Gold Weakens Further After Breaking 4055 – Downside Risk Expands

📊 Market Overview

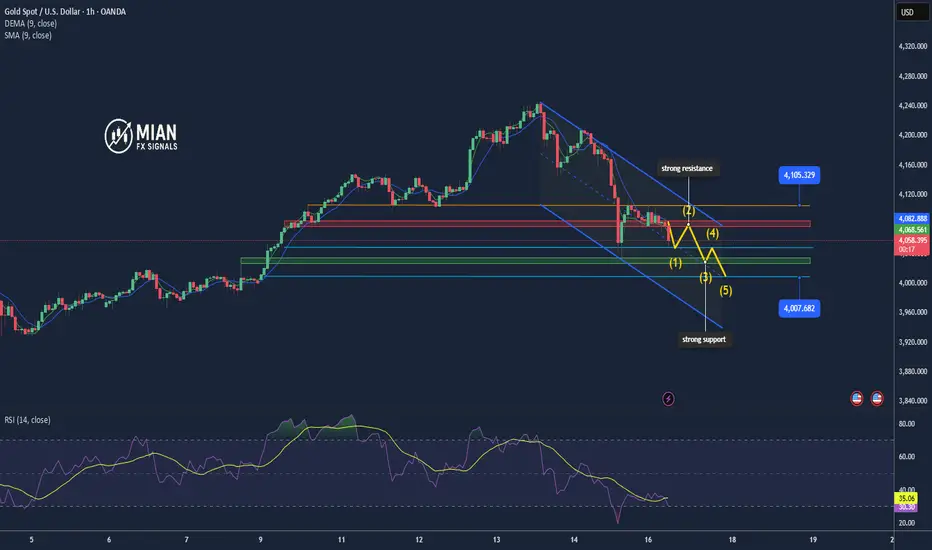

Gold has dropped to 4050 as buying pressure weakens, with the market awaiting fresh catalysts from the European session. Cautious sentiment dominates, preventing buyers from regaining momentum after the earlier rise.

📉 Technical Analysis

Key Resistance Levels

• R1: 4060 – 4068 (near-term resistance)

• R2: 4078 – 4085 (strong resistance during EU–US sessions)

• R3: 4098 – 4105 (major rejection zone; a breakout would confirm a larger bullish trend)

Key Support Levels

• S1: 4050 – 4042 (nearest support)

• S2: 4035 – 4028 (strong support with high probability of rebound)

• S3: 4015 – 4008 (deep support; breaking below may form a medium-term downtrend)

EMA & Momentum

• Price is trading below the EMA 09, confirming short-term bearish momentum.

• Bearish momentum remains strong with weak pullbacks and no reversal patterns.

Candle Structure

• M5–M15 candles show sellers actively suppressing price around 4055.

• A break below 4048 may trigger stronger selling pressure.

📌 Outlook

Gold may continue to decline in the short term if it breaks clearly below 4048, targeting 4042 → 4035.

Conversely, if price closes above 4058, short-term bullish momentum may return, aiming for 4068 → 4078.

💡 Trade Ideas

🔻 SELL XAU/USD : 4082 – 4085

🎯 TP: 40 / 80 / 200 pips

❌ SL: 4088

🟢 BUY XAU/USD: 4011– 4008

🎯 TP: 40 / 80 / 200 pips

❌ SL: 4005

Gold has dropped to 4050 as buying pressure weakens, with the market awaiting fresh catalysts from the European session. Cautious sentiment dominates, preventing buyers from regaining momentum after the earlier rise.

📉 Technical Analysis

Key Resistance Levels

• R1: 4060 – 4068 (near-term resistance)

• R2: 4078 – 4085 (strong resistance during EU–US sessions)

• R3: 4098 – 4105 (major rejection zone; a breakout would confirm a larger bullish trend)

Key Support Levels

• S1: 4050 – 4042 (nearest support)

• S2: 4035 – 4028 (strong support with high probability of rebound)

• S3: 4015 – 4008 (deep support; breaking below may form a medium-term downtrend)

EMA & Momentum

• Price is trading below the EMA 09, confirming short-term bearish momentum.

• Bearish momentum remains strong with weak pullbacks and no reversal patterns.

Candle Structure

• M5–M15 candles show sellers actively suppressing price around 4055.

• A break below 4048 may trigger stronger selling pressure.

📌 Outlook

Gold may continue to decline in the short term if it breaks clearly below 4048, targeting 4042 → 4035.

Conversely, if price closes above 4058, short-term bullish momentum may return, aiming for 4068 → 4078.

💡 Trade Ideas

🔻 SELL XAU/USD : 4082 – 4085

🎯 TP: 40 / 80 / 200 pips

❌ SL: 4088

🟢 BUY XAU/USD: 4011– 4008

🎯 TP: 40 / 80 / 200 pips

❌ SL: 4005

Trade active

If gold holds above 4085, it may continue toward 4095 → 4105.Trade closed: target reached

Gold surged from 4072 to 4085, hitting the SELL stop-loss at 4075–4078. This indicates short-term buying pressure dominates, with the market temporarily turning neutral to slightly bullish. Previous selling pressure could not hold.📊 Forex | Gold | Crypto Market Insights & Signals

📰 Real-time news updates & expert analysis

📈 Daily Buy/Sell signals for investors

💡 Technical breakdowns & market outlooks

🔗 Join our free group: t.me/+DmS-dVFJMm40MDM9

📰 Real-time news updates & expert analysis

📈 Daily Buy/Sell signals for investors

💡 Technical breakdowns & market outlooks

🔗 Join our free group: t.me/+DmS-dVFJMm40MDM9

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

📊 Forex | Gold | Crypto Market Insights & Signals

📰 Real-time news updates & expert analysis

📈 Daily Buy/Sell signals for investors

💡 Technical breakdowns & market outlooks

🔗 Join our free group: t.me/+DmS-dVFJMm40MDM9

📰 Real-time news updates & expert analysis

📈 Daily Buy/Sell signals for investors

💡 Technical breakdowns & market outlooks

🔗 Join our free group: t.me/+DmS-dVFJMm40MDM9

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.