🔥 GOLD WEEKLY SNAPSHOT — BY PROJECTSYNDICATE

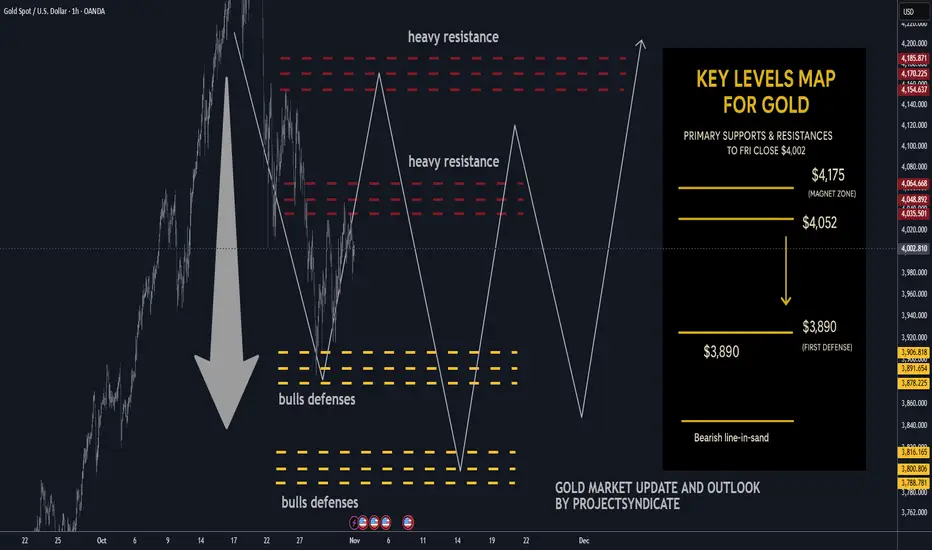

🏆 High/Close: $4,108 → ~$4,002 — sellers defended overhead; weekly close soft within range.

📈 Trend: Neutral / correction mode still ON; not expecting new highs near term.

🛡 Supports: $3,890 → $3,800 — pivotal shelves for downside containment.

🚧 Resistances: $4,052 / $4,175 — magnet zones for supply / fade attempts.

🧭 Bias next week: Prefer short sells into $4,052–$4,175 with take-profit toward $3,890 → $3,800. Invalidation on sustained reclaim > $4,175; failure of $3,800 risks extension lower.

🌍 Macro tailwinds/headwinds :

• Rates: Real yields stable-to-firm keep upside contained; any dovish surprise could spark squeezes into resistance.

• FX: DXY mixed—lack of broad USD weakness limits impulse follow-through.

• Flows: CB/ETF demand supportive on deep dips but tepid near highs.

• Geopolitics: Event risk provides intermittent bids; not a trend driver this week.

🎯 Street view: Medium-term bullish narratives reserve diversification, policy easing into 2026 remain, but near-term tape favors mean-reversion lower under resistance.

________________________________________

🔝 Key Resistance Zones

• $4,052 — immediate ceiling; prior supply pivot likely to cap first tests

• $4,175 — upper resistance; acceptance above flips tone from corrective to constructive

🛡 Support Zones

• $3,890 — first defense; loss invites momentum probes

• $3,800 — critical structural base; break risks downside acceleration

________________________________________

⚖️ Base Case Scenario

Range-to-soft trade within $3,800–$4,175. Rallies into $4,052–$4,175 are sellable; expect rotations back toward $3,890 with scope to $3,800 if sellers press.

🚀 Breakout Trigger

Only a sustained acceptance > ~$4,175 negates the correction and opens $4,200+ pathing; conversely, firm rejection at $4,052 with a daily close < $3,890 increases odds of a $3,800 test.

💡 Market Drivers

• Fed path & real-yield drift

• USD index swings

• ETF/CB flow tone on dips vs. rips

• Risk sentiment headlines (geopolitics/trade)

🔓 Bull / Bear Trigger Lines

• Bullish above: $4,175 correction phase likely over if held

• Bearish below: $3,890 → risk expands under $3,800

🧭 Strategy

Short-sell from overhead resistances ($4,052 → $4,175).

Scale profits into $3,890 then $3,800; keep stops tight above trigger levels. Stand aside on fresh longs until sustained reclaim above $4,175 reasserts momentum.

🏆 High/Close: $4,108 → ~$4,002 — sellers defended overhead; weekly close soft within range.

📈 Trend: Neutral / correction mode still ON; not expecting new highs near term.

🛡 Supports: $3,890 → $3,800 — pivotal shelves for downside containment.

🚧 Resistances: $4,052 / $4,175 — magnet zones for supply / fade attempts.

🧭 Bias next week: Prefer short sells into $4,052–$4,175 with take-profit toward $3,890 → $3,800. Invalidation on sustained reclaim > $4,175; failure of $3,800 risks extension lower.

🌍 Macro tailwinds/headwinds :

• Rates: Real yields stable-to-firm keep upside contained; any dovish surprise could spark squeezes into resistance.

• FX: DXY mixed—lack of broad USD weakness limits impulse follow-through.

• Flows: CB/ETF demand supportive on deep dips but tepid near highs.

• Geopolitics: Event risk provides intermittent bids; not a trend driver this week.

🎯 Street view: Medium-term bullish narratives reserve diversification, policy easing into 2026 remain, but near-term tape favors mean-reversion lower under resistance.

________________________________________

🔝 Key Resistance Zones

• $4,052 — immediate ceiling; prior supply pivot likely to cap first tests

• $4,175 — upper resistance; acceptance above flips tone from corrective to constructive

🛡 Support Zones

• $3,890 — first defense; loss invites momentum probes

• $3,800 — critical structural base; break risks downside acceleration

________________________________________

⚖️ Base Case Scenario

Range-to-soft trade within $3,800–$4,175. Rallies into $4,052–$4,175 are sellable; expect rotations back toward $3,890 with scope to $3,800 if sellers press.

🚀 Breakout Trigger

Only a sustained acceptance > ~$4,175 negates the correction and opens $4,200+ pathing; conversely, firm rejection at $4,052 with a daily close < $3,890 increases odds of a $3,800 test.

💡 Market Drivers

• Fed path & real-yield drift

• USD index swings

• ETF/CB flow tone on dips vs. rips

• Risk sentiment headlines (geopolitics/trade)

🔓 Bull / Bear Trigger Lines

• Bullish above: $4,175 correction phase likely over if held

• Bearish below: $3,890 → risk expands under $3,800

🧭 Strategy

Short-sell from overhead resistances ($4,052 → $4,175).

Scale profits into $3,890 then $3,800; keep stops tight above trigger levels. Stand aside on fresh longs until sustained reclaim above $4,175 reasserts momentum.

Note

🔥 GOLD WEEKLY SNAPSHOT — PROJECTSYNDICATE🏆 High/Close: $4,108 → $4,002 — soft finish; sellers capped upside.

📈 Trend: Neutral / correction mode still ON — no new highs expected.

🛡 Supports: $3,890 → $3,800 — key downside floors.

🚧 Resistances: $4,052 / $4,175 — strong overhead supply zones.

🧭 Bias: Short-sell into $4,052–$4,175 → targets $3,890–$3,800.

💣 Invalidation: Reclaim > $4,175 flips tone bullish; below $3,800 = deeper risk.

🌍 Macro: Stable yields & firm USD cap upside; dips supported by CB/ETF flows.

⚖️ Range View: Trade remains $3,800–$4,175 — rallies likely to fade.

🚀 Trigger: Sustained > $4,175 = breakout; < $3,890 = renewed weakness.

🎯 Strategy: Sell resistance, take profit near supports; avoid longs for now.

Note

let me know your thoughts on the above in the comments section 🔥🏧🚀Note

🎁Please hit the like button and🎁Leave a comment to support our team!

taplink.cc/black001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

taplink.cc/black001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.