Amazon - A quite boring new all time high!🎈Amazon ( NASDAQ:AMZN ) is simply heading for new highs:

🔎Analysis summary:

For the past couple of months, Amazon has overall just been consolidating. But in the meantime, we witnessed a major bullish break and retest and an expected rally of +50%. Following this quite slow behavior, Amazon will also slowly create new highs.

📝Levels to watch:

$250

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

Amazonstock

Amazon: Persistent Upward PressureAmazon initially continued its upward trajectory, extending the rise until January 2. There was a brief pullback of about 4% afterward, but it was quickly recovered. Consequently, price again reached the levels observed before the holiday season. In line with our primary scenario, we expect price to turn downward to carve out the final low of the beige wave IV. Ideally, this bottom should be formed above the support at $160.50. Subsequently, wave V should unfold and continue the overall upward trend. However, if Amazon breaks directly above the resistance at $259, it could suggest that the low of wave alt.IV in beige has already been established. The probability of this alternative scenario is 33%.

AMZN : What’s Taking Shape?Amazon’s recent recovery has developed into an interesting emerging structure. After the sharp drop and strong rebound, price is now building a potential continuation pattern. Momentum suggests the market may still be preparing for another upward leg once this consolidation phase completes. With the flow tightening, the next decisive move could unfold sooner than expected, making this setup worth monitoring closely.

**Disclosure:** We are part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in our analysis.

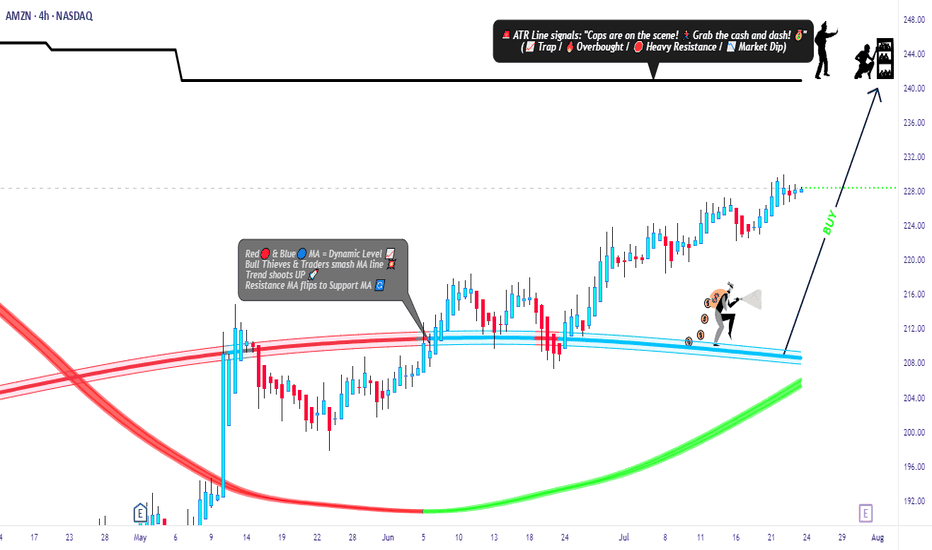

AMZN Breakout Reload? TMA Pullback Shows Buyer Strength🔥 AMZN Swing Trade Profit Playbook | Bullish Pullback + Thief Layering Strategy 🟢📦

Welcome back, Ladies & Gentlemen — the Thief OG’s 😎🕵️♂️

Here’s a polished, rule-friendly breakdown of the bullish setup developing on AMZN (Amazon.com Inc.) – NASDAQ.

📌 Market Context

AMZN is showing a clean bullish pullback into the Triangular Moving Average (TMA) zone, supported by a Heikin Ashi Doji Reversal, signaling that buyers are gaining strength and attempting to dominate momentum again. 📈🔥

🧠 Trade Plan (Swing Trade)

Plan:

A bullish pullback strategy confirmed by:

🔺 Triangular Moving Average pullback reaction

🟩 Heikin Ashi reversal-doji indicating potential trend continuation

📊 Buyers stepping in with momentum recovery

🎯 Entry Plan – Thief Style Layering (Multiple Limit Orders)

This is the famous Thief Strategy — using layered limit orders to scale into the move like a master of stealth 😎🕵️♂️💼

(TradingView-safe version: purely educational, optional, trade at your own risk.)

Layered Buy Limits:

🟢 215.00

🟢 220.00

🟢 225.00

🟢 230.00

(You may increase or adjust layers based on your own style and risk tolerance.)

🛑 Stop-Loss (Thief Style Educational Version)

SL Zone (Optional):

❌ 210.00

⚠️ Note: Dear Ladies & Gentlemen (Thief OG’s), this level is NOT a recommendation — it’s just part of the thief-style educational breakdown.

Choose your own risk plan, trade your own analysis.

🎯 Target Zone

The “Police Force” 🚓 — aka strong resistance, potential overbought zone, and liquidity trap area — sits around:

🟡 Target @ 250.00

⚠️ Note: Dear Ladies & Gentlemen (Thief OG’s), this is NOT a fixed TP recommendation.

Manage your profits as per your own risk appetite and strategy.

📡 Related Pairs to Watch (Correlation & Market Behavior)

Watching correlated tickers helps understand broader tech-sector sentiment and liquidity rotation.

Here are the key names to keep an eye on:

📌 NASDAQ:AAPL (Apple Inc.)

Strong correlation with AMZN in tech-momentum cycles.

When AAPL shows bullish continuation, AMZN often follows with similar pressure.

📌 NASDAQ:META (Meta Platforms Inc.)

Tracks consumer-tech spending sentiment.

Strong META moves can hint at acceleration across NASDAQ growth stocks.

📌 NASDAQ:MSFT (Microsoft Corp.)

A heavyweight pillar in NASDAQ.

MSFT strength boosts overall tech-index bullish bias.

📌 NASDAQ:QQQ (Invesco NASDAQ-100 ETF)

The main sentiment gauge.

If QQQ remains above its trend structure, AMZN's bullish continuation gets stronger confirmation.

📌 NASDAQ:TSLA (Tesla Inc.)

Not directly correlated, but impacts NASDAQ volatility dynamics.

High volatility in TSLA often ripples into liquidity behavior across the index.

💬 Final Thoughts

This AMZN setup blends structure, momentum, and multi-layer entries, crafted in a fun Thief-style teaching format while keeping everything compliant and research-focused 📚✨

Trade smart, manage risk, escape with profits when the “police” show up 🚓😆📈

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

⚠️ Disclaimer

This is a Thief-style trading strategy presented just for fun & educational purposes only.

Not financial advice. Do your own analysis and manage risk responsibly.

#AMZN #Amazon #SwingTrade #NASDAQ #BullishSetup #PullbackStrategy #HeikinAshi #TriangularMovingAverage #ThiefStrategy #LayeringEntries #TradingEducation #StockMarket #MarketAnalysis #TradingViewCommunity #EditorPickReady 🚀

Why os Amazon $AMZN rallying?Why os Amazon NASDAQ:AMZN rallying? Amazon st. The strong weekly demand level at $231 per share is still in control. Rallying as expected. Long positions should be managed.

Hopefully, Amazon stock will continue to rally. These imbalances are great for stock swing trading, bullish stock option strategies and intraday stock trading once the imbalance gains control.

Amazon (NASDAQ: $AMZN) Expands AI Power With $50B GovCloud PushAmazon (NASDAQ: NASDAQ:AMZN ) is strengthening its position in the AI and cloud infrastructure race with a massive pledge of up to $50 billion to expand supercomputing capacity for U.S. government agencies. The investment focuses on building advanced AWS data centers across Top Secret, Secret, and GovCloud regions starting in 2026, adding nearly 1.3 gigawatts of AI and high-performance computing power. With more than 11,000 government customers, AWS aims to widen its lead as AI competition intensifies across cloud providers.

Industry analysts note that Amazon has lost some ground in AI-specific cloud growth to rivals like Google and Oracle. As companies such as Microsoft, OpenAI, and Alphabet pour billions into AI infrastructure, Amazon’s scale-driven investment is a strategic move to ensure AWS remains the backbone of government AI systems.

The new capacity will support federal agencies with a full stack of AI tools—including Amazon SageMaker, Amazon Bedrock, and foundation models like Amazon Nova and Anthropic Claude—allowing them to build customized AI solutions at scale. Analysts expect the U.S. government to accelerate AI adoption as part of its race to maintain technological leadership over China.

Technical Outlook

AMZN is currently pulling back from the $258 resistance, forming a healthy correction toward the $232 support zone, which aligns with a weekly demand level. Bulls will look for a strong reaction here to retest the $258 high and potentially break above it.

A failure at $232 exposes the ascending trendline support that has guided Amazon’s uptrend since early 2023. The RSI cooling off suggests this is a normal correction rather than a trend reversal. If support holds, upside targets between $280–$300 remain valid, matching long-term Fibonacci projections.

Amazon(NASDAQ: $AMZN) Invests $3B in New Mississippi AI Data HubAmazon.com (NASDAQ: NASDAQ:AMZN ) announced plans to invest at least $3 billion in a new data-center campus located in Warren County, Mississippi. The project will support Amazon Web Services’ expanding AI and cloud-infrastructure needs, reinforcing AWS’s position as the company’s fastest-growing and most profitable segment.

The data-center development is expected to create more than 200 direct jobs at the site and support over 300 additional roles in the surrounding region. Amazon highlighted that the expansion will power next-generation AI workloads, machine-learning services, and global cloud capacity. The investment also deepens Amazon’s long-term footprint in the southeastern U.S., aligning with rising demand for high-compute environments across industries.

This move follows a broader trend of hyperscale cloud providers accelerating infrastructure spending to compete for AI-focused enterprise customers. With AWS already serving as the global leader in cloud services, the investment signals Amazon’s intention to maintain a technological and commercial edge amid intensifying competition from Microsoft Azure and Google Cloud.

Technical analysis:

Price is pulling back from heavy resistance at $258 and correcting toward the ascending trendline support. This level acts as a significant weekly demand area and aligns with the broader structure guiding the uptrend.

A strong bullish reaction from the trendline would likely set up another retest of the $258 highs. A clean break above that zone opens the door toward $280–$300, supported by long-term Fibonacci projections and sustained strength in AWS earnings.

If the trendline level breaks, the next key support sits at the horizontal support that has carried Amazon’s stock since early 2021. Overall, the setup remains bullish as long as price holds above the trendline.

Amazon Raises $15B for AI Expansion — Stock at Key Support ZoneAmazon has launched its first US dollar bond sale since 2022, securing $15 billion to accelerate investments in AI infrastructure. Demand was massive, reaching $80 billion, signaling strong investor confidence in Amazon’s long-term growth story. The funds will support capital expenditures, acquisitions, data-center expansion, and upcoming debt maturities.

This move aligns with a broader trend among tech giants aggressively raising capital to scale AI systems. Meta issued $30 billion earlier, Alphabet raised $25 billion, and Oracle sold $18 billion in September. The surge in funding reflects the rising cost of advanced chips, cloud infrastructure, and high-capacity data centers needed to stay competitive in the AI race.

Amazon, the world’s largest cloud provider through AWS, is increasingly focused on high-performance computing and generative AI models. The new capital gives Amazon more room to expand capacity, boost margins through automation, and strengthen its competitive edge in enterprise AI services.

Amazon’s stock (AMZN) is pulling back from the $258 resistance, forming a corrective move toward a key support area around $232. This level aligns with the structure seen on the weekly chart and acts as a short-term demand zone. A strong bullish reaction here would likely set the stage for a retest of the $258 high, followed by a potential breakout if momentum returns.

If $232 fails to hold, the next major support sits at the ascending trendline zone, which has guided Amazon’s uptrend since early 2023. A deeper correction remains possible, but the broader structure is still bullish as long as price holds above the trendline.

The RSI is cooling off, suggesting the correction is healthy rather than a trend reversal. If Amazon bounces from support, the next major upside target sits between $280 and $300, aligning with long-term Fibonacci extensions.

Amazon.com, Inc. ($AMZN) Expands Low-Cost Bazaar ServiceAmazon.com, Inc. (Nasdaq: NASDAQ:AMZN ) is making a bold move into the global low-cost e-commerce space. The retail giant announced the expansion of its Amazon Bazaar service — known as “Haul” in the U.S. — to 14 new international markets, intensifying competition with Shein and PDD Holdings’ Temu.

The service targets value-driven shoppers by offering ultra-cheap goods like $10 dresses, $5 accessories, and $2 home items, with a focus on emerging markets such as Nigeria, the Philippines, Hong Kong, Saudi Arabia, and Taiwan. The expansion builds on Bazaar’s earlier success in Mexico and the UAE, signaling Amazon’s strategy to tap into the fast-growing global demand for low-cost online retail amid weaker consumer sentiment.

This move comes as U.S. import tariffs under the Trump administration pressure household budgets, particularly for low-income groups. By diversifying into affordable goods, Amazon aims to defend its e-commerce dominance against Chinese platforms that have captured younger, price-sensitive consumers through viral marketing and social commerce. Analysts note that this pivot could enhance Amazon’s total addressable market and bolster revenue from international operations in 2026.

Technically, Amazon’s stock remains in a strong uptrend, trading near $244.41, slightly below its recent high of $258.60 market this week. The weekly chart shows consistent higher lows supported by a long-term ascending trendline from early 2023. The $220–$225 zone now serves as key support, with potential for a short-term pullback before resuming the rally toward the $300 level.

Momentum remains positive, with volume strength confirming investor interest following strong Q3 earnings. A sustained move above $260 could trigger a fresh bullish leg, extending Amazon’s dominant run as both a tech and retail powerhouse.

Amazon’s Hidden Pullback Opportunity – Smart Risk, Smart Entry🎯 AMZN: The "Thief's Playbook" — Stealing Profits Like a Wall Street Ninja

📊 Asset Overview

AMAZON.COM INC (NASDAQ: AMZN) — The E-Commerce Titan & Cloud King 👑

Strategy Type: Swing/Day Trade — Bullish Pullback Setup

Confirmation Tool: ATR (Average True Range) ✅

🎭 The "Thief Strategy" Explained

Listen up, Thief OG's! 🦹♂️ This ain't your grandma's single-entry trade. We're using layered limit orders — think of it like setting multiple traps to catch money at different price levels. Professional? Yes. Legal? Absolutely. Stylish? You bet! 😎

🔥 Entry Zones — The Multi-Layer Trap

The Thief's Ladder Entry Method:

You've got options, trader! Pick your poison:

Option 1: Aggressive Single Entry

Jump in at current market price (~$220-$225 zone)

Option 2: The Layered "Thief" Method 🎯

Set multiple buy limit orders to scale in:

Layer 1: $220

Layer 2: $218

Layer 3: $216

Layer 4: $214

Why layer? Because markets don't move in straight lines, baby! This lets you average down if price dips while maintaining a solid risk profile. Add more layers based on your risk appetite! 🍰

🛑 Stop Loss — Protecting Your Loot

Thief's Emergency Exit: $210 🚨

⚠️ IMPORTANT DISCLAIMER:

Dear Ladies & Gentlemen (my fellow Thief OG's), I'm NOT telling you to blindly follow my stop loss. This is MY risk management. YOU manage YOUR money. Trade at your own risk — this is entertainment with charts, not financial advice! 🎲

🎯 Target Zone — Where We Cash Out

⚡ High-Voltage Trap Alert — Resistance Wall Ahead! ⚡

Target Price: $235 🎯💵

Why this target?

💡 This zone shows classic signs of:

Strong resistance from previous price action 🧱

Overbought conditions brewing (RSI warming up) 📈

Liquidity build-up (big money sitting here) 💰

Potential "bull trap" zone → smart money escapes here! 🪤

My advice? When price hits $235, secure your profits! Don't get greedy.

⚠️ ANOTHER DISCLAIMER:

Dear Thief OG's, this is MY target based on MY analysis. You do YOU. Take profits when YOU feel comfortable. Your money, your rules, your risk! 💪

🔗 Related Assets to Watch

Keep an eye on these correlated movers — they can give you early signals for AMZN's direction:

📦 E-Commerce & Tech Giants:

NASDAQ:TSLA (Tesla) — Tech sentiment leader; when tech rallies, AMZN often follows 🚗⚡

NASDAQ:MSFT (Microsoft) — Cloud competitor (Azure vs AWS); inverse correlation sometimes kicks in ☁️

NASDAQ:GOOGL (Alphabet) — Ad spending indicator; strong Google ads = strong consumer spending = bullish for AMZN 🔍

NYSE:WMT (Walmart) — Retail competitor; if WMT struggles, AMZN often benefits 🛒

📊 Market Indices:

NASDAQ:QQQ (Nasdaq 100 ETF) — AMZN is heavily weighted here; QQQ direction = AMZN direction 📉📈

AMEX:SPY (S&P 500 ETF) — Overall market health check; risk-on = AMZN rallies 🇺🇸

💵 Market Sentiment Indicators:

TVC:VIX (Volatility Index) — Low VIX = calm markets = bullish for growth stocks like AMZN 😌

TVC:DXY (US Dollar Index) — Weak dollar = bullish for mega-cap tech stocks 💵📉

The Correlation Play: If you see NASDAQ:QQQ breaking higher + TVC:VIX dropping + tech stocks rallying → high probability AMZN follows the party! 🎉

🧠 Key Technical Points

✅ ATR Confirmation: Volatility is in the "sweet spot" — not too choppy, not too sleepy

✅ Pullback Structure: Classic bullish retracement setting up

✅ Risk-Reward: Solid 2:1+ ratio with layered entries

✅ Volume Profile: Watching for confirmation on breakout

⚠️ Legal Disclaimer — Read This Twice! 📢

THIS IS THE "THIEF STYLE" TRADING STRATEGY — JUST FOR FUN & EDUCATIONAL ENTERTAINMENT! 🎭

I am NOT a financial advisor. This is NOT financial advice. This is a trading idea based on technical analysis, shared for educational and entertainment purposes only.

❌ Do NOT risk money you can't afford to lose

❌ Do NOT trade based solely on this idea

❌ Do your own research (DYOR)

❌ Past performance ≠ future results

✅ Trade responsibly and manage your risk

You are 100% responsible for your own trading decisions. I'm just a chart nerd sharing ideas with the community! 🤓📊

💬 Final Thoughts from Your Friendly Neighborhood Chart Thief

Markets are a game of patience, discipline, and calculated risks. The "Thief Strategy" is about being strategic, not reckless. Set your traps, manage your risk, and let the market come to you! 🕸️💰

Stay sharp, stay profitable, and remember: the best trades are the ones you plan, not the ones you chase! 🏃♂️💨

✨ If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!

#AMZN #Amazon #StockMarket #SwingTrading #DayTrading #TechnicalAnalysis #BullishSetup #LayeredEntry #ThiefStrategy #TradingIdeas #ATR #ResistanceZone #TakeProfit #RiskManagement #NASDAQ #TechStocks #PullbackTrading #PriceAction #SupportAndResistance #TradeSmart

Trade safe, trade smart, and let's get this bread! 🍞💸

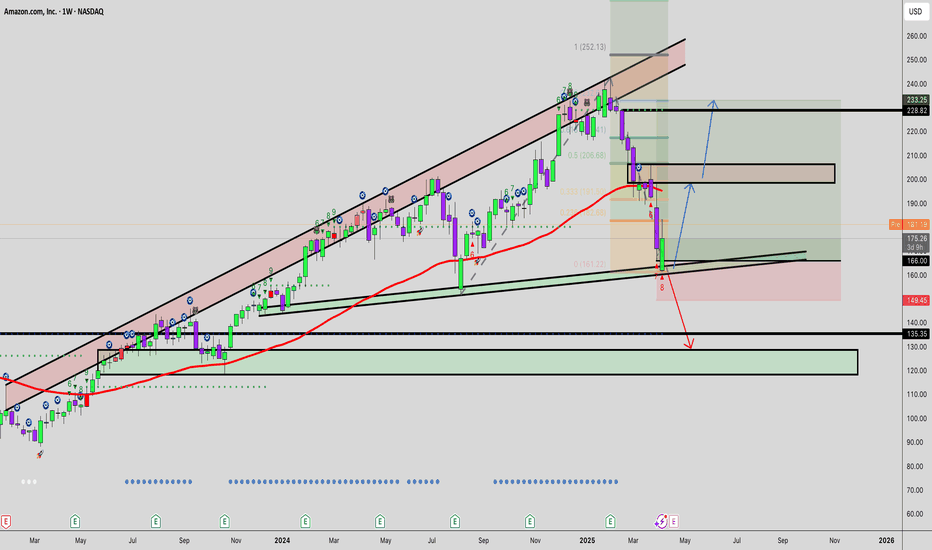

Amazon analysisRight now, I believe price is trading inside the distribution area that I’ve highlighted.

The recent break of the trendline suggests momentum may be shifting, with the risk of a reversal into a downtrend.

From an investor’s perspective, this is not the most attractive area to be buying. A more favorable entry could come if price moves back down into the accumulation area I’ve marked on the chart.

🎯 Conclusion: My view is cautious — I think AMZN may leave the distribution phase and head lower toward the accumulation area. As an investor, patience here may prove wiser than chasing current levels.

Amazon (AMZN) shares fall around 3% in a single dayAmazon (AMZN) shares fall around 3% in a single day

As the chart shows, Amazon (AMZN) shares fell by roughly 3% yesterday after reports that the US Federal Trade Commission has launched a probe into the company over alleged “dark patterns”.

According to the allegations, Amazon may have deliberately complicated the process of cancelling Prime subscriptions in order to retain customers. Should the charges be proven, this could result in significant fines and have a major impact on one of Amazon’s key revenue streams.

Amazon’s share price dipped below $220 yesterday for the first time since 12 August. Could the decline continue?

Technical analysis of Amazon (AMZN) chart

In our 5 September analysis, we:

→ used AMZN stock price swings to plot an ascending channel (shown in blue);

→ suggested the price could extend its bullish structure after breaking through resistance R (shown in red).

Indeed, in the following days there was some bullish momentum: peak B was higher than peak A. However, this appears more a sign of weakness when judged by the nature of the reversal:

→ on 10 September, the price edged only slightly above the summer peak,

→ before tumbling sharply, with bearish candles widening.

This move, showing clear signs of a Double Top pattern (A–B), may suggest that buyers at September’s high were trapped, with stop-loss closures adding to the downward pressure.

The previously plotted ascending channel remains valid, but Amazon stock price has dropped (shown by the red arrow) into its lower half. In this context, the channel’s midline and the $227.70 level could now act as resistance.

Bulls, however, still have grounds to expect support from:

→ the bullish reversal zone formed in early August, when a narrowing triangle appeared on the chart with its axis around $215;

→ the QL line, which divides the lower half of the channel into quarters.

Although the negative sentiment from FTC-related news may eventually fade, what remains concerning is AMZN’s relatively weaker performance in 2025 compared with the broader market: while the S&P 500 set a fresh all-time high this week, Amazon shares have barely moved since the start of the year.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Amazon (AMZN) Shares Jump Over 4%Amazon (AMZN) Shares Jump Over 4%

Amazon (AMZN) shares were among the top gainers in the equity markets yesterday, rising more than 4% and closing above $235 for the first time since February 2025.

The rally was fuelled by reports that Kuiper – Amazon’s project aimed at providing internet access via a network of low-Earth orbit satellites – has signed a partnership agreement with JetBlue. From 2027, this will allow free Wi-Fi to be offered on board selected aircraft. As a result, Amazon’s project is emerging as a new competitor to Elon Musk’s Starlink.

Technical Analysis of Amazon (AMZN) Chart

Since August, AMZN’s price fluctuations have been forming a bullish structure of higher highs and higher lows (0-A-B-C-D-E-F).

These and other key turning points provide the basis for constructing an upward channel (shown in blue), with the following implications:

→ in the near term, the price could surpass the previous high at point E, extending the bullish structure;

→ the channel median has proved to be an important support level – it held the price during the early August decline and continued to play this role throughout the month.

It is worth noting that AMZN’s upward momentum within the channel is unfolding step by step, making it possible to draw intermediate resistance lines R0, R1, and R2. In this context:

→ they can be viewed as examples of a bullish flag chart pattern;

→ yesterday’s rally with a bullish gap may signal the start of a new growth phase towards the next resistance at R3.

However, on this path, hurdles could come from:

→ the upper boundary of the blue channel;

→ the $230 level, around which a bearish head and shoulders pattern formed in February, marking this year’s high;

→ the psychological level of $250.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Don’t Miss: AMZN Call Opportunity at $242.50! 🚀 AMZN Swing Alert – 2025-08-15 🚀

**Sentiment:** Moderate Bullish

**Setup:** Call Option Trade

---

## 📈 Market Snapshot

* **Daily RSI:** 61.5 → Strong bullish momentum

* **5 & 10-Day Trend:** +3.68% / +7.52% → Confirmed upside

* **Volume:** Avg (1.0x) → Lacks strong institutional confirmation

* **Call/Put Ratio:** 1.00 → Neutral sentiment

* **VIX:** 14.84 → Low volatility, ideal for controlled swings

---

## ⚖️ Consensus & Conflicts

**Agreement:**

* Bullish momentum recognized across multiple models

* Favorable market conditions for swings

* Weak volume highlighted as a risk

**Disagreement:**

* Some models (Claude/Anthropic) advise caution, suggesting no immediate trade

* Confidence varies: DeepSeek favors a stronger bullish call, others remain cautious

---

## 🎯 Trade Setup – AMZN CALL

**Entry Condition:** At market open

**Strike:** \$242.50

**Expiration:** 2025-08-29

**Entry Price:** \$0.85

**Confidence:** 75%

**Profit Target:** \$2.13 (150% gain)

**Stop Loss:** \$0.50 (30% of premium)

**Key Risks:**

* Weak volume may reduce momentum sustainability

* Market shifts require active monitoring

---

## 📝 TRADE DETAILS (JSON)

```json

{

"instrument": "AMZN",

"direction": "call",

"strike": 242.5,

"expiry": "2025-08-29",

"confidence": 0.75,

"profit_target": 2.13,

"stop_loss": 0.50,

"size": 1,

"entry_price": 0.85,

"entry_timing": "open",

"signal_publish_time": "2025-08-15 11:56:23 UTC-04:00"

}

```

---

## 📊 Quick Reference – TradingView Ready

🎯 **Instrument:** AMZN

🔀 **Direction:** CALL (Long)

💵 **Entry Price:** \$0.85

📈 **Profit Target:** \$2.13

🛑 **Stop Loss:** \$0.50

📅 **Expiry:** 2025-08-29

📏 **Size:** 1 contract

⏰ **Entry Timing:** Market Open

🕒 **Signal Time:** 2025-08-15 11:56 EDT

---

### Suggested Viral Title & Tags:

**🔥 AMZN Swing Alert: Call Setup Ready – Strike \$242.50 🚀**

\#AMZN #SwingTrade #OptionsTrading #Bullish #CallOption #Momentum #TradeSetup #TechnicalAnalysis #StockAlerts #Finance #TradingSignals #MarketWatch #LongTrade

Amazon Market Robbery Blueprint – Swing/Scalp Long Setup🟨💣 “AMZN Market Heist Blueprint – Bullish Robbery in Progress 🚨💼💸” 💣🟨

By Thief Trader – Rob the Market with Precision

🌍 Hello World! Hi, Hola, Ola, Bonjour, Hallo, Marhaba!

🤑💰 Calling all Money Makers & Market Robbers – get ready to execute the next bullish heist on AMAZON.COM, INC (NASDAQ: AMZN), powered by our signature Thief Trading Style™ – where technical precision meets psychological warfare.

🔥 Plan Summary:

Based on our fundamental & technical intel, we’re eyeing a long entry into AMZN. The target? 💥The High-Risk ATR Police Barricade Zone – a zone flooded with liquidity, overbought conditions, fakeouts, and bear traps. It's where most traders get caught – but we walk in with a blueprint.

🟩 Entry Zone – “The Vault Is Wide Open!” 💼📈

🕰 Entry timeframe: 15min / 30min (preferably after confirmation or rejection wick)

💵 Buy Limit Orders: Place multiple layered entries (DCA-style) near recent swing lows/highs. Wait for breakout confirmation; no blind orders before breakout!

Thief Note: This isn’t spray-and-pray – this is sniper-mode. Scope, place, execute.🎯

🛑 Stop Loss – “SL is the Escape Route!”

📍 SL below recent 4H candle wick swing low (around 219.00 – adjust based on your risk/margin size).

Important: Only place SL after breakout; not before. Risk per order must match your lot strategy.

🎯 Target – “Grab the Bag or Escape Before the Alarms!”

💸 Target Zone: 240.00

🧠 Smart robbers know when to bail early – use a trailing SL to lock gains. Exit before reversal or heavy volume shift.

👀 Scalper Alert – “Only One Way – LONG!”

If you’re a quick thief with a fat bag, hit-and-run with a Long scalp. If you’re running lean, swing with the crew. Watch the PA and news timing. Trailing SL = insurance policy.

📊 Why Bullish? Here’s the Background:

🔍 Macro Drivers

💼 COT Report

🌍 Geo-political Influences

🧠 Sentiment Score

📈 Index Correlation

🔮 Intermarket Signals

💹 Institutional Positioning

All lights flashing green for short-to-midterm bullishness, but keep checking real-time updates.

⚠️ Risk Alert – News Triggers Can Blow Your Cover 🚨

🗞 Avoid trading near major news releases – they cause volatility spikes.

🧲 Always protect gains with trailing stops and don’t over-leverage your ammo.

💖 Support the Robbery – Hit BOOST 🔥

Smash that 💥BOOST💥 button if you ride with the Thief Trading Crew!

Let’s build this into the #1 robbery squad on TradingView.

Make money. Protect profits. Trade like a bandit – with a plan. 💼📈🏆

🔔 Stay Tuned for the Next Robbery Mission 🔔

Another heist plan dropping soon. Until then, rob smart, rob safe, and rob rich.

– Thief Trader™ | Rob The Market. Not Your Wallet.

Amazon (AMZN) Shares Rise Ahead of Earnings ReportAmazon (AMZN) Shares Rise Ahead of Earnings Report

Today, 31 July, Amazon is set to release its quarterly earnings after the close of the regular trading session. Available data show that Amazon (AMZN) shares are exhibiting bullish momentum, reflecting positive market expectations:

→ In July, AMZN shares have outperformed the S&P 500 index (US SPX 500 mini on FXOpen);

→ Yesterday, following the end of the regular session, AMZN shares surged by approximately 3% in after-hours trading.

The rise in AMZN comes amid strong earnings reports from other tech giants, such as Microsoft (MSFT) and Meta Platforms (META). For example, MSFT shares rose by more than 8% in post-market trading. Their success has likely fuelled optimism that Amazon’s upcoming report will also impress.

All of this has brought noticeable changes to the technical outlook for the AMZN stock price.

Technical Analysis of the Amazon (AMZN) Chart

Following the release of the previous earnings report, price movements have formed an upward channel, as indicated by the Regression Trend tool. However, in recent days, a series of bearish signals emerged:

→ On Thursday, AMZN broke above the $230 level (marked by an upward arrow), but the session closed well below the highs – a sign of selling pressure;

→ Friday and Monday’s sessions produced candles with small bodies, indicating market indecision;

→ On Tuesday, bears took the lead (marked by a downward arrow), with a relatively long candle closing near the session low.

Thus, the chart gave reason to assume that optimistic sentiments were waning. However, today’s session is likely to open near the $237.30 level, effectively negating the bearish interpretation of the previous five candles and shifting momentum back in favour of the bulls.

In this context:

→ Support could be provided by the $230 level as well as the median of the Regression Trend channel;

→ Key resistance could be found at the previous high of $242.23 and the psychological level of $250.

Whether AMZN can surge to a new all-time high will largely depend on the company’s performance in AI – a theme that remains highly relevant in 2025.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Profit Raiders’ Guide to Conquering AMAZON Stock!Hello, Wealth Warriors! 🌟

Stock market adventurers, let’s embark on a thrilling quest to dominate AMAZON stock with our cunning Raider Trading Strategy! 🗡️📈 Fueled by razor-sharp technical analysis and robust fundamental insights, this plan targets high-reward zones while dodging market traps. Follow the long-entry map, aim for the golden profit zone, and stay vigilant for overbought signals, consolidation, or bearish ambushes that could shift the trend. 🐻🔍 Secure your gains and celebrate your victory! 🎉

Entry 📈

The treasure chest is wide open! 🏰 Seize the bullish momentum at the current price of $206.02—your adventure begins! For precision, set Buy Limit orders on a 15 or 30-minute chart for pullback entries, targeting a retest of recent highs ($206.69) or lows ($202.19).

Stop Loss 🛑

📍 Place your Raider Stop Loss at the recent swing low ($196.00) on a 4-hour chart for day trades. Adjust based on your risk tolerance, position size, and number of trades to stay in control. 🛡️

Target 🎯

Set your sights on $217.00 or exit early to lock in your profits! 💸 Refer to the finance card above for price trends.

Scalpers, Stay Sharp! 👀

Focus on quick long-side trades. Large accounts? Strike now! Smaller portfolios? Join swing traders for the raid. Use a trailing stop to safeguard your gains as the stock moves. 🧲💰

AMAZON Stock Market Insights 📊

AMAZON is charging bullish, driven by strong fundamentals. 📈 Dive into earnings reports, macroeconomic trends, geopolitical events, market sentiment, sector correlations, and future price projections for a complete view. As of May 28, 2025, at 12:04 AM EST (UTC-5), the stock’s momentum is supported by a market cap of $2.17 trillion and a year-to-date high of $242.52. Stay informed! 🔗

⚠️ Trading Alert: News & Risk Management 📰

Market-moving news can strike fast! Protect your gains:

Avoid opening trades during major news events.

Use trailing stops to secure profits and minimize losses. 🚫

Join the Raid! 💥

Support our battle plan—smash the Boost Button! 🚀 Let’s conquer the market with the Raider Trading Strategy and stack profits like true stock market legends. 💪🤝 Prepare for the next adventure, raiders! 🤑⚔️🎉

Amazon: Continuing to RiseWith Amazon’s recent climb, prices are edging closer to the top of wave (1) in magenta. However, there is still a bit of upside potential in the short term before wave (2) makes its corrective move. Our primary scenario does not anticipate a new low below $160.50. Instead, we expect wave (3) in magenta to eventually surpass resistance at $242.52. Under our alternative scenario, there is a 30% chance we could see new lows below $160.50. In this case, wave alt.B in beige would have peaked at $242.52, prompting us to focus on a magenta downward impulse.

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do.

Amazon (AMZN) shares jump more than 7%Amazon (AMZN) shares jump more than 7%

As shown in the Amazon (AMZN) share chart, the price surged by over 7% yesterday, breaking above the key psychological level of $200 and closing at its highest point since early March.

The sharp rise in demand was driven by reports of a trade truce between the US and China following talks in Geneva. According to Reuters, the US has decided to lower the “de minimis” threshold on goods from China. This move could help de-escalate a potentially damaging trade war between the world’s two largest economies. For AMZN stock, this is a bullish signal, as Amazon sells a wide range of low-cost Chinese goods.

Technical analysis of Amazon (AMZN) shares

From a bearish perspective, the AMZN price has recovered to the 0.618 Fibonacci retracement level after falling from an all-time high to the early April low. In this context, selling pressure may re-emerge with the intention of resuming the downtrend—especially as most oscillators on the chart are signalling strong overbought conditions.

From a bullish perspective:

→ The pattern of higher highs and higher lows in late April and early May may have outlined the median of an ascending channel;

→ Yesterday’s price surge in AMZN shares may point to the channel’s upper boundary.

Given these conditions, it is reasonable to expect a minor pullback before the Amazon’s stock price resumes its upward trajectory within the blue channel.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Amazon I Detailed analysis and trading plan Welcome back! Let me know your thoughts in the comments!

** Amazon Analysis - Listen to video!

We recommend that you keep this pair on your watchlist and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support!Welcome back! Let me know your thoughts in the comments!