Breakout-trading

P2P | Gold Trade BreakdownWhat's up everyone and welcome to my first trade breakdown . In this clip you'll get an inside look at how I usually scope out my trades , what I personally look for in a setup , how & when I would execute on the trade .

*Also try your best to ignore my loud washer machine LOL*

I don't normally post these types of videos because everyone has a different bias as to how they see their trades but at this point I figure maybe my breakdown would help someone else understand the markets a little bit better. So I encourage you to enjoy this lil clip and I hope that you find some value in it. Also make sure to follow the page for more education!

DISCLAIMER:

***This page is for educational purposes only and is not intended for any financial advise. I am not a financial advisor nor do I manage any other accounts for our users. Any trades you take will be of your own doing and P2P will not be held responsible.***

We have a lot in store for 2023 & I can't wait to see everyone winning!

EURSGD the best market structure setup in forex!It has been awhile folks but I am back posting ideas on TradingView. I have kept watching and trading the markets everyday since I stopped posting and have had other consulting to do forex and market related. I will be posting ideas on a regular basis.

The strategy and set ups remain the same! We look for reversal trades after a long trend.

Many Singapore Dollar pairs look good for my technique.

EURSGD is a chart I have had on my radar for months, and we finally triggered the breakout on November 16th 2022. Currently, we are in the retest phase of the breakout with buyers stepping in on the retest of new support.

What makes EURSGD even more attractive is the fact the chart shows clear signs of market structure. All markets move in three ways: uptrend, range and a downtrend. We clearly have the long downtrend, followed by a range which points to the exhaustion of the downtrend. The breakout of the range means a new uptrend is to begin.

We still need our first higher low to confirm this uptrend which leads me to the way of entering the trade. One can enter here on the retest and place the stop loss below the breakout zone. However, just be aware the breakout could turn to a false breakout if we close back below.

The more safer way to enter is wait for EURSGD to close above recent highs at 1.4260. This also will confirm the higher low, but more importantly, it increases the probability of a new uptrend. Remember: trading is a business of probabilities! That's it!

An uptrend going higher will take us to the next resistance zone of 1.45. Overall, a great risk vs reward set up.

There is Singapore CPI on Wednesday which could impact this currency pair.

AUDSGD is another Singapore Dollar pair with a nice reversal setup as well.

InvestMate|NZD/JPY Kiwi rallies to break outNZD/JPY Kiwi rallies to break out.

🇳🇿 The NZD has been in a downtrend with a number of currencies for some time, on the chart with the yen we can see the accumulation since March this year.

🇳🇿 Looking at the data coming out of the economy.

🇳🇿 Unemployment one of the lowest on record at 3.3%

🇳🇿 Inflation at 7.2% Not the worst.

We can see that it has been slowing down over the last few months.

🇳🇿 Interest rates 3.5% with projected increases to 4% during next decision.

🇳🇿 Consumer confidence index slowly rising currently at -42.7% not too bad but the market was expecting a better result.

🇳🇿 As we can see the economic situation in New Zealand is not the worst. It definitely has the potential to perform well in the coming months.

💴In Japan, no change.

💴Unemployment Rate low at 2.5%

💴Inflation low 3%. Japan is one of those countries that has not been hit by Inflation as much as Europe and the USA.

💴Interest rates at -0.1%. Still negative from 2016. Hence these falls in the Yen. When other countries raise rates causing their currencies to strengthen, their strength against the Yen increase.

💴For now, there are no increases on the horizon. The Bank of Japan says it has no intention of changing its monetary policy.

💴But the government doesn't want the Japanese Yen so cheap either, hence in recent days we have seen sharp falls which were interventions to stop the Yen weakening sharply against other currencies.

💴I don't think this will stop investors from pushing prices up again.

💴 Looking at the situation of both currencies, I don't think anything has changed in the current up trend over the months. The only threat could be unexpected monetary interventions to strengthen the Yen.

Turning to the chart.

📈 Since 11 October, we have started again to attempt to break through the strong resistance line we are currently at. The move down to the 81 levels looked like a final attempt to see how much the Yen could be strengthened but on a reversal on the kiwi we recorded a double bottom followed by a sharp breakout.

📈 Moving to the 1H chart we see a slight jerking of the price in recent days which was caused by monetary interventions on the Japanese yen.

📈 As you can see this has not been very impressive when compared to the New Zealand dollar.

📈Transforming to the monthly chart and measuring the two largest downward waves using the fibo grid, we can see why the price just had so much trouble breaking through the 0.786 zone. We are on a cluster of two 0.786 fibo levels.

📈Using statistics, the more attempts to attack a level, the greater the attempt to break it out.

📈 The final test of strength will come at the 93.4 levels where the strongest resistance line in the history of this currency pair is located.

📈 Given that we are still in an uptrend I would be tempted to play for a breakout of the nearest resistance line, which we have been fighting since March this year.

📈 The situation could look like on the posted chart with one more attempt to test this resistance line this time from the top. Setting a stop below the current weekly candle and targeting the biggest resistance on the pair at the level of 93 gives us an excellent profit/risk ratio of 5.1

🚀If you appreciate my work and effort put into this post I encourage you to leave a like and give a follow on my profile.🚀

BREAK AND RETEST OF THE TRENDLINEThe simple beginner-old way of trading. A basic break and retest of a downward trendline.

US Dollar broke out against Japan YenAs you can see in the chart The USD broke the resistance of 135 against the JPY after crossing to the upside the exponential moving average of 377 months which is something that is not usually seen.

I will try to enter a long in the retest of 135, with an stop loss at 129.6. For the targets i recommend to keep locking profits and the main target is 175.

Clarification:

I'm not Japanese so i can not go long in dollars because i would be making nothing, I use this (USDJPY) because I see it more clearly than in JPYUSD.

So going long here means opening a short position in JPYUSD at 0.007407 with stop at 0.007716 and main target 0.00571.

If you agree give a boost and I will be glad to see points of view in the comments, if you think that I'm wrong tell me why.

Regards and happy trading.

FDAX is Now in an unpredictable rangeFDAX was moving in the last months in kind of range below the 209 MA .

A massive Resistance that FDAX hasn't been able to break since early 2022.

A key Support was tested twice in March and May around the price of 12400.

Once FDAX breaks support with a large volume, a decline towards 10800 will probably resume.

Otherwise, if FDAX breaks the resistance and 209 MA, a massive pump-up will propel the price to a potential target of 16300

$QTNT Next Target PT .50 and higherQuotient Limited, a commercial-stage diagnostics company, develops, manufactures, commercializes, and sells products for the global transfusion diagnostics market in the United States, France, Japan, and internationally. The company is developing MosaiQ, a proprietary technology platform, which provides tests for immunohematology, serological disease screening, and molecular disease screening. Its conventional reagent products for blood grouping include antisera products that are used to identify blood group antigens; reagent red blood cells, which enable the identification of blood group antibodies; whole blood control products for use as daily quality assurance tests; and ancillary products that are used to support blood grouping. The company also offers MosaiQ SDS Microarray that is designed as a serological disease screening microarray comprised assays to detect cytomegalovirus and Syphilis; MosaiQ MDS Microarray that is designed as a molecular disease screening microarray test for donor red cells or source plasma; MosaiQ IH Microarray as a blood grouping microarray; MosaiQ Autoimmune Microarray; MosaiQ COVID-19; and MosaiQ IH3 Microarray. It sells its products to hospitals, donor collection agencies, independent testing laboratories, original equipment manufacturers, and blood banking operation and other diagnostics companies. Quotient Limited was founded in 2007 and is headquartered in Eysins, Switzerland.

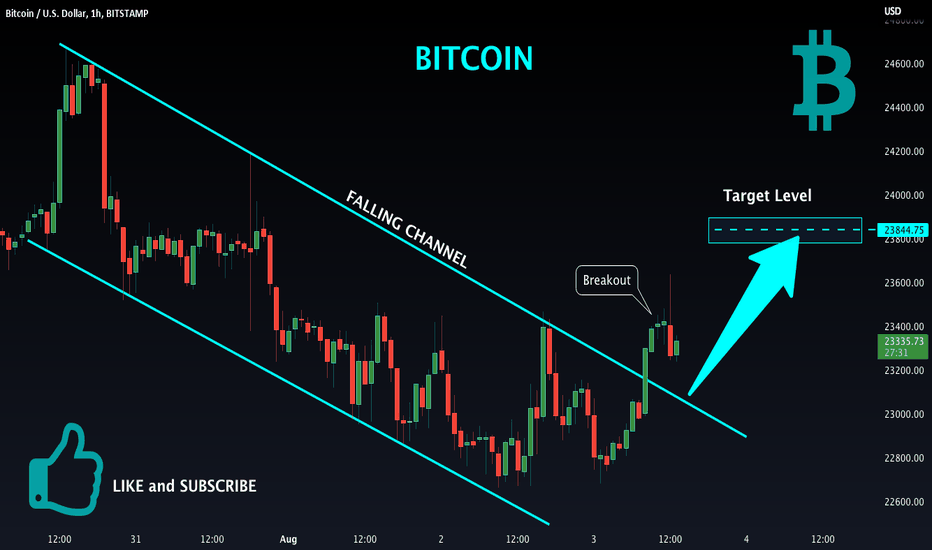

BITCOIN Wait For Breakout! Buy!

Hello,Traders!

BITCOIN is trading in a bullish triangle pattern

So we are bullish biased on the coin

And IF we see a bullish breakout of the

Horizontal key level, then the bullish continuation

It to be expected

Buy!

Like, comment and subscribe to boost your trading!

See other ideas below too!

CHFJPY SUPPORT BREAKPair: CHFJPY

Timeframe: 4H, 2H

Analysis: Round number level, trend line, volume profile, support

————--

Key Takeaway: Seen break of very valid support

—————

Level needed: Need to see price close by 138.657

—————

Trade: Short

RISK:REWARD 1:4

SL: 35

TP: 125

—————

DO NOT ENTER OUR SETUPS WITHOUT CONFIRMATION