ZEC - Time to lay a bit (part.3)Our little pause from our previous zec shorts went well, its now almost back at our entry price !

4h showing a fake out with high volume and a break of a lower trendline

> thats my short signals

(sorry volume not showed here but be sure im using it)

I will TP on all the fibs retracement (same not showed on chart) and refill on shorts if I see bearish continuation !

Im playing very safe here as i expect BTC to go higher than 94 at some point

I will react on whats happening later !

Will let you know all by updating this idea

SL around 600

Cheers

Bearmarket

$BMNR: The $161 Ghost Top – Will the Great price void be filled?💀📉 💀📉

We need to talk about #BMNR.

Tom Lee’s vision of an 'Ethereum Treasury' is a grand experiment, but for retail investors, it’s becoming a house of mirrors.

The Trap: Thousands of retail accounts are trapped at the $100+ entry levels. With the current price at $25, the psychological damage is already done.

The Gap: Look at the monthly chart. There is a massive, unfilled gap from $12.38 down to the $4.57 zone.

The Reality: $4 billion of unrealised losses on just $79.3M in revenue is not a business; it's a high-stakes bet with YOUR capital. $200M stake on youtuber is a massive gamble. Completely unrelated to bringing Tradfi on chain.

Warning: If we lose the $24.33 support, the next unfulfilled targets will likely be met.

With $16.70 a high conviction probability imho.

#BMNR #TomLee #Ethereum #StockMarketCrash #RetailTrap #DilutionWarning

📉 3 Red Flags

1. The "Split-Adjusted" Illusion & High-Price Trap

The stock reached an all-time high of $161 earlier in the year but is currently trading around $25.10.

The Danger: Retail investors who "bought the top" are now sitting on 84% losses.

The Gap: There is a significant technical gap back toward the $3.20 - $5.00 range (the 52-week low). If the market loses faith in the "Ethereum Treasury" narrative, the stock could gravity-pull toward its DCF (Discounted Cash Flow) fair value of just $0.18.

2. The "Alchemy of 5%" vs. Extreme Dilution

Tom Lee’s strategy, "The Alchemy of 5%," aims to control 5% of the total ETH supply.

The Dilution: To fund this, Lee recently asked shareholders to approve a 100x increase in authorised shares—from 500 million to 50 billion.

The Warning: While Lee claims this keeps the share price "reasonable," it effectively ensures that current retail holders will be massively diluted unless ETH prices go parabolic immediately.

3. The Financial "Flippening"

The company’s latest financials (Q1 2026) showed a staggering $5.2 billion net loss, flipping from a profit just one quarter prior.

Fragile Model: Despite having $14 billion in assets, the revenue from staking.

Is only revenue if sold for Dollars.

He made himself a Eth whale --- where dumping is part of the business model.

The Risk: This creates a situation where the stock trades purely on the sentiment of ETH, but with the overhead of a massive corporate cash-burn.

BTC Update📊 CRYPTOCAP:BTC Update

BTC is clearly in a downtrend 📉.

What’s next? 👇

Using Fibonacci extension, we have important levels where price could

stabilize, bounce, or be considered for long-term accumulation.

🔹 First key area:

Around $76,000

→ aligns with Fibo 0.618 🧲

🔹 Second key area:

Between $69,000 – $67,000

→ previous POC (red zone)

→ also the previous ATH of the last bull run

These are the most important BTC levels right now.

⚠️ Important note:

BTC is not showing any bullish signals at the moment.

The overall market also shows no clear reversal signs.

For now,

we remain in a bear market 🐻

until proven otherwise.

Stay patient,

risk management first.

$TOTAL Crypto Market Cap Complete Meltdown Well Alright Ya’ll..

Here she blows 🤯

Longs about to be obliterated ☠️

If the Crypto CRYPTOCAP:TOTAL Market Cap gets a few Daily Closes below $2.8T then $75k CRYPTOCAP:BTC is not too far away.

Sure we shoulda all sold more, but here we are...

Should be a good buying opportunity to sell into the next dead cat bounce..

MEOW 🐈

$BTC/USD - Troubled Road AheadBITMEX:XBT

January/2026

-Risk-On Sentiment of High Risk asset.

Liquidity withdrawing from Cryptomarket !

Bitcoin is headed South after breaking down for the weekly bear flag formation post ATH retracment.

Second week of Swing Short position going great, Stop Loss is now set at break-even point (considering to set it in profit).

If a Weekly Double Bottom fails at 80K, down we go to Lower High's structure of wicks just below noted as liquidity,

a support-resistance zone as well the 69K ATH level support for #bitcoin.

That is a TP target of <50% while intending to ride it down to Accumulation Area or 1.618 retracement .

TRADE SAFE

NOTE THAT THIS IS NOT FINANCIAL ADVICE !

PLEASE DO YOUR OWN RESEARCH BEFORE PARTAKING ON ANY TRADING ACTIVITY BASED SOLY UPON THIS IDEA

$USDT & $USDC vs. $ETH - Warning a Funeral could occur. 💀 💀 💀

Watch the Stablecoin/ETH Market Cap ratio carefully.

A spike here isn't always 'Dry Powder' waiting to buy.

The Trap: If ETH breaks the $2,400 support level, we could see a 'Liquidation Spiral' that sends the ratio to all-time highs.

This isn't new money coming in—it's ETH value vanishing.

Safe Haven: Cash is King until ETH reclaims its 200-day SMA at $3,400."

#ETH #Ethereum #Stablecoins #MarketCrash #LiquidityTrap #CryptoAnalysis @thecryptosniper #HVF

what does AI say:

📉 The Doomsday Ratio: (USDT + USDC) / ETH

In a crash, this ratio spikes vertically. But unlike a "healthy" spike (where new money enters), this is a "Deleveraging Spike."

1. The ETH Collapse (The Denominator Shrinks)

Revenue Compression: Layer 2s are so efficient now that they are starving the Mainnet of fees. Without a high "burn" rate, ETH is becoming slightly inflationary again, losing its "Ultra Sound Money" appeal.

The ETF "Exodus": If institutional investors see ETH as a "leveraged claim on ecosystem activity" that isn't growing, they may rotate back to Gold or Bitcoin. A sustained outflow from spot ETFs could trigger a -40% re-rating.

The Liquidation Spiral: Since many "loopers" use ETH as collateral to borrow stablecoins, a price drop below $2,400 could trigger a cascade of liquidations on Aave/Compound, forcing more ETH onto the market and crushing its market cap.

2. The TradFi Standoff (The Numerator Stagnates)

The "Trust Gap": If the ratio increases simply because ETH is dying, TradFi institutions won't "buy the dip" with new USDC. They will wait for more regulatory "Supervision" rather than just "Legislation".

The Yield Trap: If stablecoins like USDT/USDC don't offer higher yields than risk-free US Treasuries (currently highly competitive in 2026), there is no incentive for a corporate treasurer to move cash onto the blockchain.

$BTC Tops Then $SPXThe stock market normally tops ~1.5 months after BTC, but it has now continued to rip to ATHs ~3x that amount of time!

Dec 11, 2017 (BTC peak) to Jan 22, 2018 (SPX peak) = 43 days

Nov 8, 2021 (BTC peak) to Dec 27, 2021 (SPX peak) = 44 days

Oct 6, 2025 (BTC peak) to January 26, 2026 (SPX today’s date ATH) = 113 days

Is crypto broken?

US Government Shutdown - $BTC & $SPX PerformanceUS GOVERNMENT SHUTDOWNS

PAST PERFORMANCE FROM BITCOIN AND S&P 500

Doesn't make much sense to look any further back than 2008 since that's when the entire monetary world order reset and a new playbook was introduced.

*Note 2013 was the first shutdown in this new monetary regime.

Really only worth looking at 2018 and 2025 shutdowns however since those were post-election years, both under Trump.

Can't wait for the "but this is only two data points" bros to chime in here 😂

February is going to be a ROLLERCOASTER 🎢

Remember the exit strategy playbook…

Feb. should present a great buying opportunity ~$70K CRYPTOCAP:BTC to sell into March strength before Tax Season wipes out the market once again and BTC crawls back down to at least $58k.

The Crypto Accumulation PlanCrypto has had a lacklustre 2025, and we may have an even worse 2026. Despite reaching new all-time highs, BTC has not delivered as much as people hoped, while most Altcoins continue bleeding against it.

Assuming the four-year cycle is still intact (as we have had nothing to signal otherwise), 2026 should be a bear market for the asset class, where accumulation opportunities will present themselves. To build on this further, the chart highlights a similar area with regard to monetary policy, which is presenting itself again today. By taking a similar bar pattern and overlaying it, we can see a potential outcome for the year.

I believe the bleed will be relatively slow throughout the year and should reach its cycle lows approximately one year after the 2025 cycle highs, which happened in October. As social interest has been low for this cycle, I don’t believe this will cause any major sharp capitulations—more likely, we’ll see temporary moves to the upside along the way.

As a conservative target for the year, I believe BTC should go below $65,000. Good accumulation opportunities should form in the later part of the year as metals start to slow down and experience some pullbacks. I believe a realistic cycle low could form around $50,000, but I will spread my dynamic DCA over multiple months to capture price action below $65,000 and ensure I have enough cash available if BTC decides to head even lower.

MICROSOFT Hit a WALL. DOUBLE TOPPED and WILL DROPPrice action has confirmed and triggered a double top pattern.

Calling tops in tech is dangerous as we all know.

But as Tech fatigue hits, and selloffs quicken, the risk of a deeper shakeout increases.

Remember US stock market is 230% of GDP.

With increasing Job Losses.

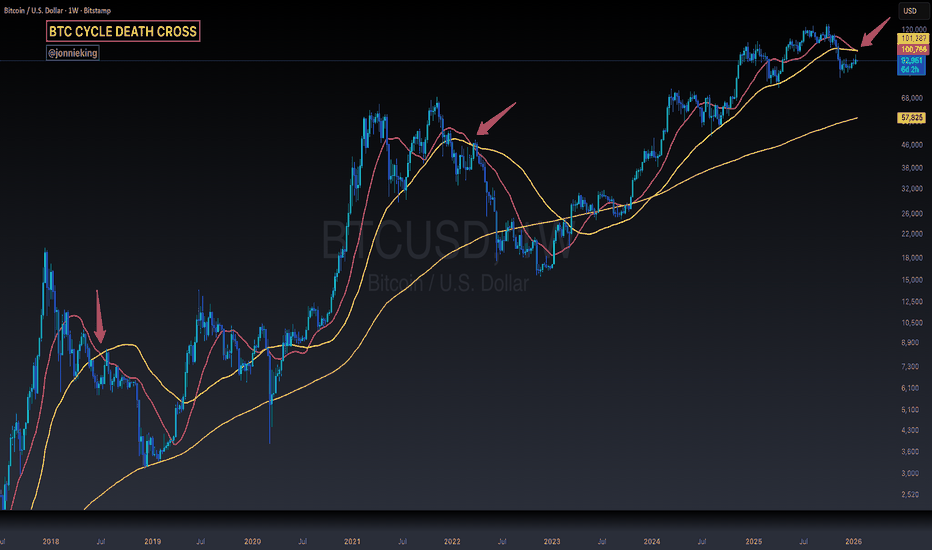

$BTC ULTIMATE DEATH CROSS HIT Historically, when the 20WMA breaks below the 50WMA this signals the final nail in the coffin for $BTC.

The GOOD NEWS is that this normally triggers one final RELIEF RALLY to the 50WMA for traders to unload their bags on the “this time is different” folks.

That sits ~$101k, but i’ll be selling a good portion of my stack before that.

My plan is to start DCAing back in starting ~$70k all the way down to $50k.

Rinse and repeat the cycle all over again.

Thanks for playing folks 🤓

BTC Weekly chart Bear Market (Updated)This is the updated version from the last post made on November 16th 2025.

At the time, I just calculated with the chart that I had at that moment, so you will notice that the short zone area has changed a bit. Nontheless the accumulation zone as well as the general projection have remained.

Do not buy BTC, wait to come for the accumulation zone.

Hope you guys are doing ok, I hope you have a wonderful year!

Bitcoin | Grand Finale Printed – Now Enjoy the Ride DownOn this chart I’ve mapped Bitcoin’s full impulsive structure from 2017–2025 as a completed 5-wave advance. We’ve tagged the (V) top, and what’s forming now looks like the early stages of a larger degree A/B/C – with the local (1)(2) already in and real downside still ahead.

• The prior rallies were clean impulse legs; this last stretch has all the signatures of an exhaustion wave (extended 5th, blow-off structure, and failed follow-through).

• Current bounce fits perfectly as a wave (2) retrace after the first leg down – textbook spot where late bulls feel “saved” while smart money quietly exits.

• Ahead of us I’m expecting a multi-year, 5-wave decline (1–5 on the right side of the chart), unwinding leverage, hype, and all the “number go up forever” narratives.

This isn’t the end of Bitcoin – it’s the end of this cycle. The next few years are, in my view, for skill-building, capital preservation, and accumulation at true value, not chasing tops.

Trade the levels, respect the structure… and enjoy the ride. 🚀⬆️ then 🪂⬇️

SPX Short: We are at the PEAK! STOP above 7050!Over in this video analysis, I spent almost 20 minutes to talk about the wave structure, the Fibonacci relationships, the fractal relationships between different waves, how to short, and also warns about "What-if-I'm-wrong" scenario.

What I missed to mention in the video is that for now, we still do not have any extensions in our waves 5 (Cycle and Primary). NOT that there MUST be an extension, but it is something to keep it mind for the alternate count of a series of 1s and 2s, leading to a compounded wave 3.

Remember that the most important part of this video, which I mentioned at the end, is the ending diagonal invalidation price: 7049.65. A stop MUST be place above this price. For easier remembering, above 7050.

Good luck!

BTC — Cypher Pattern, Fading Momentum & What Comes NextAfter the –36% drop from ATH, Bitcoin has found support in the 80K–90K range, where price has now been chopping sideways for almost 60 days. This kind of consolidation is pretty typical after a sharp selloff.

Back in June 2025, I already mentioned that a potential Cypher harmonic could be forming on BTC. At the time it was still early, but months later the structure is lining up very cleanly and looks like it’s playing out step by step.

The 86K–82K zone remains a key support area that bulls need to defend. Losing this zone would be a big deal technically and would likely open the door for further downside.

Macro Context

Cypher patterns are powerful because they combine:

impulse exhaustion

failed continuation

deep retracement psychology

They tend to appear near major cycle inflection points, especially after extended bullish phases and distribution-style highs. This makes them particularly relevant in the current market environment.

Let’s break the structure down step by step.

Cypher Structure Breakdown (X–A–B–C–D)

BTC has respected the key Fibonacci relationships of a Cypher extremely well.

X → A: Impulse Move

This was a strong, clean impulsive leg showing clear bullish dominance and participation.

Psychology:

Late bears trapped, early longs confident

A → B: Pullback

Price retraced to 0.579, sitting nicely within the Cypher sweet spot (0.382–0.618).

Structure held, which is crucial.

Psychology:

Doubt kicks in → “Is the move over?” → weak hands get shaken out.

B → C: Expansion & Euphoria

BTC pushed to the 1.274 extension of XA, clearly exceeding point A.

This is where optimism peaked and momentum chasing kicked in.

Psychology:

FOMO → breakout buying → late-cycle confidence

C → D: Reversal Zone

This is the most important part of the structure.

0.786 retracement of XC

Completion zone around 65.5K

Strong overlap with:

2021 ATH

2024 trading range

Psychology:

Euphoria → disbelief → forced selling → acceptance.

Where We Are Now

Bitcoin is currently trading between C and D, meaning:

we’re in a corrective phase

volatility has faded

and for the first time in four years, we’re seeing a clear bearish bias after a long period of bullish momentum

100K psychological level remains the major overhead barrier. As long as price stays below this level, bulls are on the defensive.

Macro Check

The broader technical picture remains cautious:

Below previous yearly open (93.5K)

Above yearly open (87.6K)

Below weekly 21 EMA/SMA (98K-102K)

Above monthly 21 EMA/SMA (87K–89K)

Structurally, this looks very similar to previous cycle transitions where momentum slowly faded before deeper moves followed.

Scenarios Going Forward

🔴 Primary Scenario

If the Cypher continues to play out:

downside pressure persists

volatility expands near liquidity pockets

target zone sits around:

66K–64K, centered near the 0.786 Fib (~65.5K)

This would be a healthy macro correction.

🟢 Invalidation Scenario

The bearish structure weakens if:

BTC reclaims and holds above prior value

price shows acceptance above 100K

momentum flips bullish again

In that case, the Cypher either gets delayed or invalidated.

Final Thoughts

Right now, the data favors patience and caution.

The most ideal path would be:

a push into the 97K–100K resistance zone

followed by continuation lower toward the 74.5K year low, which I’d like to see taken out

In choppy conditions like this, no trade is still a trade. Staying flat, preserving capital, and waiting for clarity is often the smartest move. Plan your levels, set alerts, and only act when the market gives you a high-probability setup.

_________________________________

💬 If you found this helpful, drop a like and comment!

BITCOIN PERFECT RANGEThis is the only range to keep an eye on with #bitcoin. short from the middle of the channel, or top of the channel. You can also consider a long from the highs if it gets there, then target the middle of the channel.

Calculate Your Risk/Reward so you don't lose more than 1% of your account per trade.

Every day the charts provide new information. You have to adjust or get REKT.

Love it or hate it, hit that thumbs up and share your thoughts below!

This is not financial advice. This is for educational purposes only.

How deep will the Bitcoin bear market retrace?We have already hit the 0.382 linear retrace level and the Bitcoin price is still bearishly consolidating.

So further downside is to be expected.

The question is how deep and do we have any confluent levels comparing the two fibonnaci's.

The answer is YES around the 50 thousand mark..

Which is an obvious key level to probe and ask questions of IMO

BTC vs Silver: Is This a New Major Bottom?1️⃣ BTC/Silver at Channel Support = Where Big Bottoms Formed Before 📉➡️📈**

- Every time BTC/SILVER touched the bottom of this rising channel, a major bottom followed:

- 🦠 Covid crash → huge recovery after

- 🐻 Bear‑market low of the current cycle → next bull phase started

- 🔁 Today the ratio is again sitting on that same lower trendline, which suggests we might be near another major bottom zone, not the middle of a fresh long‑term collapse.

2️⃣ RSI at All‑Time Lows = Extreme Exhaustion

- The weekly RSI for BTC/SILVER is at record low levels on this chart.

- When momentum is this oversold:

- It usually means sellers are exhausted and positioning is very one‑sided.

- Historically, extremes in the BTC–silver ratio have often been followed by mean‑reversion moves back up as risk appetite slowly returns.

This doesn’t guarantee an immediate bounce, but it strongly hints that most of the pain vs silver might already be priced in.

3️⃣ A “Different” Bull Market → A “Different” Bear Market 🤔

- Past BTC cycles often had:

- A parabolic blow‑off top, then

- A brutal −70% to −80% drawdown from the all‑time high.

- This cycle was not the same:

- ETF flows, more institutions, and more macro‑driven behavior

- Less crazy vertical move than earlier cycles

- Heavy rotation into metals while BTC cooled off instead of pure mania

Because of this, the expectation here is:

- ❌ Not a face‑melting pump straight to 300k.

- ❌ Not necessarily a textbook −70% crash like in past winters.

- ✅ More likely a “different” bear market:

- BTC consolidates, underperforms metals and some stocks

- The BTC/SILVER ratio resets at the channel bottom

- Drawdown is milder and more sideways‑grindy than previous full‑on nukes

4️⃣ Final thought for positioning 🧠

- Be prepared in case BTC does a smaller bear market.

- And at the same time, don’t be over‑exposed in case BTC still delivers a standard deep bear market like past −70% drawdowns.

Balancing those two possibilities is the key: respect the historical risk, but also recognize that this cycle’s structure and the BTC vs silver chart hint at something *less brutal* than many fear.

SOL 4H — How a Premium Zone + MSS Creates a Sell OpportunityOn the 4H timeframe, SOL shows a clear example of how market structure and premium/discount theory can be combined to identify high-probability sell opportunities.

After an impulsive bullish leg, price traded into the premium zone (above equilibrium / 50%), where selling pressure is statistically favored in a bearish or transitioning market. Rather than selling blindly at premium, confirmation was required.

At the marked swing high, price delivered bearish displacement, followed by a Market Structure Shift (MSS) as a key prior low was broken. This shift signals a change in order flow from bullish to bearish, indicating that sellers have taken control.

Using this displacement leg, Fibonacci was drawn from the structure high to the displacement low, clearly defining equilibrium and premium. Price then retraced back into the premium zone, aligning with a previous supply / reaction area, forming a high-confluence sell area.

This setup is built on:

HTF (4H) market structure context

Valid swing high that caused displacement

MSS confirming bearish intent

Premium zone as a location for shorts, not a trigger

Entries are refined only after price reaches premium, with invalidation above the structure high. Targets are aligned with opposing liquidity and prior lows.

⚠️ This idea is shared for educational purposes only, demonstrating how structure + displacement + premium zones work together. Always manage risk and wait for confirmation aligned with your trading plan.

ADBE, Second BEAR-Fractal, SHORT-Momentum DOOMSDAY Incoming!Hello There!

Welcome to my new analysis of ADBE. This stock has been massively battered by the major bear market decline setup in the gigantic bear channel. This stock did not exceed any new highs and did not have the potential to emerge with new bull momentum. The bears are still present within this stock and this is exactly why the bear momentum for this stock can accelerate heavily any time soon. There are several major bearish indications that are underlining the bearish scenario for the stock in an overwhelmingly precarious way.

Three reasons why the bear doomsday scenario for the stock is present, starting any time soon:

1.) Massive Liquidations: Over 250 Billion positions have been liquidated within the previous bearish doomsday market decline wave towards the downside.

2.) Weak Momentum: The momentum with which the recent meager recovery wave setup is highly fragile and is likely to turn anytime soon.

3.) Major Short-Side Positioning: A vast amount of institutional and smart money operators are positioning their selves on the short side. Always an important indication especially with retail traders positioned in the other direction.

Why shorting the stock through the upcoming second bear doomsday scenario will be the best approach in the current and upcoming market conditions:

1.) Second bearish ascending wedge fractal: The stock is going to complete exactly the same bearish ascending wedge fractal towards the downside once again.

2.) Total-Return Approach: By shorting the stock a trader has the candidature to a total-return approach, the trader is profiting when prices fall and at other times when they go up.

3.) Liquidation Acceleration: Once the whole ascending fractal has been completed it will trigger a fast-paced bearish wave making profits much faster than in an uptrend.

The most prevalent determining indications that are going to activate the upcoming bear market scenario wave for the stock:

As it is seen in my chart ADBE completed the huge bearish ascending triangle fractal exactly by moving into the upper distribution zone from where it emerged with the pullback towards the downside and set up the massive 250 Billion bearish liquidation wave towards the downside. This wave developed very fast and by positioning oneself before this huge bearish wave and completion of the fractal towards the downside a trader could make a big load of profit in the market.

Now, ADBE is still trading within the gigantic descending channel formation in which it has the most prevalent upper resistance distribution channel which has been the origin of the massive bearish waves towards the downside before and is now already setting up the upcoming 300 Billion bearish liquidation wave towards the downside which is going to activate the completion of the second ascending wedge fractal and the preceding wave C towards the bearish direction.

In the next times, the whole bearish ascending wedge fractal will be completed with the breakout below the lower boundary followed by the breakout below the 65EMA and 100EMA from where the bearish trend acceleration is going to unfold huge accelerations towards the downside and the severe bearish continuations towards the lower target zones. Especially, in this case, the market could still continue beyond this level in the bearish direction.

Upcoming Perspectives and the major underlying factors that are primarily important for consideration on the short side for the stock, the sector, and the economic field:

It has to be mentioned that an economic field with high interest rates, spreading inflation, a stagnation within the sector is setting up the determination to increase this whole bearish wave development, especially with a more bearish volume moving into the market. Also, highly determining in this case is the actual technology developments because when they reverse in an economic field this will have massive bearish effects on the stock as well.

Now, for traders it is highly important to follow such market situations with the appropriate setup within the market, especially in such times it is necessary to have the right positioning within the market because a massive bearish pressure acceleration can start anytime soon considering a huge acceleration in the inflation, a smart money operator bearish market making in which the bearish conclusion will be inevitable, an expiring futures market in which a lot of futures turn to an bearish volatility in the market. This is why traders need to position their selves before all these heavy bearish scenarios are set up.

In this manner, thank you everybody for watching my analysis of ADBE. Support from your side is greatly appreciated.

VP