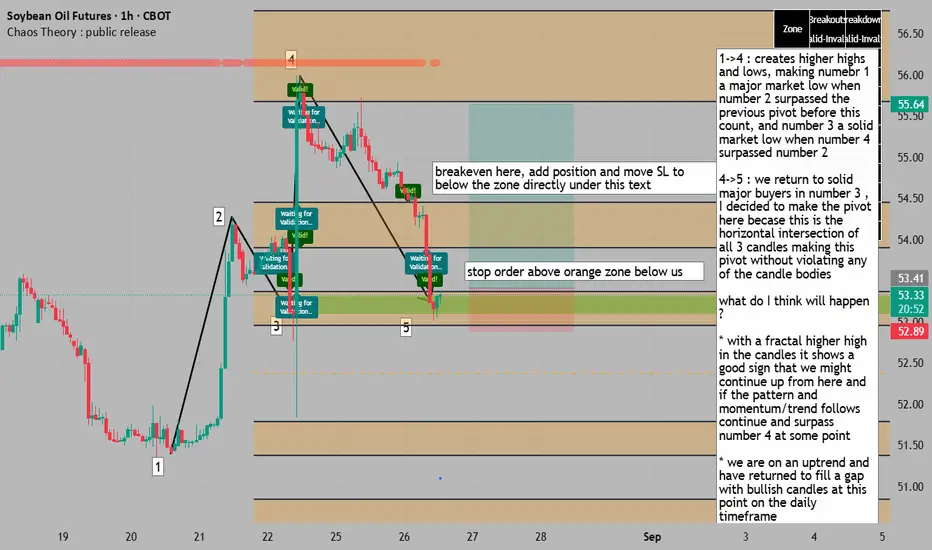

1->4 : creates higher highs and lows, making numebr 1 a major market low when number 2 surpassed the previous pivot before this count, and number 3 a solid market low when number 4 surpassed number 2

4->5 : we return to solid major buyers in number 3 , I decided to make the pivot here becase this is the horizontal intersection of all 3 candles making this pivot without violating any of the candle bodies

what do I think will happen ?

* with a fractal higher high in the candles it shows a good sign that we might continue up from here and if the pattern and momentum/trend follows continue and surpass number 4 at some point

* we are on an uptrend and have returned to fill a gap with bullish candles at this point on the daily timeframe

* bullish divergence on both RSI and MFI

* oversold on both RSI and MFI

* zones have a 62% follow through rate on bullish follow throughs , over past 2,500 candles, you can reduce lookback to a few hundred and manually count using replay to ensure its only realtime counts, this helps in confirming our stop loss as well as a breakeven ( and potentially add position ) and take profit point.

4->5 : we return to solid major buyers in number 3 , I decided to make the pivot here becase this is the horizontal intersection of all 3 candles making this pivot without violating any of the candle bodies

what do I think will happen ?

* with a fractal higher high in the candles it shows a good sign that we might continue up from here and if the pattern and momentum/trend follows continue and surpass number 4 at some point

* we are on an uptrend and have returned to fill a gap with bullish candles at this point on the daily timeframe

* bullish divergence on both RSI and MFI

* oversold on both RSI and MFI

* zones have a 62% follow through rate on bullish follow throughs , over past 2,500 candles, you can reduce lookback to a few hundred and manually count using replay to ensure its only realtime counts, this helps in confirming our stop loss as well as a breakeven ( and potentially add position ) and take profit point.

for trading mentorship and community, message me on telegram : jacesabr_real

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

for trading mentorship and community, message me on telegram : jacesabr_real

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.