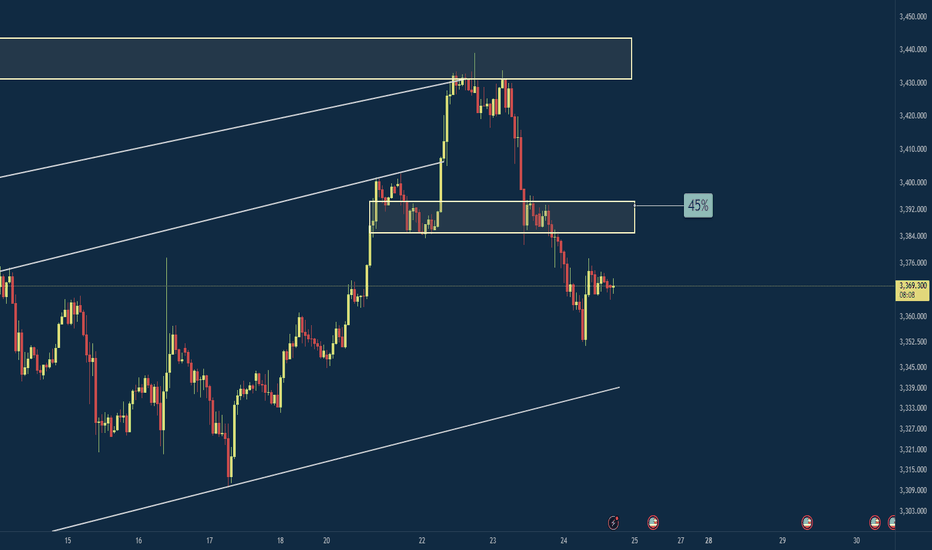

Master Horizontal Lines on Trading Charts | Signal & Structure 2In this second episode of the Signal and Structure series, we dive deep into one of the most fundamental yet powerful tools in technical analysis - horizontal support and resistance lines. This practical tutorial demonstrates a systematic approach to identifying and marking key price levels across multiple timeframes.

What You'll Learn:

Color-Coded Line System for Multiple Timeframes:

Monthly (Black, thickness 4) - The strongest levels from monthly candle closes

Weekly (Maroon/Brown, thickness 3) - Key weekly support/resistance zones

2-Day (Red, thickness 2) - Intermediate term levels

12-Hour (Orange, thickness 1-2) - Short-term trading levels

3-Hour (Yellow, thickness 1) - Day trading reference points

Key Concepts Covered:

Why monthly candle closes often matter more than wicks (with live examples)

How previous resistance becomes new support - demonstrated on Bitcoin's chart

Identifying distribution and accumulation ranges using horizontal levels

The importance of avoiding chart clutter - when NOT to add more lines

Using transparent candles to see through to your levels and indicators

Practical Techniques:

Live demonstration on TradingView using Bitcoin/USD charts

How to identify the most significant levels from each timeframe

Creating "boxes" to visualize trading ranges and distribution zones

Brief introduction to Wyckoff theory concepts (spring patterns)

Tips for maintaining clarity when working with multiple overlapping levels

Chart Setup Tips:

Why exchange charts (KuCoin, Gate.io) provide better volume data than index charts

Continuing emphasis on logarithmic scale for crypto analysis

How to organize your workspace for multi-timeframe analysis

This 20-minute tutorial walks you through the exact process of building a professional-grade support and resistance framework on your charts. The presenter demonstrates each concept in real-time on TradingView, making it easy to follow along and implement these techniques immediately.

Perfect for traders who want to move beyond random line drawing and develop a systematic, color-coded approach to identifying key market levels. Whether you're scalping on the 3-hour or position trading on the monthly, this hierarchical system helps you see exactly where the important levels are at a glance.

Next episode preview: Diagonal trend lines, channels, and Fibonacci levels - including a unique approach to stacking channels that provides an edge in the markets.

Trend Lines

FX Professor 101: How I Start My Charts with Trendlines & FibFX Professor 101: How I Start My Charts with Trendlines & Fib Levels 🧠📈

Some of you asked me to show my charting process again — so here it is, strictly educational, using Pepper as the example (because a few of you believe in it and asked about it). Let’s build this chart together from scratch. 🛠️

Step 1: Get Full Historical Context 📜

I always start by selecting a chart with the most data available. More history = more structure to work with. No shortcuts here.

Step 2: Anchor with Horizontal Trendlines 📏

I look for a clear support → resistance → support pattern with no manipulation. That becomes my anchor level.

Then I scan for secondary levels – if they’re too close or manipulated, I keep them dotted and as references.

Zooming in helps. Don't hesitate to get granular when needed. 🔍

Step 3: Respect the Manipulation 🤨

If a chart feels overly manipulated (wicks, fakeouts, no clear rejections), I lose trust in it. But sometimes even within manipulation, valid levels emerge — and I mark them clearly.

Step 4: Fibonacci Confirmation 🔢✨

Once I place the trendlines, I overlay Fibonacci retracements to see if they align. In this case, one of my levels landed exactly on 0.618 – no cap! 😂 That’s when experience meets structure.

Final Notes 🧘♂️

• Only two levels made the final cut

• Secondary levels marked with dotted lines

• 0.618 Fib validated the primary structure

• Support at 929 is looking strong as of now

This is my process. It’s how I start every serious chart. Nothing fancy — just history, structure, and experience. If it helps even one of you out there, I’m happy. 💙

One Love,

The FXPROFESSOR 💙

Food for Trading Thought:

From my experience as an AI developer, I’ve come to one firm conclusion — AI will never replace us. It can assist, but it can’t see what you see or feel what you feel. The real edge in trading is your human intuition, patience, and discipline.

Trading is a game — a risky game. Play it right if you're going to play it at all.

Stay human and remember: the best Blockchain is YOU, the best Altcoins are your loved ones and your work/creation/purpose in life. 🎯

Welcome Back! Gold Trading Strategy & Key Zones to WatchIn this week’s welcome back video, I’m breaking down my updated approach to XAU/USD and how I plan to tackle the Gold markets in the coming days. After taking a short break, I’m back with fresh eyes and refined focus.

We’ll review current market structure, identify key liquidity zones, and outline the scenarios I’m watching for potential entries. Whether you’re day trading or swing trading gold, this breakdown will help you frame your week with clarity and confidence.

📌 Covered in this video:

My refreshed trading mindset after a break

Key support/resistance and liquidity zones

Market structure insights and setup conditions

What I’ll personally avoid this week

The “trap zones” that might catch retail traders off guard

🧠 Let’s focus on process over profits — welcome back, and let’s get to work.

How Bitcoin can impact alt coins like sol and sui This video is a very quick update on the potential for bitcoin to drop into the 96/97k region and the effect it will have on alt coins .

If you hold altcoins and you see them bleed in price then its important to know and understand whats ahead for Bitcoin .

Understanding this will help you with your entry's and your exits on all altcoins .

How to Draw Support & Resistance In TradingViewLearn how to effectively identify, draw, and utilize support and resistance levels in TradingView with this comprehensive step-by-step tutorial. Whether you're a beginner trader or looking to refine your technical analysis skills, this video covers everything you need to know about one of the most fundamental concepts in trading.

What You'll Learn:

Understanding support and resistance: the foundation of technical analysis and price action trading

Step-by-step instructions for drawing horizontal support and resistance lines in TradingView

Creating support and resistance zones for more flexible trading approaches

Practical tips for using TradingView's drawing tools effectively

This tutorial may be helpful for day traders, swing traders, and investors using TradingView who want to improve their chart analysis skills. The techniques covered could help you make more informed entry and exit decisions by understanding where price might find support or encounter resistance.

Visit Optimus Futures to learn more about trading futures with TradingView: optimusfutures.com

Disclaimer:

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results. Please trade only with risk capital. We are not responsible for any third-party links, comments, or content shared on TradingView. Any opinions, links, or messages posted by users on TradingView do not represent our views or recommendations. Please exercise your own judgment and due diligence when engaging with any external content or user commentary.

This video represents the opinion of Optimus Futures and is intended for educational purposes only. Chart interpretations are presented solely to illustrate objective technical concepts and should not be viewed as predictive of future market behavior. In our opinion, charts are analytical tools—not forecasting instruments. Market conditions are constantly evolving, and all trading decisions should be made independently, with careful consideration of individual risk tolerance and financial objectives.

Crude OIL SHORT Today Ran For +4R BreakdownNYMEX:CL1!

"Successful trading has always been about understand the convictions, the strength and the weakness of buyers and sellers. Once you understand what the other traders are doing in the market, you can successfully trade with them." -Michael Valtos

Confluence Profile 500K (Expectational Order-Flow + PA) 10pt Stop / +4R Run... Well Done!!

Remember; "Our Profession is to Manage the downside costs of printing HIGHSIDE returns of $$$ consistently. Done correctly, well Abundance awaits us." -500KTrey

20pt Stop / 5R Run... Well Done!COMEX:GC1!

"In order to be successful in life you have to learn how to do something so well that the dead, the living, or the unborn could not to do any better." -Dr. MLK Jr.

Self-explanatory... 'Confluence Profile 500K' (Expectational Order Flow + PA) 20pt Stop / 5R Run... 1OOpt Target w/ a 20pt STOP. Covering Todays NY HIGH... #APBTG On to the next 1. #BHM500K

Confluence Profile 500K (Order Flow Footprint + PA) 2.5RNYMEX:CL1!

"If you can't fly then run, if you can't run then walk. If you can't walk, then crawl. But whatever you do you have to keep moving forward." -Dr. Martin Luther King Jr.

Family I hope everyone is in good spirits as we kick off this new year of 2025!!!! Here in this video I have went into gr8 detail on this trade that I took SHORT todays during NY Session on Crude OIL and I broke down the Order Flow Footprint along with PA on why I decided to enter the trade and capitalize on 2.5R. My original target was 5R however volume died out and I decided to close and walk with profit. This year I'm going to consistently Over N over N over N over N over again study the 10pt Stop entry here on Crude Oil. On overage Crude Oil will run for +120pts during NY Session. All we need is half of that to eat. (60pts) this is my sweet spot. I'm determined to master it. Added along with better tape reading of the Order Flow Footprint. Let's stay active!

Remember; "Our Profession is to Manage the downside costs of printing HIGHSIDE returns of $$$ consistently. Done correctly, well Abundance awaits us." -500KTrey

'Confluence Profile 500K' (Order Flow Footprint + PA)"10pt STOP"NYMEX:CL1!

"Successful trading has always been about understand the convictions, the strength and the weakness of buyers and sellers. Once you understand what the other traders are doing in the market, you can successfully trade with them." -Michael Valtos

Family in this video I went into a gr8 in depth breakdown of a 5-6R trade that took place today during NY session SHORT on Crude OIL. Paying very close attention to the order flow footprint all the while observing very closely how PA is setting up will help us to develop the mastery of the 'Confluence Profile 500K' (Order Flow Footprint + PA) "10pt STOP". Just think about this......

December of 2024 price moved on average of 120pts during NY session. (5am-2pm) PST.

-We know we're not going to catch the whole 120pts so were going to focus our attention on cutting that point ratio in half and catch 50-60pts with a 10Pt STOP....

-Granting us 5-6R in our Favor!!

Now this is the RISK we face, WE HAVE ONLY 10PTS of pre-determined RISK. So, the 'Confluence Profile 500K' will consist of the (Order Flow Footprint + PA) to give us the highest probability ratio of entering a position with only 10pts to RISK & this is our journey to Master the 10pt STOP w/ a 50-60pt Target!!! Let's go 2 work.

Remember; "Our Profession is to Manage the downside costs of printing HIGHSIDE returns of $$$ consistently. Done correctly, well Abundance awaits us." -500KTrey

How To Setup Your TradingView RightHey,

In this video I show you how my charting setup looks like.

I use the monthly, weekly, daily time-frames in one layout.

I use the 4hour and 1hour time-frame in my other layout.

Then I show you everything I trade for FX in my watch list.

Then I show you my crypto and stock market watch list.

Kind regards,

Max

Treasury yields at a crossroads? The implications for marketsThe long end of the US Treasury curve has been influential for FX markets recently. The rolling 10-day correlation between US 10-year yields with the DXY, EUR/USD, GBP/USD, and USD/JPY is either strongly positive or negative. Even gold shows a notable -0.73 correlation, highlighting the influence of long bonds on broader markets.

Given the inverse relationship between bond yields and prices, it’s no surprise that the correlation between 10-year yields and 10-year Treasury futures (shown in orange, left-hand pane) has been nearly perfectly negative over the past two weeks.

In terms of directional risks for yields moving forward, the right-hand pane showing US 10-year Treasury note futures is instructive. The price remains in a downtrend, repeatedly rejected since being established October. If this trend persists, it signals lower prices and higher yields.

That said, with the bullish hammer candle from the lows last week, coupled with RSI (14) and MACD which are providing bullish signals on momentum, you get the sense we may be in the early stages of a turning point.

If we were to see the price break the downtrend, resistance may be encountered at 113’00, a level that’s been tested from both sides in recent weeks. If that were to give way, it points to an environment of a softer US dollar and kinder conditions for longer duration assets and commodities.

Good luck!

DS

Triple Bottom Pattern Tutorial: 5/8 Bullish Chart PatternsTriple Bottom Pattern Tutorial: 5/8 Bullish Chart Patterns

A bullish triple bottom is a reversal chart pattern that signals the potential end of a downtrend and the start of an upward trend. Here's a breakdown:

Three Lows: The pattern is characterized by three distinct lows that are roughly equal in price. These lows form after a significant downtrend, indicating strong support at that level.

Rallies Between Lows: Each low is separated by two intermediate rallies that create peaks. These peaks form the resistance level known as the neckline.

Neckline: The horizontal line connecting the highs of the intermediate rallies is called the neckline. This is a crucial resistance level that the price must break through to confirm the pattern.

Breakout: A breakout above the neckline, typically accompanied by increased trading volume, confirms the triple bottom pattern. This breakout signifies a shift in market sentiment from bearish to bullish.

Price Target: The expected price target is often calculated by measuring the distance from the pattern's lowest low to the neckline and projecting that distance upwards from the breakout point.

Traders view the triple bottom as a strong indication that the selling pressure has been exhausted and that buyers are starting to gain control, suggesting a potential upward price movement.

Bullish Double Bottom Pattern Tutorial: 4/8 Bullish PatternsGive me the description for a bullish double-bottom

A bullish double bottom is a powerful reversal chart pattern that signals the potential end of a downtrend and the beginning of an upward trend. Here’s how it forms:

Two Troughs: The pattern starts with a significant price decline, forming a low (the first bottom). The price then rebounds to create a peak (the middle of the "W" shape) but soon declines again to form a second bottom roughly at the same price level as the first bottom. This double bottom resembles the letter "W."

Neckline: The horizontal line that connects the peak of the middle rebound is called the neckline. This is a key resistance level that the price needs to break through to confirm the pattern.

Breakout: A breakout above the neckline, typically accompanied by increased volume, confirms the double bottom pattern and signals a potential trend reversal from bearish to bullish.

Price Target: The estimated price target for the upward move is usually determined by measuring the distance from the bottoms to the neckline and projecting this distance upwards from the point of breakout.

Traders view the double bottom as a strong indication that the previous downtrend has exhausted and the bulls are gaining control, leading to a potential significant upward movement.

Ascending Triangle Pattern Tutorial: 3/8 Bullish PatternsAscending Triangle Pattern Tutorial: 3/8 Bullish Patterns

An ascending triangle is a bullish continuation chart pattern that signals the potential for an upward breakout. Here's how it forms:

Flat Upper Trendline: The upper trendline is flat, indicating a resistance level where the price consistently faces selling pressure and fails to move higher.

Rising Lower Trendline: The lower trendline is ascending, showing higher lows as buyers step in at increasingly higher prices.

Price Convergence: The price action gets squeezed between the two trendlines, leading to a tightening range.

Breakout: Eventually, the price breaks above the resistance level, indicating a continuation of the upward trend. This breakout is typically accompanied by a surge in volume.

Ascending triangles are popular among traders because they offer clear entry and exit points. The height of the triangle, measured from the base to the horizontal resistance, can be used to estimate the potential price target following the breakout.

LIKE l FOLLOW l SHARE

Symmetrical Triangle Pattern what is it/ how to draw it? 2/8Symmetrical Triangle Pattern what is it/ how to draw it? 2/8 Bullish Charting Patterns

A symmetrical triangle is a chart pattern that forms when the price of an asset converges with two trendlines that are moving towards each other, creating a triangular shape. Here’s how it works:

Converging Trendlines: The upper trendline is formed by connecting the descending highs, and the lower trendline is formed by connecting the ascending lows. These trendlines converge at a point called the apex.

Volume Decrease: As the pattern develops, trading volume typically decreases, indicating a period of consolidation and indecision in the market.

Breakout: Eventually, the price breaks out from the triangle, which can occur in either direction – upwards or downwards. The direction of the breakout often dictates the future trend of the asset.

Symmetrical triangles are considered continuation patterns, meaning they usually signal that the prevailing trend (upward or downward) before the pattern will continue after the breakout. Traders often use the height of the triangle (the distance between the initial high and low points) to estimate the potential price target following the breakout.

Like l Follow l Share

Stay tuned for the other 6 BULLISH CHARTING PATTERNS

What is a BULL Flag Charting Pattern and How to draw it? 1/8This is video 1/8 of this series of BULLISH Chart Patterns.

A bull flag is a continuation pattern that appears in a strong uptrend, signaling that the prevailing upward trend may continue. Here's how it looks:

Flag Pole: A sharp, steep rise in price forms the flag pole.

Flag: A period of consolidation with lower highs and lower lows, forming a flag that slopes against the prevailing uptrend.

Breakout: A strong move upwards out of the flag, confirming the continuation of the uptrend.

The bull flag pattern is popular among traders because it provides clear entry and exit points and is relatively easy to identify. It's a great indicator for momentum traders looking to capitalize on the continuation of a bullish trend.

Like l Follow l Share

Stay tuned for the other 7 BULLISH CHARTING PATTERNS

Unlock the Market's Hidden Rollercoaster: How to Ride the WavesXau/Usd Review with my trading personality

As a Whimsical Rollercoaster Enthusiast, your trading style is likely driven by the excitement of quick market movements and the thrill of capturing early trades. You're probably someone who thrives on dynamic entries, enjoys the fast-paced action, and may have a more intuitive approach to the market. Let’s blend that with risk management to balance your adventurous spirit while still keeping a solid trading plan.

Technical Review for a Whimsical Rollercoaster Trader:

1. Key Levels to Watch:

2,595 (Resistance) and 2,580 (Support) are your playgrounds right now. You’re drawn to the thrill of what might happen at these zones.

If price pushes toward 2,595, you might feel an urge to jump in, expecting an immediate reaction. However, I encourage you to:

Embrace your adventurous nature but temper it with tactical precision.

Let the level hit and then wait for a quick confirmation (like a wick rejection or a mini pullback). This gives you both the excitement of early entry and higher probability without losing your edge.

Scenario: Price pushes toward 2,595. Here, your Risk Entry could be triggered:

Risk-Entry Plan:

Enter short at the first rejection of 2,595.

Set a tight stop-loss just above the liquidity zone (2,600), respecting your love for quick moves but protecting from being shaken out too soon.

Target the 2,580 area first, knowing the ride might be wild but worth it.

Why it suits you: It’s a quick decision, satisfying your need for speed, while the tight stop-loss aligns with managing risk. You get that thrill, but within guardrails.

2. Confirmation Entry – Building Momentum:

Confirmation Entries might feel a bit “slow” to you, but they can help ensure you stay in the game longer. Consider them when you want to ride bigger moves, not just quick scalp trades.

Scenario: If price breaks through 2,595, wait for a retest to confirm this zone is now support. Here’s where you bring in your whimsical nature: instead of waiting too long, spot a smaller timeframe pattern, like a bullish engulfing candle or a rejection wick, and go long.

Confirmation-Entry Plan:

Enter long at the retest of 2,595 after a clear rejection pattern. Think of it as waiting for the next loop on the rollercoaster — the bigger move is coming, and you want to be on board for it.

Set a slightly wider stop-loss, maybe under 2,580, to allow the trade to develop without getting knocked out early.

Aim for the next higher liquidity zones, like 2,600 or 2,615.

Why it suits you: This method still lets you catch the excitement of a momentum breakout, but the confirmation gives you more confidence. You still get the rush but with less risk of getting thrown out before the big move.

3. Patterns Within Patterns – Your Playground:

As a Whimsical Rollercoaster Enthusiast, you probably love when the market shows intricate patterns — they're like hidden rollercoaster tracks, revealing sudden twists and turns.

Scenario: If price breaks above 2,595, zoom into lower time frames and look for miniature patterns within the broader trend. You might find a bull flag within a larger ascending channel. Entering on these small corrective patterns can satisfy your need for fast-paced decision-making while riding the overall trend.

Plan:

Use these smaller patterns for quick entries. Set your stops just outside the pattern, and take profits quickly as the price breaks out.

Think of it as riding the small waves, but always looking for the bigger momentum move to follow.

Why it suits you: You’re jumping in on short-term opportunities while always keeping an eye on the next big move. This keeps you engaged and allows you to take action when you feel that burst of adrenaline without losing sight of the bigger picture.

4. Managing Whimsical Risk:

Stop-loss flexibility: As someone who enjoys spontaneity, a tight stop might feel restrictive but necessary. Here’s the compromise:

Set initial stops tight (like just above 2,595 if shorting), but allow yourself room to evolve the trade based on market action. If the trade moves in your favor, quickly move the stop to breakeven.

Mental Resilience: Losses will happen, but you need that mental discipline to jump back in without chasing every tick. Treat each trade like a separate rollercoaster ride — whether it’s a good or bad one, there’s always another one coming.

Use your intuition and excitement to recognize evolving setups. But keep a few rules in place to avoid the pitfalls of impulsivity (e.g., no more than 3 trades per day on a single idea to avoid over-trading).

5. Incorporating the Rule of Three:

For the rollercoaster trader, the Rule of Three is your ultimate guide. This rule asks you to identify at least three confirming factors before entering a trade:

Scenario: Price reaches 2,595:

You see a rejection (touch #1).

The lower time frame shows consolidation or a mini bear flag (touch #2).

Momentum begins to fade (touch #3).

Action: This triple confirmation allows you to short confidently, knowing you have the right mix of signals to back your bold entry.

Why it suits you: The Rule of Three still gives you the excitement of quickly entering trades but ensures they are high-probability setups. It prevents you from overtrading out of sheer excitement while still letting you capture those thrilling moves.

Summary Action Plan for a Whimsical Rollercoaster Trader:

Risk Entry: When you feel the market is ready to react at key levels (like 2,595), dive in! But do it smartly — use tight stop-losses and a quick decision-making process. Think of it as jumping onto the coaster right before it starts moving.

Confirmation Entry: Use this when you're looking for a bigger, smoother ride. Wait for the breakout-retest combo, then get in for the larger trend move. Stay patient here; it’s worth the wait.

Patterns within Patterns: Zoom into the mini rollercoasters inside the bigger structure. Catch the small waves but keep your eyes on the longer ride.

Trinity Rule : Ensure three factors align before entering. This rule keeps you disciplined while still embracing your whimsical nature.

Why Most Traders Fail—and How You Can Succeed!The charts you provided showcase potential scenarios based on different liquidity zones (LQZ) on multiple timeframes, such as 15M, 1H, and 4H. Let's break down the key insights from the images:

Key Levels:

Weekly Flag Trendline: This yellow trendline represents the long-term trend and acts as a major resistance or support. It’s crucial to monitor price action around this level for significant moves.

4HR LQZ (Liquidity Zone) at 2,532.077: This level signifies an important area of liquidity on the 4-hour chart. It’s a potential reversal point or continuation area depending on how the price interacts with it.

1HR LQZ and 15M LQZ: These shorter timeframe liquidity zones are at 2,482.129 and 2,470.544 respectively. They act as interim targets or bounce zones based on the smaller trend movements.

Price Action Context:

Wedge Formation: The rising wedge pattern visible in all the charts, combined with slowing momentum near the top, suggests possible bearish pressure. Wedges often lead to sharp breakouts, so a breakout to the downside would align with the wedge structure.

Multi-Touch Confirmation: The multiple touches on trendlines, both support and resistance, increase the probability of significant movements. This concept is supported by multi-touch confirmation techniques.

Scenario Planning:

Upside Potential: A breakout above the 4HR LQZ suggests further bullish momentum, likely toward higher liquidity zones. This can result in a continuation to the upside, as shown with the green line projection on some charts.

Downside Risks: A breakdown below the wedge support and failing to hold the 15M or 1HR LQZ may lead to a bearish move toward the lower liquidity targets. The yellow line projections suggest a pullback to 2,485.055 and potentially lower.

The Trinity Rule Approach:

Confluence Setup: If price interacts with three major zones (like the 4HR LQZ, wedge support, and Weekly Flag Trendline), we can assess whether these align with other signals. This rule adds extra confirmation for higher-probability setups, as discussed in your document.

Overall, price action shows a decision point around the wedge and liquidity zones, with strong reactions expected in either direction.

Unlock Winning Strategies: Spot High-Probability Trades!Chart Analysis: XAU/USD (Gold Spot vs. USD)

Based on the two charts you have provided, here is a detailed technical analysis of XAU/USD using price action and chart pattern observations:

1. Weekly Flag Trendline (Higher Time Frame Context)

The upper and lower yellow trendlines represent a possible flag pattern on the weekly chart. This suggests a consolidation phase after a strong impulsive move. A flag pattern typically signals a continuation of the previous trend, which, if the context is bullish, indicates that after consolidation, there may be a continuation to the upside.

On both charts, we can observe that price action is contained within this broader structure, indicating that price is in a correction phase rather than an impulsive phase.

2. Key Horizontal Levels

2,532.144 and 2,506.245: These levels act as strong resistance zones. The price has struggled to break above these levels multiple times, indicating significant selling pressure or profit-taking at these points.

2,471.313: This is a key support level. The price has reacted to this level before and, most recently, has bounced back after testing this support zone. This suggests that buyers are willing to step in at this level, providing a floor for the price.

3. Descending Channel and Price Action Patterns

Descending Triangle/Channel Pattern: On the 15-minute chart, the price seems to be forming a descending triangle pattern (lower highs and a flat support at 2,471.313). This pattern is typically bearish, suggesting a potential breakdown if the support does not hold.

Potential Reversal Patterns: After testing the lower trendline of the weekly flag pattern and finding support at the 2,471.313 level, there was a notable bullish reaction. This can imply a short-term reversal, especially if confirmed by a break above the minor resistance level of 2,494.370.

4. Consolidation Zone and Lower Time Frame Patterns

The 15-minute chart shows a clear consolidation pattern after the sharp decline, with price action currently moving sideways between 2,494 and 2,506. A break above this consolidation range could signal a short-term bullish continuation towards the upper resistance levels, while a break below would imply a continuation of the bearish trend observed previously.

5. Breakout and Pullback Zones

The yellow dotted lines on the 15-minute chart indicate key areas where the price broke out from consolidation phases. These areas are crucial for identifying potential entry points in a trending market. If the price retests these zones and finds resistance or support, they could act as triggers for either continuation or reversal trades.

Trading Strategy Considerations

Bullish Bias: Traders with a bullish bias might consider waiting for a breakout above the 2,506.245 resistance, looking for a confirmation with a pullback to this level as support. The target could be the upper boundary of the flag around 2,532.144 or higher, depending on momentum and broader market conditions.

Bearish Bias: A trader with a bearish outlook might wait for the price to break below the 2,471.313 support level, looking for short positions targeting lower levels aligned with the descending channel's trajectory.

Range Trading: Given the current consolidation between 2,494.370 and 2,506.245, range traders could look for entries at the edges of this range with tight stops and defined profit targets within the range.

Conclusion

Given the price action analysis and current chart patterns, the XAU/USD market appears to be in a consolidation phase within a broader flag pattern. This suggests that while the immediate outlook may be neutral to bearish, there is potential for a bullish breakout if key resistance levels are breached. Traders should watch for confirmed breakouts or breakdowns from these levels to guide their trading decisions, keeping in mind the broader market trend and any fundamental drivers influencing gold prices.

This Simple Strategy Could Make You a Fortune in the Gold Marketprice action of Gold Spot (XAU/USD) in relation to the trendlines and patterns indicated.

Chart Analysis

1. Weekly Flag Trendline:

- The first chart shows a trendline forming a "flag" pattern on a higher time frame (possibly weekly or daily). This flag appears to be a bullish continuation pattern, indicating that after the consolidation within the flag, the price might continue in the direction of the prior trend, which seems to be up.

2. Price Action Inside the Flag:

- Within the flag, there is a period of consolidation marked by the parallel trendlines. The price has been respecting these lines, creating higher lows and lower highs, indicating indecision or preparation for a breakout.

3. Potential Breakout Zones:

- Key breakout zones are marked by the upper resistance of the flag pattern around the 2,530 level and the lower support trendline of the flag around the 2,470 level. A breakout above the upper resistance could signal a continuation of the prior uptrend, while a break below the lower support could indicate a reversal or deeper pullback.

4. Smaller Patterns:

- On the second chart (1-hour time frame), there's a more detailed view of recent price action with a potential bearish flag or pennant forming, suggesting a temporary pullback or consolidation within the larger flag. This smaller pattern appears to be within a trading range bounded by the horizontal support and resistance levels.

5. Key Support and Resistance Levels:

- The charts show horizontal support around the 2,433.301 level, which aligns with a historical low that could serve as a significant support level. Similarly, the resistance level is around 2,530, where the price has repeatedly failed to break above.

6. Current Market Context:

- The price is currently hovering around 2,497, near the middle of the trading range, suggesting indecision. This midpoint could be a neutral zone where the price could move in either direction based on upcoming market momentum or news.

Trading Strategy and Considerations

- Entry Points:

- If considering a bullish scenario, a long entry could be planned near the lower support line of the flag, around 2,470, with a stop loss slightly below the flag's support to manage risk. A breakout above the 2,530 resistance could also provide a good entry point for a continuation of the uptrend.

- For a bearish scenario, a short entry could be considered if the price breaks below the 2,470 support level, confirming a breakdown from the flag pattern.

- Risk Management:

- The proximity of the price to both upper and lower boundaries of the flag pattern provides clear levels for stop placement. This helps in managing risk effectively, keeping losses contained if the trade goes against the initial bias.

- Monitoring Price Action:

- Watch for potential breakouts from the smaller patterns within the flag, as these could provide early signals of the larger move's direction. It would also be essential to keep an eye on volume changes, as increased volume could confirm the validity of a breakout or breakdown.

By aligning your trades with these patterns and key levels, you can take advantage of the potential setups provided by the price action within these consolidating formations. Ensure to adapt to new market conditions and stay disciplined in executing your trading plan.

How I Nailed a Perfect Breakout Trade Using a Simple Strategy*The following Analysis is made by my Trading BOT*

Analysis of Your Trade:

Descending Channel:

Formation and Breakout: The descending channel is well-defined, indicating a corrective phase following an impulsive move. The breakout above the channel suggests a potential reversal or continuation of the prior trend, which appears bullish.

Entry Timing: You entered the trade after the breakout from the descending channel. This entry aligns with a strategy to buy at the break of a corrective pattern, capitalizing on the resumption of bullish momentum.

Resistance Zone (Blue Area):

Initial Resistance Encounter: The blue horizontal line represents a resistance zone where price consolidated and failed to break higher on the first attempt. This is a good spot to watch for confirmation of a breakout or reversal.

False Breakouts: There are some upper wicks visible in this resistance zone, indicating possible false breakouts or liquidity grabs. This suggests that many traders might have been stopped out before the true breakout occurred.

Price Action Post-Breakout:

Sharp Move Down: After the breakout, price made a sharp move down to retest the previous resistance (now turned support), which aligns with the principles of market structure where old resistance becomes new support.

Correction and Continuation: The downward move appears corrective in nature, forming a series of lower highs and lower lows within a descending channel, after which the price breaks out and moves upwards sharply.

Risk and Reward Considerations:

Stop Placement: If your stop loss was placed below the previous swing low or the bottom of the descending channel, this would be a strategic placement to avoid being stopped out by market noise.

Take Profit: Your target seems to be well-placed, considering the previous highs or a key Fibonacci level. The green area likely represents the take-profit zone.

Volume Analysis:

Confirmation with Volume: The volume spike during the breakout from the descending channel and the subsequent move up indicates strong buying interest, which is a good confirmation signal.

Key Takeaways for Future Trades:

Pattern Recognition: Identifying descending channels and their breakouts is a strong skill that can be leveraged in various time frames.

Risk Management: Your trade shows a good understanding of risk management, especially if stops were placed beyond significant levels to avoid market noise.

Confirmation Signals: Waiting for volume confirmation during breakouts is an excellent strategy to avoid false moves.

Suggestions:

Multiple Time Frame Analysis: Ensure that your lower-time-frame trades are aligned with the higher-time-frame trends or setups to increase the probability of success.

Post-Trade Analysis: Continue reviewing your trades like this to refine your entry and exit strategies, especially around key zones like support and resistance.

Chart Patterns Within Patterns: A Guide to Nested Setups Daily Chart Analysis:

Pattern Overview:

The daily chart shows an Ascending Channel formation, which generally indicates a bullish trend but can also signal a potential reversal if the upper trendline acts as strong resistance.

Within the ascending channel, there are continuation patterns such as smaller bull flags, which suggest bullish momentum continuation.

Key Resistance and Liquidity Zone (LQZ):

The upper trendline of the ascending channel aligns closely with the recent highs around the $2,530 - $2,540 region, creating a significant resistance area.

The 1-Hour Liquidity Zone (LQZ) at $2,486.793 is marked below the current price, indicating potential areas where price might retest before any significant upward or downward move.

Potential Reversal Signal:

The upper boundary of the ascending channel has recently been tested multiple times, and each time, there has been a slight pullback, indicating selling pressure. This could be a precursor to a possible reversal if this level is not broken with conviction.

4-Hour Chart Analysis:

Nesting Patterns:

The 4-hour chart also reveals several nested patterns within the broader ascending channel, including smaller bull flags and a potential double-top pattern forming at the resistance zone.

The price action is consolidating below the resistance line at $2,530.750, creating a possible Double Top scenario, which could indicate a bearish reversal if confirmed by a breakdown below the neckline support.

Impulse and Correction Phases:

The recent impulsive moves upwards have been followed by corrective pullbacks, which have been forming higher lows, reinforcing the bullish bias in the medium term.

However, the proximity to the resistance and the potential double-top formation might signal caution for long positions.

1-Hour and 15-Minute Chart Analysis:

Short-Term Structure:

The 1-hour chart shows a more detailed view of the recent consolidation phase near the key resistance level. There are signs of weakening momentum as prices approach the upper trendline.

The 15-minute chart further shows a tightening range and potential bear flag or a descending channel, which could indicate a short-term bearish continuation if the lower trendline of this smaller pattern breaks.

Critical Levels:

The support level around $2,486.793 (1HR LQZ) is critical for intraday trading. A break below this could lead to a sharper correction towards the lower boundary of the ascending channel on the daily chart.

For bullish continuation, a clear break above the $2,530 - $2,540 resistance with strong volume would be needed to confirm further upside potential.

Trading Strategy and Recommendations:

Bullish Scenario:

Look for a strong breakout above the $2,530 - $2,540 resistance on the daily chart, accompanied by increased volume and a break above the smaller continuation patterns (flags) on the lower timeframes.

Enter on a reduced risk entry after a pullback to the breakout level, with stops placed below the recent consolidation range or the 1-Hour LQZ.

Bearish Scenario:

Watch for a confirmed Double Top breakdown on the 4-hour chart, with a clear break below the neckline support around $2,486.793.

Consider short positions on the break of the neckline or after a retest of the breakdown level, with stops placed above the recent highs or the upper boundary of the descending channel on the 15-minute chart.

Risk Management:

Given the proximity to a key resistance level and the potential for a reversal, it is crucial to manage risk carefully. Use tight stops and consider reducing position size until a clear directional move is confirmed.