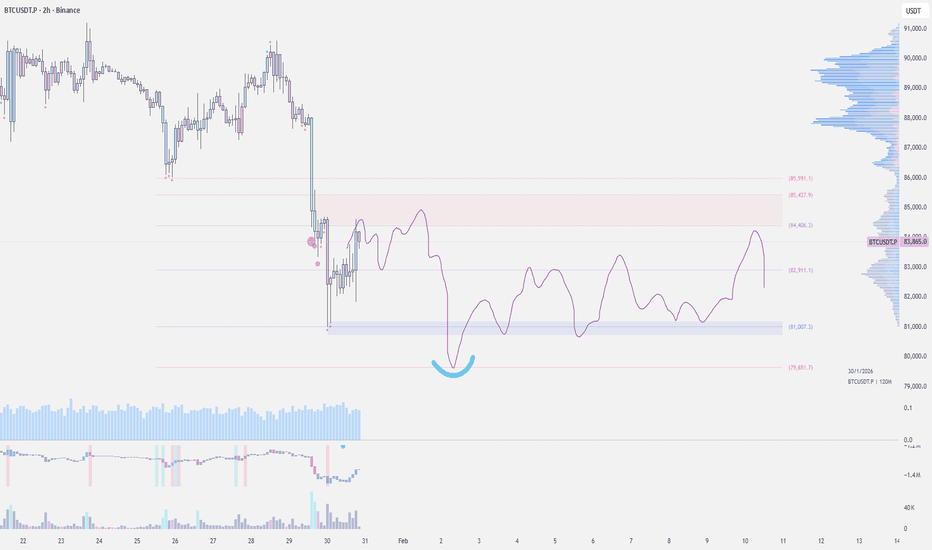

$BTC - LTF OutlookBINANCE:BTCUSDT | 2h

Something I’m watching on the lower time frame.

For now, I’m letting price action develop and not forcing anything. Ideally, I’d be interested in a long only if we get a clean deviation into the 79k–78k area and see some stabilization there.

Going into the weekend, I’m expecting more chop and two-way price action rather than a clean trend, so patience is key here. Happy to wait and react once the setup is clearer.

Bitcoin (Cryptocurrency)

XAU/USD | Targets ahead (READ THE CAPTION)By examining the hourly chart of Gold, we can see that it has had several 1000+ pips moves in the past couple of days! 3-4 1000+ pips moves in just the past 3 hours!

Since last night, gold has dropped over 4000 pips! Going as low as 4941, going through the NWOG, and sweeping the Sellside Liquidity there before going back up and now it's being traded at 5100. The wicks did their damage, they swept the liquidity and then went back up, and the Body of the candle closed just above the Jan 26 NWOG High.

At the moment, Gold is moving towards the Liquidity pool above the 5241 level, should it make it above the Daily FVG, it'll go for it.

However, if Gold closes below the Jan 26th NWOG low, I can see it going for the Sellside Liquidity below the 4899 level.

Bullish targets for Gold: 5170, 5200, 5230 and 5260.

Bearish Targets: 5060, 5030, 5000 and 4970.

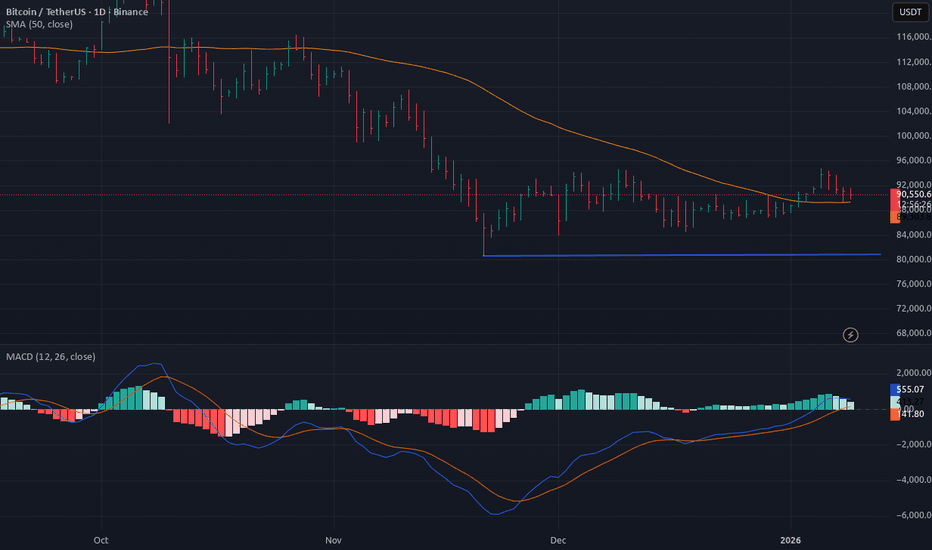

BTC mid-term TABitcoin is having some positive accumulation in the bearish area and it remains technically bearish with inverse trampoline formation, which means any pumps are short-lived. Considering heavy bearish volumes on weekly the risk remains high, the correction of the trend may continue soon.

GOLD DROPPING BADLYXAUUSD is showing a strong impulsive bullish structure on the higher timeframe followed by a sharp rejection candle, signaling a corrective phase after an overextended rally rather than a confirmed trend reversal, with price pulling back into a key Fibonacci retracement and previous breakout demand zone where resistance flipped to support, a classic breakout and retest scenario watched by smart money and trend traders. The broader market context still favors gold strength as safe haven demand, inflation hedge positioning, central bank gold accumulation, and ongoing macro uncertainty continue to underpin the long term bullish narrative, while short term volatility is being driven by US dollar flows, bond yield expectations, and high impact economic releases that temporarily fuel profit taking after parabolic moves. Technically this is a healthy pullback within an overall uptrend, with liquidity being rebalanced and momentum resetting from overbought conditions, and as long as price holds above the major demand block and structural higher low zone, dip buying, trend continuation, bullish order flow, and breakout retest setups remain the dominant strategy for positioning toward higher resistance levels once the correction completes.

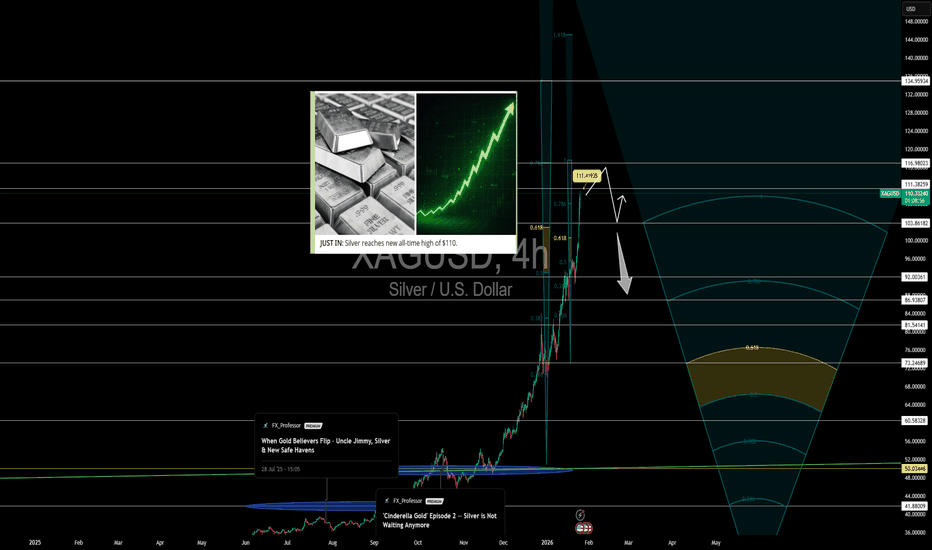

Silver $110, Gold $5K — Bitcoin Pump Next?Silver at $110, Gold at $5K, Bitcoin at Support — The Rotation Has Begun

New all-time highs for silver at $110 mark a historic moment. From $50 in November 2025 to blasting through $70, $80, $90 — and now triple digits — this has been one of the most aggressive moves in precious metals history .

Next resistance? $111.40 , followed by $116 and potentially $134.

Yes, I shorted at $103 and got smashed — life goes on. We adapt. 👊

But this video and analysis isn’t just about silver. It’s about where we are in the macro rotation — across silver, gold, and Bitcoin.

Gold is holding firm above $5,000 , with $5,405 as the next upside target. $5K now acts as psychological support. The metal remains strong — but the key question is: how much longer can gold outperform?

Bitcoin still looks weak — but the BTC/Gold ratio tells a different story . We’re hitting major long-term support from a 2020 ascending channel , backed by positive divergences . From here to the channel midpoint, there’s 73% room for corrective upside . That’s no small move.

The Gold/Silver ratio , using nearly 100 years of history, shows that sharp drops in gold’s relative value happen fast — and reverse just as fast . We’re at 46 now, with 41 as a possible floor. So yes — silver may still squeeze out another 10% outperformance … but exhaustion is near.

BTC/Silver reflects the same dynamic: silver still has the upper hand, but we're nearing major support levels . And when these ratios snap back, they do so hard.

These aren’t trades to chase blindly. They’re rotations to observe, prepare for, and trade with precision. Momentum is shifting — in real time.

Trading Wisdom 📜

When one market peaks, another prepares to rise. Silver's breakout is historic and undeniable — but century-old ratios don’t lie. Bitcoin is approaching key support against both gold and silver simultaneously . If the shift comes, it won’t be slow. It’ll be sharp, fast, and violent. Stay sharp, stay reactive, examine everything.

Disclaimer: What you read here is not financial advice — it’s high-level market philosophy from the FXPROFESSOR himself. Risk is real, and your capital is your responsibility. Learn, adapt, evolve.

One Love,

The FXPROFESSOR 💙

BUY Signal: BTC/USD (Bitcoin)

Entry: ~82,800–83,000 (demand zone reclaim)

SL: <82,000 (below purple demand low)

TP1: 86,000–88,000

TP2: 90,000–92,000 Reason: Price wicked deep into major demand zone (~82,000–83,000, purple shaded area), rejected lower with bullish reversal structure after sharp drop. Demand defended post-liquidity grab → strong bounce potential from oversold levels in broader uptrend. #Bitcoin #BTCUSD #Crypto #DemandZone #Bullish #BTC Not financial advice. Trading carries high risk of loss. DYOR and manage risk properly.

BTC | 4H Outlook: Liquidity Zones & Confirmation NeededOn the 4H timeframe, the first area I’m personally monitoring for potential positioning is the $80,600 liquidity zone. However, price has not yet swept liquidity from this level.

As shown on the lower timeframe in the third chart, a 4H close above $84,738 would allow us to start discussing a possible reaction or short-term reversal. Until then, there are no clear bullish signals.

Minor upside moves are normal at this stage, as price may simply be relieving RSI before continuing its downside move. In such an uncertain environment, waiting for clearer confirmation is the more disciplined approach.

If price loses the $80,600 level, a deeper pullback toward the $74,450 low could come into play.

Evaluating Bitcoin's Value Through User Adoption MetricsIn the spirit of classic value investing principles, which emphasize understanding an asset's intrinsic value through its user base and network effects, let's apply a similar lens to Bitcoin.

As of January 2026, Bitcoin's daily active addresses have shown a concerning stagnation, hovering around 475,000 down about 63% from 2021 peaks of around 1.3 million despite price highs above $125,000 in 2025.

This metric serves as a proxy for real network usage and adoption, much like customer growth for a traditional business. When active addresses decouple from price surges, it may signal overvaluation driven by speculation rather than utility.

For a potential trade setup: Consider accumulating Bitcoin if active addresses rebound above 1 million (indicating renewed adoption), targeting zones where price dips to $81,000 support levels seen recently.

This approach focuses on sustainable growth rather than short-term hype, emphasizing investing in assets with a strong, understandable 'moat' like Bitcoin's network.

BTC/USDT | Sweeping the SSL (READ THE CAPTION)After failing to sweep the liquidity, BTCUSDT has been experiencing a dramatic drop in its price, going as low as $81,118 and now being traded at 82,735. I would like to see BTC drop more and sweep the sellside liquidity before make an upwards move.

Targets for BTC: 82,000, 81,500, 81,000 and 80,500.

Bitcoin: The relief rally has been cancelled? Is it over?Bitcoin's bear market bottom can easily hit a range between $40,000 to $50,000. It can happen a bit higher but not likely to go lower than 40K. This would be a worst case scenario.

The question I am getting from my followers and readers is related to the short-term: What about the relief rally, is it over? No!

It is true that Bitcoin is set to move lower in the latter part of 2026 but this is still far away. The bearish cycle continuation is a process that is set to start in March or after March 2026, which means we still have some, or plenty, of time left. The relief rally is still on! Bitcoin is going up next.

Bitcoin's 2026 relief rally

We can divide the action that started in November 2021 in two parts: 1) The move from $80,600 toward $98,000, and 2) the retrace from $98,000 toward $81,118, today's low. So far, we continue to be at, and we are at, a classic higher low.

The volume 21-November 2025, the previous low, was 72.26K. Volume yesterday (today is not yet over) was 30.43K. So you can see how volume is lower. Today can result in higher volume than yesterday but it isn't likely to be higher than 21-November. It can also happen that the day closes green but this we do not know.

Market conditions changed, a tiny bit.

A rise from $82,550 toward $116,441 would mean 41% total growth. This is a lot for a relief rally. The previous move peaked around 21%. Normally, we would expect a relief rally to end with total growth around 30-40%. This is to say that we need to update our final target, we need to be a bit more conservative.

For the last bullish move before the major bearish climax, the 2026 Bitcoin market crash, we are going to be aiming at a range between $108,000 to $110,000. This is our updated target for the last leg up of the relief rally.

The altcoins are a completely different game and should be considered individually. It seems many will work as a safe haven as the global financial markets crash. Money will flow from conventional markets to the altcoins, yet, there will still be strong bearish action when Bitcoin moves down.

Thanks a lot for your continued support.

Namaste.

BITCOIN Bullish Rebound Ahead! Buy!

Hello,Traders!

BITCOIN collapses sharply today, and hit a strong demand level around 81k$ from where we are already seeing a bullish rebound, and as BTC is oversold we will be expecting a further bullish correction into the higher liquidity pools above. Time Frame 10H.

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

BITCOIN This Bearish Cross is the final confirmation of collapseBitcoin (BTCUSD) is currently past a Relative Vigor Index (RVGI) Bearish Cross on the 3M (quarterly) time-frame. This is a huge development as it is basically the last indicator to confirm the new Bear Cycle beyond any technical doubt.

Every time this took place historically, BTC was on the first quarter of a Bear Cycle. The consistency between those Bearish Cross formations is remarkable: 15 or 16 quarters (1369 - 1461 days) between each occurrence.

What's even more interesting is that following each RVGI Bearish Cross, the Bear Cycle bottomed in exactly 4 quarters, i.e. 1 year. This technically confirm our long-term expectation from previous analyses that the current Cycle should bottom around October 2026.

In addition to the RVGI, take a look at the 3M RSI. The quarter before the RVGI Bearish Cross topped on the 7-year Lower Highs trend-line, consistent with all previous Highs.

So what do yo think? Is the RVGI right to confirm the new Bear Cycle and pinpoint its bottom around October 2026? Feel free to let us know in the comments section below!

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

BTCUSDT Long: Recovery From Demand Zone - $89,800 in FocusHello traders! Here’s a clear technical breakdown of BTCUSDT (3H) based on the current chart structure. Bitcoin is trading within a broader corrective-to-recovery phase following a strong bullish impulse that previously developed inside a well-defined ascending channel. Within that channel, price consistently printed higher highs and higher lows, confirming buyer dominance and healthy trend conditions. The rally ultimately reached a key pivot point near the upper boundary of the ascending channel, where bullish momentum began to weaken. From this pivot high, BTC transitioned into a consolidation range, signaling temporary balance and distribution rather than immediate continuation.

Currently, BTC is recovering from the demand zone and moving higher along a rising demand line, while approaching the former supply level near 89,800. Price action suggests a corrective recovery rather than a full trend reversal, with buyers attempting to reclaim key structure. The area around 89,800 now acts as a critical decision zone, where market acceptance or rejection will likely define the next directional move.

My scenario: as long as BTCUSDT holds above the 87,200 Demand Zone and continues to respect the rising demand line, I expect a continuation of the recovery toward the 89,800 Supply Level (TP1). A clean breakout and acceptance above this resistance would strengthen the bullish recovery scenario and open the door for a move back toward higher resistance levels. However, a strong rejection from supply followed by a breakdown below demand would invalidate the recovery and suggest continuation of the broader corrective move. For now, price action shows buyers regaining short-term control, but confirmation at resistance is key. Manage your risk!

BTCUSD: continuation of the fall🛠 Technical Analysis: BTC is trading below the 90K psychological zone after the recent pullback, with price compressing near the MA cluster (dynamic resistance). The rising support line and the 88,335 area act as the key “trigger” zone: a clean breakdown can open the way for a deeper correction. Nearest resistance is 92,193 . Key downside support/target zone is 80,820.

———————————————

❗️ Trade Parameters (SELL)

———————————————

➡️ Entry Point: 88335.83

🎯 Take Profit: 80820.02

🔴 Stop Loss: 92193.50

⚠️ Disclaimer: This is a potential trade idea based on current analysis; market conditions and price direction are subject to change based on news factors and volatility.

BTCUSDT: Recovery From Support Within a Uptrend Toward $92,300Hello everyone, here is my breakdown of the current BTCUSDT setup.

Market Analysis

BTCUSDT is trading within a broader bullish market structure, previously supported by a well-defined upward channel. Inside this channel, price consistently printed higher highs and higher lows, confirming strong buyer dominance. During the advance, BTC reached the upper boundary of the channel, where a fake breakout occurred. This failure to hold above the channel top signaled temporary exhaustion and triggered a sharp corrective move to the downside. Following the rejection, price broke below the mid-channel structure and dropped aggressively into a clearly defined Support Zone around 88,500–89,000. This zone acted as a key reaction area, where selling pressure weakened and buyers began to absorb liquidity. The initial breakdown below support resulted in a fake breakout to the downside, after which BTC quickly reclaimed the level, indicating seller trap behavior.

Currently, after the fake breakdown, price entered a consolidation range, showing balance and compression rather than continuation selling. This range reflects a corrective phase after the impulsive drop, not a trend reversal. Recently, BTC broke out of this range to the upside and is now respecting a rising triangle support line, which suggests growing buyer strength and improving short-term structure.

My Scenario & Strategy

My primary scenario is bullish continuation as long as BTCUSDT holds above the 88,500–89,000 Support Zone and respects the ascending triangle support line. The recent breakout from the consolidation range strengthens the probability of a corrective recovery turning into a continuation move. I expect buyers to push price higher toward the 92,300 Resistance Zone (TP1), which represents previous resistance and a key reaction level. A clean breakout and acceptance above this resistance would confirm bullish continuation and open the door for a move back toward the upper boundary of the larger bullish structure.

However, if price fails to hold above support and shows strong bearish acceptance below the 88,500 zone, this long scenario would be invalidated and increase the probability of deeper downside continuation. For now, structure favors buyers, and the current move appears to be a healthy recovery after a corrective shakeout.

That’s the setup I’m tracking. Thank you for your attention, and always manage your risk.

Bitcoin Moment of Truth- This simple chart compares Bitcoin to gold, not to dollars. ( Remove the dollar = Compare real value ).

- Remember? Resistance often turns into support. Support often turns into resistance.

- A long time ago, when BTC reached this same level against gold, it failed and stayed weak for years. Today, BTC is back at the exact same line.

- This is a make it or break it zone: If Bitcoin stays above this level, it proves it’s stronger than Gold. If BTC falls below it, gold wins and BTC struggles again.

- No magic, no prediction. Bitcoin either holds the line…or loses the fight.

- Boomers vs Gen Z

Happy Tr4Ding !

SOL/USDT | SSL sweep? (READ THE CAPTION)As you can see in the 4h chart of SOLUSDT, it has experienced a massive drop from 148.74 all the way to 117.15, but managed to recover a bit and reached 128.34 before dropping again and now it's being traded at 122.70.

I don't want Solana to go for the Sellside liquidity pinpointed on the chart, but it is not unlikely for it to go there and sweep the liquidity below the 116.88 level, then starting a move upwards, going for the IFVG.

Bullish Targets for Solana: 123.00, 123.50, 124.00, 124.50 and 125.

Bearish targets: 122.50, 122.00, 121.50 and 121.00.

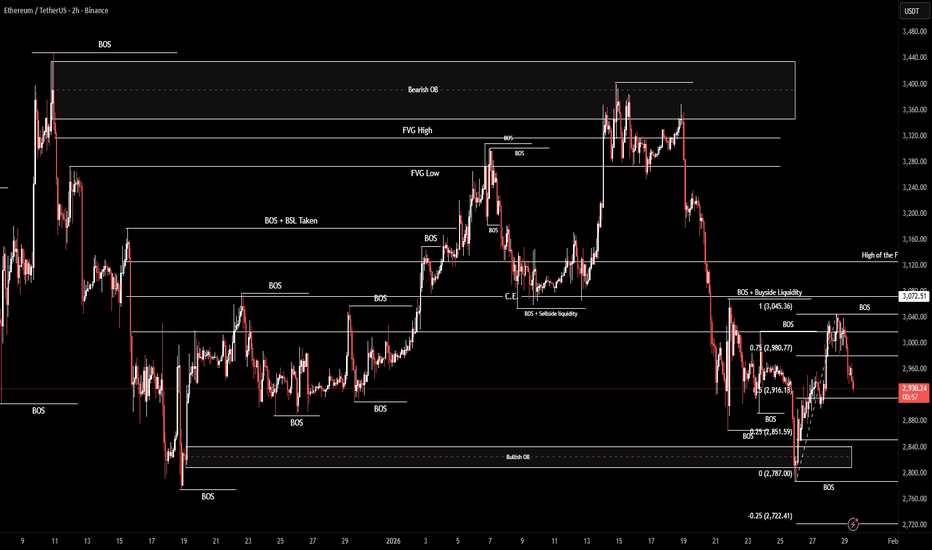

ETH/USDT | Where will it go? (READ THE CAPTION)By examining the 4H chart of the ETHUSDT we can see that Ethereum hit 3045, hitting the low of the FVG, but then today it dropped all the way to 2923, now being traded at 2928.

I'd like to see Ethereum retest the FVG again and then sweep the Buyside Liquidity pool.

Bullish Targets: 2936, 2954, 2972 and 3000.

Bearish targets: 2916, 2900 and 2884.

BTC/USDT | What's ahead? (READ THE CAPTION)As you can see in the Hourly chart of BTCUSDT, it reached all 4 targets of the previous analysis, reaching 90,600, going above the high of the IFVG, but then again, it returned to the IFVG zone and then went even lower, being traded now at 87,900.

There are relatively equal lows below with liquidity residing below them.

Ideally, I'd like BTCUSDT to sweep the liquidity below there and then make an upwards move.

For the time being, bullish targets: 88,200, 89,200 and 90,200.

Bearish Targets: 87,500, 86,900 and 86,300.