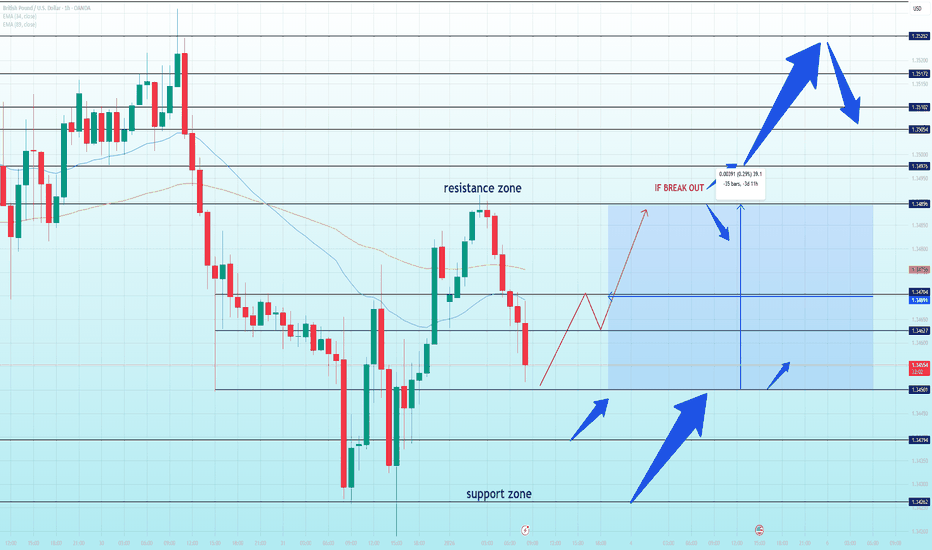

GBP/USD at a Decision Point: Breakout Potential or Another RangeGBP/USD is currently trading inside a clearly defined range structure, with price compressing between a well-respected support zone around 1.3450 and a resistance zone near 1.3490–1.3500. Recent price action shows a sharp recovery from the lower boundary, but upside momentum has stalled again as price re-enters the prior resistance area. This behavior suggests the market is not trending, but rotating liquidity within the range.

From a technical perspective, the rejection from the resistance zone is technically clean. Price failed to hold above the short-term equilibrium and slipped back below the mid-range, indicating that buyers lack conviction at higher levels. The moving averages are flattening and overlapping, reinforcing the idea of balance rather than trend. Until a decisive break occurs, upside moves should be treated as corrective, not impulsive.

The bullish scenario only becomes valid if GBP/USD can break and hold above the 1.3490–1.3500 resistance zone, followed by acceptance above that level. In that case, upside expansion could open toward 1.3510 → 1.3525, where higher-timeframe supply is located. Without that confirmation, any push higher remains vulnerable to rejection.

On the bearish / range-continuation scenario, failure to reclaim resistance keeps price rotating back toward the 1.3450 support zone. A clean breakdown below this support would expose deeper downside toward 1.3430 and below, extending the range rather than reversing the broader structure.

From a macro standpoint, GBP remains sensitive to the USD side of the equation. Persistent USD resilience—supported by relatively restrictive financial conditions and cautious Fed messaging—continues to cap upside in GBP/USD. At the same time, the Bank of England’s stance remains restrictive but growth concerns limit aggressive GBP inflows. This macro backdrop favors choppy, range-bound price action, not clean directional trends.

Summary:

GBP/USD is in a neutral-to-range environment. The market is waiting for confirmation. A sustained break above resistance is required to unlock upside continuation; otherwise, the higher-probability outcome remains range rotation back toward support. Patience and confirmation are key at this level.

Analysis

Gold Turns at Key Support — Break or Fake Into Resistance?Gold on the H1 timeframe has completed a clean rebound from the major support zone, confirming that buyers are actively defending this area. The sharp rejection from the lows suggests the recent sell-off was corrective rather than the start of a sustained bearish trend.

Price is now recovering above the short-term structure and pushing back toward the key resistance zone around 4,425–4,450. This area is critical, as it previously acted as a strong supply region and aligns with prior breakdown levels. The current move should be treated as a reaction leg, not a confirmed continuation yet.

Two clear scenarios are in play.

Scenario 1: Price holds above the recent pullback level, consolidates, and breaks cleanly through resistance. This would open the path toward higher levels and a potential retest of the upper range and ATH zone.

Scenario 2: Price stalls or rejects at resistance, forming a lower high, which would signal ongoing range behavior and a possible rotation back toward mid-range or support.

In summary, Gold has turned bullish from support , but confirmation depends on acceptance above resistance. Until a clean breakout occurs, the market remains reactive and range-controlled, with resistance being the key decision point.

Bitcoin Is Not Escaping Yet — This Is H2 Accumulation Hello everyone,

On the H2 timeframe, the key focus right now is not an immediate breakout, but the fact that Bitcoin remains locked inside a broad accumulation range, where price continues to rotate between clearly defined support and resistance.

Structurally, BTC has spent an extended period compressing inside the 86,200–90,500 range. Multiple upside attempts toward the upper resistance zone have been rejected, while every pullback into the lower support zone has been absorbed. This repeated rotation confirms balance, not trend, and signals that liquidity is still being built.

From a technical perspective, price is currently holding above the EMA34–EMA89 cluster, which has acted as dynamic support during the recent recovery. The latest dip was defended cleanly and followed by a push higher, forming a support-and-retest structure around the 88,200–88,400 area. This behavior shows that buyers are active, but not yet aggressive enough to force acceptance above resistance.

Importantly, there is no structural breakout at this stage. Highs remain capped below the range top, and price action continues to print overlapping swings, typical of accumulation rather than continuation. The projected path on the chart reflects this well: a shallow pullback to retest support, followed by another attempt higher toward resistance.

Resistance zone: ~90,400–90,600 — range high and breakout trigger.

Mid-range support / retest: ~88,200–88,400 — current decision area.

Major support: ~86,200–86,500 — accumulation floor.

Invalidation: Acceptance back below the EMA cluster would weaken the constructive setup.

Only a clean breakout and sustained acceptance above the resistance zone would confirm that accumulation has completed and open the door for upside expansion. Until then, Bitcoin is not trending — it is absorbing liquidity and preparing, where patience and level discipline remain critical.

Wishing you all effective and disciplined trading.

EURUSD Is Not Reversing — This Is a Pullback Into H1 SupportHello everyone,

On the H1 timeframe, the key focus right now is not the recent bearish candles, but how EURUSD is reacting after rejecting from a descending resistance and pulling back into a well-defined support zone.

Structurally, the market remains capped by a descending resistance trendline, with price consistently forming lower highs beneath it. The most recent push higher stalled precisely at the EMA cluster and the resistance zone, where sellers stepped in aggressively. This rejection confirms that upside attempts are still being sold and that bullish momentum has not yet regained control.

Following that rejection, EURUSD is now rotating lower toward the 1.1720–1.1730 support zone, which has already acted as a strong reaction base in previous sessions. This area is technically important: it marks prior demand and has previously absorbed selling pressure before producing sharp rebounds. The current move lower appears orderly and corrective, rather than an impulsive breakdown.

From a price action perspective, there is no confirmed trend reversal at this stage. The decline into support fits well with a pullback within a broader corrective structure, not a fresh bearish expansion. As long as price holds above the support zone, downside follow-through remains limited.

The projected path on the chart reflects this logic:

A test or sweep of the 1.1720 support zone to check demand

A technical rebound back toward the mid-range

Potential continuation higher toward the descending resistance if buyers regain strength

Only a clean breakdown and acceptance below the support zone would invalidate this pullback scenario and open the door for deeper downside. Conversely, a reclaim above the EMA cluster and descending trendline would be the first signal that bearish pressure is fading and that a larger recovery toward resistance is possible.

Until confirmation appears, EURUSD is not trending aggressively in either direction. It is rebalancing after rejection, and patience around key levels remains critical.

Wishing you all effective and disciplined trading.

Fundamental Market Analysis for January 5, 2025 EURUSDEUR/USD on Monday, January 5, is holding near 1.16800–1.17000. The US dollar is strengthening at the start of the first full week of 2026 as investors refocus on fresh US macro data and reduce risk appetite. Sentiment is also influenced by heightened geopolitical uncertainty: when headlines escalate, demand for defensive assets typically supports the dollar.

The key focus today is US manufacturing activity data and its impact on expectations for the Federal Reserve’s policy rate in 2026. If the figures prove resilient, it becomes harder for the market to price in rapid rate cuts, giving the dollar an additional tailwind. Another volatility driver is anticipation of a decision on the next Fed Chair candidate, which increases sensitivity to comments and shifts in forecasts.

In the euro area, there are fewer immediate catalysts. The ECB aims to keep inflation near target, while the recovery remains uneven. With the US agenda dominating and investors staying cautious, the euro may remain under pressure—especially if incoming US data confirms solid demand and employment conditions.

Trading recommendation: SELL 1.16850, SL 1.17150, TP 1.15950

Gold at a Tipping PointHello Traders,

Gold is currently trading within a short-term recovery structure after forming a clear swing low and establishing a rising support trendline. Price has respected this ascending support well, producing higher lows and signaling that buyers are gradually regaining control following the prior impulsive sell-off.

At the moment, price is pressing into a clearly defined resistance zone. This area previously acted as supply and now represents a critical decision point for the market. The recent bullish push into this zone suggests growing momentum, but continuation is not confirmed until acceptance above resistance is seen.

If price breaks above this resistance and holds, the structure opens the door for upside continuation toward the next higher liquidity levels. In this scenario, the preferred execution is not chasing the initial breakout, but waiting for a pullback that successfully retests the broken resistance as support. This confirms acceptance and provides a cleaner risk-to-reward framework.

Alternatively, failure to hold above the resistance could result in a corrective rotation. A rejection here would likely send price back toward the rising support trendline. As long as this support remains intact, such a move would still be considered a healthy pullback within an emerging bullish structure rather than a reversal.

The bullish outlook is invalidated if price decisively breaks below the ascending support and accepts beneath the recent swing low. That would signal a structural failure and shift the market back into a bearish or neutral regime.

At this stage, Gold is at a decision zone rather than an execution zone. Patience is required. Let price confirm whether it accepts above resistance or rotates back toward support before committing to directional bias.

Share your perspective below.

Can Bitcoin Hold This Level?Hello Traders,

On the H1 timeframe, Bitcoin is currently trading back into a clearly defined resistance zone after recovering from the prior sell-off. The recent price action shows a series of higher lows, indicating short-term bullish pressure rebuilding as price rotates upward toward supply.

This resistance zone is a key decision area. Historically, this level has acted as a distribution zone, and price reaction here will determine whether the move develops into a sustained continuation or another corrective rotation.

If price manages to break above the resistance and hold with acceptance, the structure opens the path toward higher targets, as marked on the chart. In this scenario, continuation would likely unfold in stages, with upside extensions toward Target 1, then Target 2, and potentially Target 3, assuming structure remains intact.

However, failure to accept above resistance would likely trigger a pullback. A rejection from this zone could rotate price back toward the mid-range support levels. As long as price holds above the broader support zone, such a move would still be considered a corrective pullback within a developing recovery, not a full bearish reversal.

The bullish continuation scenario is invalidated if price decisively breaks below the marked support zone and shows acceptance below it. That would signal a structural failure and reopen the downside.

At this point, Bitcoin is not at a high-conviction entry area but at a decision zone. Patience and confirmation are required. Let the market show whether it accepts above resistance or rotates back toward support before committing to directional bias.

Share your view below.

USDJPY — Multi-Timeframe Short Bias (1M, 1Week,D / 4H)After a choppy bullish move, price is now reacting to a fresh 4H supply zone, where selling pressure is beginning to show. This area aligns well with higher-timeframe resistance and presents a potential downside opportunity.

From a daily and 4H perspective, market structure shows signs of weakening momentum as price struggles to continue higher. The setup highlighted on the chart offers a 1:2 risk-to-reward, targeting the downside if supply holds.

Zooming out to the monthly timeframe, price is currently trading into a fresh higher-timeframe supply zone. As we move into January, momentum appears to be slowing, I suggesting distribution at these levels.

This technical view is further supported by fundamentals:

Recent COT data shows increasing strength in the Japanese Yen

The U.S. Dollar is weakening as price reacts to higher-timeframe resistance

If supply continues to hold, price could rotate lower toward the 149.960 zone.

This is my current bias on USDJPY.

As always, waiting for confirmation is key.

Happy trading 📊

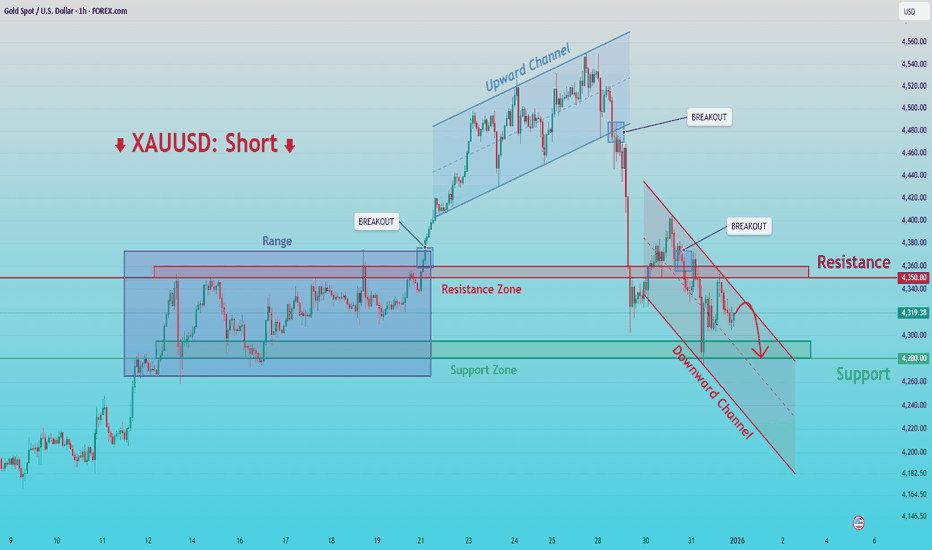

XAUUSD Short: Rejection from Supply – 4,340 Demand as TargetHello traders! Here’s a clear technical breakdown of XAUUSD (1H) based on the current chart structure. After an extended bullish phase, Gold was trading inside a well-defined ascending channel, confirming strong buyer control and a sequence of higher highs and higher lows. During this phase, price respected the channel structure multiple times, using the lower boundary as dynamic support. Before the impulsive move higher, XAUUSD also formed two visible consolidation ranges, indicating accumulation prior to expansion. A clean breakout from the upper range triggered strong upside momentum and accelerated price toward the upper channel boundary.

Currently, XAUUSD is trading near the Demand Zone around 4,340, which aligns with a rising trend line and a previous reaction area. A recent dip below this level resulted in a fake breakout, followed by a quick recovery back above demand, suggesting buyers are still active in this zone. Price is now reacting upward from demand, but remains capped below the 4,400 supply area, keeping the structure corrective rather than fully bullish.

My scenario: as long as XAUUSD remains below the 4,400 Supply Zone, the bias favors sellers. I expect price to show rejection signals in this area—such as long upper wicks, bearish engulfing candles, or failed breakouts—followed by renewed downside pressure. The first downside target is a move back toward the 4,340 Demand Zone. A clean breakdown and acceptance below this level would confirm bearish continuation and open the door for a deeper move toward lower support levels. Manage your risk!

EURUSD Holding Buyer Zone - Rebound Toward 1.1780 in FocusHello traders! Here’s my technical outlook on EURUSD (2H) based on the current chart structure. EURUSD is trading within a broader bullish structure after a strong upside move from the lower levels. Earlier, price advanced inside an ascending channel, confirming sustained buyer control and a sequence of higher highs and higher lows. Following this impulsive rally, EURUSD broke above a key structure level and transitioned into a consolidation phase near the highs. Currently, price is reacting around the Buyer Zone near 1.1740, which aligns with a key Support Level and a previous breakout area. This zone has already shown multiple reactions, indicating active demand. Above, the market remains capped by a descending Resistance Line and the Seller Zone around 1.1780, where selling pressure previously caused a rejection. The recent move into support appears corrective rather than impulsive, suggesting a pause within the broader bullish trend. My scenario: as long as EURUSD holds above the 1.1740 Buyer Zone, the bullish structure remains intact. A strong reaction from this area could lead to another push toward the 1.1780 Resistance Level (TP1). A confirmed breakout and acceptance above resistance would open the door for further upside continuation. However, a decisive breakdown below the buyer zone would weaken the bullish setup and signal a deeper corrective move toward lower support levels. For now, price remains at a key decision area, with buyers defending structure while consolidation continues. Please share this idea with your friends and click Boost 🚀

EURUSD Awaiting Confirmation Before Bearish ContinuationQuick Summary

EURUSD has rallied strongly in recent days leaving a clear liquidity void below price .. A break above 1.18039 is expected first After that a bearish structure is required to confirm that the upside move is complete and that price is ready to target lower levels

Full Analysis

After the strong bullish expansion on EURUSD the market left a significant liquidity void below current price, This makes a downside move likely at some point However selling directly into this strength is not justified without clear confirmation

From a Liquidity perspective price is expected to first break the high at 1.18039 This move would allow the market to collect remaining buy side liquidity and complete the upside objective Once this high is taken the focus will shift to price behavior and structure

A bearish structure must appear after the break of 1.18039 This would be the key confirmation that bullish momentum has weakened and that the market is transitioning from expansion to distribution Without this confirmation any sell position would be premature and exposed to further upside continuation

BTCUSDT (W1)🔍 Market Structure

For many months, the uptrend has been in a channel – clear higher highs and higher lows.

A breakout from the uptrend channel → indicates a change in market structure (BOS) to weekly.

The current move is a correction after a downward impulse, not a new uptrend.

➡️ HTF Bias: BEARISH / Corrective

🧱 Key Levels

🟢 Resistance (now resistance)

98,000 – 100,000 → former support, currently flipping to resistance

109,000 → strong weekly supply / EQ of the previous range

~125,000 → upper band of the old channel (unrealistic without a change in structure)

🔴 Support

85,400 → current reaction zone (local demand)

74,300 → key weekly demand, a very important level

Below: ~68–70k (another HTF zone – not marked, but logical)

📉 Price Action

Strong, impulsive bearish candle + long lower wick → liquidations + panic sell

No strong upward momentum after the rebound → weak demand

Current move = bear flag / bear range

➡️ This does NOT look like the end of the correction.

📊 Volume

High volume on the decline → distribution

Declining volume on the bounce → no real buyers

➡️ Classic pattern: dump → weak bounce → continuation

📈 Indicators

Stochastic RSI (W1)

In the oversold zone, but:

No strong bullish cross + no price impulse

➡️ May grind low for many weeks

CHOP

Falling → market preparing for a bigger move

Direction still more down than up

🧠 Scenarios

🟥 Baseline scenario (most likely)

Rejection 98-100k

Return to 85k

Test 74k

Only then the decision is made: bounce vs. Deeper bear market

🟩 Alternative scenario (less likely)

Weekly close above 100k

Retest of 98k as support

Only then can we consider 109k

❗ Key takeaways

❌ This is not a good time to go long on HTF

❌ The current rebound is a pullback, not a reversal

✅ Shorts only on retests of resistance

✅ Spot DCA only makes sense at 74k ±

GBPUSD Range Based Point of InterestQuick Summary

GBPUSD price action is currently unclear, Two key levels stand out at 1.34015 and 1.35020

Both levels showed strong reactions with large wicks from FVG

These areas will be treated as points of interest with targeting the opposite level

Full Analysis

At the moment GBPUSD price action is somewhat confusing and lacks a clear directional bias

The market has highlighted two very important levels that deserve attention

The first level is the low at 1.34015

The second level is the high at 1.35020

At both of these areas price reacted strongly and formed large wicks with immediate rejection from FVG

This behavior indicates that both zones contain significant liquidity and strong participation from both buyers and sellers

Because of these two levels will act as main points of interest, The plan is to remain patient and wait for price to reach either one of them

If price reaches one of these zones a trade will be considered targeting the opposite level

This approach allows trading within a clearly defined range while respecting the strong reactions already shown by the market.

BTCUSDT Long: Demand Support Intact, Next Test at $89,000Hello traders! Here’s a clear technical breakdown of BTCUSDT (4H) based on the current chart structure. After a strong bearish impulse, Bitcoin was trading inside a well-defined descending channel, reflecting sustained seller control. This bearish phase ended with a clear breakdown and a sharp reaction from a key pivot low, where buyers stepped in aggressively, marking an important structural shift. From this pivot point, BTC transitioned into a consolidation phase, forming a broad range, which signals balance between buyers and sellers after the impulsive move. Price respected both the upper and lower boundaries of this range multiple times, confirming it as a valid accumulation zone. Eventually, Bitcoin broke below the range briefly, but this move was quickly absorbed by buyers near the Demand Zone around 86,800, leading to a strong recovery and reclaim of structure.

Currently, BTCUSDT is trading above the rising Demand Line, having confirmed a breakout and subsequent retest. Price is gradually moving higher toward the Supply Zone near 89,000, where multiple tests and rejections have already occurred. This area represents a key resistance, with sellers actively defending it, as shown by repeated reactions and failed continuation attempts.

My scenario: as long as BTCUSDT holds above the 86,800 Demand Zone and respects the rising demand line, the bias remains bullish and corrective pullbacks are likely to attract buyers. A clean breakout and acceptance above the 89,000 Supply Zone would confirm bullish continuation and open the door for further upside. However, failure to hold demand and a breakdown below the demand line would invalidate the bullish scenario and shift focus back toward range lows. For now, price is compressing between demand and supply, and a decisive move is likely ahead. Manage your risk!

EURUSD Long: Demand at 1.1720 Sets Up a Push Toward 1.1770Hello traders! Here’s a clear technical breakdown of EURUSD (2H) based on the current chart structure. After forming a solid pivot low, EURUSD transitioned into a bullish trend, supported by a rising trend line that guided price action higher. Following this move, the market entered a consolidation range, signaling temporary balance before the next expansion phase. Price later broke out of the range to the upside, confirming renewed buyer strength. However, upon reaching the upper Supply Zone near 1.1770–1.1780, EURUSD experienced a fake breakout, followed by rejection and increased selling pressure. This rejection highlighted active sellers defending supply. Despite this, buyers managed to push price higher again, leading to another breakout attempt above supply, though momentum remained limited.

Currently, EURUSD is pulling back from the supply area and is trading near the Demand Zone around 1.1720, which aligns with the rising demand line and prior breakout structure. This zone represents a key decision area, where buyers may attempt to defend the bullish structure.

My scenario: as long as EURUSD holds above the 1.1720 Demand Zone, the broader bullish structure remains intact, and the pullback can be considered corrective. A strong reaction from demand could lead to another test of the 1.1770 Supply Zone. However, a decisive breakdown below demand would signal a loss of bullish control and open the door for a deeper corrective move. For now, price is at a critical level, with demand acting as the key area to watch. Manage your risk!

XAUUSD: Rejection at 4,350 Resistance Signals Further DownsideHello everyone, here is my breakdown of the current XAUUSD setup.

Market Analysis

XAUUSD previously traded within a well-defined upward channel, confirming a strong bullish structure during that phase. Price then broke down from the channel, signaling a loss of bullish momentum and a shift in market control. After the breakdown, Gold attempted to recover but was capped by a clearly defined Resistance Zone around 4,350, which previously acted as a key level during the range phase.

Currently, price formed a lower high and transitioned into a downward channel, confirming bearish continuation. Multiple breakout attempts above descending resistance were rejected, reinforcing seller dominance. The market is now trading below the former resistance, with structure favoring further downside pressure. Below current price, a Support Zone near 4,280 is visible, acting as the next key area where buyers may attempt to slow the decline.

My Scenario & Strategy

My primary scenario: as long as XAUUSD remains below the 4,350 Resistance Zone and continues to respect the downward channel, the bearish bias remains valid. Any pullbacks into resistance that show rejection can be viewed as short opportunities, with downside continuation toward the 4,280 Support Zone as the primary target.

However, a clean break and acceptance above resistance would invalidate the short scenario and suggest a potential shift back toward consolidation or recovery. Until then, structure favors sellers, with momentum aligned to the downside.

That's the setup I'm tracking. Thank you for your attention, and always manage your risk.

BTCUSDT: Range Compression Signals Potential Break Above $90,100Hello everyone, here is my breakdown of the current BTCUSDT setup.

Market Analysis

BTCUSDT is trading within a broader consolidation after a strong bearish impulse earlier in the chart. Following the sell-off, price found a key support base around the 87,300 Support Zone, from which buyers stepped in and stabilized the market. Since then, Bitcoin has been moving inside a series of well-defined ranges, indicating compression and balance between buyers and sellers. Structurally, price is capped by a descending triangle resistance line, while at the same time respecting a rising trend line from below. This creates a tightening structure, suggesting a potential directional move ahead.

Currently, BTC is consolidating above the support zone and just below the 90,100 Resistance Zone, which has repeatedly rejected price in recent attempts. The latest pullbacks remain shallow and corrective, showing that sellers are struggling to push price back below support.

My Scenario & Strategy

My primary scenario as long as BTCUSDT holds above the 87,300 Support Zone, the structure remains constructive and biased toward a bullish resolution. A sustained hold above support could allow price to build momentum for another push toward the 90,100 Resistance Zone. A clean breakout and acceptance above this resistance would confirm bullish continuation and open the door for further upside.

However, a decisive breakdown below the support zone would invalidate the bullish scenario and shift focus toward lower levels. For now, BTC remains compressed between support and resistance, with buyers defending structure and pressure building for a potential breakout.

That's the setup I'm tracking. Thank you for your attention, and always manage your risk.

XAUUSD Fake Breakout at 4,520 - Price Tests Buyer Zone at 4,260Hello traders! Here’s my technical outlook on XAUUSD (4H) based on the current chart structure. Gold is trading within a broader ascending channel, confirming a dominant bullish structure despite the recent sharp pullback. After a strong impulsive rally, price respected the channel support and continued forming higher highs and higher lows, highlighting sustained buyer control throughout the trend. Currently, XAUUSD is trading below the broken channel support and has entered the Buyer Zone around 4,260, which aligns with a key Support Level and a prior breakout area. This zone represents an important reaction area where buyers may attempt to regain control. The projected path suggests a possible corrective bounce from this level, but overall price action remains vulnerable as long as it stays below the former resistance and channel structure. My scenario: as long as XAUUSD remains below the 4,520 Seller Zone and fails to reclaim the broken channel support, the bias favors further downside or consolidation. A clean hold above the Buyer Zone could trigger a short-term rebound toward the mid-channel area, while a decisive breakdown below 4,260 would open the door for a deeper corrective move. Please share this idea with your friends and click Boost 🚀

Ethereum Is Not Chasing — It’s Compressing Beneath Resistance Hello everyone,

On the H2 timeframe, the key focus right now is not an immediate breakout, but how Ethereum is steadily rebuilding structure while pressing into a major resistance zone. The market is transitioning from range rotation into controlled compression, a typical pre-expansion behavior.

Structurally, ETH has respected the 2,880–2,920 support zone multiple times, producing higher reaction lows and preventing any downside follow-through. Each sell-off into this area has been absorbed, while rebounds have grown progressively stronger. This establishes a defended base rather than a distribution floor.

From a technical standpoint, price is now holding above EMA34 and EMA89, with both averages beginning to slope upward. The recent pullbacks have been shallow and orderly, indicating that buyers are maintaining positions rather than exiting. This is not impulsive buying; it is acceptance at higher prices.

Overhead, the 3,060–3,090 resistance zone remains the key obstacle. Previous approaches into this zone resulted in sharp rejections, which explains the current hesitation. However, the difference this time is structure: higher lows into resistance and tightening ranges suggest pressure building, not exhaustion.

The projected path on the chart reflects this logic:

Continued consolidation just below resistance

A brief pullback to retest dynamic support (EMA cluster)

A renewed push higher, with a clean break and acceptance above resistance opening the door toward the next upside extension

Only a decisive loss of the EMA cluster and acceptance back below 2,950 would weaken this constructive setup. Until then, ETH is not overextended. It is compressing beneath resistance, and the market is preparing for resolution rather than reversal.

Wishing you all effective and disciplined trading.