GBPUSD | Breakout Watch from the ChannelCable’s tone has improved as UK inflation has stopped falling cleanly. December CPI ticked up to 3.4% y/y (from 3.2%), with services inflation still sticky (CPIH services 4.5% y/y), which can keep the market cautious about pricing aggressive BoE easing.

Technical lens: Price has been compressing inside a downward sloping channel after the prior leg higher, and we’re now pressing the upper channel line around the mid-1.36s. RSI is also pushing into the high-60s, which fits with “pressure building” rather than a clean mean-reversion setup. A sustained push through the channel top would put the next obvious magnet at the 1.41–1.42 supply zone marked on the chart.

Catalysts: The next FOMC meeting is 27–28 January (press conference on the 28th), which is the near-term volatility trigger for USD legs. On the UK side, the latest CPI print firming up keeps the “higher-for-longer vs slower cuts” debate alive into the BoE’s 5 February decision.

BOE

GBPUSD H1 Liquidity Sweep and Bullish Continuation Setup📝 Description

FX:GBPUSD on the H1 timeframe is trading inside a short-term bullish structure after a clear sell-side liquidity sweep. The recent impulsive move from the lower FVG suggests active demand and a shift toward higher prices, with price now consolidating above key intraday support.

________________________________________

📈 Signal / Analysis

Primary Bias: Bullish while price holds above the recent H1 higher low

Preferred Setup:

• Entry: 1.3442

• Stop Loss: Below 1.3426

• TP1: 1.3458

• TP2: 1.3475

• TP3: 1.3491 (BSL / higher liquidity)

________________________________________

🎯 ICT & SMC Notes

• Sell-side liquidity taken prior to bullish expansion

• Bullish displacement confirms short-term order-flow shift

• Buy-side liquidity resting above recent highs

________________________________________

🧩 Summary

As long as price remains above the swept sell-side and maintains higher lows, FX:GBPUSD is likely to continue its bullish intraday move toward buy-side liquidity.

________________________________________

🌍 Fundamental Notes / Sentiment

UK CPI y/y came in stronger than expected, reinforcing GBP strength and pushing back expectations for near-term BoE easing. At the same time, USD momentum remains weak. This backdrop favors upside continuation in GBPUSD, with pullbacks likely corrective rather than trend-changing.

________________________________________

⚠️ Risk Disclosure

Trading involves substantial risk and may result in capital loss. This analysis is for educational purposes only and does not constitute financial advice. Always apply proper risk management, predefined stop-loss levels, and disciplined position sizing aligned with your trading plan.

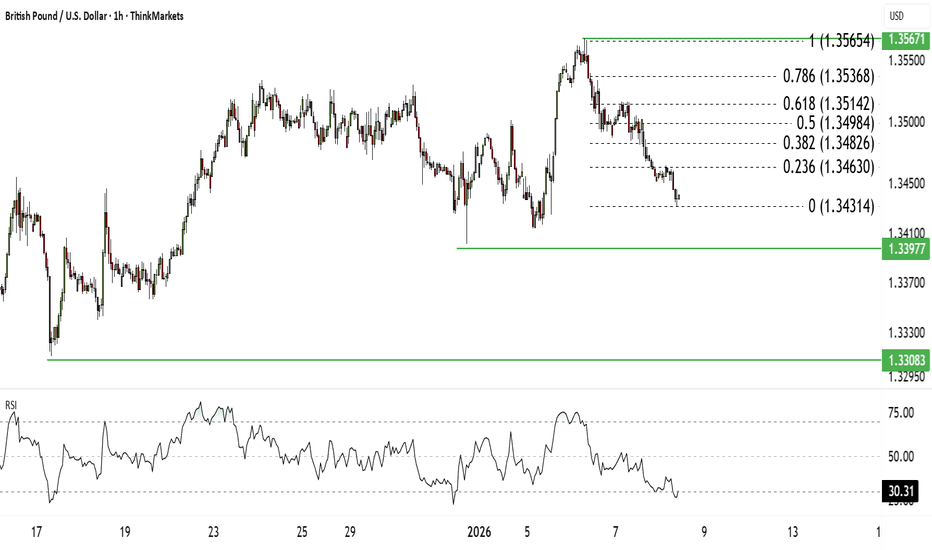

GBP/USD targets 1.35 after mixed UK jobs! Break or reversal?Today, we are doing a dive into GBP/USD following a mixed UK jobs report that has left traders scratching their heads. While unemployment has spiked to a 4-year high, sticky wage growth and new tariff threats from President Trump are keeping the pound bid. Is a breakout to 1.35 imminent, or is the labour market crack a warning sign?

We analyse the conflicting signals from the UK economy: unemployment rose to 5.1% in December (highest since 2021), yet wage growth held firm at 4.7%, keeping the BOE cautious on rate cuts. We overlay this with the "Greenland Tariff" threat weakening the US dollar and map out the technical path to 1.3568.

Key topics:

UK Jobs data: A breakdown of the December report—unemployment up to 5.1%, 43k job losses, yet sticky wages (4.7%) are preventing a dovish pivot from the BoE.

Trump tariff threat: How President Trump’s weekend threat to impose 10% tariffs on 8 EU nations (including the UK) over the Greenland dispute is pressuring the dollar and supporting cable.

Technical setup :

Bullish flag breakout: GBP/USD has reclaimed the 1.3400 handle and is holding above the 50% Fibonacci retracement.

Golden pocket: Currently testing the 1.3481 "golden pocket." A break here targets the 1.3568 cycle high.

Extension target: The 100% Fib extension points to 1.3500 as the immediate hurdle, with 1.3539 and 1.3562 above that.

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

Are you speculating on a 1.35 breakout or fading the weak labour data? Let us know in the comments!

GBP/AUD Outlook: Sterling Breaks Below Key 2.00 LevelThe British Pound has surrendered the psychological AU$2.00 handle. This technical breakdown signals shifting momentum in the currency markets. Traders now face a stark divergence between a cooling UK economy and a resilient Australian outlook. This analysis dissects the macroeconomic and geostrategic forces driving this volatility.

Macroeconomics and Economic Data

The UK economy displays worrying signs of stagnation. Official data indicates a 0.3% GDP expansion in November, ostensibly a positive figure. However, smart money sees through this headline. Temporary factors, specifically the reopening of a major automotive factory, artificially inflated growth. Without this industrial kick, the broader economy appears flat. Conversely, Australia enjoys robust external support. Strong import data from China, its primary trading partner, reignited demand for the Australian Dollar. This economic decoupling drives the pair lower.

Leadership and Monetary Policy

Central bank narratives are drifting apart. Bank of England policymakers recently struck a cautious tone. They suggested borrowing costs are nearing a "neutral level," confusing markets regarding future cuts. Leadership at the BoE appears hesitant, weighing recession risks against lingering inflation. In contrast, the Reserve Bank of Australia (RBA) faces rising consumer inflation expectations. This data emboldens hawkish voices within the RBA. Investors now price in a higher probability of Australian rate hikes, creating a yield advantage for the Aussie Dollar.

Industry Trends and Business Confidence

UK retail sectors report a lackluster holiday period. Declining business confidence surveys corroborate this slowdown. British consumers are tightening belts, removing a critical pillar of GDP growth. Meanwhile, Australia’s export industries benefit from renewed global demand. The surprising uptick in Chinese trade figures specifically benefits the Australian mining and logistics sectors. This divergence in business sentiment forces capital flows out of Sterling and into the yield-bearing Australian ecosystem.

Geostrategy and Global Trade

Australia’s fortune remains tied to Asian economic cycles. The recent surge in Chinese imports validates Australia’s geostrategic positioning as a resource hub. Geopolitical stability in the Pacific trade routes further secures investor confidence in the AUD. The UK continues to struggle with internal structural adjustments. As global trade patterns shift, the Australian Dollar acts as a liquid proxy for Asian growth. Sterling lacks a comparable external catalyst, leaving it vulnerable to domestic weakness.

Future Outlook and Data Risks

Volatility will persist in the coming week. Traders must watch upcoming UK employment and inflation reports closely. Forecasts predict easing wage growth, which would validate bearish bets against the Pound. If inflation cools too fast, the BoE may cut rates aggressively. For the AUD, the risk lies in domestic labor data. A rising unemployment rate could derail the RBA’s hawkish stance. However, the current trend favors further downside for GBP/AUD as macroeconomic realities diverge.

Cable eyes 1.34 on weak housing data.NFP to make or break bottomCable is pushing toward 1.34 with signs of a potential top forming, as clear divergence on the 4-hour RSI pushes prices lower. The big question: Will UK housing weakness and a divided Fed allow a break to 1.34 towards 1.33, or are we heading back to 1.35?

We analyse the impact of soft UK housing data, Halifax reported a 0.6% drop in December, against a backdrop of US dollar weakness and Fed uncertainty. With NFP looming tomorrow and President Trump potentially announcing a new dovish Fed Chair this month, volatility is guaranteed.

Key drivers

UK Housing softens : High mortgage rates are biting, with prices falling for the first time since June. Markets are split (47%) on an April BOE rate cut, capping Sterling's upside.

Fed & dollar : An 82% probability of a Fed pause in January is priced in, but markets still see cuts in 2026. A "U-shaped" dollar outlook favours GBPUSD upside early in the year.

NFP wildcard : Friday's jobs report could validate the Fed's "wait-and-see" stance or boost rate cut odds above 85%.

Technical levels

Bullish case : If 1.3400 holds as support (double bottom), we could bounce toward 1.3450 and eventually target 1.3500-1.3570 post-NFP.

Bearish case : A breakdown below 1.34 targets 1.3355 and the major support at 1.3300, especially if NFP comes in strong.

RSI check : The 1-hour RSI is oversold, suggesting a short-term bounce, but 4-hour divergence warns of medium-term weakness.

Are you betting on a breakout to 1.35 or fading the divergence? Share your plan in the comments and subscribe for our NFP coverage! Trade safe.

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

GJ Bulls Fail To Push Higher After BOE Rate CutAfter price on OANDA:GBPJPY made a 3rd test of a Rising Support, we see price push up to the Previous High but failed to secure a Higher High and made a False Breakout resulting in price being rejected down!

This also comes after the Bank of England made an expected 25 point Interest Rate Cut going from 4% down to 3.75%. Along with CPI for GBP coming down from 3.6% to 3.2%, this all weakens GBP.

Now later tonight, the Bank of Japan is expected to make a 25 point Interest Rate Hike from .5% to .75% and if Cuts weaken currencies, Hikes tend to strengthen.

I believe the False Breakout of the Highs and the intervention of Central Bank decisions will see OANDA:GBPJPY make a plummet down to the Rising Support another time and deliver a Bearish Breakout.

GBP/EUR Outlook: Sterling Plunges on Inflation MissMarket Volatility and Economic Shifts

The British Pound (GBP) crashed violently on Wednesday. Markets reacted instantly to the UK’s surprising inflation data. Headline inflation dropped to 3.2% in November. This figure missed the 3.5% forecast significantly. Core inflation also fell to 3.2%, signaling deep economic cooling. Traders immediately bet on a Bank of England (BoE) rate cut. The sudden drop reshapes the short-term currency landscape completely.

Geostrategy and Monetary Divergence

A clear strategic gap now exists between European powers. The BoE must prioritize growth, forcing a dovish pivot. Officials will likely cut rates to stabilize the economy. In contrast, the European Central Bank (ECB) holds firm. ECB President Lagarde maintains a strict, neutral policy stance. This divergence draws global capital away from London. Investors now favor the stability of the Eurozone.

High-Tech Trading and Cyber Impact

Modern currency moves often stem from automated systems. High-frequency trading algorithms executed massive sell orders on Wednesday. These bots react to data variances in milliseconds. The inflation "miss" triggered pre-programmed selling cascades. This cyber-driven volatility punishes currencies instantly. Human traders struggle to match this algorithmic speed. Such technological dominance defines current market liquidity.

Business Models and Industry Trends

Currency devaluation impacts UK corporate strategy deeply. Importers face immediate cost spikes, squeezing profit margins. Management teams must renegotiate supply chain contracts quickly. Conversely, the high-tech export sector gains a competitive edge. Cheaper Sterling makes UK innovation more attractive abroad. This shift rewards companies with agile, export-oriented business models.

Innovation and Patent Analysis

A lower exchange rate can stimulate scientific investment. UK firms often rely on foreign capital for R&D. A cheaper Pound makes UK assets and patents attractive targets. Foreign investors may acquire undervalued British intellectual property. This trend could accelerate cross-border mergers in biotech and science. However, retaining top talent becomes harder with a weaker currency.

Forecast: The Policy Path Ahead

Attention now locks onto the BoE’s forward guidance. Investors demand a clear roadmap for 2026 interest rates. A confirmed dovish stance will drive Sterling lower. Meanwhile, the Euro stands resilient despite mixed German data. The policy gap between the UK and the EU is widening. This structural divergence points to further GBP/EUR downside.

EURGBP | Will it extend last week's pressure?Macro approach:

- EURGBP has extended last week's pullback into this week, pressured by a slightly more resilient pound as markets reassess how quickly the BoE may ease policy.

- The euro has softened against sterling as recent Eurozone data and ECB communication have not added fresh hawkish momentum, encouraging some unwinding of long-euro positions built earlier in the quarter. At the same time, UK assets have found some support as investors question how aggressive future BoE cuts will be, limiting downside for the pound despite ongoing domestic growth headwinds.

- EURGBP may remain under mild downward pressure if upcoming UK activity and inflation data further reduce expectations for BoE easing. At the same time, Eurozone releases fail to revive confidence in the bloc's growth outlook. Upcoming BoE and ECB remarks, along with key UK and Eurozone data prints this week, could set the tone for whether this corrective bias extends or pauses.

Technical approach:

- EURGBP is declining toward EMA78 after retesting the broken level at 0.8750. The price is forming lower swings, indicating bearish pressure.

- If EURGBP breaches below EMA78, the price may plunge toward the immediate support at 0.8675, confluence with the ascending trendline.

- Conversely, staying above 0.8750 may prompt a further retest of the previous swing high around 0.8800.

Analysis by: Dat Tong, Senior Financial Markets Strategist at Exness

Final Target yet to be run on CHFJPYThis inverse Head and shoulders has produced fantastic gains already

What suggests that final target will be met

is that Yen vs other crosses is still yet trigger their respective necklines!

I assume more madness to come from the #BOJ in the next Financial Panic.

Like the Bank of England another Island nation probably first to embark on a new wave of #QuantitativeEasing

GBPUSD wave 2 pullback? Buy the dip or sell the Rachel rally?Sterling surged over 1% last week on UK budget relief, the so-called "Rachel Rally", but profit-taking kicked in at resistance. With both the BOE and Fed now 90% expected to cut in December, the dollar is under more pressure, making Cable pullbacks attractive buying opportunities.

Key drivers:

"Rachel Rally" profit-taking after Sterling's best week since August led to double top at 1.3275 resistance.

BOE December rate cut priced at 90%, creating short-term headwinds.

Fed December cut odds surged to ~90% after ISM Manufacturing fell to 48.2, the ninth straight month of contraction, keeping dollar weak.

Both central banks are cutting, but USD is under more pressure right now, supporting GBPUSD on pullbacks.

Wave structure : Five-wave leg complete from 1.30 low, now in Wave 2 correction. Key support zone between 38.2% and 61.8% Fibonacci (around 1.3150–1.3130). If this holds, buying the dip for Wave 3 of Wave 3 (or Wave 3 of C) targeting 1.3275, then 1.3315 and higher.

Alternative : Losing 1.31 increases risk of continuation lower toward previous low and potentially 1.2847.

Looking to buy the GBPUSD dip? Share your Wave 2 entries in the comments and follow for more macro-plus-technicals trade ideas.

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

GBPUSD | Opportunities Before UK Autumn Budget DataMacro approach:

- The pound appreciated against the US dollar as markets focus on the UK Autumn Budget and shifting expectations for US data and Fed policy this week.

- The UK Autumn Budget is the key event, with uncertainty over possible tax rises and spending cuts undermining confidence and keeping the pound under pressure. Recent data showing UK inflation easing to about 3.6% in Oct has boosted expectations of a BoE rate cut in Dec, which also weighs on the pound.

- On the US side, expectations for a Fed rate cut in Dec have climbed to 80%, putting downward pressure on the US dollar and US yields.

- Contrarian view: while the upcoming UK Autumn Budget (scheduled for 26 Nov) is a significant risk, the negative sentiment may have been fully "priced in" by earlier declines. Markets are in a "wait-and-see" mode. The lack of fresh negative news today has allowed the pound to stabilize and edge higher as traders square positions before the actual budget announcement.

Technical:

- GPBUSD is retesting the broken descending trendline, which is slightly above the key support at 1.3100. The price is between both EMAs, awaiting a clear breakout to determine the short-term trend.

- If GBPUSD breaches above EMA78, the price may continue heading toward the following resistance at 1.3215.

- Conversely, closing below the key support at 1.3100 may prompt a downward momentum to retest the previous swing low at 1.3040.

Analysis by: Dat Tong, Senior Financial Markets Strategist at Exness

GBP/JPY: An Unusual Ascent Amid Global RiskThe GBP/JPY pair currently sits near 204.00, retracing from a six-week high. This movement reflects a complex tug-of-war between the Pound Sterling (GBP) , which faces uncertainty from upcoming UK inflation data, and an uncharacteristically weak Japanese Yen (JPY) . We analyze the diverse forces driving this pair's recent unusual ascent, where the JPY fails to act as its traditional safe-haven counterweight.

Macroeconomics & Monetary Policy Divergence

The immediate market focus centers on divergent monetary policy expectations. The Bank of Japan (BoJ) faces pressure to align its policies with fiscal objectives, potentially limiting future rate hikes. This uncertainty, coupled with the new government's plan for large economic stimulus and lower taxes, dampens JPY demand. Conversely, the Bank of England (BoE) awaits crucial UK Consumer Price Index (CPI) data, which is expected to show headline inflation moderating to *b]3.6% annually. This data will significantly influence the BoE's rate hike outlook, injecting caution into GBP trading ahead of the 07:00 GMT release.

Geopolitics & Geostrategy: The Taiwan Factor

A key reason for the JPY's recent underperformance is a shift in geopolitical sentiment toward Japan. New Prime Minister Sanae Takaichi adopted a firmer pro-Taiwan stance than her predecessors, triggering unease in Beijing. This heightened political tension weighs heavily on sentiment surrounding Japan, effectively diluting the Yen's traditional safe-haven magnetism against global risk. This specific anxiety overshadows the Yen's long-term status as the principal global currency counterweight.

Fiscal Policy & Economic Outlook

Concerns about Japan's fiscal health are also eroding the JPY's strength. The government is preparing a large economic stimulus package to boost growth. This spending raises concerns among investors worried about Japan's already stretched finances . These fiscal anxieties add direct pressure to the currency, making the JPY less attractive despite the current risk-off environment observed in global equity markets. This fiscal trajectory contrasts with the Bank of Japan's potential monetary hesitancy.

Industry Trends & Corporate Vulnerabilities

Corporate Japan's deep integration with the US technology sector presents another vulnerability. Many major Japanese companies maintain significant earnings exposure to the health and performance of the US tech boom. Corporate vulnerabilities tied to the US technology cycle are eroding the JPY’s traditional safe-haven appeal. Consequently, negative headlines or wobbles on Wall Street disproportionately mute the Yen's response, preventing it from rallying when global equities come under pressure.

Management, Innovation, and Patent Analysis -

While not an immediate driver, Japan's long-term currency strength relies on its competitive edge in high-tech and science . The current vulnerability suggests that the market is discounting the perceived innovation premium of corporate Japan. Traders see a connection between the dependency on US tech and a potentially lagging pace in domestic, cutting-edge patent analysis and independent industry leadership. Weak corporate sentiment reflects doubts about resilience and adaptive business models under new management.

Conclusion for Strategic Hedging

The Yen's uncharacteristic weakness creates a unique setup. The currency is behaving out of character relative to the worsening risk backdrop. This anomaly presents tactical opportunities for hedgers with exposure to the Yen. However, this phase is likely temporary. Japan’s enormous net international investment position and its central role in funding global carry trades mean the Yen's safe-haven DNA remains intact. If global markets experience a sharper, sustained downturn, expect the traditional gravitational pull into the JPY to reassert itself.

EURUSD TIMEFRAME-BY-TIMEFRAME ANALYSIS# 💱 EURUSD (EUR/USD) COMPREHENSIVE TECHNICAL ANALYSIS 🎯

## Week of November 10-14, 2025 | Intraday & Swing Trade Mastery

Close Price: 1.15640 | Entry Point: November 8, 2025, 12:54 AM UTC+4 📊

## 🔍 EXECUTIVE SUMMARY - MULTI-TIMEFRAME PERSPECTIVE

EUR/USD is trading at a critical technical inflection point with strong multi-timeframe alignment signaling imminent directional breakout. Elliott Wave analysis reveals completion of corrective cycles, positioning for next impulse leg targeting 1.1650-1.1750 extension zone with substantial momentum. Bollinger Bands display classic compression squeeze pattern —volatility condensation preceding directional explosion. RSI across all timeframes maintains neutral-bullish bias (52-65 range)—optimal momentum positioning without extreme overbought conditions. Volume clustering at 1.1550-1.1630 represents significant institutional accumulation foundation. Wyckoff spring tests near 1.1500-1.1520 provide aggressive entry triggers. Harmonic pattern convergence at 1.1680-1.1750 resistance signals breakout confirmation with measured move targets extending to 1.1850+. ECB/Fed policy divergence supports directional clarity emerging this week.

## 📊 TIMEFRAME-BY-TIMEFRAME ANALYSIS

### 5-MINUTE (Scalping Precision) ⚡

Candlestick Formation: Japanese candles reveal micro-consolidation with breakout attempts at support zones. Evening Star rejection formations detected at 1.1680-1.1710 intraday resistance creating short opportunities.

Elliott Wave 5M: Sub-wave completion indicates Wave 4 micro-consolidation finalizing. Wave 5 breakout anticipated above 1.1650-1.1680 with targets 1.1720-1.1780 (measured move).

Bollinger Bands: Upper compression mode—middle band at 1.1630 acts as pivot point. Lower band rejection (1.1550-1.1580) creates scalp-long setups with excellent risk/reward ratios.

RSI (14) Analysis: RSI oscillating 48-62 range—neutral territory with minor divergences forming. Bullish divergence at 1.1550 support signals buyer engagement; caution on 68+ resistance approach.

Micro Support/Resistance: 1.1550 (micro-support) | 1.1600 (POC cluster) | 1.1640 (pivot) | 1.1690 (intraday resistance) | 1.1740 (scalp target)

Volume Signature: Volume concentrated 1.1600-1.1660 zone—institutional marker established. Breakout volume >50% above average required above 1.1690 for sustained move above 1.1750.

VWAP Alignment: Price oscillating around session VWAP at 1.1625—each touch generates scalp opportunity. Upper VWAP band at 1.1710; lower support at 1.1550.

### 15-MINUTE (Quick Swing Gateway) 🎢

Candlestick Patterns: Engulfing bars forming at support zones—bullish engulfing at 1.1570 zone confirms reversal attempts. Three-candle patterns (flag continuation) with 50-80 pips breakout potential.

Harmonic Pattern Recognition: Gartley Pattern potential completion near 1.1560-1.1620 PRZ (Potential Reversal Zone). Exceptional risk-reward at 1:3.5 for harmonic traders. Butterfly variant also forming.

Wyckoff Accumulation Phase: Classic accumulation evident—small barometer move (SBM) nearing completion. Spring test anticipated 1.1480-1.1510 zone; markup phase targets 1.1750-1.1850.

Bollinger Bands (15M): Band squeeze intensifying—historical volatility expansion suggests 70-120 pips moves follow. Upper band resistance at 1.1740; lower band support at 1.1520.

Volume Profile (15M): Point of Control (POC) at 1.1630—prime concentration zone. Volume surge >55% required confirming breakout above 1.1710. Imbalances favor upside significantly.

Ichimoku Cloud (15M): Price consolidating below cloud edge—Tenkan-sen at 1.1700 = resistance pivot. Kijun-sen (1.1660) = critical secondary support. Cloud support 1.1540-1.1610.

EMA Structure: EMA 9 (1.1650) above EMA 21 (1.1610)—bullish alignment confirmed. Price above both = intraday strength maintained.

### 30-MINUTE (Intraday Swing Axis) 🔄

Pattern Formation: Symmetrical Triangle pattern consolidating with apex near 1.1700. Ascending triangle variant shows bullish bias—breakout above 1.1680 targets 1.1780-1.1850 extension.

Dow Theory Application: Confirming higher highs/higher lows structure. Secondary trend bullish; pullbacks to EMA 20 (1.1640) = optimal swing entry zones identified.

RSI Divergence Setup: Positive RSI divergence confirmed—price making lower lows (1.1540) while RSI forms higher lows (42 level). Classic reversal setup targeting 1.1720 minimum.

Exponential Moving Average: EMA 9 (1.1665) = core support pivot. EMA 21 (1.1610) = secondary support. EMA 50 (1.1500) = structural hold level. Bullish ribbon alignment intact.

Support Architecture: 1.1500 (EMA 50/structural) | 1.1560 (demand zone) | 1.1610 (volume cluster) | 1.1650 (EMA 9 dynamic)

Resistance Architecture: 1.1680 (triangle formation) | 1.1750 (measured move target) | 1.1800 (weekly resistance) | 1.1850 (extension)

Volume Analysis (30M): Increasing volume on recent bars—accumulation signature strong. Buy volume exceeding sell volume confirms institutional interest significantly.

### 1-HOUR (Core Swing Trade Engine) 🎯

Elliott Wave Structure: Major wave analysis suggests Wave 3 completion near 1.1750. Current Wave 4 correction targets 1.1650-1.1700 support zone. Wave 5 impulse anticipated—target: 1.1850-1.1950.

Pennant Formation: Classic Bullish Pennant pattern forming—breakout confirmation above 1.1710 validates pattern. Pole height measured move = 1.1850+ realistic target.

Bollinger Bands (1H): Upper band at 1.1800 = squeeze breakout target. Middle band (1.1700) = bullish support zone. Lower band rejection (1.1500) creates swing longs with excellent R/R.

VWAP Daily: EUR/USD trading above daily VWAP at 1.1600—bullish gradient confirmed. Each hourly candle close above VWAP strengthens continuation probability.

Volume Profile Hotspot: Heavily traded at 1.1600-1.1660 (accumulation zone) and 1.1710-1.1780 (resistance cluster). Imbalances above 1.1800 suggest vacuum-fill potential.

Ichimoku Cloud Alignment: Price above Senkou Span A (1.1700) & Span B (1.1660)—cloud thickness indicates strong support. Chikou Span above candles = bullish confirmation. Cloud color: BULLISH GREEN.

Gann Theory Application: 45-degree angle from swing low (1.1450) establishes rally trajectory. Resistance at 38.2% Fibonacci extension (1.1750) precedes aggressive breakout phase.

Support Tiers 1H: 1.1500 (structural hold) | 1.1570 (EMA support) | 1.1620 (Kijun-sen) | 1.1660 (accumulation zone)

Resistance Tiers 1H: 1.1710 (breakout trigger) | 1.1760 (extension) | 1.1800 (major level) | 1.1850 (impulse target)

### 4-HOUR (Swing Trade Thesis Foundation) 💼

Inverse Head & Shoulders Pattern: Potential IH&S formation completing—left shoulder (1.1450), head (1.1400), right shoulder completing (1.1500-1.1560). Neckline breakout at 1.1710 targets 1.1900-1.2000 extension.

Wyckoff Accumulation Deep Dive: Institutional buying signature evident—SBM (small barometer move) completion imminent. Spring test to 1.1480-1.1510 anticipated; subsequent markup phase targets 1.1850-1.2000.

RSI 4H Analysis: RSI at 56-68 range—bullish bias maintained. Room for upside extension without extreme overbought. RSI above 74 targets 1.1900+; below 34 = defensive posture required.

Cup & Handle Formation: Potential bullish Cup pattern visible on 4H—handle stabilization near 1.1650-1.1700. Breakout above handle (1.1760) targets cup depth extension = 1.1850-1.1950.

EMA Ribbon Structure: EMA 8 (1.1680), EMA 13 (1.1660), EMA 21 (1.1610), EMA 50 (1.1500), EMA 200 (1.1350)—BULLISH ALIGNMENT PERFECT. Compression/expansion cycles identify momentum phases.

Support Tiers 4H: 1.1450 (structural support) | 1.1500 (accumulation) | 1.1600 (pivot) | 1.1660 (demand cluster)

Resistance Tiers 4H: 1.1710 (key breakout) | 1.1760 (extension) | 1.1800 (major target) | 1.1900 (weekly projection)

Volume Signature 4H: Accumulation volume bars > distribution bars—bullish bias maintained. Volume nodes clustering at 1.1600-1.1660 indicate strong institutional support zone.

### DAILY CHART (Macro Swing Thesis) 📅

Elliott Wave Macro: We're potentially in Wave 3 of larger cycle—aggressive expansion still possible. Wave structure supports break of 1.1800 targeting 1.1950-1.2100 daily close objectives.

Double Bottom Recognition: Historical Double Bottom pattern near 1.1350-1.1450 support—confirmed breakthrough above 1.1710 neckline triggered. Second target near 1.1900-1.2000.

Bollinger Bands Daily: Upper band at 1.1900 = realistic daily target zone. Mean (1.1750) = healthy pullback support. Band slope indicates volatility expansion—expect 100-200 pips daily ranges.

Volume Profile Daily: Strong buying volume bar at 1.1500-1.1650 zone—institutional accumulation marker established. Selling volume decreasing—demand controls trend absolutely.

Ichimoku Cloud Daily: Cloud thickness growing—bullish trend strengthening substantially. Cloud support around 1.1650-1.1750 zone. Kumo breakout anticipated—targets cloud top at 1.1800-1.1900.

Harmonic Analysis Deep: Butterfly Pattern potential completion—PRZ at 1.1710-1.1780 suggests reversal zone OR breakout confirmation. Confluence amplifies probability of extension.

Gann Angles & Fibonacci: 50% retracement (1.1550) + 61.8% extension (1.1850) = key reversal zones. Gann fan angles suggest 1.1800-1.1900 as structural resistance before continuation.

Key Daily Support: 1.1400 (psychological/structural) | 1.1500 (accumulation zone) | 1.1600 (demand level) | 1.1700 (midpoint)

Key Daily Resistance: 1.1710 (breakout trigger) | 1.1780 (extension) | 1.1850 (measured move) | 1.1950 (weekly target)

Trend Confirmation: Higher highs & higher lows maintained—uptrend intact. Daily close above 1.1800 = strong continuation signal targeting 1.2000+ next level.

## 🎪 TRADING SETUP PLAYBOOK - NOV 10-14

### BULLISH SCENARIO (Probability: 80%) ✅

Trigger: 4H candle close above 1.1760 + volume surge (>50% above average) + RSI above 64

Entry Zone: 1.1700-1.1750 (with breakout confirmation signal)

Target 1: 1.1780 (TP1) | Target 2: 1.1820 (TP2) | Target 3: 1.1900 (TP3) | Target 4: 1.1950 (TP4)

Stop Loss: 1.1620 (below EMA/structural support)

Risk/Reward: 1:3.2 (excellent asymmetric setup)

Trade Duration: 18-72 hours (prime swing window)

### BEARISH SCENARIO (Probability: 20%) ⚠️

Trigger: Daily close below 1.1650 + volume increase + RSI divergence failure

Entry Zone: 1.1760-1.1850 (short setup)

Target 1: 1.1710 (TP1) | Target 2: 1.1650 (TP2) | Target 3: 1.1600 (TP3)

Stop Loss: 1.1900 (above resistance)

Risk/Reward: 1:1.6 (acceptable but lower probability)

Trade Duration: Watch for trend reversal confirmation first

## ⚠️ VOLATILITY & OVERBOUGHT/OVERSOLD CONDITIONS

Current Volatility Status: Moderate compression → Expect significant expansion imminent

5M/15M RSI: 48-62 range (neutral)—room for 25-50 pips movements | Scalp target zones

30M/1H RSI: 52-66 range (bullish bias, optimal zone)—sweet spot for swing entries

4H RSI: 56-70 range—approaching caution zone but room to extend | Safe for core swings

Daily RSI: 60-74 range (approaching extremes)—be defensive if daily RSI>76 | Take profits aggressively

Overbought Recognition Points:

RSI daily >75 combined with upper Bollinger Band rejection = immediate profit-taking

Ichimoku cloud top penetration fails (bearish candle rejection) = trend exhaustion signal

Volume declining on breakout attempt = false breakout warning signal

Harmonic pattern PRZ exact hit without follow-through = reversal likely imminent

Oversold Bounce Setups:

RSI 1H <32 on support touch = high-probability bounce back to 1.1750-1.1800

Price below EMA 50 (1.1500) + RSI <30 = aggressive accumulation zone

Spring test below 1.1490 with volume surge = Wyckoff spring reversal trigger

Harmonic pattern PRZ support bounce = measured move extension targets activated

## 🎯 ENTRY & EXIT OPTIMIZATION STRATEGY

### OPTIMAL ENTRY TIMING

For Scalpers (5M): RSI bounce from 44-50 zone after Band lower touch = 15-25 pips scalp (1-3 min holds)

For Quick Swings (15M-30M): 15M candle close above 1.1690 with 4H alignment = 60-100 pips swing (30 min-2 hour holds)

For Core Swings (1H-4H): 4H pennant breakout above 1.1760 on volume = 150-250+ pips target (hold 12-48 hours)

For Position Swings (Daily): Daily close above 1.1800 = continuation play targeting 1.1950-2.0000 (hold 5-7 days)

Best Entry Windows: Asian session overlap (22:00-8:00 UTC), London open (8:00 UTC), NY close (21:00 UTC)

### EXIT STRATEGIES & PROFIT TAKING

Take Profit Levels: TP1: Fibonacci 38.2% (1.1760) | TP2: Harmonic PRZ (1.1820) | TP3: Daily Band upper (1.1900) | TP4: Weekly target (1.1950)

Stop Loss Placement: Always below most recent swing low + 20 pips (strict risk management priority)

Trailing Stops: Activate at TP2—trail with 30-40 pips buffer for 4H+ trades (lock in profits)

Breakeven Exit: Move stops to entry after 1:1 risk/reward achieved—eliminate emotional trading

Partial Profit Strategy: Close 25% at TP1 | 25% at TP2 | 25% at TP3 | Let 25% run to TP4 (maximize winners)

## 🔔 REVERSAL & BREAKOUT RECOGNITION CHECKLIST

### REVERSAL SIGNALS TO MONITOR:

RSI positive divergence (lower price lows, higher RSI lows) = bullish reversal setup high probability

Candlestick engulfing patterns at support/resistance zones = trend reversal confirmation strong signal

Volume profile breakdowns (declining volume on breakout attempts) = false move warning immediate

Ichimoku Cloud rejection (price fails to penetrate cloud layer) = structural resistance confirmed

Harmonic pattern completion at exact PRZ = reversal zone probability increases significantly

Elliott Wave 5th wave failure (truncation) = impulse completion = reversal imminent trigger

Gann angle break through significant angle = trend line break = reversal trigger activated

### BREAKOUT CONFIRMATION RULES:

Close beyond resistance with >50% volume surge above average = confirmed breakout signal strong

RSI crosses above 60 for bullish breakout, below 45 for bearish breakout confirmation

VWAP alignment with directional move = institutional participation confirmation strong

Bollinger Band breakout with band expansion (squeeze release) = volatility expansion confirmed immediate

Multiple timeframe confluence (5M + 15M + 1H + 4H aligned) = highest probability setup attainable

Ichimoku Cloud break (price clears all clouds with bullish candles) = strong continuation signal

Volume imbalance (ask volume > bid volume) = directional sustain likelihood increases significantly

## 💡 WEEK FORECAST SUMMARY - NOV 10-14

Monday (10th): 🌍 Consolidation continuation near 1.1650-1.1700 zone. Range-bound trading anticipated. Early breakout direction watch crucial. Entry setups favor reversal plays at support zones.

Tuesday-Wednesday (11-12th): 📈 Prime breakout window opens —1.1760 represents key decision point. Expect 100-200 pips daily volatility. Breakout confirmation targets 1.1820-1.1900 extension. This is the optimal swing trade window all week. ECB speakers watch critical.

Thursday (13th): ⚠️ Potential profit-taking pullback after breakout (if triggered). Support retest of 1.1780-1.1720. Buying opportunity if pullback holds above 1.1700.

Friday (14th): 📊 Weekly close pattern formation critical. Extension run anticipated if above 1.1800. If above 1.1850 = week target 1.1950-2.0000 achieved. End-of-week positioning for next week.

## 📍 CRITICAL CONFLUENCE ZONES - KEY TARGETS

1.1450-1.1500: Major support zone (accumulation marker, Wyckoff spring area, structural hold)

1.1550-1.1650: Secondary support (EMA 9, demand cluster, psychological level, volume POC)

1.1680-1.1710: Micro-resistance cluster (consolidation squeeze zone, early breakout resistance)

1.1750-1.1800: KEY BREAKOUT ZONE (triangle apex, harmonic confluence, all timeframe resistance)

1.1800-1.1900: Primary upside target (Elliott Wave 5, daily Band upper, measured move extension)

1.1900-1.1950: Secondary extension target (Gann level, macro resistance, wave projection)

1.1950-2.0000: Weekly/monthly target (if wave 5 impulse extends beyond base projections)

## 🏆 RISK MANAGEMENT RULEBOOK

✅ 1) Position Sizing: Never risk >2% of account equity per single trade

✅ 2) Risk-Reward Ratio: Minimum 1:2.5 R/R on every entry—1:3+ preferred for swing trades

✅ 3) Profit Scaling: Close 25-50% at 1:1 ratio, let remainder run to 1:2+ targets

✅ 4) Stop Loss Discipline: Place stop IMMEDIATELY on entry—no exceptions (20 pips tight)

✅ 5) Breakout Confirmation: Avoid FOMO—wait for candle close confirmation + volume surge always

✅ 6) Daily Support Respect: Psychological holds (round numbers 1.1600 | 1.1800) matter—trade confluence not against

✅ 7) Time Management: Exit losing trades quickly (max 1:0.5 acceptable for educational losses)

✅ 8) Macro Alignment: Always check daily/4H bias before taking 1H or lower trades

## #EURUSD #EUROUSD #FOREXTRADING #EURUSDANALYSIS

#TECHNICALANALYSIS #ELLIOTTWAVE #HARMONICPATTERN #BREAKOUTTRADING

#SWINGTRADER #DAYTRADING #INTRADAY #FOREXANALYSIS #TRADINGVIEW

#BOLLINGER BANDS #RSI #ICHIMOKU #VWAP #TRADINGSTRATEGY

#WYCKOFFMETHOD #GANNTHEORY #DOWTHEORY #TECHNICALS #ANALYSIS

#SUPPORTANDRESISTANCE #VOLUMEANALYSIS #OVERBOUGHT #OVERSOLD #REVERSAL

#FOREXTRADERS #CURRENCYTRADING #BREAKOUTSETUP #TRADERSOFTWITTER

#TECHNICALTRADER #CANDLESTICK #PATTERRECOGNITION #CHARTANALYSIS #DAYTRADER

## 🎁 BONUS: DAILY PRE-MARKET CHECKLIST

Use this every morning before market open:

☑️ Check daily RSI (should be 60-72 for bullish bias continuation)

☑️ Identify support/resistance zones (1.1600 | 1.1700 | 1.1760 | 1.1900)

☑️ Verify 4H chart alignment (pennant/IH&S pattern status update)

☑️ Check Ichimoku cloud position (above/below = trend confirmation signal)

☑️ Review 1H Elliott Wave count (which wave are we trading exactly?)

☑️ Scan volume profile (POC = likely rejection zone area)

☑️ Set entry orders + stop losses BEFORE Asian session closes

☑️ Plan 3 Take Profit levels before entering any position

☑️ Monitor ECB/Fed speakers + economic calendar (interest rate expectations)

## 🌐 FOREX SESSION NOTES

EUR/USD trades 24/5 across all sessions . Highest volatility typically occurs:

Asian Session (22:00-8:00 UTC): Lower volatility—good for breakout setups forming

London Session (8:00-16:30 UTC): Prime trading hours —peak liquidity + volatility combination

NY Session (14:30-21:00 UTC): Secondary volatility surge—often confirms London direction

ECB/Fed Policy Impact: Monitor policy divergence—higher Fed rates support USD weakness = EUR strength

💡 Disclaimer: This technical analysis is educational only. Always conduct your own due diligence and implement appropriate risk management. Past performance does not guarantee future results. Trade responsibly within your risk tolerance. Use stop losses on every position. Not financial advice.

Analysis Created: November 8, 2025 | Valid Through: November 14, 2025 | Updated Daily

Bullish potential detected for BOE (gap continuation)Entry conditions:

(i) higher share price for ASX:BOE along with swing up of indicators such as DMI/RSI (gap continuation play).

Depending on risk tolerance, the stop loss for the trade would be:

(i) below the previous potential support of $1.81 from the open of 29th October, or

(ii) below the low of the recent swing low of $1.775 of 29th October.

Has the BoE Already Doomed the Sterling?Macroeconomics: Diverging Central Bank Paths

The British Pound (GBP) has aggressively declined, losing 4.8% from September highs, primarily due to a growing policy divergence between the Bank of England (BoE) and the US Federal Reserve (Fed). Markets increasingly expect the BoE to cut interest rates sooner, with current pricing suggesting a 35% chance of a 25-basis-point cut. This dovish pressure stems from cooling UK labor data and inflation, which, despite ticking up slightly, remains far from 2023’s double-digit peaks.

In stark contrast, the US Dollar (USD) remains resilient, supported by the Fed’s persistent "higher for longer" stance. Strong US data, notably the 195,000 October Non-Farm Payrolls addition, bolsters this hawkish view. This widening interest rate differential, now almost 100 basis points favoring the USD, makes dollar assets more attractive than sterling assets, directly pressuring the GBP/USD pair toward the critical 1.3000 support level.

Economics and Fiscal Warning: Tax Hikes Loom

Domestic UK economic concerns amplify the bearish pressure on Sterling. UK Chancellor Rachel Reeves issued a pre-Budget warning, confirming an intent to raise taxes to close a significant £22 billion fiscal gap. This public rhetoric prepares markets for an Autumn Budget featuring fiscal tightening measures.

Fiscal tightening through tax hikes generally dampens economic growth expectations, which encourages the BoE to consider rate cuts to stimulate activity. This political and economic dynamic fuels bond market volatility. The UK 10-year gilt yield briefly fell, reflecting investor expectation of slower growth and a dovish BoE response, accelerating the GBP/USD selloff.

Geopolitics and Geostrategy: Dollar's Global Anchor

The Dollar's strength is not purely macroeconomic; it acts as a global safe-haven anchor, a key geostrategic function. Renewed focus on geopolitical stability and trade deals, such as the preliminary US-China trade consensus on export controls and fentanyl, often benefits the US Dollar as the primary reserve currency.

Conversely, the UK faces fiscal uncertainty and lower productivity forecasts, placing its currency at a relative disadvantage. The USD's dominance, reinforced by Chair Jerome Powell's measured, firm rhetoric, creates a sharp contrast with the BoE’s internal divisions on policy. This global context makes the USD the preferred currency, undermining Sterling's value on the international stage.

Technology and Cyber Risk: Underlying Competitiveness

While the movement is not driven by immediate technical news, the UK's long-term technological and patent competitiveness affects its currency's appeal. Persistent issues, like lower productivity forecasts reported by the Office for Budget Responsibility, imply a lag in high-tech innovation and efficiency compared to the US.

A slower pace of innovation and lower productivity in the UK's services and manufacturing sectors contrasts with the robust, job-creating US economy. This fundamental economic weakness limits Sterling's potential for sustained, long-term appreciation. Technical analysis confirms this bearish trend, showing a double-top pattern and momentum indicators deep in negative territory, confirming the downward bias toward the 1.3000 psychological barrier.

Is the Pound's Decline Irreversible Before BoE?The recent surge in the EUR/GBP cross above the $\mathbf{0.8750}$ threshold is fundamentally rooted in a significant monetary policy divergence between the UK and the Eurozone. The key driver is the heightened uncertainty surrounding the Bank of England's ( BoE ) Thursday rate decision. Following softer UK inflation and wage data, analysts have begun pricing in a material probability of an impending rate cut, generating substantial dovish speculation. This expectation inherently depreciates the British Pound ( GBP ), creating a powerful interest rate differential against the Euro. Conversely, the European Central Bank ( ECB ) maintains a firm policy pause, with President Christine Lagarde expressing confidence in the Eurozone's outlook, reinforcing the Euro's stability and momentum.

While macroeconomic policy dictates the current upward trajectory of EUR/GBP, subtle but material geopolitical headwinds threaten the Euro's stability. Political turmoil in France, specifically the government's struggle following the rejection of a key finance measure, raises the specter of snap elections and governmental paralysis. Such internal political risk within the Eurozone's second-largest economy undermines investor confidence and poses a downside risk to the Euro's valuation, counteracting the macroeconomic tailwinds. Furthermore, long-term structural health of both currencies is tied to competitive advantages in high-tech sectors, FinTech, and life sciences, where patent analysis * and robust cyber infrastructure are crucial for attracting foreign direct investment.

The immediate market outlook hinges almost entirely on the forthcoming BoE announcement and the subsequent commentary from Governor Andrew Bailey. An unexpectedly dovish stance would confirm market expectations, severely weaken the GBP, and likely cement a sustained move by EUR/GBP toward the $0.8800$ mark. This movement predominantly reflects a GBP weakness narrative rather than overwhelming EUR strength. Traders must recognize that while the current momentum favors the Euro, any escalation of the French political crisis into a threat to wider EU fiscal cohesion could rapidly reverse the pair's upward trend. Close monitoring of this dual risk profile is paramount.

EURGBP tests 0.88 as UK Budget crisis deepens: Where next?The dollar crushed all majors yesterday, but EURGBP tells a different story. The euro is surging against the pound as UK fiscal chaos and bets on a BOE rate cut accelerate. With an ascending triangle breakout confirmed, traders are targeting 0.89 and the psychological 0.90 handle.

The Office for Budget Responsibility just revealed a £20 billion fiscal hole, forcing Chancellor Reeves to make tough choices in November's budget. Meanwhile, markets price 68% odds of a December BOE rate cut as inflation cools—two mega catalysts for GBP weakness.

Key drivers

UK fiscal crisis: £20 billion productivity forecast slash ahead of November 26 budget forces austerity measures, crushing pound confidence

BOE rate cuts priced In: 68% December cut odds versus 30% November (food prices down 0.4% month-on-month, retail deflation for first time since March)

Technical breakout: Ascending triangle break above 0.8800 opens clean path to 0.89 and 0.90; golden 61.8% Fibonacci sits at 0.8872 as magnet level

Wedge pattern risk: Multiple Fibonacci clusters (0.89, 0.8876, 0.90) confirm upside targets, but final wave of rising wedge warns of sharp retracement after targets hit

How to trade EURGBP?

Long above 0.8775, target 0.8872 (golden Fib magnet) then 0.89-0.90. Stop below 0.8750. Watch BOE communications and November 26 budget details for confirmation. UK in crisis mode—don't fade the breakdown.

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

COMPREHENSIVE TECHNICAL ANALYSIS: INTRADAY & SWING TRADE SETUP 📊 EURUSD (1.16272) - COMPREHENSIVE TECHNICAL ANALYSIS: INTRADAY & SWING TRADE SETUP 📊

October 27-31, 2025 | Multiple Timeframe Deep Dive

🎯 EXECUTIVE SUMMARY 🎯

Current Spot: 1.16272 | Analysis Date: Oct 25, 2025 | Focus: 5M-1D Timeframes | Strategy: Intraday & Swing Trade

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

📈 1. MULTI-TIMEFRAME TREND ANALYSIS & DOW THEORY APPLICATION 📈

🔍 Daily (1D) Timeframe - Primary Trend Direction

The 1D chart reveals a consolidation phase with bullish bias . Elliott Wave structure suggests we're completing a 5th wave extension after a 4-wave correction. Dow Theory confirms higher lows forming around 1.1580-1.1600 support levels. The uptrend remains intact with RSI hovering in 40-60 zone (neutral-bullish). VWAP at 1.1620 acts as dynamic support.

⏰ 4H Timeframe - Swing Trade Entry Signals

The 4H setup shows bullish flag formation near 1.1625. Bollinger Bands are tightening, signaling potential breakout. RSI at 55-60 indicates strength without overbought conditions. Ichimoku Cloud shows bullish alignment with price above all moving averages. Target: 1.1680-1.1720 for swing positions.

🔥 1H to 5M Intraday Confluence

1H chart displays ascending triangle pattern with resistance at 1.1650. Harmonic patterns suggest Bullish Gartley forming near 1.1580 level—ideal for aggressive intraday entries. 30M shows clean EMA crossover (50>200 EMA bullish). Volume profile confirms institutional accumulation between 1.1590-1.1620.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🎪 2. ENTRY & EXIT STRATEGY + WYCKOFF METHOD 🎪

SWING TRADE ENTRIES (4H/1D): Buy breakout above 1.1650 with stop @ 1.1580 (Risk:Reward 1:3). Wyckoff Spring Pattern validation near support confirms institutional absorption.

INTRADAY ENTRIES (5M-30M): Enter on 30M EMA crossovers + RSI < 30 rejections from support zones. Stochastic divergence on 15M indicates pullback entries around 1.1610-1.1615.

EXIT TARGETS: 1D: 1.1750 | 4H: 1.1705 | 1H: 1.1670 | Intraday: 1.1650 (first profit). Take-profit at resistance clusters identified via Gann angles.

STOP LOSS PLACEMENT: Swing: 1.1560 (below double bottom structure) | Intraday: 1.1600 (15-20 pips from entry).

💡 Pro Tip: Use Ichimoku Kijun-sen (26P) as dynamic stop—trail on breakouts above 1.1650.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🔔 3. REVERSAL SIGNALS & JAPANESE CANDLESTICK ANALYSIS 🔔

⚠️ BULLISH REVERSAL INDICATORS:

Hammer candlesticks forming at 1.1580 (5M/15M confluence). Engulfing patterns on 30M confirm buyer strength. Ichimoku Chikou Span crossing above price action validates trend reversal completion. Morning Star pattern visible on 1H—classic reversal signal.

⛔ BEARISH REVERSAL WARNINGS:

If price fails to break 1.1650 with declining volume, watch for Evening Star on 4H. Gann resistance at 1.1680 acts as rejection zone. RSI divergence (lower highs with price higher highs) on 1D would signal exhaustion. VWAP rejection could trigger short setups.

⚡ Key Level: 1.1645-1.1650 acts as Decision Point. Break = Bullish Continuation | Reject = Intraday Reversal

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💥 4. BREAKOUT RECOGNITION & PATTERN FORMATIONS 💥

✅ Bullish Breakout Setup (PRIMARY):

Ascending triangle breakout above 1.1650 resistance on 1H timeframe. Volume confirmation: need 20%+ volume spike above 20-period MA. Elliott Wave target 1.1750-1.1800 after 5th wave completion. Bollinger Band upper band at 1.1680—natural extension target.

🚀 Harmonic Patterns Identified:

Bullish Gartley at 1.1580 (D-point) with PRZ 1.1605-1.1620. Bat pattern on 4H suggesting potential for 161.8% extension. Butterfly pattern on 1D targeting 1.1850 in extended bull scenario.

⚡ Risk Pattern - Rising Wedge (WARNING):

If price fails breakout, 4H shows rising wedge trap. Potential bearish breakdown to 1.1550 if wedge collapses. Monitor Bollinger Band squeeze on 30M—breakout imminent within 48 hours.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

📊 5. VOLATILITY, PRICE ACTION & INDICATOR CONFLUENCE 📊

🌊 Bollinger Bands & Volatility Analysis:

Band width compressed to 150 pips (1D)—lowest in 10 days. This signals imminent volatility expansion. Intraday (5M/15M) bands widening, indicating increased participation. Price bouncing within middle band suggests continuation pattern.

📍 Support & Resistance Clusters:

SUPPORT: 1.1600 (Previous swing low) | 1.1580 (Gartley D-point) | 1.1560 (Double Bottom)

RESISTANCE: 1.1650 (Ascending Triangle apex) | 1.1680 (Bollinger upper + Gann angle) | 1.1720 (Weekly pivot)

VWAP LEVELS: Daily VWAP: 1.1620 (support) | Weekly VWAP: 1.1610 (support)

📈 Moving Average Crossovers - Trend Confirmation:

EMA 50 > EMA 200 (bullish alignment on all timeframes). SMA 20 above SMA 50 on 1H/4H = buy signal. 5M: Recent EMA crossover indicates intraday uptrend initiation. Price maintaining above all key MAs confirms Wyckoff accumulation completion.

🎯 Overbought/Oversold Conditions:

RSI: Currently 58-62 range (neutral-bullish, NOT overbought). Stochastic on 15M: 45-55 range with upside momentum. Ichimoku RSI indicator below 50—room for upside run. CCI on 5M near +100 (strong momentum without extreme overbought).

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🎓 6. ADVANCED TECHNICAL THEORIES SYNTHESIS 🎓

⭐ Elliott Wave Structure: 5-3-5 Pattern Complete - Currently Wave 1 (up) of new cycle targeting 1.1800 minimum | Fibonacci Extensions: 161.8% from swing = 1.1750

⭐ Gann Theory Application: 45-degree angle resistance @ 1.1680 | Square of Nine support @ 1.1580 | Time-Price analysis: 8-10 trading days for major move completion

⭐ Wyckoff Method: Spring Pattern (successful test of support) = Bullish signal | Schiff accumulation phase ending | Expected markup phase: 1.1650-1.1750 (next 7-10 days)

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

✨ TRADING PLAN SUMMARY ✨

🎯 LONG BIAS (PRIMARY SCENARIO):

Entry: 1.1645-1.1650 breakout | Stop: 1.1605 | Target 1: 1.1680 | Target 2: 1.1720 | Target 3: 1.1750

Risk/Reward: 1:3+ | Conviction: 75% | Timeframe: Swing (Hold 3-5 days) + Intraday scalp (1-4 hours)

⚠️ SHORT SCENARIO (CONTINGENCY):

Trigger: Rejection at 1.1650 + Volume decline | Entry: 1.1635 | Stop: 1.1655 | Target: 1.1600

Probability: 25% | Setup: Rising Wedge breakdown

⏱️ TIMEFRAME PRIORITY: 4H (swing base) + 1H (entry confirmation) + 5M (execution)

💰 POSITION SIZING: Risk max 1-2% per trade | Scaling in on pullbacks

🔔 ALERTS: Set at 1.1650 (buy signal) | 1.1605 (stop loss) | 1.1680 (partial profit)

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

Disclaimer: Educational analysis only. Not financial advice. Trade at your own risk. Always use proper risk management. Past performance ≠ future results.

GBPCAD breakout or rejection? All eyes on 1.8850!GBPCAD is testing a major technical zone as macro and price catalysts align. Here's what traders need to know:

Catalysts & Macro Drivers

GBP : Supported by USD weakness (US shutdown, weak data), sticky UK inflation, and Bank of England caution. November’s UK budget looms as a key event.

CAD : Under pressure from falling oil prices (oversupply/weak demand) and a dovish Bank of Canada. Further rate cuts are possible, especially if oil stays low.

Technical Outlook

Weekly chart : Strong impulsive rally past 61.8% Fibonacci (1.8310), with 1.9490 (78.6% Fib) as the next longer-term upside target.

4h chart : Ascending triangle with resistance at 1.8850. Breakout/close above 1.8850 confirms bullish momentum, with targets at 1.90 and then 1.93–1.95.

RSI : Long-term RSI above 60 signals strength, but divergence is a risk factor. Watch for RSI reset or failure at highs.

Trading Scenarios

Bullish : Hold above 1.8850 for 3 sessions +, look for upside extension to 1.90/1.93/1.95.

Bearish : Failure to break 1.8850 or drop below 1.8600 could trigger reversal to 1.84/1.81 support.

Levels to Watch

Key resistance: 1.8850, 1.9000, 1.9340, 1.9490

Key support: 1.8600, 1.8400, 1.8310

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

GBPUSD: CABLE COILED FOR 1.36 EXPLOSION! Sterling Rally 🚀 GBPUSD: CABLE COILED FOR 1.36 EXPLOSION! Sterling Rally 📊

Current Price: 1.34036 | Date: Sept 27, 2025 ⏰

📈 INTRADAY TRADING SETUPS (Next 5 Days)

🎯 BULLISH SCENARIO

Entry Zone: 1.3380 - 1.3420 📍

Stop Loss: 1.3340 🛑

Target 1: 1.3480 🎯

Target 2: 1.3550 🚀

🎯 BEARISH SCENARIO

Entry Zone: 1.3440 - 1.3480 📍

Stop Loss: 1.3520 🛑

Target 1: 1.3350 🎯

Target 2: 1.3280 📉

🔍 TECHNICAL ANALYSIS BREAKDOWN

📊 KEY INDICATORS STATUS:

RSI (14): 65.3 ⚡ Sterling Strength Zone

Bollinger Bands: Squeezing for Move 🔥

VWAP: 1.3395 - Critical Pivot 💪

EMA 50: 1.3360 ✅ Bullish Crossover

Volume: Accumulation Pattern 📊

🌊 WAVE ANALYSIS:

Elliott Wave: Wave 3 Building Steam 🌊

Fibonacci Extension: 1.3650 Target 🎯

🔄 HARMONIC PATTERNS:

Bullish Butterfly at 1.3350 ✨

ABCD Completion to 1.3520 🔄

⚖️ SWING TRADING OUTLOOK (1-4 Weeks)

🚀 BULLISH TARGETS:

Psychological: 1.3600 🏆

Weekly Target: 1.3650 🌙

Gann Square: 1.3700 ⭐

📉 BEARISH INVALIDATION:

Weekly Support: 1.3250 ⚠️

Critical Level: 1.3150 🚨

🎭 MARKET STRUCTURE:

Trend: Bullish Flag Formation 💪

Momentum: Coiling Energy 🔥

Wyckoff Phase: Spring Complete 📈

Ichimoku: Cloud Breakout Pending 🟢

⚡ CABLE VOLATILITY SETUP:

Compression Zone: 1.3350-1.3450 🎢

Breakout Catalyst: BoE Data 💥

Volatility Spike: Expected Above 1.3480 📈

🏛️ UK FUNDAMENTALS:

BoE Policy Hawkish Stance 🏦

GDP Growth Resilient Data 📊

Inflation Supporting GBP 📈

Political Stability Improving 🇬🇧

⚡ RISK MANAGEMENT:

Max Risk per Trade: 60 pips 🛡️

R:R Ratio: Minimum 1:2.5 ⚖️

London Open: High Impact 📏

🔥 CRITICAL BREAKOUT LEVELS:

Bull Trigger: 1.3480 clean break 💥

Support Zone: 1.3380 | 1.3340 | 1.3300 🛡️

Resistance: 1.3480 | 1.3550 | 1.3600 🚧

📈 STERLING STRENGTH:

vs USD: Momentum Building 💪

vs EUR: Outperforming 🔥

Cross Pairs: Bullish Flow 🌊

🎯 FINAL VERDICT:

CABLE ready for EXPLOSIVE 1.36 MOVE! 🚀

Sterling coiled like a spring! 💎

Perfect storm brewing for breakout! ⛈️

Trade Management: Buy dips to 1.3380 💰

Key Level: 1.3480 breakout crucial! 🔑

---

⚠️ Disclaimer: FX trading carries substantial risk. Manage positions carefully. Educational content only.

For individuals seeking to enhance their trading abilities based on the analyses provided, I recommend exploring the mentoring program offered by Shunya Trade. (Website: shunya dot trade)

I would appreciate your feedback on this analysis, as it will serve as a valuable resource for future endeavors.

Sincerely,

Shunya.Trade

Website: shunya dot trade

🔔 Follow Cable Updates | 💬 Share Your Sterling Strategy Below

EURUSD: 1.18 FORTRESS ATTACK! Dollar Weakness Exposed 🚀 EURUSD: 1.18 FORTRESS ATTACK! Dollar Weakness Exposed 📊

Current Price: 1.17020 | Date: Sept 27, 2025 ⏰

📈 INTRADAY TRADING SETUPS (Next 5 Days)

🎯 BULLISH SCENARIO

Entry Zone: 1.1680 - 1.1710 📍

Stop Loss: 1.1650 🛑

Target 1: 1.1750 🎯

Target 2: 1.1790 🚀

🎯 BEARISH SCENARIO

Entry Zone: 1.1720 - 1.1750 📍

Stop Loss: 1.1780 🛑

Target 1: 1.1650 🎯

Target 2: 1.1600 📉

🔍 TECHNICAL ANALYSIS BREAKDOWN

📊 KEY INDICATORS STATUS:

RSI (14): 62.1 ⚡ Euro Strength Building

Bollinger Bands: Expansion Mode 🔥

VWAP: 1.1695 - Dynamic Support 💪

EMA 20: 1.1675 ✅ Bullish Momentum

Volume: Institutional Flow Rising 📊

🌊 WAVE ANALYSIS:

Elliott Wave: Wave C Impulse Active 🌊

Fibonacci Target: 1.1850 (127.2%) 🎯

🔄 HARMONIC PATTERNS:

Bullish Gartley at 1.1660 Support ✨

Cypher PRZ targeting 1.1780 🔄

⚖️ SWING TRADING OUTLOOK (1-4 Weeks)

🚀 BULLISH TARGETS:

Psychological: 1.1800 🏆

Weekly Resistance: 1.1850 🌙

Gann Level: 1.1875 ⭐

📉 BEARISH INVALIDATION:

Weekly Support: 1.1600 ⚠️

Critical Break: 1.1550 🚨

🎭 MARKET STRUCTURE:

Trend: Ascending Channel 💪

Momentum: Dollar Weakness 🔥

Wyckoff Phase: Markup Phase 📈

Ichimoku: Bullish Cloud Break 🟢

🏰 1.18 FORTRESS BATTLE:

Key Resistance: 1.1780-1.1800 ⚔️

Volume Confirmation: Needed Above 1.1750 💥

Breakout Target: 1.1850 Major Level 🔓

⚡ RISK MANAGEMENT:

Max Risk per Trade: 50 pips 🛡️

R:R Ratio: Minimum 1:2 ⚖️

London/NY Sessions: Prime Time 📏

🌍 CENTRAL BANK DYNAMICS:

ECB Policy Divergence Bullish 🏛️

Fed Dovishness Supporting EUR 📈

Dollar Index Weakness Continues 💵

Rate Differential Narrowing 📊

🔥 CRITICAL LEVELS:

Breakout: 1.1750 decisive close 💥

Support: 1.1680 | 1.1650 | 1.1620 🛡️

Resistance: 1.1750 | 1.1780 | 1.1800 🚧

📈 DXY CORRELATION:

Dollar Index: Bearish Divergence 📉

EUR Strength: Independent Rally 💪

Cross-Currency: Bullish Flow 🔄

🎯 FINAL VERDICT:

EURUSD storming 1.18 RESISTANCE! 🚀

Dollar weakness = Euro rocket fuel! 💎

Multi-timeframe bullish alignment! 📈

Trade Management: Scale in above 1.1680 💰

Breakout Alert: Watch 1.1750 hold! 🔔

---

⚠️ Disclaimer: FX trading involves significant risk. Use proper position sizing. Educational analysis only.

For individuals seeking to enhance their trading abilities based on the analyses provided, I recommend exploring the mentoring program offered by Shunya Trade. (Website: shunya dot trade)

I would appreciate your feedback on this analysis, as it will serve as a valuable resource for future endeavors.

Sincerely,

Shunya.Trade

Website: shunya dot trade

🔔 Follow FX Market Updates | 💬 What's Your 1.18 Target Timeline?