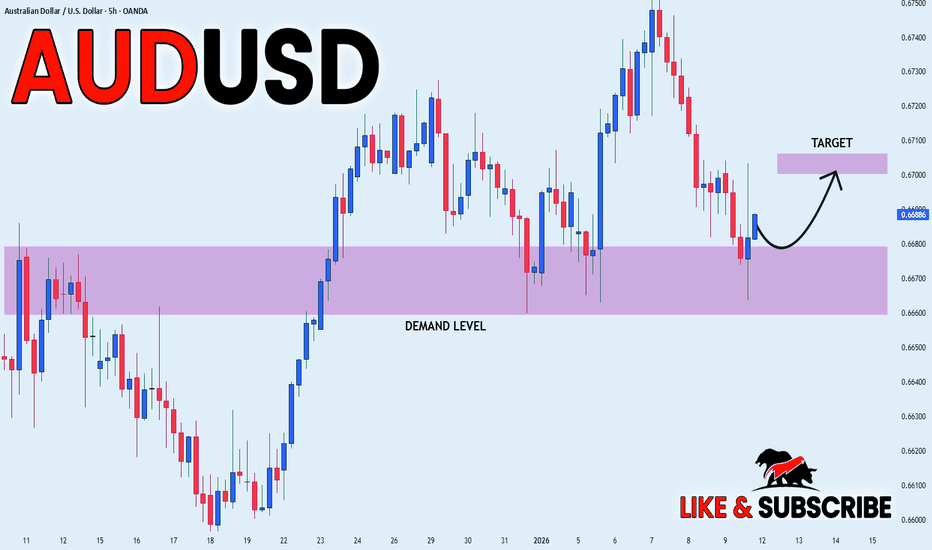

AUDUSD REBOUND AHEAD|LONG|

✅AUDUSD is reacting from a discounted ICT demand zone after a corrective pullback. Bullish structure remains intact, with mitigation holding and price expected to expand higher toward resting buy-side liquidity above recent highs. Time Frame 5H.

LONG🚀

✅Like and subscribe to never miss a new idea!✅

AUDUSD

AUDUSD Massive Long! BUY!

My dear friends,

Please, find my technical outlook for AUDUSD below:

The instrument tests an important psychological level 0.6675

Bias - Bullish

Technical Indicators: Supper Trend gives a precise Bullish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 0.6699

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

AUDUSD Will Go Up From Support! Long!

Take a look at our analysis for AUDUSD.

Time Frame: 1h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The price is testing a key support 0.668.

Current market trend & oversold RSI makes me think that buyers will push the price. I will anticipate a bullish movement at least to 0.670 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Like and subscribe and comment my ideas if you enjoy them!

AUD/USD Is Under Bearish PressureAUD/USD Is Under Bearish Pressure

As indicated by the AUD/USD chart, the Australian dollar has fallen below the 0.6680 level today, with the decline from Wednesday’s high (A) exceeding 1.1%.

Key bearish drivers include:

→ Declining inflation expectations. Data released on Wednesday showed a sharp slowdown in Australian inflation to 3.4%. This has removed the likelihood of a February rate hike by the Reserve Bank of Australia, which had previously maintained a hawkish stance.

→ Uncertainty surrounding China. The economy of Australia’s main trading partner is failing to deliver the expected strong growth, with today’s PMI data coming in mixed. This raises doubts about Chinese demand for Australian commodities and weighs on the AUD, which is often viewed as a proxy for the Chinese economy.

→ NFP-related risk aversion. Ahead of today’s US labour market report, investors are shifting into risk-reduction mode and increasing demand for so-called safe-haven US dollars amid concerns over potential negative surprises.

Technical Analysis of AUD/USD

On 26 December, we drew an ascending channel, which remained in place at the start of 2026. However, the following developments should be noted:

→ the current downward move represents a bearish breakout below the lower boundary of the channel;

→ the bullish impulse that began on 5 January (marked by the arrow) has been fully neutralised.

These signals point to a meaningful shift in market sentiment, clearly reflected in price action. Should bulls attempt to bring AUD/USD back within the ascending channel, resistance might emerge near 0.6720, where the sharp sell-off began on 8 January, highlighting the dominance of sellers.

The release of high-impact news could fuel further downside momentum, opening the way for the continuation of the descending trajectory (highlighted in red).

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

AUDUSD: pullback toward 0.66🛠 Technical Analysis: On the H4 chart, AUDUSD is printing a "Rising Wedge", which often signals a potential corrective move after an extended climb. Price is currently stalling near the upper boundary of the wedge, while the nearest structure support sits around 0.66728 (close to the rising SMA cluster). The broader uptrend is still intact above the SMA 200, but a breakdown of wedge support would confirm a bearish correction. In that case, the next downside magnet becomes the 0.66000 support area highlighted on the chart.

———————————————

❗️ Trade Parameters (SELL)

———————————————

➡️ Entry Point: Sell near 0.6738 – 0.6740 (rejection area inside the wedge)

🎯 Take Profit: 0.66728, extended target 0.66000

🔴 Stop Loss: 0.67923

⚠️ Disclaimer: This is a potential trade idea based on current analysis; market conditions and price direction are subject to change based on news factors and volatility.

TheGrove | AUDUSD Sell | Idea Trading AnalysisYou can expect a reaction in the direction of selling from the specified Support zone

AUDUSD moving higher as it tests the strong resistance level..

We expect a bearish move from the confluence zone.

Hello Traders, here is the full analysis.

I think we can soon see more fall from this range! GOOD LUCK! Great SELL opportunity AUDUSD

I still did my best and this is the most likely count for me at the moment.

-------------------

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 🤝

EURUSD: bearish view before NFP🛠 Technical Analysis: On the H4 chart, EURUSD has broken below the rising support line, turning the recent upswing into a local bearish setup. Price is now trading under the key moving-average cluster (SMA50/100 around 1.1714–1.1735) with the SMA200 near 1.1690 acting as additional overhead resistance. The current zone around 1.1646–1.1631 is an important support area, and a confirmed breakdown would validate continuation to the next demand level. The primary downside target is the marked support at 1.15491.

———————————————

❗️ Trade Parameters (SELL)

———————————————

➡️ Entry Point: Sell when the 1.16440 support zone is broken (approx. 1.16300)

🎯 Take Profit: 1.15491

🔴 Stop Loss: 1.16851

⚠️ Disclaimer: This is a potential trade idea based on current analysis; market conditions and price direction are subject to change based on news factors and volatility.

AUDUSD — FRGNT FUN COUPON FRIDAY DAILY CHART FORECAST📅 Q1 | D9 | W1 | Y26

📊 AUDUSD — FRGNT FUN COUPON FRIDAY DAILY CHART FORECAST

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

FX:AUDUSD

AUD/USD H1 | Bullish Reversal SetupBased on the H1 chart analysis, we can see that the price has bounced off our buy entry level at 0.6683, which aligns with the 78.6% Fibonacci retracement.

Our stop loss is set at 0.6660, which is a pullback support.

Our take profit is set at 0.6717, which is an overlap resistance that is slightly above the 38.2% Fibonacci retracement.

High Risk Investment Warning

Stratos Markets Limited (

AUD-USD Local Long! Buy!

Hello,Traders!

AUDUSD has reacted into a well-defined horizontal demand zone after a corrective sell-off. Sell-side liquidity has been swept, with clear smart money mitigation and bullish response forming, suggesting continuation toward higher liquidity pools and premium pricing. Time Frame 10H.

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Stop!Loss|Market View: AUDUSD🙌 Stop!Loss team welcomes you❗️

In this post, we're going to talk about the near-term outlook for the AUDUSD currency pair☝️

Potential trade setup:

🔔Entry level: 0.66813

💰TP: 0.65955

⛔️SL: 0.67244

"Market View" - a brief analysis of trading instruments, covering the most important aspects of the FOREX market.

👇 In the comments 👇 you can type the trading instrument you'd like to analyze, and we'll talk about it in our next posts.

💬 Description: Most instruments are trading near key levels that will lead to impulse movements. AUDUSD is one such trading instrument, where the price is trading near the support of an ascending channel. Markets are also actively anticipating the release of this week's most important data, namely, the Non-Farm data (NFP). Ahead of this event, the technical picture favors sellers over buyers, but sharply negative NFI data will certainly lead to immediate weakening of the USD.

Thanks for your support 🚀

Profits for all ✅

Bullish bounce off?AUD/USD has bounced off the support level, which is a pullback support that aligns with the 78.6% Fibonacci retracement, and could bounce from this level to our take profit.

Entry: 0.6685

Why we like it:

There is a pullback support that aligns with the 78.6% Fibonacci retracement.

Stop loss: 0.6665

Why we like it:

There is a multi-swing low support.

Take profit: 0.6712

Why we like it:

There is a pullback resistance that aligns with the 38.2% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

USD/JPY | What's next? (READ THE CAPTION)As you can see in the hourly chart of USDJPY, in the early hours of today, it managed to break through the NWOG and the FVG, going as high as 156.955, before dropping to the low of the FVG at 156.460. Currently it's being traded at 156.680 and it's retesting the NWOG. I expect it to continue working the NWOG and FVG. Bullish targets are: 156.780, 156.860, 156.940 and 157.020.

EUR/USD | Falling further? (READ THE CAPTION)By analysing the 2h chart of EURUSD, it can be seen that after hitting 1.17429 on Teusday morning, EURUSD has been gradually dropping in price, falling into the FVG and consolidating there for a while, and then going as low as 1.16728, but by hitting the high of the next FVG it retraced a bit and now is being traded at 1.16810.

I expect EURUSD to retest the FVG above soon at 1.16850. If it goes through the FVG, the targets are: 1.16860, 1.16930, 1.17000 and 1.17070.

If it fails, then the bearish targets are: 1.16730, 1.16660, 1.16590 and 1.16520.

GBP/USD | Bearish momentum continues? (READ THE CAPTION)As you can see in the hourly chart of GBPUSD, ever since it hit the low of the FVG at 1.35630, it has been in a bearish move, falling over 100 pips since Teusday morning, and is being traded at 1.34540, stuck in the NWOG.

I expect a reaction to the Consequent Encroachment (C.E.) of the wick of the orderblock that is shown in the chart, at 1.34390.

Targets for the GBPUSD are: 1.34620, 1.34680 and 1.34740.

Bearish drop off?Aussie (AUD/USD) is reacting off the pivot and could drop to the overlap support that aligns with the 61.8% Fibonacci retracement.

Pivot: 0.6718

1st Support: 0.6666

1st Resistance: 0.6752

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

AUDUSD — FRGNT DAILY CHART FORECAST Q1 | D8 | W1 | Y26📅 Q1 | D8 | W1 | Y26

📊 AUDUSD — FRGNT DAILY CHART FORECAST

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

FX:AUDUSD

AUDUSD(20260108)Today's AnalysisMarket News:

U.S. Energy Secretary Chris Wright stated that the Trump administration plans to take over Venezuela's future oil sales and use the proceeds to rebuild the country's economy.

"If we control where the oil flows and the cash flow generated from those sales, we will have tremendous leverage," Wright said Wednesday at the Goldman Sachs Energy, Clean Technology, and Utilities conference in Miami. "We need that leverage and control over oil sales to drive the necessary changes in Venezuela." Wright anticipates that Venezuela's daily crude oil production could increase by hundreds of thousands of barrels in the short to medium term. The U.S. government plans to deposit the proceeds into government accounts to benefit the Venezuelan people.

Technical Analysis:

Today's Buy/Sell Threshold:

0.6733

Support and Resistance Levels:

0.6783

0.6764

0.6752

0.6714

0.6703

0.6684

Trading Strategy:

If the price breaks above 0.6733, consider buying with a first target price of 0.6752.

If the price breaks below 0.6714, consider selling with a first target price of 0.6703.

AUD/USD – Corrective pressure emerges after inflation coolsIt can be observed that AUD/USD is starting to show signs of slowing down after a relatively smooth advance. While the medium-term trend has not been fully broken , the latest macroeconomic factors from Australia are making the market more cautious toward the AUD.

From a fundamental perspective, Australia’s November CPI fell more than expected (3.4% vs. a 3.6% forecast and down from 3.8% previously). This indicates that headline inflation pressures are easing rapidly, particularly due to lower electricity prices. For the market, this development reduces expectations that the RBA will maintain a hawkish stance, thereby adding short-term downside pressure on the AUD — despite core inflation remaining sticky.

On the chart, AUD/USD has moved close to the resistance zone around 0.6780 within its ascending channel and is starting to show signs of exhaustion. Price is pulling away from the upper boundary of the channel, while 0.6730 stands out as the nearest support level. The current structure leans more toward a technical correction rather than a renewed bullish breakout.

In the base scenario, if selling pressure persists , AUD/USD may pull back to retest 0.6730, or even extend lower toward the lower support area of the ascending channel. Only if core CPI unexpectedly shifts RBA policy expectations would the AUD have a chance to regain immediate upside momentum.

Overall, AUD/USD is entering a necessary “cool-off” phase . With inflation easing and technical resistance overhead, the current pullback is more likely a rebalancing move before the market commits to a clearer directional bias.

AUDUSD📊 OANDA:AUDUSD Technical Analysis (4H Timeframe)

The overall trend for AUD/USD is strongly bullish, as evidenced by the consistent formation of higher highs and higher lows 📈. The price is currently trading comfortably above the EMA 200 (black line), which shows a clear upward slope, confirming long-term buyer control. The EMA 50 (red line) is also trending upwards and providing immediate dynamic support, highlighting robust bullish momentum. Looking at the candle bodies, we see significant strength in the recent impulsive moves. Currently, the price is testing a major resistance zone near 0.67550 USD. A clean break and hold above this grey box would confirm the continuation of the trend toward the next structural targets 🚀.

🔑 Key Levels to Watch:

Primary Resistance Target: 0.68190 USD (Top Grey Box) 🚩

Immediate Resistance: 0.67550 USD (Current Grey Box) 💡

Dynamic Support 1: 0.66850 USD (EMA 50 / Broken Resistance) 🎯

Dynamic Support 2: 0.66330 USD (EMA 200 / Grey Box) ⚡

Structural Support: 0.66000 USD & 0.65700 USD (Dashed Lines) 🛡️

Major Demand Zone: 0.64270 USD (Origin Grey Box) 🏗️

USD/JPY | What's next? (READ THE CAPTION)In the hourly chart of USDJPY, we can see that in the early hours of the day, it reached the Consequent Encroachment of the NWOG at 156.810, and then dropping to below the low of the FVG at 156.294 and now is back in the FVG, being traded at 156.52. If USDJPY fails to hold in the FVG and drops further, the targets are: 156.440, 156.370, 156.300 and 156.230.

If it holds, the targets are: 153.590, 156.660, 156730 and 156.800.

AUD/USD | Drop further or going back high? (READ THE CAPTION)By analysing the hourly chart of AUDUSD, we can see that after hitting a high at 0.67666, it dropped all the way to 673640, now being traded at 0.67390. AUD has hit the NDOG twice and retraced higher, but it is struggling to make meaningful upwards move. If it goes lower than the NDOG, the Targets are: 0.67300, 067170 and 0.67040.

If it holds above the NDOG, the targets are: 0.67420, 0.67550, 0.67680 and 0.67810.

AUDUSD Potential Bullish Bias | 0.66500 Support + USD Weakness!Hey Traders,

In today’s trading session, we are closely monitoring AUDUSD for a potential buying opportunity around the 0.66500 zone. AUDUSD remains in a well-established uptrend and is currently experiencing a healthy corrective pullback, approaching a key trendline confluence and the 0.66500 support & resistance zone, which may act as a strong demand area for bullish continuation.

From a fundamental perspective, increasing expectations of a potential interest rate cut at the upcoming FOMC meeting continue to weigh on the US Dollar. Ongoing USD weakness typically supports risk-sensitive currencies such as the Australian Dollar, further strengthening the bullish bias on AUDUSD.

As always, wait for confirmation before entry and manage risk responsibly.

Trade safe,

Joe.