Adausdtradeidea

ADAUSDT Near Major Breakout Level — Trend Reversal or Bull Trap?On the 12-hour timeframe, ADAUSDT remains within a clear medium-term downtrend structure. Over the past few months, price has consistently formed lower highs and lower lows, capped by a dominant descending trendline.

However, recent price action shows an early bullish reaction from the lower support area, suggesting a potential transition phase or a short-term relief rally.

---

Pattern & Technical Structure

Primary Pattern:

Descending Trendline / Bearish Channel Breakdown Test

Price has been trading below the descending trendline (dynamic resistance) for an extended period.

The latest candles indicate a retest of the trendline, which now acts as a critical decision zone.

The marked horizontal levels (yellow dashed lines) represent key historical support and resistance zones.

Pattern Summary:

As long as price remains below the trendline, the broader structure stays bearish. A valid break and close above the trendline would be the first signal of a potential trend reversal or short-term bullish continuation.

---

Key Levels

Major Resistance:

0.413

0.468

0.520

High Resistance / Reversal Zone:

0.616 – 0.682

Key Support:

0.370

0.345

0.321 (structural low)

---

Bullish Scenario

Price successfully breaks and closes above the descending trendline (12H close).

Trendline flips into support after a successful retest.

Upside targets:

TP1: 0.413

TP2: 0.468

TP3: 0.520

If bullish momentum and volume expand, further upside toward 0.616 – 0.682 becomes possible.

Bullish Confirmation:

Higher low formation

Minor market structure shift

Strong candle close, not just a wick

---

Bearish Scenario

Price fails to break the trendline and forms a clear rejection (long upper wick / bearish engulfing).

Price revisits lower support zones:

First support: 0.370

Next support: 0.345

Worst-case scenario: 0.321 (new lower low)

A breakdown below 0.321 would confirm continuation of the major downtrend.

Bearish Confirmation:

Clear rejection at the trendline

Lower high formation

Increasing selling volume

---

Conclusion

ADAUSDT is currently at a critical decision zone.

The macro trend remains bearish, but the recent bullish reaction from lower support opens room for a short-term reversal or relief rally.

Traders are advised to wait for confirmation — either a breakout or rejection — at the trendline, as this area will define the next major move.

---

#ADA #ADAUSDT #Cardano #CryptoAnalysis #TechnicalAnalysis #Downtrend #Trendline #SupportResistance #Altcoins

ADA Bounces 10% From Critical Support - 3 Scenarios AheadCARDANO (ADA/USD) | Daily Chart | Technical Update - Bounce From Critical Support

Current Price: $0.393 | Date: January 3, 2026

🔄 UPDATE: STRONG REVERSAL FROM WEEKLY SUPPORT

💥 ADA surged over 10% from $0.33 lows - critical weekly support held strong

📈 Price now trading at $0.393, showing first signs of buyer strength after prolonged decline

⚡ 37,851% surge in futures volume signals major trader repositioning

🐋 Whale buying activity detected - large orders accumulating at support

📊 PRICE ACTION OVERVIEW

✅ Successfully defended $0.30-$0.33 multi-year support zone (tested multiple times 2023-2024)

🔄 Strong bounce with volume confirms buyer interest at these levels

📍 Currently testing $0.385 - first support/resistance on the recovery path

⚖️ Market at critical decision point - three distinct scenarios emerging

🎯 KEY TECHNICAL LEVELS

Resistance Zones:

$0.385-$0.407 - Immediate resistance cluster;

$0.435-$0.48 - Green scenario target zone; breaking here signals full trend reversal

Support Zones:

$0.33 - CRITICAL WEEKLY SUPPORT - Just defended successfully, highest priority watch level

$0.30 - Secondary weekly support - breach here invalidates bullish scenario

$0.26-$0.21 - Extreme downside target (Red scenario) - October 2023 lows

📈 THREE SCENARIO ANALYSIS

🟢 SCENARIO 1: BULLISH REVERSAL (Green Arrow)

Probability: 35-40% based on current momentum

Path: Break above $0.385 → Test $0.407 → Rally to $0.435-$0.45

Catalyst: Sustained whale accumulation, positive funding rate, volume continuation

Confirmation: Daily close above $0.385 with strong volume

🟡 SCENARIO 2: CONSOLIDATION (Yellow Arrow)

Probability: 40-45% - Most likely near-term outcome

Path: Sideways range between $0.32-$0.38 for several weeks

Pattern: Accumulation phase as market digests recent drop

Confirmation: Repeated tests of $0.33 support without breakdown

🔴 SCENARIO 3: BEARISH CONTINUATION (Red Arrow)

Probability: 20-25% if support fails

Path: Break below $0.33 → Rapid decline to $0.30 → Ultimate target $0.26-$0.21

Risk: Loss of weekly support triggers cascading sell orders

Confirmation: Daily close below $0.33 with volume

🌐 MARKET CONTEXT

🔥 Cardano futures volume exploded 37,851% on Bitmex exchange - from near zero to $255.52M

🐋 Whale activity shows accumulation pattern - large orders defending $0.33 support

📊 Funding rate flipped positive to 0.0068% - historically precedes ADA rallies

💼 Critical Integrations Budget approved late 2025 - enables third-party app integration with Cardano

🌍 Midnight protocol launch and Leios upgrades approaching - major technical catalysts

😨 Market sentiment: Fear & Greed Index at 28 (Fear) but improving from Extreme Fear

📈 Analysts targeting $0.48-$0.50 if weekly support holds and momentum continues

💡 TECHNICAL OUTLOOK

🎯 Short-term bias: Cautiously Bullish - successful support defense shifts momentum

✅ Critical win: Holding $0.33 weekly support validates bull case and attracts buyers

🚧 First challenge: Must reclaim $0.385-$0.407 zone to confirm reversal

⚖️ Base case (45% probability): Consolidation between $0.32-$0.38 while market decides direction

🟢 Bull scenario (35% probability): Break above $0.407 opens path to $0.435-$0.45, volume is key

🔴 Bear scenario (20% probability): Breakdown below $0.33 triggers capitulation to $0.26-$0.21

📊 Volume analysis: Current bounce needs sustained buying volume above 800M-1B daily to confirm

⏰ Watch period: Next 7-10 days critical - either confirms reversal or resumes downtrend

------------------------------------------------------------------------------------------------------------------

⚠️ DISCLAIMER

This is technical analysis for educational purposes only. Not financial advice. Always do your own research and manage risk appropriately.

ADAUSDT – Daily Chart. ADAUSDT – Daily Chart.

Macro downtrend intact (descending channel)

The price is sitting at a major HTF demand level after a prolonged sell-off.

Selling momentum is exhausting near channel support

Price is compressing → base formation possible

This zone often leads to sideways accumulation before expansion

Support: 0.35 – 0.32 (critical demand zone)

Invalidation: Below 0.30

First Resistance: 0.48 – 0.52

Major Supply: 0.70 – 0.82 (previous value area)

In Extreme Fear, strong coins usually move sideways at support to absorb sell pressure before trend reversal.

No blind longs. Wait for structure shift + volume confirmation.

DYOR | NFA

ADA - Bearish Expanding TrianglePrice is trading within a broadening (expanding) triangle , with higher highs and lower lows indicating increasing volatility and distribution. The structure favors a bearish resolution , and I’m expecting a breakdown below the lower trendline to confirm continuation to the downside.

Expectations:

Breakdown from the expanding triangle → acceleration lower.

Downside Targets:

🎯 $0.25

🎯 $0.15

As long as price stays below the upper boundary, the bearish scenario remains dominant.

ADAUSDT —Breakout: 0.4355–0.4150 Will Decide the Next Trend?ADA is approaching a critical phase after successfully breaking above a major descending trendline that has guided the market lower for weeks. This breakout signals a potential shift in momentum, but the bullish move is not confirmed yet. Everything now depends on how price reacts to the 0.4355–0.4150 demand zone, the yellow block on the chart.

This zone is not just a simple consolidation range; it is the area where buyers previously stepped in aggressively and prevented deeper downside. If price retests this zone and holds, the breakout gains strong validity and opens the door for a broader trend reversal.

The breakout has happened. The market will now decide whether this is the beginning of a larger bullish leg, or merely a relief bounce within the existing downtrend.

---

Bullish Scenario

The bullish case remains intact as long as ADA holds above the 0.4355–0.4150 zone. A clean retest followed by a strong bullish 8h close would confirm buyers are in control.

If bullish confirmation holds:

First target: 0.5200, a key pivot resistance

Break above 0.52 leads to the next level at 0.5925

Sustained momentum could push ADA into the 0.6800–0.7300 zone

A full extension points toward the 0.8750 supply area, the larger upside magnet

As long as the yellow zone holds, the bias remains bullish.

---

Bearish Scenario

The bearish outlook only activates if price convincingly breaks back below 0.4150, invalidating the breakout and signaling that sellers still dominate the trend.

If a breakdown occurs:

Initial downside target sits around 0.375–0.360, the previous structural lows

Losing this level opens the possibility of forming a new lower low

In short, bearish momentum returns only if the key demand zone fails.

---

Pattern & Market Structure

Clean breakout from a major descending trendline

Price currently testing the transition phase between downtrend continuation or higher-low formation

The 0.4355–0.4150 zone acts as the trend validation zone, the most critical area on the chart

This is the most important structural zone ADA has interacted with in weeks.

#ADA #Cardano #ADAUSDT #CryptoAnalysis #Breakout #DemandZone #TechnicalAnalysis #MarketStructure

ADA : LIVE TRADE

Hello friends

According to the channel in which the price is located, you can see that every time it reached support, we had a growth, and now that it has reached the same support, we can expect another growth.

This analysis is purely technically reviewed and is not a buy or sell recommendation, so do not act emotionally and observe risk and capital management.

*Trade safely with us*

ADA/USDT — Major Reversal or Deep Breakdown?ADA/USDT on the weekly timeframe has returned to one of the most decisive zones since 2022.

The 0.275–0.22 region is not just another support — it is a historical demand and accumulation block where major reversals have repeatedly formed.

This week, ADA once again tapped this zone with a long downside wick, signaling a massive liquidity sweep. This is a clear indication that larger players are active here, collecting liquidity before choosing the next major direction.

This chart doesn’t reflect a simple pullback — it reflects the early stages of a major battle between long-term buyers and the dominant sellers who have controlled the trend since 2021.

---

🔥 Key Pattern & Market Dynamics

1. Long-term downtrend structure

Since the macro top, ADA has continued forming lower highs, maintaining bearish pressure in the weekly structure.

2. Strong accumulation demand (0.275–0.22)

This area has produced three major reversals in the past.

The latest reaction suggests either:

A liquidity hunt before a potential rebound, or

The beginning of a deeper breakdown if buyers fail to defend it.

3. Increased volatility

A wick of this size is rarely random.

It often precedes large directional moves, especially on the weekly chart.

---

📈 Bullish Scenario (If the Zone Holds)

A bullish continuation requires clear conditions:

✔ Strong rejection from 0.275–0.22

✔ Weekly close above the pivot zone at 0.40–0.45

✔ Formation of a higher-low structure

If confirmed, ADA may begin a structural trend reversal with:

Target 1: 0.65

Target 2: 1.00 – 1.20 (if volume expansion supports the breakout)

This would mark a shift from long-term weakness to medium-term recovery.

---

📉 Bearish Scenario (If the Zone Breaks)

A weekly close below 0.22 would be a significant bearish signal:

Historical demand fails

Market structure breaks down

A deeper markdown phase begins

Downside targets:

0.16 — next major psychological support

0.09 — historical accumulation zone

A loss of 0.22 would be one of ADA’s strongest bearish confirmations in years.

---

🧠 Core Message for Traders

This is not an ordinary support level —

this is a macro decision point that will define ADA’s direction for months ahead.

ADA now stands exactly where it stood in 2022–2023, and from this zone the market has only two paths:

➡ Hold the historical accumulation zone and reverse upward

or

➡ Break below it and enter a deeper long-term downtrend

Professional traders do not guess —

they wait for the weekly close, analyze volume, and watch how the market reacts to this key zone.

---

#ADA #ADAUSDT #Cardano #CryptoAnalysis #PriceAction #MarketStructure #WeeklyChart #SupportZone #CryptoTrading #CryptoOutlook

#ADAUSDT: Two Targets Both Possible, Let's See How Price MoveADAUSDT collapsed following the announcement of new tariffs on China, which caused fear in the cryptocurrency market and affected minor currency pairs. This led to a significant drop in the price of ADAUSDT. A minor decline may occur before the price reverses. There are two potential targets for the price to reach.

Entry area:

- We have identified the key area where a price reversal is likely to occur.

We wish you the best of luck and trade safely.

Team Setupsfx

ADAUSDTNothing special, after October 10, we found a "bottom" in this cycle, where it will probably move in a chaotic direction, shedding shorts and longs on its way. The yellow dotted line indicates the area where a "turn" is possible (it is possible to make some decisions, political or drastic regulatory changes or in that spirit)

Red showed resistance zones in case of a possible reversal. And a break of the negative trend on TF 1D.There is also weak support, which may act as a "hope" zone with a possible slight increase and a rapid decline in price to the lows that we have already tested on October 10, and clearly rested in the support zone.

But I wouldn't be surprised if we're in the near future, it will bounce back significantly below October 10th.

ADAUSDTIn this week’s BINANCE:ADAUSDT analysis, after a bearish reaction from the 0.85 USD zone, the price remains consolidating below previous highs, showing weakness in bullish momentum on the daily timeframe. If the current support fails, a move toward lower zones is likely before a potential bullish correction begins from support levels.

Supports:

* 0.59 USD

* 0.51 USD

Resistances:

* 0.69 USD

* 0.85 USD

Cardano/ADA Primed for Explosion: Key Targets Up to $5The chart should display sufficient key points and important levels while maintaining simplicity and order, avoiding clutter – this is what true analysis means. These levels in the monthly timeframe provide ideal zones for long-term investors to enter and exit, and offer traders a broader movement perspective since we're in a higher timeframe BINANCE:ADAUSD

ADA/USDT — at a Make-or-Break Zone: Will Bulls Defend?Cardano (ADA) is now sitting at a critical decision point, testing the major demand zone between 0.55–0.625 USDT — a key level that has acted as the foundation for multiple rallies since early 2024. This zone represents the battlefield between long-term buyers and sellers, where price reactions have historically triggered large directional moves.

Recently, ADA experienced a deep liquidity sweep, leaving a long wick below the zone — a common sign of stop-loss hunting or institutional accumulation. Such moves often occur before a trend reversal, making this area one of the most strategic zones to watch in the coming weeks.

---

Pattern and Market Structure Analysis

The yellow block (0.55–0.625) is a macro demand/support zone, repeatedly tested and defended by buyers.

Main resistances are located at 0.9239, 1.2075, and 1.3264, forming the upper bounds of ADA’s broader trading range.

The overall structure shows a wide consolidation phase, potentially signaling re-accumulation if the current zone holds.

The long wick beneath support reflects a liquidity grab, often used by smart money to fill large buy orders before an upward move.

---

Bullish Scenario — Potential Start of a Major Rebound

1. Price holds and rebounds from 0.55–0.625 with a strong bullish reversal candle (bullish engulfing, hammer, or pin bar).

2. Increasing buying volume confirms accumulation interest at this level.

3. A clean breakout and daily close above 0.9239 would confirm bullish continuation toward 1.20 and 1.32.

4. Formation of a higher low above 0.625 will further validate a new uptrend structure.

🎯 Bullish Targets:

TP1: 0.92

TP2: 1.20

TP3: 1.32

📉 Suggested Stop Loss: Below 0.53 (outside the demand zone).

Narrative:

If this pattern confirms, ADA could begin a new major recovery wave, potentially marking the start of a strong uptrend cycle heading into 2026.

---

Bearish Scenario — Breakdown and Failed Retest

1. Price fails to hold above 0.55 and closes decisively below the yellow zone.

2. High selling volume confirms continuation pressure.

3. A failed retest of 0.55–0.625 as new resistance strengthens bearish momentum.

4. The next key downside targets are 0.40 and 0.27, both major liquidity levels.

🎯 Bearish Targets:

TP1: 0.40

TP2: 0.27

📈 Confirmation: Daily candle close below 0.55 with strong volume.

Narrative:

If this support collapses, ADA could enter a mid-term redistribution phase, potentially setting a new bottom before the next macro bull run.

---

Conclusion and Strategic Outlook

The 0.55–0.625 zone is ADA’s make-or-break region — a critical level that will likely define its direction for the months ahead.

Holding the zone could trigger a strong reversal rally toward 0.92–1.32.

Losing it would confirm a bearish continuation toward 0.27.

Traders should wait for confirmation through daily candle closes and volume surges before committing to major positions.

This zone offers both a high-risk accumulation opportunity for patient investors and a decisive pivot area for short-term traders.

---

#ADA #Cardano #ADAUSDT #CryptoAnalysis #TechnicalAnalysis #PriceAction #SupportZone #ReversalZone #Altcoin #CryptoMarket #DemandZone

BUY AND HOLDHello friends

You see that after the good rise we had, the price is correcting, which is a natural thing and there is no need to worry, and in these corrections, you can buy in steps with capital and risk management and move with it to the specified goals.

Note that the holding period is at least 3 months, so be patient and observe capital management.

*Trade safely with us*

ADA analysisFrom the current structure, I think price may continue lower to retest the trendline support before setting up for a reversal.

The harmonic pattern visible on the chart also supports this idea — suggesting that the market could complete the pattern with a touch of the trendline before turning back higher.

If this plays out, I see potential for ADA to bounce strongly and work its way back toward the 2024 highs.

It’s also worth highlighting that Cardano remains a fundamentally strong project in the crypto space, and that broader strength gives more weight to the long-term bullish outlook once technical retracements play out.

🎯 Conclusion: This is my analysis — not financial advice. I don’t want to see people lose money in the markets, but from a technical standpoint, the chart points to a likely move into the trendline first, followed by a possible recovery toward prior highs.

👉 For more structured market insights and professional analysis, follow along.

Cardano Whales $500 Million ADA Selling To Delay Price Rise To $Cardano’s price sits at $0.888 at press time, holding slightly above the $0.880 support. However, the current environment suggests a risk of losing this critical level if bearish sentiment intensifies. The vulnerability to downside remains clear as whale selling persists.

Should ADA fall through $0.880, the next key support sits at $0.837. A drop to this level would extend recent losses and may prompt further liquidation from smaller holders, creating additional downward pressure. This could stall ADA’s path to recovery.

Conversely, a successful bounce off $0.880 could open a short-term rally toward $0.931. Flipping this resistance into support would improve market sentiment, enabling ADA to target $0.962. Breaking this barrier would invalidate the bearish thesis and bring Cardano closer to $1.

ADA/USDT – Cup & Handle PerspectiveHello guys!

Currently, the chart is showing the formation of a potential cup and handle pattern. The rounded bottom of the cup has already developed, suggesting that market participants are gradually regaining buying interest after the recent decline.

However, it’s important to note that:

The handle has not yet formed, and

A breakout confirmation is still missing.

This means the pattern is not yet validated —> it’s only a perspective and assumption at this stage. For the setup to confirm, we would need:

A consolidation forming the handle, and

A clean breakout above the neckline area.

If the breakout occurs with solid volume, the measured target of the pattern could push the price toward the $1.00 level, which also aligns with psychological resistance.

ADA/USDT — Breakout & Retest at a Critical Fibonacci Zone!

Currently, Cardano (ADA/USDT) is at a decisive point on the 3D timeframe, where price has just broken out of a mid-term downtrend line and is now retesting a very strong support area.

---

🔎 Technical Structure & Pattern

Downtrend line has been broken to the upside → sign of trend reversal.

Price is retesting a confluence support zone (0.78 – 0.83) consisting of:

Historical support/resistance (yellow box).

Fibonacci retracement 0.5 (0.8217) and 0.618 (0.7955).

This setup forms a classic “breakout & retest” pattern — where old resistance potentially flips into new support. If it holds, ADA could confirm a mid-term bullish continuation.

---

🟢 Bullish Scenario

If the price holds and closes above 0.795–0.821, bullish momentum remains valid.

Potential upside targets:

R1 = 0.9364 (short-term swing target).

R2 = 1.1213 (strong confirmation of trend shift).

R3 = 1.2152 (key resistance before major highs).

R4 = 1.3262 (major high & psychological zone).

In this scenario, ADA could stage a significant rally if market sentiment supports it.

---

🔴 Bearish Scenario

If the price breaks down below 0.7955 (Fib 0.618), the bullish setup may turn into a false breakout.

Downside targets to watch:

Previous consolidation range around 0.60–0.70.

Deeper support near 0.44.

Worst-case scenario: retesting the major low at 0.27.

---

📌 Conclusion

ADA is currently at a make-or-break level.

As long as price holds above 0.795–0.821, the bias remains bullish with targets at 0.94 – 1.12 in the mid-term.

A failure to hold this zone would shift bias to bearish, opening the way for deeper corrections.

Traders should closely monitor price action & volume around this retest, as it will determine ADA’s next big move.

---

📝 Notes

Always apply risk management (stop-loss & position sizing).

Wait for 3D/weekly candle close confirmation.

This is technical analysis, not financial advice.

#Cardano #ADA #ADAUSDT #CryptoBreakout #CryptoTrading #TechnicalAnalysis #PriceAction #Altcoins #CryptoSetup

ADA : BUY OR SELL?Hello friends

Well, after the decline we had, the price was able to create a small channel in the specified support area, which indicates the accumulation of the price, and if the support is maintained and the channel is broken, the price can move to the specified targets.

Otherwise, and if the support is broken, the decline will continue with a valid formation...

*Trade safely with us*

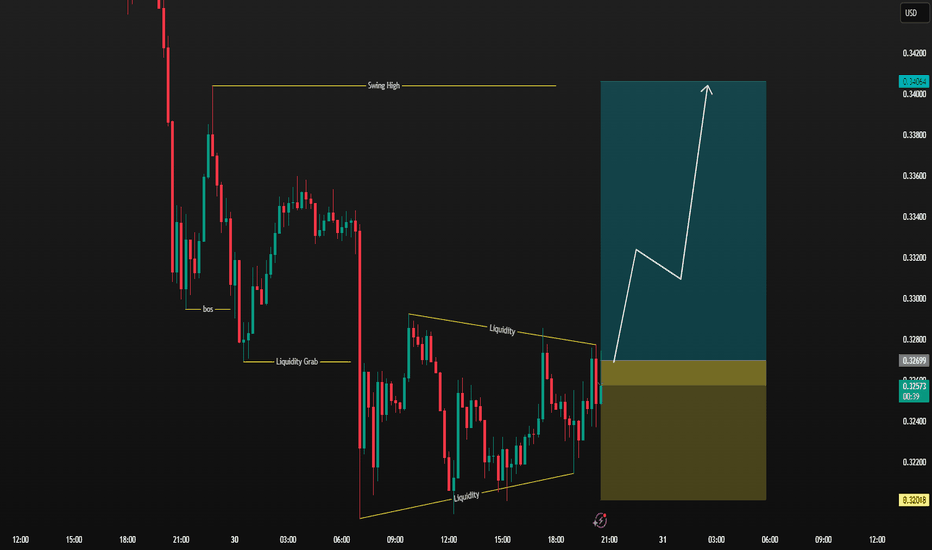

ADA/USDT – Liquidity Sweep & Reversal Setup ADA/USDT – Liquidity Sweep & Reversal Setup (15m TF)

Price recently swept liquidity below the prior low, triggering a manipulation trap. After the liquidity grab, bullish momentum started forming, confirming rejection from the demand zone.

Entry: Taken after the liquidity sweep confirmation.

Stop-loss: Placed below the manipulation low to protect against deeper downside.

Target: 0.9430 resistance zone (major supply level).

This setup is based on liquidity sweep, manipulation trap, and demand zone reaction, expecting a move back to the upside.

Risk management is key – waiting for structure confirmation before continuation.