Stop Dreamig, Start Trading!I’ve talked quite a lot about the illusions in crypto. I’ve made fun of the arrival of altcoin season, and even about 3 weeks ago I wrote an article saying that if I want, I can see any chart bullish, even if I flip it upside down 🙂

It’s Sunday, I’m scrolling aimlessly on the internet and I keep seeing the same thing again, something that repeats like the voice of an alcoholic saying he’ll quit drinking again starting Monday.

Altcoin season is coming again.

These prices will never be found again.

BTC has hit the bottom again — a bottom that was also at 100k where it was the opportunity of a lifetime, at 90k it was an unbelievable bargain.

Again.

Again, and...

Again...

The idea is simple: I also had a 75k target, it went to 60k… I didn’t know. The one who said 60k didn’t know either. And nobody knows if it goes to 50, to 30, or to 250k by the end of the year.

That’s basically the idea.

No grand conclusions.

Just reality.

A Simple Advice

If I were to give one clear and simple piece of advice:

- Stop dreaming, start trading.

- Start learning technical analysis

- Start using money management

Not because TA predicts the future like a crystal ball, but because it gives structure.

Not because money management is exciting, but because it keeps you alive.

A Funny Story From Last Night (But Also Not Funny)

Funny story from last night — and I swear it’s real.

Last night I was out with a friend in the Old Town in Bucharest. We were celebrating… well, celebrating his sports betting ticket that hit with odds of 486. In crypto language: a 486x.

He does this every weekend — places a few tickets, about 100 RON each (around 20 EUR). Most lose, one hits once in a while, this one hit BIG.🙂

What’s truly funny is the contrast.

The same friend bought a crypto coin at the top in 2021. Since then, he’s been DCA-ing into what is objectively a garbage coin. Yesterday I even asked him about it and he told me he’s about 60k in the hole.

60k...for a guy that is not rich at all...

The irony writes itself.

Investing vs. Calling It Investing

The reality is he believes he’s an investor.

But he doesn’t know how to draw a trendline.

I’m more than convinced the first time he ever looked at his coin’s chart was when I tried to analyze it for him about two years ago.

He bought because of an influencer’s story.

Now he keeps DCA-ing endlessly, with the desperate hope that one day he’ll recover.

That’s not investing.

That’s anchoring to a mistake.

And psychologically, it’s not that different from betting slips — just slower and dressed in nicer words.

The Lesson Hidden in Plain Sight

There’s actually a lesson in the contrast:

With sports betting, he knows it’s gambling.

With crypto, he believes it’s investing.

But behavior matters more than labels.

If decisions are based on:

- influencers

- hope

- blind DCA

- refusal to reassess

Then the difference between gambling and investing/trading becomes very thin, if any.

The Market Owes Nobody a Recovery

Markets don’t care where you bought.

They don’t owe you a comeback.

They don’t reward loyalty.

Sometimes a bad asset stays bad forever.

Sometimes a narrative never returns.

Sometimes the “cycle comeback” is just a story people tell to cope.

Harsh? Maybe.

But expensive lessons are usually the honest ones.

The Real Shift

At some point, every trader faces a choice:

Treat the market like a place for dreams

or

Treat it like a place for decisions.

Dreams feel better.

Decisions work better.

Final Thought

You don’t need to predict bottoms.

You don’t need 100x stories.

You don’t need altcoin seasons to save you.

You need structure.

You need risk control.

You need honesty with yourself.

Stop dreaming.

Start trading.

Have a nice Sunday!

Mihai Iacob

Risk Management

Market Regime Analyzer — Understanding Consolidation Regimes

Markets don’t always trend. Much of the time, price oscillates within a range where mean reversion dominates and breakout strategies underperform.

This example illustrates how the Market Regime Analyzer identifies a Consolidation Regime and how price behavior aligns with that classification.

What the chart is showing:

Price rotates within a defined range without sustained directional expansion

Breakouts repeatedly fail or fade back into the range

Volatility remains contained and directional follow-through is limited

This behavior matches the indicator’s Consolidation Regime classification.

Indicator interpretation:

The oscillator fluctuates around a mean-reversion reference level

Oscillations around this level define the regime’s behavior

Volume pressure remains muted, reinforcing range-bound conditions

Transition probabilities strongly favor continued consolidation

Important:

The Market Regime Analyzer is not a trade signal. It is designed for regime awareness and strategy selection.

How this should influence decision-making? When a consolidation regime is active:

Trend-following strategies lose edge

Mean-reversion and range-based approaches perform better

Risk should be reduced on breakout attempts

Patience becomes a position

Understanding when not to force trades is a competitive advantage.

Indicator used:

Market Regime Analyzer

This indicator is designed to help traders align execution with market conditions, not predict direction.

The Repaint Illusion in Rotation SystemsIntroduction

In this idea, I’ll explain what repainting in rotation systems is, why it can be misleading and how you can spot it when you don’t have access to the code. Many indicators look perfect on the preview image but are actually very different in live trading. My goal in this idea is to help you understand the signs of repainting so you can judge a rotation system using only what you see on the chart.

General Information

First, it is important to understand what a Rotation System is. Rotation Systems are investment or trading models that move your capital between multiple assets, usually majors, over time. Repainting in this context means it alters past allocations using future information, creating unrealistic backtest results. Instead of holding one single asset infinitely, these systems rotate allocation into assets that outperform others and reduce exposure to weaker ones.

The main goal has two parts:

Capture the biggest gains during bull markets

Minimize drawdowns by moving into CASH or PAXG during bear markets or downtrends

The main logic behind rotation systems is relative strength. Assets that have outperformed usually continue outperforming for some time. By reallocating capital into these stronger assets, rotation systems aim to stay invested in what’s performing best.

Rotation systems are very important in risk management as well. By exiting underperforming assets and remaining in cash during downtrends, they try to reduce volatility and protect capital, having the lowest possible max equity drawdowns.

How well a rotation system performs doesn’t only rely on the selection of assets. It depends on the robustness of the design. This means it should have:

No repainting

No overfitting

No unrealistic execution assumptions

In practice, rotation systems can be used in many markets:

Equity indices and sectors

Cryptocurrencies

Commodities

The default timeframe for rotation systems is usually daily, because this means it allows at minimum one switch a day.

Important rules:

Rotation systems do not use leverage

Execution must be realistic and based on bar closes

Repainting

Why Repainting Is Dangerous

There are many forms of repainting, and most users cannot see them. In rotation systems, this problem is even more important because users often don’t have access to the underlying code. The only way to judge a rotation system this way is by checking how it behaves on the chart.

Building a truly non-repainting rotation system requires a lot of skill and time. In reality, more than 90% of all the rotation systems include some form of repainting, which, when used in live trading, will cost users a lot of money.

Identifying Repainting: Top vs Bottom Curve

How to Spot It Clearly

To make repainting easier to understand, I’ve marked these points:

Cyan = Entry

Pink = Exit

The goal of a clean rotation system is to:

Enter on the bar close when the signal appears

Ride the full trend or cash period in real time

Entry Behavior

Non-repainting (Top Curve):

The line changes color (to white for cash) before it goes flat

This allows entry at the correct bar close

You correctly experience the full flat cash period

Repainting (Bottom Curve):

The system thinks that you were already in cash one bar earlier, which doesn't make sense because you are trading it now, not yesterday.

To match performance, you would need to enter at the bar open without knowing the close and final choice.

This is impossible in real trading and indicates repainting

Exit Behavior

Non-repainting (Top Curve):

The line switches to purple (SOL) while still flat

You exit at the correct close and then ride the asset’s equity.

Repainting (Bottom Curve):

The equity line immediately jumps as if you were already invested earlier

This artificially boosts performance

Key Rule to Detect Repainting

Focus on cash periods as it is easiest to see here:

Non-repainting systems

→ First change color

→ Then stay flat

→ You can act on the close and experience the flat period live

Repainting systems

→ Change color and go flat at the same moment

→ This means future data is already being used

Replay Mode Trap

Some systems look correct in static screenshots but fail in replay mode.

Example:

At bar 1, everything appears normal

Move forward one bar, and previous bars all of the sudden change color

This is a deliberate trick. The system repaints past states to appear correct, but in live trading it will behave differently and lead to losses. This means that it will show results that are so insanely high with "correct looking entries and exits" that many will fall into this trap.

Hidden Repainting

Some traders hide repainting even better by:

Removing visible switches from the equity curve. I have seen this in a lot of places, and then when you look at the actual switches, you see this type of repainting immediately.

It makes two systems look identical at first glance. The only visible difference is performance:

The repainting system shows very boosted profits

The clean system shows realistic results

Rule:

If you are evaluating a rotation system, always demand a version where switches are visible before purchase. If the creator refuses, assume repainting is being hidden and do NOT proceed to trade it.

This is not financial advice. For educational purposes only. Trading involves risk.

How to Trade a $2,000 Drawdown Without Blowing Up (MES Strategy)Are you trading a prop firm account with a tight $2,000 drawdown? One bad trade shouldn't end your career. In this video, I break down a strict risk management plan using MES (Micro E-mini S&P 500) that ensures you survive to trade another day.

In this video, we cover:

The 10% Rule: Capping risk at $200 max per trade so you always have at least 10 opportunities.

The VX Algo Strategy: How to use the 10-minute signal with 48-minute chart confirmation for high-probability entries.

Dynamic Position Sizing: Stop guessing how many contracts to buy. I explain my A+, B+, and C+ setup system.

The Blueprint:

Instrument: MES ($5/point)

Stop Loss: 10 Points ($50/contract) | Take Profit: 5 Points ($25/contract)

Sizing:

A+ Setup: 4 Contracts ($200 Risk)

B+ Setup: 2 Contracts ($100 Risk)

C+ Setup: 1 Contract ($50 Risk)

Discipline is key. If the charts don't align, we don't trade. Let's get funded and stay funded.

How to Play the Game of Prop firms and XAUAUD walkthroughThis video does not promote any prop firms or any 3rd party services. Instead, it focuses on teaching the method of account cycling where you have 4 accounts of which you stagger them so 3 are being traded at once and one has a week off. You also stagger when you start trading them to avoid overexposure. This is a great way to reduce risk and get faster pay outs.

The goal is to make 50% of the payout target every week staggering risk throughout the month losing no more than 25% of allowed total drawdown each week. For example, an account with 10% drawdown has a profit target of 5% per week with a 2.5% max drawdown per account.

Let me know in the comments below how you handle the game of prop accounts

Why You Keep Losing Money in the Financial MarketsWhy You Keep Losing Money in the Financial Markets 💸

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

One of the main reasons you keep losing money in the financial markets is that this activity is directly associated with turning money into more money.

This blurs the understanding of the value of skill. In any field, the most important thing is skill, while money is merely the reward for the level of that skill.

A simple example.

A person makes chairs. At the beginning of their journey, the chairs are rough and not very attractive — because they are still developing. But as their mastery grows, the quality of the chairs improves, and with it, their price.

The better they do their job, the more they earn.

When people come to the financial markets, they see someone turning $1,000 into $100,000, or someone else turning $50,000 into $250,000 in a single day. This creates the illusion that this is how it will work for everyone.

It’s important to understand:

Financial markets are not a wish-granting machine. They are a zero-sum game.

If someone makes money, someone else must lose. There is no winner without a loser. That’s how the system works.

━━━━━━━━━━━━━━━━━━━━━━

The Path of a Beginner Trader 🧠

Let’s return to the person who has just entered the market and started their journey.

All experienced traders have gone through the stage where, at first, something seems to work — but eventually the entire deposit (or most of it) gets wiped out.

And at that moment, a choice appears:

Either I quit,

or I continue.

Those who choose to continue are strong people.

But it’s crucial not to fall into madness. You cannot keep doing the same things that already led you to losing your deposit. You must change — both internally and in your strategy.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

The Main Reasons for Losses ⚠️

1. Chaos

Chaos in trades.

Chaos in thoughts.

Chaos in the market.

First of all, you need to:

calm down,

take a breath,

structure what you already know,

write it down,

start testing your strategy.

Only this way can you remove chaos from your mind and move away from random, impulsive trades.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

2. Emotions and Impulsivity

Impulsive decisions look like this:

A person sees the last candle going up and enters a long.

The price then reverses and goes down.

And on the higher timeframe, the market is actually in a downtrend.

A person opens a new instrument they have never traded before.

They see a setup similar to another asset and enter without understanding the instrument’s specifics.

After losing part of the deposit, instead of taking a pause, the trader tries to “win back” the loss.

All decisions become emotional — and as a result, even more money is lost.

The most important tool against impulsivity is a pause.

Step away from the chart.

Stop talking about the market.

Switch to something that calms you down.

For me, for example, it’s feeding stray animals — it genuinely brings me back into balance. 🐾

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

3. Opening the Chart Not to Analyze, but to Trade

A very common problem:

A trader opens the chart not to analyze, but with an already (subconsciously) made decision to enter a trade.

They convince themselves:

“I’ll just look at the market, analyze the phase, find a setup…”

But in reality, the decision to trade has already been made, and the analysis is only used as justification.

Here it’s important to learn to observe your own thoughts and honestly answer yourself:

Am I analyzing the market right now — or am I looking for an excuse to enter?

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

4. Trading as Emotional Compensation

For a beginner trader, an open trade becomes an emotional game:

Price goes against them → anxiety, fear, stress

Price goes in their favor → euphoria, joy, excitement

Over time, this can turn into a way of escaping reality:

a person experiences negative emotions in life and, instead of solving the problem, goes to the market to get emotions through trading.

This is where signs of gambling addiction begin to appear.

And it’s extremely important not to let yourself reach that state.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

5. Lack of Self-Trust

This shows up when people:

subscribe to signal groups,

copy other people’s trades,

fully rely on opinions from chats.

Here you need to ask yourself an honest question:

Why do you think you are worse?

Why have you decided that you won’t succeed?

This is work with fear and self-esteem.

You can only learn to trust yourself when:

you have structured your approach

tested it through backtesting,

seen consistency,

and only then brought it into live trading.

These are the main reasons that prevent traders from becoming profitable.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

Write in the comments 💬

What exactly held you back when you were a beginner trader?

Perhaps your experience will help a newcomer find the answer in your words.

Also, if you’re facing any issues that are holding you back from trading, don’t hesitate to share them in the comments — we’ll help you.

Enjoy!

The Missing Skill After Entry: Staying AlignedMost traders learn how to enter.

Few learn how to stay aligned.

Entries are technical.

Execution is psychological.

What breaks most traders isn’t their strategy — it’s what happens after they’re in a trade:

• second-guessing

• over-managing

• fear of giving back profits

• impatience when price pauses

• breaking rules to “fix” discomfort

Alignment is what keeps execution clean:

• timeframe agreement

• session context

• predefined risk

• acceptance of outcome

When alignment is present, discipline becomes natural — not forced.

This chart isn’t about predicting price.

It’s about recognizing when you are aligned enough to execute your plan without interference.

Trade well.

Stay aligned.

How to survive a losing streak and win big in a winning flow.There is no strategy in the world that wins every trade. Accepting the fact that the outcome of every trade is uncertain and acting like risk management is all that you have is the only way to be successful in the long run. Refer to the tab as a guide for your risk management. Let’s assume you win less than half of your trades, but you use a 3:1 RRR. Congrats, you are profitable!!! In fact, you need only 30% of trades to be winners. So why is it so difficult to keep winning in the long term?

You may have a 65% win rate. It still means that you can have 35 losses out of 100 trades. Remember: the distribution of wins and losses is random — you never know the outcome of the next trade.

It could be win win loss win. Or loss loss loss win win. Or a brutal streak of seven losses before the market pays you back.

✅✅❌✅❌❌✅✅✅✅❌✅

When wins and losses are evenly distributed, it’s quite comfortable to continue opening new trades. You still believe in your strategy, and it’s simply normal to have a loss from time to time.

✅❌❌❌✅❌❌❌❌❌✅✅

But what are you going to do when such a streak comes? Are you going to doubt your strategy? Are you going to look for a different strategy? Remember: a 65% success rate means 35 possible losses out of 100. If 20 losses come in a row, your long-term statistics still are not broken.

Don’t think this can’t happen to you. If this didn’t happen to you yet, you are not trading for long enough. It will come, and it’s better to be prepared. And here is where risk management will take you through hard times.

📌 Calculate your risk per trade

It should be such a % of your account that you simply don’t care about losing trades, and it doesn’t affect your emotions at all. Many people use 1% per trade because it’s a well-known standard, but it requires deeper expertise to decide how much you’re going to risk. If you want to know more, check the post below — click the picture below 👇 💊Just for a quick overview: it’s unusual that you get 30 losses in a row, but it’s good to know where you will be if that happens.

📍0.25% Risk - 30x Loss = -7.5%

📍0.5% Risk - 30x Loss = -15%

📍1% Risk - 30x Loss = -30%

📍2% Risk - 30x Loss = -60%

📍3% Risk - 30x Loss = -90%

💎 Great, but we of course don’t want to risk just 0.25% per trade — hence dynamic risk management comes into play. Basically, you reduce % per trade if you’re facing a losing period, and once you start to recover, you increase your risk % back to normal and when you’re in a winning flow you can also temporarily increase your risk.

📌 Dynamic Risk management

Start by risking 0.5% per trade

If your balance increases +1%, increase risk per trade to 1%

If your balance increases +3%, increase risk per trade to 1.25%

If your balance drops back to 0%, reduce risk to 0.5% If your balance drops below -3%, reduce risk per trade to 0.25% and stick to this risk until you trade it back from drawdown.

This will help you reduce emotional pressure during a losing period, and it will keep you in the game. When fear hits, you will not feel like taking the next setup — which could be the profitable one.

The idea of dynamic risk management came to my mind when I started trading prop accounts, where your max drawdown is limited and you can risk only 10% in total. So you need to be a little bit more flexible with risk so passing challenges doesn’t take years, and when risking more, you’re not knocked out in a few bad trades. Check it out — click the picture below 👇 I promised myself I’d become the person I once needed the most as a beginner. Below are links to a powerful lessons I shared on Tradingview. Hope it can help you avoid years of trial and error I went thru.

📊 Sharpen your trading Strategy

⚙️ 100% Mechanical System - Complete Strategy

🔁 Daily Bias – Continuation

🔄 Daily Bias – Reversal

🧱 Key Level – Order Block

📉 How to Buy Lows and Sell Highs

🎯 Dealing Range – Enter on pullbacks

💧 Liquidity – Basics to understand

🕒 Timeframe Alignments

🚫 Market Narratives – Avoid traps

🐢 Turtle Soup Master – High reward method

🧘 How to stop overcomplicating trading

🕰️ Day Trading Cheat Code – Sessions

🇬🇧 London Session Trading

🔍 SMT Divergence – Secret Smart Money signal

📐 Standard Deviations – Predict future targets

🎣 Stop Hunt Trading

💧 Liquidity Sweep Mastery

🔪 Asia Session Setups

📀 Gold Strategy

🧠 Level Up & Mindset

🛕 Monk Mode – Transition from 9–5 to full-time trading

⚠️ Trading Enemies – Habits that destroy success

🔄 Trader’s Routine – Build discipline daily

💪 Get Funded - $20 000 Monthly Plan

🧪 Winning Trading Plan

⭕ Backtesting vs Reality

🛡️ Risk Management

🏦 Risk Management for Prop Trading

📏 Risk in % or Fixed Position Size

🔐 Risk Per Trade – Keep consistency

🧪 Risk Reward vs Win Ratio

💎 Catch High Risk Reward Setups

☯️ Smart Money - Who control Markets

Adapt useful, Reject useless and add what is specifically yours.

David Perk

How to build a resilient mindset and stop losing moneyHow to Build a Resilient Mindset and Stop Losing Money Because of Yourself

Trading is commonly described through strategies, indicators, market models, and macroeconomics. In practice, however, the decisive factor is not analysis, but a person’s ability to act consistently under conditions of uncertainty.

The market does not follow the logic of an individual trader. It is not required to be fair, consistent, or understandable. The only things truly under a trader’s control are their decisions, reactions, and behavior. This is why psychology in trading is not an “additional skill.” It is the foundation.

Why Trading Breaks the Psyche More Than Other Professions

Trading combines several factors that rarely occur together in ordinary work:

1. Direct Connection Between Decisions and Money

Every action is immediately converted into profit or loss. For the brain, money is equivalent to safety, which is why any fluctuation in the account balance is perceived as a threat.

2. Lack of Predictable Outcomes

Even a perfect decision can result in a loss. This destroys the familiar mental model: “If I did everything right, I should be rewarded.”

3. Absence of External Structure

There is no boss, no fixed working hours, no external performance evaluation. The trader is their own regulator.

4. Random Reinforcement

Sometimes rule-breaking leads to profit, while discipline leads to losses. This creates dangerous behavioral distortions.

As a result, trading becomes an environment where the following are activated:

anxiety

impulsivity

perfectionism

the desire for control

fear of missing out

Without conscious psychological work, these factors gradually destroy even a good strategy.

Key Thinking – Error of Most Traders

The most common psychological error in trading is not fear, greed, or lack of discipline.

It is a false cognitive expectation:

“If I analyze well and follow the rules, I should be right.”

This expectation is deeply rooted in how people are conditioned outside of markets. In school, work, and most professions, correct actions are consistently rewarded. Trading violates this model entirely.

The market operates as a probabilistic system, not a deterministic one.

This means that:

Correct decisions can produce negative outcomes

Incorrect decisions can be rewarded

Individual outcomes contain no reliable information about skill

Most traders intellectually understand this, but psychologically they still evaluate themselves trade by trade. This creates constant internal conflict.

The Correct Mental Shift

A trader does not make money on an individual trade.

A trader makes money on a series of trades executed according to the same process.

When a trader becomes emotionally attached to a single trade, that trade stops being a probabilistic event and turns into a psychological one. The outcome begins to matter more than the quality of execution, and decisions are no longer guided by rules, but by emotional reactions to uncertainty.

As price approaches a stop loss, emotional discomfort increases. To avoid the feeling of being wrong, the trader moves the stop, transforming a defined risk into an undefined one. When a position shows a small profit, fear of losing it leads to premature exits, reducing the average win and damaging expectancy.

After losses, emotional pressure builds. The trader may average into losing positions or increase risk in an attempt to restore emotional balance and regain a sense of control. In other cases, losses create hesitation, causing valid signals to be skipped. As a result, losses are fully realized while winners are partially or completely missed.

Only when individual trades lose emotional significance can probability work as intended. Profit and loss become properties of the series, not of a single decision. At this point, the trader stops trying to be right and starts executing a process consistently.

Accepting Losses as the Foundation of Psychological Stability

Accepting losses is not an intellectual concept but an emotional agreement with the inevitability of loss. Many traders believe they have accepted losses because they understand that losses are part of trading. However, their behavior reveals the opposite. After a stop-out they feel anger, attempt to recover the loss immediately, change strategies after a small series of losing trades, or experience a sharp drop in self-confidence. These reactions indicate that losses are still perceived as personal failure rather than as a normal component of a probabilistic process

Practice: Pre-Agreement With Losses

Before the trading week begins, write down:

acceptable weekly drawdown

maximum number of consecutive losing trades

conditions under which trading must stop

If a loss produces a strong emotional reaction, it is a clear signal that the risk was psychologically excessive, even if it was technically correct according to the rules. Psychological stability is not achieved by avoiding losses, but by ensuring that losses remain within limits the trader can emotionally tolerate without altering behavior.

Trading Plan as a Tool for Psychological Stabilization

A trading plan is often perceived as a technical document focused on entries and exits. In reality, its primary function is to reduce cognitive and emotional load. By limiting the number of decisions that must be made in real time, a plan removes the need for constant judgment and interpretation under pressure.

A well-constructed plan minimizes improvisation, lowers anxiety, and protects the trader from impulsive entries driven by emotion rather than logic. It creates a stable framework in which decisions are made in advance, when emotional arousal is low.

From a psychological perspective, a trading plan must clearly define when trading is prohibited, set maximum risk limits per day and per week, enforce mandatory pauses after losing streaks as well as after unusually large profits, and limit the number of trades that can be taken. These constraints are not restrictions on performance, but safeguards for mental stability.

If a plan cannot be followed during periods of emotional stress, it is not a functional plan. A valid trading plan must be designed to operate not only in optimal mental conditions, but also when discipline is most vulnerable.

Trading Journal as a Mirror of Behavior

Without a journal, a trader’s memory becomes selective. Dramatic losses, random successes, and emotionally intense moments dominate recollection, while the majority of trades fade from awareness. This creates a distorted perception of performance and reinforces false conclusions about skill and strategy.

An effective trading journal does not primarily track the market; it tracks the trader. After each trade, recording the emotional state before entry, the level of confidence, the presence of doubt, any urge to break rules, and the emotional state after exit reveals information that price data alone cannot provide.

After twenty to thirty trades, recurring behavioral patterns begin to emerge. Trades taken out of boredom, increased risk following profits, hesitation or avoidance after losses, and premature exits become visible as consistent tendencies rather than isolated mistakes. At this stage, the journal stops being a record of trades and becomes a diagnostic tool.

Working with a journal is not about refining the strategy. It is about understanding and correcting the trader’s own behavior.

Fear of Missing Out (FOMO)

FOMO is one of the most destructive psychological forces in trading. It does not arise from greed, but from the fear of being excluded from a move, the perception that others are profiting while one is not, and the constant pressure created by social media and shared results. These factors distort judgment and create urgency where none objectively exists.

Effective protection against FOMO must be structural, not emotional. The trading plan should strictly limit entries to pre-defined scenarios and explicitly prohibit participation in impulsive moves that lack proper pullbacks or confirmation. These rules remove discretion at moments of emotional vulnerability.

Most importantly, the trader must accept a fundamental reality of markets: they are not designed to allow participation in every move. Their purpose is to offer choices. Sustainable performance comes not from chasing activity, but from disciplined selection.

Emotional Neutrality: Reality and Myths

Complete emotional neutrality is impossible. Emotions are a natural response to uncertainty and risk. The objective of a professional trader is not to eliminate emotions, but to prevent emotions from influencing decisions.

This requires continuous awareness of one’s internal state, the ability to step away at the right moment, and the discipline to avoid decision-making during emotional extremes. Trades taken under heightened emotional arousal are rarely aligned with a structured process.

For this reason, planned pauses are a critical component of psychological stability.

Pause Practice

After a significant profit, a series of losses, or a strong emotional reaction, trading must stop for a predefined period of time. This practice is not a sign of weakness. It is a form of capital protection that preserves both financial and psychological resources.

Fatigue, Burnout, and Hidden Forms of Self-Sabotage

Burnout in trading rarely presents itself as apathy or disengagement. More often, it manifests as increased trading frequency, irritation toward the market, rising position sizes, declining discipline, and a persistent sense of internal pressure. These behaviors are commonly mistaken for motivation or determination, when in fact they signal nervous system overload.

Trading demands sustained concentration and emotional regulation. Continuous exposure to the market without structured recovery gradually exhausts cognitive resources, making disciplined execution increasingly difficult.

Structuring Practice

To prevent this form of self-sabotage, trading must be deliberately structured. Trading must be divided into:

trading days

analysis days

days completely away from the market

Rest is not a reward for profitability; it is an essential component of a sustainable trading process.

The Most Difficult Skill for a Trader

The most difficult skill in trading is the ability to do nothing when conditions are not met. The absence of a trade is not a missed opportunity, but an expression of discipline and adherence to the plan.

To reinforce this behavior, days without trades should be recorded as completed work. Performance must be evaluated by the quality of process execution rather than by short-term profit and loss. This reframes inactivity as a valid and productive outcome.

Sustainable trading is not built on finding perfect entries. It is built on accepting uncertainty, limiting risk, executing a repeatable process with consistency, maintaining discipline, and working continuously with one’s own psychology.

Trading is not a fight with the market. It is a systematic practice of managing how an individual responds to uncertainty, risk, and expectations.

Enjoy!

Altcoin season is coming, now doubt about this!Yesterday, I wrote something that might sound harsh — but I stand by it:

In my opinion, 99% of altcoins are junk (and I’m putting it nicely).

Not necessarily scams… just assets with weak long-term survival chances.

And what makes smaller alts dangerous isn’t only the volatility.

It’s the bullish bias they create.

Because if you want to be bullish badly enough, you can take almost any chart, build a bullish narrative around it, and sound smart, logical, and “technical”.

In fact, I can prove it.

I can write two bullish analyses on the exact same chart.

The only difference?

In the second one…

I simply flip the chart upside down.

Let’s go.

✅ Analysis #1 (Bullish… on the normal chart)

"As we can see on the chart, after the major market high in December 2024, altcoins went through a sharp and aggressive drop, which finally found support around the $175B zone in April 2025.

From that point, the market managed to recover nicely, pushing higher — but once price reached the $335B resistance area, momentum faded and sellers stepped back in.

That rejection sent the market lower again, and the decline ended with the mid-October flash crash, where price once again reacted strongly from support.

Now, the start of 2026 is showing something important:

✅ a higher low is in place

If this structure continues to hold, the next logical upside is:

🎯 a return toward the $335B resistance zone.

The market still needs confirmation — but the setup is getting cleaner 🚀"

✅ Analysis #2 (Bullish… on the inverted chart)

Now we flip the same chart upside down.

Same data. Same price action. Same bullish bias.

"After the major low formed back in December 2024 around -450, smaller altcoins printed a very strong impulsive leg up, pushing the price all the way to the -175 zone.

The correction that followed was something normal and found solid support around -335, perfectly aligned with the previous lows from March 2024 — a strong technical floor.

Since September 2025, altcoins have been recovering in a controlled way, gradually building higher lows.

Right now, we’re consolidating just below -175 resistance, which also acts as the neckline of a massive inverted Head & Shoulders pattern.

If buyers break and hold above -175, then:

🎯 -80 becomes the obvious target 🚀"

The point? Bias can turn anything bullish.

But here’s the funny part:

It doesn’t matter, because, regardless

Altcoin season is coming:)) 🚀

Have a nice weekend!

Mihai Iacob

Trend Doesn’t Cancel Corrections (And the Herd Always Pays)Yesterday, I made a call that sounded “wrong” to most retail traders.

✅ Silver will fill the gap.

✅ Gold will drop into the 4750 zone.

Both happened.

Not because I’m a prophet.

But because markets don’t work like retail emotions want them to work.

Even in a strong bullish trend, corrections are not a surprise — they’re a requirement.

And the trader who understands that simple fact will outperform the trader who only understands “up or down”.

1) A Trend Is Not a Straight Line — It’s a Negotiation

Retail traders love clean narratives:

- “Gold is bullish, so it must go up.”

- “Silver is strong, so dips are impossible.”

- “If news is positive, price must pump.”

But a real trend is not a straight line.

A trend is a sequence of impulses and corrections.

And every correction exists for a purpose:

- to rebalance positioning

- to shake out weak hands

- to refill liquidity

- to reset the market’s ability to continue

In other words:

Corrections are not “against the trend.”

They are the trend’s fuel.

If you’re only prepared for continuation, you’re not trading a trend…

You’re worshipping it.

2) The Herd Always Thinks in One Direction (Because It Feels Safe)

Here’s one of the most dangerous illusions in trading:

When everyone agrees, it feels like certainty.

But in markets, mass agreement usually means something else: the trade is already crowded.

That’s when you start seeing the same comments everywhere:

- “Gold only goes up 🚀”

- “This is the breakout!”

- “Buy every dip!”

- “No more pullbacks, strong fundamentals!”

And that’s exactly the moment you should pause.

Not because the crowd is always wrong…

…but because when everyone is positioned the same way, the market has a problem:

✅ too many stops in one place

✅ too many emotions in one direction

✅ too little liquidity for continuation

✅ too many people chasing the “obvious move”

That’s where the correction becomes not only likely… but necessary.

3) Even If You Don’t Fade the Herd… At Least Don’t Join It Late

Let’s be clear:

You don’t need to be the hero who always sells the top or buys the bottom.

Sometimes the highest-IQ decision is simply: Stay out.

Because most traders don’t lose money by being wrong…

They lose money by being late.

They enter after:

- the breakout is old news

- the move is extended

- the risk is huge

- the stop placement is obvious

- the crowd is fully committed

So the market does what markets always do: it punishes certainty.

That’s how bullish trends still produce brutal red candles.

Not because the trend is broken…

…but because positioning needs to be cleaned.

4) The Market Isn’t “Against You” — It’s Against Predictability

Retail wants predictability.

Smart money wants liquidity.

And retail provides liquidity in the most predictable way possible:

- buying after too many green candles

- selling after too many red candles

- placing stops in obvious locations

- reacting emotionally to headlines

This is why the “herd trade” is so profitable for the other side.

Not because smart money is magical.

But because retail behavior is repetitive.

And anything repetitive becomes exploitable.

5) “Trading Is Zero-Sum” — So Ask the One Question That Matters

Here is the part most traders avoid because it kills their fantasy: Trading is a zero-sum game (especially in leveraged derivatives).

Meaning: If you win, someone else loses.

Now ask yourself: If all retail is bullish… who is left to buy?

And more importantly: If everyone is bullish, who is the liquidity?

Because it’s never “smart money”.

Smart money isn’t the one buying the last breakout candle at maximum risk.

Retail is.

So if all retail is bullish and fully committed… then the real question becomes:

✅ who is trapped?

✅ who owns their stops?

✅ who will panic first?

And once you think this way, the market becomes clearer.

Not easier.

But clearer.

The Real Lesson: Trends Are Easy — Positioning Is Hard

Anyone can say:

“Gold is bullish.”

That’s not analysis.

That’s a weather report.

The real skill is knowing when:

- the bullish trend needs a correction

- the “obvious continuation” becomes the trap

- the herd has overloaded one side

- patience becomes the edge

Because the market rewards:

✅ timing

✅ discipline

✅ structure

✅ emotional neutrality

Not crowd confidence.

Final Thought

When you see everyone on the same side… don’t blindly fight them.

But most of all, don’t blindly join them.

Do the professional thing: pause, reassess, and respect the correction inside the trend.

Because in the end…

Smart money doesn’t need to outsmart everyone.

It only needs retail to behave like retail.

And retail never disappoints.

✅ Stay sharp.

✅ Stay patient.

✅ Stay out when it’s crowded.

That alone puts you ahead of 90% of traders.

Best Of Luck!

Mihai Iacob

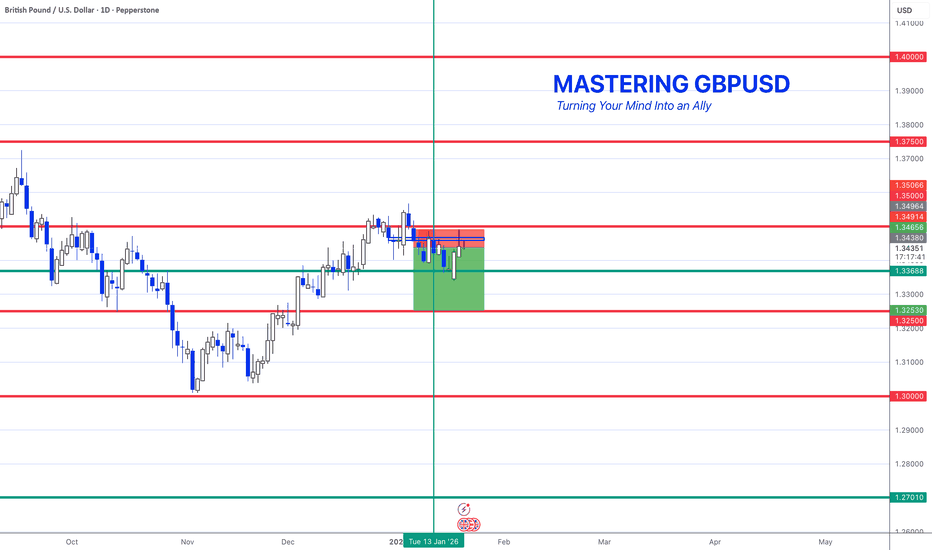

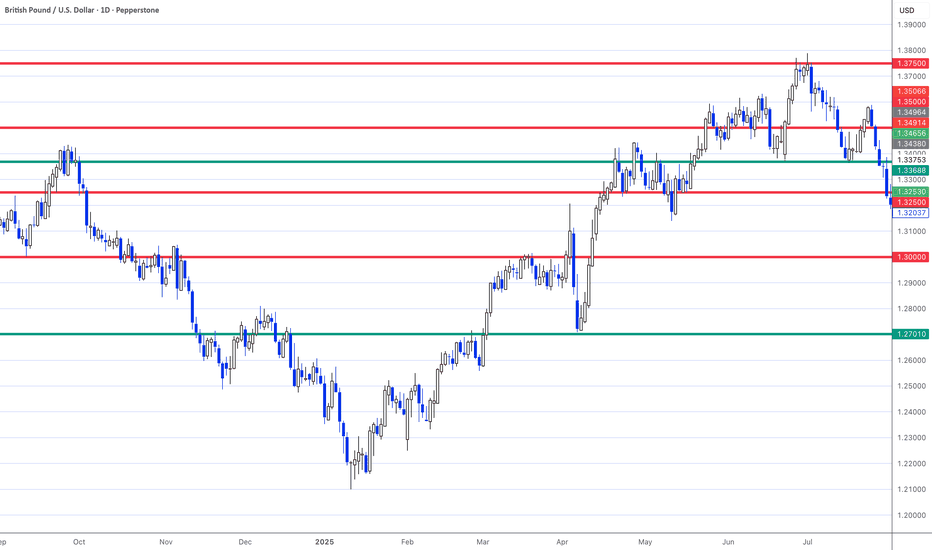

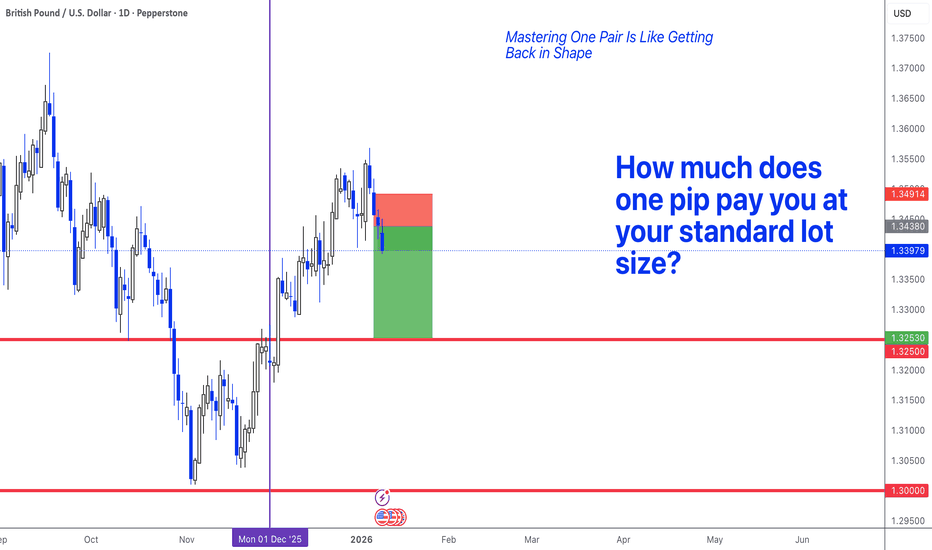

Psychology: Fighting the Urge – How I Learned to Stop OvertradinUnlock the secrets to mastering GBPUSD in this three-part series designed for traders ready to level up. Learn how to fight impulsive trading urges, embrace mindfulness to stay calm under pressure, and gain full control by focusing on a single pair. Each video is packed with practical insights, real examples, and actionable strategies you can apply immediately to your TradingView charts.

Discover how to:

Recognize and control trading impulses for better decision-making.

Use mindfulness and alerts to manage drawdowns and avoid stress.

Track GBPUSD like a pro, from lot sizes to price behavior, and build confidence in every trade.

Whether you’re coming back to trading or leveling up your consistency, this series gives you the tools to trade smarter, not harder.

CTA: Watch all three videos, apply the strategies to your charts, and comment below with your biggest takeaway—I’ll respond with tips to help you master your trades even faster.

Psychology: Mindfulness in Trading: Your Mind = Your AllyUnlock the secrets to mastering GBPUSD in this three-part series designed for traders ready to level up. Learn how to fight impulsive trading urges, embrace mindfulness to stay calm under pressure, and gain full control by focusing on a single pair. Each video is packed with practical insights, real examples, and actionable strategies you can apply immediately to your TradingView charts.

Discover how to:

Recognize and control trading impulses for better decision-making.

Use mindfulness and alerts to manage drawdowns and avoid stress.

Track GBPUSD like a pro, from lot sizes to price behavior, and build confidence in every trade.

Whether you’re coming back to trading or leveling up your consistency, this series gives you the tools to trade smarter, not harder.

CTA: Watch all three videos, apply the strategies to your charts, and comment below with your biggest takeaway—I’ll respond with tips to help you master your trades even faster.

Indices Futures or Forex? The Practical Truth Nobody MentionsToday is not gonna be technical. There is a lot of debate online about whether Indices futures or forex is better, but most of the time this discussion is completely disconnected from real trading life. Im not saying one is better than the other here is just my recent observations.

The real differences are not hidden in some advanced strategy. They are very practical. Spreads, fees, Trading hours, chart quality, and how all of this fits into your daily routine.

From a cost perspective, Indices futures are very transparent. You know exactly what you pay per contract and the spread is usually tight and stable. What you see is what you get.

Forex works differently. Costs are mostly built into the spread and swaps that spread can widen. This does not make forex worse, but it does change how clean your execution feels, especially if you trade intraday.

💊 Trading form US Timezone

I spent the last two weeks in the US, and for the first time I fully felt what it means to miss the London session. Opening the charts straight into New York felt completely different, almost like stepping into the market mid-story. As I perform better in reversal and market manipulations joining continuation setups was not comfortable for me. Why?

Because, during London session is where most of the manipulation and real positioning happens for Forex. That is where liquidity is built, swept this is where Im usually entering for past few years. No saying that New York also cannot make a manipulations and good setups, but trading just New York session felt like having just a half time to trade.

That experience helped me understand why so many US traders focus almost exclusively on the US Indices Futures Day-trading like NQ, ES and YM.

📌 Trading time

US Futures traders getting ready around 9 am. Real move usually starts at after 9:30 manipulation. I believe that we are focusing best in the morning hours, so US day traders can be basically done before the lunch. Then the platform is closed and life continues. That is the point of trading and I can imagine doing that if living in the US.

In Europe, the reality is flipped. Trading US Indices futures means coming to the charts in the afternoon around 3pm, which for me and many people is when focus and energy are already lower. However it can fit to someone who has some job or school and don't have other option.

🧩 Forex Traders

Forex traders usually watch many pairs at the same time on timeframes like W1, D1, H4, M15. for swing trades or intra week trades. If you scalping in and out in the CFD broker you should consider Futures E6 etc... contracts for better fees which can make difference in the your final profitability.

🧩 Futures day traders

Usually specialize to One market. And watches other highly correlated as NASDAQ, S&P, Dow,, which allows traders to use relative strength and SMT between NQ, ES, and YM instead of scanning dozens of charts. Timeframes M1, M3, M5, and levels.H1, H4, D1

📉 Chart quality Futures

Futures Contracts are centralized. One market, one price feed. A NQ chart looks the same on every platform and with every broker. Highs, lows, wicks, and closes are identical. Your analysis is based on the market itself, not on which broker you use.

📉 Chart quality Forex

FX is decentralized. Every broker uses slightly different liquidity sources, and that creates differences in candles. Sometimes small, sometimes big enough to completely change your analysis. One broker shows a clean sweep of a level, another one does not. One candle taps a key level, another misses it by a few pips. If you trade price action or liquidity concepts, this can create hesitation and second-guessing.

So if you ask me whether futures or forex is better, my answer is simple.

Trading let you express yourself like nothing else and you really need to find yourself comfortable in your approach. Trading should adapt to your life and your energy, not force you to adapt your life to the charts. I would say it can depends on:

🧪 1. What kind of trader you are

- Day trader - Entering and Closing multiple trades in a day - Go Futures

- Swing Trader - Watching also cross pairs and holding for days / weeks - CFD is good

🧪 2. Where you are based

- United States - Indices Futures day trading is usually option for most traders, because waking up at 2am for London session is not suitable for everyone. Also at 5PM US time spreads are already widen.

- Europe - You can take advantage of London session which is where mostl of the Forex Market movements starts. If scalper - go with Indices Futures as FDAX, if scalping FX got with futures contracts E6 - EURO etc...

⭕ Summary:

I can not say one is better than the other, go with the one that fits your lifestyle, timezone and your mainly your trading style.

Let me know your experience and what I missed

I promised myself I’d become the person I once needed the most as a beginner. Below are links to a powerful lessons I shared on Tradingview. Hope it can help you avoid years of trial and error I went thru.

📊 Sharpen your trading Strategy

⚙️ 100% Mechanical System - Complete Strategy

🔁 Daily Bias – Continuation

🔄 Daily Bias – Reversal

🧱 Key Level – Order Block

📉 How to Buy Lows and Sell Highs

🎯 Dealing Range – Enter on pullbacks

💧 Liquidity – Basics to understand

🕒 Timeframe Alignments

🚫 Market Narratives – Avoid traps

🐢 Turtle Soup Master – High reward method

🧘 How to stop overcomplicating trading

🕰️ Day Trading Cheat Code – Sessions

🇬🇧 London Session Trading

🔍 SMT Divergence – Secret Smart Money signal

📐 Standard Deviations – Predict future targets

🎣 Stop Hunt Trading

💧 Liquidity Sweep Mastery

🔪 Asia Session Setups

📀 Gold Strategy

🧠 Level Up & Mindset

🛕 Monk Mode – Transition from 9–5 to full-time trading

⚠️ Trading Enemies – Habits that destroy success

🔄 Trader’s Routine – Build discipline daily

💪 Get Funded - $20 000 Monthly Plan

🧪 Winning Trading Plan

⭕ Backtesting vs Reality

🛡️ Risk Management

🏦 Risk Management for Prop Trading

📏 Risk in % or Fixed Position Size

🔐 Risk Per Trade – Keep consistency

🧪 Risk Reward vs Win Ratio

💎 Catch High Risk Reward Setups

☯️ Smart Money - Who control Markets

Adapt useful, Reject useless and add what is specifically yours.

David Perk

TRADING DISCIPLINE — READ BEFORE YOU TRADE!!Every trade must have a reason.

Not a feeling. Not FOMO.

Entry & Exit

You only enter when there is clear confirmation or a specific price level that fits the plan.

Your stop loss is placed at the invalidation level if price reaches it, the idea is wrong.

Take profit is set based on realistic market conditions, not greed.

Once the stop loss is set, it is final. Never widen your stop loss.

What you decide before entering is your responsibility as a disciplined trader.

Risk Management

Risk per trade is 1%. Maximum 2.5% only when using a high win-rate strategy.

You must have daily and weekly loss limits.

When the limit is hit, stop trading! your mindset is no longer objective.

The market will always be here tomorrow, but your capital might not be.

Limit the number of trades per day, because more trades do NOT mean more profit.

Never trade during high-impact news. Trade after the news, when direction is clearer.

Market & Timeframe

Define bias on the higher timeframe.

Execute on the lower timeframe.

Never trade against the higher timeframe context.

Market Conditions

Always understand the environment: bull or bear market.

Identify market structure / trending or ranging.

Avoid unstable or chaotic volatility.

Trade only during your chosen market session: Asian, London, or New York not all sessions.

Psychology

Losses are business expenses.

Wins don’t justify breaking rules.

If you’re tired or emotional, don’t trade.

Discipline over emotion.

Always.

The Math Retail Traders Ignore: Risk-Reward Ratios Are WorthlessA Quantitative Analysis of the Relationship Between Risk-Reward Ratios and Win Rates, and Why the Popular Money Management Narrative Fails Under Mathematical Scrutiny

1. Introduction

Open any trading course, scroll through any trading forum, or watch any YouTube tutorial on money management, and you will encounter some variation of the same claim: with a risk-reward ratio of 3:1, you only need to win 25 percent of your trades to be profitable. The implication is seductive. You can be wrong three out of four times and still make money. Suddenly, profitable trading seems achievable even for those who struggle with market prediction. The risk-reward ratio, often abbreviated as RRR in English literature or CRV in German-speaking markets, has become the cornerstone of retail money management education.

But here is a question that almost never gets asked: if setting a favorable risk-reward ratio were sufficient to generate profits, why would anyone ever lose money trading? Why would hedge funds employ teams of quantitative researchers when a simple rule about stop losses and profit targets would apparently suffice?

This study was designed to answer that question through rigorous mathematical analysis, Monte Carlo simulation, and empirical testing across multiple asset classes. Our findings reveal an uncomfortable truth that contradicts the foundation of retail money management education. The risk-reward ratio, as typically presented, contains a fundamental mathematical flaw that renders its supposed advantage illusory. What retail traders understand as money management bears no resemblance to how professional systematic traders actually approach position sizing and risk control.

Figure 1 displays the theoretical relationship between risk-reward ratio and win rate under random walk conditions. The curve represents the break-even line derived from first-passage time theory. Notice how the win rate decreases in exact proportion to the increase in risk-reward ratio. At RRR 1:1, the theoretical win rate is 50 percent. At RRR 2:1, it drops to 33 percent. At RRR 3:1, it falls to exactly 25 percent. This is not coincidence. It is mathematical necessity.

2. The Mathematical Foundation: First-Passage Time Theory

To understand why the retail risk-reward narrative fails, we must examine the mathematics that govern price movements and barrier hitting probabilities. The relevant framework comes from probability theory, specifically the study of first-passage times for stochastic processes.

Consider a trade entry at price P with a stop loss at distance S below and a take profit at distance T above. The question becomes: what is the probability that price reaches the take profit level before reaching the stop loss level? For a symmetric random walk, where price has equal probability of moving up or down at each step, the answer is given by a remarkably simple formula derived from the gambler's ruin problem:

P(Take Profit first) = S / (S + T)

If we express this in terms of the risk-reward ratio, where RRR = T / S, the formula becomes:

P(Take Profit first) = 1 / (1 + RRR)

This equation has profound implications. It tells us that for any given risk-reward ratio, there exists an exact win rate that produces zero expected profit. At RRR 2:1, that break-even win rate is 33.3 percent. At RRR 3:1, it is 25 percent. At RRR 5:1, it is 16.7 percent.

The retail money management narrative presents these numbers as if they represent some kind of advantage. The trader is told they only need 25 percent accuracy with a 3:1 ratio. What they are not told is that under efficient market conditions, they will achieve exactly 25 percent accuracy, no more and no less. The higher risk-reward ratio does not create an edge. It merely redistributes the probability mass from win rate to reward size. The expected value remains precisely zero.

Figure 2 presents a heatmap showing trade expectancy across different combinations of risk-reward ratio and win rate. The white dashed line represents the break-even condition derived from random walk theory. Areas above this line are profitable. Areas below are unprofitable. Notice how the break-even line traces the exact curve predicted by our formula. Any trading system operating at random walk efficiency will fall precisely on this line, generating zero expected profit regardless of the chosen risk-reward ratio.

3. The Retail Trader Illusion

Before examining what this means in practice, it is worth understanding why the risk-reward myth persists despite its mathematical invalidity.

The standard retail narrative proceeds as follows. Markets are unpredictable, so even skilled traders will have many losing trades. By setting a favorable risk-reward ratio, traders ensure that their winners are larger than their losers. This way, even with more losses than wins, the account grows over time. The advice typically includes specific recommendations: never risk more than one percent of capital per trade, always aim for at least 2:1 or 3:1 reward to risk, and let winners run while cutting losers short.

This narrative contains surface-level logic that appeals to intuition. It feels correct. The problem is that it treats the risk-reward ratio and win rate as independent variables that can be chosen separately. In reality, they are mathematically linked. You cannot simply decide to have a 3:1 ratio and maintain any win rate you choose. The market determines your win rate based on the distance to your profit target and stop loss.

Consider a practical example. A trader enters a long position in the S&P 500 with a 20-point stop loss and a 60-point profit target, establishing a 3:1 ratio. The market does not know or care about the trader's intended ratio. It simply fluctuates according to its statistical properties. If those fluctuations follow approximately random walk behavior, the probability of the 60-point target being reached before the 20-point stop is hit will be approximately 25 percent. The trader achieves exactly the win rate required for break-even, not because of skill or because the ratio was favorable, but because of mathematical necessity.

Figure 3 compares the theoretical win rates predicted by first-passage time theory with the results of 500,000 Monte Carlo simulated trades for each risk-reward configuration. The near-perfect alignment between theory and simulation confirms that the mathematical relationship holds under realistic price dynamics. The slight deviations visible at extreme ratios result from the finite time horizon imposed in simulations, where some trades neither hit their target nor stop within the allowed period.

4. The Illusion of Choice

The fundamental error in retail money management education is treating risk-reward ratio as a strategic choice that confers advantage. In reality, changing your risk-reward ratio does not change your edge. It changes the distribution of your outcomes while preserving the expected value.

To illustrate this concretely, consider two traders with identical entry signals but different risk-reward approaches. Trader A uses tight stops with 1:1 ratios, while Trader B uses the same entries but wider stops with 3:1 ratios. Under random walk conditions, Trader A will win approximately 50 percent of trades, each winning or losing the same amount. Trader B will win approximately 25 percent of trades, with winners three times larger than losers. The expected profit per trade for both traders is identical: zero.

The only difference lies in the psychological experience. Trader A experiences frequent small wins and losses, creating a sense of consistent activity. Trader B experiences infrequent large wins punctuated by strings of small losses, creating an emotional roller coaster that many traders find difficult to sustain. Neither approach is inherently superior because neither creates edge where none exists in the underlying entry signal.

This reveals the critical insight that retail education systematically obscures: the risk-reward ratio is not a source of edge. It is a preference about how to experience the variance of an existing edge, or lack thereof. If your entries have no predictive value, no choice of risk-reward ratio will make them profitable. If your entries have genuine predictive value, the risk-reward ratio determines how that edge manifests in your equity curve, but does not alter the fundamental profitability.

The distribution of trade outcomes for identical entry signals with three different risk-reward configurations follows predictable patterns. With RRR 1:1, the win rate approaches 50 percent. With RRR 2:1, it drops to near 33 percent. With RRR 3:1, it falls to approximately 25 percent. In all cases, the expected value per trade is identical. The only difference is the shape of the distribution.

5. What About Markets With Drift?

A natural objection to the random walk analysis is that real markets, particularly equity indices, exhibit positive drift over time. The S&P 500 has historically returned approximately 8 percent annually. Does this positive drift change the mathematics?

The answer is yes, but far less than most traders assume. When drift is present, the first-passage time formula becomes more complex, incorporating both the drift rate and volatility:

P(Take Profit first) = (1 - exp(-2*kappa*x)) / (1 - exp(-2*kappa*a))

where kappa = (mu - sigma^2/2) / sigma^2

For typical equity parameters with 8 percent annual drift and 16 percent annual volatility, the improvement in win rate is modest. At a 2:1 risk-reward ratio, the theoretical win rate increases from 33.3 percent under random walk to approximately 35 percent with drift. This represents an improvement, but a small one, certainly not the dramatic advantage that would justify treating risk-reward as a primary edge source.

More importantly, the positive drift is already priced into the market through the equity risk premium. Traders who simply hold long positions capture this drift automatically. The question is whether active trading with stop losses and profit targets captures more or less of this drift than simple buy-and-hold. Research consistently shows that in markets with positive drift, the use of stop losses tends to reduce rather than increase total returns. The stops trigger during normal fluctuations, causing traders to exit positions that subsequently recover and continue upward.

Figure 4 compares win rates across three market conditions: pure random walk, S&P 500-like drift of 8 percent annually, and forex markets with near-zero drift. The improvement from drift is visible but modest, ranging from 1 to 3 percentage points depending on the risk-reward ratio. For forex markets, which constitute the primary venue for retail speculation, the random walk approximation holds closely.

6. The Gain-Loss Time Asymmetry

Recent academic research has uncovered an additional phenomenon that further complicates the risk-reward picture. Studies by Siven, Perello, and others have documented that in equity markets, losses of a given percentage magnitude tend to occur faster than gains of the same magnitude. This gain-loss time asymmetry results from the clustering of downward movements during market stress, when correlations increase and selling becomes self-reinforcing.

The practical implication is sobering for traders using fixed risk-reward ratios. When targeting a 3:1 ratio with equal percentage distances to stop and target, the stop loss will typically be reached faster than the take profit when the trade goes wrong, while the take profit takes longer to reach when the trade goes right. This creates a temporal asymmetry that can psychologically devastate traders who experience rapid sequences of losses followed by slow, grinding recoveries.

Our Monte Carlo simulations confirm this asymmetry. For S&P 500-like parameters with a 2 percent stop loss and 6 percent profit target, the average time to hit stop loss on losing trades is approximately 15 trading days, while the average time to hit take profit on winning trades is approximately 45 trading days. Traders must endure three times longer in winning positions than losing positions, a patience requirement that few retail traders can maintain.

Figure 5 illustrates the time asymmetry between winning and losing trades across different risk-reward configurations. The left panel shows average bars to exit for wins versus losses. The right panel displays the ratio of loss time to win time, with values below 1.0 indicating that losses occur faster than wins. The asymmetry becomes more pronounced at higher risk-reward ratios.

7. How Professionals Actually Use Risk-Reward Concepts

If the retail interpretation of risk-reward ratios is mathematically flawed, how do professional systematic traders approach these concepts? The answer reveals a fundamentally different philosophy.

Professional traders do not select risk-reward ratios based on desired profit profiles. Instead, they determine position sizes based on the volatility characteristics of each instrument and the correlation structure of their portfolio. The risk-reward ratio that emerges from any individual trade is a consequence of the entry signal, the volatility-adjusted stop placement, and the exit rules, not a predetermined parameter chosen to achieve some target win rate.

The volatility-adjusted approach, documented extensively by Robert Carver and implemented by firms like AQR and Winton, sizes positions so that each trade contributes approximately equal risk to the portfolio:

Position Size = (Target Risk) / (Instrument Volatility x Price)

This formula ensures that a position in a volatile instrument like crude oil does not dominate the portfolio simply because it moves more. The stop loss distance is typically set as a multiple of recent volatility, often 2 to 3 times the 20-day average true range. The profit target, if used at all, is similarly volatility-adjusted or determined by the exit signal reversing.

Notice what is absent from this approach: any mention of achieving a specific risk-reward ratio. Professionals understand that the ratio emerges from the system's characteristics rather than being imposed upon it. They focus on developing entry signals with genuine predictive value and managing risk through position sizing and diversification, not through arbitrary ratio targets.

The contrast between retail and professional approaches to risk management is stark. The retail approach begins with a desired risk-reward ratio and works backward to set stop and target distances. The professional approach begins with signal generation, applies volatility-adjusted position sizing, and accepts whatever risk-reward ratio emerges from the system's natural characteristics.

8. The Kelly Criterion: When Risk-Reward Actually Matters

There is one context in which the risk-reward ratio becomes genuinely important for position sizing: when combined with a known, statistically verified edge. The Kelly criterion provides the mathematically optimal bet size for a sequence of bets with known win probability and payoff ratio:

Kelly Fraction = (p * b - q) / b

where p is the win probability, q = 1 - p is the loss probability, and b is the ratio of win size to loss size.

If a trader has genuinely verified that their system wins 40 percent of trades with a 2:1 payoff ratio, the Kelly formula recommends betting:

f = (0.40 * 2 - 0.60) / 2 = 0.10, or 10 percent of capital

The critical requirement here is that the win rate must be known and must exceed the break-even rate for the given payoff ratio. A 40 percent win rate with 2:1 payoff exceeds the 33 percent break-even threshold by 7 percentage points, representing genuine edge. The Kelly criterion then optimizes the exploitation of this edge.

However, most retail traders have not rigorously verified their win rates through out-of-sample testing. They operate with assumed or back-fitted parameters that typically degrade significantly in live trading. Applying Kelly sizing to unverified edge estimates is dangerous because the formula is highly sensitive to estimation error. Overestimating edge leads to overbetting, which can result in catastrophic drawdowns.

Professional systematic traders who use Kelly or fractional Kelly approaches invest heavily in statistical verification before deploying capital. They require hundreds or thousands of out-of-sample trades before trusting their edge estimates, and they typically use only a fraction of the Kelly-optimal size to provide margin for estimation error.

The Kelly optimal position size as a function of win rate varies dramatically across risk-reward ratios. The optimal bet size increases rapidly as win rate exceeds the break-even threshold, highlighting the importance of accurate edge estimation. For a 2:1 payoff ratio, the Kelly fraction jumps from zero at 33 percent win rate to 10 percent at 40 percent win rate, demonstrating the formula's sensitivity to edge magnitude.

9. Empirical Evidence From Real Markets

To test whether the theoretical relationships hold in practice, we analyzed historical price data for multiple asset classes, simulating trades at regular intervals with various stop loss and take profit configurations.

For the S&P 500 ETF spanning from 2000 to 2024, we initiated hypothetical trades at each trading day with a 2 percent stop loss and varying take profit levels. At 2 percent take profit, yielding a 1:1 ratio, the empirical win rate was 51.2 percent, slightly above the 50 percent theoretical prediction, consistent with the market's positive drift. At 4 percent take profit with 2:1 ratio, the empirical win rate was 34.8 percent, above the 33 percent theoretical but below what many retail traders assume. At 6 percent take profit with 3:1 ratio, the empirical win rate was 26.3 percent, only marginally above the 25 percent theoretical threshold.

The edge provided by drift, while real, is small. Converting it to annual terms, the improvement represents approximately 2 to 3 percent additional return compared to what would be expected under random walk conditions. This is meaningful over long horizons but negligible in the context of typical retail trading frequencies and transaction costs.

For forex pairs, where central bank intervention and mean-reverting tendencies create different dynamics, the results aligned even more closely with random walk predictions. The EUR/USD pair showed win rates within one percentage point of theoretical values across all risk-reward configurations tested, providing no evidence of exploitable drift.

The close alignment between observed and predicted win rates confirms that real markets behave approximately as first-passage time theory predicts, with only modest deviations attributable to drift or other market microstructure effects. This empirical validation across multiple asset classes and time periods strengthens confidence in the mathematical framework presented throughout this analysis.

10. What Retail Traders Can Actually Learn

Given that the traditional retail interpretation of risk-reward ratios provides no inherent advantage, what practical lessons can individual traders extract from this analysis?

First, stop treating risk-reward ratio as a source of edge. It is not. The ratio you choose affects the shape of your equity curve but not its expected slope. A 3:1 ratio will produce infrequent large wins and frequent small losses. A 1:1 ratio will produce balanced wins and losses. Neither is inherently superior.

Second, recognize that edge must come from entry timing, not exit parameters. If your entries have no predictive value, no stop loss or take profit configuration will make them profitable. Focus your energy on developing and verifying entry signals rather than optimizing exit ratios.

Third, if you believe you have edge, verify it rigorously before betting real capital. This means out-of-sample testing across multiple market conditions, accounting for realistic transaction costs and slippage, and achieving statistical significance with enough trades to rule out luck. The threshold for statistical significance in trading is high because multiple testing bias is severe.

Fourth, use volatility-adjusted position sizing rather than fixed dollar amounts or percentages. This ensures that your risk exposure remains consistent across instruments and market conditions. A 2 percent stop in a low-volatility environment represents different risk than a 2 percent stop during a volatility spike.

Fifth, consider whether active trading with stops and targets is appropriate for your market at all. In markets with positive drift like equities, research suggests that buy-and-hold strategies often outperform active trading after costs. The most reliable way to capture the equity risk premium is simply to remain invested.

A proper decision framework for evaluating risk-reward configurations must begin with verified edge characteristics. The framework emphasizes that ratio selection should follow from system properties rather than being imposed based on desired win rate characteristics. Only after establishing genuine predictive ability through rigorous testing should traders consider how to structure their exits.

11. The Professional Alternative

For traders determined to pursue systematic approaches, professional trend followers offer a template that differs fundamentally from retail risk-reward mythology.

The professional framework begins with signal generation through methods like time series regression, where the slope of price over a lookback window is tested for statistical significance. Only when the trend signal exceeds a confidence threshold is a position initiated. This contrasts with retail approaches that generate signals constantly based on simple indicator crossovers.

Position sizing follows volatility normalization, ensuring each position contributes equal expected risk to the portfolio. The formula incorporates recent volatility, correlation with existing positions, and total portfolio risk constraints. This systematic approach prevents any single position from dominating outcomes.

Exit signals typically mirror entry signals. Rather than using fixed take profit levels, positions are held until the trend signal reverses or weakens below threshold. This allows winning trades to continue as long as the underlying momentum persists, rather than being truncated by arbitrary targets.

Risk management occurs at the portfolio level through diversification across uncorrelated markets and strategy types. The goal is to generate returns that are uncorrelated with traditional asset classes, providing crisis alpha during market dislocations when traditional investments suffer.

This framework does not eliminate losses or guarantee profits. Professional trend followers experience extended drawdowns and multiple years of underperformance. What the framework provides is a statistically grounded approach to capturing genuine market inefficiencies rather than an illusory edge from ratio selection.

Figure 6 presents a summary dashboard illustrating the key findings of this analysis. The four panels show the theoretical RRR-win rate relationship validated by Monte Carlo simulation, the modest improvement from market drift, the time asymmetry between wins and losses, and the expectancy calculations that confirm zero expected profit under random walk conditions. Together, these visualizations demonstrate why the retail risk-reward narrative fails under mathematical scrutiny.

12. Conclusion