Valneva: Between Correction and Long-Term PotentialXETR:AYJ Hey guys,

I started analyzing Valneva around mid-October 2025 after the company was brought to my attention by a friend. I find it to be a very interesting company and chart. There aren't many ideas or analysis to find on TradingView so I figured I try to make my own. I focused on understanding the price structure and the broader technical context.

From a technical perspective, the stock had already put in a significant bottom below 2 EUR, around 1.75 EUR, in December 2024. From that low, price advanced strongly up to roughly 4.20 EUR.

My analysis is purely chart-based and primarily relies on Fibonacci structures. On the initial 0–A move from approximately 1.75 EUR to 4.20 EUR, I applied a Fibonacci retracement. Price corrected into the projected retracement zone (light blue), overshot at around 10% max. into a lower area. Importantly, price eventually broke above point A, confirming a valid B–C continuation and the start of a sequence.

Following that, I analyzed a larger 0–A structure (green), whose Fibonacci retracement levels are located a bit higher. This broader corrective zone starts roughly around 3.50 EUR (0.5 Fib) and extends to just below 3.00 EUR (0.667 Fib), overlapping with the upper area of the previous correction zone (0.5 Fib light blue). After the price had already tested the 0.5 retracement once in early September and rallied from there, I waited for a second approach. I placed a first limit order in mid November, which was filled in exactly one month later as price moved back into the green corrective zone.

However, I do not assume that the correction is necessarily complete. From my point of view, further downside remains possible. Price could revisit the light-blue corrective area, meaning a deeper overshoot below the green retracement zone. A move not only below 3.00 EUR, but potentially toward 2.80 EUR or even 2.70 EUR cannot be ruled out. I am prepared for such a scenario and would view it as an opportunity rather than a problem.

On the upside, my moderate targets start at around 6.20 EUR and higher, based on the projected extension levels shown in light blue. In a more extended scenario, the broader sequence in green theoretically allows for moves toward the 9–10 EUR area if the higher-level structure plays out.

From a fundamental and news-driven perspective I guess, 2025 has been mixed so far. The company reported negative developments related to the Chikungunya vaccine, which has effectively been put on hold in the U.S.. Additionally, forecasts were revised downward, which clearly impacted price action and led to a second test of the green corrective zone. After the first test in early September, price has now entered this area again in recent days.

Looking ahead, I would not be surprised to see further weakness around or ahead of the Q4 2025 results, as guidance has already been adjusted lower. This could add additional downside pressure independent of the broader technical structure. However since the beginning of 2025 the price is still up more than 75%.

That said, the key long-term catalyst remains the Phase 3 data for VLA15, the Lyme disease vaccine candidate. Phase 1 and Phase 2 results have been very encouraging. If Phase 3 data also turns out positive, this could represent a major inflection point for the company. In that case, current price levels would likely become irrelevant in hindsight.

Price levels seen during the COVID period above 20 EUR are, at this stage, speculative and should be viewed as long-term upside, or to the moon if you will, scenarios rather than basic cases. For now, my focus remains on the current structure: managing entries within the corrective zones, expecting deeper Fibonacci retracement levels such as 0.559, 0.618, 0.667 or lower if reached, and reassessing once meaningful clinical data is released.

I am positioned, prepared for volatility, and willing to add on further weakness. If the upcoming data is positive, I expect a structural trend shift with significantly higher price levels over time. Let's see what happens.

I'd very much like to here your opinions and potential suggestions for improvements :)

Biotechnology

VTYX - Strong Gap-Up on Catalyst, Watching for Delayed SetupThe stock is showing a strong gap-up move on what appears to be a solid catalyst. However, given the current trading environment, which remains unfavorable for sustained breakouts, I’ll be watching for a potential delayed-reaction setup to develop over the coming days or weeks.

6.20 - 5.40 is a local support for potential pullback.

Chart:

VKTX Viking Therapeutics Exploding Higher TodayVKTX surges higher today after pulling back again near 200-day EMA. Not sure what the news is that's driving the big move higher. The news I did find talks about the following:

1) Viking Therapeutics completed a drug clinical trial stage earlier than expected last week

2) VKTX is on lists of hot stocks to buy for 2026 and could be a takeover, acquisition target

3) VKTX is recommended by 15 Wall Street Ranked analysis who give stock 12-month consensus average price target of $92

4) VKTX is on lists of stocks with high short interest (over 20% short interest) TO BUY because they are vulnerable to getting short-squeezed

Let's talk about the 4th item above. Just imagine VKTX continues to move higher on good news about clinical trials or possibly getting acquired by a larger company. This would push the stock even higher and will force traders who have big short positions on the stock to quickly cover, creating a snowball effect that frantically drives VKTX even higher and completely surges! This is reminiscent of what happened to Game Stop (GME) a few years back. I hope that this happens because I am long on several rather large call option positions on VKTX!

Whatever you all decide to do..... Good Luck!

Can One Shot Silence a Disease Forever?Benitec Biopharma has emerged from clinical obscurity to platform validation with unprecedented Phase 1b/2a trial results showing a 100% response rate across all six patients treated with BB-301, their gene therapy for Oculopharyngeal Muscular Dystrophy (OPMD). This rare genetic disorder, characterized by progressive swallowing difficulties that can lead to fatal aspiration pneumonia, has no approved pharmaceutical treatments. Benitec's proprietary "Silence and Replace" approach uses DNA-directed RNA interference to simultaneously shut down production of the toxic mutant protein while delivering a functional replacement, a sophisticated dual-action mechanism delivered via a single AAV9 vector injection. The clinical data revealed dramatic improvements, with one patient experiencing an 89% reduction in swallowing burden, essentially normalizing their eating experience. The FDA's subsequent Fast Track Designation for BB-301 underscores the regulatory conviction in this approach.

The company's strategic positioning extends well beyond a single asset. November 2025 marked a transformative capital event with a $100 million raise at $13.50 per share, nearly triple the $4.80 pricing from just 18 months prior, anchored by a $20 million direct investment from Suvretta Capital, which now controls approximately 44% of outstanding shares. This institutional validation, coupled with a fortress balance sheet providing runway into 2028-2029, has fundamentally de-risked the investment thesis. The manufacturing partnership with Lonza ensures scalable, GMP-compliant production while avoiding geopolitical supply chain risks that plague competitors reliant on Chinese CDMOs. With robust IP protection extending into the 2040s and Orphan Drug Designation providing additional market exclusivity, Benitec operates in a competitive vacuum, as no other clinical-stage programs target OPMD.

The broader implications position Benitec as a platform leader rather than a single-product company. The "Silence and Replace" architecture addresses a fundamental limitation of traditional gene therapy: it can treat autosomal dominant disorders where toxic mutant proteins render simple gene replacement ineffective. This unlocks an entire class of previously undruggable genetic diseases. The company's leadership, including CEO Dr. Jerel Banks (who brings both M.D./Ph.D. credentials and biotechnology equity research experience) and board member Dr. Sharon Mates (who guided Intra-Cellular Therapies to a $14.6 billion acquisition by J&J), suggests preparation for either commercial scale-up or strategic acquisition. With potential pricing power in the $2-3 million range per treatment based on comparable gene therapies, and an enterprise value of approximately $250 million against a multi-billion dollar revenue opportunity, Benitec represents a compelling asymmetric risk-reward profile at the vanguard of curative genetic medicine.

GLUE jumped 191% with 93% score on the indicator almost perfectHi guys,

A stock that jumped in the daily scan of the indicator and could be very interesting right now.

It received a score of 93 percent and therefore caught the eye like fire. My indicator is simply enthusiastic about it - it sees an almost perfect setup for momentum there.

It has a near-perfect stop and the third quarter 2025 reports were released this morning before the open. These reports can move the stock in either direction, so I recommend waiting to see the market's reaction and then perhaps considering an entry. I personally will not enter until I see that the market has digested the reports.

About the company:

Monte Rosa Therapeutics is a relatively small company from Boston that was founded only in 2019, but it is doing something really special. They have developed an innovative technology called Molecular Glue Degraders (MGD for short). It's basically a type of small drug that uses the body's natural mechanisms to break down proteins that cause disease instead of just blocking them.

Their secret engine is called QuEEN and uses artificial intelligence to identify proteins that can be broken down and design precision drugs. It's a technology that's considered revolutionary in the industry because it can treat diseases that no other drug has been able to treat.

The company is currently developing three main drugs in parallel. MRT-2359 to treat cancers driven by the MYC protein (including hard-to-treat prostate cancer), MRT-6160 for autoimmune and inflammatory diseases like lupus, and MRT-8102 for inflammatory diseases related to the NLRP3 mechanism. The first drug is already in advanced clinical stages with promising results, and the other two are in the early stages of human testing.

Institutional investors and large banks believe in this company. They have 10 analyst coverage and the majority of the average is BUY with an average target price of $13.50, which is another increase of almost 110 percent from the current price.

Massive Collaborations:

This is the interesting part. Last September, they announced a second collaboration with Novartis, one of the largest pharmaceutical companies in the world. In this agreement, Novartis paid them $120 million immediately in cash, and there is another potential of $5.7 billion if they meet all the milestones.

This is in addition to the first agreement they already had with Novartis in October 2024 for the drug MRT-6160, where they received $150 million upfront and up to an additional $2.1 billion in milestones. In total, there is a potential of almost $8 billion from the two agreements with Novartis alone.

They also have a collaboration with Roche to research and develop additional drugs in the field of cancer and neurological diseases. This shows that their technology is of interest to the big players in the industry.

Latest news:

Last week, the company presented strong preclinical data on MRT-6160 at the ACR Convergence 2025 conference, showing that the drug degrades more than 90 percent of the VAV1 protein and significantly inhibits the function of T and B cells. This is important because VAV1 is involved in many autoimmune diseases.

A few weeks ago, they announced that they would be attending four investor conferences in November-December 2025, including at Guggenheim Healthcare in Boston, TD Cowen Immunology Summit, Jefferies Global Healthcare in London, and Piper Sandler in New York. This means that they want to promote their story to big investors.

In March 2025, they presented exciting results from the clinical study of MRT-2359 in patients with castration-resistant prostate cancer (CRPC). Of the three patients treated, one achieved a confirmed partial response (PR) and two achieved stable disease (SD). Interestingly, all three patients had mutations that link resistance to standard treatments. In one of them, PSA levels dropped by 90 percent and the tumor shrank by 57 percent. As a result, they plan to expand the study to 20-30 more patients.

In July 2025, they began dosing the first people in a phase 1 study of MRT-8102 (the anti-inflammatory drug) with results expected in the first half of 2026.

In their second-quarter 2025 financial statements released in August, they reported revenue from collaborations of $23.2 million, a huge jump from $4.7 million in the same quarter last year. Their net loss fell from $30.3 million to $12.3 million. They have $295.5 million in cash that should fund operations through 2028.

In the fourth quarter of 2024 (reported in March 2025) they reported a colossal $60.6 million in revenue from collaborations and $38.9 million in R&D expenses.

Technical View:

Technically, the stock was at an ATH of around $44 in September 2021 and then crashed to $3.50 in August 2025. Since then, it has been on a strong rise and has already climbed to $13.22, a 191% increase in three months.

It is now at $12.31 in a three-day consolidation in the range of 11.50-13.22. The price is above the EMA10 at 11.9 and above the SMA200 at 5.88. There is a Perfect Order of all moving averages here and they are rising at a slope of 24.34 percent - this is a Strong Uptrend.

The average volume is 1.13 million shares per day and the ADR (average daily volatility) is 7.61 percent. The RSI is at 68.3 which is still normal and not overbought. The performance ratio compared to the S&P 500 is 181.93 percent - the stock is simply driving the market crazy.

In the last 10 days there have been 6 Higher Highs and 6 Higher Lows, this is a classic and clean uptrend.

There are currently no distribution signs or warnings on the chart. This is a Setup looking Ready for a breakout.

Weekly Trend:

Here I have one comment - in the weekly view the trend is still Neutral. This means that although the stock has made a strong increase in recent months, it has not yet clearly broken above significant resistance levels on the week. This should be taken into account.

*Sentiment and Social Networks:

I searched StockTweets and Reddit and saw that there are discussions, but they are not super active. This is not a stock that is talked about a lot on the networks or social media.

The main investors here are institutional rather than retail traders. The sentiment on StockTweets seems neutral to slightly positive but there is not a lot of activity there.

The analysts and experts are actually very positive. There are 9 companies with an Outperform or Buy recommendation, an average of 1.8 (scale of 1 to 5).

The risks:

This is still a clinical-stage biotech company without sales of real drugs. All the drugs are still in development and they have to go through the regulatory processes. If one of the clinical trials fails, the stock could collapse. Their cash is only supposed to last until 2028 and if they don't get more money from Novartis or other investors, they will have to raise capital.

The biotech sector is one of the most volatile and risky sectors. Most companies at this stage fail. The stock's beta is 1.53, which means it is 50 percent more volatile than the market.

It should be noted that the M-Score (financial manipulation indicator) has a score of 23.4 which could indicate a warning, but this is common in biotech companies at this stage because there is a lot of fluctuation in revenue from collaborations.

In conclusion:

I'll wait for the report.

My method is always to wait for large volume in the pre-market, which is at least 1.5 times and preferably the average volume, and then use my ORB indicator to get additional confirmation in the first 5 minutes of the open; but since they have reports coming out and I still don't know if it'll be far enough to cause a commotion in the pre market I'll wait.

This is a stock that my indicator really likes technically - it has a Perfect Order, strong momentum, and a clean setup. Fundamentally it has innovative technology, collaborations with giant pharmaceutical companies, promising clinical data, and good cash for several years.

But this is biotech with all the risks that come with that. The reports came out this morning and the current price of $12.31 already embodies some of the expectations. I personally wouldn't enter now before seeing the market's reaction to the reports and maybe wait for a small pullback to the 11-11.50 area where there is support. If it breaks 13.48 on high volume then you could consider entering with a very short stop loss below 11.84.

Definitely a stock to watch, but with great caution.

Just before you jump in:

Listen, I'm not an investment advisor and I don't want to be one. What I've written here is simply my analysis with the indicator I developed, and it could be completely wrong.

Biotechnology is not a game - it's one of the riskiest sectors there is. Ninety percent of clinical-stage companies fail and the money goes down the drain. You could lose everything.

I **do** not own this stock now and **will** not enter before I see what happens with the reports that came out today . I don't know you, I don't know the state of your portfolio, and I don't know how much risk you can take.

Before you put money in - do your homework, talk to someone professional who knows you, and only then decide. And don't invest money that you need for your electric bill.

Good luck to all of us, and may the goddesses shower us with an abundance of money.

When Does Progress Move Backward?UniQure N.V. experienced a catastrophic 75% stock plunge in November 2025 following an unexpected FDA reversal on its Huntington's disease gene therapy, AMT-130. Despite having received Breakthrough Therapy Designation and Regenerative Medicine Advanced Therapy designation, the company learned during a pre-BLA meeting that the FDA now considers its Phase I/II data, which relied on external controls from the Enroll-HD natural history database, insufficient for approval. This contradicted prior regulatory guidance and forced UniQure to abandon its planned Q1 2026 submission, immediately destroying billions in market capitalization and rendering near-term revenue projections obsolete.

The regulatory reversal reflects broader instability within the FDA's Center for Biologics Evaluation and Research (CBER), where leadership turnover and philosophical shifts have created systemic uncertainty across the gene therapy sector. New CBER leadership, particularly Director Vinay Prasad, favors traditional evidence standards over accelerated pathways that rely on surrogate endpoints or external controls. This policy hardening invalidates development strategies that biotechnology companies had pursued based on previous regulatory assurances, demonstrating that breakthrough designations no longer guarantee acceptance of innovative trial designs.

The financial consequences extend beyond UniQure's immediate valuation collapse. Every year of regulatory delay erodes patent exclusivity. AMT-130's patents expire in 2035, directly destroying net present value. Analysis suggests that a three-year delay could render 33-66% of rare disease therapies unprofitable, and UniQure now faces the prospect of funding expensive randomized controlled trials while operating with negative profit margins and declining revenues. The company's only viable hedges involve pursuing approval through European regulators (EMA) or the UK's MHRA, where regulatory philosophies may prove more accommodating.

This case serves as a critical warning for the entire gene therapy sector: accelerated approval pathways are contracting, single-arm trials using external controls face heightened scrutiny, and prior regulatory agreements carry diminishing reliability. Investors must now price significantly higher regulatory risk premiums into biotech valuations, particularly for companies dependent on single assets and novel trial methodologies. The UniQure experience confirms that in biotechnology investment, regulatory predictability, not just scientific innovation, determines commercial viability.

TSHA: substantial upside potentialPrice as been showing constructive four weeks of sideways consolidation following the early October gap-up move.

I continue to see substantial upside potential as long as price respects the 10-week MA on the macro view and the 21-day EMA in the more immediate perspective.

Daily chart:

Weekly chart:

Previously:

On bullish structure (Oct 2):

Chart:

www.tradingview.com

NTLA: reached key resistance zonePrice has followed through strongly from the mid-term support outlined in the September update, moving directly into the target mid-term resistance zone.

As long as the price remains below 30, I expect a near-term pullback below the 21dEMA to complete the first leg of decline.

If, however, the price breaks out above the October highs, it would open the door for further extensions toward the 31–34 resistance zone in the short term.

Chart:

Previously:

On bullish trend structure and support zone (Sep 26):

Chart:

www.tradingview.com

On resistance zone and pullback potential (Oct 8 and Oct 13):

Chart:

See weekly review:

AVDL on the way to macro resistance Price continues to follow the trend structure outlined since August and is showing strong follow-through from the mid-term support mentioned last week.

As long as price is holding above the 21 EMA, I’m watching for upside momentum to extend toward the 19–21 macro resistance zone.

Chart:

Previously:

• On upside potential (Oct 14):

Chart:

www.tradingview.com

• On mid-term support (Oct 3):

Chart:

www.tradingview.com

• On resistance and support (Aug 27):

Chart:

www.tradingview.com

$PGEN: decent upside potential NASDAQ:PGEN continues to act well from the mid-term support zone highlighted in the September and October updates.

I’ll be viewing any potential pullbacks toward the rising EMA as possible buying opportunities, with the next target resistance zone near 8.

Chart:

Previously:

On support (Oct 8): weekly review —

Chart:

On bullish structure (Sep 15): www.tradingview.com

Chart:

Can Machines Rewrite the DNA of Discovery?Recursion Pharmaceuticals is redefining the boundaries of biotech by positioning itself not as a traditional drug developer, but as a deep-technology platform built on artificial intelligence and automation. Its mission: to collapse the pharmaceutical industry’s notoriously slow and costly research model - one that can demand up to $3 billion and 14 years for a single approved drug. Through its integrated platform, Recursion aims to transform this inefficiency into a scalable engine for global health innovation, where value is driven not by one-off products but by the speed and reproducibility of discovery itself.

At the core of this transformation lies BioHive-2, a proprietary supercomputer powered by NVIDIA’s DGX H100 architecture. This computational behemoth fuels Recursion’s ability to iterate biological experiments at a pace that competitors cannot match. In collaboration with MIT’s CSAIL, Recursion co-developed Boltz-2, a biomolecular foundation model capable of predicting protein structures and binding affinities in seconds rather than weeks. By open-sourcing Boltz-2, the company has effectively shaped the scientific ecosystem around its standards, granting access to the community while retaining the true moat: its proprietary biological data and infrastructure.

Beyond its technological might, Recursion’s growing clinical pipeline provides proof of concept for its AI-driven discovery process. Early successes, including REC-617 (a CDK7 inhibitor) and REC-994 (for cerebral cavernous malformations), illustrate how computational prediction can rapidly yield viable drug candidates. The company’s ability to compress the time-to-market curve doesn’t merely improve profitability; it fundamentally redefines which diseases can be economically targeted, potentially democratizing innovation in previously neglected therapeutic spaces.

Yet with such power comes strategic responsibility. Recursion now operates at the intersection of biosecurity, data sovereignty, and geopolitics. Its commitment to rigorous compliance frameworks and aggressive global IP expansion underscores its dual identity as both a scientific and strategic asset. As investors and regulators watch closely, Recursion’s long-term value will hinge on its ability to transform computational speed into clinical success - turning the once-impossible dream of AI-driven drug discovery into an operational reality.

Can Innovation Survive Manufacturing Chaos?Regeneron Pharmaceuticals stands at a fascinating crossroads, embodying the paradox of modern biotechnology: extraordinary scientific achievement shadowed by operational vulnerability. The company has successfully transformed from a blockbuster-dependent enterprise into a diversified biopharmaceutical powerhouse, driven by two key engines. Dupixent continues its remarkable ascent, achieving 22% growth and reaching $4.34 billion in Q2 2025. Meanwhile, the strategic transition from legacy Eylea to the superior Eylea HD demonstrates forward-thinking market positioning, despite apparent revenue declines.

The company's innovation engine supports its aggressive R&D strategy, investing 36.1% of revenue, nearly double the industry average, into discovery and development. This approach has yielded tangible results, with Lynozyfic's FDA approval marking Regeneron's first breakthrough in blood cancer, achieving a competitive 70% response rate in multiple myeloma. The proprietary VelociSuite technology platform, particularly VelocImmune and Veloci-Bi, creates a sustainable competitive moat that competitors cannot easily replicate, enabling the consistent generation of fully human antibodies and differentiated bispecific therapies.

However, Regeneron's scientific triumphs are increasingly threatened by third-party manufacturing dependencies that have created critical vulnerabilities. The FDA's second rejection of odronextamab, despite strong European approval and compelling clinical data, is due to manufacturing issues at an external facility, rather than scientific deficiencies. This same third-party bottleneck has delayed crucial Eylea HD enhancements, potentially allowing competitors to gain market share during a pivotal transition period.

The broader strategic landscape presents both opportunities and risks that extend beyond manufacturing concerns. Although the company's strong victories in intellectual property cases against Amgen and Samsung Bioepis showcase effective legal defenses, the proposed 200% drug tariffs and industry-wide cybersecurity breaches, such as the Cencora incident impacting 27 pharmaceutical companies, highlight significant systemic vulnerabilities. Regeneron's fundamental strengths-its technological platforms, diverse pipeline spanning oncology to rare diseases, and proven ability to commercialize breakthrough therapies-position it for long-term success, provided it can resolve the operational dependencies that threaten to derail its scientific achievements.

OPKO Health | OPK | Long at $1.12OPKO Health finally closed the price gap on the daily chart between $1.11 and $1.12. There are no more price gaps below the current price (bullish). In the past year, insiders (primarily the CEO), have purchased over $4.7 million of shares at an average price of $1.55. Historically, this stock is very cyclical, and I believe we are near the bottom before the next cycle up. I have no idea when this will occur (may trade sideways for a while or dip below $1 in the near-term), but the insider purchases tell me they are preparing for a move. Average analyst price targets are between $2.75 and $3.99 right now, depending on the source. Book value = $1.66. As with any biopharmaceutical and diagnostics company, NASDAQ:OPK is purely speculative at this stage - yet raking in over $600 million in annual revenue.

My personal buy for NASDAQ:OPK was triggered at $1.12 and I hope to see more insider buying at this level.

Targets into 2028:

$1.40 (+22.8%)

$1.66 (+45.6%)

Squeeze for any reason = $5.00 (+338.6%)

How Does VIZZ Redefine The Future of Vision Care?LENZ Therapeutics, Inc. is rapidly establishing itself as a dominant force in the presbyopia treatment market following the FDA's approval of its VIZZ eye drops. This aceclidine-based solution, which restores near vision for up to 10 hours, has been met with a highly positive market response. The company's stock has soared, reaching a new 52-week high, with analysts issuing "strong buy" ratings and setting price targets up to $56. This success is underpinned by strategic initiatives across multiple domains, from global expansion to technological innovation.

The company's growth is fueled by a savvy geopolitical and geostrategic approach. By forging licensing and partnership agreements in key markets like China and Canada, LENZ Therapeutics is mitigating risks associated with global trade tensions and solidifying its position as a leader in ophthalmic innovation. These deals, with CORXEL Pharmaceuticals and Laboratoires Théa, provide substantial milestone payments and royalties, diversifying revenue streams and accelerating the commercialization of VIZZ. Macroeconomic trends, such as an aging global population and rising healthcare spending, further amplify the demand for non-invasive treatments, positioning LENZ for sustained growth.

VIZZ’s technological superiority is a key differentiator. The drops work by selectively contracting the iris sphincter to create a pinhole effect, enhancing near vision without the common side effects like headaches or brow ache associated with competing treatments. This scientific breakthrough, backed by robust Phase 3 trial data, has been protected by a strong patent portfolio covering its unique formulations and methods. Additionally, the company's commitment to cybersecurity and high-tech delivery methods ensures the integrity of its data and the efficient distribution of its product, building investor confidence and securing its competitive edge in the evolving biotech landscape

Can Global Chaos Fuel Pharmaceutical Giants?Merck's remarkable growth trajectory demonstrates how a pharmaceutical leader can transform global uncertainties into strategic advantages. The company has masterfully navigated geopolitical tensions, including US-China trade disputes, by diversifying supply chains and establishing regionalized manufacturing networks. Simultaneously, Merck has capitalized on macroeconomic trends such as aging populations and rising chronic disease prevalence, which create sustained demand for pharmaceutical products regardless of economic fluctuations. This strategic positioning allows the company to thrive amid global instability while securing revenue streams through demographic tailwinds.

The foundation of Merck's success lies in its innovation engine, powered by cutting-edge scientific breakthroughs and comprehensive digital transformation. The company's partnership with Moderna for mRNA technology and its continued expansion of Keytruda's indications exemplify its ability to leverage both external collaborations and internal R&D prowess. Merck has strategically integrated artificial intelligence, big data analytics, and advanced manufacturing techniques across its operations, creating a holistic competitive advantage that accelerates drug development, reduces costs, and improves time-to-market efficiency.

Protecting future growth requires fortress-like defenses of intellectual property and cybersecurity assets. Merck employs sophisticated patent lifecycle management strategies, including aggressive biosimilar defense and continuous indication expansions, to extend the commercial life of blockbuster drugs beyond their primary patent expiry. The company's substantial cybersecurity investments safeguard its valuable R&D data and intellectual property from increasingly sophisticated threats, including state-sponsored espionage, thereby ensuring operational continuity and a competitive advantage.

Looking forward, Merck's sustained momentum depends on its ability to maintain this multifaceted approach while adapting to evolving market dynamics. The company's commitment to ESG principles and corporate social responsibility not only attracts socially conscious investors but also helps retain top talent in a competitive landscape. By combining organic innovation with strategic acquisitions, robust IP protection, and proactive risk management, Merck has positioned itself as a resilient leader capable of converting global complexity into sustained pharmaceutical dominance.

Is a Spider's Silk the New Steel and Kevlar?Kraig Biocraft Laboratories, Inc. is a leading biotechnology company that has pioneered a scalable method for producing genetically engineered spider silk. By leveraging the domesticated silkworm as a "microfactory," the company has overcome the challenges of traditional spider farming. Its proprietary gene-editing technology inserts specific spider silk protein genes into silkworms, enabling them to spin high-performance fibers like Dragon Silk™ and Monster Silk®. This unique approach provides a cost-effective and efficient manufacturing platform, setting the company apart from competitors who rely on expensive fermentation-based methods.

The resulting material possesses properties that exceed those of conventional high-performance fibers. Genetically engineered spider silk is renowned for its exceptional toughness and tensile strength, a combination that makes it stronger than steel and tougher than Kevlar, while remaining remarkably lightweight. This unique blend of characteristics positions the company to capitalize on the rapidly expanding technical fibers and biomaterials markets, which are valued at billions of dollars annually. The company's production platform offers a significant competitive advantage in creating high-value materials for a wide range of industries.

This groundbreaking material has substantial strategic and geopolitical implications, particularly for defense and security. Its superior strength and energy absorption capabilities make it an ideal candidate for applications such as advanced ballistic protection and lightweight military gear. The company has engaged in collaborative agreements with government agencies, further validating its technology and demonstrating its strategic importance. Beyond defense, the material's potential extends to aerospace, high-end textiles, and advanced medical devices like sutures and implants.

Furthermore, Kraig Biocraft Laboratories’ technology offers a sustainable alternative to petroleum-based synthetics. The spider silk is a protein-based, biodegradable fiber, and its production process is less resource-intensive. This focus on sustainability and scalability aligns with the growing global demand for eco-friendly materials. By combining innovative technology, superior material performance, and a clear path to commercialization, Kraig Biocraft Laboratories is poised to be a pivotal player in the future of advanced materials.

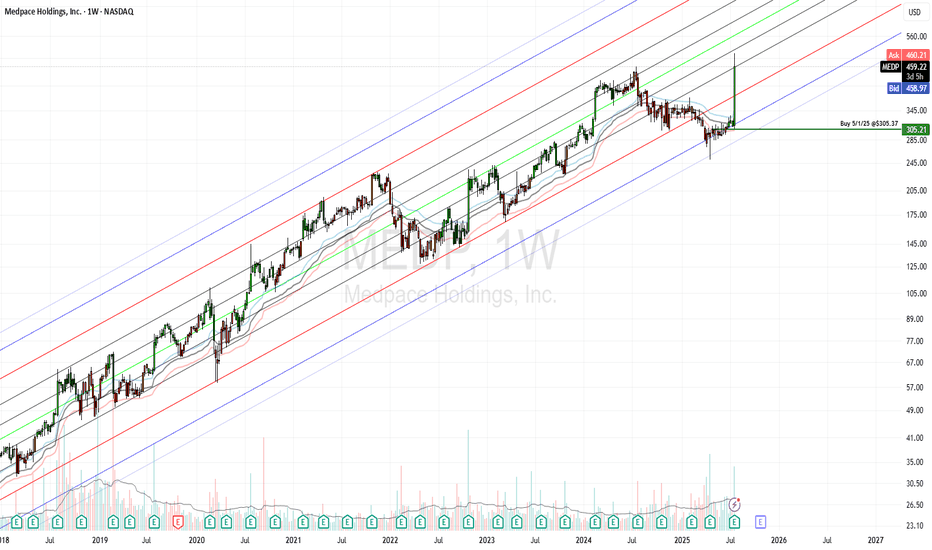

Medpace Holdings (MEDP): From Molecule to MarketMedpace is a late-stage contract research organization that provides full-service drug-development and clinical trial services to small and midsize biotechnology, pharmaceutical, and medical-device firms. It also offers ancillary services such as bioanalytical laboratory services and imaging capabilities. The company was founded over 30 years ago and has over 5,400 employees across 40 countries. Medpace is headquartered in Cincinnati and its operations are principally based in the US, but it also operates in Europe, Asia, South America, Africa, and Australia.

ClinTrak®: Integrated Clinical Trial Management System.

Electronic Data Capture (EDC), ePRO/eCOA, eConsent: Digital tools for patient-reported outcomes and consent.

Interactive Response Technology (IRT): Randomization and drug supply management.

Wearables & Apps: TrialPACE (patient app), OnPACE (site app), and centralized monitoring tools.

Narrow Moat: Intangible assets, high switching costs.

Differentiation: Speed and precision in trial execution, especially for complex therapies like biologics and gene therapies.

Ranks: Strong

GreenRed: 363 / 3,147

GreenBlue: 258 / 2,500

ABCL: When biotechnology not only curesABCL: When biotechnology not only cures, but also makes your wallet happy!

Hello, fellow investors and those who just like to tickle your nerves on the stock exchange!

Today we have on our agenda (and on the chart) - the stock AbCellera Biologics Inc. (ABCL), which seems to have decided to prove that even at the bottom there is life, and then even throw a party with a breakthrough!

As you can see, our hero ABCL has been playing ‘hide and seek with the trend line’ for a long time, showing an enviable resilience in the fall, just like your sofa after a day at work. However, if you look closely, the ‘ma/ema below price’ signalled that buyers, like secret agents, had already taken control of the situation, preparing for the decisive throw.

And here it is, it's happening! The recent ‘breakout + retest’ is not just a technical term, but a real escape from the ‘bearish’ prison with a subsequent test of strength. Not only did price break through resistance, but it came back to see if it was indeed broken. It's like going out of the house, forgetting your keys, coming back in, getting them, and then going out again - only in the stock market it's a sign of strength and determination!

Now that the dust has settled and the ‘1d’ trendline is behind us, our sights are set on the upside. Targets? Of course! ‘tp1-4.81’ and ‘tp2-6.00’ are not just numbers, they are potential points where we can pat ourselves on the shoulder and say, ‘I told you so!’. А ‘2,618 (6,61)’ - is for the very brave and patient who are willing to wait for the true bull dance.

All in all, ABCL seems to have turned a page in its history, swapping sad ballads for upbeat dance hits. But remember, friends: the market is a capricious thing, and even the most beautiful charts can bring surprises. So, act wisely, don't forget about risks and, of course, enjoy the process! Have a good trading!

ATAI Life Sciences | ATAI | Long at $1.30ATAI Life Sciences NASDAQ:ATAI , a clinical-stage biopharmaceutical company aiming to transform the treatment of mental health disorders, is fast approaching my selected historical simple moving average (SMA). Often, but not always, the closer the price gets to this line, the higher chance there is for a fast upward move. In anticipation of this move, NASDAQ:ATAI is in a personal buy zone at $1.30.

A word of caution: this is a pure technical analysis play and this company is not expected to be profitable for many, many years...

Target #1 = $1.75

Target #2 = $2.50

Target #3 = $2.95

ImmunityBio: Catalyst for a New Era?ImmunityBio, Inc. is rapidly emerging as a significant force in the biotechnology sector, propelled by the success and expanding potential of its lead immunotherapy asset, ANKTIVA® (nogapendekin alfa inbakicept-pmln). The company achieved a pivotal milestone with the FDA approval of ANKTIVA in combination with BCG for treating BCG-unresponsive non-muscle invasive bladder cancer (NMIBC) with carcinoma in situ. This approval addresses a critical need and leverages ANKTIVA's unique mechanism as a first-in-class IL-15 agonist, designed to activate key immune cells and induce durable responses. Building on this success, ImmunityBio is actively pursuing global market access, submitting applications to the EMA and MHRA for potential approval in Europe and the UK by 2026.

Beyond regulatory progress, ImmunityBio proactively tackles challenges in patient care, notably addressing the U.S. shortage of TICE® BCG. Through an FDA-authorized Expanded Access Program, the company supplies recombinant BCG (rBCG), providing a vital alternative source and expanding treatment access, particularly in underserved areas. This initiative supports patients and establishes a new market channel for ImmunityBio's therapies. Commercially, ANKTIVA's U.S. launch gains momentum, facilitated by a permanent J-code that simplifies billing and broadens insurance coverage, reaching over 240 million lives.

ImmunityBio's strategic vision extends to other major cancer types. The company is advancing ANKTIVA's potential in non-small cell lung cancer (NSCLC) through a confirmatory Phase 3 trial with BeiGene. This collaboration follows promising Phase 2 data demonstrating ANKTIVA's ability to rescue checkpoint inhibitor activity in patients who have progressed on prior therapies, showing prolonged overall survival. This highlights ANKTIVA's broader potential as a foundational cytokine therapy capable of addressing lymphopenia and restoring immune function across various tumors. ImmunityBio's recent financial performance reflects this clinical and commercial traction, marked by a significant revenue increase driven by ANKTIVA sales and positive investor sentiment.

Post-Report Sell-Off Seen as UnwarrantedSupporting Arguments

The market's reaction to the Q1 report was excessively negative

The stock possesses fundamental upside potential driven by a high revenue growth rate

The technical analysis indicates a probable rebound

Investment Thesis

GeneDx (WGS) specializes in delivering precise medical diagnostic results, leveraging exome and genomic testing to accurately diagnose genetic disorders. The company exclusively generates its revenue within the United States.

The recent GeneDx report significantly exceeded market expectations, yet the market's reaction was starkly negative. In our assessment, this presents a promising acquisition opportunity for WGS. Revenue for the first quarter of 2025 surpassed consensus estimates by 9.6%, also resulting in a substantial positive EPS surprise. The company has revised its full-year 2025 revenue guidance upwards by a median of $12.5 million, now projecting between $360 million and $375 million. This adjustment accounts for an anticipated $3 million to $5 million in revenue from the prospective acquisition of Fabric Genomics. The net increase in the guidance aligns closely with the value realized from the first-quarter surprise.

The only potentially contentious aspect of the report is the recorded 0.5% q/q decline in testing volumes within the largest revenue-generating segment, exome and genome sequencing. This trend has not been observed in this segment before. However, a seasonal dip in Q1 testing volumes is typical within the laboratory industry. This decline is primarily driven by a reduced number of working days in the first quarter and heightened diagnostic demand in Q4, as patients seek to maximize their insurance benefits before year-end. Historically, the low base effect coupled with GeneDx's robust sequential growth has counterbalanced unfavorable seasonal trends in Q1. Additionally, in the latest quarter, management cited the California wildfires as a possible negative influence on testing volumes. Consequently, we believe this testing dynamic does not warrant the marked downtrend seen in the price of WGS, especially given the upgraded guidance and the expansion of the product portfolio, both of which are poised to drive revenue growth over the next three years.

WGS stock is fundamentally undervalued. The GeneDx peer group has maintained a trading average of a 6.8 EV/Sales multiple over the past three years. We regard this figure as an appropriate target for GeneDx. Presently, the 2026 EV/Sales multiple stands at 5.6. We believe that sustained robust revenue growth over the next three years provides ample opportunity for valuation appreciation from the existing levels. Utilizing comparative valuation metrics, we project a target price for WGS shares at $87 over the next two months, accompanied by a "Buy" recommendation.

To mitigate risks, we advise establishing a stop-loss at $58. From a technical standpoint, a robust short-term support zone is identified within the range extending from $60 to the 200-day moving average.

A Long-term Bullish Trend ?With an upcoming Earnings report we can observe rather uncertain future behavior.

But since the trend has been bearish for a longer period of time and the price is "nearly" at the same position which was achieved for the first time in early April in 2019, we can, mostly based only on the technical analysis and Earnings report, determine quite confidently that the price is ready to rise.

Important data:

EPS Estimate: -$3.12

Revenue Estimate: $106 million to $166.7 million

Notable developments:

Cost-cutting initiative = Targeting $1.1B in reductions by 2027

By the end of 2024 $9.5 billion allocated in investments