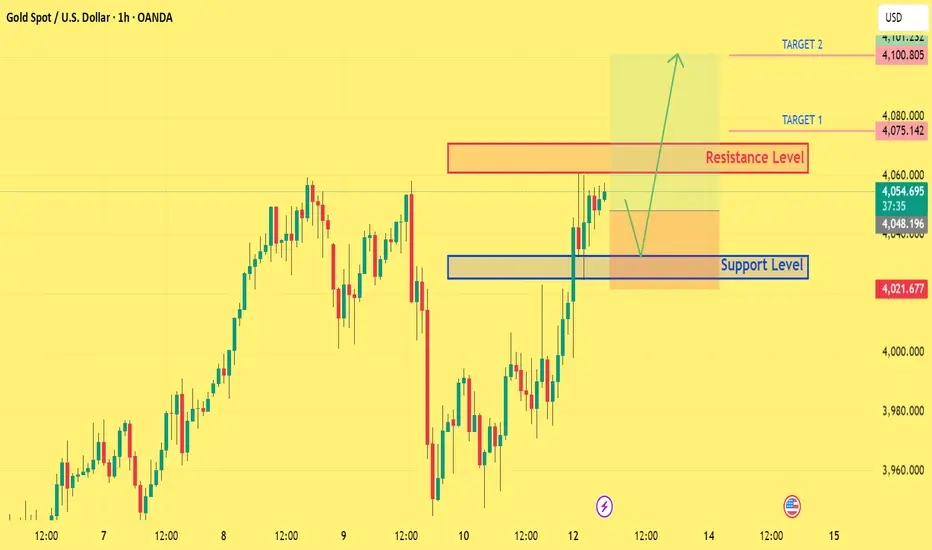

Gold is currently trading around 4054, maintaining a bullish market structure on the 1-hour timeframe. The price continues to create higher highs and higher lows, indicating sustained bullish momentum.

I’ve identified key support and resistance zones on the chart:

Support: 4032

Resistance: 4060

Targets (Observation Levels): 4075 and 4100

From a technical perspective, the bullish trend remains intact as long as the 4032 support area holds. A break above the 4060 resistance could open the path for the next leg higher.

Fundamental Context:

Recent tariff-related tensions introduced by President Trump have contributed to increased demand for safe-haven assets like gold, further supporting the bullish bias in the short term.

🕓 Timeframe: 1H

📊 Trend Bias: Bullish

📈 Technical Basis: Higher highs formation, support-resistance structure, and continuation pattern

💬 If you find this analysis useful, feel free to like, comment, and share your thoughts below!

Regards: Forex Insights Pro.

#Gold #XAUUSD #TechnicalAnalysis #MarketStructure #SafeHaven #TradingView #PriceAction #Forex #Commodities

Gold is currently trading around 4054, maintaining a bullish market structure on the 1-hour timeframe. The price continues to create higher highs and higher lows, indicating sustained bullish momentum.

I’ve identified key support and resistance zones on the chart:

Support: 4032

Resistance: 4060

Targets (Observation Levels): 4075 and 4100

From a technical perspective, the bullish trend remains intact as long as the 4032 support area holds. A break above the 4060 resistance could open the path for the next leg higher.

Fundamental Context:

Recent tariff-related tensions introduced by President Trump have contributed to increased demand for safe-haven assets like gold, further supporting the bullish bias in the short term.

🕓 Timeframe: 1H

📊 Trend Bias: Bullish

📈 Technical Basis: Higher highs formation, support-resistance structure, and continuation pattern

💬 If you find this analysis useful, feel free to like, comment, and share your thoughts below!

Regards: Forex Insights Pro.

#Gold #XAUUSD #TechnicalAnalysis #MarketStructure #SafeHaven #TradingView #PriceAction #Forex #Commodities

Trade active

Price moved as anticipated from the 4054 area, reaching the 4075 zone successfully. Market continues to respect the bullish structure, with momentum still supported by safe-haven demand amid tariff tensions. Watching price behavior for continuation toward higher resistance zones.#Gold #XAUUSD #MarketUpdate #TechnicalAnalysis #MarketStructure #SafeHaven #PriceAction #TradingView

Trade closed: target reached

Gold maintained its bullish momentum from the 4054 zone and reached the 4100 level, as the move remained supported by global market turmoil and rising Fed rate-cut expectations. The trend continues to reflect strong safe-haven demand and positive sentiment.join our free signal channel t.me/ForexGoldpips81

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

join our free signal channel t.me/ForexGoldpips81

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.