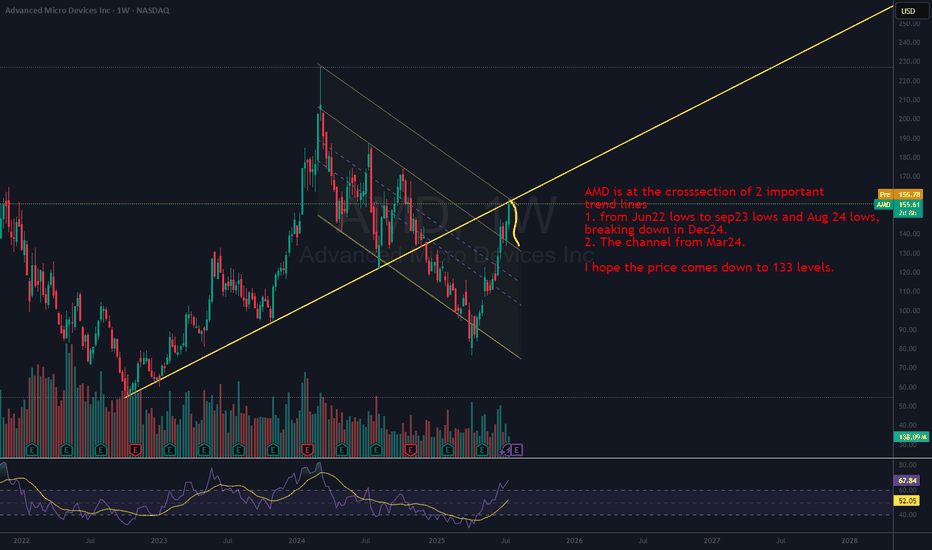

Amd - This correction is not over yet!🤬Amd ( NASDAQ:AMD ) can still drop another -30%:

🔎Analysis summary:

2025 has been an incredible - yet expected - year for Amd. And now, Amd is literally just perfectly rejecting the overall resistance trendline. Looking at higher timeframe structure, Amd is still not done with the drop and can correct another -20% to -30% soon.

📝Levels to watch:

$175

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

Amdshort

Amd - This stock is just crashing!🎯Amd ( NASDAQ:AMD ) is clearly heading lower:

🔎Analysis summary:

After we witnessed a major bullish break and retest in April of 2025, Amd rallied about +150%. But with the recent rejection at the major resistance trendline, Amd is now reversing. Following this bearish market structure, Amd can still correct about -25%.

📝Levels to watch:

$150

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

Amd - Here comes the massive reversal!🩻Amd ( NASDAQ:AMD ) is starting to reverse:

🔎Analysis summary:

Starting back in mid 2025, Amd retested a major confluence of support and rallied about +200%. All of this was expected and the rally ended with a retest of a significant trendline. Eventually, after some back and forth, Amd will then create a short term retracement.

📝Levels to watch:

$250

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

AMD Under Watch ⇌ Sellers Strengthening at Major Supply Zones🔥📉 AMD “ADVANCED MICRO DEVICES INC.” – Bearish Profit Playbook | Thief Layers Deployed 🚨

Hey traders! 😎🔍

Here’s my bearish swing/day-trade playbook on AMD, crafted with a fun + professional thief-style twist while staying within TradingView rules. Let’s break it down 👇💼

📉 Plan: Bearish Outlook Active

Price action remains heavy, momentum cooling off, and sellers showing presence near key zones.

Thief Squad preparing for controlled entries 😎🧤.

🎯 Entry Plan (Thief Layering Strategy)

This setup uses a layered limit-style approach — also known as multiple staggered entries to smooth positions.

📌 Proposed Sell-Limit Layers:

230

220

210

(You can extend layers based on your own system — thief flexibility ALWAYS 😎)

⚠️ Note: These are example layers for illustration, not fixed instructions. Adjust based on your own risk model.

🛑 Stop-Loss (Thief Safety Net)

SL Zone: 240

Dear Ladies & Gentlemen (Thief OG’s) 💼🕶️

This SL is simply my reference point — NOT a rule.

You decide your own SL based on your risk appetite, not mine.

Make money? Then take money… at your OWN risk 💰😄.

🎯 Target Zone

Price has a strong support cluster aligning with:

Moving Averaging acting as dynamic support

Oversold zone building

Trap mechanics likely

So the quick escape target is:

👉 TP: 180

Dear Ladies & Gentlemen (Thief OG’s) 💼😄

My TP is not mandatory — adjust yours as you wish.

Take your profits and leave before the “police” catches our position 🚓💨😆.

🔗 Related Pairs to Watch (Correlation Insights)

These assets often move with similar sentiment due to tech-sector correlation, semiconductor supply chain, and risk-on/off flows:

💻 NVDA (NVIDIA)

Strong semiconductor leader — AMD often shadows NVDA’s volatility and sector direction.

📱 QQQ (NASDAQ 100 ETF)

AMD is inside the NASDAQ index. When QQQ sells off, AMD typically follows the broader tech flow.

🌐 SMH (Semiconductor ETF)

Tracks the entire chip sector. Helps understand overall industry strength or weakness.

⚡ TSLA (Tesla)

Not directly connected, but both ride similar high-beta risk cycles. Weak tech sentiment can drag TSLA and AMD simultaneously.

Watching these helps confirm momentum, risk appetite, and sector-wide signals 📊🔍.

🧠 Additional Notes

This setup is for educational, fun, strategy-style illustration purposes.

NOT forcing a fixed entry, SL, or TP on anyone.

Trade smart. Manage risk. Thief style = creativity + discipline ✨😎

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

Breaking; Advanced Micro Devices, Inc. (AMD) Is Up 7%The price of Advanced Micro Devices, Inc. (AMD) spike 7% in early market trading on Thursday as the stock broke from a bullish flag pattern.

In another news that served as a catalyst, AMD, Cisco and HUMAIN to invest in a joint venture and serve as its exclusive technology partners, deepening their multi-year strategic collaboration announced in May during U.S. President Donald J. Trump's visit to the Kingdom of Saudi Arabia.

The joint venture plans to deploy up to 1 GW of AI infrastructure by 2030, with the shared ambition to expand capacity to multiple gigawatts, as a key pillar of HUMAIN's overall ambitions.

With the RSI at 44, the stock is more than able to break through highs and claim the $300 resistance.

Financial Performance

In 2024, Advanced Micro Devices's revenue was $25.79 billion, an increase of 13.69% compared to the previous year's $22.68 billion. Earnings were $1.64 billion, an increase of 92.15%.

About AMD

Advanced Micro Devices, Inc. operates as a semiconductor company worldwide. It operates in three segments: Data Center, Client and Gaming, and Embedded. The company offers artificial intelligence (AI) accelerators, x86 microprocessors, and graphics processing units (GPUs) as standalone devices or as incorporated into accelerated processing units, chipsets, and data center and professional GPUs; and embedded processors and semi-custom system-on-chip (SoC) products.

Amd - Here comes the major reversal!👺Amd ( NASDAQ:AMD ) is reversing right now:

🔎Analysis summary:

Over the course of the past couple of months, we witnessed a very expected rally on Amd of about +250%. But right now, Amd is retesting a major resistance trendline. If we actually see bearish confirmation in the near future, the next bearmarket will start quite soon.

📝Levels to watch:

$250

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

Advanced Micro Devices, Inc. (AMD) Gearing For A BreakoutThe share price of Advanced Micro Devices, Inc. (NASDAQ: NASDAQ:AMD ) is setting sail for a 50% breakout albeit market condition is overbought.

Sitting with an RSI of 73, Advance Micro Devices (AMD) shows continuous bullish momentum with the daily price chart indicating a golden cross pattern- this is an interception between the 50day-MA and the 200-day MA indicating bullish momentum building.

In another news, - Advance Micro Devices (NASDAQ: AMD) today announced the completion of the agreement to divest the ZT Systems U.S.-headquartered data center infrastructure manufacturing business to Sanmina (NASDAQ: SANM).

About AMD

Advanced Micro Devices, Inc. operates as a semiconductor company worldwide. It operates in three segments: Data Center, Client and Gaming, and Embedded. The company offers artificial intelligence (AI) accelerators, x86 microprocessors, and graphics processing units (GPUs) as standalone devices or as incorporated into accelerated processing units, chipsets, and data center and professional GPUs; and embedded processors and semi-custom system-on-chip (SoC) products, microprocessor and SoC development services and technology.

Amd - The path is too clear!🪓Amd ( NASDAQ:AMD ) will rally another +75%:

🔎Analysis summary:

For the past five years, Amd has been trading in a simple rising channel formation. With the recent retest of a major confluence of support, Amd once again confirmed the bullish trend. Following those previous cycles, Amd will now break the all time high and rally another +75% from here.

📝Levels to watch:

$200

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

Big move for AMD monday inverted H&S greatly confirmed 150USD!!!The pattern have been greatly confirmed for me and i will sell my amd this week at 150 USD and i will wait at july when a drop will occurs to rebuy and i will cumulate more stock or more profits in cash.

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations.

Thank you!

Subcribe TSXGanG! (For real chart)

Bearish forecast for DXYWith regards my previous forecast, we have a strong reaction from Weekly and daily premium arrays.

On the weekly TF, we have IOFED of the SIBI and BSL above previous 2 weeks' highs was taken.

Tf: time frame

IOFED: Institutional Order Flow Express Entry Drill

SIBI: Sellside Imbalance, Buyside Inefficiency.

BSL: Buy side liquidity

DXY Bearish Forecast for Quarter 2, 20251. Technical analysis

The idea is based in ICT's PO3; AMD pattern.

We have a rally above the open price of May 2025, to take out BSL above the highs.

It also aligns with Daily tf premium arrays to short from.

The lowest hanging fruit being the relative equal lows at equilibrium of the dealing range.

2. Fundamental analysis

Investor's confidence in the Dollar is low due to POTUS' tariffs.

ICT: Inner Circle Trader

PO3: Power of 3

AMD: Accumulation, Manipulation & Distribution

BSL: Buy side liquidity

tf: Timeframe

AMD Weekly Options Trade Plan 2025-04-16NASDAQ:AMD AMD Weekly Analysis Summary (2025-04-16)

Below is a synthesis of all the reports and our analysis:

─────────────────────────────

COMPREHENSIVE SUMMARY OF EACH MODEL’S KEY POINTS

─────────────────────────────

• Grok/xAI Report

– Technical indicators show AMD trading below its short‐term moving average and near the lower Bollinger Band.

– Negative MACD histogram and bearish news (export restrictions, potential $800M charge) support a downward bias.

– Recommends a bearish options trade using a near–ATM put – the $89 put at a premium around $1.78 (a higher premium but with a clear bearish thesis).

• Llama/Meta and DeepSeek Reports

– Confirm the bearish bias: price action below key moving averages, negative MACD and extreme moves below support.

– Note that the option chain (and high open interest on lower strikes) points to a greater probability for further decline.

– Both suggest a trade on put options that have a lower premium than the Grok suggestion (with DeepSeek favoring the $85 put at roughly $0.62) for improved risk/reward.

• Gemini/Google Report

– Emphasizes the strong negative catalyst from news and a rapid breakdown below support levels (with current price near $89).

– Technical indicators and volatility (VIX above 30) signal that the underlying is likely to fall further.

– Offers several put strike ideas and finds that the $84 put (premium ca. $0.49) fits the ideal price range; however, liquidity and open interest are better for the $85 strike.

─────────────────────────────

AREAS OF AGREEMENT AND DISAGREEMENT

─────────────────────────────

Agreements:

– All models (except for the one reporting an error) agree that the market sentiment is bearish.

– The negative news catalyst (export controls and potential charges) and the technical breakdown clearly drive the consensus.

– There is broad recognition that options data (with high OI on puts and max pain around $95)

is supportive of a downside move.

Disagreements:

– The primary difference is in the strike selection. Grok favors a put close to the current price (the $89 put) despite its higher premium, while Gemini, Llama/Meta, and DeepSeek lean toward lower strikes ($84–$85) that offer a lower premium (falling in or near our ideal range) and better liquidity for a weekly trade.

─────────────────────────────

CLEAR CONCLUSION & RECOMMENDED TRADE

─────────────────────────────

Overall Market Direction Consensus:

– The overall view is bearish. All models (apart from the one error) indicate that AMD is under significant downside pressure fueled by both technical breakdown and negative news sentiment.

Recommended Trade:

• Trade Type: BUY single‐leg, naked PUT (weekly option only)

• Chosen Strike: $85

– Rationale: The $85 put (ask at $0.64) offers good liquidity (high open interest of 10,218 contracts) and although its premium is slightly above the preferred $0.30–$0.60 range, its risk/reward profile is attractive given the bearish momentum.

• Expiration: April 17, 2025 (weekly options)

• Entry Timing: At market open

• Proposed Parameters:

– Entry Premium: Approximately $0.64

– Profit Target: Around $1.00 (this represents an attractive move if the bearish trend continues)

– Stop Loss: Approximately $0.45 to limit risk if price recovers unexpectedly

• Confidence Level: ~70%

• Key Risks and Considerations:

– Short‐term volatility may create intraday bounces despite the overall bearish trend.

– An oversold reaction or a temporary return toward the max pain level ($95) could adversely affect the trade.

– As this is a news–driven and highly volatile environment, trade size must be limited relative to account size.

─────────────────────────────

TRADE_DETAILS

─────────────────────────────

The final trade parameters in JSON format are shown below.

TRADE_DETAILS (JSON Format)

{

"instrument": "AMD",

"direction": "

put",

"strike": 85.0,

"expiry": "2025-04-17",

"confidence": 0.70,

"profit_target": 1.00,

"stop_loss": 0.45,

"size": 1,

"entry_price": 0.64,

"entry_timing": "open"

}

AMD Analysis: Shorting to $100 as Cup & Handle Pattern FormsHello Traders,

I'm sharing a weekly chart analysis for AMD, where I’ve identified a Cup & Handle pattern. The current price is $148, and it's retesting the broken red trend line.

I suggest considering a short position targeting $100. I've also included a back test for the two previous patterns, which support the validity of the middle red trend line.

It's important to note that if AMD reaches the $100 level, the Cup & Handle pattern above the blue trend line will become valid, potentially targeting even lower levels around $55, or possibly further down.

Additionally, pay attention to the downtrend progression channel in cyan. The current price of $148 is positioned around the resistance of this channel's middle line.

If these scenarios play out, a harmonic pattern may also form, which I will define at a later stage.

Stay cautious and manage your risk!

AMD = The Trader Slayer!NASDAQ:AMD

We got a lot going on here with AMD!

- In the volume gap and could fall down to the shelf at $108 or we could have just hit a double bottom with a breakout spot at $174ish.

-H5 Indicator is RED and they are in a downtrend while also forming a Bull Flag (barely).

-Sitting on the bottom of the Wr% and could form a downtrend box or start running to the upside.

It all makes sense to me. This name is an extremely difficult name to trade and has eaten the best traders whole, myself included.

One thing is clear to me! trying to trade this name right now with all of these mixed signals is risky-business! I'm steering clear until we get some certainty!

No price targets because who knows whats gonna happen. 🤣

Not financial advice.

AMD’s Earnings Stumble | A Golden Opportunity for Investors?Post Earnings Dip, Is AMD ready for a 2025 Comeback?

Shares of Advanced Micro Devices dropped over 10% after releasing its third quarter FY2024 earnings report, which fell short of investors’ expectations. Although the results were not poor, the market had high hopes given AMD's premium stock valuation. The company did surpass revenue projections, but its non GAAP EPS matched market expectations plus the midpoint of its fourth-quarter revenue forecast slightly missed estimates.

In my prior analysis, I upgraded AMD from a sell to a buy after a 20% dip, which realigned market expectations. Since that upgrade, the stock has climbed 15%, outperforming the S&P 500 Index by 9%. The recent earnings-driven decline has brought AMD's stock price close to my previously mentioned level.

While the gaming segment saw a sharper decline in revenue in 3Q, the Data Center GPU division continued to exhibit strong growth, boosting overall revenue growth and improving margins. I believe AMD is still in a strong position to further accelerate revenue growth and margin expansion in the fourth quarter and beyond. As a result, I see the post-earnings dip as a buying opportunity and maintain my buy rating on the stock, supported by its anticipated growth phase justifying its premium valuation.

For 4Q FY2024, AMD projects 21.6% YoY revenue growth at the midpoint of its guidance, with a $300 million potential variance. This growth is expected to be driven by continued expansion in Data Center GPUs. Although the midpoint guidance is slightly below market consensus, I believe AMD could exceed this number, given its track record. My estimate suggests a 24% YoY revenue increase, or $150 million above the midpoint.

3Q EPS Analysis Shows Margin Pressure

AMD has shown consistent margin improvement since 4Q FY2023, though the pace in 3Q didn't meet expectations. EPS aligned with estimates despite revenue exceeding forecasts, indicating margin challenges. Non-GAAP gross margin rose by 50 bps sequentially, while non-GAAP EBIT margin showed strong improvement, rising by 350 bps QoQ.

AMD forecasts a 4Q non-GAAP gross margin of 54% and operating expenses of $2.05 billion, driven by a favorable mix from its Data Center segment, which now represents 52% of total revenue. Management noted that gross margins in the Data Center segment are below the company average, focusing on customer needs and market growth for future gains. This contrasts with NVIDIA (NVDA), which reportedly has higher Data Center margins, though specific figures are not disclosed.

With a 4Q revenue consensus at $7.65 billion, AMD projects a non-GAAP EBIT margin of 27.2%, suggesting an additional 200 bps sequential increase. The company appears well-positioned for both revenue growth and margin improvement, despite its valuation declining after the recent stock pullback.

4Q EPS Outlook Signals Continued Growth

Although 3Q non-GAAP EPS met expectations, AMD’s growth accelerated from 18.1% YoY in 2Q to 32% in 3Q. However, the selloff post-earnings implies that investors anticipated even higher growth. Based on 4Q guidance, I estimate AMD’s non-GAAP EPS at $1.10, marking a 44% YoY increase.

AMD's FCF profile also improved, generating $496 million in 3Q, a 13% QoQ increase despite a one-time acquisition-related expense of $123 million. Higher capital expenditures are expected in FY2025 to support MI300 growth and maintain momentum.

Market Expectations and Valuation Impacts

Before the 10% post 3Q selloff, AMD’s EV/EBITDA TTM was higher than NVIDIA’s, but they are now on par, despite AMD’s margins and growth trailing NVIDIA's. AMD’s non-GAAP EV/EBITDA forward multiple is 46.3x, compared to NVIDIA’s 42.6x, and its forward P/E ratio is 50.4x, 17% above its 5-year average and higher than NVIDIA’s 49.7x.

While AMD's premium valuation can be justified given its growth acceleration, NVIDIA’s triple-digit EPS growth is not expected to continue. Moreover, NVIDIA’s gross margin recently declined, reinforcing the case for AMD’s valuation as it expands its growth in FY2025.

AMD’s stock has retraced to a 0% YTD return due to margin concerns and underperformance in Gaming and Embedded segments, though the latter is gradually recovering. However, the company’s strong Data Center gains and continued margin expansion indicate a solid growth phase. The recent selloff has recalibrated market expectations, and with ongoing AI-driven demand, AMD’s growth is likely to extend into FY2025, making the pullback an attractive buying opportunity.

What you think, Are you Moonish on AMD?

AMD (Advanced Micro Devices) SELL TF H1 TP = 134.58On the H1 chart the trend started on Aug. 21 (linear regression channel).

There is a high probability of profit taking. Possible take profit level is 134.58

Using a trailing stop is also a good idea!

Please leave your feedback, your opinion. I am very interested in it. Thank you!

Good luck!

Regards, WeBelievelnTrading

AMD Investigating Potential Data Breach by Hacking GroupChipmaker AMD is facing a potential data security breach after a hacking group known as IntelBroker claimed to have stolen sensitive information. This information allegedly includes details on upcoming AMD products, customer databases, and internal documents. While leaked screenshots provide some evidence of a compromise, AMD is working with law enforcement to determine the full scope of the breach and mitigate any potential damage.

Investor Jitters and Competitive Risks: The news caused a slight dip in AMD's stock price as investors grappled with the potential consequences. If confirmed, the stolen data could significantly impact AMD's competitive edge, especially if information about future product lines and proprietary technologies is compromised. This wouldn't be the first time AMD has faced such a challenge – the company previously dealt with a data breach in 2022.

Cybersecurity Concerns in the Tech Sector: This incident underscores the escalating threat of cyberattacks within the technology industry. With a reported 78% increase in data breaches from 2022 to 2023, the need for robust cybersecurity strategies and vigilant monitoring is paramount.

Beyond AMD: Broader Implications: The potential breach highlights the far-reaching effects of cyberattacks. Stolen data sold on the dark web can be used for various malicious purposes, impacting not only the targeted company but also its partners, customers, and the entire industry.

Looking Forward: Lessons from the Investigation: As AMD investigates the claims, the outcome will be closely watched not just for its impact on the company's future but also for the broader lessons it offers in the ongoing fight against cybercrime. This incident serves as a stark reminder for all companies to remain proactive and continuously strengthen their cybersecurity defenses against increasingly sophisticated threats.