Trading Weekends Is a Dead-Man ZoneWeekend trading in crypto looks active on the surface, but the structure underneath is fragile. Liquidity thins, participation drops, and price becomes easier to move with relatively small orders. What appears to be opportunity is often noise amplified by absence of depth. This is why weekends quietly drain accounts rather than build them.

Institutional participation is minimal during weekends.

Many large players reduce exposure or remain inactive, which removes the stabilizing force that normally absorbs volatility and validates structure. Without that participation, levels lose reliability. Breakouts occur without follow-through. Reversals happen without warning. The market is not directional; it is reactive.

Spreads widen and order books thin. This increases slippage and distorts risk. Stops that would survive during active sessions are easily tagged. Entries that look precise on the chart fill poorly in reality. Execution quality degrades, even if the setup appears valid in hindsight.

Another issue is narrative vacuum. During the week, price responds to macro flows, funding dynamics, and session-based participation. On weekends, these drivers are largely absent. Price often rotates aimlessly or runs obvious liquidity pools without establishing commitment. Traders mistake movement for intent and become the liquidity that others exit against.

Psychology also shifts. Weekends invite boredom trading.

Without a structured routine, traders lower standards, widen assumptions, and take setups they would normally ignore. Losses feel smaller individually, but they accumulate through frequency and poor sequencing.

There are exceptions. High-impact events or structural carryover from a strong weekly close can create opportunity. These situations are rare and require reduced size and stricter confirmation. For most traders, restraint is the edge.

The market will still be there on Monday with clearer structure, deeper liquidity, and better execution conditions. Survival in trading is not about participation at all times. It is about choosing when conditions justify risk. Weekends rarely do.

Fundamental Analysis

Yen rebound (JPY): a systemic threat?The Japanese yen is close to its lowest level in 40 years and has been the weakest currency in the FX market for several years. However, since the end of January 2026, it has shown a bullish impulse that could mark the beginning of a longer-term upward phase. Could such a regime shift in the yen’s trend represent a threat to Japan, the foreign exchange market, and global finance in general?

First, it is important to keep in mind that the recent rebound in the yen (JPY)—that is, the decline in USD/JPY since last Friday—does not yet change the yen’s underlying trend. The yen remains in a broader downtrend. However, if this underlying trend were to reverse from bearish to a new long-term bullish trend, then significant risks for global finance could indeed emerge. These risks are not driven by the yen rebounding per se, but rather by the speed and momentum of any potential appreciation of the Japanese currency.

The main systemic risk would stem from the unwinding of yen carry trade positions that are still outstanding. At the same time, it should not be overlooked that a yen rebound can also have positive effects, particularly for the Japanese economy, which is seeking to combat inflation.

Here is where the systemic risk to global finance could arise:

• If the yen rebounds too quickly (speed is the key factor), there could be a full unwinding of the approximately USD 200 billion in remaining yen carry trade positions, potentially triggering a global market sell-off

• If the yen rebounds sharply while Japanese interest rates continue to rise, a major source of global funding would disappear

• If the yen rebounds too strongly and too quickly, Japanese institutional investors may

repatriate capital invested abroad into domestic assets, triggering selling pressure on global equity markets

• From a technical perspective, USD/JPY must not fall below the 140 JPY support level

These risks must nevertheless be nuanced and placed within a broader macroeconomic context. A persistently weak yen has certainly supported the competitiveness of Japanese exports and boosted the profits of large listed companies, but it has also imported significant inflation, particularly in energy and food. In this context, a controlled rebound in the yen could instead be viewed as a factor of macroeconomic stabilization for Japan.

A stronger yen would help reduce imported inflation, improve the purchasing power of Japanese households, and restore some credibility to the Bank of Japan’s (BoJ) monetary policy, which has long been perceived as ultra-accommodative and isolated compared with other major central banks. It would also give the BoJ greater room to gradually normalize its interest rate policy without triggering an inflationary shock.

In summary, a yen rebound is not, in itself, a systemic threat. It only becomes potentially dangerous if it is too rapid, too violent, and leads to a sudden end of the yen carry trade. Under a central scenario of gradual normalization, a stronger yen could instead help reduce some of the imbalances accumulated over recent years, both in Japan and globally.

DISCLAIMER:

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only. The presented idea (including market commentary, market data and observations) is not a work product of any research department of Swissquote or its affiliates. This material is intended to highlight market action and does not constitute investment, legal or tax advice. If you are a retail investor or lack experience in trading complex financial products, it is advisable to seek professional advice from licensed advisor before making any financial decisions.

This content is not intended to manipulate the market or encourage any specific financial behavior.

Swissquote makes no representation or warranty as to the quality, completeness, accuracy, comprehensiveness or non-infringement of such content. The views expressed are those of the consultant and are provided for educational purposes only. Any information provided relating to a product or market should not be construed as recommending an investment strategy or transaction. Past performance is not a guarantee of future results.

Swissquote and its employees and representatives shall in no event be held liable for any damages or losses arising directly or indirectly from decisions made on the basis of this content.

The use of any third-party brands or trademarks is for information only and does not imply endorsement by Swissquote, or that the trademark owner has authorised Swissquote to promote its products or services.

Swissquote is the marketing brand for the activities of Swissquote Bank Ltd (Switzerland) regulated by FINMA, Swissquote Capital Markets Limited regulated by CySEC (Cyprus), Swissquote Bank Europe SA (Luxembourg) regulated by the CSSF, Swissquote Ltd (UK) regulated by the FCA, Swissquote Financial Services (Malta) Ltd regulated by the Malta Financial Services Authority, Swissquote MEA Ltd. (UAE) regulated by the Dubai Financial Services Authority, Swissquote Pte Ltd (Singapore) regulated by the Monetary Authority of Singapore, Swissquote Asia Limited (Hong Kong) licensed by the Hong Kong Securities and Futures Commission (SFC) and Swissquote South Africa (Pty) Ltd supervised by the FSCA.

Products and services of Swissquote are only intended for those permitted to receive them under local law.

All investments carry a degree of risk. The risk of loss in trading or holding financial instruments can be substantial. The value of financial instruments, including but not limited to stocks, bonds, cryptocurrencies, and other assets, can fluctuate both upwards and downwards. There is a significant risk of financial loss when buying, selling, holding, staking, or investing in these instruments. SQBE makes no recommendations regarding any specific investment, transaction, or the use of any particular investment strategy.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts suffer capital losses when trading in CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Digital Assets are unregulated in most countries and consumer protection rules may not apply. As highly volatile speculative investments, Digital Assets are not suitable for investors without a high-risk tolerance. Make sure you understand each Digital Asset before you trade.

Cryptocurrencies are not considered legal tender in some jurisdictions and are subject to regulatory uncertainties.

The use of Internet-based systems can involve high risks, including, but not limited to, fraud, cyber-attacks, network and communication failures, as well as identity theft and phishing attacks related to crypto-assets.

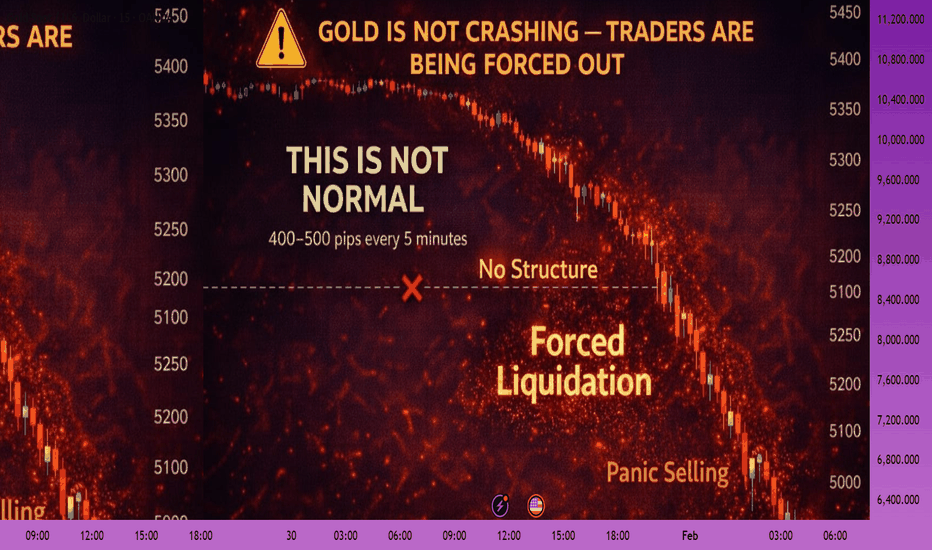

Gold Is Not Crashing — Traders Are Being Forced OutWhat we are seeing in Gold right now is NOT normal volatility.

In my entire trading career, I have rarely seen:

• 400–500 pips moves on every 5-minute candle

• 4000+ pips drop in under 30 minutes

• Zero respect for structure, zones, or indicators

This is not technical selling.

This is forced liquidation.

Here’s what’s really happening:

• Over-leveraged traders getting margin called

• Brokers force-closing positions

• Algorithms accelerating panic

• Liquidity disappearing between candles

That’s why: ❌ No pullbacks

❌ No structure respect

❌ No “entry confirmation” works

If you are trading this like a normal market, you are already late.

🔑 Reality check:

When volatility explodes, survival matters more than accuracy.

This is not the time to: • Chase trades

• Predict bottoms

• Prove you’re right

This is the time to: • Reduce risk

• Reduce size

• Or stay out completely

💬 Serious question:

Are you trading this market —

or is this market trading you?

JINDAL STEEL looks potential upside 25-30%JINDAL STEEL having good numbers of results this quarter. also technically breaks rounding bottom formation on daily basis, also weekly if close above 1095.

As per this set up this can move towards 1400-1420 in next 6-8 month.

I am Not a SEBI Registered Research Analyst. Views shared are for educational purposes only. Please consult your financial advisor before investing.

FinEco For Dummies | The Economic Eco-System Simplified🟢 Intro For Financial Economics & The Financial Eco-Sytem For Dummies

This little book is not about predictions or strategies.

It’s about understanding how financial markets connect, interact, and move together.

If you can read capital flows, risk appetite, and macro relationships,

markets stop feeling random and start making sense.

Financial markets are a system.

Money flows between assets based on risk, growth, inflation, and policy.

This book explains those relationships in simple terms,

so you can understand the environment before making decisions.

Most traders focus on charts.

Few understand the environment those charts live in.

This little book lays out a simple framework for reading market conditions,

capital rotation, and risk behavior, without strategies or hype.

This is a foundation, not a strategy.

A simple guide to how stocks, bonds, currencies, commodities, and crypto

fit together inside the global financial system.

Markets are not random.

They react to incentives, risk, and expectations.

This book helps you see those forces clearly.

🟢 1 - The Big Picture: Markets as a Flow System

Before charts, indicators, or trades, financial markets should be understood as a system of flows, not isolated instruments. Every market, stocks, bonds, currencies, commodities, crypto, etc is simply capital moving between buckets. Nothing trades in a vacuum. When money flows into one place, it must flow out of another.

-

➡️ The Core Idea

Markets are a constant process of:

- Allocation

- Re-allocation

- Risk assessment

Investors are always asking, consciously or not:

“Where do I want my money to park right now?”

The answer changes with:

- Economic expectations

- Central bank policy

- Inflation / deflation fears

- Financial stability

- Geopolitical stress

- Liquidity conditions

Price is just the result of those decisions.

Risk Is the Organizing Principle

At the highest level, all markets organize around risk.

Capital rotates between:

- Risk-on assets → growth, leverage, expansion

- Risk-off assets → safety, preservation, defense

This is not emotional.

It is structural.

Institutions manage:

- Mandates

- Drawdowns

- Volatility targets

- Capital requirements

They must rotate.

-

➡️ The Two Master Regimes

Most market behavior can be simplified into two regimes:

➡️ 1. Risk-On Environment

Characteristics:

- Optimism about growth

- Liquidity is abundant

- Credit flows easily

- Volatility is tolerated

Money prefers:

- Equities (especially growth)

- High beta sectors

- Small & mid caps

- Emerging markets

- Cyclical commodities

➡️ 2. Risk-Off Environment

Characteristics:

- Uncertainty or stress

- Liquidity tightens

- Credit risk rises

- Volatility is avoided

Money prefers:

- Government bonds

- Strong reserve currencies

- Defensive equities

- Gold

- Cash equivalents

Most of the time, markets live between these two, rotating, not flipping instantly.

➡️ Why This Matters for Trading

If you don’t know which regime you’re in, technical setups lose meaning.

A perfect long breakout:

- Works beautifully in risk-on

- Fails constantly in risk-off

A short breakdown:

- Accelerates in risk-off

- Gets absorbed in risk-on

Your job is not to predict the future.

Your job is to identify the current state.

-

🟢 2 - Capital Rotation: How Money Actually Moves

Markets do not rise or fall as one unified object.

They rotate.

Capital is constantly shifting between:

- Sectors

- Asset classes

- Regions

- Risk profiles

This rotation is not random. It follows incentives.

-

➡️ Rotation vs Direction

A common beginner mistake is thinking:

“The market is bullish or bearish.”

In reality, markets are often:

- Bullish somewhere

- Bearish somewhere else

While headlines say “stocks are flat,” money may be:

- Leaving defensives

- Entering growth

- Rotating from large caps into small caps

- Moving from bonds into equities

- Or the opposite

Understanding where money is going matters more than knowing the index direction.

-

➡️ Why Rotation Exists

Large institutions:

- Cannot move all at once

- Cannot hold everything

- Must rebalance constantly

They rotate because of:

- Changing growth expectations

- Interest rate shifts

- Inflation outlook

- Volatility targets

- Risk management rules

This creates waves, not straight lines.

-

➡️ The Economic Cycle (Simplified)

While real life is messy, capital often behaves as if it follows a loose cycle:

Early Expansion

- Rates low or falling

- Liquidity improving

- Confidence returning

Capital prefers:

- Small caps

- Cyclicals

- Growth sectors

- High beta assets

Mid-Cycle

- Growth strong

- Earnings expanding

- Rates stable or slowly rising

Capital prefers:

- Large caps

- Technology

- Industrials

- Consumer discretionary

Late Cycle

- Inflation concerns

- Rates restrictive

- Margins pressured

Capital rotates into:

- Energy

- Materials

- Value

- Financials (if yield curve allows)

Stress / Contraction

- Growth uncertainty

- Credit risk rising

- Liquidity tightening

Capital hides in:

- Defensives

- Bonds

- Gold

- Cash (Liquidity tightening)

This is not a checklist, it’s a lens.

-

➡️ Why Broad Sector ETFs Matter

Broad ETFs allow you to:

- Observe rotation in real time

- See what is being rewarded

- Identify what is being abandoned

They act as market thermometers.

A single stock can lie.

A sector rarely does.

-

➡️ Relative Strength Is the Tell

The most important question is not:

“Is this going up?”

But:

“Is this outperforming other places capital could go?”

Outperformance = demand

Underperformance = avoidance

This relative behavior often appears before major market pivots.

-

➡️ Setting the Stage

From here, we’ll start breaking the market into functional blocks:

- Broad indices

- Sector ETFs

- Bonds

- Currencies

- Hard assets

- Others

Each block tells a different part of the story.

-

🟢 3 - Broad Market Structure: Who Leads, Who Follows

Before zooming into sectors, it’s critical to understand the hierarchy of the equity market itself.

Not all stocks matter equally.

Not all indices send the same signal.

Markets have leaders and followers.

-

➡️ The US Equity Market as a Pyramid

At the top of the pyramid sit the largest, most liquid companies.

At the bottom sit smaller, more fragile, higher-risk firms.

Large Caps

- Highly liquid

- Globally owned

- Institutional core holdings

They represent:

- Stability

- Capital preservation with growth

- Confidence in the system

Mid Caps

- More domestic exposure

- More growth-sensitive

- Less balance-sheet protection

They represent:

- Expansion

- Risk tolerance

- Economic optimism

Small Caps

- Least liquid

- Most rate-sensitive

- Highly dependent on credit conditions

They represent:

- Risk appetite

- Liquidity abundance

- Speculation tolerance

-

➡️ Why Size Matters

When confidence rises:

- Capital flows down the pyramid

- Large → Mid → Small

When stress appears:

- Capital flows up the pyramid

- Small → Mid → Large → Cash

This movement often happens before headlines change.

➡️ Reading the Market Through Indices

Broad indices act as regime filters:

SPY (S&P 500)

Represents large-cap US equity exposure

- Dominated by mega-cap tech and financials

Strength here means:

- Core capital is comfortable staying invested

- The system is stable enough to hold risk

RSP (Equal-Weight S&P 500)

Removes mega-cap dominance

- Shows participation breadth

If SPY rises but RSP lags:

- Leadership is narrow

- Risk is concentrated

- The rally is fragile

If RSP leads:

- Participation is broad

- Confidence is healthy

- Moves are more sustainable

-

➡️ Breadth Is Not a Detail - It’s a Warning System

Strong markets:

- Many stocks participating

- Many sectors contributing

- Leadership rotates smoothly

Weak markets:

- Few leaders

- Defensive hiding

- Sudden rotation spikes

Breadth deterioration often appears long before price collapses.

-

➡️ Why This Matters for Everything Else

Equity leadership sets the tone for:

- Sector performance

- Currency flows

- Bond behavior

- Commodity demand

If equities are unhealthy internally, risk assets elsewhere struggle to hold gains.

-

➡️ Key Takeaway

Markets don’t break all at once.

They weaken from the inside out.

If you learn to read:

- Size

- Breadth

- Leadership

You stop reacting and start anticipating.

-

🟢 4 - Sector ETFs: Reading the Economy Through Capital

KRE — Regional Banks

US regional banks, credit-sensitive, domestic lending.

Best in: Early recovery, rate cuts, steepening yield curve.

Struggles in: Tight liquidity, stress, rising defaults.

ITB — Homebuilders

US residential construction and housing demand.

Best in: Falling rates, easing financial conditions.

Struggles in: Rising yields, affordability stress.

SMH — Semiconductors

Global chipmakers, cyclical growth, capex-driven.

Best in: Expansion, liquidity growth, tech-led cycles.

Struggles in: Hard slowdowns, demand shocks.

XME — Metals & Mining

Steel, miners, raw materials.

Best in: Reflation, infrastructure cycles, USD weakness.

Struggles in: Deflation, global slowdown.

XLRE — Real Estate

REITs, income and rate-sensitive assets.

Best in: Falling yields, stable growth.

Struggles in: Rising rates, credit stress.

XLY — Consumer Discretionary

Non-essential spending (retail, autos, leisure).

Best in: Strong consumer, expansion phases.

Struggles in: Recessions, confidence drops.

EBIZ — E-Commerce / Digital Consumption

Online retail and digital consumer platforms.

Best in: Growth + digital shift, USD weakness.

Struggles in: Consumer pullbacks, tightening liquidity.

XLK — Technology

Large-cap US tech, growth and duration exposure.

Best in: Liquidity expansion, falling rates.

Struggles in: Tight policy, rising real yields.

XLE — Energy

Oil & gas producers and services.

Best in: Reflation, supply constraints, USD weakness.

Struggles in: Demand destruction, growth shocks.

XLB — Materials

Chemicals, construction materials, inputs.

Best in: Early-cycle recovery, reflation.

Struggles in: Late-cycle slowdowns.

RSP — Equal-Weight S&P 500

Broad market without mega-cap dominance.

Best in: Healthy, broad-based expansions.

Struggles in: Narrow leadership, defensive markets.

SPY — S&P 500

US large-cap benchmark.

Best in: Most regimes, reflects overall risk appetite.

Struggles in: Systemic shocks.

XLI — Industrials

Manufacturing, transport, capital goods.

Best in: Expansion, infrastructure, global growth.

Struggles in: Recessions, trade slowdowns.

XLF — Financials

Banks, insurers, financial services.

Best in: Steep yield curve, economic growth.

Struggles in: Credit stress, inverted curves.

XLC — Communication Services

Media, telecom, platforms.

Best in: Growth environments, ad spending cycles.

Struggles in: Economic slowdowns.

IGV — Software

Enterprise software and digital services.

Best in: Liquidity expansion, productivity cycles.

Struggles in: Rate shocks, valuation compression.

XLV — Healthcare

Pharma, biotech, medical services.

Best in: Defensive regimes, late cycle.

Struggles in: High-risk-on rotations.

XLU — Utilities

Regulated utilities, income-focused.

Best in: Risk-off, falling yields.

Struggles in: Rising rates, strong growth cycles.

XLP — Consumer Staples

Essentials (food, household goods).

Best in: Defensive, late-cycle, risk-off.

Struggles in: Strong risk-on rotations.

Once you understand broad market structure, the next layer is sectors.

Sector ETFs are not just industries.

They are expressions of economic belief.

Each sector answers a different question:

- Growth or safety?

- Inflation or deflation?

- Rates up or rates down?

- Confidence or caution?

By watching sector behavior, you can see what investors are preparing for, not what they are reacting to.

-

➡️ Sectors as Economic Sensors

Sectors move differently because:

- They respond differently to rates

- They depend differently on credit

- They react differently to inflation and demand

This makes them ideal tools for:

- Identifying rotation

- Confirming or rejecting index moves

- Spotting regime changes early

➡️ 1. Risk-Oriented Sectors (Risk-On)

These sectors perform best when:

- Liquidity is abundant

- Growth expectations are rising

- Investors are willing to take risk

Technology - XLK / IGV / EBIZ

- Growth-driven

- Highly rate-sensitive

- Dependent on future earnings

Strength implies:

- Falling or stable rates

- Confidence in innovation and growth

- Risk-on environment

Weakness implies:

- Rising real yields

- Liquidity stress

- De-risking behavior

Consumer Discretionary - XLY

- Depends on consumer confidence

- Sensitive to employment and credit

Strength implies:

- Healthy consumers

- Economic expansion

- Optimism about income growth

Weakness implies:

- Caution

- Demand slowdown

- Household stress

➡️ Cyclical / Expansion Sectors

These sectors benefit from economic activity itself.

Industrials - XLI

- Linked to manufacturing and infrastructure

- Sensitive to growth and capex cycles

Strength implies:

- Expansion

- Business investment

- Trade and logistics activity

Materials - XLB / Metals & Mining - XME

- Sensitive to inflation and construction

- Linked to global demand

Strength implies:

- Rising inflation expectations

- Commodity demand

- Late-cycle or reflation themes

Energy - XLE

- Tied to inflation and geopolitics

- Sensitive to supply constraints

Strength implies:

- Inflation pressure

- Tight energy markets

- Often late-cycle behavior

-

➡️ 2. Defensive Sectors (Risk-Off)

These sectors attract capital when:

- Growth is uncertain

- Volatility rises

- Preservation matters more than return

Healthcare - XLV

- Inelastic demand

- Stable cash flows

Strength implies:

- Defensive rotation

- Risk reduction

- Uncertainty ahead

Consumer Staples - XLP

- Everyday necessities

- Low growth but high stability

Strength implies:

- Capital hiding

- Caution

- Late-cycle or stress environment

Utilities - XLU

- Yield-oriented

- Rate-sensitive

Strength implies:

- Demand for safety and income

- Falling rates or risk-off mood

-

➡️ Interest-Rate Sensitive Sectors

Some sectors are less about growth and more about rates.

Real Estate - XLRE

- Highly sensitive to interest rates

- Dependent on financing costs

Strength implies:

- Falling or stabilizing rates

- Yield-seeking behavior

Weakness implies:

- Rising rates

- Credit stress

Financials - XLF / KRE

- Banks reflect system health

- Credit creation and yield curve dependent

Strength implies:

- Healthy lending environment

- Confidence in the financial system

Weakness implies:

- Credit stress

- Yield curve pressure

- Systemic caution

-

➡️ Breadth and Rotation Inside Sectors

A healthy market:

- Multiple sectors leading

- Smooth rotation

- No single sector carrying the index

An unhealthy market:

- Narrow leadership

- Defensive outperformance

- Violent sector rotations

-

➡️ Key Takeaway

Sectors tell you why the market is moving.

Index price tells you that it moved.

Sector behavior tells you what investors believe.

-

➡️ Market Regime Cheat-Sheet

How to Read Sector ETFs in Context

🟢 Risk-On / Expansion

Liquidity flowing, growth rewarded

SMH — Semiconductors (cyclical tech leadership)

XLK — Technology (liquidity + duration)

IGV — Software (productivity, growth)

XLY — Consumer Discretionary (strong consumer)

EBIZ — E-Commerce (digital spending)

XLC — Communication Services (ads, platforms)

Macro backdrop:

- Falling or stable rates

- Easy financial conditions

- Weak or stable USD

- Strong equity breadth

-

🟡 Reflation / Early Cycle

Growth + inflation expectations rising

XLE — Energy (oil, supply constraints)

XME — Metals & Mining (raw materials)

XLB — Materials (inputs, construction)

XLI — Industrials (capex, infrastructure)

ITB — Homebuilders (rate relief + demand)

Macro backdrop:

- Inflation stabilizing or rising

- USD weakness

- Yield curve steepening

- Commodity strength

-

🔵 Broad & Healthy Market

Participation matters more than leaders

RSP — Equal-Weight S&P 500

SPY — Market benchmark

Macro backdrop:

- Balanced growth

- No extreme policy pressure

- Internal market strength

- Rotation instead of liquidation

-

🟠 Financial Sensitivity

Rates, credit, curve shape matter

XLF — Financials (steep curve, growth)

KRE — Regional Banks (credit health)

XLRE — Real Estate (rate sensitivity)

Macro backdrop:

Rate cuts help

Credit stability required

Stress shows early here

-

🔴 Defensive / Risk-Off

Capital preservation, not growth

XLV — Healthcare

XLP — Consumer Staples

XLU — Utilities

Macro backdrop:

- Tight liquidity

- Economic uncertainty

- Rising volatility

- Capital rotates, doesn’t disappear

How to Use This Cheat-Sheet:

- Leadership = regime signal

- Rotation ≠ crash

- Defensives leading = caution

- Cyclicals + tech leading = expansion

- Banks & housing weaken first in stress

-

🟢 5 - Bonds and Central Banks: The Gravity of Markets

If equities are the expression of confidence,

bonds are the constraint.

No market ignores bonds for long.

Interest rates determine:

- The cost of money

- The price of leverage

- The value of future cash flows

- The tolerance for risk

This makes bonds the gravitational force of financial markets.

-

➡️ Why Bonds Matter More Than Headlines

Stocks can stay irrational for a while.

Bonds can not.

Bond markets are dominated by:

- Institutions

- Governments

- Pension funds

- Central banks

They reflect:

- Inflation expectations

- Growth expectations

- Trust in policymakers

When bonds move, everything else eventually follows.

-

➡️ US Treasuries - The Global Benchmark

US Treasuries are the foundation of:

- Global pricing

- Risk-free rates

- Collateral systems

Rising yields mean:

- Tighter financial conditions

- Higher discount rates

- Pressure on growth assets

Falling yields mean:

- Easier conditions

- Support for risk-taking

- Relief for leveraged assets

-

➡️ Short-Term vs Long-Term Yields

The shape of the yield curve matters.

Rising short-term yields:

- Reflect central bank tightening

- Increase funding stress

- Pressure equities and credit

Rising long-term yields:

- Reflect inflation or growth expectations

- Hurt duration-sensitive assets

- Strengthen the currency

Falling long-term yields:

- Signal slowing growth or stress

- Support defensives and gold

-

➡️ The Federal Reserve - Liquidity Manager

The Fed does not control markets directly.

It controls liquidity conditions.

Through:

- Policy rates

- Balance sheet operations

- Forward guidance

The Fed influences:

- Risk appetite

- Credit creation

- Volatility tolerance

Markets often move in anticipation of Fed actions, not after them.

-

➡️ Japan: The Silent Anchor (BoJ & JGBs)

Japan plays a unique role in global markets.

- Ultra-low rates

- Yield curve control history

- Massive domestic savings

Japanese bonds (JGBs) act as:

- A funding benchmark

- A pressure valve for global yields

When Japanese yields rise:

- Global yields tend to follow

- Yen strengthens

- Risk assets feel pressure

This is why Japan matters even if you don’t trade it directly.

-

➡️ Fed vs BoJ - A Critical Relationship

When:

- US rates rise

- Japanese rates stay suppressed

Capital flows:

- Into USD

- Out of JPY

- Into risk assets funded by cheap yen

When that gap narrows:

- Carry trades unwind

- Volatility increases

- Risk assets struggle

-

➡️ Key Takeaway

Bonds tell you:

- How tight or loose the system is

- Whether risk-taking is rewarded or punished

- When markets are approaching stress

Ignore bonds, and everything else becomes noise.

-

🟢 6 - Currencies and FX Indexes: The Language of Capital Flows

Currencies are often misunderstood as “forex trades.”

In reality, currencies are statements of preference.

They show:

- Where capital feels safest

- Where returns are most attractive

- Which economies are trusted

- Which risks are being avoided

Currencies don’t move because of opinions.

They move because of flows.

-

➡️ Why Currencies Matter Even If You Don’t Trade FX

Every asset is priced in a currency.

That means:

- Stocks

- Bonds

- Commodities

- Crypto (later)

Are all influenced by currency strength and weakness.

If you ignore currencies, you miss:

- Hidden tailwinds

- Silent headwinds

- False breakouts caused by FX pressure

-

➡️ The US Dollar (DXY) - Global Liquidity Thermometer

The US dollar is:

- The world’s reserve currency

- The primary funding currency

- The denominator for global trade

A rising USD usually means:

- Tighter global liquidity

- Pressure on risk assets

- Stress for emerging markets

- Headwinds for commodities

A falling USD usually means:

- Easier financial conditions

- Support for equities

- Tailwinds for commodities and risk assets

The dollar is not “bullish” or “bearish.”

It is restrictive or permissive.

-

➡️ Safe-Haven Currencies - JPY and CHF

Some currencies strengthen not because of growth, but because of fear.

Japanese Yen (JPY)

- Historically used for funding

- Ultra-low rate environment

JPY strength implies:

- Risk-off behavior

- Carry trade unwinds

- Stress in global markets

JPY weakness implies:

- Risk-on

- Leverage expansion

- Yield chasing

Swiss Franc (CHF)

- Capital preservation currency

- Financial system trust play

CHF strength implies:

- Capital hiding

- Defensive positioning

- Systemic caution

Risk-Sensitive Currencies

Other currencies strengthen when:

- Growth is strong

- Commodities are in demand

- Risk appetite is healthy

These act as confirmation tools, not drivers.

Weakness here alongside strong equities is often a warning sign.

-

➡️ Currency Indexes as Regime Filters

Watching individual FX pairs can be noisy.

Indexes simplify the message.

Currency indexes help you:

- Identify broad strength or weakness

- Avoid pair-specific distortions

- See regime shifts early

If:

- USD strengthens

- JPY strengthens

- CHF strengthens

That combination rarely supports sustained risk-on behavior.

➡️ Currencies and Equity Behavior

Healthy risk environments usually show:

- Weak or stable USD

- Weak JPY

- Broad equity participation

Stress environments often show:

- Strong USD

- Strong JPY or CHF

- Narrow or defensive equity leadership

Currencies often lead equities, not the other way around.

➡️ Key Takeaway

Currencies are the nervous system of global markets.

They transmit:

- Stress

- Confidence

- Liquidity shifts

If you listen to them, markets stop surprising you.

-

➡️ Currency Regime Cheat-Sheet

*How to Read XY Indices in a Macro Context

-

USDX / DXY — US Dollar Index

Global reserve, liquidity gauge

Strong DXY → global liquidity tightens

Weak DXY → risk assets breathe

Strength signals:

- Risk-off

- Higher real yields

- Global stress

Weakness signals:

- Risk-on

- Commodity support

- EM + crypto tailwind

-

JXY — Japanese Yen Index

Carry trade & volatility trigger

Weak JPY → leverage, risk-taking

Strong JPY → carry unwind, stress

Watch for:

- USDJPY turning points

- BoJ policy shifts

- Global volatility spikes

Yen strength often precedes:

- Equity pullbacks

- Tech weakness

- Crypto drawdowns

-

CXY — Canadian Dollar Index

Commodity & energy proxy

Tracks oil, metals, global growth

Pro-cyclical currency

Strength signals:

- Risk-on

- Commodity demand

- Inflation expectations

Weakness signals:

- Growth slowdown

- Commodity pressure

-

EXY — Euro Index

Growth vs stability balance

Sensitive to global trade

Often moves opposite DXY

Strength signals:

- Global growth optimism

- Risk-on rotation

Weakness signals:

Fragmentation risk

- Banking stress

- Energy shocks

-

BXY — British Pound Index

High beta developed-market currency

Volatile, sentiment-driven

Sensitive to rates & growth

Strength signals:

- Risk-on

- Hawkish BoE expectations

Weakness signals:

- Risk-off

- Political or fiscal stress

-

AXY — Australian Dollar Index

China & global growth barometer

Closely tied to commodities & China

One of the best early growth signals

Strength signals:

- Expansion

- Commodity demand

- Risk-on

Weakness signals:

- China slowdown

- Risk aversion

-

NXY — New Zealand Dollar Index

Pure risk appetite signal

Thin liquidity, high beta

Amplifies global sentiment

Strength signals:

- Risk-on extremes

- Yield-seeking behavior

Weakness signals:

- Flight to safety

- Liquidity stress

-

➡️ How to Read *XYs Together

DXY + JXY rising → risk-off, deleveraging

DXY down + CXY / AXY up → reflation, commodities

JPY leading strength → early warning

AUD / CAD leading → growth confidence

Currencies move first.

Assets react later.

-

➡️ Key Takeaway

XY indices are not trades.

They are context engines.

If you know which currencies are gaining strength,

you know where capital is moving — and why.

Context first.

Positioning second.

-

🟢 7 - Gold and Hard Assets: Trust, Fear, and Real Value

Gold is not a growth asset.

It is not a risk asset.

It is not a productive asset.

Gold is a belief asset.

It reflects:

- Trust in money

- Confidence in institutions

- Fear of debasement

- Desire for permanence

➡️ Why Gold Exists in Modern Markets

Gold does not compete with stocks.

It competes with currencies and bonds.

Gold becomes attractive when:

- Real yields fall

- Currency purchasing power is questioned

- Financial stability is doubted

It is an alternative to:

- Paper promises

- Credit systems

- Central bank credibility

-

➡️ Gold vs Nominal Yields (Coupon rate on a bond)

A common mistake is watching gold against nominal rates.

Gold responds primarily to:

- Real yields (rates minus inflation)

- Currency strength, especially USD

Rising real yields:

- Pressure gold

- Favor cash and bonds

Falling real yields:

- Support gold

- Signal hidden stress or easing

Gold often rises before inflation becomes obvious.

- Gold and the US Dollar

- Gold and USD often move inversely.

Strong USD:

- Makes gold expensive globally

- Reduces gold demand

Weak USD:

- Supports gold

- Signals easier financial conditions

When gold rises despite a strong USD:

- That is a warning signal

- Stress or distrust is increasing

-

➡️ Gold as a Stress Barometer

Gold strength often appears when:

- Financials weaken

- Credit risk rises

- Volatility increases

- Central banks lose control narratives

Gold does not panic.

It prepares.

-

➡️ Hard Assets Beyond Gold

Other hard assets (commodities, metals) behave differently:

- They depend on demand

- They are growth-sensitive

- They can fall in deflationary stress

Gold is unique because:

- It does not depend on growth

- It does not default

- It does not dilute

-

➡️ Gold in a Healthy Market

In strong risk-on environments:

- Gold often lags

- Capital prefers productive assets

In unstable or late-cycle environments:

- Gold begins to lead

- Quietly at first

Gold strength during equity rallies is often a yellow flag.

-

➡️ Key Takeaway

Gold measures confidence in the system itself.

It does not chase returns.

It waits for doubt.

If gold starts outperforming while risk assets struggle, the market is telling you something important.

-

🟢 8 - Silver, Copper, and Oil: The Economy’s Lie Detectors

If gold measures trust,

Industrial commodities measure reality.

Silver, copper, and oil don’t care about narratives.

They respond to:

- Demand

- Production

- Energy use

- Industrial activity

They tell you whether the economy is actually functioning, not whether markets hope it is.

-

➡️ Silver - The Hybrid Asset

Silver sits between two worlds:

- Monetary metal

- Industrial commodity

Because of this, silver often behaves as:

- A leveraged version of gold when confidence is high

- An industrial proxy when growth is strong

Silver strength implies:

- Inflation expectations

- Manufacturing demand

- Liquidity abundance

Silver weakness implies:

- Industrial slowdown

- Deflationary pressure

- Liquidity stress

Silver usually:

- Lags gold in early stress

- Leads gold in reflation

Gold moves on fear.

Silver moves when fear meets demand.

-

➡️ Dr. Copper - The Doctor of the Economy

Copper is often called:

“The metal with a PhD in economics”

That’s because copper demand is tied directly to:

- Construction

- Infrastructure

- Manufacturing

- Electrification

Copper strength implies:

- Real economic activity

- Capital investment

- Expansionary conditions

Copper weakness implies:

- Demand destruction

- Growth slowdown

- Recession risk

Copper rarely lies.

If equities rally while copper falls, something is off.

-

➡️ Copper vs Equities

Healthy expansions usually show:

- Rising equities

- Rising copper

- Rising industrial demand

Danger zones appear when:

- Equities rise

- Copper falls

- Liquidity-driven rallies dominate

That divergence often precedes:

- Growth disappointments

- Equity corrections

- Risk repricing

-

➡️ Oil - The Lifeblood of the System

Oil is not just a commodity.

It is energy, and energy underpins everything.

Oil prices reflect:

- Global demand

- Transportation activity

- Industrial throughput

- Geopolitical stress

Rising oil can mean:

- Strong demand

- Inflation pressure

- Supply constraints

Falling oil can mean:

- Demand destruction

- Economic slowdown

- Deflationary forces

Context matters more than direction.

-

➡️ Oil and Inflation

Oil spikes often:

- Pressure consumers

- Hurt margins

- Force central bank responses

Sustained high oil prices:

- Act like a tax on growth

- Accelerate late-cycle dynamics

Oil collapses often:

- Signal recession

- Precede central bank easing

Putting Them Together

- Gold asks: Do you trust the system?

- Silver asks: Is inflation and demand building?

- Copper asks: Is the economy actually growing?

- Oil asks: Can the system afford this energy cost?

When all agree, markets trend smoothly.

When they diverge, volatility follows.

-

➡️ Key Takeaway

Commodities expose the difference between financial optimism and economic reality.

Equities can float on liquidity.

Commodities need demand.

If hard assets stop confirming financial markets, risk is being mispriced.

-

🟢 9 - Volatility and Options: Stress Beneath the Surface

Price tells you where markets go.

Volatility tells you how they feel about it.

The VIX and the options market are not predictors.

They are emotion and insurance markets.

They show:

- Fear

- Complacency

- Protection demand

- Risk tolerance

-

➡️ What the VIX Actually Is

The VIX measures:

- Expected volatility in the S&P 500

- Derived from option prices

- Forward-looking, not historical

Think of the VIX as:

- The price of fear

- The cost of insurance

High fear = expensive protection

Low fear = cheap protection

-

➡️ What High and Low VIX Mean

Low VIX

- Complacency

- Confidence

- Cheap leverage

- Risk-taking encouraged

This usually aligns with:

- Risk-on environments

- Strong equity trends

- Narrow pullbacks

But extremely low VIX can mean:

- Fragility

- Overconfidence

- Vulnerability to shocks

High VIX

- Fear

- Demand for protection

- Forced hedging

This usually aligns with:

- Risk-off environments

- Equity stress

- Violent price moves

But high VIX can also mean:

- Capitulation

- Opportunity

- Panic already priced in

-

➡️ Context matters.

Why VIX Is a Confirmation Tool, Not a Signal

The VIX should not be traded as a direction indicator.

Instead, it helps answer questions like:

- Is fear rising or falling?

- Is this move relaxed or stressed?

- Are investors hedging or chasing?

Examples:

- Rising equities + rising VIX = unhealthy

- Falling equities + falling VIX = complacent risk

- Falling equities + spiking VIX = stress or panic

-

➡️ Broad Options Market: Insurance Demand

Options markets reflect:

- Where traders fear losses

- Where institutions hedge exposure

- Where risk is concentrated

Heavy put demand implies:

- Protection seeking

- Defensive positioning

Heavy call demand implies:

- Speculation

- Momentum chasing

You don’t need details.

You just need to know which side is desperate.

-

➡️ Volatility and Market Regimes

Healthy markets usually show:

- Moderate or declining volatility

- Predictable rotations

- Orderly pullbacks

Unhealthy markets show:

- Volatility spikes

- Sudden regime shifts

- Failed breakouts

Volatility often changes first, price follows later.

-

➡️ Why This Belongs in the Foundation

VIX and options help you:

- Avoid false confidence

- Recognize fragile rallies

- Respect stressed markets

- Adjust expectations

They don’t tell you what to trade.

They tell you how careful to be.

-

➡️ Key Takeaway

Volatility measures psychology under pressure.

When price and volatility agree, trends persist.

When they diverge, caution is warranted.

Used simply, volatility adds clarity, not noise.

-

🟢 10 - Crypto: Liquidity, Speculation, and Confidence

Crypto is not a replacement for money.

It is not a hedge like gold.

It is not a stock.

Crypto is a reflection of liquidity, trust, and speculative appetite.

To understand crypto, you must stop asking:

“Is it valuable?”

And start asking:

“Why does capital flow here now?”

-

➡️ What Crypto Represents in the Financial Ecosystem

Crypto sits at the edge of the system.

It attracts capital when:

- Liquidity is abundant

- Trust in traditional systems weakens

- Speculation is rewarded

- Regulation feels distant

It loses capital when:

- Liquidity tightens

- Risk appetite falls

- Funding costs rise

- Fear replaces optimism

Crypto does not create liquidity.

It absorbs excess liquidity.

-

➡️ Crypto Is a Risk-On Asset

Despite its narratives, crypto behaves mostly as:

- High beta (volatile)

- Leverage-sensitive

- Confidence-dependent

Strong crypto markets usually align with:

- Weak or falling USD

- Easy financial conditions

- Tech leadership

- High risk tolerance

Weak crypto markets usually align with:

- Strong USD

- Rising yields

- Liquidity stress

- Risk aversion

Crypto exaggerates what markets already feel.

-

➡️ Bitcoin vs the Rest

Bitcoin often behaves differently from smaller crypto assets.

Bitcoin represents:

- The most liquid crypto asset

- A proxy for crypto confidence

- A store of belief, not value

Smaller crypto assets represent:

- Speculation

- Excess risk appetite

- Leverage

In stress:

- Bitcoin holds better

- Smaller assets collapse

This mirrors:

- Large caps vs small caps in equities

-

➡️ Crypto and Trust

Crypto rallies often coincide with:

- Distrust in institutions

- Banking stress

- Monetary uncertainty

- Policy confusion

But unlike gold:

- Crypto requires liquidity

- Crypto requires participation

- Crypto collapses without buyers

Gold survives fear.

Crypto needs belief and liquidity.

-

➡️ Crypto as a Timing Tool

Crypto often:

- Moves early in risk-on phases

- Peaks before broader markets

- Collapses faster in risk-off events

This makes crypto useful as:

- A sentiment amplifier

- A liquidity stress detector

Crypto rarely causes market turns.

It reveals them.

-

➡️ Why Crypto Should Be Side-eyed as Traditional Investor

Crypto helps answer:

- Are people willing to speculate?

- Is liquidity leaking out of the system?

- Is confidence rising or cracking?

Crypto is not the center of the system.

It is the canary at the edge.

-

➡️ Key Takeaway

Crypto measures belief under abundance.

When money is cheap and confidence is high, crypto thrives.

When money tightens or fear rises, crypto breaks first.

It is not a leader.

It is a mirror.

-

🟢 11 - High Impact News & The Weekly Economic Calendar

Financial markets don’t move randomly.

They move around expectations and those expectations are challenged by scheduled news.

High impact news is not about surprise headlines.

It’s about known events that can change how markets price the future.

-

➡️ What Is “High Impact” News?

High impact news is data or events that can:

- Shift central bank policy expectations

- Reprice interest rates

- Change currency flows

- Alter risk-on / risk-off behavior

Traders don’t trade the number itself.

They trade the difference between expectations and reality.

-

➡️ Why the Weekly Calendar Matters

The economic calendar tells you:

- When volatility risk is highest

- When trends can accelerate or break

- When fakeouts are more likely

Markets are often quiet before big releases

and violent after them.

Knowing the calendar helps you:

- Avoid bad timing

- Size risk correctly

- Understand sudden moves

-

➡️ Tier 1 - The Market Movers

These events can move everything at once.

Central Bank Rate Decisions (Fed, ECB, BoJ, etc.)

What they control:

- Interest rates

- Liquidity conditions

- Financial stability

Why they matter:

- Rates affect currencies

- Rates affect bonds

- Rates affect equity valuations

Markets react more to:

- Forward guidance

- Tone of communication

- Changes in wording

Rates don’t need to change for markets to move.

-

➡️ Non-Farm Payrolls (NFP)

What it measures:

- US job creation

- Labor market strength

Why it matters:

- Direct input for Fed policy

- Strong labor supports higher rates

Key components:

- Wage growth

- Participation rate

- Unemployment rate

Typical reactions:

- Strong NFP → USD up, yields up

- Weak NFP → USD down, yields down

Equities react based on what it means for rates, not jobs.

-

➡️ CPI / Inflation Data

What it measures:

- Price pressure in the economy

Why it matters:

- Determines rate direction

- Affects real yields

- Impacts purchasing power

Typical reactions:

- Hot CPI → bonds down, USD up, equities pressured

- Cool CPI → bonds up, USD down, equities supported

Inflation surprises ripple across all markets.

-

➡️ Tier 2 - Growth & Activity Signals

These shape the broader macro narrative.

➡️ PMI / ISM Data

What it measures:

- Business activity

- Economic momentum

Key level:

- Above 50 = expansion

- Below 50 = contraction

Implications:

- Strong PMI → cyclicals, commodities, equities benefit

- Weak PMI → defensives, bonds, safe havens benefit

-

➡️ Retail Sales

What it measures:

- Consumer demand

Why it matters:

- Consumption drives growth

- Confirms economic strength or slowdown

Strong sales support growth narratives

Weak sales raise recession risk.

-

➡️ GDP

What it measures:

- Overall economic output

Why it matters:

- Confirms trends already in motion

GDP rarely shocks markets.

Markets usually price it before it’s released.

➡️ Tier 3 - Context & Confirmation

These rarely move markets alone but add depth.

Includes:

- Housing data

- Consumer sentiment

- Trade balance

- Regional surveys

Useful for:

- Macro confirmation

- Long-term assessment

- Narrative validation

-

➡️ How Traders Actually Use High Impact News

Professionals focus on:

- Expectations vs outcomes

- Market reaction, not logic

- Yield and currency response first

They often:

- Reduce risk before events

- Wait for post-news structure

- Trade continuation, not the spike

-

➡️ Key Takeaways

High impact news:

- Sets volatility windows

- Tests market narratives

- Exposes weak positioning

The calendar doesn’t tell you what to trade.

It tells you when risk is highest.

If you know:

- What’s coming

- Why it matters

- Who it affects

You’re already ahead of most participants.

-

🟢 12 - Politics & Policy (For Dummies)

Politics matters to markets only when it affects:

- Growth

- Inflation

- Liquidity

- Confidence

Markets do not care about ideology.

They care about impact.

-

➡️ The Three Policy Buckets That Move Markets

1. Monetary Policy (Central Banks)

Handled by:

- Federal Reserve (US)

- ECB (Europe)

- BOJ (Japan)

- Others

Main tools:

- Interest rates

- Balance sheet size (QE / QT)

- Forward guidance

Typical market reactions:

- Rate cuts → risk-on, weaker currency, bonds up

- Rate hikes → risk-off, stronger currency, bonds down

- Dovish tone → equities up

- Hawkish tone → equities down

-

➡️ This is the most powerful policy lever.

2. Fiscal Policy (Governments)

Handled by:

- Governments

- Parliaments

- Treasuries

Includes:

- Government spending

- Tax cuts or hikes

- Stimulus packages

- Infrastructure plans

- Defense budgets

Typical market reactions:

- Stimulus → growth assets up, inflation expectations up

- Austerity → growth slows, defensive assets favored

- Large deficits → bond supply pressure, currency sensitivity

Fiscal policy works slower than monetary policy but lasts longer.

-

➡️ 3. Regulatory & Geopolitical Policy

Includes:

- Trade policy

- Sanctions

- Industrial policy

- Energy policy

- Tech regulation

Typical reactions:

- Protectionism → inflation risk, supply chain stress

- Deregulation → sector-specific rallies

- Geopolitical tension → commodities, defense, USD strength

- Stability → risk assets favored

Markets price uncertainty, not morality.

-

➡️ Key Takeaway

Politics matters only through:

- Rates

- Spending

- Rules

- Stability

Ignore the noise.

Track the economic consequences.

-

🟢 13 - Transmission Channels (Final)

Now you understand the engine.

This section explains where the effects show up.

-

➡️ Housing Markets

Sensitive to:

- Interest rates

- Credit availability

- Employment

Why it matters:

- Major household asset

- Wealth effect on consumption

- Banking system exposure

Typical signals:

- Falling housing → economic slowdown

- Rising housing → consumer confidence

-

➡️ Pensions & Long-Term Capital

Sensitive to:

- Bond yields

- Equity performance

- Demographics

Why it matters:

- Forces long-term asset allocation

- Drives demand for bonds and equities

- Creates slow, structural flows

Pensions don’t trade headlines.

They rebalance trends.

-

➡️ Government Debt

Sensitive to:

- Rates

- Inflation

- Confidence in institutions

Why it matters:

- Competes with private capital

- Influences currency credibility

- Affects future policy flexibility

Debt becomes a problem when:

- Growth < interest costs

- Confidence weakens

-

➡️ Trade & Global Capital Flows

Sensitive to:

- Currency strength

- Relative growth

- Yield differentials

Why it matters:

- Explains currency trends

- Explains sector winners

- Explains regional outperformance

Money flows where:

- Returns are higher

- Risk is perceived lower

-

➡️ Putting It All Together

Markets are not random.

They are a feedback system between:

- Policy

- Growth

- Inflation

- Risk appetite

- Capital flows

If you understand:

- Who controls liquidity

- Where growth is accelerating

- Which assets signal stress

You don’t need predictions.

You read the system!

The end.

How to Trade FOMC Days – Smart Money FrameworkFOMC days consistently produce some of the most volatile price movements in the market. The key is not predicting the news, but understanding how liquidity behaves around it. Below is a structured approach based on Smart Money Concepts.

1. Before the Release

Price typically consolidates and builds liquidity on both sides of the range.

Key steps:

Mark previous day’s high/low

Identify Asia range liquidity

Note premium/discount zones

Avoid early trades — the market often engineers traps before the announcement

2. During the Release (14:00–14:30 ET)

This is the most dangerous window.

Spreads widen

Slippage increases

Algo-driven spikes invalidate technical setups

The highest‑probability decision is to stay flat and observe.

3. After the Release

This is where the clean setups form.

Look for:

A sweep of a key high/low

A clear market structure shift

Retracement into an FVG, order block, or breaker

Targeting the next liquidity pool

This post‑news phase often delivers the most controlled and directional move of the day.

4. Markets Most Affected

USD pairs

Gold (XAUUSD)

Indices (US500, NAS100)

DXY for directional bias

Summary

FOMC is not about predicting the rate decision. It’s about letting liquidity do its job and trading the reaction, not the release. Patience during the chaos leads to clarity afterward.

⚠️ Disclaimer – DYOR

This idea is shared for educational purposes only. It reflects a personal interpretation of price action and smart money concepts.

Always do your own research before making trading decisions. Markets are volatile and carry risk.

Past performance does not guarantee future results.

Why Did Natural Gas Fall by 50 % in One Day ? - AnalysisWhat you’re seeing is not a real 50% collapse in natural gas prices, but a futures contract rollover effect. Natural gas trades in monthly contracts, and each month has its own price based on expected supply, demand, and especially weather risk. The February contract often carries a big premium in winter because of heating demand and cold-weather risks, while the March contract can trade much lower if those risks are expected to ease. When trading platforms switch from showing the expiring February contract to the March one, it can look like a massive price drop, but in reality, it’s just a shift from one contract to another with different fundamentals.

If you had an open position, you would not automatically lose 50% just because of this chart change. Your profit or loss is calculated based on the specific contract you traded (e.g., February gas), not the new one displayed. A large loss would only occur if your position was actually closed and reopened in the new contract at the lower price, which is a rollover transaction, not a market crash. So the dramatic percentage drop you see is mostly a visual effect of switching contracts, not natural gas suddenly becoming half as valuable.

Disclaimer:

This analysis is for informational and educational purposes only and does not constitute financial advice, investment recommendation, or an offer to buy or sell any securities. Asset prices, valuations, and performance metrics are subject to change and may be outdated. Always conduct your own due diligence and consult with a licensed financial advisor before making investment decisions. The information presented may contain inaccuracies and should not be solely relied upon for financial decisions. I am not a licensed financial advisor or professional trader. I am not personally liable for your own losses; this is not financial advice.

Why Volume Profile Changed the Way I TradeWhen I first started trading, I focused on what most beginners do — indicators, patterns, and endless strategies.

RSI. MACD. Support & resistance.

They worked sometimes.

But many times, price moved in ways that didn’t make sense.

It wasn’t until I truly understood Volume Profile that the market finally started to feel logical.

After trading for several years, I can confidently say:

👉 Price doesn’t move because of indicators.

👉 Price moves because of where money is traded.

And Volume Profile shows exactly that.

⸻

What Is Volume Profile (In Simple Words)

Volume Profile is a tool that shows:

• Where the most trading activity happened

• Where big players were interested

• Where price found real acceptance or rejection

Instead of looking at time (like normal volume bars), it shows volume at each price level.

In other words:

📍 It tells you where the market considers “fair value”

📍 And where price is likely to react again

⸻

The Market Leaves Footprints — Volume Profile Reveals Them

Think of the market like this:

Big institutions don’t enter randomly.

They build positions at specific price zones with high volume.

These zones often become:

✔ Strong support

✔ Strong resistance

✔ Major turning points

Volume Profile highlights these areas clearly through:

• High Volume Nodes (HVN) – areas of heavy trading

• Low Volume Nodes (LVN) – areas price moves quickly through

Once you learn to read them, you’ll start seeing:

“Ah… this is where real money stepped in before.”

⸻

Why I Trust Volume Profile More Than Most Indicators

Indicators are calculated from price.

Volume Profile is built from real market participation.

That’s a huge difference.

From my experience:

❌ Indicators react after price moves

✅ Volume shows interest before big moves happen

It helps me:

• Find high-probability entry zones

• Avoid chasing breakouts

• Hold trades with more confidence

⸻

How I Personally Use It in TradingView

Here’s my simple approach:

1. Identify major high volume areas (value zones)

2. Wait for price to return to these zones

3. Look for reaction or confirmation

4. Trade where risk is clear and controlled

No guessing.

No emotional entries.

Just trading around where the market already showed interest.

⸻

Final Thoughts (From a Trader, Not a Guru)

Volume Profile isn’t a magic tool.

But it gives you something most retail traders never look at:

The real story of where money flows in the market.

If I had learned this earlier, I would’ve avoided many bad trades.

For anyone serious about improving their trading —

understanding volume is not optional. It’s essential.

PSYCHOLOGY: The Future of Money and TradingThe future of money is not just digital or decentralized it is psychological.

The first big shift is not what we trade but how people relate to risk certainty and time. Markets are increasingly driven by narrative cycles attention flows faster than capital and price reacts before logic catches up. Traders who survive the next decade will not be the fastest or the smartest but the most emotionally regulated.

The second idea shaping the future of trading is compression. Information that once took years to learn is now available in minutes which means edge no longer comes from complexity. It comes from restraint. Fewer tools fewer markets fewer opinions. Mastery will belong to traders who can simplify their process and repeat it under pressure while others constantly reinvent themselves into inconsistency.

The third shift is the return of currency awareness. As trust in institutions fluctuates and reserve currency conversations resurface traders will be forced to understand money itself not just price patterns. Currency pairs are no longer just charts they are reflections of policy confidence capital migration and social stability. Traders who study one pair deeply will understand global flows better than traders who chase everything.

The future of trading does not reward prediction.

It rewards alignment discipline and patience.

If you are trading today you are not late.

You are early to a different game.

Emerging Markets vs. Developed Markets: A Comprehensive Overview1. Definition and Classification

Developed Markets (DMs) refer to countries with highly advanced economies, well-established infrastructure, high standards of living, stable political environments, and mature financial markets. Examples include the United States, Germany, Japan, the United Kingdom, and Canada. These countries exhibit steady economic growth, high per capita income, strong institutions, and a diversified industrial base.

Emerging Markets (EMs), on the other hand, are nations in the process of rapid growth and industrialization. They often have lower per capita income compared to developed markets, but they exhibit higher growth potential. Emerging markets are characterized by evolving infrastructure, improving political stability, and increasingly sophisticated financial markets. Examples include China, India, Brazil, Mexico, Indonesia, and South Africa.

The term “emerging” reflects a dynamic stage in economic evolution—a transition from low or middle-income economies to higher levels of income and industrial sophistication.

2. Economic Characteristics

Developed Markets

Developed economies are distinguished by:

High GDP per capita: Citizens enjoy high income levels and purchasing power.

Diversified economy: Growth is supported by services, advanced manufacturing, and technology sectors.

Stable financial systems: Banking and capital markets are mature, regulated, and liquid.

Low inflation and interest rates: Monetary policy is effective and predictable.

Strong infrastructure: Advanced transportation, communication, and energy networks.

Social indicators: High human development index (HDI), literacy rates, healthcare standards, and life expectancy.

Emerging Markets

Emerging markets, in contrast, often exhibit:

Moderate GDP per capita: Lower income levels compared to developed countries.

Rapid growth potential: Industrialization, urbanization, and consumption growth fuel expansion.

Developing financial systems: Stock exchanges and banking sectors may be growing but less liquid and volatile.

Higher inflation and interest rates: Monetary stability is often a challenge.

Infrastructure development: Urban centers may be modern, but rural areas often lag behind.

Social indicators: Education, healthcare, and income inequality vary widely, often improving over time.

Emerging markets tend to have young, growing populations, which provide a demographic advantage for long-term economic growth, while developed markets often face aging populations and slower growth.

3. Market and Investment Perspective

From an investment standpoint, developed and emerging markets offer different risk-return profiles:

Developed Markets

Lower risk, lower growth potential: Investors can expect relatively stable returns due to mature economies.

Predictable regulatory environment: Legal systems are transparent, reducing uncertainty.

Market efficiency: Developed financial markets efficiently price assets and provide liquidity.

Sectoral opportunities: Focus is on high-tech, healthcare, financial services, and consumer staples.

Emerging Markets

Higher risk, higher growth potential: These markets are more volatile due to political, currency, and economic instability.

Investment opportunities: Rapid industrialization and urbanization provide opportunities in infrastructure, consumer goods, technology, and energy sectors.

Currency risk: Exchange rate fluctuations can significantly impact returns for foreign investors.

Market inefficiency: Emerging markets may present arbitrage and high-growth opportunities due to less efficient pricing.

For global investors, emerging markets provide diversification benefits but require higher risk tolerance, while developed markets offer stability and lower volatility.

4. Key Drivers of Growth

Developed Markets

Growth in developed markets is generally driven by:

Innovation and technology adoption

High productivity and efficiency

Consumption-driven economies

Strong institutions and governance

Capital-intensive industries and services

Emerging Markets

Emerging markets’ growth is fueled by:

Rapid industrialization and urbanization

Expanding middle class and consumption

Foreign direct investment (FDI) inflows

Resource availability (natural resources, labor)

Government reforms and liberalization policies

The pace of growth in emerging markets often outstrips that of developed markets, making them attractive for long-term investment despite higher risks.

5. Risks and Challenges

Developed Markets

Slower economic growth due to aging populations

High debt levels in some countries

Market saturation in key sectors

Vulnerability to geopolitical tensions despite strong institutions

Emerging Markets

Political instability or policy uncertainty

Currency depreciation and inflationary pressures

Less mature legal and regulatory frameworks

Infrastructure bottlenecks

Vulnerability to external shocks, such as commodity price swings or global recessions

Investors in emerging markets must carefully evaluate country-specific risks, including political, fiscal, and market risks.

6. Global Trade and Economic Integration

Developed Markets often dominate global trade, advanced manufacturing, and service exports. They have established global supply chains and are major sources of innovation and technology. Many multinational corporations originate from these economies, contributing to global economic stability.

Emerging Markets are increasingly influential in global trade due to lower labor costs, growing domestic markets, and strategic natural resources. They are becoming key suppliers in manufacturing and industrial sectors while expanding in services and technology sectors. Emerging markets are also major players in commodity markets, such as oil, metals, and agriculture.

7. Examples and Comparative Overview

Feature Developed Markets Emerging Markets

GDP per capita High Moderate to low

Growth rate 2–3% 5–8% or higher

Infrastructure Advanced Developing

Financial markets Mature, liquid Developing, less liquid

Population Aging Young, growing

Investment risk Lower Higher

Key sectors Tech, finance, healthcare Manufacturing, infrastructure, energy

Examples USA, UK, Germany, Japan India, China, Brazil, Indonesia

8. Conclusion

Developed and emerging markets represent two ends of the economic development spectrum. Developed markets offer stability, transparency, and predictable returns, making them suitable for risk-averse investors. Emerging markets, by contrast, provide dynamic growth opportunities driven by industrialization, urbanization, and demographic advantages, albeit with higher volatility and risk.

Global investors often adopt a balanced approach, allocating funds across both developed and emerging markets to optimize risk and reward. Policymakers in emerging markets aim to adopt reforms, improve infrastructure, and stabilize economies to transition toward developed-market status. Meanwhile, developed markets continue to focus on innovation, productivity, and sustainability to maintain global competitiveness.

Understanding the differences between these markets is essential not only for investment strategies but also for comprehending global economic trends, trade flows, and geopolitical dynamics. The interplay between developed and emerging markets will continue to shape the 21st-century global economy, offering both challenges and opportunities for businesses, investors, and governments worldwide.

Latest Global Currency Shift & De‑Dollarization News Introduction: The Global Currency Landscape

Since World War II, the U.S. dollar (USD) has functioned as the primary global reserve and settlement currency. This means that central banks hold dollars as a major part of their foreign exchange reserves, international trade is often priced in dollars (especially oil), and global investors prefer dollar‑denominated assets for safety and liquidity.

However, over the past decade—and especially in recent years—this dominance has started to shift. Multiple economic, geopolitical, and technological forces are reshaping how currencies are used globally, weakening the dollar’s monopoly and contributing to what analysts call a global currency shift or de‑dollarization.

1. Why the Dollar Dominated — And Why That’s Changing

Why the Dollar Became Dominant

The dollar became dominant due to several historical factors:

Bretton Woods System (1944): The dollar was pegged to gold, and other currencies were pegged to the dollar, making it the linchpin of international finance.

Economic Size & Stability: The U.S. economy is the largest in the world, with deep, liquid capital markets and strong legal institutions.

Petrodollar System: Oil was widely priced and traded in dollars, creating consistent global demand.

These factors together encouraged countries and banks worldwide to hold and use dollars in reserves and transactions.

Why Its Dominance Is Eroding