SPY – Feb 11 Market Preview: Compression Before ExpansionSPY spent the session consolidating just under the 696–697 resistance zone after the strong recovery off 670s earlier this week. The structure on the 15m remains constructive, but momentum has clearly slowed. This is no longer expansion — this is positioning.

We are sitting inside a tight value pocket between 692–697. These are the kinds of ranges that frustrate impatient traders and reward those who wait for confirmation.

Market Structure (15m Focus)

Price reclaimed prior breakdown structure and built higher lows from 670 → 686 → 692. That’s bullish repair.

However, we are now compressing right under:

* 696–698 call wall / gamma resistance

* Prior supply zone

* Short-term liquidity above equal highs

This creates a decision area, not an automatic breakout.

As long as SPY holds above 692–693, bulls maintain short-term control. Lose that level, and we likely rotate back toward 690, with 686 below as next liquidity pocket.

GEX & Options Flow Context

From the options side:

* Heavy call interest stacked 697–698

* Put support building around 690

* Overall gamma leaning positive

Positive gamma usually compresses volatility and pins price near high OI strikes. That aligns with today’s range behavior.

Translation:

Expect controlled moves until a wall is cleared.

A clean acceptance above 698 would likely trigger dealer hedging flows and open 700–702 quickly.

Failure and breakdown under 692 flips tone short-term and reopens 690–686.

Trade Plan Into Feb 11

Bullish Scenario

Break and hold above 697–698 on volume → target 700–702.

If momentum builds, continuation toward 704 is possible.

Bearish Scenario

Lose 692 with acceptance below → quick test of 690.

If 690 fails, 686 liquidity becomes magnet.

No edge inside 693–696 chop. Let the level break first.

This is a compression market.

Compression markets:

Reward patience.

Punish anticipation.

Do not front-run walls.

Do not assume breakout.

Wait for confirmation and react.

The expansion move will likely be clean once it starts.

Overall, SPY is neutral to slightly bullish while above 692.

Break 698 then trend continuation.

Lose 692, we will see pullback.

Let the level decide.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Always manage risk and trade responsibly.

Beyond Technical Analysis

Hype - previous trade update with order flowJust to show what happened near the SL. Huge amounts of sellers enter the market as seen in the added photo (wich is 1min candles with 1h delta profile) could not bring price lower and above them new longs entered. I expect a continuation on the upside as it was in my previous ideea posted.

$WTRG , Setup (Very Long Term)ENTRY : CMP

TP1 : 42.79

TP2 : 54.06

TP3 : 113.16

TP4 : 262.06

TP5 : Let It Roll

SL : If you wish

My SL is never a SELL, just an alarm to stop adding money and wait for better dca

Follow, Boost, Thank You !!

⚠️ Financial Disclaimer:

This post is not financial advice. I am not your financial advisor, your life coach, or your legally responsible adult.

Always do your own research and never trade based solely on internet comedy.

Designing a Trading Process You Can ScaleA scalable trading process is built to function independently of mood, focus, or screen time. Many traders remain inconsistent because results depend on how alert they feel or how closely they watch price. That approach does not scale. A process that scales is one where decisions are defined in advance, execution follows fixed rules, and outcomes can be evaluated objectively. The trader executes the process rather than improvising inside it.

The foundation of scalability is clear role separation. Analysis, execution, and review must operate as distinct phases with defined inputs and outputs. Analysis establishes context. It answers where the market is positioned, which conditions are active, and which areas matter. Execution exists only to act on pre-approved conditions with predefined risk. Review evaluates whether rules were followed and whether the process behaved as expected. When these phases overlap, emotional interpretation enters the workflow and consistency breaks down.

The next requirement is standardized inputs. A scalable process uses the same timeframes, the same market types, and the same session windows every day. It does not scan endlessly for opportunity or adapt rules based on boredom. Instead, it waits for price to reach predefined locations under known conditions. This reduces trade frequency, but it increases signal quality and mental clarity. Fewer decisions lead to higher execution accuracy.

Risk rules are the structural backbone of scalability. Fixed risk per trade, daily loss limits, and exposure caps ensure that no single decision can materially damage the system. These rules must be non-negotiable. They protect the process during drawdowns and prevent emotional recovery behavior. A strategy that cannot survive losing periods without modification is not scalable, regardless of its upside.

A scalable process also defines when not to trade. Conditions such as low volatility, unfavorable sessions, or unclear structure should be explicitly excluded. This prevents forced participation and preserves capital for higher-quality environments. Discipline is reinforced not by activity, but by selective absence.

Finally, the process must be transferable. A scalable framework can be written, explained, and followed by someone else. If your edge exists only in intuition or experience, growth is capped. When rules are documented, tested, and reviewed, improvement becomes systematic. Performance feedback becomes actionable rather than emotional.

Scaling in trading is not about increasing trade count or leverage. It is about building a process that holds up under repetition, pressure, and time. When execution no longer depends on how you feel, consistency becomes a natural outcome rather than a constant struggle.

Keep it short, keep it simple and avoid unnecessary mistakes is the path to greatness. 💚

Become a Successful Trader- Full Course in 10 minutesThis is not an advert, this is my entire trading curriculum taught as a lesson live on trading view to help you guys out. This covers your motivation for trading, trading maths (risk of ruin, variance, expected value, game theory), momentum structures to read price action correctly, Money Makers (key levels to target for liquidity and why) and finally managing trades and yourself through journaling and trendlines.

Hopefully this is a great starting point for you guys and you get value from this!

Execution waits for clarity.Market's choppy across the board. No clean direction on my pairs.

Gold bouncing between levels with no commitment. EUR/USD same story. USD/CHF unclear.

Could be liquidity hunt before the actual move. Or just consolidation. Either way, I'm not guessing.

When there's no structure, I don't trade. Waiting for clarity to return.

Days like this are about protecting capital, not forcing opportunities. The setups will come back when the market decides to move with direction.

Sitting out and watching.

Can Moog Engineer Dominance in the New Defense Era?Moog Inc. has entered 2026 with transformative momentum, delivering record-breaking Q1 results that crushed analyst expectations by 19% with adjusted earnings per share of $2.63. Revenue surged 21% year-over-year to $1.1 billion, while the company's backlog exceeded $5 billion, providing unprecedented visibility into future revenue streams. This exceptional performance is driven by a global rearmament cycle, with management raising full-year 2026 EPS guidance to $10.20 and the stock soaring to new heights near $305.

Beyond financial metrics, Moog is strategically repositioning itself as a techno-industrial leader rather than a traditional manufacturer. The company's partnership with Niron Magnetics to develop rare-earth-free Iron Nitride actuators addresses critical supply chain vulnerabilities, as China controls approximately 90% of the global rare earth processing market. This move toward supply chain independence, combined with advanced systems integration through partnerships like the Echodyne collaboration for integrated weapon systems, demonstrates Moog's evolution from component supplier to full-spectrum defense technology provider. Every operating segment achieved record quarterly sales simultaneously, with Space and Defense leading at 31% growth.

The company is capitalizing on multiple tailwinds, including NATO's new 5% GDP defense spending targets, the U.S. Department of Defense's Acquisition Transformation Strategy, which favors high performers, and the shift toward AI-enabled defense systems. With C-130 Hercules modernization programs, hypersonic missile technology, and an aggressive patent portfolio spanning autonomous navigation and robotics, Moog is positioning itself at the intersection of mechanical precision and digital innovation. Despite tariff headwinds and inflationary pressures on fixed-price contracts, the company's 13.0% adjusted operating margin and conservative 2.0x leverage ratio provide the financial strength to sustain this technological transformation through 2026 and beyond.

GBP/USD 11th of FebruaryAlthough yesterday price dropped some there was good enough push towards the DOL to get a nice trade and we are still in tact with the bullish bias because it did not violate any of the lows that are supporting my narrative we just retraced to a daily FVG and respected it so far forming a 1H low at that POI which I don't expect to be violated so I will wait for the marked FVG to be mitigated and create a STL there and then go up again to the DOL target from yesterday even if doesn't reach to it getting a move higher will be enough to profit from it because it is not a small amount of pips

Massive Head and Shoulders on OKLO - Are you prepared?Things are about to get ugly for OKLO as the companies largest shareholders dump on retail at every pump and the weekly candle is currently back testing the neckline of this massive head and shoulders as resistance.

Is this company nothing but hot air and about to go negative?

NIFTY 50 | Time & Price Interaction Study (26 Nov 2022)This idea presents a historical study of how time-based pressure zones can interact with important price levels, using concepts derived from WD Gann methodology.

⚠️ This is not a trading signal or forecast.

It is shared purely for educational and structural study purposes.

📌 Study Background

In late November 2022, NIFTY was trading near an important reference low formed around 26 November.

This study observes how markets often respond when time alignment and price structure intersect

.

📊 What the Chart Shows

A clearly defined reference price zone

Subsequent increase in volatility once price closed below that zone

Expansion in directional movement after time–price imbalance

How pressure zones often act as decision points, not guarantees

🧠 Key Learning Takeaways

Time-based levels often define risk zones, not direction

Price behavior changes when pressure builds near reference dates

WD Gann analysis focuses on structure and balance

Studying past cycles helps traders understand market behavior, not predict outcomes

⚠️ Disclaimer

This content is for educational and research purposes only.

It does not constitute financial advice or market recommendations.

AUD/USD Surge: Navigating the Aussie’s Three-Year HighThe AUD/USD pair recently shattered market expectations by climbing past the 0.7100 threshold. This rally marks a definitive three-year peak for the Australian Dollar. Domestic monetary strength and shifting global dynamics drive this impressive performance. Investors now prioritize the Australian Dollar as a premier "risk-on" asset.

The Monetary Pivot: RBA Takes the Lead

Hawkish commentary from the Reserve Bank of Australia (RBA) ignited the latest surge. The RBA maintains a restrictive stance to combat persistent inflation. Unlike its global peers, the RBA resists premature interest rate cuts. This policy divergence creates a significant yield advantage for the Aussie Dollar.

Geostrategic Leverage and Critical Minerals

Australia occupies a vital position in the modern global supply chain. Its geostrategy focuses on providing critical minerals to Western allies. Nations prioritize Australian lithium and rare earths to decouple from volatile markets. These strategic partnerships ensure consistent capital inflows and bolster the currency's value.

Industrial Innovation and Business Excellence

Australian mining giants lead the world in automation and high-tech integration. Companies deploy autonomous fleets to maximize efficiency and safety. These innovations lower operational costs and increase export volumes. Such robust business models attract significant foreign direct investment into the Australian economy.

Leadership and Corporate Culture

Australian corporate leaders embrace agile management and transparency. They foster cultures that prioritize sustainable growth and technological adoption. This leadership style builds immense investor confidence in Australian equities. Strong corporate governance provides a stable foundation for currency appreciation during volatile periods.

Technological Sovereignty and Cybersecurity

Australia invests heavily in quantum computing and biotechnology. Rising patent filings in green hydrogen technology showcase a diversifying economy. Simultaneously, the government enforces world-class cybersecurity frameworks to protect financial infrastructure. This digital resilience encourages institutional traders to maintain long-term positions in AUD.

Macro Outlook: Risk Appetite and Data

The current market environment reflects a rampant appetite for risk. Global traders are moving away from the safe-haven US Dollar. Upcoming US Non-Farm Payroll data will likely dictate the next short-term move. However, the structural strength of the Australian economy suggests a continued bullish trajectory for AUD/USD.

NYSE Composite cracking support as downside pressure builds:Current Price: 23252.81 (Analysis was generated on Monday Morning)

Direction: SHORT

Confidence level: 63%(Several professional traders point to weakening momentum, repeated support tests, and fading rallies, suggesting short-term downside risk despite limited social data.)

Targets

Target 1: 22900

Target 2: 22600

Stop Levels

Stop 1: 23550

Stop 2: 23900

Key Insights:

Here’s what’s driving the trade. Multiple traders described the NYSE Composite as broadly stable but heavy, with mixed sector performance and no clear leadership. That kind of tape usually favors sellers on rallies rather than buyers chasing strength. What caught my attention is how often the 22,900 and 22,600 levels came up as key pivots for the week — traders see these as natural downside magnets if current pressure continues.

Another important angle is momentum. Professional traders pointed out weakening short‑term indicators and price sitting below key moving averages. That doesn’t guarantee a straight drop, but it does tilt odds toward another leg lower before any meaningful bounce shows up.

Recent Performance:

The NYSE Composite has pulled back roughly 1% recently, sliding from the 23,000 area into the low 23,200s. Attempts to recover have been sold into quickly, and price has spent more time drifting lower than building a base. This kind of action usually tells me sellers are still in control in the very near term.

Expert Analysis:

From the trader analysis I reviewed, the consensus isn’t panic — it’s caution. Several traders emphasized that unless the index can reclaim the 23,500 area decisively, rallies are likely to fade. The repeated references to a possible move toward 22,900, and then 22,600 if selling accelerates, give clear structure for a short‑term downside trade this week.

News Impact:

Macro headlines around inflation and interest rates continue to hang over equities. Traders are reacting to the idea that rates may stay higher for longer, which tends to pressure broad indices like the NYSE Composite. Without a positive catalyst, the news flow is doing little to support aggressive buying right now.

Trading Recommendation:

Here’s my take. I’m favoring a SHORT position at current levels, targeting a move back to 22,900 first and potentially 22,600 if selling pressure persists this week. Risk is clearly defined above 23,550, with a hard stop near 23,900 in case the index squeezes higher. This is a tactical, short‑term trade based on trader consensus around weakening momentum, not a long‑term market call.

USD/CNY 2026: Tech Dominance and Fiscal Shifts Drive YuanThe USD/CNY pair is entering a transformative era in 2026. The Chinese Yuan recently hit three-year highs against the US Dollar. This shift reflects bigger structural changes in global economics and technology. Investors now witness a move beyond simple interest rate differentials.

Macroeconomic Divergence and Fiscal Policy

The People’s Bank of China (PBOC) maintains a firm stance on the Yuan's value. Robust policy backing currently supports a stronger Yuan. Meanwhile, the US faces cooling growth and shifting Federal Reserve priorities.

Differing fiscal strategies drive this currency decoupling. China’s targeted stimulus focuses on high-tech manufacturing rather than broad consumption. This precision attracts long-term institutional capital. Consequently, the USD/CNY reference rate continues to trend lower.

Technological Sovereignty and Patent Leadership

Technology now serves as the primary engine for currency valuation. China leads the world in 6G and renewable energy patent filings. These innovations create a structural trade advantage for the Yuan.

Institutional investors track patent quality to gauge future economic strength. China’s focus on "Little Giant" enterprises fosters a specialized high-tech ecosystem. This dominance in critical supply chains reduces reliance on dollar-denominated imports.

Geostrategy and Global Trade Blocs

Geopolitical alignments are reshaping currency demand across Asia. The expansion of regional trade agreements bolsters Yuan usage in cross-border settlements. These geostrategy shifts decrease the Dollar’s historical dominance in Eastern markets.

Stable political leadership provides a predictable environment for investors. This stability contrasts with the political polarization often seen in Western markets. Traders increasingly price this "stability premium" into the Yuan's exchange rate.

Cyber Security and Financial Infrastructure

Cyber resilience determines modern market confidence. China has implemented rigorous data security laws to protect its financial core. This robust infrastructure ensures the integrity of the digital Yuan and offshore trading.

A secure digital environment attracts risk-averse global funds. Enhanced cyber defenses mitigate the impact of external financial shocks. This technological moat strengthens the Yuan’s status as a reliable reserve currency.

Management Innovation and Business Models

Chinese firms are redefining global management through "Digital Agility." They integrate AI to streamline decision-making and reduce operational waste. This efficiency boosts corporate margins and supports domestic currency value.

Business models in China now emphasize "Dual Circulation." This strategy balances domestic consumption with high-end exports. Stronger corporate leadership ensures China remains competitive despite global inflationary pressures.

Industry Trends: The Green Revolution

The automotive industry highlights China's industrial ascent. Breakthroughs in battery science have secured China’s lead in the EV market. These high-value exports generate consistent demand for the Yuan.

Western competitors struggle to match China’s scale and speed of innovation. This industrial gap influences long-term capital flows. As the world goes green, the Yuan becomes the currency of the energy transition.

Strategic Outlook for 2026

The USD/CNY pair represents a clash of two economic philosophies. China’s focus on science and manufacturing creates a formidable currency floor. Investors should expect continued Yuan strength as tech leadership matures.

The era of Dollar exceptionalism faces a sophisticated challenger. Monitoring patent trends and fiscal policy remains essential for traders. The Yuan is no longer just a currency; it is a high-tech asset.

SILVER H1 | Price Action & Liquidity-Based AnalysisSilver previously tapped into a higher-timeframe bearish order block, which caused a sharp impulsive sell-off. The strong displacement confirms institutional selling pressure from premium levels.

Following the expansion, price swept sell-side liquidity below the prior lows, completing a classic liquidity grab. This was immediately followed by a bullish reaction, signaling short-term demand entering the market from discount.

Price is now retracing upward and approaching a key internal bearish order block, which acts as the nearest supply zone.

Key Trading Areas

POI / Demand Zone:

74.80 – 76.20

(Liquidity grab + bullish reaction area)

Internal Bearish Order Block (Supply):

88.50 – 90.50

(High-probability reaction zone)

Bullish Scenario (Intraday Continuation)

Entry consideration from POI (74.80 – 76.20)

Requires lower-timeframe bullish confirmation (HL, BOS, displacement)

Targets:

TP1: 82.00

TP2: 88.50 (internal OB)

Stop Loss:

Below liquidity low → below 73.80

Bearish Scenario (HTF Continuation)

If price reaches 88.50 – 90.50 and shows rejection,

Look for bearish confirmation on lower timeframes,

This would signal continuation of the larger bearish structure.

Bearish Targets:

• 82.00

• 76.00

• Sell-side liquidity lows

⸻

Conclusion

Liquidity has already been engineered.

Current move remains corrective until internal supply is broken and accepted.

Direction will be decided at internal OB reaction — patience is key.

Bias: Neutral → reactive

Method: Pure price action, structure & liquidity

Rule: Confirmation before execution

Prop trading: capital under management or self-insurance?The market is changing rapidly, not gradually — it knows how to switch . Yesterday there were neat breakouts and trend continuations, today there are sudden shoots, sharp reversals, knocking out stops and moving on the news, which you will see after the candle has made a maximum and a minimum at the same time.

There is a lot of talk right now that the market has become more manipulative, nervous and volatile . And let someone argue with the wording, the essence remains: in such conditions, it is not the smartest and not the fastest who survives, but the one who respects the risk .

And here prop trading suddenly stops being a fashionable way to get money fast , and begins to look like ...** a protective contour . And not only for beginners, but also for strong traders who have already seen how easily the market takes away capital from those who decide to break the rules a little .

Disclaimer: the material is educational. Not an investment council.

1) What is prop trading really?

Prop trading (proprietary trading) — trading on the company's capital. In classical logic, everything is simple:

the firm allocates capital (or gives a risk limit),

the trader trades according to the rules,

profits are divided by agreement,

Loss is limited: there is a loss limit after which trading stops or conditions become tougher.

The main truth about prop sounds dry, but it's more important than all the advertising:

A prop firm does not buy signals — it buys manageable risk .

A stable trader is more valuable to a company than a genius who sometimes makes X's, but periodically makes a “peak" in drawdown.

---

2) Why prop has become relevant again right now

There is a feeling that the market has become tougher towards discipline in recent years. And this is evident from the typical stories.

Previously, you could afford to disrupt the risk a little bit : increase the leverage, move the stop, sit out the negative - and sometimes the market returned. Today, such a number increasingly ends the same way: a sharp move against a position , a series of liquidations, and you look at the chart not as a trader, but as a person who has just dropped an important thing from his hands.

Many previously successful traders lost deposits not because they forgot how to analyze, but because:

stopped complying with the risk,

began to catch up with the market,

confused confidence in the setup with the right to ignore the stop.

And against this background, the professionals had a very pragmatic idea.:

what if we stop substituting fixed assets for a series of mistakes or a “bad phase of the market"?

Hence the new perspective on prop: a prop firm is not easy money , but a way to take the risk of capital loss outside , keeping for yourself what you know how to trade.

The meaning is simple:

you risk your capital minimally (the cost of an attempt/subscription),

and you work at a volume that would otherwise be psychologically and financially too dangerous,

in fact, you shift the risk of a complete loss of the deposit to the prop rules.

---

3) The two worlds of prop firms: Don't confuse them

Today, the word prop firm refers to very different models.

A) Classic prop desks (traditional prop)

more often offline or hybrid,

selection through an interview/internship/verification of real trading,

capital is really “branded”, relationships are built for a long time.

Advantages: A more transparent model, less marketing, and a higher chance of a real career .

Disadvantages: harder to get in, stricter requirements, sometimes limited markets/instruments.

B) Online prop with challenges (evaluation model)

entry through a paid assessment,

Strict drawdown/day/series limits,

After completing the course, you will receive a “funded” account and profit-split payments.

Advantages: Accessibility, quick start, clear “entrance ticket".

Disadvantages: the rules are sometimes designed so that you compete not with the market, but with the mathematics of the rules.

---

4) A new class of traders: acceleration from $100 to “millions”

There is another reason why the prop theme has become popular: the market has brought a whole wave of people who sincerely believe that trading is overclocking .

You've probably seen these scenarios:

deposit of $100–$300,

shoulder 50–100x,

An all-or-nothing bet,

a few successful attempts — and the feeling that the grail has been found,

then one candle, and “why am I always being carried out?”

The problem is not that overclocking is impossible as a fact. The problem is that:

luck can be repeated a couple of times ,

but system trading cannot be built on a constant huge risk , because mathematics and variance will catch up with you.

The market can deliver a series of victories. But the market has never signed a contract to forgive such maneuvers . Sooner or later, the inevitable happens: one impulse against a position erases everything.

And that's where prop firms turn out to be for different :

A prop can give a beginner discipline and a loss ceiling (if he is willing to obey the rules),

experienced — to protect the fixed capital from a period of mistakes, emotions or the wrong phase .

5) What are you really paying for in the prop model

Prop is sold as capital , but in reality you are buying a combination of four things:

1. A risk framework (restrictions that cannot be persuaded)

Prop does not allow you to “merge everything to zero”. And sometimes it saves you from the most dangerous enemy— your own impulse.

2. The psychological contract

When you know that you will be turned off for a certain drawdown, you suddenly begin to respect the stop.

3. Infrastructure and access (not always)

Some models have a platform, data, fees, and conditions.

4. Funnel (if the business is built on paying for attempts)

If the company earns mainly on challenges, you are the client. If you are a trader, you are a partner. These are different worlds.

---

6) The advantages of prop trading when it suits your style

✅ Limited worst case scenario

Ideally, you only risk the cost of the attempt, not the entire deposit.

✅ Discipline is built into the rules

You don't need to reassemble your willpower every day. The frame will do it for you.

✅ Rapid growth of responsibility

You start thinking like a risk manager, not an X-hunter.

✅ Potential scalability

If you are stable, the company can increase the limits / give more accounts / improve the conditions.

---

7) Cons and pitfalls: Where even the strong ones break

## The main enemy is not the market, but the rules

Many fail not according to strategy, but according to the mechanics of limits.:

daily loss limit,

maximum drawdown,

equity calculation (including floating minus),

bans on news/overnight/weekend,

requirements for consistency.

The same regulation can be the norm for a scalper and a death sentence for a swing trader.

❌ Trailing drawdown is a hidden mine

If the maximum drawdown is considered from the peak of equity (and tightens after your profit), an unpleasant paradox arises: you have earned — and the usual rollback of the strategy begins to look like a violation.

This changes behavior: the trader is afraid of normal pullbacks, closes profits too early, and worsens expectations.

## Conflict of interest in the evaluation model

If a company earns mainly by paying for attempts, it is beneficial for it that there are many attempts, but only a few pass.

## Execution, spreads and toxic flow

Delays, widening spreads, paragraphs about “abuse” and latency — all this should be read in advance, not after problems.

❌ Consistency as a KPI trap

Restrictions on an “overly profitable day” can provoke overtrading and trading for the sake of the report.

8) Who is prop suitable for and who is not

### Suitable if you:

you already know how to trade and want to scale the risk without threatening the fixed capital,

understand the series, the variance, the inevitability of drawdowns,

ready to live by the rules.

### Not suitable if you:

looking for “magic capital" without a system,

trading martingale/averaging without restrictions,

emotionally “catching up” after the cons,

not ready to read the rules as a legal document.

---

9) The checklist: what to watch BEFORE payment

A) The mathematics of constraints

* Drawdown: fixed or trailing? by balance or equity?

* daily limit: on closed trades or on floating PnL?

* what happens in case of violation: closing positions or blocking?

* minimum trading days? a one-day profit limit? consistency?

B) Terms of trade

* fees/spreads, especially on volatility,

* is it possible to trade news,

* is it possible to hold positions through the night/weekend,

* Style restrictions: scalping, arbitration, copying.

C) Payments and legal aid

* payment frequency, minimum threshold, KYC,

* conditions for canceling payments in case of “violations”,

* reputation and payment history (preferably verifiable).

---

10) How to trade prop in an adult way so that it helps, not hinders

1) Choose a company for the style, not the style for the company.

A swing trader in tight daily limits will suffer.

2) Immediately build a risk plan for the limits.

Not “how much I want to earn", but:

what is the risk of the transaction,

how many cons are allowed in a row,

where is the stop for the day,

what I do after the series.

3) Not to “finish off the target”, but to protect statistics.

The best prop trader is not the one who made x, but the one who does not break down in a bad week.

4) Keep a journal as a risk manager.

Reason for entry, invalidator, violation of rules, quality of execution.

---

All the arguments about prop trading sound easy on paper. But the market doesn't read the articles — the market checks in practice. Therefore, we decided not to limit ourselves to theory.

Our team also accepted the challenge of the time and decided to go all the way from the inside out on their own experience:

test our trading strategy under real-world prop constraints,

understand where the rules really discipline and protect,

and where they start to get in the way and require an adaptation of the approach.

We took a challenge from a popular prop firm and will share with you not only the final results , but also the process itself:

how do we build a risk plan, how do we conduct transactions, what difficulties arise, what needs to be changed, and what is confirmed in practice.

The market has become more complicated. But this is not a reason to play all-in. This is a reason to grow up: build a system, keep the risk and survive where others burn out.

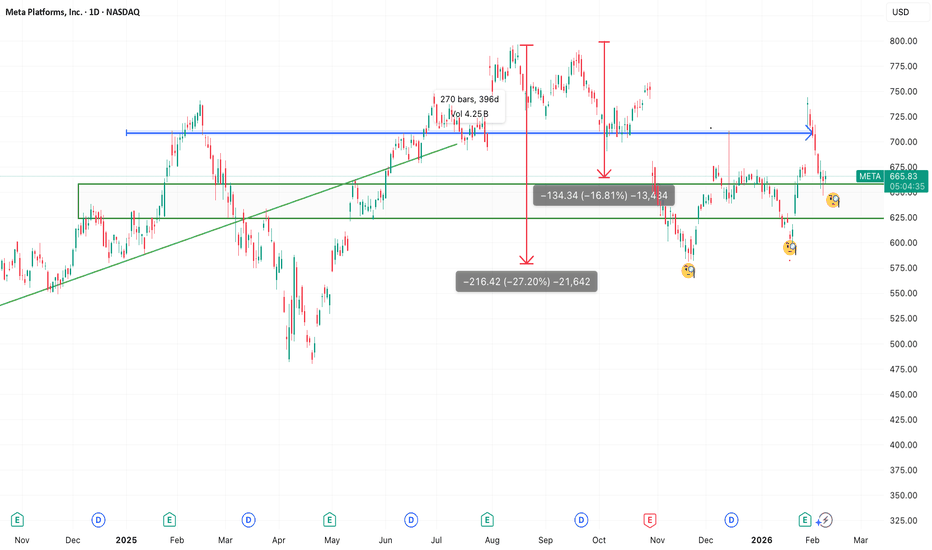

META: Third Higher Low + good Risk/Reward Setup#META

Third test of $625 support after -25% pullback from ATHs.

The Setup:

- Entry: $665

- Stop: $644

- Target 1: $720

- Target 2: ATHs ($750+)

Why I like it:

- Triple bottom = institutional accumulation

- Higher lows = buyers stepping up earlier each time

- Risk/reward 3:1 to first target

Target:

- $700-725 zone rejected twice — heavy supply

- Broader market still shaky

Small position. Defined risk. Let it work.

Not financial advice. Just sharing my analysis. Do your own research and manage your own risk.

Unlocking Altseason: Chart Signals You Can't IgnoreAltseason without myths: what actually shows up on charts before alts go crazy

Everyone loves to say “altseason is coming” the same way kids say “summer is coming” in March. Feels good, zero responsibility.

But altseason isn’t magic. It’s just money rotating. And that rotation leaves fingerprints on the charts way before your favorite microcap does +500%.

Let me walk you through the main conditions I usually want to see before I start taking alt setups seriously – not memes, not hopium, just price.

1. King Bitcoin does his move first

Healthy altseasons rarely start from flat Bitcoin.

Typical pattern:

- First, a strong impulsive move up on BTC

- After that move, BTC stops trending and starts chopping in a range

- Volatility cools down, candles get smaller, volume drops

TL;DR: Big boys rode BTC, locked in chunky profits, and now their fresh capital is looking for higher beta plays. That’s when alts start feeling “lighter”.

If BTC is nuking or making fresh parabolic highs every day, alts usually just get dragged around like bags on a train.

2. BTC dominance stops climbing and starts bleeding

Open BTC.D (Bitcoin dominance) and zoom out.

Before most big alt runs, I usually see:

- A clear uptrend in dominance while BTC is running

- Then a topping structure: double top, lower high, or a fake breakout above the previous high

- And then – the key part – a confirmed breakdown with lower lows

That’s literally money leaving BTC relative to alts.

No need to overcomplicate:

Rising dominance – market respects Bitcoin.

Falling dominance – market starts gambling on the side quests.

3. ETH vs BTC wakes up

ETHBTC is my canary in the coal mine.

If ETH can’t even beat BTC, why should I expect your random GameFi coin to do it?

Before many altseasons I’ve watched:

- ETHBTC prints a base or higher low

- Breaks local resistance

- Starts grinding up, even if slowly

ETH often leads the rotation. When this pair wakes up, liquidity is starting to accept “more risk”.

4. Total alt market cap breaks structure

Open TOTAL2 or TOTAL3 – that’s your x-ray of altcoins as a whole.

What I like to see:

- A clear downtrend turning into a sideways accumulation range

- Higher lows forming under a big horizontal resistance

- Breakout of that resistance with expanding volume

That’s not your random lucky pump – that’s the whole sector getting repriced.

5. Volume rotation: BTC quiet, alts noisy

Check the volume bars:

- BTC: volume fades while it ranges

- Major alts: volume spikes on green days, pullbacks on lower volume

That’s exactly what “rotation” looks like. Money doesn’t appear from nowhere – it walks from chart to chart.

Maybe I’m wrong, but I think “altseason” is mostly a marketing word influencers use when they ran out of Bitcoin content. On charts it’s just a sequence:

BTC pumps → BTC chills → dominance tops → ETHBTC turns → alt market cap breaks out → volume rotates.

Last nuance: don’t try to guess the exact start like it’s New Year’s midnight. Focus on conditions, not dates. When several of these signals line up, I start hunting alt setups. When they disappear, I stop dreaming about 50x and go back to trading what the market actually gives.

In the end, altseason is just greed with a chart pattern. Learn to spot the pattern – and the greed will find you on its own.

Natural Gas MCX Future Intraday Analysis - 10 Feb., 2026MCX:NATURALGAS1!

NATURAL GAS Futures — Chart Pathik Intraday Levels for 10-Feb-2026 - 01:51 AM

(If these levels add value to your trades, a quick boost or comment goes a long way in supporting this free content and keeping our trading community thriving!)

Natural Gas MCX shows consolidation around 290 after downside pressure, with key resistance at 298-300 and support near 285—bearish tilt unless breaks higher decisively. Each comment or share builds the momentum for disciplined, structured analysis across our trading community!

Bullish Structure:

Longs activate above 298 (Long Entry), with confirmation as price sustains above this level and defends 292 support zone.

Targets: 307 (major booking zone), 315 (extended move on breakout)

Control: Stop or trail near 292 or 288 to manage risk

Bearish Structure:

Shorts open below 292 or on rejection at 298 after failed upside attempts.

Targets: 285 (partial/scalp), 280 (extended move if breakdown holds)

Control: Fast short covers required above 298 or on sharp reversals

Neutral Zone:

298 is today’s inflection—practice patience until a strong direction emerges above or below this level.

Every setup is designed for structure, plan, and logic—let the chart work for you, not your emotions.

Boost or comment if these levels help your preparation—help Chart Pathik keep delivering quality analysis to more intraday traders!