Why Risk Management works differently in Funded AccountsRisk management inside funded accounts is often reduced to position sizing and percentage risk. In reality, it operates under a very different set of constraints than personal capital. The presence of hard rules changes what risk actually represents.

In a funded account, risk is not only financial. It is structural. Daily loss limits, maximum drawdowns, and trailing equity thresholds define a fixed boundary. Once that boundary is crossed, the account ends. There is no recovery phase, no opportunity to adjust or wait for conditions to improve. This turns normal variance into a critical threat rather than a temporary setback.

Because of this, two trades with identical risk on paper can carry very different consequences. A perfectly valid loss taken early in the day may remove the ability to participate in high-quality setups later. A sequence of small losses, well within a strategy’s historical tolerance, can still violate account rules simply due to timing. Risk becomes path-dependent rather than distribution-based.

This reality shapes execution. Traders tighten stops to protect drawdown, even when market structure suggests wider protection is needed. They reduce position size beyond what their edge requires to survive longer. Some shift toward higher win-rate setups with lower expectancy to smooth equity. These adjustments are logical responses to constraints, but they redefine what “good” risk management looks like.

In personal accounts, drawdown is elastic. Losses are uncomfortable, but they do not end participation. This allows traders to think in terms of long-term expectancy, sample size, and recovery. Risk management focuses on sustainability over time rather than immediate survival.

Problems arise when traders apply real-account logic to funded environments, or vice versa. What feels conservative in one context can be reckless in another. Funded accounts reward survival within limits. Real accounts reward consistency across cycles.

Understanding this distinction removes confusion and self-blame. Effective risk management is not universal. It is conditional on capital structure. Traders who adapt their expectations and execution to those constraints stop fighting the rules and start working within them.

Bitcoin (Cryptocurrency)

$BTC 1W: Zoomed out update, down we go Bitcoin continues to weaken on the weekly timeframe after decisively losing the 72.9k support, with price now trading in the mid-60s and firmly below the rising trendline that had supported the broader uptrend. The rejection from the 92.6k region marked a clear lower high, and the impulsive breakdown that followed shifts momentum firmly in favor of sellers in the near term. Structurally, this opens the door for a grind lower toward the major macro support around 52.8k, which represents the prior cycle higher low and the most important level on the chart. From a market structure perspective, it would not be surprising to see BTC chop and bleed lower into that 52k region, allowing time-based correction and sentiment reset before any meaningful reversal attempt. While this does not invalidate the broader bull market unless 52k is lost on a weekly closing basis, the current trend favors rallies being sold until strong acceptance back above 72.9k occurs. For now, the path of least resistance remains slightly lower, with 52k acting as the key demand zone that could determine whether this is a deeper bull-market retracement or the start of something structurally heavier.

Gitcoin in Danger Zone- currenty under the 200 week EMA

But on a brighter Note, this is usually the sign that we are entering the Bottom Area, as mentioned Previously..

I was hoping PA would remain above and it may go back by End of this week, by Candle close.

PA is oversold on may Timeframes but the 4 hour has reached up to Beutral and the Nulls may let this cool off before a continued Range..

We just have to wait and see BUT it does present EXCELLENT Buying oppertunities.

And again, as mentioned Previously, On Friday 13th ( snigger snigger ) We have the inflation figures being released in the USA..

THIS could be a signal for a movement.....We may just be waiting till then

Bitcoin Bored Range… Big Bounce Loading? (66K Zone)Over the past four or five days, Bitcoin ( BINANCE:BTCUSDT ) has been moving within a range, which might have made some traders a bit bored.

Right now, BTC is moving inside a heavy support zone($78,260-$64,850) and, in the past couple of days, seems to be inside a small descending channel.

From an Elliott Wave perspective, it looks like Bitcoin is completing the corrective wave C of the main wave Y, in a Double Three Correction structure(WXY).

I expect that Bitcoin will rise from the Cumulative Long Liquidation Leverage($66,120-$64,420) and climb at least to $68,971. If it breaks the upper line of the descending channel with strong momentum, we could even anticipate a move up to $71,311. Let me know your thoughts!

First Target: $68,971

Second Target: $71,311

Stop Loss(SL): $63,821

Points may shift as the market evolves

Cumulative Long Liquidation Leverage: $60,000-$58,000

Cumulative Short Liquidation Leverage: $73,100-$71,620

CME Gap: $84,560-$79,660

CME Gap: $54,545-$52,980

💡 Please respect each other's opinions and express agreement or disagreement politely.

📌Bitcoin Analysis (BTCUSDT), 1-hour time frame.

🛑 Always set a Stop Loss(SL) for every position you open.

✅ This is just my idea; I’d love to see your thoughts too!

🔥 If you find it helpful, please BOOST this post and share it with your friends.

BTC/USDT Analysis. Testing the Lower Range Boundary

Hello everyone! CryptoRobotics trader-analyst here with your daily market analysis.

Yesterday, Bitcoin continued its decline and reached the lower boundary of the range at $67,300. After breaking this level, price failed to reclaim it. Instead, when retesting the level from below, volumes increased but failed to produce upward movement. The primary expectation for the next 24 hours is continued decline toward the nearest demand zone.

Within the buy zone, we will look for confirmation signals to consider long positions. If buyer reaction is absent, the decline may continue, potentially pushing Bitcoin below $60,000.

Buy Zones

$65,000–$63,000 (maximum traded volumes)

$72,200–$56,000 (daily buy zone)

Sell Zones

$72,500–$75,200 (selling pressure)

$77,800–$79,200 (accumulated volumes)

$82,000–$85,500 (volume anomalies)

$87,600–$90,500 (accumulated volumes)

This publication is not financial advice.

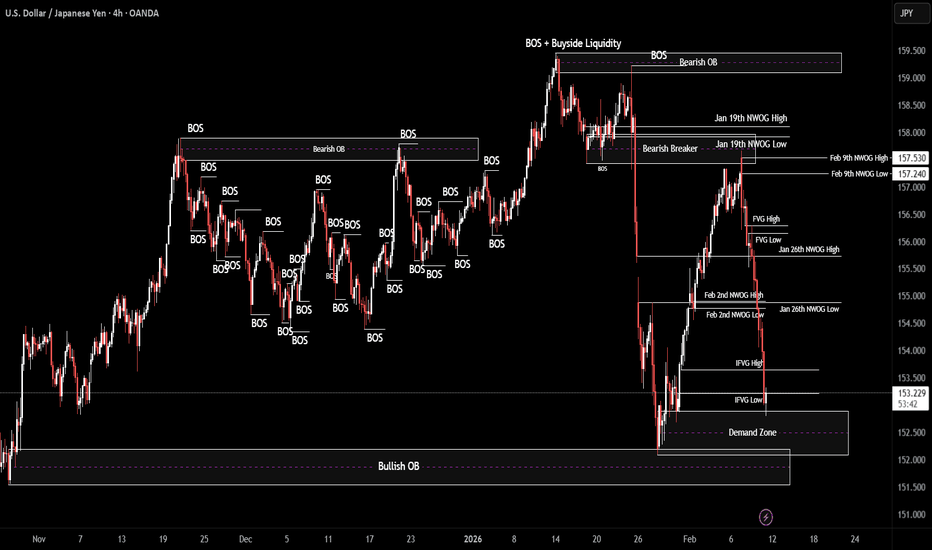

USD/JPY | Retesting (READ THE CAPTION)As you can see in the 4H chart of USDJPY, it has been on a bearish run for the past 3 days from Monday open. It gradually dropped in the price from 157.66 all the way to 152.80, that's almost 400 pips in a span of 3 days!

USDJPY hit the demand zone today and it is being traded at 153.21.

If USDJPY manages to stay above the demand zone and manages to go through the IFVG, the targets are: 153.28, 153.40, 153.52 and 153.64.

If it fails at retesting the IFVG: 153.10, 153.00, 152.90 and 152.80.

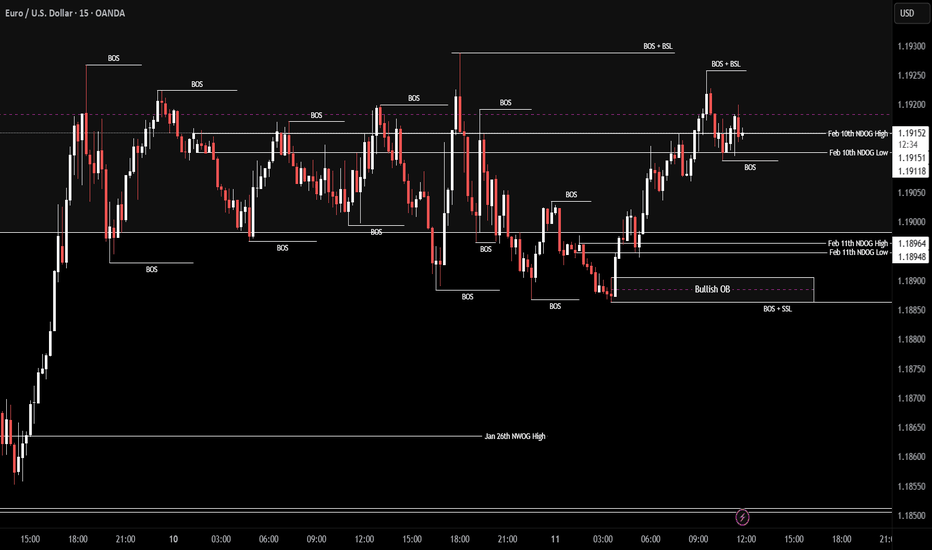

EUR/USD | Consolidation over? (READ THE CAPTION)By analyzing the 15m chart of EURUSD we can see that it has been consolidating in the same range in the past 2 days, Currently being traded at 1.1915, barely above the NDOG High. If EURUSD manages to hold itself above the NDOG, the targets are: 1.1922, 1.1929, 1.1936 and 1.1943.

If it fails to hold itself above the NDOG Midpoint (1.19135), the targets will be: 1.1908, 1.1900 and 1.1892.

TradeCityPro | Bitcoin Daily Analysis #265👋 Welcome to TradeCity Pro!

Let’s move on to Bitcoin analysis. The market has finally started its bearish move.

⌛️ 1-Hour Timeframe

Yesterday, we had two short triggers on Bitcoin. The first was the break of 68,586, and the second was the break of 67,375.

✔️ If you opened a position on the break of either of these levels, price has now reached the target, and you can take profits.

🔍 That said, I believe there’s still a good chance price continues toward Bitcoin’s main low at 62,824. For that reason, I suggest securing partial profits and keeping the rest of the position open.

💥 If the RSI enters the oversold zone, the probability of this move increases significantly. Volume is also currently in favor of the sellers, with red candles showing stronger volume than green ones.

✨ Based on this, the chances of price moving down toward 62,824 are high. However, if you didn’t enter using yesterday’s triggers, we don’t have a new trigger today on Bitcoin itself, and we need to wait for a new structure to form.

⚖️ If this bearish move that started yesterday turns out to be a fake move, and price manages to stabilize back above 68,586, strong bullish momentum will enter the market, and the probability of breaking the 71,616 high will increase significantly.

🎲 So we need to stay alert and, if yesterday’s move gets invalidated, look for long opportunities.

🔔 As for short positions, just like I mentioned, we don’t have a new trigger today and need to wait for fresh structure to develop.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

Bitcoin Breaks Major Support — Extreme Fear or Another Leg Down?Bitcoin ( BINANCE:BTCUSDT ), as I highlighted in my previous weekly idea , started its decline. The drop came with higher momentum than expected, surprising many, and it successfully broke the heavy support zone($78,260-$64,850).

Now, here are the fundamental reasons for Bitcoin’s movement in the last 24-48 hours, as well as the general context:

•Global Risk-Off Sentiment: Investors moved away from high-risk assets as global equity markets—especially tech stocks—came under heavy selling pressure.

•Lack of Strong Spot Demand: There was no meaningful inflow of fresh capital to absorb selling pressure at key support levels.

•Institutional Pressure & Unrealized Losses: Large BTC holders and public companies with Bitcoin on their balance sheets reported increased unrealized losses, weakening market confidence.

•Correlation With Traditional Markets: Bitcoin continued to trade as a risk asset, following the downside momentum of global financial markets.

•Forced Liquidations: High leverage across the market led to cascading liquidations, accelerating the downside move.

Bitcoin Fear & Greed Index is currently at 9 — marked as “Extreme Fear”.

This is the lowest reading since June 2022, when the market sentiment collapsed following major events like the Terra crash.

Historically, when the Fear & Greed Index dropped this low, Bitcoin experienced prolonged selling pressure and volatility, followed by eventual stabilization as fear subsided. Extreme Fear readings often coincide with market bottoms or oversold conditions, but they do not guarantee an immediate price reversal.

In short: Extreme fear can signal that market participants are overly pessimistic — possibly a contrarian buying environment — but confirmation from price action and other indicators is crucial before assuming a trend reversal.

Now, let’s take a quick look at Bitcoin’s 4-hour chart to assess the current situation.

It appears that Bitcoin, given its momentum, has successfully broken the heavy support zone($78,260-$64,850) and is currently pulling back toward that zone.

From an Elliott Wave perspective, it seems we are in the final stages of the main wave 4. After this pullback near Fibonacci levels, we anticipate another decline. Since the drop’s momentum has been strong, wave 5 could potentially be truncated.

I expect Bitcoin to resume its drop from one of the Fibonacci levels or Cumulative Short Liquidation Leverage($68,900-$67,200), targeting at least $64,123.

First Target: $64,123

Second Target: $62,103

Stop Loss(SL): $72,033

Points may shift as the market evolves

Cumulative Long Liquidation Leverage: $60,000-$58,000

CME Gap: $84,560-$79,660

CME Gap: $54,545-$52,980

💡 Please respect each other's opinions and express agreement or disagreement politely.

📌Bitcoin Analysis (BTCUSDT), 4-hour time frame.

🛑 Always set a Stop Loss(SL) for every position you open.

✅ This is just my idea; I’d love to see your thoughts too!

🔥 If you find it helpful, please BOOST this post and share it with your friends.

BTCUSDT Long: Descending Channel Breakout - Demand HoldingHello traders! Here’s a clear technical breakdown of BTCUSDT (2H) based on the current chart structure. Bitcoin previously traded within a well-defined consolidation range, where price moved sideways for an extended period. This ranging phase reflected a temporary balance between buyers and sellers and allowed liquidity to build above and below the range boundaries. Eventually, this equilibrium resolved to the downside, triggering a strong bearish impulse. After the range breakdown, BTC entered a clean descending channel, characterized by consistent lower highs and lower lows. Price respected both the upper and lower channel boundaries well, confirming controlled bearish pressure rather than emotional selling. This structured decline indicates that sellers remained in control while buyers were only able to generate short-lived pullbacks. The bearish move culminated at a clear pivot low, where selling momentum exhausted and aggressive buyers stepped in. From this pivot point, Bitcoin produced a sharp bullish reaction, breaking decisively above the descending channel, which marked a meaningful structural shift from bearish continuation to recovery. Following the breakout, price impulsively rallied and reclaimed key levels before reaching the Supply Zone around 71,700, where bullish momentum temporarily stalled. This level acted as a logical resistance, leading to a pullback.

Currently, BTC is consolidating above the Demand Zone and along the rising demand line, suggesting that the retracement is corrective rather than the start of a new bearish trend. Multiple reactions from this demand area indicate active buyer interest and defense of the level, reinforcing the idea of a developing higher-low structure. As long as price holds above the Demand Zone and respects the rising demand line, the broader bias remains cautiously bullish.

My primary scenario favors upside continuation after consolidation. A sustained hold from demand opens the door for a renewed push toward the 71,700 supply level (TP1), which represents the first major upside target and a logical area for partial profit-taking. A clean breakout and acceptance above this supply zone would confirm bullish continuation and signal potential expansion toward higher highs. Conversely, a decisive breakdown below the Demand Zone and loss of the rising demand line would invalidate the bullish recovery scenario and suggest a deeper corrective move. Until such confirmation appears, the current market structure points to balance with a bullish continuation bias from demand. Manage your risk!

BTCUSDT 5X Long with 339% profits potentialAt times, numbers can convey a stronger message than words... Maybe because we are talking about trading? Or maybe because there is no room for hiding mistakes. It is either hit or miss, and many people can appreciate this —thank you.

Numbers cannot lie, words either. Only humans can lie. Here comes the truth!

Bitcoin is bullish now based on a strong recovery and major low 6-February. The move we are witnessing today is a classic retrace. The retrace that tends to happen after prices move up in anticipation of additional growth.

Since the market is red... "Buy when the market is red."

Full trade-numbers below:

_____

LONG BTCUSDT

Leverage: 5X

Potential: 339%

Allocation: 5%

Entry zone: $60,000 - $67,000

Targets:

1) $69,800

2) $75,625

3) $85,300

4) $93,100

5) $100,911

6) $112,033

Stop: Close weekly below $58,000

_____

Thank you for reading. Your continued support is highly appreciated.

If you missed the entry 6-February, here is your second chance. It is now or never.

Leveraged trading is for experts only.

Namaste.

BITCOIN Is $50000 inevitable??Bitcoin (BTCUSD) is again on the downturn after almost reaching its 1W MA200 (orange trend-line) just last week. One would thought that long-term buyers would make their presence clear on this historically supportive level but so far their absence is more than emphatic. If this continues, the market eyes the next critical Support level, the 1W MA350 (red trend-line), which is where the previous 2022 Bear Cycle bottomed.

In fact, we identify a quite similar pattern on BTC's last three major correction events (2022 Bear Cycle and late 2019 - early 2020 on COVID flash crash). As you can see a Double Top rejection followed by a Higher Lows trend-line bearish break-out has been the common pattern on all (including the current correction). The previous two both broke below the 1W MA200 and their respective 1.618 Fibonacci extension levels, with the 2022 fractal bottoming just above the 1.786 Fib ext while the 2020 below it. In both cases, the 1W MA350 held.

As a result, if buyers continue to be absent and BTC is getting heavily sold after every short-term rally, we can expect the market to target $50000, which isn't just the next psychological level but also just above the current 1.786 Fib and will still be above the 1W MA350 (based on its current trajectory).

So do you think a $50k test is inevitable at this point? Feel free to let us know in the comments section below!

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

OKB: recovery or further decline? key levels to watch todayOKB. Still recovering from that brutal liquidation crash? After the wipeout and all the talk about compensations and “risk controls” according to industry sources, the market is clearly in trust‑rebuild mode, and OKB is trading like a wounded alt. That’s why this sideways chop here matters a lot: it’s either a base for recovery or just a pause before the next leg down.

On the 4H chart price is stuck under local resistance around 75‑77 with a flat, heavy range and RSI failing to get back above 50. Volume profile shows a fat node right here and a vacuum below, while all the serious supply zones sit much higher near 95‑110. That combo makes me lean to the downside over the next days, expecting sellers to press again once this support gives up.

My base plan: if 72 breaks and flips to resistance, I see room toward 68 and then the green demand area near 60 ✅ I’m watching shorts from the upper edge of the range with a tight invalidation above 80. Alternative: if buyers suddenly reclaim 80 and hold a 4H close, that opens the door for a squeeze into 90‑95 and I step aside or rethink long. I might be wrong, but ignoring risk here is how accounts get flash‑crashed too ⚠️

Ethereum (ETHUSD) – Key Support Breakdown & Final Washout Ahead?Back to Ethereum this week as the crypto carnage continues and the infamous 4-year cycle unfolds right before our eyes.

ETH has now reversed back to levels not seen since May 2025, breaking down through multiple key technical zones. Here’s what’s unfolding:

📉 Key Technical Breakdown

✅ 2600–2800 zone – Former support, now turned resistance after last week’s breakdown.

⚠️ 2100–2200 zone – Also breaking down, reinforcing bearish momentum.

🔻 Potential washout target: 1650–1750 – ETH tagged the upper bound of this zone late last week.

🧠 Why This Matters

We could be entering the final phase of the drawdown—what many refer to as a "capitulation low." The 1650–1750 range will be critical.

If ETH holds this zone, we may be setting the stage for a major macro bottom, potentially creating one of the best long-term accumulation opportunities in years.

🧭 What to Watch

📌 Resistance: 2100–2200 (short-term), 2600–2800 (major reversal level)

🛑 Support: 1650–1750 – Key area to watch for reaction and volume pickup

🔄 Invalidation: Continued weakness below 1650 could signal deeper downside

If You Invested $1000 in BITCOIN vs GOLD vs SILVER in Dec 2017 !If You Invested $1,000 in BTC, Gold, and Silver in Dec 2017 – Performance Today!

Back in December 2017, Bitcoin was all the rage. Hitting nearly $20,000, it promised to be the ultimate “store of value” and the future of money. Fast forward to February 11, 2026, and the reality looks very different. Bitcoin, a technology now nearly two decades old, has failed to live up to that promise—not even as a reliable store of value.

Let’s break down what would have happened if you invested $1,000 in Bitcoin, gold, and silver on December 19, 2017:

Asset Investment Dec 2017 Value Feb 2026 Gain

Bitcoin (BTC) $1,000 $2,740 +274%

Gold (XAU) $1,000 $3,000 +300%

Silver (XAG) $1,000 $4,250 +425%

The numbers speak for themselves:

Bitcoin: Despite its hype, your $1,000 only grew to $2,734 - barely keeping pace with inflation over the past eight years.

Gold: The traditional safe haven performed slightly better, reaching $3,000, proving that stability and trust still matter.

Silver: Surprisingly, silver outperformed both Bitcoin and gold, turning $1,000 into $4,250 - an impressive 425% gain.

Bitcoin may have been exciting in 2017, but in terms of long-term wealth preservation and real returns, gold and silver have clearly delivered better results. Volatility and hype can create dramatic short-term gains, but over the long haul, proven assets still dominate.

In 2026, Bitcoin is no longer the revolutionary “digital gold” it once claimed to be.

Meanwhile, traditional metals like gold and silver continue to reward patience and prudence—sometimes more than the latest crypto craze!

GBP/USD | what's ahead? (READ THE CAPTION)Good morning folks, Amirali here.

As you can see, after yesterday's fall, GBPUSD went well below the Jan 26th NWOG and Feb 5th NDOG. However, it made an upwards move after the initial drop and is now being traded at 1.3670, just above the Jan 26th NWOG High.

Now, if the price holds above 1.3670 in the next 2 hours, I can see it go for the Feb 2nd NWOG and for 1.37000.

For the time being, the targets are: 1.3680, 1.3690 and 1.3700.

If it fails to hold above this level, the targets will be: 1.3670, 1.3663, 1.3656 and 1.3650.

Bitcoin Rejected at Resistance — Is 63K the Next Magnet?Bitcoin is currently trading inside a short-term bearish structure after failing to reclaim the 68.5K resistance zone. Price attempted a minor recovery but was rejected cleanly from the lower boundary of the previous range, confirming that former support is now acting as resistance.

1️⃣ Market Structure

- Clear lower highs forming on the right side of the chart.

- EMA cluster is sloping downward short-term momentum favors sellers.

- Price is trading below both dynamic resistance levels.

The inability to hold above 68.5K signals weak bullish follow-through. This suggests the market is in a distribution-to-markdown transition rather than accumulation.

2️⃣ Key Levels

Resistance Zone: ~68,000 – 68,500

This level is now a supply flip. Any bounce into this area is likely to face selling pressure unless strong momentum reclaims it.

Support Zone: ~63,000 – 63,500

This is the next high-liquidity demand area. If bearish pressure continues, this zone becomes the primary downside magnet.

The projected path suggests:

Minor relief bounce

Followed by continuation lower toward support

3️⃣ Invalidation Scenario

Bearish bias weakens if:

Price closes decisively above 68.5K

EMAs flatten and reclaim structure

Higher high forms on H1

Until that happens, rallies remain corrective within a developing downtrend.

Trader’s Mindset

Bitcoin is not breaking down impulsively yet but it is failing to reclaim resistance.

That is often how markdown begins.

👉 Trade the structure. Respect the resistance flip.

63K is the liquidity pool that matters next.

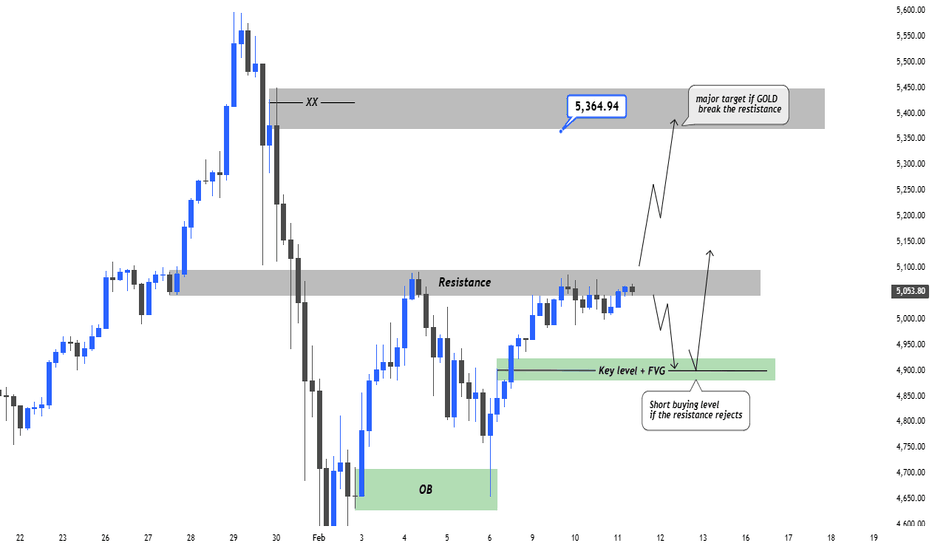

XAU/USD | Waiting for NFP! (READ THE CAPTION)By examining the hourly chart of gold it seems that it has been consolidating in a certain range since yesterday and it's not moving neither down nor up, which makes sense given today is the NFP news release date (a few days later than usual).

Now, if Gold manages to go above 5086 and hold itself above there, it'll signal that it'll go higher. Now, we have to wait until after NFP numbers come out to make a move.

Targets for gold, if it goes above 5086 and holds itself there: 5100, 5115, 5130, 5145 and 5160.

If it fails to get there: 5035, 5020, 5005 and 4990.

XAUUSD – H4 Next possible moveToday is NFP day, so volatility will be high.

I personally avoid taking trades before the news release.

🔹 Resistance zone: 5050 – 5100

🔹 Key support / POI: 4900 – 4860

📈 Scenario 1 — Breakout

If Gold breaks and holds above the resistance after NFP, the next major target is 5300.

📉 Scenario 2 — Rejection

If price rejects the resistance, a buying opportunities is around 4900–4860 (key level + FVG).

⚠️ Always wait for confirmation before entering any trade.

Bitcoin Analysis | 1D | Key Support and Targets | TraderTilkiGuys,

I analyzed Bitcoin for you on the 1-day timeframe, which is a swing analysis. 📊

Those who remember my previous Bitcoin analysis know it was very successful, because I predicted that drop in advance.

Now I’ll share another key point: the critical zone is between 59,000 and 50,000.

If Bitcoin finds support in the 59,000–50,000 range and rises upward, the first target will be 75,000 and the second target will be 80,000.

If Bitcoin falls below the 59,000–50,000 zone, the first target will be 45,000 and the second target will be 40,000.

Guys, whales are currently taking profit. Keep this in mind: if whales don’t sell their Bitcoin, how would they realize profits? Nothing falls forever, and nothing rises forever.

Every rise has a fall, every fall has a buy. Never forget this rule.

Don’t pay too much attention to media news, because even those headlines are influenced by whales. Whales are the ones who move the market; they have the financial power and influence everywhere, including the media. Please don’t forget this.

Guys, I share these kinds of analyses thanks to your likes.

I sincerely thank all my friends who support me with their appreciation, because your likes increase my motivation. 💛

Where Can Bitcoin Go? Part 10 – The ChartWhere Can Bitcoin Go? Part 10 – The Chart 📊🔥

Same structure.

Same levels.

Same battlefield.

This is the clean chart version following the video update:

“Where Can Bitcoin Go? Part 10 (Major Support)”

🎥 Video breakdown here:

Now let’s focus purely on the chart.

66,300 remains the key level.

This is the major support/resistance flip zone we’ve been tracking since 2023.

The yellow level worked before.

It acted as resistance.

It acted as support.

It defined structure.

And today — price is reacting from it again.

As long as 66,300 holds , the continuation scenario remains valid.

Lose it with acceptance below? I’m out of longs. Simple.

This is not emotion.

This is execution.

Hold support → expansion toward 70k and above

Lose support → risk management activates immediately

The beauty of structure is that it removes noise.

Perspective Shift 🔄

Most traders look for targets first.

Professionals define invalidation first.

It’s not about being right.

It’s about being protected.

Hope is expensive.

Structure is profitable.

Trade the level. Respect the level.

And let the market decide the rest. 📈

I’m just sharing wisdom, not instructions. No licenses, no guarantees — just years of trading scars and precision chartwork. Be smart, protect your capital, and don’t copy blindly.

One Love,

The FXPROFESSOR 💙

Where Can Bitcoin Go? Part 10 (Major Support)Part 1, click on Play:

Where Can Bitcoin Go? Part 10 – The Sequel 🚀📈

Time for a major update today.

I’m back on my all-time big chart — the same framework I’ve been using since 2023 in the “Where Can Bitcoin Go?” series. And guess what?

The levels are the same.

And the chart? It worked.

Back in 2023, I marked the yellow level as both support and resistance. Price respected it. We hoped for continuation higher at the time — it didn’t happen — but the level itself? Flawless. 🎯

Fast forward to today.

66,300 is once again the battlefield.

A major support/resistance level that we must hold and master.

Right now, we are reacting from that zone, and that gives room for a calculated trade .

Let me be clear:

• This is a support/resistance flip zone.

• If 66,300 is lost with acceptance below, I’m out of longs. No ego. No hope.

• But as long as it holds? I’m loading long positions for very, very good reasons. 🔥

This is not gambling.

This is structure.

This is history repeating with precision.

The bigger chart still shows:

• Massive structural resistance from prior cycles

• Massive structural support underneath

• A clean technical framework that has worked across years

And now we’re sitting exactly where decisions are made.

Keep the level — continuation scenario opens.

Lose the level — risk management takes over.

Simple. Mechanical. Professional.

Trading Wisdom 📜

The market doesn’t reward prediction.

It rewards risk management .

Anyone can say “Bitcoin to 200K.”

Few can say: “If this level breaks, I’m out.”

That’s the difference between hope and structure.

Human traders survive because they adapt.

AI calculates. Humans decide. 🧠

Master your invalidation before you master your target.

Disclaimer

Nothing I post is financial advice. It's perspective. I’ve mastered the art of prognosis, but you are the one behind the trigger. Always know your levels, and respect your risk.

One Love,

The FXPROFESSOR 💙