October 19th Gold Weekly Review

In-Depth Analysis of the Gold Market | Technical Correction and Trend Outlook After Reaching a Record High

I. Core Market Review

Milestone Breakthrough: Spot gold hit a record high of $4,380 on Friday (October 17th), with its total market capitalization exceeding $30 trillion for the first time, highlighting global capital demand for safe-haven assets.

Technical Pullback: Gold prices subsequently retreated to around $4,220, with a single-day fluctuation exceeding $190, primarily due to a rebound in the US dollar and profit-taking, but the weekly chart still recorded its ninth consecutive week of gains.

II. Analysis of Multiple Driving Factors

1. Macroeconomic Policy Support

Federal Reserve Rate Cut Expectations: The market is betting on 25 basis point rate cuts in October and December, respectively (with a 96.8% and 81.3% probability). The low interest rate environment continues to weaken the dollar's appeal.

Increasing Fiscal Risks: The continued US government shutdown and regional bank risk events (Zions Bancorp and Western Union Bank) are fueling risk aversion.

2. Geopolitical Tensions

Trade Friction Escalates: Trump's tariff rhetoric and countermeasures against China on rare earth metals have raised uncertainty, but expectations of a high-level meeting have temporarily eased market anxiety.

Global Growth Concerns: Under the dual pressures of the trade deadlock and geopolitical conflicts, demand for gold as the "ultimate safe-haven asset" has surged.

III. In-Depth Technical Analysis

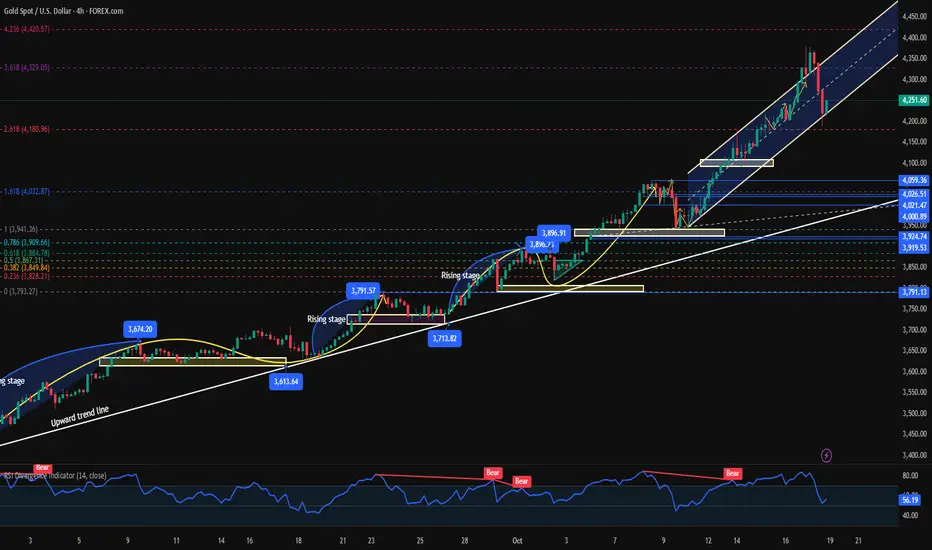

Trend Positioning

Long-Term Pattern: The daily moving average system is bullish, and the $30 trillion market capitalization confirms structural capital inflows, maintaining the bull market's foundation.

Short-Term Adjustment: The 4-hour RSI has retreated from the overbought zone to 53, and the price is testing support at the 21-period moving average ($4,230), indicating a healthy technical correction.

Key Price Levels

Resistance: $4275-4280 (Neckline Conversion), $4379 (All-Time High)

Support: $4180-4160 (Bull Resistance), $4090 (Key Level for Deep Pullbacks)

Market Signals

The 4-hour chart shows a double top formation at $4379. If it falls below the $4180 support level, a deep pullback to the $4090 area could occur.

If it holds above $4230 at the beginning of the week and reclaims $4280, the uptrend is expected to resume, with a target of $4500.

IV. Trading Strategy and Risk Management Guide

Operational Logic

Primary Strategy: Short positions in batches upon a rebound to the $4275-4280 area, with a stop-loss of $8 and a target of $4230-4180.

Secondary Strategy: After a pullback to the $4175-4180 area and stabilization, try a small long position with a stop-loss of $8 and a target of $4230-4250.

Risk Management Key Points

Position Management: Open a single position ≤ 20% of your total position to avoid excessive risk exposure;

Stop-loss Discipline: Strictly set physical stop-losses to guard against unilateral fluctuations;

Cycle Adaptation: Short-term traders focus on 4-hour momentum, while medium- and long-term investors focus on the integrity of the daily trend.

V. Response Plans for Special Market Conditions

Position Unwinding Recommendations

Deeply trapped positions (>$100): If a trend reversal signal is confirmed, decisively reduce your position and stop loss, freeing up funds to participate in rebound opportunities;

Shallowly trapped positions (<$30): Use support/resistance levels to cover your position to increase the average price, or hedge and lock in your position to wait for a technical correction.

Beginner's Guide

Avoid blindly chasing gains and losses; instead, consider trading based on fundamental and technical signals.

For first-time traders, a three-step transition model is recommended: simulated trading, light positions, and regular copy trading.

VI. Market Outlook

Despite short-term technical correction pressure, the three core drivers of the Federal Reserve's easing cycle, global debt inflation, and the normalization of geopolitical risks continue to support the long-term bull market for gold. Investors should focus on the defensive strength of the 4180-4160 area. If effective support forms here, gold prices could potentially reach a new high of $4,500.

If you're facing:

🔴 Deeply trapped positions and feeling overwhelmed

🔴 Repeated losses and a lack of a trading system

🔴 Missing out on key market opportunities

👉 Please send a private message with "Solution" to receive:

Account Diagnostic Report

Personalized Trading Plan

Next Week's Key Gold Trading Positions

Professionalism Makes Trading Simple | We Focus on Building a Sustainable Profitable System

In-Depth Analysis of the Gold Market | Technical Correction and Trend Outlook After Reaching a Record High

I. Core Market Review

Milestone Breakthrough: Spot gold hit a record high of $4,380 on Friday (October 17th), with its total market capitalization exceeding $30 trillion for the first time, highlighting global capital demand for safe-haven assets.

Technical Pullback: Gold prices subsequently retreated to around $4,220, with a single-day fluctuation exceeding $190, primarily due to a rebound in the US dollar and profit-taking, but the weekly chart still recorded its ninth consecutive week of gains.

II. Analysis of Multiple Driving Factors

1. Macroeconomic Policy Support

Federal Reserve Rate Cut Expectations: The market is betting on 25 basis point rate cuts in October and December, respectively (with a 96.8% and 81.3% probability). The low interest rate environment continues to weaken the dollar's appeal.

Increasing Fiscal Risks: The continued US government shutdown and regional bank risk events (Zions Bancorp and Western Union Bank) are fueling risk aversion.

2. Geopolitical Tensions

Trade Friction Escalates: Trump's tariff rhetoric and countermeasures against China on rare earth metals have raised uncertainty, but expectations of a high-level meeting have temporarily eased market anxiety.

Global Growth Concerns: Under the dual pressures of the trade deadlock and geopolitical conflicts, demand for gold as the "ultimate safe-haven asset" has surged.

III. In-Depth Technical Analysis

Trend Positioning

Long-Term Pattern: The daily moving average system is bullish, and the $30 trillion market capitalization confirms structural capital inflows, maintaining the bull market's foundation.

Short-Term Adjustment: The 4-hour RSI has retreated from the overbought zone to 53, and the price is testing support at the 21-period moving average ($4,230), indicating a healthy technical correction.

Key Price Levels

Resistance: $4275-4280 (Neckline Conversion), $4379 (All-Time High)

Support: $4180-4160 (Bull Resistance), $4090 (Key Level for Deep Pullbacks)

Market Signals

The 4-hour chart shows a double top formation at $4379. If it falls below the $4180 support level, a deep pullback to the $4090 area could occur.

If it holds above $4230 at the beginning of the week and reclaims $4280, the uptrend is expected to resume, with a target of $4500.

IV. Trading Strategy and Risk Management Guide

Operational Logic

Primary Strategy: Short positions in batches upon a rebound to the $4275-4280 area, with a stop-loss of $8 and a target of $4230-4180.

Secondary Strategy: After a pullback to the $4175-4180 area and stabilization, try a small long position with a stop-loss of $8 and a target of $4230-4250.

Risk Management Key Points

Position Management: Open a single position ≤ 20% of your total position to avoid excessive risk exposure;

Stop-loss Discipline: Strictly set physical stop-losses to guard against unilateral fluctuations;

Cycle Adaptation: Short-term traders focus on 4-hour momentum, while medium- and long-term investors focus on the integrity of the daily trend.

V. Response Plans for Special Market Conditions

Position Unwinding Recommendations

Deeply trapped positions (>$100): If a trend reversal signal is confirmed, decisively reduce your position and stop loss, freeing up funds to participate in rebound opportunities;

Shallowly trapped positions (<$30): Use support/resistance levels to cover your position to increase the average price, or hedge and lock in your position to wait for a technical correction.

Beginner's Guide

Avoid blindly chasing gains and losses; instead, consider trading based on fundamental and technical signals.

For first-time traders, a three-step transition model is recommended: simulated trading, light positions, and regular copy trading.

VI. Market Outlook

Despite short-term technical correction pressure, the three core drivers of the Federal Reserve's easing cycle, global debt inflation, and the normalization of geopolitical risks continue to support the long-term bull market for gold. Investors should focus on the defensive strength of the 4180-4160 area. If effective support forms here, gold prices could potentially reach a new high of $4,500.

If you're facing:

🔴 Deeply trapped positions and feeling overwhelmed

🔴 Repeated losses and a lack of a trading system

🔴 Missing out on key market opportunities

👉 Please send a private message with "Solution" to receive:

Account Diagnostic Report

Personalized Trading Plan

Next Week's Key Gold Trading Positions

Professionalism Makes Trading Simple | We Focus on Building a Sustainable Profitable System

Trade active

Next Week's Precise Strategies

Key Position Attack and Defense System

Bull Vital Line: 4180-4160 Area (Weekly Core Support)

Bear Watershed: 4280-4300 (Breakthrough Opens 4500)

Breakdown Warning Line: 4090 (Loss Triggers a Deep Pullback)

Major Tactical Layout

Trend Continuation Strategy

Buy on a pullback to 4175-4185, stop loss at 4150, target 4250-4280

Technical Correction

Buy short positions in batches on a rebound to 4275-4280, stop loss at 4300, target 4200-4180

Breakthrough Pursuit Strategy

Buy on a strong break above 4300, stop loss at 4270, target 4380-4390 4400

Customized 3D Unwinding Plans

Emergency Management for Deeply Trapped Positions

Limited Position Reset Method: If floating losses exceed 100 points, immediately reduce your position by 50%, freeing up funds for trend trading

Hedging and Cost Reduction Method: After locking your position, focus on short-term swing trading, taking 50% of each profit to cover the original loss

Technical Unwinding of Shallow Trapped Positions

Pyramiding: Add to your position in batches at the 4160/4130/4090 levels, and exit once your cost is evened out

Trading Time for Space: Switch your trapped position to a mid-term position, with three preset take-profit levels at 4200/4250/4280

Real-Time Equity

Real-Time Strategy Push: Accurate buy/sell/stop-loss/take-profit orders

Position Diagnosis and Optimization: Provide rebalancing suggestions and risk management enhancements for each order

Late-Night Emergency Response: Manual alerts for major market fluctuations

Immediate Action Guide

If you are facing:

🔴 Deeply trapped in positions, feeling lost

🔴 Repeated losses and lack of a system

🔴 Missing key market opportunities

👉 Send a private message with "Plan" to receive:

Account Diagnostic Report

Personalized Trading Plan

Next Week's Key Gold Trading Positions

Professionalism Makes Trading Simple | We Focus on Building a Sustainable Profitable System

Global Gold Analysis

Real-time strategy sharing. Here are the features:

🔥 Free trading signals:t.me/+IfIgG4N_J-U3YWFh

🔥 Risk control and position management advice

Real-time strategy sharing. Here are the features:

🔥 Free trading signals:t.me/+IfIgG4N_J-U3YWFh

🔥 Risk control and position management advice

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Global Gold Analysis

Real-time strategy sharing. Here are the features:

🔥 Free trading signals:t.me/+IfIgG4N_J-U3YWFh

🔥 Risk control and position management advice

Real-time strategy sharing. Here are the features:

🔥 Free trading signals:t.me/+IfIgG4N_J-U3YWFh

🔥 Risk control and position management advice

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.