Comprehensive Guide to Bull and Bear Flag PatternsBull and bear flag patterns are some of the most reliable and widely used chart patterns in technical analysis.

These patterns are particularly effective for traders who prefer trading with the trend, offering clear entry and exit points.

They appear frequently in trending markets and represent short consolidations before the trend resumes.

In this guide, we’ll cover the characteristics of bull and bear flags, trading strategies, and how to enhance your flag trading using multi-timeframe analysis.

What Are Bull and Bear Flag Patterns?

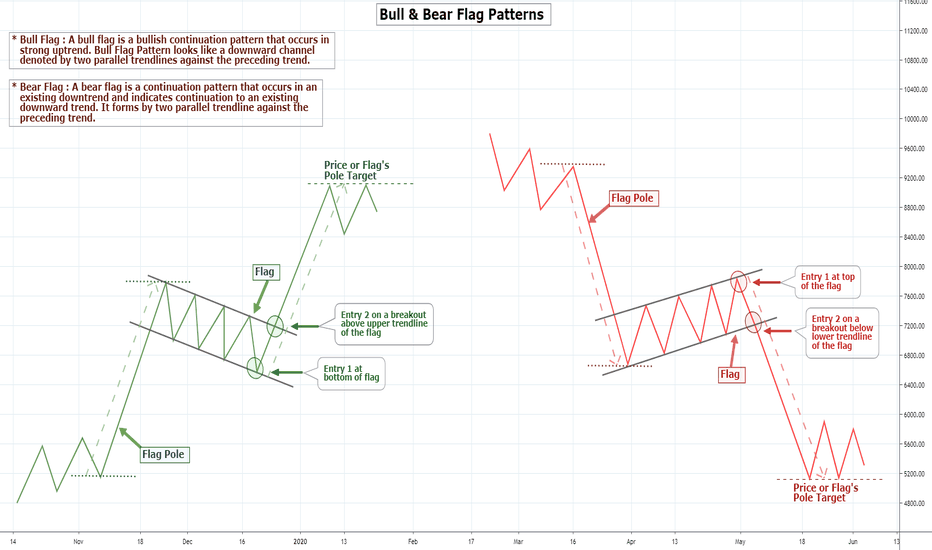

Bull and bear flags are continuation patterns, meaning they signal the potential for a price move to continue in the direction of the prior trend after a brief consolidation or retracement.

Bull Flag: This pattern occurs during an uptrend. After a sharp rise in price (the flagpole), the price begins to consolidate within a downward-sloping channel (the flag). A breakout to the upside typically follows, continuing the trend.

Bear Flag: In a downtrend, after a strong decline (the flagpole), the price consolidates in an upward-sloping channel (the flag). When the price breaks downward, it continues the downtrend.

These patterns are valuable for traders as they provide clear entry signals when the price breaks out of the flag's consolidation range.

Anatomy of a Flag Pattern

The flag pattern consists of two main components:

The Flagpole: This is the sharp price movement that occurs in the direction of the trend. It signifies strong momentum and establishes the direction in which the trend is moving.

The Flag: The flag is a period of consolidation or retracement that follows the flagpole. The price moves within parallel or slightly converging trendlines and typically retraces about 30% to 50% of the flagpole. The flag represents a pause in the market before the trend resumes.

Key Characteristics:

Bullish Flag: Occurs in an uptrend, and the consolidation takes place in a downward-sloping channel.

Bearish Flag: Occurs in a downtrend, and the consolidation takes place in an upward-sloping channel.

Volume (if you trade Crypto or stocks) tends to decrease during the consolidation phase and increases significantly at the breakout point, confirming the continuation of the trend.

Trading Strategies for Bull and Bear Flags

While bull and bear flags are relatively simple to identify, using different strategies can help enhance the effectiveness of trades. Here’s a breakdown of the most effective approaches to trading these patterns:

1. Breakout Strategy

The breakout strategy is a straightforward approach that traders use to enter a position when the price breaks out of the flag's consolidation. This marks the continuation of the trend and offers a high-probability setup.

Entry: Enter the trade when the price breaks above the upper trendline of a bull flag or below the lower trendline of a bear flag.

Stop-Loss: Place the stop just outside the flag’s opposite boundary (below the flag for bull flags or above for bear flags).

Take-Profit: Measure the length of the flagpole and project it from the breakout point. This will give you a target for where the price could potentially move.

2. Multi-Timeframe Strategy

The multi-timeframe strategy involves using multiple timeframes to analyze the flag pattern. This strategy can provide a more robust confirmation for entering the trade, as it gives you a broader perspective on the overall trend.

Higher Timeframe Analysis: Begin by analyzing a higher timeframe (e.g., the daily chart). Look for a strong trend, either bullish or bearish, and identify if a flag pattern is forming within this trend.

Lower Timeframe Confirmation: Once the pattern is identified on the higher timeframe, zoom in on a lower timeframe (e.g., the 1-hour or 4-hour chart) for precise entry points. Look for the price to break out of the flag pattern on the lower timeframe, confirming the trend continuation.

Why Use This Strategy?

Multi-timeframe analysis reduces the risk of false breakouts by confirming the broader trend on a higher timeframe.

It allows you to refine your entries by using a lower timeframe for greater precision.

Note:

A critical benefit of this strategy is its ability to significantly enhance the risk-to-reward (R:R) ratio, with the example presented achieving an impressive 1:5 ratio. This means that for every unit of risk taken, the potential reward is five times greater—a highly efficient use of capital and risk management.

3. Pullback Entry Strategy

The pullback entry strategy offers a more conservative approach to trading flag patterns. Instead of entering at the initial breakout, this strategy waits for a pullback toward the breakout level to confirm the trend’s continuation.

Entry: Enter the trade after the breakout has occurred but wait for the price to pull back to the flag’s trendline. This pullback gives you a better risk-to-reward ratio.

Stop-Loss: Place the stop just below the flag’s trendline for a bull flag or above it for a bear flag.

Take-Profit: As with the breakout strategy, project the flagpole's length from the breakout point for your target.

When Not to Trade Flag Patterns

While flag patterns are reliable, they are not always guaranteed to work. There are specific conditions when you should avoid trading them:

Choppy or Sideways Markets: Flags perform best in trending markets. If the market is choppy or moving sideways, flag patterns are less likely to lead to a strong breakout.

Weak Flags: If the flag's consolidation is too broad or the market loses momentum during the consolidation, the breakout may be weak or fail altogether.

Conclusion

Bull and bear flag patterns are essential tools in any trader's toolkit, offering high-probability setups in trending markets.

By understanding how to spot them, applying different trading strategies, and incorporating multi-timeframe analysis, traders can enhance their chances of success.

Final Tip: Always combine flag patterns with good risk management techniques, such as proper stop-loss placement and positive risk:reward.

Bullflags

Advanced Bull Flag ConceptsHave you ever wondered why price action sometimes forms a bull flag pattern?

Have you ever wondered if there is a way to predict whether a bull flag will break out before it actually does so?

In this post, I will try to address these questions by presenting a couple of theories about the nature of bull flags.

Bull Flag Theories

(1) The flag structure of a bull flag tends to form along Fibonacci levels, with the ideal flag proportion being an approximated golden ratio to the flagpole; and

(2) Fibonacci and regression analyses can provide useful insight into whether price will successfully break out of its bull flag pattern, sometimes long before price even attempts to do so.

I will try my best to clearly explain both theories in detail below.

Note: Although this analysis is also generally true for bull pennants, bear flags, and bear pennants, to keep things simple I will focus solely on bull flags. Additionally, this analysis is generally true across timeframes.

Part I - The Basics of a Bull Flag

First, let's begin with the basics. As shown in the image below, bull flags form when an asset is in a strong uptrend. The uptrend forms the flagpole of the bull flag structure.

The flag structure forms when price consolidates, usually in a falling trend. This consolidation phase is often characterized by price oscillators rotating back down while the price retraces only a small part of its prior upward move.

From a market psychology perspective, bull flags often form when most market participants who bought the asset continue to hold it expecting the uptrend to resume, while only a minority of market participants sell (or short the asset) as its price corrects downward. The bull flag pattern is a continuation pattern because it reflects the market's general expectation that price will eventually resume its upward move.

Once the price definitively breaks above the upper channel of the flag (often with strong momentum and high volume), the bull flag pattern is validated. Upon breakout, the expected move up is equal to the vertical height of the flagpole.

Part II - The flag structure of a bull flag tends to form along Fibonacci levels, with the ideal flag proportion being an approximated golden ratio to the flagpole

Here's where things begin to get interesting. Below is the golden ratio.

Two quantities, a and b (where a > b ), form the golden ratio if their ratio is the same as the ratio of their sum to the larger of the two quantities. (See the equation below)

The equation above shows the Greek letter phi which denotes the golden ratio. Phi is equivalent to a/b when such ratio is also equivalent to (a + b)/a.

Although bull flags can take various forms, it is my hypothesis, based on chart analysis and research, that the most perfectly structured bull flags (ones that also have the highest probability of successful breakouts) occur when the flag forms a golden ratio to the flagpole.

Mathematically, this means that the vertical height of the flagpole is equivalent to (a + b) and the vertical height (i.e. the width) of the flag is equivalent to b. This is also to say that price retraces down to the 0.382 Fibonacci level as measured by applying Fibonacci retracement levels along the flagpole (or to the 0.618 point on the vertical height of the flagpole if one measures from the bottom to top).

I realize that this can be quite confusing, so let’s walk through some visualizations.

Let's first visualize this hypothesis using the golden rectangle. Below is an image of the golden rectangle. A golden rectangle is composed of a square (with sides equal to a) and a smaller golden rectangle (with width equal to b and length equal to a).

Now let's rotate the golden rectangle to better visualize the hypothesized flag pattern.

The bull flag is hypothetically an approximation of the golden rectangle, whereby the width of the flag is in a golden ratio approximation to the length of the flagpole.

In the illustration below, there are multiple bull flags contained within a Fibonacci spiral. The spiral is made up of golden rectangles, with each larger golden rectangle containing a smaller golden rectangle inside it. The smaller golden rectangle is the flag structure, and the length of the larger golden rectangle is the flagpole.

One can think of the Fibonacci spiral and the golden rectangles as a series of bull flags that build on top of each other in a repeating pattern. In this diagram, price is represented by the increasing length of the sides of each golden rectangle. In other words, the price on a chart can be seen as spiraling higher after each bull flag breakout.

Of course, not all bull flags form a structure that approximates the golden ratio, but it is my belief that in forming a bull flag, price action is aspiring to achieve as close of a golden ratio approximation as it can. I believe that the bull flags that best approximate the golden ratio structure also present the highest probability for a successful break out.

To learn more about Fibonacci spirals, including the golden spiral that Fibonacci spirals approximate, you can check out this Wikipedia article: en.wikipedia.org

Part III - Fibonacci and regression analyses can provide useful insight into whether price will successfully break out of its bull flag pattern, sometimes long before price even attempts to do so.

To see how Fibonacci levels and regression analysis can give insight into whether a bull flag will break out or break down before it does so, let's consider an example.

Let’s consider the massive bull flag that the iShares Russell 2000 ETF (IWM) formed in 2021.

In 2021, the monthly chart of IWM formed what appeared to be a bull flag, as shown below.

Now let's see why Fibonacci analysis and regression analysis were warning that this bull flag was not likely to break out successfully.

First, IWM's price did not retrace to a Fibonacci level before attempting a breakout (when using the pole as the Fibonacci retracement reference point). In the chart below, we see that price tried to break out, without even so much as retracing down to the highest Fibonacci retracement level: $196.71. By not undergoing Fibonacci retracement, price did not give its oscillators the opportunity to rotate back down fully. Instead, price remained overextended at the time it attempted to break out.

Now let's look at regression analysis. Below is a log-linear regression channel that contains IWM's entire price history. As noted in my prior posts, a regression channel simply indicates how far above or below the mean (or average) price an asset's current price is trading. In the regression channel above, the red line is the mean price, the upper channel line is 2 standard deviations above the mean, and the lower channel line is 2 standard deviations below the mean.

A successful breakout of the bull flag would have taken IWM's price way above its regression channel, to a level that is too many standard deviations above its mean price for us not to question the probability of the breakout’s success. Achieving the full measured move up would have been extremely unlikely, assuming that the regression channel is valid and that price tends to revert back to its mean over time. What was more likely than a breakout was a breakdown, and a reversion back to the mean, which is what ended up happening with IWM.

Another interesting note about IWM’s bull flag is that it presented a false breakout in November 2021. This false breakout was presenting multiple warnings signs including being a UTAD test of a Wyckoff Distribution. As shown below, however, another important clue that the November 2021 breakout would likely fail was that the breakout was not confirmed when comparing IWM to the money supply (M2SL). See the chart below.

One can interpret this chart to mean that in late 2021, IWM’s price was rising because the central bank was increasing the money supply, but not due to improving strength of the underlying companies that comprise the ETF. Using the money supply as a ratio to an asset elucidates the true inherent strength of the asset's value. To understand more about why the money supply can be used in this manner, you can check out my post below.

Part IV - Additional Comments

I have a few additional comments. I usually use Fibonacci levels on a log-scale chart to identify Fibonacci spirals because Fibonacci spirals are logarithmic spirals. However, when using Fibonacci levels based on log scale, the ratios, percentages and numbers, can seem quite confusing because they are logarithmically adjusted. If you choose to replicate my process, please be mindful of this. While using log-scale charts is critical for higher timeframes (e.g. the monthly chart or higher), I have not identified much benefit to using it on shorter timeframes.

In a prior post, I noted that Plug Power (PLUG) is currently forming one of the best-looking log-scale, golden ratio bull flags I have ever seen. If my above hypotheses are true, I would expect to see PLUG move dramatically higher in the years to come. For more information about PLUG, you can read my post linked below. (This is not a solicitation to buy PLUG. Please do your own research and carefully consider all risks.)

At the risk of making this post too long and too dense, I just want to briefly note that it is also my hypothesis, based on observation and research, that the golden ratio is where many S-curve dilemmas are solved. If you don't know what an S-curve dilemma is and you'd like to read about this you can see my post below about Jumping S-Curves .

In short, an S-curve dilemma is another way of conceptualizing the question of whether a bull flag will break out or break down.

I hope that someone finds value in this post. I spent a lot of time studying, researching, analyzing, and cogitating the mathematical nature of price action to reach many of the conclusions here. Thank you for your valuable time in reading my post.

🚩 Bull Flags VS Bear Flags🚩What is a Flag Pattern?

A flag pattern is a commonly observed technical analysis pattern used to identify potential continuation of current market trends.

It is characterized by a period of consolidation, where the market experiences a relatively small range of movement, following a significant price movement.

This pattern is formed as the market returns to a state of equilibrium, following a large move. The flag pattern is considered a continuation pattern,

as it often indicates that the market will continue to move in the same direction as the preceding trend, once the flag breaks out.

This breakout typically occurs when the price of the security breaches the upper or lower boundary of the flag, and it is usually accompanied by an increase in trading volume.

📈📉The difference between a Bull flag VS Bear flag

The difference between a bullish and a bearish flag is in the direction of the price movement. With the bullish flag, the idea is to participate in a strong uptrend. Meanwhile, with the bearish flag pattern, the idea is to trade short in the direction of the prevailing downtrend.

- Downtrend vs uptrend: Bull flag and bear flag are both continuation patterns that form when the price of a stock or asset pulls back from the predominant trend in a parallel channel.

- Bull flag: A bull flag is a sharp, strong volume rally of an asset or stock that portrays a positive development.

- Bear flag: A bear flag is a sharp volume decline on a negative development.

- Bull flag and bear flag share the same traits: Traits of Flag Patterns include support and resistant levels, flag, flag pole, breakout points and price projections.

📍Entry opportunities

The most important component of any flag pattern trade is the entry. It’s generally advisable to wait for a candle to close beyond the breakout point before creating any orders to avoid being burned by a false signal. In the example above, the entries are made on a High risk - High reward mindset with stop loss bellow the flag pattern. Most traders will enter a flag pattern trade on the day after the price has broken beyond the trend line. The length of the flag pole is typically used to calculate the profit target. Even when the formation of a flag pattern is obvious, there is no guarantee that the price will move in the expected direction. As with most technical analysis, you will get the best results from flag patterns by applying them to longer-term charts as you will have more time to consider your strategy and analyze the price action.

👤 @AlgoBuddy

📅 Daily Ideas about market update, psychology & indicators

❤️ If you appreciate our work , Please like, comment and follow ❤️

FLAG PATTERNS & PSYCHOLOGY BEHIND BULL AND BEAR FLAG FORMATIONSHi everyone and Good morning. Welcoming you back (after 18-week break)

Thanks for your like and supports.

This is Part 3 of my Technical Analysis series of CHART PATTERNS

BULL AND BEAR FLAGS

Now, for those meeting the words BULLS and BEARS for the first time, these are terms used to describe the buying and selling action of traders

BULLS generally refer to the price action of buyers as they drive Stock PRICES UP, while BEARS refer to the selling action of sellers as they drive stock PRICES DOWN.

For starters, let’s define what a Flag pattern is:

A flag pattern is a TREND CONTINUATION PATTERN . It is named a flag pattern because its formation resembles a flag on a flagpole.

The pole is usually the result of an almost VERTICAL RISE IN PRICE, and the flag part results from a PERIOD OF CONSOLIDATION

When the price breaks out of the consolidation range, it triggers the next move higher.

Flag patterns can either be BULLISH or BEARISH.

Follow me closely, as We will now look at BULL and BEAR Flags in turn:

BULL FLAGS

Bullish flag formations are found in stocks with STRONG UPTRENDS.

They look something like (sketch 1 on chart)

As can be seen on the sketch 1 chart above, the pattern starts with a STRONG, ALMOST VERTICAL price spike, that eventually start losing steam forming an orderly pullback where the highs and lows are parallel to each other forming the FLAG in the form of a tilted rectangle.

The tilted rectangle (flag) usually breaks to the upside resulting in another powerful move higher, usually measuring the length of the prior flag pole (Let’s consider the sketch 2 chart)

Now let’s look at BEAR FLAGS :

The bear flag is an upside-down version of the bull flag. It has the same structure as the bull flag but inverted. looks like sketch 3

As can be seen above, the flagpole forms from an ALMOST VERTICAL price drop, which is followed by a period of consolidation, with parallel upper and lower trendlines forming the flag.

A break of the support structure of the flag, results in another move lower, with the same length as the prior pole.

Just as with any Chart pattern, there is usually psychology behind its formation.

Let us look at the

PSYCHOLOGY BEHIND BULL AND BEAR FLAG FORMATIONS:

On bull flags, the bears (short sellers) get blindsided due to complacency as bulls (buyers) charge ahead with a strong breakout causing bears (short sellers) to either panic and cover their ‘shorts’; or add to their ‘short’ positions.

Once the stock is in the consolidation stage, the bears (short sellers) regain some confidence and they add to their ‘short’ positions with the expectation of a price drop; only to get trapped again when the price break to the upside causing short sellers to cover their ‘Shorts’ thereby driving prices even higher

Since some short-sellers from the initial flagpole run up may still be trapped, the second breakout forming through the flag can be even more extreme in terms of the angle and severity of price move.

That is precisely the psychology behind BULL FLAGS; and that same psychology applies on BEAR FLAGS, just in reverse.

Now let’s consider the sketch 4 on how we can make money from bull and bear flags:

On a bull flag, you typically want to enter a Long trade on a breakout to the upside. Take profit target should be the same length as the prior flagpole. Stop loss should be placed just below the broken resistance line, which will now be acting as support.

I will leave it here for this week, that’s all I had in store for you. Follow me And JOIN me again next week as we will be talking about another Chart Pattern that works.

Until then, here is to Profitable trading!

Bull flags explainedBull Flags are one of the most well known & easily recognized chart patterns.

The most important factor in identifying any flag pattern is the clear "staff" or "flagpole"; there should be a straight run upwards leading up to the pattern or it is not a valid pattern.

After the straight run upward price starts to Zig Zag between two converging trendlines forming a tight wedge (it can be slanted, or even symmetrical) until the price "breaks out" above the upper trendline signifying a possible continuation in trend upwards.

Bull Flags have the highest success rate out of any pattern and work extremely well when paired with long term support & resistance areas. Enter at the invalidation point of the pattern (A), second entry on the bullish retest (B). Pennants that are “tighter” have higher success rates, look for patterns forming on top of long term resistances (not below) to increase probability of success also. Pattern height is measured and added to swing low before breakout for possible target.

Sometimes large size traders can generate liquidity by faking out under the pattern support as we can see on some of the examples. The liquidity generated by triggering stop losses underneath the pattern can fill large position sizes for whales and is a good indicator for a long position once the price confirms support back inside the pattern.

LendingTree: Bullish Technicals and Fundamentals ExplainedIn this analysis, I'll be providing an in-depth analysis on LendingTree, as well as an explanation on megaphone patterns and its bullish upside.

What is LendingTree Inc.?

Lendingtree (TREE) is a company that offers a platform for borrowers and multiple lenders, offering the opportunity for its users to find the best possible deal on their loans.

Business Model

- Users of TREE gain access to multiple loan offers, and TREE’s clients gain the benefit of a cost-efficient customer acquisition.

- Essentially, LendingTree is a platform where people shop for money.

- Lendingtree works with major banks such as Citibank, Wells Fargo, as well as mortgage brokers, p2p specialty finance institutions, and small businesses.

- Their clients’ pain point is that borrower acquisition is a key constraint to growth.

- They offer a personalized platform called My LendingTree in which users can track their financial credit and performance

- Their cumulative user growth has been increasing at an exponential rate

- One fact many people misunderstand is that LendingTree does not take a markup fee.

- Their revenue comes from the payments made by lenders (their institutional clients), who pay to join the LendingTree marketplace.

- TREE also gets paid by their clients when its users sign up for their loans or services.

- While mortgage loans are their main focus, they are expanding into areas of: personal loans, auto loans, business loans, student loans, credit cards, saving accounts, and home equity loans.

Financials

- LendingTree’s revenue has tripled to $1.1 Billion by the end of 2019, almost triple the revenue of 2016.

- They continue to demonstrate tremendous growth as consumers shop for mortgages over time

- While their revenue was dominantly mortgage based, they have managed to diversify into generating revenue from non-mortgage related loans and services.

- However, their operating expenses have also significantly increased due to huge marketing budgets, and their operating income is not as exponential as their revenue growth

- Their quarterly revenue changes have been showing inconsistencies, and reported negative earnings for 2020 Q2.

- However, the company demonstrates steady and strong free cash flow

Technical Analysis

- We can take a look at TREE’s weekly chart for long term insight

- To begin with, the chart is currently trading within a textbook megaphone pattern

- A megaphone pattern can be a continuation or reversal pattern depending on how prices react near the resistance

- This pattern demonstrates 5 distinct swings, each getting larger than the previous one,

- As demonstrated above, we are currently in the middle of the fifth swing

- We can see that a reverse head and shoulders pattern has been forming since the third swing.

- We have temporarily broken out of the descending trend line resistance (marked by the dotted blue line), and forming what seems to be the right shoulder

- The formation of the right shoulder can also be seen as a bullish flag pattern, where prices are consolidating before a breakout

- On the short term, we are consolidating below the 0.618 Fibonacci retracement resistance.

- We have tested the pivot line support, as prices look to break out

- Even if we see a rejection at the trend line resistance on the fifth swing, there is a 60% upside potential based on the megaphone pattern structure

Conclusion

With the Fed having said that interest rates will remain at near zero, and considering the fact that the US housing market is still in an uptrend, given that we see more recovery in the economy, we could anticipate huge growth for LendingTree as more users seek to get loans. The technicals demonstrated on LendingTree’s chart are also extremely bullish, making this stock a solid mid-term investment.

If you like this analysis, please make sure to like the post, and follow for more quality content!

I would also appreciate it if you could leave a comment below with some original insight.

How to Trade Bull & Bear Flag Pattern | Flag Pattern Tutorial !Bull & Bear Flag chart patterns Tutorial!

Bull Flag : A bull flag forms in bullish trending market, After a strong bullish movement when this pattern forms it signals the market is likely to move more higher. Bull flag pattern much similarly looks like a horizontal parallel channel or downward parallel channel along with a strong bullish vertical rally; when we draw the pattern it looks like flag on a pole, that's why they are called bull flags.

How to identify and Trade Bull Flags : - It is easy to identify a bull flag you just need to look for a Bullish Vertical Rally or Trend which is Pole of the Flag then identify the consolidation which will look like either horizontal channel or downward channel which will be the Flag. After identifying the pattern you can enter at the bottom of the flag or you can enter when price breaks the upper trendline of the flag which is more safe.

The breakout may also be a fakeout that's why we will take help of Volume and RSI Indicator to confirm the breakout. As shown on the below example you can see when price breaked the uppper trend of the flag the Trend drawn on the RSI was also broke and the Volume was high.

()

( *Key things to know : If the retracement measured from the vertical rally or Flag Pole retrace more than 50% the pattern becomes weak and it may not be a Flag Pattern but sometimes it stays valid if it breakouts above the uppertrend of the flag.)

Bear Flag : Bear Flag is just the opposite of the Bull Flag Pattern. A bear Flag forms in bearish trending market. Bear Flag pattern signals the market is likely to drop more lower. You need to identify Bear Flag in bearish trend when the price of a financial asset drops then if the price forms a horizontal channel or upward channel which will look like a inverted flag whose flag pole will be upside and the flag will be downside.

Stay Tuned; 👍

Like this tutorial & share your comment below and also

check other tutorials with example linked below;

Thank You-

Another bull flag or a massive bull trap for a down trend

It appears we might be having a big run up if BTC price follows through upwards over the 9500 (red line) area towards 9800 - 9920, thereby creating what appears to be a bull flag.

Another range trading will then be within the flag before it shoots up but if goes down below the 9200 without hitting the 9800 area, I would assume that move invalidates creating a bull flag and prepare for a downtrend.

This is not a Trading advice. Just following the price action and putting down my opinion of things.

Basic Market Structure and Pattern BehaviorBasic Market Structure and Pattern Behavior applied on every timeframe and any markets (stocks, crypto, fx, futures, indices etc).

Common Patterns I showed on the chart:

Double Bottom / Triple Bottom

Bull Flag / Bear Flag

Ascending Wedge / Descending Wedge / Expanding Wedge

Head and Shoulders / Inverted Head and Shoulders

Cup and Handle / Inverted Cup and Handle

All of given patterns generates good trading signals, and if you combining them with indicators you can have a good trading system.

Litecoin Wyckoff Accumulation Event "Continuous Weakness"Litecoin showing great setup of Re-Accumulation (Bull-Flag) and you can find this chart easy to use on other assets where you can find Descending Wedges.

My previous Litecoin analysis was posted on January 23 2019, achieved about 45% profits so far, and still active targets.

How to Trade Bullish Flag Patterns - ETHUSDThe flag pattern is fairly simple with just three components.

1. The flagpole

2.The flag

A strong up trend

Ideally, we want to see a retracement of 38.2% or less for trend continuation.

To trade the flag, you can time an entry at the lower end of the price channel or wait for a break up above the upper channel. Look to take profits by projecting the length of the flag pole at the bottom of the flag.

Stop loss is to be placed below the flag channel.

Anyone interested to know more about forex, cryptocurrencies or crypto mining feel free to drop me a message here.