ADA Update: Weak Momentum Tests Support - Bulls AbsentCARDANO (ADA/USD) | Multi-Timeframe Analysis | Consolidation at Critical Support

Current Price: $0.392 (+0.21%) | Date: January 12, 2026

📊 WEEKLY UPDATE: TESTING MAJOR SUPPORT ZONE

⚠️ ADA trading at $0.392, hovering just above critical $0.36-$0.38 support cluster

📉 Underperforming broader crypto market (-0.8%)

🎯 Consolidating between $0.36-$0.46 range for several weeks - compressed price action

✅ Weekly $0.30-$0.33 support (2023-2024 base) remains unbroken - strong foundation intact

📈 MULTI-TIMEFRAME CONTEXT

📅 Weekly Chart: Long-term downtrend from 2024-2025 highs, but holding key $0.30+ support

📅 Daily Chart: Range-bound consolidation $0.36-$0.46, testing lower end currently

✅ Major weekly support at $0.30-$0.33 remains intact - critical psychological level

⚠️ Current position near daily support - decision point approaching

🎯 KEY TECHNICAL LEVELS - WEEKLY PERSPECTIVE

Major Weekly Resistance:

$1.00-$1.20 - 2024-2025 highs, long-term target zone

$0.65-$0.75 - Intermediate resistance, mid-range target

$0.50-$0.52 - First major weekly resistance to reclaim

Major Weekly Support:

$0.36-$0.38 - Current daily support zone, immediate defense line

$0.30-$0.33 - CRITICAL WEEKLY SUPPORT - Multi-year base, highest priority level

$0.25-$0.27 - Secondary weekly support, extreme bear scenario

🎯 KEY TECHNICAL LEVELS - DAILY PERSPECTIVE

Daily Resistance Zones:

$0.407-$0.420 - Immediate resistance

$0.45-$0.50 - Major daily resistance cluster, range top

$0.52-$0.55 - Breakout target if range resolves upward

Daily Support Zones:

$0.380-$0.400 - Current support range, being tested NOW

$0.360-$0.370 - Critical daily support, must hold for bullish case

$0.330-$0.350 - Weekly support approach zone

🌐 MARKET CONTEXT & CATALYSTS

📊 Price stabilizing around $0.39-$0.40 ahead of US CPI data (Jan 13) - cautious positioning

🐋 Whales accumulated 120M ADA (~$50M) in January 2026 near $0.42 support level

💼 Cardano approved ₳70M for institutional stablecoin integrations + ₳96.8M for scalability (Hydra, Leios)

🏦 Clarity Act progress: Could classify ADA as commodity - Grayscale ETF decision by October 2025

📈 Analysts target $0.42-$0.45 range for mid-January 2026 if support holds

⚠️ Bearish sentiment persists: Fear & Greed Index at 27 (Fear), only 30% green days in last 30 days

🔮 Long-term forecasts: $0.45-$0.54 by February 2026 if bullish momentum returns

📊 Network metrics positive: DeFi activity up, smart contract growth, steady ecosystem expansion

🎯 Key macro event: CPI data January 13 could provide volatility catalyst

💡 TECHNICAL OUTLOOK

🎯 Short-term bias: Cautiously Bearish - Testing support with weak momentum

⚠️ Critical level: $0.36-$0.38 support - breakdown here opens path to $0.33 weekly support

✅ Foundation intact: Weekly $0.30-$0.33 base unbroken, provides long-term floor

🚧 Resistance cluster: $0.42-$0.45 zone proving difficult to reclaim

📊 Range scenario (55%): Chop between $0.36-$0.46 for 2-3 more weeks, low conviction

🔴 Bearish scenario (30%): Break $0.36 with volume → Test $0.33 weekly support (-15% downside)

🟢 Bullish scenario (15%): Reclaim $0.42 with volume → Push to $0.45-$0.50 zone

⏰ Catalysts needed: CPI data (Jan 13), ETF decision clarity, or tech upgrade milestone

🎯 Risk/Reward: Approaching interesting level - $0.36 support offers defined risk vs $0.45+ upside

💎 Key watch: Volume spike + daily close outside $0.36-$0.46 range = direction confirmed

🔮 Position: Defensive - holding support but no bullish momentum yet, need catalyst

------------------------------------------------------------------------------------------------------------------

⚠️ DISCLAIMER

This is technical analysis for educational purposes only. Not financial advice. Always do your own research and manage risk appropriately.

Adausdanalysis

ADA Bounces 10% From Critical Support - 3 Scenarios AheadCARDANO (ADA/USD) | Daily Chart | Technical Update - Bounce From Critical Support

Current Price: $0.393 | Date: January 3, 2026

🔄 UPDATE: STRONG REVERSAL FROM WEEKLY SUPPORT

💥 ADA surged over 10% from $0.33 lows - critical weekly support held strong

📈 Price now trading at $0.393, showing first signs of buyer strength after prolonged decline

⚡ 37,851% surge in futures volume signals major trader repositioning

🐋 Whale buying activity detected - large orders accumulating at support

📊 PRICE ACTION OVERVIEW

✅ Successfully defended $0.30-$0.33 multi-year support zone (tested multiple times 2023-2024)

🔄 Strong bounce with volume confirms buyer interest at these levels

📍 Currently testing $0.385 - first support/resistance on the recovery path

⚖️ Market at critical decision point - three distinct scenarios emerging

🎯 KEY TECHNICAL LEVELS

Resistance Zones:

$0.385-$0.407 - Immediate resistance cluster;

$0.435-$0.48 - Green scenario target zone; breaking here signals full trend reversal

Support Zones:

$0.33 - CRITICAL WEEKLY SUPPORT - Just defended successfully, highest priority watch level

$0.30 - Secondary weekly support - breach here invalidates bullish scenario

$0.26-$0.21 - Extreme downside target (Red scenario) - October 2023 lows

📈 THREE SCENARIO ANALYSIS

🟢 SCENARIO 1: BULLISH REVERSAL (Green Arrow)

Probability: 35-40% based on current momentum

Path: Break above $0.385 → Test $0.407 → Rally to $0.435-$0.45

Catalyst: Sustained whale accumulation, positive funding rate, volume continuation

Confirmation: Daily close above $0.385 with strong volume

🟡 SCENARIO 2: CONSOLIDATION (Yellow Arrow)

Probability: 40-45% - Most likely near-term outcome

Path: Sideways range between $0.32-$0.38 for several weeks

Pattern: Accumulation phase as market digests recent drop

Confirmation: Repeated tests of $0.33 support without breakdown

🔴 SCENARIO 3: BEARISH CONTINUATION (Red Arrow)

Probability: 20-25% if support fails

Path: Break below $0.33 → Rapid decline to $0.30 → Ultimate target $0.26-$0.21

Risk: Loss of weekly support triggers cascading sell orders

Confirmation: Daily close below $0.33 with volume

🌐 MARKET CONTEXT

🔥 Cardano futures volume exploded 37,851% on Bitmex exchange - from near zero to $255.52M

🐋 Whale activity shows accumulation pattern - large orders defending $0.33 support

📊 Funding rate flipped positive to 0.0068% - historically precedes ADA rallies

💼 Critical Integrations Budget approved late 2025 - enables third-party app integration with Cardano

🌍 Midnight protocol launch and Leios upgrades approaching - major technical catalysts

😨 Market sentiment: Fear & Greed Index at 28 (Fear) but improving from Extreme Fear

📈 Analysts targeting $0.48-$0.50 if weekly support holds and momentum continues

💡 TECHNICAL OUTLOOK

🎯 Short-term bias: Cautiously Bullish - successful support defense shifts momentum

✅ Critical win: Holding $0.33 weekly support validates bull case and attracts buyers

🚧 First challenge: Must reclaim $0.385-$0.407 zone to confirm reversal

⚖️ Base case (45% probability): Consolidation between $0.32-$0.38 while market decides direction

🟢 Bull scenario (35% probability): Break above $0.407 opens path to $0.435-$0.45, volume is key

🔴 Bear scenario (20% probability): Breakdown below $0.33 triggers capitulation to $0.26-$0.21

📊 Volume analysis: Current bounce needs sustained buying volume above 800M-1B daily to confirm

⏰ Watch period: Next 7-10 days critical - either confirms reversal or resumes downtrend

------------------------------------------------------------------------------------------------------------------

⚠️ DISCLAIMER

This is technical analysis for educational purposes only. Not financial advice. Always do your own research and manage risk appropriately.

ADA - Bearish Expanding TrianglePrice is trading within a broadening (expanding) triangle , with higher highs and lower lows indicating increasing volatility and distribution. The structure favors a bearish resolution , and I’m expecting a breakdown below the lower trendline to confirm continuation to the downside.

Expectations:

Breakdown from the expanding triangle → acceleration lower.

Downside Targets:

🎯 $0.25

🎯 $0.15

As long as price stays below the upper boundary, the bearish scenario remains dominant.

DeGRAM | ADAUSD is testing the $0.4 level📊 Technical Analysis

● ADA/USD is testing the main long-term support zone after an extended decline, with repeated touches of the primary support line indicating exhaustion of bearish momentum.

● The pair is forming a falling-wedge–style compression toward resistance near 0.52–0.55, suggesting the potential for a bullish rebound if the 0.40–0.42 base continues to hold.

💡 Fundamental Analysis

● Market sentiment is stabilizing as altcoins see renewed accumulation and Cardano activity improves ahead of upcoming ecosystem upgrades.

✨ Summary

● Bullish bias above 0.42. Targets: 0.50 → 0.55. Support: 0.40.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

DeGRAM | ADAUSD seeks to the $0.5 level📊 Technical Analysis

● ADA/USD remains locked within a descending channel, with the price recently rebounding from support near $0.50 but facing strong resistance around $0.60. The structure shows repeated bearish continuations through flag and triangle formations, reflecting sustained selling momentum.

● A rejection from the resistance line could confirm another leg down toward $0.50, the key demand level defining medium-term support.

💡 Fundamental Analysis

● Cardano sentiment remains muted amid declining DeFi inflows and network activity, while broader crypto risk aversion caps upside momentum.

✨ Summary

● Resistance: $0.60. Support: $0.50. Bias remains bearish with potential continuation toward $0.50 after another failed breakout attempt.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

ADAUSDTNothing special, after October 10, we found a "bottom" in this cycle, where it will probably move in a chaotic direction, shedding shorts and longs on its way. The yellow dotted line indicates the area where a "turn" is possible (it is possible to make some decisions, political or drastic regulatory changes or in that spirit)

Red showed resistance zones in case of a possible reversal. And a break of the negative trend on TF 1D.There is also weak support, which may act as a "hope" zone with a possible slight increase and a rapid decline in price to the lows that we have already tested on October 10, and clearly rested in the support zone.

But I wouldn't be surprised if we're in the near future, it will bounce back significantly below October 10th.

DeGRAM | ADAUSD is forming a triangle📊 Technical Analysis

● ADA/USD is consolidating within a falling wedge pattern, with strong support near 0.6240 and a resistance barrier at 0.7000.

● The structure indicates potential bullish reversal as price tests the lower boundary while forming higher lows, hinting at breakout momentum.

💡 Fundamental Analysis

● Cardano’s network activity and DeFi adoption continue to expand, supporting gradual recovery prospects despite broader crypto market caution.

✨ Summary

● Long bias above 0.6240; target zone 0.7000. Technical and on-chain dynamics align for medium-term upside continuation.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

DeGRAM | ADAUSD seeks to the $1.1 level📊 Technical Analysis

● ADA/USD is consolidating near 0.92 after reclaiming the support line, with price compressing under a key resistance zone.

● A breakout above 0.95 could accelerate momentum toward 1.10, confirming bullish continuation within the rising channel.

💡 Fundamental Analysis

● Cardano’s network growth, highlighted by increased dApp activity and higher staking participation, underpins demand and supports the breakout thesis.

✨ Summary

Bullish above 0.85; targets 0.95 → 1.10. Invalidation on a close below 0.85.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

ADA/USDT | Low-Risk Swing Setup with 215%+ Upside Potential🚀 Trade Setup Details:

🕯 #ADA/USDT 🔼 Buy | Long 🔼

⌛️ TimeFrame: 1D

--------------------

🛡 Risk Management (Example):

🛡 Based on $10,000 Balance

🛡 Loss-Limit: 1% (Conservative)

🛡 The Signal Margin: $463.61

--------------------

☄️ En1: 0.721 (Amount: $46.36)

☄️ En2: 0.6644 (Amount: $162.26)

☄️ En3: 0.6269 (Amount: $208.62)

☄️ En4: 0.5915 (Amount: $46.36)

--------------------

☄️ If All Entries Are Activated, Then:

☄️ Average.En: 0.6458 ($463.61)

--------------------

☑️ TP1: 0.8789 (+36.09%) (RR:1.67)

☑️ TP2: 1.0193 (+57.84%) (RR:2.68)

☑️ TP3: 1.2306 (+90.55%) (RR:4.2)

☑️ TP4: 1.5637 (+142.13%) (RR:6.59)

☑️ TP5: 2.0372 (+215.45%) (RR:9.99)

☑️ TP6: Open 🔝

--------------------

❌ SL: 0.5065 (-21.57%) (-$100)

--------------------

💯 Maximum.Lev: 3X

⌛️ Trading Type: Swing Trading

‼️ Signal Risk: 🙂 Low-Risk! 🙂

--------------------

🔗 www.tradingview.com

❤️ Your Like & Comments are valuable to us ❤️

Cardano Price To Bounce As IOHK Audit Report Nears ReleaseBINANCE:ADAUSDT price is currently $0.85 , holding steady above the $0.83 support level. The Ichimoku Cloud shows a bullish outlook, suggesting positive momentum for ADA. Investors are keeping a close eye on price movements, with potential for further gains if market conditions remain favorable for the altcoin.

A key catalyst for potential price growth is the upcoming audit report of Input Output Global’s ADA holdings. Charles Hoskinson, BINANCE:ADAUSDT founder, requested the audit to address transparency concerns after allegations of $600 million in misappropriated ADA . The report could play a crucial role in boosting investor confidence and market sentiment.

If the audit report meets investor expectations, BINANCE:ADAUSDT could see a price increase, potentially pushing it to $0.90. Successfully securing this level as support may pave the way for further gains, reaching $1.00. Such a move would solidify Cardano's position and help avoid a drop below the $0.83 support level.

DeGRAM | ADAUSD is testing the resistance line📊 Technical Analysis

● ADAUSD recently bounced off a rising support line near $0.85, staying within a broader ascending channel. The initial rebound sets sights on the key resistance at $1.02 (formerly a breakout zone).

● A breakout above this $1.02 level would confirm upward momentum and could propel ADA toward $1.10–$1.15, in line with the channel’s upper boundary and prior swing highs.

💡 Fundamental Analysis

● Regulatory clarity under the Clarity Act reclassified ADA as a commodity, boosting institutional confidence. Grayscale's ADA ETF approval odds now sit at 80–83%, backed by $1.2 billion in ADA custodied by major firms.

● ADA futures volume has surged to a five‑month high of $7 billion, and DeFi TVL on Cardano has risen 56% to over $420 million—underscoring growing on‑chain demand.

✨ Summary

Bullish above $0.85; breakout above $1.02 targets $1.10 → $1.15. Invalidation triggers if price closes below $0.85.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support

ADA/USDT – Liquidity Sweep & Reversal Setup ADA/USDT – Liquidity Sweep & Reversal Setup (15m TF)

Price recently swept liquidity below the prior low, triggering a manipulation trap. After the liquidity grab, bullish momentum started forming, confirming rejection from the demand zone.

Entry: Taken after the liquidity sweep confirmation.

Stop-loss: Placed below the manipulation low to protect against deeper downside.

Target: 0.9430 resistance zone (major supply level).

This setup is based on liquidity sweep, manipulation trap, and demand zone reaction, expecting a move back to the upside.

Risk management is key – waiting for structure confirmation before continuation.

DeGRAM | ADAUSD broke the resistance line📊 Technical Analysis

● ADAUSD has confirmed a breakout above the mid-channel range, holding above 0.78 and signaling an acceleration toward the 0.86–0.88 resistance zone.

● Momentum is reinforced by a successful retest of broken flag resistance, aligning with the broader bullish channel structure.

💡 Fundamental Analysis

● Recent data shows ADA network activity rising, with daily active addresses and DEX volumes reaching multi-month highs, supporting sustained upside interest.

✨ Summary

Bullish above 0.78; targets 0.86–0.88. Invalidation below 0.75.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support

DeGRAM | ADAUSD held the $0.7 level📊 Technical Analysis

● ADAUSD is respecting the newly established rising support line after bouncing from the 0.695 level, confirming higher lows within a bullish channel.

● The price is now breaking out of a falling flag structure and is on course to retest the confluence resistance near 0.88 and the descending purple trendline.

💡 Fundamental Analysis

● Cardano’s DeFi metrics remain strong, with TVL surpassing $400M—its highest since early 2022—boosted by staking and stablecoin growth.

● Optimism surrounding the Chang hard-fork and renewed institutional interest is helping reinforce mid-term buying pressure.

✨ Summary

Buy above 0.695. Target 0.86 → 0.88. Setup remains valid while price holds above 0.68 trend support.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support

Cardano is forming the falling wedge ┆ HolderStatBINANCE:ADAUSDT is testing the $0.70 level after a clean breakout from previous consolidation. The current retracement channel indicates a controlled pullback, likely to flip into bullish continuation if $0.70 holds. Watch for a move toward $0.8576 once the pattern breaks upward.

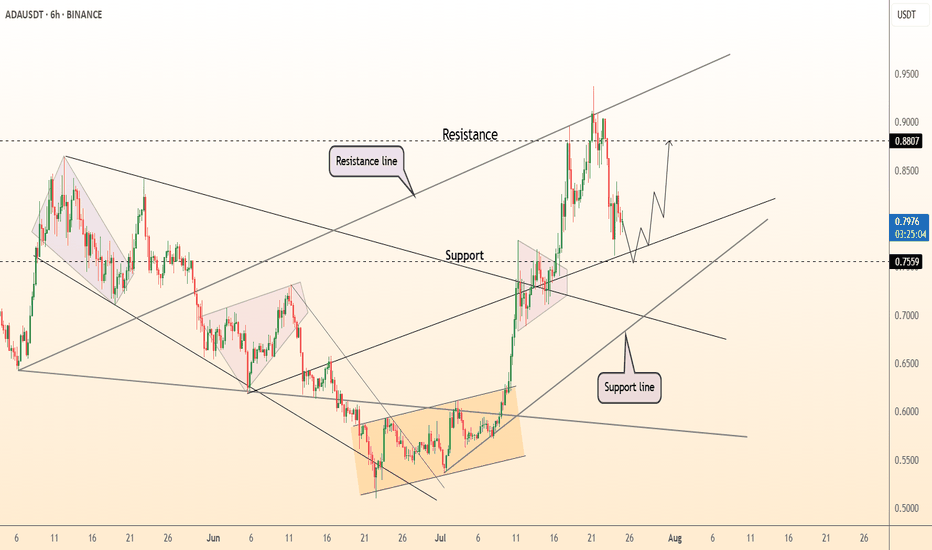

DeGRAM | ADAUSD holding above the support level📊 Technical Analysis

● Mid-July breakout from the 10-week falling wedge cleared the long-term resistance line; price retested that line & the 0.756 support band (prior range high) and printed a higher-low on the rising channel’s lower rail.

● The new up-sloper guides bulls toward the channel crest / horizontal target at 0.880, while the 0.775–0.780 zone now acts as a launch pad for the next leg.

💡 Fundamental Analysis

● Buzz around August’s Chang governance hard-fork and a 12 % m/m jump in Cardano TVL signal improving network demand, backing the technical upside.

✨ Summary

Buy 0.775-0.790; hold above 0.756 eyes 0.86 ▶ 0.88. Bull view void on a 16 h close below 0.72.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support

DeGRAM | ADAUSD above the demand zone📊 Technical Analysis

● ADA is testing the confluence of the long-term support line and the 0.54-0.63 demand zone; every prior touch of this area sparked a 20-30 % rebound.

● A falling wedge within the broader descending channel is close to completion; a 16 h close above the wedge roof (~0.66) activates a measured move to the first horizontal resistance at 0.73 and the channel cap near 0.86.

💡 Fundamental Analysis

● The upcoming Chang hard-fork, which introduces on-chain governance and boosts staking utility, is scheduled for main-net in Q3 2025, lifting on-chain activity and TVL.

✨ Summary

Long 0.58-0.63; wedge breakout >0.66 targets 0.73 ➜ 0.86. Bull bias void on a 16 h close below 0.54.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support

ADA/USD Thief Trading Plan – Bullish Snatch & Run!🚨 ADA/USD HEIST ALERT! 🚨 – Bullish Loot Grab Before the Escape! (Thief Trading Strategy)

🌟 Greetings, Market Pirates & Profit Raiders! 🌟

🔥 THIEF TRADING STRIKES AGAIN! 🔥

💎 The Setup:

Based on our stealthy technical & fundamental heist tactics, ADA/USD is primed for a bullish loot grab! The plan? Long entry with an escape near key resistance. High-risk? Yes. Overbought? Maybe. But the heist must go on!

🎯 Key Levels:

📈 Entry (Vault Cracked!) → Swipe bullish positions on pullbacks (15m-30m precision).

🛑 Stop Loss (Escape Route) → Recent swing low (4H basis) at 0.5290 (adjust per risk!).

🏴☠️ Target (Profit Snatch!) → 0.6500 (or bail early if bears ambush!).

⚡ Scalpers’ Quick Heist:

Only scalp LONG!

Big wallets? Charge in! Small stacks? Ride the swing!

🔐 Lock profits with Trailing SL!

📢 Breaking News (Heist Intel!):

Fundamentals, COT, On-Chain, Sentiment— All hint at bullish momentum!.

🚨 ALERT! News volatility ahead—Avoid new trades during releases! Secure running positions with Trailing SL!

💥 BOOST THIS HEIST! 💥

👉 Hit LIKE & FOLLOW to fuel our next market robbery! 🚀💰

🎯 Profit taken? Treat yourself—you earned it!

🔜 Next heist incoming… Stay tuned, pirates! 🏴☠️💎

ADAUSDT Intraday SetupAda Showing some good movement. Trade Rules

must gave 30m candle closing above marked area, if wick above marked area then trade will become risky. Must use the sl. Target is given.

If retraces back before the marked area then it also good, in this case 30m marked area will first tp book 30% here, rest hold till final tp or SL.

HolderStat┆ADAUSD retesting the support levelBINANCE:ADAUSDT is attempting to reverse from the lower bound of a descending wedge, echoing a previous breakout structure from May. With a bounce forming near 0.54 and price climbing inside a narrowing wedge, a move toward 0.70 could materialize if volume supports the push.

Cardano Rangebound – Is a Breakout or Breakdown Imminent?📉 ADA is Rangebound! I’m watching closely—if price breaks out of this consolidation, it could set up a strong trading opportunity.

🎯 In this video, we analyze the market structure and price action, breaking down a possible trade setup—if the right conditions align.

🚨 Stay sharp, manage risk—this is not financial advice! 🚀🔥