The "US Bitcoin Reserve" is a Lie. (A Macro Deep Dive)While Retail is chasing headlines about a "Strategic Bitcoin Reserve," Smart Money is aggressively de-risking. Why? Because the "News" is a linguistic misunderstanding, and the "Macro" just turned violently bearish.

If you are buying this dip because you think the US Government is about to print trillions to buy Bitcoin, you are walking into a trap. Today, we are going to deconstruct the three pillars of this bearish thesis: The "Project Vault" Deception, The Kevin Warsh Pivot, and the Technical Reality of DXY and ETHUSD .

__________________________________________________________________________________

1. The "Project Vault" Deception (Fact Check) 🕵️♂️

The entire bullish narrative right now hangs on the rumor that the administration's "$12 Billion Project Vault" is a secret plan to accumulate Bitcoin.

This is false.

I dug into the executive details. "Project Vault" is indeed a strategic reserve, but not for Crypto. It is a stockpile for Critical Minerals ,specifically Gallium, Cobalt, and Lithium—to secure the US defense supply chain against China.

• Retail hears: "Vault" = Cold Storage for BTC.

• Reality: "Vault" = Warehouses for EV Batteries and Fighter Jet components.

• The Takeaway: The market is pricing in a massive liquidity injection for Crypto that simply does not exist. When this realization hits the masses, the repricing will be severe.

__________________________________________________________________________________

2. The Macro Villain: Kevin Warsh 🦅

While everyone watches the "Reserve" headlines, they are ignoring the single most important variable: The Federal Reserve.

The new nominee for Fed Chair, Kevin Warsh , is the ultimate Hawk.

• History: He resigned from the Fed in 2011 specifically because he opposed Quantitative Easing (QE).

• Philosophy: He believes in a "Smaller Fed," "Positive Real Rates," and a "Strong Dollar."

• The Impact: Warsh is the anti-thesis to the "Money Printer Go Brrr" narrative. His nomination is a signal that the era of easy liquidity is ending. This is a Liquidity Withdrawal Event , and risk assets like BTCUSD are the first to suffer.

__________________________________________________________________________________

3. The Technical Truth: DXY & ETH 📉

The charts are confirming the Macro view perfectly. The "Smart Money" is already positioning for a liquidity crunch.

A) The DXY (US Dollar Index) Squeeze

The Dollar is waking up.

• Price Action: DXY is compressing tight at 26.9950 , sitting exactly at the confluence of the EMA50 and EMA200 . This is a massive decision point.

• Momentum: Stochastic is overbought (95.3), BUT ADX is at 52.2 . This tells us the trend strength is real.

• The Trigger: A 4H close above 27.09 (Upper Bollinger Band) triggers a breakout. If the Dollar flies, Crypto dies. It’s that simple.

B) Ethereum (The Canary in the Coal Mine)

If the "US Reserve" story were real, insiders would be front-running it on ETHUSD . Instead, ETH is lifeless.

• Structure: We have confirmed a CHoCH Bearish . Price is trading below every major Moving Average (20, 50, 200).

• The Trap: RSI is oversold (25.1), but ADX is 53.0 . Do not mistake "Oversold" for "Reversal." High ADX + Low RSI = A strong, relentless downtrend.

• Volume: We are trading at 39% below average volume . There is ZERO institutional support at these levels. The "Smart Money" has left the building.

__________________________________________________________________________________

4. The Operational Risk (The "John Lick" Scandal) 🚨

Finally, for those who believe the US Government is competent enough to manage a trillion-dollar Bitcoin reserve, look at the news from last week. A government contractor’s son was caught draining US-seized wallets on Telegram to flex wealth.

The Reality: The US Government cannot even secure the Bitcoin it already has. The idea that they are about to execute a sophisticated sovereign accumulation strategy is a fantasy.

__________________________________________________________________________________

🎯 The Verdict & Strategy

The "Strategic Reserve" narrative marked the top. The "Kevin Warsh" reality will drive the trend.

• The Trade: I am fading this narrative entirely.

• Invalidation: A DXY breakdown below 26.41 or an ETH reclaim of 3,403 (Bearish Order Block).

• Target: As long as DXY holds above the EMA200, I am targeting a flush on BTCUSD to 70k and ETH to 2,224 .

Do not trade the Headlines. Trade the Liquidity.

Do you trust the "US Reserve" hype?

A) Yes, HODL for nation-state adoption 🇺🇸

B) No, the chart is broken 📉

Vote A or B below! 👇

Bitcoin (Cryptocurrency)

BTC Rettesting old ATH - Next HigherBitcoin is retreating ATH 2022 of end cycle

BTC: Retreating to the 2022 Cycle Highs – The Ultimate Panic Buy? 📉🚀

Market Mood: Extreme Fear / Panic Timeframe: Daily / Weekly

Bitcoin is currently undergoing a brutal stress test, retracing toward the $69,000 - $70,000 zone—the previous "end of cycle" peak from 2021/2022. This area is more than just a horizontal support; it’s a psychological line in the sand for the entire market.

The Thesis: Reversal is Immiment

While the "Crypto Winter 2026" headlines are starting to scream, the technicals and sentiment suggest we are approaching a capitulation floor.

The Retrace: We have officially pulled back to the 2022 ATH levels. Historically, previous cycle highs act as massive magnets and, once tested, often provide the launchpad for the next structural leg up.

Sentiment Washout: The "moon" talk has been replaced by "zero" talk. We are seeing massive liquidations and "forced selling" from over-leveraged players. This is exactly the kind of blood in the streets that contrarian whales look for.

The RSI Signal: We are dipping into oversold territory on multiple timeframes, reminiscent of the mid-2022 and late-2018 bottoms.

BITCOIN COMING COLLAPSE 15.800/11,800 OCT 2026 LOW The Chart Posted Is that of a NON TANGIBLE ASSETS And has now followed The similar pattern in each of it bull market and bear markets since it has began in 2009 . In 2018 I called for a major top 19600 to 20380 That high was 19800 area and it followed the pattern of 1929 to a near perfect which called for a decline to 3400 the low was 3300 area . since this we have had clean and clear rallies in 5 waves up followed by ideal ABC declines and all have reached targets for the low within 2.7% and the next Bull phase . We are now near the End of the bull phase and a record of Leverage and Speculation and the creation of Derivatives and even more Leverage from 2 to 3 X times Now similar to The year of 1620 The peak in the Tulip mania . I have called for a final peak into the spiral turn we saw our first high on on time at 99600 . we are now near completed All sub divisions and bear cycles Points to a Low in mid Oct 2026 . The targets are for a 85 % decline at a MIN with the likelihood of a possible print o f8900/11,300 into this time frame . I also tend to see The Crypto market to lose over 90 % of the coins that are traded . Oct 2026 is the first low in the Great depression . All cycles are based on golden ratio and Natural Law of the 18.8 cycles Best of trades WAVETIMER

BITCOIN targets updated The chart is that of my work in Bitcoin I still see this as the ending of the first ABC decline .we are now into the second cluster of support . I still see a 5th wave ENDING Now beginning . I am watch IGV I have a low in 79 Handle they are all connected . I started buying CALLS in spy as of this post and will in IGV best of trades WAVETIMER

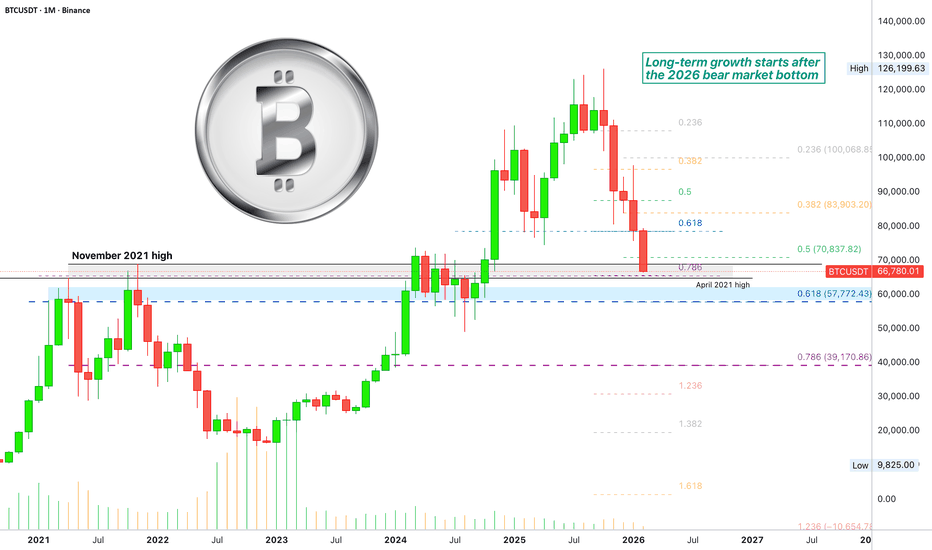

Bitcoin monthly—Hope! The 2026 bear market in its full gloryI waited before sharing this chart to see if market conditions would improve but nothing happened. While it is extremely bearish now, I haven't lost hope, things can easily turn after sustained, really strong, bearish action.

Bitcoin is now on its strongest bearish momentum in all of its history and also with five consecutive months trading in the red. This month is still early though.

Bitcoin is moving at super strong support. The strongest support ever sits at $57,772, the 0.618 Fib. retracement for the bigger, broader cycle. I would call this one an unbreakable support.

This zone has the candle closures from 2021, both April and November, as well as the entire consolidation period between March - October 2024. Months and months of consolidation and not a single month managed to close below this level.

Two things about it: If it is challenged, a reversal of some type develops here. If it breaks, a recovery can happen after some weak action below it, similar to Q3 2022. Instead of strong bearish momentum, more like consolidation at bottom prices, like we see on the smaller altcoins.

The extreme level sits at $39,172. We are using $40,000 for simplicity.

If Bitcoin continues straight down, it is possible to have an early end to the bear market. If it produces a second relief rally—the move from $80,000 to $98,000 was the main one—then it can crash again to produce a final low.

Conclusion

After five months of bearish action, it is more likely that a very strong relief will happen next. The market is bearish though. Oversold.

Thank you for reading.

Namaste.

Bitcoin Entry- When BTC was $500, it was “a Scam”.

- When BTC was $20k, it was " too dangerous".

- When BTC was $100k+. it was "too expensive".

- The problem today is simple: big hands are positioned ahead of you, with a professional strategy.

- You already have some tools for DCA entries : Fib levels, volume profiles, MA200 and key historical points of interest.

- Everything is priced in graphic, lower numbers would be very lucky.

Remember. Everyone gets BTC at the price they deserve.

Happy Tr4Ding !

THIS IS THE TIME TO START ACCUMULATING BITCOIN FOR LONG-TERMThinking of buying bitcoin and keep for long term? This is the right time to start buying. With price declined towards previous buying level, bitcoin may find needed support to start another journey to the upside.

N.B!

- BTCUSD price might not follow the drawn lines . Actual price movements may likely differ from the forecast.

- Let emotions and sentiments work for you

- ALWAYS Use Proper Risk Management In Your Trades

#ethusd

#crypto

#btcusd

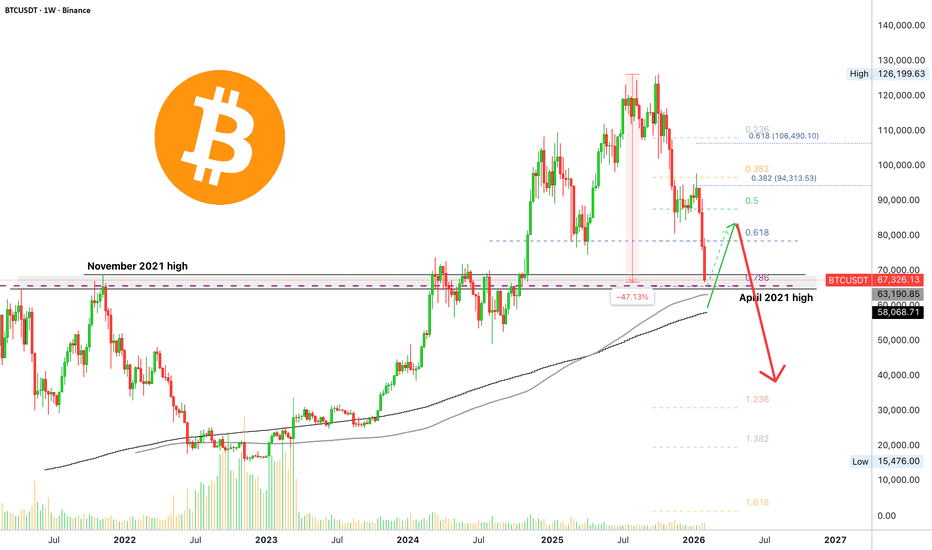

Bitcoin hits strongest long-term support —2021 ATH & 0.786 Fib.Bitcoin just hit its strongest support ever long-term, this is where the first reversal can happen.

The support level in question sits perfectly between the high from November and April 2021. It is happening right above EMA233 weekly and also the 0.786 Fib. retracement level in relation to Bitcoin's last major bullish wave—August 2024 through October 2025.

I mentioned this level yesterday at $65,000 but it is actually a range. 65K is only the 0.786 Fib. The range sits between $64,850 (can start at $63,200 if we count EMA233) to $69,000.

Bitcoin so far produced a low of $66,666, right in-between these two levels and below $70,000. A major bearish development.

The full size of the crash so far amounts to -47.13%. Time duration is 119 days. In 2018, Bitcoin produced a major low on the 5th of February. Here, anything goes.

If the current support range were to break a new support zone becomes active between $50,000 and $60,000 short-term. With $57,777 being a major level as shown here .

The bear market bottom can sit around $40,000. We still expect some sort of relief or pause before this level is reached. We still have until mid-February for wild shaky action on Bitcoin and the bigger projects. Many of the smaller projects are not duplicating what Bitcoin and Ether are doing. Those can be bought.

If we consider the $98,000 high as the end of the relief rally, and Bitcoin matches the same pattern as the 2022 bear market, then a major low can be reached around late March 2026. This is a different scenario to what we've been seeing, the one were straight down happens.

Namaste.

BITCOIN (BTC) — THE FALL HAS ONLY JUST BEGUN⚠️ THE GREAT BITCOIN REVERSAL — THE STORM NO ONE IS READY FOR ⚠️

For years, Bitcoin INDEX:BTCUSD climbed with the arrogance of a king convinced its throne was eternal.

But every empire falls.

And the chart…

The chart has been whispering the truth long before anyone wanted to hear it.

Today, that whisper has become a SCREAM. 📉⚡

🔥 1. The Final Wave Has Broken — and So Has the Illusion

The macro Wave 5 top is in.

Perfect confluence.

Perfect exhaustion.

Perfect euphoria.

The same pattern that ended EVERY Bitcoin mega-cycle… just printed again.

This wasn’t a top.

It was THE top.

The moment the bull cycle let out its final breath. 💀📈

🩸 2. Smart Money Has Already Left the Building

While retail celebrated “new highs,” Smart Money carved out:

• Stop hunts

• Liquidity grabs

• Breaker blocks

• Distribution ranges

• A devastating SOW

• And the cleanest market structure break BTC has shown since 2018

Institutions aren’t buying dips.

They are offloading the mountain .

The crowd doesn’t see it — yet.

⚡ 3. A Market Structure Collapse Echoing 2014, 2018 and 2021

Each cycle’s death began the same way:

A gentle pullback…

A sudden rejection…

Then a violent swing failure ,

followed by the HTF structure snapping in half.

That exact sequence is happening right now .

This is not a correction.

This is a cycle reset .

🎯 4. Fibonacci Retracements Don’t Lie — They Warn

Every true macro Wave 2 in history has returned to:

🔻 0.786

🔻 0.886

🔻 1.0 – 1.618 extensions

Where do they converge this time?

👇

🔮 $6,000 – $1,250

The forgotten land of 2017 mania…

A level BTC has avoided for 8 years.

But the cycle demands balance.

And balance always returns.

🌪️ 5. Price Action Has Flipped From Confidence to Panic

The candles have changed character:

• Weak closes

• Long tall wicks of rejection

• Failed rallies

• Imbalances breaking lower

• Bull traps everywhere

• A violent displacement to the downside

This isn’t cooling off.

This is unwinding.

📉 6. Market Cycle Psychology Has Entered Its Darkest Phase

We just exited Euphoria.

We are in Complacency.

Next comes:

😨 Anxiety

😱 Fear

💀 Capitulation

🔥 Anger

🌑 Depression

Only after that does a new accumulation begin.

And that’s why Wave 2 is infamous.

It destroys what Wave 1 built.

🚨 THE VERDICT: THE DOWNFALL IS IN MOTION — AND WE ARE EARLY

From $126K to $90K was not the crash.

It was merely the first spark in a forest full of dry leaves.

Wave A has barely begun.

Wave B will deceive.

Wave C will devastate.

The endgame target remains:

🎯 $1,250 – $6,000

The cycle reset.

The cleanse.

The opportunity of the decade — but only after the fire burns everything above it.

🔥 This is not fear. This is structure, math, psychology, liquidity, and time itself.

And all of them point in the same direction. Down, Down And Down

🔥 Follow this idea to stay ahead of the next macro move.

📈 We’ll update the chart as the structure unfolds — Wave A, Wave B trap, and the full Wave C capitulation zone.

💬 Drop your thoughts below — agree or disagree, the chart will decide.

🚀 Turn on notifications so you don’t miss the next critical breakdown.

⚠️ DISCLAIMER: This analysis is for educational and informational purposes only.

Not financial advice. Always manage risk and make decisions based on your own research and personal strategy.

#Bitcoin #BTC #Crypto #CryptoAnalysis #TradingView #BTCUSD #BearMarket #ElliottWave #SmartMoney #PriceAction #MarketCycle #Fibonacci #TechnicalAnalysis #CryptoCrash #CryptoWarning

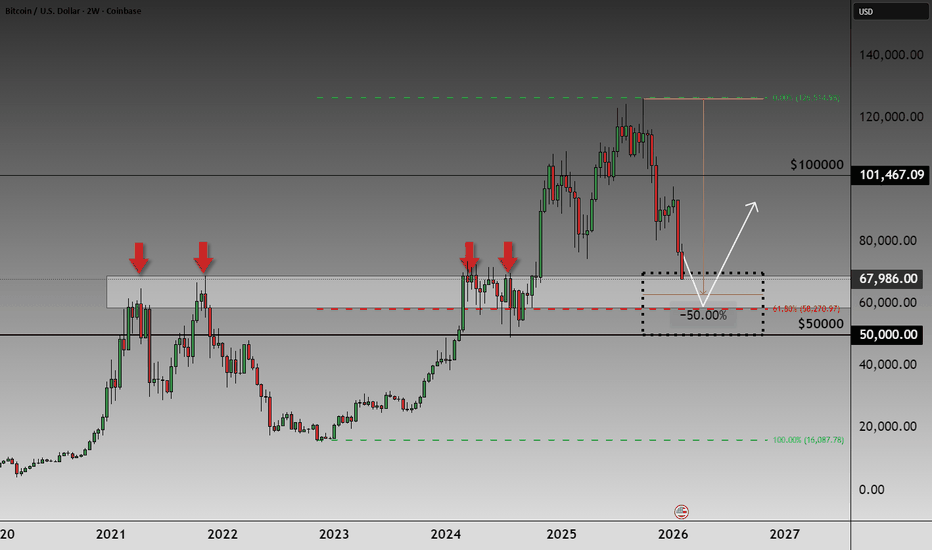

BITCOIN: The $50K–$70K Decision ZoneRemember this post 👇

Eight months ago, Bitcoin was trading just above the 100k area.

At the time, price action looked strong on the surface, but beneath it, there was unfinished business.

A "clear" inefficiency below the price.

A one-way move that hadn’t been properly filled.

Markets rarely like that.

They don’t rush, but they tend to revisit areas where participation was thin and emotions were one-sided.

Not because of narratives.

Because of the structure.

Today, the price is finally here.

Not via the road most people expected, including me, but exactly where technical logic said it could end up.

🔍 Why this Bitcoin zone matters to me

Price has arrived in a long-watched high-confluence area between $50,000–$70,000 - a zone built on multiple independent technical criteria:

1. Multiple prior yearly highs

Former resistance clustered in this range, now being revisited from above - acting as a potential support zone.

2. -50% drawdown from the all-time high

A level where excess optimism tends to reset and risk/reward begins to normalize. In crypto, this zone often becomes a meaningful liquidity "provider."

3. Psychological round number: $50,000

A level that matters not because it is magical, but because humans react to it... as seen clearly during 2024.

4. Weekly 200 moving average

A long-term trend reference widely respected by institutions and systematic players.

5. Fibonacci Golden Ratio (61.8%)

Currently measured from the last major upside move, from the end of 2022 to the 2025 all-time high, aligns perfectly with this zone.

----------------

This is not a buy-now signal.

Not a prediction.

Not a bottom call.

It’s a “pay attention” zone.

For me, this is where charts say:

Slow down. Reduce noise. Let structure take the lead.

It’s also the type of zone where I’m confident that my preparation makes sense.

The criteria I’ve waited for, and seen work repeatedly, are finally aligned.

Areas like this tend to do a few important things:

- They attract liquidity.

- They flush out panic.

- And they often mark the moment where control starts shifting from emotional sellers to participants who have a plan — and are ready to execute it.

If this area holds, it matters.

If it fails, that information matters just as much.

Either way, this is a range where I’m active, selective, and responsive... not impulsive, but not on the sidelines either.

Good luck,

Vaido

ONDO – Swing Trade Setup from Key Support ZoneONDO has now pulled back into a major support area between $0.25 and $0.29, a level that previously held as a strong demand zone. This presents a solid opportunity to ladder into a long swing trade, anticipating a potential move back toward higher resistance levels.

📈 Trade Plan:

Entry Zone: $0.25 – $0.29 (ladder entries)

Take Profit Targets:

TP1: $0.35 – $0.45

TP2: $0.55 – $0.68

Stop Loss: Just below $0.24

We're watching for confirmation from price action and volume at this zone. If momentum builds, ONDO could push back toward those higher resistance levels. A gradual scale-in approach helps manage risk while positioning for potential upside.

BITCOIN BULLS ARE GAINING STRENGTH|LONG

Hello, Friends!

BITCOIN pair is trading in a local downtrend which we know by looking at the previous 1W candle which is red. On the 4H timeframe the pair is going down too. The pair is oversold because the price is close to the lower band of the BB indicator. So we are looking to buy the pair with the lower BB line acting as support. The next target is 75,119.34 area.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

BTCUSD | Bearish Pressure Builds Below 72.6KBTCUSD | Bearish Pressure Builds Below 72.6K

Bitcoin slipped below key levels, increasing downside risk as market sentiment weakens. A sustained move under major support zones could accelerate selling pressure and trigger further liquidations across the crypto market.

Technical Outlook

Bitcoin maintains a bearish structure while trading below the 72.6K pivot.

As long as price remains below 72.6K, downside pressure is expected toward 66.4K, followed by the major psychological support at 60K.

A recovery toward 72.6K is likely to be corrective unless a strong breakout occurs.

Key Levels

• Pivot: 72.6K

• Support: 60.27K – 57.45K – 50K

• Resistance: 82.6K – 88.10K – 92.92K

LINK – Retracement into Key Support | Long Spot SetupChainlink has retraced into a major support zone, offering a potential opportunity for a long spot position. This area ($8.50–$9.50) has held well in the past and could act as a base for the next leg up, especially if broader market sentiment improves.

🛠 Strategy Setup:

Entry (Ladder In): $8.50 – $9.50

Take Profit Targets:

TP1: $11.00 – $12.00

TP2: $13.00 – $14.00

Stop Loss: Below $8.00 (to manage downside risk)

The idea here is to accumulate gradually (laddering) within the support zone, not all at once. This helps manage timing risk and smooths out entry price. If bulls return, we could see a push toward key resistance clusters around $11–$14.

$BTC – Looking for the Panic Flush Before the LongCRYPTOCAP:BTC – All Key Supports Broken | Watching for a Seller Capitulation Wick

Bitcoin has officially broken all major support levels, and the $70K zone is the last big psychological area before things can get ugly fast. That said — this is exactly the kind of tape I wait for.

🔹 What I’m Seeing:

Supports have failed across multiple timeframes.

Liquidations are accelerating — forced selling, not orderly distribution.

Sentiment is awful across crypto — fear, frustration, and disbelief everywhere.

That’s not when you short.

That’s when you prepare.

🔹 What I’m Waiting For (Very Important):

I want a true flush day — heavy selling pressure, big red candle.

Ideally we get long downside wicks showing seller exhaustion.

That kind of candle often marks the end of forced selling.

🔹 Key Levels:

$70K: Psychological pivot, already cracked.

Low $60Ks: This would be roughly a 50% retracement, a very normal reset after a cycle run.

If we get there with panic + wick = that’s when I start paying attention.

🔹 My Game Plan:

I have not touched CRYPTOCAP:BTC in months — intentionally.

I’m now stalking it again, but I will not catch a falling knife.

I want to see capitulation first, then a remount before I step in long.

🔹 Why This Matters:

Big bottoms don’t form quietly — they form with emotion.

Extreme liquidations + horrible sentiment are prerequisites, not problems.

When everyone gives up, risk/reward finally flips.

Patience here matters more than prediction.

Let the sellers exhaust themselves — then we strike.

USDT Dominance - Wyckoff AccumulationCRYPTOCAP:USDT.D could be mirroring Tesla’s 2022–2024 Wyckoff structure. From 2022 to late 2024, NASDAQ:TSLA formed a clear Wyckoff Accumulation on the weekly chart: a Selling Climax set the range, an Automatic Rally confirmed resistance, and a brief Spring in early 2023 shook out bears before prices recovered on strong volume. The stock then established a Last Point of Support, followed by a Sign of Strength breakout in late 2024, signaling institutional accumulation and the start of a new uptrend.

BTC is taking the direct route to long held targetsOriginally, I was counting BTC as subdividing in a minor B higher of intermediate (C)...but with the current price action, it appears we're taking a more direct route to long held targets for a durable bottom in the area of $58,000 to where price is now.

BTC/USDT | Going below 70,000?! (READ THE CAPTION)Well, BTCUSDT has been on a downtrend for a while and is still going lower, and it hit 70,140! The last time BTC has been in this range was in November of 2024! It is currently being traded at 71,600. BTC might hit the bullish OB and then make an upwards move. But if it fails to go back up, the targets are: 70,900, 70,100, 69,300 and 68,500.

Bullish targets: 72,000, 72,800, 73,600 and 74,400.

The recent Bitcoin slump ⭕️ The recent Bitcoin slump is not an isolated event, but rather part of a broader downward retrenchment trend that began in US stock markets, specifically in AI-related technology stocks.

⭕️ As these stocks declined, liquidity flowed out of high-risk assets and partially into traditional safe havens like gold. Meanwhile, cryptocurrencies failed to attract the same inflows. The result is continued pressure on Bitcoin and altcoins, with no strong support factors in place.

⭕️ When technology stocks decline, cryptocurrencies often follow suit because both are high-risk assets that rely on ample liquidity and investor confidence. The momentum of AI-driven investment is no longer providing the same support to the markets, and the focus has shifted to political uncertainty. This shift has driven money out of risky assets and into safe havens.

⭕️ The Bitcoin slump coincided with a sharp decline in Ethereum and Ripple, indicating widespread pressure rather than a problem specific to a single currency. In such situations, investors tend to sell the most liquid assets first, and Bitcoin is the most liquid in the cryptocurrency market.