Bollinger Bands in Crypto: See Volatility in ActionHey traders! 😎

Bollinger Bands — they’re everywhere in crypto trading, and for good reason. This powerhouse of an indicator helps you track volatility and forecast price moves like a seasoned trader. Let's explore how you can use them to navigate the market, whether it's a breakout or a pullback, and effectively manage your trades.

Bollinger Bands and Volatility: Where to Look

Bollinger Bands are built around a simple moving average (SMA), with the upper and lower bands reflecting standard deviation bands. When the bands contract, it’s a sign that volatility is low — often referred to as a BB squeeze. This is typically followed by a period of expansion, where the price starts to move more aggressively. If you're watching for price breakouts, this is where to pay attention.

However, Bollinger Band width alone doesn’t always tell the full story. When using BB, combine it with other indicators for a more accurate view of market conditions:

RSI: Confirm if the market is overbought or oversold. Extreme values may signal a less sustainable breakout;

MACD: Identify trend reversals or confirm breakout strength with bullish or bearish crossovers;

Volume: High volume confirms breakout strength; low volume suggests a potential fakeout;

Stochastic Oscillator: Overbought (above 80) or oversold (below 20) conditions can indicate reversal points.

Combining Bollinger Bands with Other Indicators

Bollinger Bands work best when used in combination with momentum indicators like the MACD (Moving Average Convergence Divergence) or Stochastic Oscillator. These can help you confirm whether a trend is strong enough to break out of the BB squeeze or if a potential reversal is on the horizon:

⬆️ Price hits the upper Bollinger Band and MACD shows a bearish crossover, that could indicate a potential reversal, even if the price is technically in an uptrend.

⬇️ Price hits the lower Bollinger Band and MACD shows bullish momentum, it could suggest the price might bounce back.

Avoiding Overreliance on Bollinger Bands

While Bollinger volatility behavior can be useful, don’t rely solely on band contraction and band expansion for your trading decisions. These signals are helpful for understanding the overall market atmosphere, but they don’t provide an exact entry or exit point. It’s essential to look at the BB dynamics alongside other data points, like volume and price action, to get a fuller picture.

⚠️ When volatility is high and BB expansion is happening, be cautious. Price can get erratic, and big swings may not always give you the clearest direction. It’s important to watch for confirmation from other indicators, especially when the market is volatile.

When to Stay Away from Bollinger Bands

Bollinger Bands can sometimes be less reliable in certain market conditions. Here are a few scenarios where you should be cautious:

Strong Trending Market: When the market is trending, Bollinger Bands may give false reversal signals, as prices move consistently in one direction.

Choppy or Range-Bound Market: In sideways markets, frequent band squeezes and expansions can lead to false breakout signals with little price follow-through.

Short-Term Focus: Avoid focusing too much on short-term price movements. Instead, combine Bollinger Bands with trend-following indicators like moving averages to confirm the overall market direction.

Wrapping It Up

Bollinger Bands are like a weather forecast for market volatility, helping you spot potential breakouts. However, just like you wouldn’t rely solely on a weather report to plan your day, you shouldn’t use Bollinger Bands in isolation. You can combine them with other indicators like RSI, MACD, and volume to confirm trends and avoid false signals. Band contraction and expansion provide insight into crypto volatility, but always assess the broader market context.

This isn’t trading advice—always DYOR and make decisions based on your analysis.

This material is for informational purposes only and does not constitute trading or investment advice.

Community ideas

Best Trend Following Strategies for Gold. XAUUSD Day Trading

The recent bull run on Gold is a perfect example of a strong trending market. For traders, such sentiment always provides very profitable trading opportunities.

In this article, I will share 3 best trend-following strategies for day trading Gold that showed extremely high performance the last 3 years.

So what I did, I back tested 4H/1H time frame since the middle of February of 2023 when the bull market started.

I tested various strategies: price action, SMC, multiple indicators, candlestick patterns; and I was looking for the ones that showed the highest accuracy and profitability.

1. Moving Averages Crossover

The first strategy that showed a very high performance was based on a crossover of 2 moving averages.

Exponential MA with 30 length.

Simple MA with 9 length.

For entry signal, Simple MA should cross Exponential MA from the downside and a candle should close above both MAs'.

Stop loss will b e below the closest horizontal support.

The setup is considered to be profitable if, after the entry, the price moved up at least by pips distance from entry to stop loss.

13 setups we spotted.

9 of them were profitable.

Total winning rate is 69%.

2. Trend-Following Patterns

The second strategy that showed a very high performance was based on classic price action patterns.

I was looking for bullish patterns like bullish flag, falling wedge, horizontal range, double bottom, head and shoulders, ascending triangle, cup & handle.

Bullish confirmation was a breakout and a candle close above a neckline of the pattern.

The pattern is considered to be losing if after the breakout of the neckline, the price dropped below its lows.

The pattern is considered to be profitable if, after the entry, the price moved up at least by pips distance from entry to stop loss.

I found and tested 37 bullish patterns.

According to the rules that I described above, 31 pattern turned out to be profitable.

That gives 83% winning rate.

3. Break of Structure (BoS)

The Break of Structure strategy is very old and based on breakouts of current highs.

In a bullish trend, after the price violates the levels of a current Higher High HH, a bullish continuation is expected.

A long trade is opened after the candle closes above HH or on a retest.

With such a strategy, Stop Loss is lying below the last Higher Low HL.

The setup is considered to be profitable if, after the entry, the price moved up at least by pips distance from entry to stop loss

For the same period, I identified 21 Breaks of Structure.

According to the rules, 18 setups were profitable.

Total win rate is 85%.

Remember that you should not overestimate the performance of these strategies. They work perfectly only in times of a strong bullish market. Such periods are extremely rare.

However, once you see a strong bullish season, these strategies will help you to get maximum from it.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

are you ignoring the power of divergence in trading?Let’s talk about divergences - the closest thing we have to seeing the future in technical analysis.

Price is lying to you all the time. Indicators lie too. But when price and indicator start lying in different directions - that’s divergence. And that moment, when the lies don’t match anymore, is where reversals are often born.

Imagine a car climbing a hill. It’s still moving forward, but the engine is clearly dying, speed is dropping. That’s a trend with divergence. Price still pushes in the old direction, but momentum is already bailing out.

Classic bullish divergence:

- Price makes a lower low

- Your indicator (RSI, MACD, whatever you use) makes a higher low

Translation into normal human language: sellers pushed price even lower, but they did it with less strength than before. The punch is weaker. That’s often how downtrends fade and bottoms form.

Classic bearish divergence:

- Price makes a higher high

- Indicator makes a lower high

Market makes a fresh high, everyone gets euphoric, but under the hood momentum is already dropping. That’s how tops are made - not with fireworks, but with quiet exhaustion.

Why divergences are so powerful:

Because most TA tools react to what already happened. Divergence is one of the few things that lets you catch when the current trend is running out of fuel before the actual reversal candle hits you in the face.

A few simple rules I use so divergences don’t kill my account:

1. Higher timeframe - stronger signal

H1 divergence beats M5. H4 and Daily are kings. On low timeframes, the market draws divergences every time it sneezes.

2. I never trade divergence alone

Best combo: divergence + level.

Support/resistance, demand/supply, trendline, key zone - if price shows divergence exactly there, that’s where I pay attention.

3. I don’t try to nail the exact top or bottom

Divergence is a warning, not an entry trigger. I wait for price action: break of structure, impulse in the new direction, retest. Let the market show it really wants to turn.

4. Stops are not optional

Bullish divergence - stop usually goes under the last low.

Bearish divergence - above the last high.

Otherwise you’ll watch a “strong signal” keep diverging while your account converges to zero.

There is also hidden divergence - when price makes a higher low, but the indicator makes a lower low (in an uptrend), or the opposite in a downtrend. That’s more about trend continuation: the market is correcting, but momentum hinting that the main trend is still strong.

Maybe I’m wrong, but divergence is the only TA signal I still respect after watching thousands of indicators lie to people for years.

The market doesn’t reverse out of nowhere. It first slows down, runs out of fuel, and only then turns. Divergence is you watching the fuel gauge, not just the speedometer.

Next time you see a clean trend, don’t just stare at candles. Glance at your RSI or MACD and ask:

“Are you sure you still believe in this move?”

If price says “yes” and momentum says “no” - that’s where things get interesting.

Sectors that could outperform the S&P 500 (methodology)While the S&P 500 is still trading at all-time highs and appears very expensive in valuation terms, is it possible to optimize and diversify by identifying sectors that could outperform the S&P 500 over the coming months? Vincent Ganne presents his methodological answer. The research is conducted within the 11 “super sectors” of the S&P 500 index.

Analysis methodology applied to the 11 super sectors that make up the S&P 500 index: CAPE ratio + net margin + average medium/long-term technical score

1) Shiller P/E (CAPE ratio)

The CAPE ratio (Cyclically Adjusted Price-to-Earnings) measures the valuation level of a market by comparing its price to the average real earnings (inflation-adjusted) over 10 years.

It helps smooth economic and accounting cycles and is mainly used to assess the relative expensiveness of a market over the long term. Historically, a high CAPE is associated with lower future returns over several years.

2) Net margin

The net margin of a sector measures the average final profitability of companies within the sector, i.e. the share of revenue that remains as net profit after all costs. At the sector level, this is a weighted average of the net margins of the companies in the sector (often weighted by market capitalization).

3) Average medium/long-term technical score

A technical score that qualifies the maturity of the trend according to the ratings “early”, “mature”, and “late”. From a technical analysis perspective, potential outperformance is more likely to be found in the “early” and “mature” categories. The rating is based on technical analysis of monthly and weekly charts.

By combining these three criteria, the objective is to identify sectors that offer a reasonable valuation, sufficient structural profitability, and a technical momentum that remains exploitable. This approach aims to avoid sectors that are highly performant in terms of earnings growth but already significantly overvalued and technically in a late-cycle phase.

Sales and earnings growth data show a strong concentration of recent performance in technology and, to a lesser extent, industrials. However, these sectors are also among the most expensive in terms of the CAPE ratio, which limits their potential for relative outperformance over the medium term, despite high margins and solid earnings growth.

The table below presents the results of the research. The best opportunities are found among sectors that are inexpensive (see CAPE ratio), with a net margin above average and a technical score that is not classified as “late”.

Conversely, several sectors display a more balanced profile. Financials stand out with a CAPE ratio significantly below average, robust net margins, and a still favorable technical positioning. Defensive sectors such as consumer staples and healthcare also show more moderate valuations, with technical scores classified as “early”, suggesting potential sector rotation in their favor in the event of an economic slowdown or increased volatility.

Real estate and utilities also deserve particular attention. Although their earnings growth is more modest, their high margins and valuations that have become more attractive again after several quarters of underperformance could make them credible candidates for relative outperformance if monetary conditions ease.

DISCLAIMER:

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only. The presented idea (including market commentary, market data and observations) is not a work product of any research department of Swissquote or its affiliates. This material is intended to highlight market action and does not constitute investment, legal or tax advice. If you are a retail investor or lack experience in trading complex financial products, it is advisable to seek professional advice from licensed advisor before making any financial decisions.

This content is not intended to manipulate the market or encourage any specific financial behavior.

Swissquote makes no representation or warranty as to the quality, completeness, accuracy, comprehensiveness or non-infringement of such content. The views expressed are those of the consultant and are provided for educational purposes only. Any information provided relating to a product or market should not be construed as recommending an investment strategy or transaction. Past performance is not a guarantee of future results.

Swissquote and its employees and representatives shall in no event be held liable for any damages or losses arising directly or indirectly from decisions made on the basis of this content.

The use of any third-party brands or trademarks is for information only and does not imply endorsement by Swissquote, or that the trademark owner has authorised Swissquote to promote its products or services.

Swissquote is the marketing brand for the activities of Swissquote Bank Ltd (Switzerland) regulated by FINMA, Swissquote Capital Markets Limited regulated by CySEC (Cyprus), Swissquote Bank Europe SA (Luxembourg) regulated by the CSSF, Swissquote Ltd (UK) regulated by the FCA, Swissquote Financial Services (Malta) Ltd regulated by the Malta Financial Services Authority, Swissquote MEA Ltd. (UAE) regulated by the Dubai Financial Services Authority, Swissquote Pte Ltd (Singapore) regulated by the Monetary Authority of Singapore, Swissquote Asia Limited (Hong Kong) licensed by the Hong Kong Securities and Futures Commission (SFC) and Swissquote South Africa (Pty) Ltd supervised by the FSCA.

Products and services of Swissquote are only intended for those permitted to receive them under local law.

All investments carry a degree of risk. The risk of loss in trading or holding financial instruments can be substantial. The value of financial instruments, including but not limited to stocks, bonds, cryptocurrencies, and other assets, can fluctuate both upwards and downwards. There is a significant risk of financial loss when buying, selling, holding, staking, or investing in these instruments. SQBE makes no recommendations regarding any specific investment, transaction, or the use of any particular investment strategy.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts suffer capital losses when trading in CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Digital Assets are unregulated in most countries and consumer protection rules may not apply. As highly volatile speculative investments, Digital Assets are not suitable for investors without a high-risk tolerance. Make sure you understand each Digital Asset before you trade.

Cryptocurrencies are not considered legal tender in some jurisdictions and are subject to regulatory uncertainties.

The use of Internet-based systems can involve high risks, including, but not limited to, fraud, cyber-attacks, network and communication failures, as well as identity theft and phishing attacks related to crypto-assets.

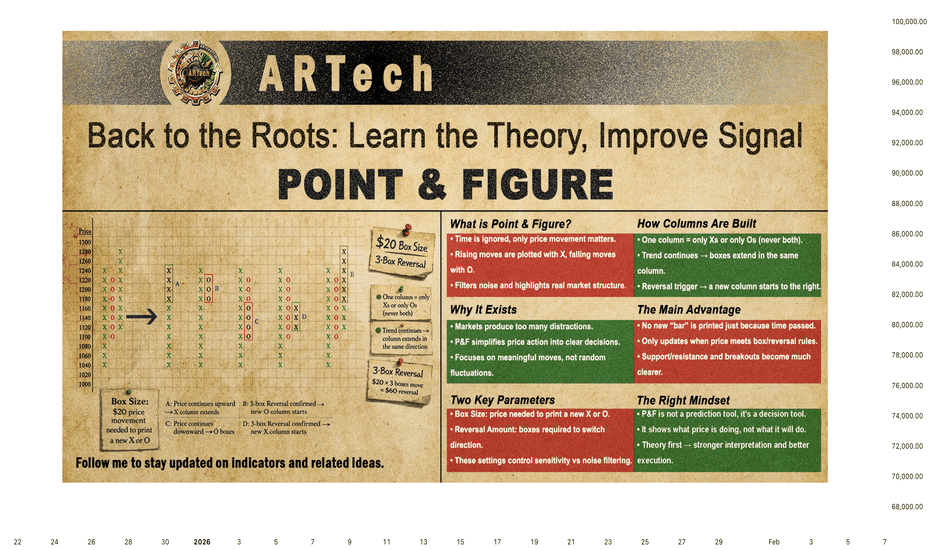

POINT & FIGURE🔸🔸🔸 1 - Back to the Roots: Learn the Theory, Improve Signal 🔸🔸🔸

Many traders believe that history repeats itself. Others think past performance can clearly explain what will happen next. The most common mistake is believing that technical indicators, calculated only from past data, can predict the future.

In reality, price charts do not show the future. They show only what has already happened and what is happening right now. Nothing more.

For this reason, we do not use charts as prediction tools. We use them as decision tools. Their purpose is not to tell us what will happen, but to help us build a roadmap in an uncertain future - a strategy, not a forecast.

To do this properly, we must understand the theory behind price behavior. Without theory, charts become pictures. With theory, they become structure.

That is why learning theory comes first.

🔸🔸🔸 2 - Point & Figure 🔸🔸🔸

Financial markets produce more information than traders can process. Prices move constantly, news never stops, and decisions must often be made under pressure. The real challenge is not accessing data, but turning that data into something useful.

Point & Figure (P&F) charts were created to address this problem. Instead of reacting to every small fluctuation, they record only meaningful price movement. By removing time and minor noise, Point & Figure charts provide a clear and structured view of market behavior.

Point & Figure charts display price movement only. Time is completely ignored. This is the main difference between Point & Figure charts and traditional bar charts.

In bar charts, both price and time are part of the structure. The vertical axis shows price, while the horizontal axis represents time. As time passes, new bars are added to the right side of the chart. Even if price stays the same, a new bar is still printed for each time period.

Point & Figure charts work in a very different way. There is no time axis. The horizontal space does not represent days or hours. The chart grows only when price moves enough to matter.

Price is plotted using fixed price boxes.

When price rises, Xs are added.

When price falls, Os are added.

If price continues moving in the same direction, the chart stays in the same column. For example, if price rises continuously for 5 days without a pullback equal to the reversal amount, this entire move appears as a single column of Xs. In a bar chart, the same move would create 5 separate bars.

If price does not meet the predefined rules, nothing is added to the chart. No X, no O. In contrast, time-based charts will always print a new bar simply because time has passed.

🔸🔸🔸 3 - Point & Figure Graph 🔸🔸🔸

Before drawing a Point & Figure chart, two parameters must be defined:

Box Size

The box size determines how much price movement is required to add a new X or O.

In this example, the box size is set to $20 . This means:

Every $20 rise adds one X upward.

Every $20 drop adds one O downward.

Reversal Amount

The reversal amount defines how many boxes price must move in the opposite direction to start a new column.

In Point & Figure charts, Xs and Os never appear in the same column. Each column contains only Xs or only Os.

In this example:

Box size = $20

Reversal amount = 3 boxes

This means a reversal requires a $60 move in the opposite direction.

Graph A

If the current column is an X column and price continues to rise, new Xs are added to the same column as long as the box size rule is met.

Graph B

When price falls by 3 boxes ($60), a new column begins to the right. Three 0s are placed starting one box below the highest X of the previous column.

Graph C

If price continues to fall, additional Os are added downward in the same column.

Graph D

If price then rises by 3 boxes ($60), another new column starts. Three Xs are placed one box above the lowest O of the previous column.

Graph E

As long as price continues higher without another 3-box reversal, Xs keep extending in the same column.

🔸🔸🔸 4 - The Rules for Plotting Point & Figure Charts 🔸🔸🔸

Before drawing a Point & Figure chart, a few basic rules must be defined. These rules determine which price source will be used and how price movement will be measured. The chart can be built using Close prices or High–Low data , and the box size can be calculated in different ways, such as Fixed value, Percentage, or ATR-based methods.

Each choice affects how sensitive the chart is to price movement and how much noise is filtered out. Understanding these rules is essential, because a Point & Figure chart only reacts when price movement meets the predefined conditions - nothing more, nothing less.

📌 4.1- High-Low Price Source

Preference is always given to price movements that continue the current trend. The price in the opposite direction is considered only if the trend cannot be extended.

The process starts by defining two key parameters: box size and reversal amount. In this example, the box size is set to $20, and the reversal amount is 3 boxes. These values determine when the chart should update.

The algorithm first reads the high and low prices of the current timeframe candle. The next step depends on the current column direction.

4.1.1 - When the Current Column Is Xs (Uptrend)

If the chart is currently in a column of Xs , preference is given to upward price movement.

The algorithm first checks whether the current candle's high is at least one box above the previous high.

If this condition is met and the box is fully filled, new Xs are plotted in the same column.

If the price does not move high enough to extend the X column, only then is the low price checked.

If the candle's low falls at least three boxes below the previous high, a reversal occurs:

A new column begins to the right.

Three Os are plotted, starting one box below the highest X of the previous column.

If neither condition is met, the chart remains unchanged.

4.1.2 - When the Current Column Is Os (Downtrend)

If the chart is in a column of Os , preference is given to downward price movement.

The algorithm first checks whether the current candle's low is at least one box below the previous low.

If the box is fully filled, new Os are added to the same column.

If the price does not extend the O column, the algorithm then checks the high price.

If the candle's high rises at least three boxes above the previous low, a reversal is triggered:

A new column starts to the right.

Three Xs are plotted, starting one box above the lowest O of the previous column.

Again, if neither condition is met, no action is taken.

📌 4.2 - Close Price Source

When the Close Price is used as the price source, the same plotting algorithm applies without any structural changes. The only difference is that high and low values are ignored. All decisions - box extensions and reversals - are made using closing prices only . If the close fills a box in the direction of the current column, new Xs or Os are plotted. If the close reaches the reversal amount in the opposite direction, a new column is started.

📌 4.3 - Box Size Method

Box size defines how much price must move before a new X or O is plotted on a Point & Figure chart. For this reason, box size directly controls the sensitivity of the chart. A small box size produces more signals and more noise, while a larger box size filters noise but reacts more slowly.

Choosing the correct box size is one of the most important decisions in Point & Figure charting. Markets differ in price level and volatility, and these characteristics can also change over time. A single box size cannot work equally well for every instrument or every market condition.

Each method has its strengths and weaknesses. The key is not finding a "perfect" box size, but choosing a method that matches the behavior of the market and the objectives of the trader.

To address this, Point & Figure charts commonly use three different box size methods:

4.3.1 - Fixed Box Size

The box size is defined as a fixed price value (for example, $20 per box). This method is simple and easy to understand, but it does not adapt to changing volatility.

4.3.2 - Percentage Box Size

In the percentage box size method, each box represents a constant percentage of the current price rather than a fixed price value.

Using a percentage-based box size helps normalize charts across markets with different price ranges and makes long-term comparisons more meaningful. However, because the box size is recalculated as price changes, the chart effectively adapts continuously. Rising prices increase the reversal distance, which can delay reversals and extend trends. Falling prices reduce the reversal distance, potentially triggering reversals more quickly.

While this method improves adaptability compared to fixed box sizes, it does not directly measure volatility. In markets where volatility changes sharply without large price changes, fixed percentage-based box sizing may still produce inconsistent signals.

4.3.3 - ATR-Based Box Size

The ATR Box Size method adjusts the box size based on market volatility rather than price alone. Instead of using a fixed value or a percentage of price, each box is calculated as a multiple of the Average True Range (ATR).

ATR measures how much price typically moves over a given period. As volatility increases, ATR rises and box sizes become larger. When volatility decreases, ATR falls and box sizes become smaller. This allows the Point & Figure chart to adapt naturally to changing market conditions.

For example, if the 50-period ATR of an instrument is 8 points and the ATR multiplier is set to 1.0, each box represents 8 points. A 3-box reversal would therefore require a 24-point move. If volatility later doubles, the box size increases automatically, filtering out noise during highly volatile periods.

ATR Box Size does not predict price direction. It simply ensures that the chart reflects meaningful price movement relative to current volatility, keeping the focus on true supply and demand rather than random fluctuations.

🔸🔸🔸 5 - Point & Figure on TradingView 🔸🔸🔸

This section explains how to open Point & Figure charts on TradingView and how to adjust the key parameters properly. Before discussing trading techniques, it is important to understand how to enable Point & Figure charts and configure their settings correctly.

📌 5.1 - Enable Point & Figure from Chart Type Menu

Point & Figure charts can be enabled directly from the Chart Type menu on TradingView. To activate it, open the chart type selector and choose Point & Figure from the list.

Note: Point & Figure charts are available only on TradingView Plus and higher plans.

Good news 🚀 At the end of this article, you can find the link to the indicator I developed based on Point & Figure logic.

📌 5.2 - Chart Settings

To change Point & Figure settings, right-click on the chart and select Settings from the menu. Then, open the Symbol tab to adjust the Point & Figure parameters. These settings allow you to control both the visual appearance of the chart and the logic used to build it.

Up Bars

Customize the color of rising columns (X columns).

Down Bars

Customize the color of falling columns (O columns).

Projected Up Bars

Represents potential rising columns (Xs) based on the current price before the bar is closed.

Projected Down Bars

Represents potential rising columns (Os) based on the current price before the bar is closed.

Source

Selects which price data is used for Point & Figure calculations (such as Close or High/Low). The logic and differences between these source types are explained in Section 4 .

Box Size Assignment Method

Choose how the box size is calculated:

Traditional: A fixed, user-defined box size

Percentage (LTP): Box size is calculated as a percentage of the last closed price

ATR: Box size is based on the Average True Range

The logic and usage of each method are explained in detail under the Box Size Methods section in Section 4.

ATR Length

If the ATR method is selected, this defines the look-back period used to calculate volatility.

Box Size

When using the Traditional method, this value defines the fixed price movement required to add one box.

Reversal Amount

Defines how many boxes price must reverse before a new column is created. The most common setting is a 3-box reversal.

Percentage

When using the Percentage (LTP) method, this value defines the box size as a percentage of the last closest price.

🔸🔸🔸 6 - Point & Figure Trading Technique 🔸🔸🔸

In this section, we will focus on three core trading techniques that are commonly used with Point & Figure charts: Reversal-based entries, Vertical Count, and Horizontal Count. Each method approaches the market from a different perspective - risk control, trend projection, and consolidation analysis - while remaining fully consistent with Point & Figure principles.

📌 6.1 - Reversal Based Entries

Point & Figure trading is based on breakouts to new highs and new lows. The most basic signals are simple and well defined:

Buy when the current column of Xs breaks one box above the previous X column.

Sell when the current column of Os breaks one box below the previous O column.

Using these basic rules, the trader is almost always in the market, reversing positions when an opposite signal appears (except in long-only stock trading).

In the figure above:

A new high is formed by breaking one box above the top of the previous O column, generating a buy signal. The stop-loss is placed one box below the lowest level of the prior column.

Price fails to show sufficient continuation and reverses downward with a 3-box reversal. When price breaks one box below the bottom of the previous X column, a sell signal is triggered, stopping out the previous long position.

After the pullback that follows the breakout, price turns upward again. A new buy signal occurs when price rises one box above the top of the previous O column. The stop-loss is placed one box below the lowest X in the current column.

However, many traders prefer alternative entry techniques to reduce risk and avoid false breakouts. One of the most common approaches is to enter after a pullback, rather than buying immediately at the breakout. This method limits risk while still respecting the Point & Figure structure.

Instead of buying at the first breakout, the trader waits for a reversal and enters at a lower price (or a higher price for short positions) that aligns with an acceptable risk level. This approach aims to reduce risk by waiting for a pullback, allowing entry closer to the stop-loss level. However, this comes with a trade-off: while risk is reduced, some trading opportunities may be missed if price continues in the breakout direction without a meaningful pullback.

📌 6.2 - Horizontal Count

In Point & Figure charting, the time price spends in a consolidation area is considered related to the size of the next price move. The longer the consolidation, the larger the potential breakout.

The horizontal count method is used to estimate price targets based on this idea.

6.2.1 - Upside Horizontal Count

To calculate an upside price objective:

Upside Target = Lowest price of the base + (Width × Reversal Value)

Lowest price of the base is the lowest box in the consolidation area

Width is the number of columns in the base (excluding the breakout column)

Reversal value is the box size multiplied by the reversal amount (for example, 3 (boxes) x 20$ = 60$)

Steps:

Identify the base after the breakout has occurred.

Count the number of columns across the base.

Multiply this number by the reversal value.

Add the result to the lowest price of the base.

This gives a projected upside price target.

6.2.2 - Downside Horizontal Count

The downside objective is calculated in the same way, but in the opposite direction:

Downside Target = Highest price of the top − (Width × Reversal Value)

Highest price of the top is the highest box in the distribution area

Width is the number of columns in the top formation

Reversal value is the box size multiplied by the reversal amount (for example, 3 (boxes) x 20$ = 60$)

Steps:

Identify the top formation after a downside breakout has occurred.

Count the number of columns across the top formation (do not include the breakout column).

Multiply the width by the reversal value.

Subtract the result from the highest price level of the top formation.

Key Notes

Wider bases or tops produce larger price objectives.

Smaller formations usually lead to shorter moves.

Multiple possible widths can be selected; closer targets are easier to reach, while wider counts often align with major support or resistance levels.

Horizontal counts provide price objectives , not guarantees, and should be used together with trend analysis and risk management.

📌 6.3 - Vertical Count

The vertical count is a simpler and more direct method than the horizontal count. It is used to estimate a price objective based on the strength of the first move away from a top or bottom. While the horizontal count measures accumulation or distribution, the vertical count measures volatility and momentum.

Like the horizontal count, the vertical count allows enough time to identify the formation and calculate the target before it is reached.

Purpose of the Vertical Count

Measures the initial price thrust after a confirmed top or bottom

Estimates how far price may travel in the direction of the new move

Often used to project retracements or continuation targets after major reversals

The vertical count relies on the idea that a strong first reversal often leads to a move of proportional size.

6.3.1 - Upside Vertical Count

To calculate an upside vertical count:

Confirm a bottom formation

Identify the first reversal column of Xs after the bottom.

Count the number of boxes in that first reversal.

Multiply this number by the minimum reversal value.

Add the result to the lowest box of the bottom.

Upside Vertical Count = Lowest box + (First reversal boxes × Minimum reversal boxes)

6.3.2 - Downside Vertical Count

The downside vertical count follows the same logic, but in the opposite direction:

Confirm a top formation.

Identify the first reversal column of Os after the top.

Count the number of boxes in that first reversal.

Multiply this number by the minimum reversal value.

Subtract the result from the highest box of the top.

Downside Vertical Count = Highest box − (First reversal boxes × Minimum reversal boxes)

Key Notes

The vertical count is based on volatility , not time.

It often provides conservative targets and may underestimate very strong trends.

Multiple vertical counts from nearby highs or lows can confirm each other.

Vertical counts are price objectives , not predictions, and should be used together with trend analysis and risk management.

🔸🔸🔸 7 - Conclusion 🔸🔸🔸

Finally, it is important to remember a principle that applies to all forms of technical analysis: Point & Figure charts, like any other method, are not a complete buy–sell system on their own.

Point & Figure does not predict the future, and it does not eliminate uncertainty. What it offers is something far more valuable: a structured way to interpret price behavior, free from time-based noise and emotional distraction. It helps us understand where supply and demand are truly in control, where risk is defined, and where decisions can be made logically.

For this reason, trading decisions should never be based on Point & Figure alone - or on any single technique. A robust trading strategy is built by combining multiple tools, perspectives, and confirmations. Trend analysis, support and resistance, market context, volatility, and risk management must all work together.

Even if Point & Figure charts are a core part of your approach, they should be seen as one weapon in a larger arsenal, not the entire strategy. The goal is not to find a perfect indicator, but to build a disciplined process where each tool supports and confirms the others.

Returning to theory gives us that discipline. And with theory in place, Point & Figure becomes not just a chart - but a framework for decision-making in an uncertain market.

Market Regime Analyzer — Understanding Consolidation Regimes

Markets don’t always trend. Much of the time, price oscillates within a range where mean reversion dominates and breakout strategies underperform.

This example illustrates how the Market Regime Analyzer identifies a Consolidation Regime and how price behavior aligns with that classification.

What the chart is showing:

Price rotates within a defined range without sustained directional expansion

Breakouts repeatedly fail or fade back into the range

Volatility remains contained and directional follow-through is limited

This behavior matches the indicator’s Consolidation Regime classification.

Indicator interpretation:

The oscillator fluctuates around a mean-reversion reference level

Oscillations around this level define the regime’s behavior

Volume pressure remains muted, reinforcing range-bound conditions

Transition probabilities strongly favor continued consolidation

Important:

The Market Regime Analyzer is not a trade signal. It is designed for regime awareness and strategy selection.

How this should influence decision-making? When a consolidation regime is active:

Trend-following strategies lose edge

Mean-reversion and range-based approaches perform better

Risk should be reduced on breakout attempts

Patience becomes a position

Understanding when not to force trades is a competitive advantage.

Indicator used:

Market Regime Analyzer

This indicator is designed to help traders align execution with market conditions, not predict direction.

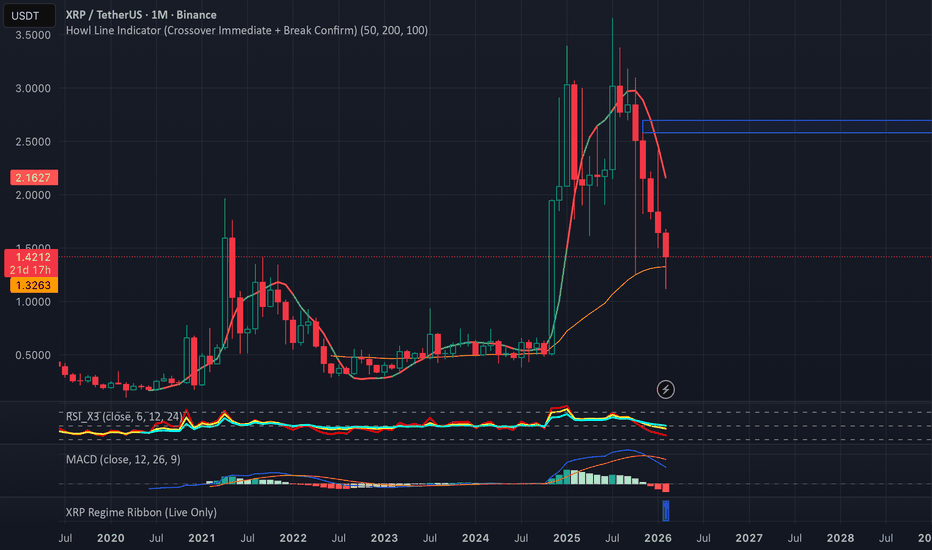

Crypto Is In Extreme Fear — And What Retail Traders Get WrongOver the past few weeks, the crypto market has slipped into what can only be described as extreme fear territory. Prices have pulled back heavily, sentiment has turned negative, and many traders are now questioning whether this is simply a correction or the start of something much deeper.

If you’ve been in crypto for any length of time, you’ll know this emotional cycle is nothing new. In fact, extreme fear is often when the most important market decisions are made — not by retail traders, but by institutions and experienced investors

Fear in crypto markets usually builds when prices drop quickly or when uncertainty hits the wider financial system. This can be caused by regulatory concerns, macroeconomic shifts, or profit taking after large rallies.

Right now, we are seeing a combination of several of these factors. Liquidity has tightened, volatility has increased, and traders are reacting emotionally rather than strategically.

Historically, fear tends to peak when retail traders start to lose confidence in their positions. This often leads to panic selling, which can push prices even lower in the short term.

One of the biggest mistakes retail traders make during fear-driven markets is reacting emotionally rather than following structured plans.

Common behaviours include:

• Selling at heavy losses

• Chasing quick recovery trades

• Overleveraging to recover previous losses

• Losing confidence in long-term crypto adoption

These reactions are completely understandable, but they are also the behaviours that historically lead to poor trading outcomes.

While retail sentiment tends to become fearful, experienced investors often shift into accumulation mode during uncertainty.

This does not mean markets instantly recover. Fear phases can last weeks or even months. However, historically, some of the strongest long-term entry opportunities have formed during periods of extreme negative sentiment.

Markets move in cycles, and sentiment often reaches its lowest point shortly before structural recoveries begins

Instead of focusing purely on price, traders should be watching:

• Market structure

• Liquidity zones

• Volume behaviour

• Macro economic signals

• Institutional activity

Understanding where liquidity sits in the market often gives better insight than emotional sentiment alone.

Extreme fear does not guarantee immediate bullish movement. Markets can always move lower, and risk management remains essential.

However, fear phases are often when long-term positioning strategies are developed. The key difference between successful traders and struggling traders is usually preparation and discipline during uncertain periods

Markets reward patience, structure, and emotional control.

Fear is part of every crypto cycle, but it is also where education, strategy, and community support often become most valuable.

I regularly break down market sentiment, technical structure, and retail psychology across my social platforms and within my trading community, the Crypto Wolf Pack, where traders focus on structured learning and disciplined decision making

Bitcoin Isn’t a Trap for Money — It’s a Trap for EmotionsBody / Analysis:

When traders look at Bitcoin, many think the biggest risk is financial loss. But in reality, Bitcoin isn’t just a trap for your money — it’s a trap for your emotions. The volatile nature of crypto markets triggers fear, greed, and impulsive decisions more than it threatens your actual capital.

1️⃣ Emotional Trading: The Real Trap

Bitcoin’s price can swing 5–10% in a single day. This volatility can make even experienced traders second-guess their strategies. Emotional reactions like panic selling during dips or FOMO buying during rallies often lead to losses, even for traders who understand market fundamentals.

2️⃣ Understanding Market Psychology

Success in Bitcoin trading isn’t just about numbers—it’s about mindset. Traders who control their emotions and stick to clear entry and exit strategies outperform those who react to price spikes. Recognizing the psychological traps of fear and greed is key to staying consistent.

3️⃣ Strategies to Avoid Emotional Traps

Plan your trades: Set clear entry, stop-loss, and take-profit levels.

Stick to your strategy: Avoid impulsive decisions based on market hype.

Journal your trades: Track decisions and emotions to learn patterns.

Use technical indicators wisely: RSI, FVG, and support/resistance levels can guide decisions without emotional bias.

4️⃣ Why Long-Term Mindset Wins

Traders focused solely on short-term profits are more prone to emotional mistakes. A long-term mindset, combined with disciplined risk management, can transform Bitcoin from an emotional trap into a strategic opportunity.

💡 Key Takeaway:

Bitcoin doesn’t steal your money—it exposes your emotional weaknesses. The best traders aren’t those who predict every price move, but those who control fear and greed, sticking to their plan regardless of market chaos.

Why Volatility Breaks Retail Traders?Why Volatility Breaks Retail Traders

“Volatility doesn’t destroy accounts.

It exposes them.”

When markets move fast, many traders feel lost.

Setups fail.

Stops get hit quickly.

Confidence disappears.

It feels like the strategy stopped working.

But volatility didn’t break the strategy.

It revealed the weaknesses around it.

What Volatility Actually Changes

During calm markets:

• Entries feel clean

• Stops feel respected

• Moves feel predictable

During high volatility:

• Price moves faster than decisions

• Pullbacks become violent

• Stops feel too tight or too wide

• Emotions accelerate

The environment changes — and so must behavior.

Why Retail Traders Struggle

High volatility exposes hidden habits:

• Position sizes that are too large

• Stops that are too tight for fast markets

• Emotional reactions to fast losses

• The urge to “recover quickly”

• The need to stay active

In slow markets, these weaknesses stay hidden.

In fast markets, they surface immediately.

Volatility removes the margin for error.

The Speed Problem

Retail traders make decisions emotionally.

Volatility speeds up emotion.

Fear appears faster.

FOMO appears stronger.

Revenge trading happens sooner.

The faster the market moves,

the harder it becomes to stay objective.

The Real Risk of Fast Markets

It isn’t direction.

It isn’t analysis.

It’s behavior.

• Overtrading increases

• Discipline weakens

• Risk expands

• Patience disappears

And small mistakes become expensive quickly.

How Professionals Adapt

Professionals don’t fight volatility.

They adapt to it.

They:

• Reduce position size

• Trade less frequently

• Accept wider stops or stay flat

• Focus on survival first

• Wait for clarity to return

They protect capital before chasing opportunity.

Volatility doesn’t create bad traders.

It reveals unprepared ones.

📘 Shared by @ChartIsMirror

Do you trade more during volatility… or become more selective?

Comment honestly.

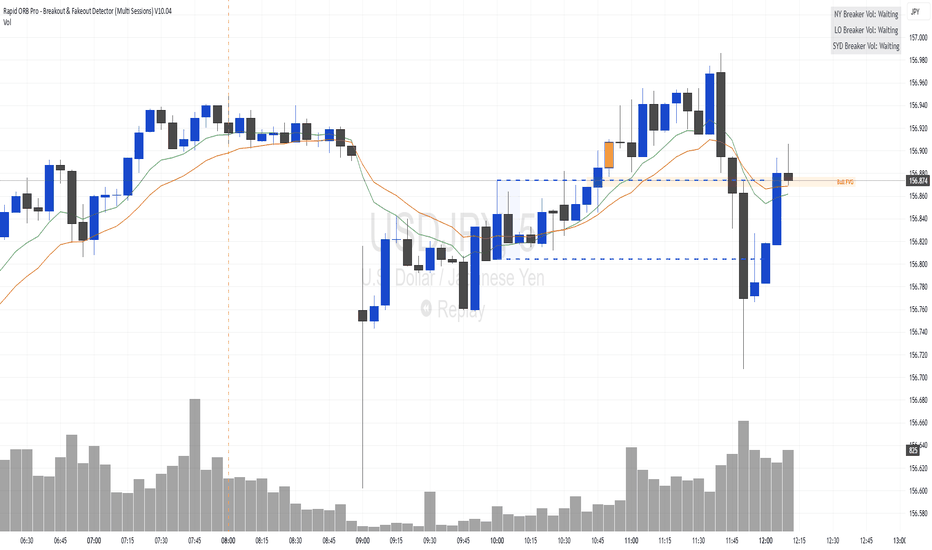

How to Trade Using Rapid ORB ProRapid ORB Pro is a structure-first, confirmation-based ORB framework .

It does not execute trades automatically. Instead, it provides context, timing, and high-probability zones , while trade execution is performed using price action confirmation .

Below is the recommended execution process we use.

1. Signal + FVG Appears (Primary Setup)

Context

A valid ORB breakout signal prints

A Fair Value Gap (FVG) forms in alignment with the breakout

Execution

Follow the default entry guidance shown by the indicator

Risk Management

Stop Loss: High / Low of the 2nd FVG candle, plus a small buffer

Take Profit: As advised by indicator

This setup combines range expansion + inefficiency, and is treated as the highest-quality condition.

2. Only FVG Appears (No ORB Signal)

When an FVG forms without a breakout signal, additional confirmation is required.

Three execution models are commonly used:

A. Two-Bar Sweep Setup

Requirements

Two consecutive candles form outside the ORB range after break

Neither candle re-enters or touches the range

Confirmation

A Pin Bar forms at the range boundary (Sitting like a Lolli Pop)

Entry

50% retracement of the Pin Bar

Risk Management

SL: High / Low of the 2nd FVG candle (+ buffer)

TP: 3R

B. Gap Fill → Engulfing Reaction

Requirements

Price retraces into the FVG

A strong engulfing or marubozu candle forms

Entry

50% of the engulfing candle

Risk Management

SL: High / Low of the retest candle (+ buffer)

TP: 3R

C. Gap Cross → Liquidity & CISD

Requirements

Price fully crosses the FVG

Reaches prior swing high/low

Liquidity sweep + Change in State of Delivery (CISD)

Entry

Inside the inverse FVG (iFVG) which created by the CISD

Risk Management

SL: Below protected structure (+ buffer)

TP: Previous market structure

3. Only ORB Signal Appears (No FVG)

Requirements

Signal candle closes beyond EMA

Chart-timeframe trend aligns with signal direction

Execution

Locate a prior FVG

Wait for a valid candle pattern inside that zone

Accepted Patterns

Power engulfing

Harami

Star formations

Three Soldiers

Marubozu

Entry

50% of the confirmation candle

Risk Management

SL: High / Low of the 2nd FVG candle (+ buffer)

TP: 3R

4. Fresh EMA Cross Setup

Requirements

New EMA cross occurs

CISD with displacement is present

FVG forms

Price pulls back to EMA without breaking it

Confirmation

Pin Bar at EMA or

Engulfing candle inside FVG

Entry

50% of the Pin Bar or engulfing candle

Risk Management

SL: High / Low of the 2nd FVG candle (+ buffer)

TP: 2R

Important Notes

The indicator provides structure and timing, not trade execution

All trades require price action confirmation

Risk must be defined before entry

Not every signal must be traded

Rapid ORB Pro is designed to help traders align with:

Session structure

Liquidity behavior

Market momentum

Multi-timeframe bias

12 Laws of RSI: BTC Edition What if everything you’ve been told about “oversold” and “overbought” was statistically backwards? CRYPTO:BTCUSD

Most traders learn RSI as a simple reversal tool: buy when it’s oversold, sell when it’s overbought. But when you actually test RSI behavior across market structure, volatility conditions, volume environments, and forward‑return distributions, a very different picture emerges. The 12 Laws of RSI (BTC Edition) were created to correct the most common misunderstandings traders have about the Relative Strength Index. These laws rely on statistical findings (Due to be released soon) that summarizes the truth about the behavioral characteristics of how this indicator performs on bitcoin daily chart with a 10-day horizon. Instead of treating RSI as a simple “overbought/oversold” reversal tool, these laws reveal how RSI actually behaves in bull markets, bear markets, momentum phases, and periods of weakness. If you want to use RSI intelligently, these 12 laws are the foundation:

Law 1: RSI Is a Continuation Indicator in Bull Markets, not a Reversal Indicator.

• In bullish market structure (price > MA50 > MA200), treat RSI > 70 as a momentum confirmation, not a sell signal.

• When the market is going up, and RSI is high, do not bet against it, it means that the move is strong and its going to keep going for at least 5 days.

• If the market is strongly moving upward, and RSI is in a strong overbought position, that is an indication of double strength, not a warning sign.

Law 2: RSI < 30 is not a buy signal in bear markets.

• Do not aim for long setups with an RSI under 30 in downtrends, treat the oversold condition if the market is bearish as a sign of continuation in the negative direction.

Law 3: RSI > 70 Outperforms RSI < 30 Over 10 day horizons.

• RSI>70 can be used as a trend-strength filter for continuation setups

• This is the first place where RSI behavior produces a real, measurable statistically significant edge.

Law 4: RSI Behavior is Asymmetric, meaning Overbought does NOT equal oversold conditional wise.

• RSI > 70 has stronger, more consistent continuation in bull markets

• RSI < 30 has weaker, inconsistent bounces in bear markets

• This breaks the concept of the “buy when oversold” and “sell when overbought”

Law 5: Oversold means sellers are in control, not that a immediate reversal is incoming.

• Sellers have been beating up price for days

• This is NOT a buy signal

• RSI < 30 means the price is weak, not a discount alert.

Law 6: Oversold moves are very fast and hard, and are not statistically random.

• Bearish moves are very sharp and aggressive, and usually steep negative movements fall with force

• Sharp drops are going to often keep going rather before they stop

• Expect volatility and instability, not a clean bounce

Law 7: Oversold does not prove that positive returns are within a 10 day horizon.

This is because of how violent price can move in an oversold territory.

Law 8: Oversold price reversals are weak, inconsistent and mostly random.

• RSI values below 30 do not indicate a “bottom is in”

Law 9: Buying the “dip” just because the RSI indicator indicates a bottom is statistically a bad idea.

• Never assume that oversold means “Safe to buy”, you should like always, treat values below 30 as a signal to expect more moves to the downside.

Law 10: It’s not smart to pair volatility indicators to see if you can get a statistical edge with even the best oversold setups with the RSI.

• High volatility oversold, and low volatility oversold produce statistically indistinguishable forward returns, and volatility does not make RSI < 30 better or worse in any reliable way.

Law 11: Trend Indicators with low RSI filters do not offer a “fix”.

• Strong downtrends do not make RSI < 30 reversals any stronger

• All the “Oversold works best after a big dump” narratives fail statistically.

• Avoid rules like “buy RSI<30 after a 10 day crash”

Law 12: Prior uptrends do not offer an extra edge

• High RSI + Prior uptrends do not equal major bull runs are about to occur at all, that’s why you should use good risk management and position sizing, and only sacrifice what you can afford to lose

The 12 Laws of RSI make one thing clear: RSI is not a reversal tool, it is a context‑dependent continuation tool.

High RSI in bull markets signals strength, not danger.

Low RSI in bear markets signals weakness, not opportunity.

Oversold reversals are unreliable, inconsistent, and cannot be repaired with volatility indicators, trend indicators, or deep‑decline indicators.

The only meaningful edge comes from understanding RSI’s asymmetry: RSI > 70 has more continuation power than RSI < 30 has reversal power.

If you want to use RSI effectively, you must stop treating it as a bottom‑finder and start treating it as a market structure aware momentum gauge.

Legal Disclaimer

These laws summarize historical behavior and are provided for educational purposes only.

They do not constitute financial advice, trading recommendations, or predictions of future performance. Cryptocurrency markets are volatile and unpredictable; always use proper risk management and consult a qualified financial professional before making investment decisions.

A guide to Optimise your profits using your trading DiaryI could have done 1037% more in 2025

Introduction:

In the following article, I will try to breakdown the following points

1.why is it important to accumulate trading data

2.what data to collect

3.how can it be used to maximise profit and boost confidence

4.Examples and stats from my own trading experience

• Why is it important to collect data?

Collecting your trading data is a great way to keep track on your performance and also compare your trading with past periods whether you are a trader who doesn't change strategy often or you are someone who change strategy every now and then. But also it can help you to answer the "what if" questions which I believe every trader ask himself, mostly beginners but also more seasoned traders.

What if I held the trade longer?

What if my Stop Loss was larger?

What if I had bigger account and so on…

This is where you trading diary comes in to help you simulate or back test the real trades you took under different conditions set up by you and that's what makes trading diary back test personal and tailored to your own trading style.

With a little knowledge of using tools like Excel, Sheets or even Python you can make the data work for you. The results will surprise you.

Now, I want to state here that I have just very basic knowledge of how to use Excel, performing basic task, but is just enough, what I'm saying you don't have to be an Excel Guru.

So if you want to find your trading sweet spot I think this is a good read worth your time, if you are only interested in the results and real data from my 2025 trades scroll to the bottom where I will post some interesting stats.

I could have done 1038% more or 10.38£ more for every 1£ of profit!

• What data to collect?

I will display it in two types of data Raw Data (just raw numbers) and Derivatives (relationship between two or more raw data sets) and Formulas (the mathematical operation used to derive those numbers). For completeness I will add all the data I collect for each trade, and the data sets marked with * are the one needed to perform the optimisation. Note that your broker already collects some of your trading data, but usually is very general information (i.e trade duration, P/L ratios, RRR etc.) in our case we need a bit more detailed information.

• How to perform the Optimisation, and Assumptions .

Now, first I will start with the assumptions one has to take in consideration, specifically when reading the examples of my own trading simulation. I want you to understand more about my trading technic because it is very likely it's different than your and the set up for the computation might differ when you try to replicate it.

- I'm a day trader but I want to move into swing trading, that is why I collect 5DayMax and 5DayMin, I'm interested to see how far a trade go in a full trading week

- I have two accounts my own 5k and funded 50k, and later in the example you will see in my stats I took this into consideration.

- I trade support and resistance (parallel channels) , both breakouts and rejections

- My max risk is 30 pips, my overall average is 21.32, my 2025 average is 17.39 pips

- My targets are next support/resistance not RR ratios (if a set-up is good I'm happy to take 1:1 ratio)

- I had 210 trades last year about 4 per week, and I enter the same entries both in the small and big account, they are practically synchronised the only difference is the size of the entries.

- Random PL, I intend closing trade following signals, for example a counter pattern, divergence, volume or any other tool you are using to close your trades. Random because it doesn't specify where exactly you will exit the trade, but rather "I will exit if".

This is how my optimisation table looks like, I excluded some other sets I add, but they are irrelevant to the subject we are discussing now.

Examples

Example 1 Real PL: In the first example we will just compare real values, i.e keep the actual PL pips constant only manipulate size

Assume 1 lot = 10 pips

Simulation I: Ideal Fixed Size 2 Lots

Simulation II: Optimal Lost per trade 120£ max

Let's break this down.

Real PL -12£

Simulation I (hold size constant) 60£

Simulation II (hold SL£ constant) 120£

Three different outcomes to two absolutely identical trades. We haven't change anything else in the trades except the inputs of the size. The difference comes because the PL it is not a function of your stop loss or target, but rather a function of the size(x) and your actual closing(a). PL(x) = a(X) - s (spread).

** Opt. N is very similar to buying an option where the profit can go up to "infinity" if you have infinite amount of capital (x can be 0.1 to ∞, ) but our loss it's just the premium for that option.

Example 2 Optimising the Target:

Assume Mini Lots 1mini lot = 1Pip

Target Optimisation at 50%

Simulation I: Take profit at 50% from open to target, all other things equal

Simulation II: Ideal Fixed Size 6mini lots, take profit at 50% from open to target

Simulation III and IV: Opt. Lost per trade 100 and 250, take profit at 50% from open to target

Additional notes:

**It is very useful to use conditional formatting to separate winners from losers by target %

** When a trade is lost is multiplied by the risk not by % target

Now, I know at first glance this table can look a little bit confusing and I promise you, but once you summarise the totals only in a separate table it becomes much easier to read.

Real PL: 169.35

Simulation I: 169.50

Simulation II: 289.90

Simulation III and IV: 258.44 and 645.22

Takeaways from the example, having a Fixed Size or a Fixed Stop Loss in dollar value (not in pips) it's an absolute gamechanger, and you can see it by yourself and this are just 3 example trades if you perform this on a quarter or an yearly performance the numbers are mind-blowing as you will see in the next session where I will show my own stats.

To make it clear this doesn't imply you have to change your strategy or your trading decisions, but rather shows how a different set up based on your Size and SL can maximise your profits.

To clarify you still measure your targets the way you always did, but instead of waiting to take profit when the signal comes or when the target get hit, you set an alert at the % which maximises your profits over time, and once has been reached you close your trade. You might ask, why not changing directly your Target at the moment of entry, let's say your next support is at t pips you hold constant n% target why not directly cut to n pips target, well because you want to take advantage of the sudden volatility which may hit your asset.

The Goal is to take profits above n% not below n%.

Little inside of how this was thought

Essentially, when we enter in a trade we have 3 variables SL(x), Size(z) and Target(y) (in pip value), and we have to evaluate/decide their values before enter a trade based on some kind of trading strategy we follow.

By doing what I just shown in the example, we are playing with all possible relations between this variables to understand what is actually the optimal relation between X,Y and Z for that type of trading strategy. In the table below I put down the relations for completeness.

You will see them all at work at the end of this note.

• My own Stats

How to read the table:

Suppose 1 (top left corner of the table) is my profit last year(normalised to 1), then take any value from the table is X times 1.

In other words for every £ I made last year I could have done X times more.

Example: T50% Opt250 is 1x10.37 = 10.37 for every £ I made, if my real profit was 100£ then the optimised profits is 100x10.37 = 1,037£ or 1037%

Also I attached a chart where is visually easier to see the performance of each column.

Takeaways from the table:

1. 5k account best performing by holding size and target (5 mini, %mean) constant, stop loss variable.

2. 50k account best performing by holding stop loss and target (250£, 50%) constant, size variable. Here one can also imagine the more I increase the risk the more will increase the profit, there is no need to of another chart to show that, they are perfectly correlated.

3. Win % is there for a boarder view, but I don't really take it in consideration.

4. RRR not included because completely unrelated to this study, and I don't do much of it.

5. One might note that this technic also gives you a broader view of your trading strategy, and as you probably already notice my strategy (parallel channels) is profitable in nearly all x,y,z configurations even if I increase the target to 125%. The only configuration which failed completely is holding stop loss and size constant (5mini and 20pips) and having a variable target.

6. The follow up of this study will be next year, I have already adjusted my trading style to follow this findings, and can't wait to see how this will work out.

What I gained from this study:

1. I found my trading sweet spots, and therefore I can maximise my profits

2. It boost my confidence that my strategy is solid

3. I think this one is super important, I don't have to ask myself anymore "what if" questions, because I have the answers

4. I can project a better future value and growth%. Trading is a business and has to be treated as so.

5. And the most important for my personal growth, I wrote my first educational Idea.

To you:

1. Keep collecting data, anything you think can be useful.

2. Put some of this in practice a check how it works for you ( I'm sure you will benefit from it)

3. If you don't have any knowledge of how to use Excel (or similar), do a basic course.

4. Trading is not just watching at the charts, it is a continuous learning and development.

5. Set up learning targets and goals, use your screen time wisely.

Trading is a business and has to be treated as so!!!

• Final words

I really hope you enjoyed reading this study and it was worth your time, also I hope you will put some of this work in practice and maximise your 2026 profits.

There are many other possibilities here which we haven't explored yet (one very interesting example is to simulate your stop loss distance) and maybe in future I will write a few words about it.

If there is interest about this study I will be also more than happy to create Excel samples, ready to use, and of course for free, to share and simplify your job a little.

I'm not doing this for fame or money, this is just part of my learning goal.

I'm also happy to answer any questions or criticism, If you spot any mistakes please do get back to me, feedback is really important.

If you think this was a good article, please comment and click on that rocket so we can send it the moon and make it visible to as many people as possible.

Thank you!!!

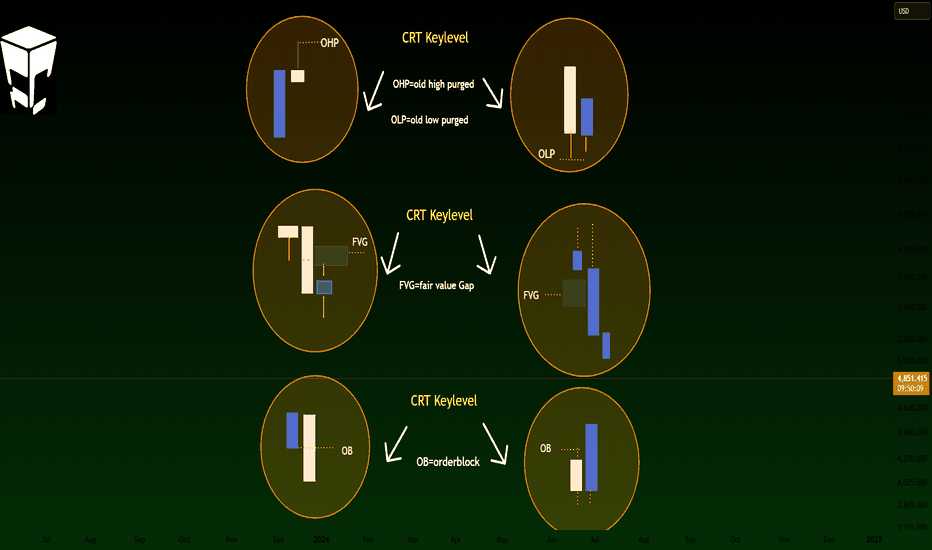

Reading Price Control Using the Reference CandleCRT – Candle Range Theory

Advanced Professional Guide with Key Levels

Candle Range Theory (CRT) is an advanced price-action framework that analyzes market behavior through price control within a defined candle range, rather than relying on classical candlestick patterns.

Before any meaningful move, the market builds a Decision Range.

CRT is the skill of reading and trading that range.

1️⃣ Reference Candle | What Is It?

A Reference Candle is a candle that:

Has a clear and meaningful range (High–Low)

Forms before or after a liquidity event

Appears at a significant Key Level

Is often accompanied by volume expansion or momentum shift

📌 This candle defines the decision framework for near-future price behavior.

2️⃣ Candle Range Structure | Internal CRT Levels

Each Reference Candle contains three critical levels:

Level Function

High Seller control ceiling

Low Buyer control floor

Midpoint (50%) Balance of power

🎯 The Midpoint (50%) is the most important CRT level

Price acceptance above or below it defines market bias.

3️⃣ Bias Determination | Market Direction

Price above 50% → Bullish Control

Price below 50% → Bearish Control

Price inside the range → Indecision / Liquidity Hunt

❌ Trading inside the range without a break and confirmation is a structural mistake.

4️⃣ Key Levels | The Backbone of CRT

CRT without Key Levels is incomplete.

Major Key Levels include:

Previous High / Low

Liquidity Highs & Lows

Daily / Weekly Open

Session High / Low (London / New York)

Higher-Timeframe Support & Resistance

📌 The highest-quality CRT setups form when the Reference Candle is created directly at a Key Level.

5️⃣ Liquidity & Manipulation | The Hidden Dimension

In many cases:

Initial breaks of the Reference Candle’s High or Low

are liquidity grabs (stop hunts), not real breakouts.

CRT helps you:

Identify false breakouts

Enter after manipulation, not before it

6️⃣ Professional Long Setup (Buy Model)

Conditions:

Price reaches HTF Support or a Liquidity Low

Liquidity sweep occurs

A Reference Candle forms

Price holds above the Midpoint

Break & Close above the candle High

Execution:

Entry: High retest or LTF confirmation

Stop Loss: Below the candle Low

Targets:

TP1: Internal range high

TP2: External liquidity

🎯 Risk–Reward: Minimum 1:3, optimal 1:5

7️⃣ Professional Short Setup (Sell Model)

Exact inverse logic:

HTF Resistance or Liquidity High

Reference Candle formation

Price acceptance below Midpoint

Break & Close below the candle Low

Entry with confirmation

8️⃣ Multi-Timeframe Alignment

A professional CRT trader uses:

Higher Timeframe (H1–H4):

Market bias

Key Levels

Reference Candle

Lower Timeframe (M1–M15):

Entry execution

Risk refinement

Precision confirmation

9️⃣ Risk Management (Institutional Style)

Stop Loss always outside the range

Risk per trade: 0.5%–1%

Partial profits allowed, core position maintained

No trade if:

The range is too small

Market is ranging with no liquidity presence

🔟 Common Advanced Mistakes

❌ Choosing a Reference Candle without context

❌ Ignoring liquidity behavior

❌ Trading mid-range

❌ Entering without break & close

❌ Trading against HTF bias

🎯 Professional Summary

CRT is the art of reading price control, not chasing candles.

When combined with Liquidity, Key Levels, and Multi-Timeframe alignment,

it becomes a repeatable, low-risk, institutional-grade trading framework.

Why Market ChangesMarkets change because participation changes. Price is not driven by patterns. It is driven by order flow, liquidity conditions, and shifting incentives across timeframes. When those inputs change, the behaviour of the chart changes with them. The same strategy can look flawless for weeks and then feel unusable, not because the market became random, but because the environment that supported the edge is no longer present.

One driver is liquidity. Crypto liquidity is not stable. Depth increases during overlap sessions and dries up during dead zones. When liquidity is thick, moves are cleaner, levels respect more often, and retests tend to hold. When liquidity thins, spreads widen, stops get tagged more frequently, and structure becomes less reliable on lower timeframes. Many traders call this manipulation. It is often just a liquidity problem.

Another driver is volatility regime. Volatility expands when uncertainty rises, new information enters, or leverage builds and gets forced out. Volatility compresses when participation slows and the market waits for fuel. Strategies that rely on tight invalidation distance struggle during expansion because candle ranges widen and execution becomes less precise. Strategies that rely on momentum struggle during compression because price rotates without follow-through. A strategy does not stop working. It becomes mismatched with the regime.

Market phase also matters. Trends, ranges, and transitions behave differently because the market is doing different work. Trends move between liquidity pools with momentum. Ranges build inventory and sweep both sides repeatedly. Transitions are messy because control is shifting and both sides are active. Traders lose most money in transitions because they apply trend logic to a market that is no longer trending.

Timeframe alignment is another source of change. A clean intraday trend can exist inside a higher timeframe range. A strong lower timeframe breakout can occur while the higher timeframe is still completing a liquidity objective in the opposite direction. When timeframes are aligned, trades feel easy. When timeframes conflict, trades feel like constant stop hunts.

Finally, participants adapt. When one side becomes crowded, the market seeks the liquidity created by that crowd. Retail tends to chase clean breakouts and obvious levels. Larger participants use those obvious levels to fill positions. As positioning shifts, the market shifts with it. Price changes behaviour because the incentives behind price change.

The practical takeaway is simple: your job is not to predict direction. Your job is to diagnose environment before you execute. Liquidity conditions, volatility regime, market phase, and timeframe alignment should decide whether you trade aggressively, trade selectively, or stay flat. Consistency comes from adapting exposure to conditions, not forcing the same behaviour onto every chart.

Losing Trades deep dive talk. Introduction to GOLD.GBPJPY short: wishful trading, no MS, no fib, calling the top.

USDCHF long: tight SL, fibs with different biases, choppy structure, bigger fib in direction of the opened position.

USDJPY long: pivotal trading, ranging, consolidation, SL to 120% of biggest candle in the range or to a closest swing.

USTEC long: no engulfing confirmation, tight SL, no retracement (pullback), low confidence in the trade.

Clear Portfolio Structure Matters More Than Market PredictionsOne of the most common mistakes investors make is believing that better predictions automatically lead to better results. In reality, markets remain uncertain regardless of how much data we consume. What often separates consistent investors from reactive ones is not forecasting ability, but portfolio structure and decision clarity.

Markets Don’t Reward Certainty - They Test Discipline

No matter how advanced analytics become, uncertainty remains a constant feature of financial markets. Prices move for reasons that are often only clear in hindsight. In this environment, relying too heavily on predictions can lead to overtrading, emotional positioning, and inconsistent risk exposure.

Experienced investors tend to shift their focus away from trying to predict every move and toward building portfolios that can function across different market regimes. Structure becomes the anchor when conviction is tested.

TradingView is full of signals, indicators, and short-term ideas. While these tools can be useful, they rarely replace a coherent framework. Without structure, even accurate signals can lead to poor outcomes if position sizing, timing, or risk alignment are unclear.

A structured portfolio approach helps transform insights into controlled action. It creates boundaries that limit emotional responses and supports consistency over time.

At its core, portfolio management is a decision system rather than a collection of trades. Allocation, diversification, and risk controls work together to reduce dependence on single outcomes.

This philosophy aligns with the approach taken by FinanceStPierre, where portfolio strategy is built around clarity, transparency, and long-term alignment rather than short-term speculation. By focusing on disciplined processes and adaptive strategy, the goal is to help clients move from insight to action without being overwhelmed by market noise.

Emotional risk is often underestimated. When portfolios lack structure, investors tend to react more strongly to volatility, news cycles, and short-term drawdowns. Clear allocation logic and predefined risk parameters reduce the need for constant intervention.

Clarity does not eliminate losses, but it helps investors understand why they occur and how they fit into the broader strategy. This perspective is essential for maintaining confidence during periods of uncertainty.

Modern markets reward speed, but long-term performance is built on patience and preparation. Investors who prioritize structure over prediction are better positioned to adapt without abandoning their strategy at the first sign of stress.

Portfolio clarity supports sustainable growth by keeping decisions grounded in process rather than impulse. It allows investors to evolve while remaining aligned with their objectives.

Predictions come and go, but structure remains. In an environment defined by volatility and constant information flow, the ability to maintain a clear and disciplined portfolio framework is a powerful advantage.

Markets will always be uncertain. The real question is whether your decision-making process is built to handle that uncertainty consistently.

How Much Can You Lose?Every trade carries two risks. One is visible and measured. The other is hidden and cumulative. Most traders focus on the visible number: the percentage or dollar amount they risk on a single position. What actually ends trading careers is the second risk, the one created by behavior, sequencing, and correlation.