EURUSD Bearish Bias With CautionQuick Summary

The bearish view on EURUSD remains valid and A clear orderflow has formed on the M15 timeframe which supports further downside, However this orderflow may also act as trendline liquidity and attract price higher

Selling should only be considered with a clear reversal signal like a rejection candle with long wick

Full Analysis

The bearish outlook on EURUSD continues to develop as price has formed a clear orderflow on the 15 minute timeframe

This structure is typically a strong indication of bearish pressure and suggests that sellers are still in control

Despite this bearish signal it is important to remain cautious

This type of orderflow can sometimes represent trendline liquidity which may attract price upward before the actual downside move resumes

For this reason entering sell positions without confirmation carries risk

A clear reversal signal is required to validate bearish continuation and confirm that the move is not simply a liquidity grab to the upside

Analysis

XAUUSD Short: Trend Line Break Signals Downside ContinuationHello traders! Here’s a clear technical breakdown of XAUUSD (3H) based on the current chart structure. Gold previously traded inside a well-defined range, indicating a phase of accumulation before buyers gained control. From this range, price broke out to the upside and followed a rising trend line, confirming a strong bullish impulse and a clear shift in market structure. The trend remained intact as price continued to form higher highs and higher lows.

Currently, gold is trading below the broken trend line and moving toward the Demand Zone near 4,320, which aligns with a previous breakout area and an important horizontal reaction level. Below this area lies the next Demand Zone around 4,270, which represents the next key downside target if selling pressure continues. The move lower appears impulsive, suggesting that the market is entering a corrective or reversal phase rather than a simple pullback.

My scenario: as long as XAUUSD remains below the Supply Zone and stays under the broken trend line, the bias favors sellers. I expect continuation to the downside toward the 4,320 Demand Zone, with a possible extension to 4,270 if bearish momentum remains strong. A strong bullish reaction from demand could lead to short-term consolidation, but without reclaiming the trend line, any upside remains corrective. Manage your risk!

BTCUSDT Long: Buyers Defend Channel Support, Upside in FocusHello traders! Here’s a clear technical breakdown of BTCUSDT (4H) based on the current chart structure. After a prolonged consolidation phase defined by a broad range, BTC established multiple internal breakouts, highlighting volatility but no clear directional dominance. This range acted as an accumulation zone, with price repeatedly reacting around key horizontal levels. From the lower boundary of the range, BTC formed a clear pivot low, which marked the start of a bullish recovery and shift in short-term market structure.

Currently, BTC is holding above the Demand Zone around 86,800, which aligns with prior range support and the lower boundary of the ascending channel. This area has already shown buyer reaction, reinforcing it as a key level for continuation. Price is now attempting to push higher toward the upper boundary of the channel.

My scenario: as long as BTCUSDT holds above the Demand Zone and respects the ascending channel support, the bias remains bullish. I expect buyers to defend this area and attempt a move back toward the 89,000 Supply/Resistance Zone as the first target. A clean breakout and acceptance above this level would confirm bullish continuation and open the path toward higher targets within the channel. A breakdown below demand would invalidate the long scenario. Manage your risk!

EURUSD: Bullish Structure Holds - Market Eyes 1.1810 ResistanceHello everyone, here is my breakdown of the current EURUSD setup.

Market Analysis

EURUSD is trading within a well-defined bullish structure after breaking out of a descending triangle formation, signaling a clear shift in control from sellers to buyers. The initial breakout was followed by a brief consolidation phase, where price formed a tight range, suggesting accumulation rather than distribution. After this pause, the pair continued higher and successfully broke above the triangle resistance line, confirming bullish continuation.

Currently, EURUSD is trading above a rising trend line, which continues to act as dynamic support. The market recently tested the Resistance Zone around 1.1810, where selling pressure appeared, leading to a short-term pullback. This retracement is now developing toward the Support Zone near 1.1760, which aligns with the previous breakout area and the ascending structure. As long as price holds above this support, the broader bullish trend remains intact and the pullback appears corrective.

My Scenario & Strategy

My primary scenario remains bullish while EURUSD holds above the 1.1760 Support Zone. I expect buyers to defend this area and push price higher for another attempt toward the 1.1810 Resistance Zone.

Therefore, a clean breakout and acceptance above resistance would confirm bullish continuation and open the way for further upside expansion. However, a decisive breakdown below support would weaken the structure and signal a deeper correction. For now, price action continues to favor buyers as long as the ascending structure holds.

That's the setup I'm tracking. Thank you for your attention, and always manage your risk.

XAUUSD: Bullish Trend Remains Intact in Rising ChannelHello everyone, here is my breakdown of the current XAUUSD (Gold) setup.

Market Analysis

Gold has confirmed a bullish shift after breaking out of a prior triangle structure, where price was previously compressed between descending resistance and ascending support. This breakout marked a clear change in market structure and initiated a strong impulsive move higher. After the breakout, price transitioned into a consolidation range, indicating temporary balance before continuation.

Currently, XAUUSD established a clear upward channel, respecting both the lower channel support and the ascending trend line. This structure confirms sustained bullish momentum with higher highs and higher lows. Price has continued to trend higher and recently pushed into a key Resistance Zone, where the market is currently showing signs of reaction and testing supply. Below current price, the former resistance has flipped into a well-defined Support Zone, which aligns with the prior breakout level and the lower boundary of the upward channel. This area has already shown buyer response, reinforcing its importance as a demand zone within the bullish structure.

My Scenario & Strategy

My primary scenario remains bullish as long as XAUUSD holds above the Support Zone and respects the upward channel structure. I expect buyers to defend this area and attempt another push toward the Resistance Zone. A successful breakout and acceptance above resistance would confirm continuation of the bullish trend and open the path toward higher targets.

However, a strong rejection at resistance followed by a breakdown below the support zone would weaken the bullish structure and suggest a deeper correction or consolidation. For now, price action continues to favor buyers while the ascending structure remains intact.

That’s the setup I’m tracking. Thank you for your attention, and always manage your risk.

BTCUSDT Above Support - $88,900 Resistance in PlayHello traders! Here’s my technical outlook on BTCUSDT (1H) based on the current chart structure. BTCUSDT is trading within a broader ascending channel, confirming an overall bullish structure despite recent volatility. After a sharp drop earlier on the chart, price formed a clear base and started to grow, establishing higher lows along the channel’s support line. This recovery phase shows that buyers remain active and are defending key levels. Price then moved into a consolidation area between a clearly defined Buyer Zone (support) and Seller Zone (resistance), creating a range-like environment inside the channel. Multiple breakouts and false moves around the Seller Zone highlight strong supply pressure in this area, while repeated defenses of the Buyer Zone confirm solid demand. The dashed midline reflects interim structure guiding price action within the channel. Currently, BTC is holding above the Support Level around the Buyer Zone (~87,300), while facing overhead Resistance near the Seller Zone (~88,900). The projected move suggests a potential bounce from support toward resistance, with TP1 aligned near the upper resistance area inside the channel. My scenario: as long as BTCUSDT holds above the Buyer Zone and the ascending support line, the bias remains bullish, with a move toward the resistance and TP1 as the primary objective. A strong rejection from resistance could lead to further consolidation. However, a clean breakdown below support would invalidate the bullish setup and signal a deeper pullback. Please share this idea with your friends and click Boost 🚀

EURUSD Failed Break Above 1.1800 Opens Path to 1.1740Hello traders! Here’s my technical outlook on EURUSD (4H) based on the current chart structure. EURUSD is trading within a broader bullish structure after breaking above a descending resistance formation earlier on the chart, signaling a clear shift in market control from sellers to buyers. Following this breakout, price entered a consolidation phase, forming a well-defined range, which reflected temporary balance before trend continuation. The subsequent upside breakout from this range, supported by a rising trend line, confirmed renewed bullish momentum and continuation of the upward structure. Currently, price is testing a key Resistance Level near 1.1800, where a fake breakout has already occurred, suggesting potential exhaustion of buyers at the highs. This resistance aligns with a descending resistance line, increasing the probability of seller reaction. Below current price, the former resistance has flipped into a Support Level around 1.1740, overlapping with the Buyer Zone and the previous breakout area, making it a critical demand region. My scenario: as long as price is rejected from the 1.1800 resistance, a corrective move toward 1.1740 is likely (TP1). A clean breakdown below support would open the door for a deeper pullback. A confirmed breakout above 1.1800 would invalidate the short bias and signal further upside. Please share this idea with your friends and click Boost 🚀

Fundamental Market Analysis for December 31, 2025 GBPUSDGBP/USD is trading near 1.34600–1.34700 ahead of the New Year after a quiet session. Sterling remains relatively resilient, but the market is heading into January with increased caution: low liquidity amplifies the impact of headlines and can cause sharper moves even in the absence of major data releases.

In the UK, investors continue to reassess the rate outlook after the Bank of England’s December cut to 3.75% (with a close voting split) and guidance suggesting further easing may be gradual as inflation slows. Cooling signals from the labour market also weigh on the pound, as they can reduce sterling’s relative advantage.

In the US, the dollar finds support because the Fed minutes reflected significant disagreement after the cut to 3.50–3.75% and hinted at a smaller number of moves in 2026. If expectations for US easing are revised toward a more limited scale, GBP/USD may shift into a corrective phase from current levels.

Trading recommendation: SELL 1.34600, SL 1.34900, TP 1.33700

What will the price of gold be on the last day of the year?1️⃣ Trendline

Medium-term: The uptrend remains valid (price has not broken the major ascending trendline).

Short-term: Corrective decline. Price has broken below the EMA and the short-term ascending trendline → selling pressure dominates.

Current structure: Sideways–bearish movement within a converging wedge/triangle, tight range → waiting for a breakout.

2️⃣ Resistance

4,425 – 4,427: Strong resistance (confluence of Fibo 0.5 + 0.618 + broken trendline).

4,452 – 4,454: Higher resistance (previous distribution zone).

3️⃣ Support

4,300 – 4,302: Near-term support (short-term swing low inside the wedge).

4,275 – 4,277: Strong support (medium-term ascending trendline + demand zone).

4️⃣ Main Scenarios

SELL priority: If price pulls back to 4,425 – 4,427 and gets rejected.

BUY only when: Clear breakout and candle close above 4,425, confirming a short-term reversal.

Risk: A break below 4,300 increases the probability of a test toward 4,270 – 4,280.

📌 Trade Setups

BUY GOLD: 4,300 – 4,302

Stop Loss: 4,390

Take Profit: 100 – 300 – 500 pips

SELL GOLD: 4,425 – 4,427

Stop Loss: 4,435

Take Profit: 100 – 300 – 500 pips

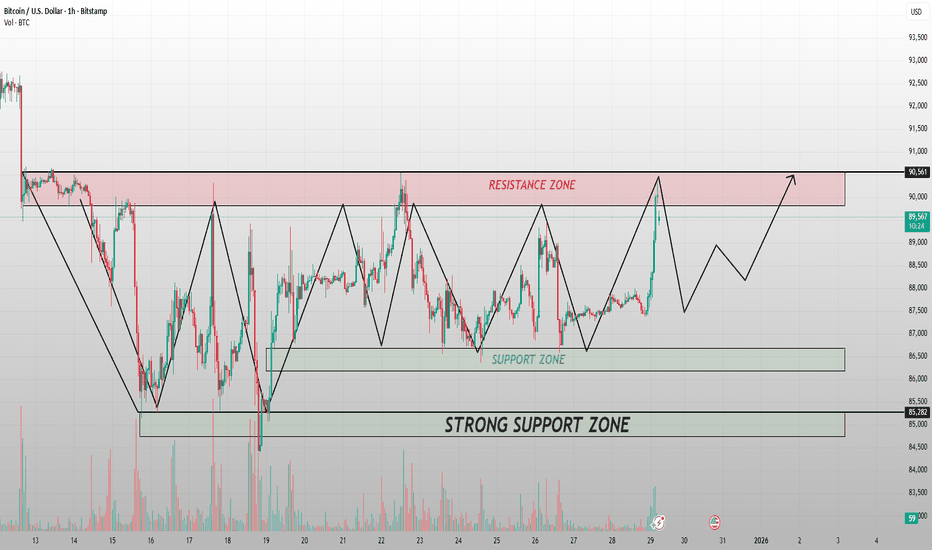

Bitcoin Is Compressing — Range Control Before the Next ExpansionOn the 1H timeframe, Bitcoin remains locked in a well-defined range structure, capped by a strong resistance zone around $89,800–$90,500 and supported by demand between $86,800–$87,200. Price has repeatedly failed to achieve acceptance above resistance, while sellers also lack follow-through below support. This behavior confirms that the market is not trending, but rotating liquidity within a controlled environment.

From a market structure perspective, the repeated swing highs into resistance followed by sharp pullbacks suggest distribution rather than breakout pressure. Each push toward the upper boundary has been met with aggressive selling, indicating that larger participants are using higher prices to offload positions instead of initiating continuation. Until resistance is decisively reclaimed, upside moves should be treated as range highs, not trend signals.

The area labeled as the accumulation zone in the mid-range reflects prolonged consolidation with overlapping candles and reduced volatility. This is typical of a market waiting for external confirmation. Price acceptance here shows balance between buyers and sellers, but importantly, balance is not direction. A breakout from such zones requires volume expansion and structural follow-through, neither of which is currently present.

On the downside, the support zone around $86,500–$87,000 continues to act as a reliable demand pocket. Each test has produced a reaction, confirming short-term buyer interest. However, below this lies a stronger macro support near $85,200, which represents the level where bullish structure would be meaningfully threatened if broken. A clean loss of this zone would shift the broader bias toward downside continuation.

In summary, Bitcoin is in a classic range-bound environment. The market is compressing energy between clearly defined levels, and directional conviction remains absent. Until price breaks and holds above $90,500 or loses $86,500 with momentum, the optimal approach remains range-based execution and patience. The next impulsive move will come from resolution — not prediction.

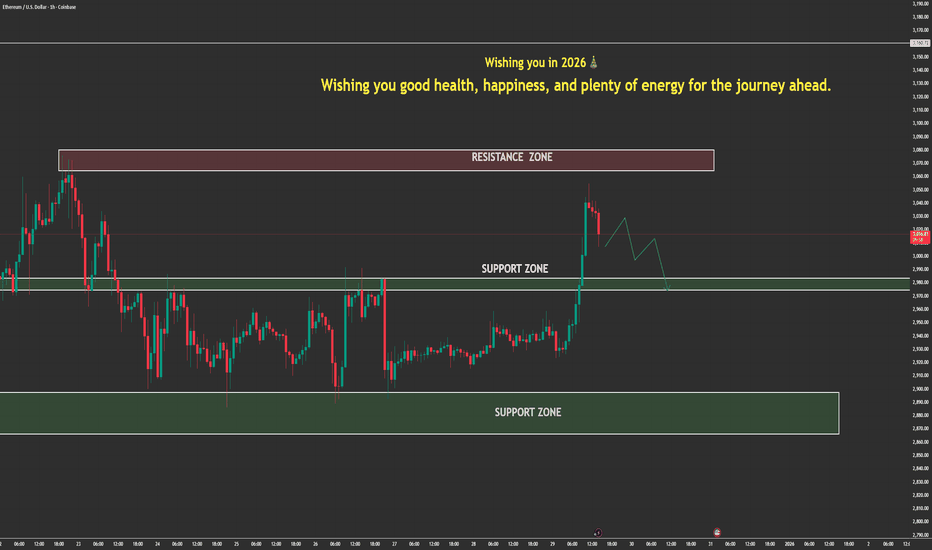

ETH — Relief Rally or Another Distribution Trap?On the 1H timeframe, Ethereum is staging a sharp rebound back into a well-defined resistance zone around 2,980–3,000, following a strong sell-off from above 3,030. While the bullish impulse candle appears aggressive at first glance, structurally this move is best interpreted as a counter-trend reaction rather than a confirmed trend reversal. Price is still trading below the prior breakdown area, where selling pressure previously accelerated.

From a market structure perspective, ETH shows clear signs of distribution near the highs. The impulsive rejection from the 3,030 area was followed by a sequence of lower highs and lower lows, indicating that sellers regained control after liquidity was taken above resistance. The current rebound lacks follow-through and occurs inside a known supply zone, increasing the probability of another rejection rather than sustained upside continuation.

The support zone around 2,890–2,910 remains the key downside reference. This area has previously absorbed selling pressure, but it has now been tested multiple times. Each subsequent reaction has become less impulsive, suggesting weakening demand rather than strong accumulation. If price fails to hold above 2,950 and rolls over from resistance, a rotation back toward this support zone becomes the higher-probability scenario.

From a broader macro and risk environment, crypto assets remain sensitive to U.S. dollar stability, Treasury yields, and overall risk sentiment. Without a clear risk-on catalyst or strong volume expansion, upside moves into resistance are vulnerable to selling, particularly during low-liquidity conditions where false breakouts are common.

In summary, ETH is currently trapped between short-term resistance and fragile support. As long as price remains capped below 3,000, the structure favors range trading to bearish continuation, not trend expansion. A clean rejection from resistance would reinforce downside risk toward 2,900, while only a sustained acceptance above 3,030 would meaningfully shift the technical bias.

Holding Support — The Range Is Still in PlayEURUSD remains in a range-to-reaccumulation structure, with price holding above a well-defined support zone around 1.1745–1.1750. Buyers continue to defend dips, while upside attempts are capped below the 1.1805–1.1815 resistance zone, keeping the market in consolidation rather than expansion.

The recent higher low suggests demand is still active. As long as price holds above support, upside continuation toward the upper range remains the favored path.

Resistance: 1.1805 – 1.1815

Support: 1.1745 – 1.1750

Range focus: 1.1750 – 1.1815

➡️ Primary: support holds → higher lows → rotation toward 1.1805–1.1815.

⚠️ Risk: clean break below 1.1745 → deeper pullback before buyers reassess.

Happy New Year 2026 TRADERSAs we close the chapter on 2025, it’s worth acknowledging what this year truly tested — not just strategies, but discipline, patience, and emotional control. The market offered moments of clarity and long stretches of uncertainty, sharp trends followed by brutal consolidations, and powerful macro moves that rewarded preparation while punishing impulse. Every win came from respecting structure, and every loss carried a lesson for those willing to learn from it.

To all traders who stayed committed to the process managing risk, protecting capital, and waiting for high-probability setups this year has strengthened you more than any single trade ever could. Progress in trading is built quietly, over time, through consistency and self-control.

As we step into 2026, may your decisions be calm, your risk disciplined, and your confidence grounded in experience rather than emotion. May you trade with clarity, adapt quickly, and continue evolving with the market. Wishing every trader health, resilience, and a year ahead filled with focus, growth, and sustainable profitability.

HAPPY NEW YEAR 2026

EURUSD Short: Failed Break 1.1800 - Demand at 1.1740 as TargetHello traders! Here’s a clear technical breakdown of EURUSD (4H) based on the current chart structure. After a prolonged consolidation phase marked by a broad range, EURUSD formed a clear pivot low and transitioned into a bullish recovery. From that pivot point, price established a well-defined ascending channel, confirming a shift in market structure and sustained buyer control through higher highs and higher lows.

Currently, price is trading below a key Supply Zone near 1.1800, where a fake breakout occurred, indicating strong selling pressure at the highs. This rejection from supply suggests that buyers struggled to gain acceptance above resistance. Following the rejection, price broke below short-term structure and is now pulling back toward the 1.1740 Demand Zone, which aligns with prior breakout structure and the lower boundary of the ascending channel.

My scenario:as long as EURUSD remains below the 1.1800 Supply Zone, the risk of a bearish reaction stays elevated. A clear rejection from this resistance area, especially with bearish confirmation, would favor short positions, targeting a move back toward the 1.1740 Demand Zone as the first objective. Manage your risk!

What the Market Is Actually Doing Right NowBitcoin continues to trade inside a clearly defined horizontal range, and the latest 1H price action reinforces that this market is still in distribution–accumulation rotation rather than trend continuation.

Price is currently reacting just below the $90,000–$90,500 resistance zone, an area that has repeatedly capped upside attempts over the past sessions. Every impulsive move into this zone has been met with immediate rejection, indicating that sell-side liquidity remains heavy and that larger players are using this level to offload positions rather than chase breakout momentum. Importantly, these rejections are occurring without follow-through volume, confirming the absence of strong bullish commitment.

On the downside , Bitcoin continues to respect the $86,500–$86,000 support zone , with a deeper strong support area around $85,200–$85,500 . Each rotation lower into these zones has attracted responsive buying, but notably buyers are not pushing price to new highs, only back toward range highs. This behavior confirms a mean-reversion environment , where price oscillates between liquidity pools instead of forming a directional trend.

Structurally, Bitcoin is printing lower highs within the range, while lows remain defended. This creates internal compression and signals that the market is waiting for a catalyst. Until either side of the range breaks decisively, both bullish and bearish narratives remain incomplete. A clean hourly and daily close above $90,500 would invalidate the range and open the path toward higher continuation targets. Conversely, a break and acceptance below $85,200 would expose downside expansion toward lower demand zones.

From a macro perspective, this consolidation aligns with the broader market context. Risk assets are currently lacking fresh drivers as Federal Reserve rate-cut expectations remain uncertain , and liquidity conditions are stable but not accelerating. Without a strong shift in macro liquidity or a surge in institutional inflows, Bitcoin is behaving exactly as expected rotating, absorbing orders, and building a larger move.

In summary, Bitcoin remains neutral and range-bound , not weak, but not ready for sustained upside yet. Traders should respect the range, remain patient, and avoid chasing moves in the middle. The real opportunity will come only after a confirmed breakout , not before.

Gold’s Sharp Sell-Off Is a Reset, Not the Start of a Bear TrendHello everyone,

Price OANDA:XAUUSD has now reacted strongly from the 4.30x–4.32x demand zone, which aligns with a previous base and marks the end of the impulsive leg down. The current bounce should be viewed as a technical reaction, not a trend reversal. Structurally, this fits well with the early stages of an ABC corrective structure.

4.38x–4.40x: first resistance zone, previously broken support and near EMA34. This is a high-probability reaction area for sellers (wave A).

4.34x–4.35x: potential pullback zone (wave B) if price fails to reclaim structure.

4.46x–4.48x: corrective upside extension (wave C) if momentum sustains, but still within a corrective context.

Price continues to rebound to retest the 4.40x – 4.41x zone (short-term resistance / Wave A).

- A corrective phase B may occur here before:

- If buying pressure is strong enough → price continues wave C, heading towards a higher zone (4.48x – 4.50x).

- If the price fails to break through zone A and is strongly rejected, the market will return to a sideways consolidation phase within the Liquidity range, needing more time to absorb supply.

Only a clean reclaim above EMA89 and acceptance back above the broken channel would signal that buyers have regained control and reopen the path toward the 4.55x–4.60x region. Until that happens, any upside movement on H1 should be treated as corrective rebalancing after a completed trend, not a fresh impulsive advance.

Wishing you all effective and disciplined trading.

Fundamental Market Analysis for December 30, 2025 EURUSDThe market remains cautious ahead of the release of the minutes from the Federal Reserve’s December meeting. Investors are assessing how quickly the regulator may be ready to continue cutting rates in 2026 and how the outlook could be influenced by employment and consumer inflation data. With thinner year-end liquidity, any new emphasis in the commentary can amplify swings in the dollar.

The euro is being supported by inflows into European assets amid a narrowing yield gap and firmer inflation expectations in the euro area. At the same time, market participants are closely watching signals from the European Central Bank: a faster rise in prices would push it to keep rates unchanged for longer, while weak manufacturing and demand data would increase the likelihood of further measures to support the economy.

Another key factor remains the debate around U.S. fiscal policy and possible trade restrictions, which supports demand for currency diversification and reduces reliance on the dollar as the sole safe anchor. If the Fed minutes confirm a cautious, data-dependent approach, the euro may gain room for moderate appreciation over the coming sessions.

Trading recommendation: BUY 1.17700, SL 1.17350, TP 1.18750

Gold Just Absorbed a Sharp Sell-Off — This Is a PullbackGOLD (XAUUSD) — 1H Market Analysis

Gold remains firmly within a primary bullish structure , despite the recent aggressive bearish candle. The current price action is best interpreted as a technical pullback into dynamic support , not a breakdown. The market is resetting momentum after a strong impulsive leg higher.

1) Market Structure: Bullish Trend Still Intact

The broader structure continues to show:

- Higher highs and higher lows on the intraday trend

- Price still trading above the 89 EMA, which is acting as a medium-term trend support

- The recent sell-off failed to break the last structural higher low

This confirms that buyers remain in control, and the decline is corrective rather than impulsive.

2) Key Technical Levels (Execution Zones)

Support Zone 4,470 – 4,450

Confluence of:

- EMA 89 (~4,476)

- Prior breakout structure

The long lower wick shows strong buy-side absorption at this level.

If this zone holds, the bullish trend remains valid.

Resistance & Upside Targets

- Target 1: 4,505 – 4,520

First reaction zone after the bounce

- Target 2: 4,525 – 4,550

Previous consolidation high

- Target 3: 4,580 – 4,600

Measured move extension + psychological round number

High probability zone for partial profit-taking

3) Momentum & Moving Averages

- EMA 34 has been briefly lost but price is attempting to reclaim it

- EMA 89 remains unbroken → trend bias stays bullish

- Momentum reset is healthy after the prior impulsive rally

In strong trends, price often pulls back to EMA 89 before expanding again.

4) Macro Context: Why Gold Is Still Supported

- Gold strength is not random it is backed by macro tailwinds:

- U.S. Dollar weakness continues to support precious metals

- Expectations of future rate cuts keep real yields under pressure

- Ongoing geopolitical uncertainty sustains safe-haven demand

- Central bank gold accumulation remains structurally supportive

These factors limit downside risk and favor dip-buying behavior rather than trend reversal selling.

5) Scenarios Going Forward

Bullish Continuation (Primary Scenario)

Price holds above 4,450

Reclaims 4,500

Extension toward 4,550 → 4,600

Bearish Invalid Scenario

Clean breakdown and acceptance below 4,450

Would expose 4,420 – 4,400

Only then would the bullish structure be compromised

Final Assessment

This move is a controlled pullback within a strong uptrend, not a bearish signal. As long as price holds above the EMA 89 and structural support, the path of least resistance remains upward.

Smart money buys pullbacks — not tops — and the current zone is exactly where trend continuation setups usually form.

ETH/USD – H1 Technical Analysis DetailETH/USD – H1 Technical Analysis

Ethereum has just delivered a strong impulsive breakout from the consolidation structure around 2,950–2,980, pushing price decisively above the prior balance area and reclaiming the psychological $3,000 level. This move is technically significant because it comes after an extended period of compression, where liquidity was building on both sides of the range.

From a structure perspective, ETH has flipped the former resistance zone around 2,980–3,000 into a new support zone. The impulsive bullish candle was accompanied by a clear volume expansion, confirming that this was not a false breakout but rather active participation from buyers. As long as price holds above this reclaimed support, the bullish structure remains intact.

The next key levels are clearly defined:

Immediate support: 2,980–3,000

Resistance 1: ~3,033

Major resistance: ~3,073

A healthy pullback into the 3,000 zone would be structurally bullish, allowing the market to build a higher low before attempting continuation toward 3,030 → 3,070. A clean break and acceptance above 3,073 would open the door for a broader upside expansion on higher timeframes.

On the macro backdrop, ETH is benefiting from a stable risk-on environment, with crypto sentiment supported by expectations of easier monetary conditions in 2026, declining US real yields, and continued institutional positioning in large-cap digital assets. As long as Bitcoin holds its higher range and the USD remains capped, Ethereum retains upside potential.

Conclusion:

This is no longer a range trade. ETH has shifted into a bullish continuation phase, with pullbacks likely to be corrective rather than trend-reversing. The market now favors buying dips above $3,000, not chasing breakouts blindly, while respecting that failure back below 2,980 would invalidate the bullish scenario.

Gold Just Broke Its Rising ChannelGold (XAUUSD) – H1 Technical & Macro Analysis

Gold has shifted from a bullish continuation structure into a clear distribution and breakdown phase . After trending higher inside a rising channel, price failed to sustain momentum near the upper boundary around 4,520–4,540 , forming lower highs and showing repeated rejection. This behavior signals that buying pressure has been absorbed and smart money has begun distributing positions rather than pushing price higher.

From a technical structure standpoint, the critical signal was the clean break below the rising channel support near 4,480–4,460. This breakdown invalidates the bullish channel and confirms a short-term trend reversal. The subsequent pullback attempts were weak and corrective, indicating that sellers are now in control. As long as price remains below 4,500, the market structure favors downside continuation rather than a bullish recovery.

Key levels to monitor:

Broken support /new resistance: 4,480–4,500

Intermediate support: ~4,420

Major downside target: 4,340–4,300 (previous demand & liquidity zone)

On the macro side, gold is currently pressured by stabilizing US yields and a resilient US dollar , which reduce the attractiveness of non-yielding assets like gold. Additionally, the absence of immediate geopolitical escalation or aggressive dovish signals from the Federal Reserve has cooled safe-haven demand. With markets pricing a more gradual rate-cut path, gold is losing short-term momentum despite its longer-term bullish narrative.

Conclusion:

Gold has transitioned from an uptrend into a bearish corrective phase on the H1 timeframe. Any bounce toward 4,480–4,500 is technically a sell-the-rally opportunity, not a trend reversal, unless price reclaims and holds above the broken channel. Until then, the probability favors continued downside toward 4,420 and potentially 4,300 , where stronger demand may re-emerge.

Will gold continue to correct in the last two days of the year?1️⃣ Trend Line

Medium-term trend: Upward, but short-term is undergoing a sharp correction.

The price has broken the upward trend line and closed below the EMA, indicating that short-term selling pressure is dominant.

Current structure: Technical correction within a short-term downtrend.

2️⃣ Resistance

4.413 – 4.415: Strong resistance (combination of the broken trend line + previous support zone).

3️⃣ Support

4.300 – 4.303: Important support zone, recent reaction bottom.

A clear break below this area → continued downside risk.

4️⃣ Trading Scenario

Prioritize selling when the price corrects to 4.413 – 4.415, waiting for confirmation signals.

Only consider buying if the price holds above 4,300 and forms a clear reversal pattern.

BUY GOLD: 4,300 – 4,302

Stop loss: 4,292

Take profit: 100 – 300 – 500 pips

SELL GOLD: 4,413 – 4,415

Stop loss: 4,423

Take profit: 100 – 300 – 500 pips

ETH Is at a Make-or-Break ZoneEthereum is currently trading inside a clearly defined range, capped by major resistance around 3,160 and supported by a key demand zone near 2,980, with a deeper structural support around 2,780. The recent impulsive rally was decisively rejected at resistance, confirming that sellers are still defending the upper boundary of this range.

From a technical perspective, price action shows classic range behavior. After the rejection, ETH rotated back toward the mid-range and is now hovering just above support (~2,980). As long as this level holds on a closing basis, the market structure remains neutral-to-bullish within the range. A successful defense here would likely lead to a rebound toward 3,060 and a retest of the 3,160 resistance zone.

However, a clean breakdown below 2,980, especially with strong volume and a 1H/4H close, would invalidate the range floor and open downside continuation toward 2,900, followed by the major liquidity pocket around 2,780.

On the macro side, year-end conditions are playing a critical role. Holiday liquidity is thin, which statistically increases the probability of false breakouts and liquidity sweeps rather than clean trend continuations. At the same time, recent Federal Reserve adjustments to liquidity conditions and easing expectations around monetary policy have kept risk assets supported, but without enough conviction to force a decisive breakout. Crypto markets are therefore reacting more to positioning and short-term flows than to long-term macro repricing.

For Ethereum specifically, the broader narrative around institutional adoption, staking yield, and ETF-related expectations continues to provide medium-term support. That said, these factors are not yet strong enough to override the current technical range in the short term.

Bottom line: ETH remains a range-bound market. As long as 2,980 holds, upside rotations toward 3,060–3,160 remain the higher-probability scenario. A confirmed break below support would shift control back to sellers and expose 2,900 → 2,780. Until a decisive breakout occurs, traders should expect sideways price action with sharp intraday swings, typical of the Christmas trading period.

This Resistance Test Will Decide the Next 10% MoveETH/USD – 1H Market Analysis

Ethereum is currently locked in a clear range structure, trading between a major support zone around 2,880–2,920 and a well-defined resistance zone near 3,060–3,120. Price has already tested both extremes multiple times, confirming that this is not a trending environment yet, but a controlled consolidation where liquidity is being built.

From a structural perspective, ETH is forming repeated higher lows inside the range, while sellers continue to defend the resistance zone aggressively. This behavior reflects compression, not weakness. The market is balancing orders, shaking out impatience, and preparing for expansion rather than reversing impulsively.

Forward Scenarios to Watch:

Primary scenario (Higher probability): Another pullback toward the mid-range or support zone, followed by a rotation higher and a renewed test of resistance.

Bullish continuation: A clean hourly close above 3,120 with acceptance opens upside toward 3,200–3,280.

Bearish invalidation: A decisive breakdown below 2,880 would shift the structure bearish and target the lower demand zone.

Bottom line:

Ethereum is not breaking out yet it’s compressing. This is the phase where smart money positions quietly, while reactive traders get chopped. The breakout will come, but only after liquidity has been fully harvested. Patience remains the edge.